Review Your Credit Reports

Monitoring your credit report is a good practice because it can help you catch and fix credit reporting errors. After going through bankruptcy, you should review your credit reports from all three credit bureausExperian, Equifax and Transunion. Due to Covid-19, you can view your credit reports for free weekly through April 20, 2022 by visiting AnnualCreditReport.com.

While reviewing your reports, check to see if all accounts that were discharged after completing bankruptcy are listed on your account with a zero balance and indicate that theyve been discharged because of it. Also, make sure that each account listed belongs to you and shows the correct payment status and open and closed dates.

If you spot an error while reviewing your credit reports, dispute it with each credit bureau that includes it by sending a dispute letter by mail, filing an online dispute or contacting the reporting agency by phone.

File A Dispute Directly With The Reporting Business

Reporting businesses include credit card issuers and banks. Upon receiving a dispute, they are required by law to investigate and respond. If the reporting business corrects the issue, you saved yourself the step of contacting the credit reporting agency. It is vital to make sure the items are cleaned up for all three credit bureaus mentioned above.

However, trying to work out your debt directly with the lender will not necessarily change the amount of time said negative item would remain on your credit report. It will only change if the dispute is resolved with the lender and deleted from your credit report.

Read Also: Does American Express Report To Credit Bureaus

How Long Does A Chapter 13 Bankruptcy Stay On Your Credit Report

A Chapter 13 bankruptcy stays on your credit reports for up to seven years. Unlike Chapter 7 Bankruptcy, filing for Chapter 13 bankruptcy involves creating a three- to five-year repayment plan for some or all of your debts. After you complete the repayment plan, debts included in the plan are discharged.

If some of your discharged debts were delinquent before filing for this type of bankruptcy, it would fall off your credit report seven years from the date of delinquency. All other discharged debts will fall off of your report at the same time your Chapter 13 bankruptcy falls off.

You May Like: How Long Does A Delinquency Stay On Credit

Chapter 7 Vs Chapter 13

Chapter 7 and Chapter 13 bankruptcies are the two most common types of consumer bankruptcies. The process for each is different, as is the length of time they remain on your credit report.

In a Chapter 7 bankruptcy, also known as straight or liquidation bankruptcy, there is no repayment of debt. Because all your debts are wiped out, Chapter 7 has the most serious effect on your credit and will remain on your credit report for 10 years. The accounts included in the bankruptcy, however, are removed from the credit report earlier than that.

In a Chapter 13 bankruptcy, your debts are restructured and you typically pay a portion of them over three to five years. A Chapter 13 bankruptcy is deleted seven years from the filing date and has a lesser effect on your credit than Chapter 7.

You Still Deserve An Accurate Credit Report

The one good thing about bankruptcy is that it gets debt collectors off your back and discharges the burdensome debt that has been haunting you for years. If that is not reflected on your credit reports, however, you are not getting the full benefit of bankruptcy. Heres what I recommend:

- Send a copy of your discharge to each of the three credit reporting agencies Experian, Equifax, and TransUnionimmediately to let them know that they should no longer report any negative information on those accounts.

- Check your credit reports until the discharged accounts show a zero balance.

- If one of the CRAs continues to report negative information about an account that has been discharged, send a written dispute to the agency to have it corrected.

If a CRA fails to correct your credit report after you have notified them in writing, you may have cause to file a lawsuit.

Read Also: Affirm Approval Odds

Ask The Courts How The Bankruptcy Was Verified

Next, you will need to contact the courts that were specified by the credit bureaus.

Ask them how they went about verifying the bankruptcy. If they tell you they didnt verify anything, ask for that statement in writing.

After you receive the letter, mail it to the credit bureaus and demand that they immediately remove the bankruptcy as they knowingly provided false information and therefore are in violation of the Fair Credit Reporting Act.

If all goes well, the bankruptcy will be removed.

Consider Applying For A Secured Credit Card

After filing for bankruptcy, its unlikely that you will qualify for a traditional credit card. However, you may qualify for a secured credit card. A secured credit card is a credit card that requires a security depositthis deposit establishes your credit limit.

As you repay your balance, the credit card issuer usually reports your payments to the three credit bureaus. Repaying your balance on time can help you build credit. Once you cancel the card, a credit card provider typically issues you a refund for your deposit.

When shopping for secured credit cards, compare annual fees, minimum deposit amounts and interest rates to secure the best deal.

Read Also: What Is Aargon Agency

How A Bankruptcy Filing Affects Your Credit Score

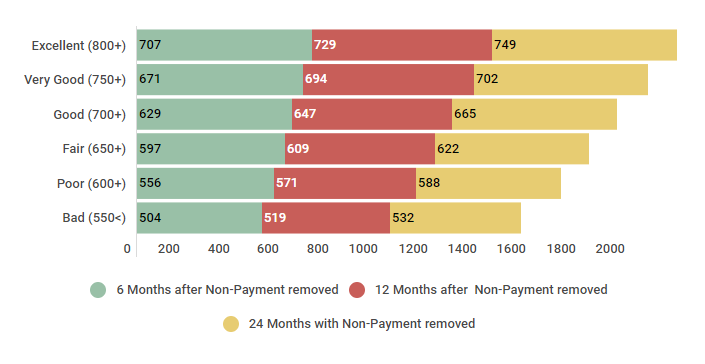

When you file for bankruptcy, your credit score will drop. The range of the drop is usually 130 to 240 points. Typically, people who have a higher credit score of over 700 points lose more points. If you already have a poor credit score, the deduction of these points may not really affect you that much.

When you have a bankruptcy on your credit score, it can be difficult to get approval for new credit and get the best deals people with excellent credit scores enjoy. For example, if you are planning to get a cell phone plan with bad credit, you will not be eligible to get the best deals available that require no deposit or no upfront fees. If you have bad credit due to a bankruptcy, you may have to settle for a no credit check cell phone plan where you have to buy the device in full and prepay your usage.

How Long Does A Bankruptcy Stay On Your Credit Report

The amount of time a bankruptcy stays on your credit report is determined by the type of bankruptcy you filed for.

- A Chapter 7 bankruptcy will be removed from your credit report automatically in 10 years because, in this case, none of the debt is repaid.

- A Chapter 13 bankruptcy is cleared in 7 years since the debt is partially repaid.

Also Check: Paypal Credit Report

But Ive Never Missed A Payment I Just Have No Hope Of Ever Paying Off My Debt

If youâre one of the few that has been able to stay current with all debt payments, but need to reorganize your financial situation through a Chapter 13 bankruptcy, your credit score will go down initially.

But, thatâs not the end of the story. Once your bankruptcy discharge is granted, your debt amount will go down significantly! And guess what helps build and maintain good credit? A low debt-to-income ratio.

Debt-to-income ratio?!

Put differently, the best credit rating is possible only if your total unsecured debt is as low as possible. A bankruptcy discharge eliminates most, if not all of your debt. Itâs the one thing you can do that your current debt management methods canât accomplish.

Doesnât bankruptcy stay on your record for 10 years?

Well, yes, under federal law, the fact that you filed bankruptcy can stay on your credit report for up to 10 years. This is true for all types of bankruptcy. But, Chapter 13 bankruptcy stays on your credit report for only seven years from the filing date.

According to Experian, thatâs because unlike a Chapter 7 bankruptcy, Chapter 13 involves a repayment plan that pays off some amount of debt before a bankruptcy discharge is granted.

Removing Errors From Your Credit Report

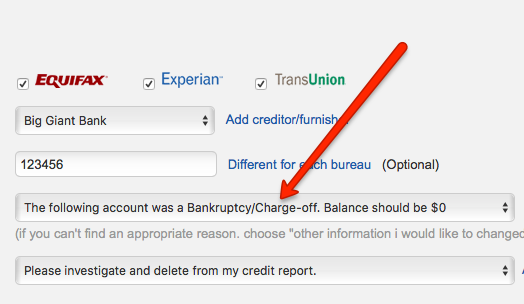

When you find errors on your credit history related to bankruptcy, you should dispute them immediately. You will need to reach out to any of the three credit reporting agencies that show incorrect information. You can contact these agencies online or by mail. Itâs best to do so by mail because the agenciesâ online forms frequently make you agree to clauses that prevent you from suing. Sending the dispute by mail also leaves a paper trail. The Consumer Financial Protection Bureau and Federal Trade Commission both have templates for writing the letter.

Your letter should include your personal information like your name, credit report number, date of birth, and address. Be sure to date the letter, so you know when the timeline starts to hear a response. You can include your Social Security number and driverâs license number, but these arenât required. Then include information related to the dispute such as:

-

The account number

-

The dates of the disputes

-

Which company is responsible for the dispute

-

A numbered list of items to correct

-

An explanation of all of the inaccuracies

-

A list of documents that you are using to support your claim.

Dispute Timeline

If the credit bureau disagrees they still need to provide you an answer within the required time frame. But if they disagree, they wonât remove the information. Even so, you can ask to include a statement regarding the dispute on your future reports.

Recommended Reading: Does Paypal Credit Affect My Credit Score

Checking A Credit Report For Accuracy

It’s prudent to review your credit report from time to time, even if you aren’t considering bankruptcy. One way to check is by taking advantage of the free copy from each of the three major credit bureausExperian, TransUnion, and Equifaxthat you’re entitled to once per year at no cost. The website for ordering your credit reports is www.annualcreditreport.com.

It’s important to review all three carefully because not all creditors report to all three agencies. A few months after filing your bankruptcy, each of your creditors should notate that the account was included in bankruptcy. If not, it’s a good idea to have that corrected because any line item that appears open but unpaid could lead a potential lender to believe that you’re still responsible for paying that debt.

Your credit report should also identify whether your Chapter 7 bankruptcy case was discharged or dismissed. A successful bankruptcy that leads to a discharge has a different effect on a potential lender’s decision to grant you credit than if the bankruptcy had been dismissed, leaving your account liability intact.

It’s a good idea to address any errors you see as soon possible. You can do this by disputing the item, either through the credit bureau’s website or by sending a letter directly.

Getting Professional Help For Bankruptcy Disputes

Some people prefer to outsource credit disputes to someone else because theyre busy or feel overwhelmed by the process. If this describes you, you might want to consider hiring a reputable professional to help.

A credit repair specialist can send disputes to the credit bureaus on your behalf and follow up with additional suggestions if the credit bureaus fail to remove inaccurate data from your credit report. Call 1-877-637-2673 to schedule a free credit consultation with a Credit Saint counselor today.

Recommended Reading: How To Remove Repossession From Credit Report

Removing Chapter 13 Bankruptcy From Your Credit Report

Each year, more than 500,000 consumers file for bankruptcy to help alleviate a mounting burden of debt they can no longer afford to pay. And while filing bankruptcy has the benefit of wiping out or seriously reducing whats owed to creditors, it creates a less than rosy credit picture that can be difficult to overcome. Individuals who file bankruptcy may find it challenging to acquire new credit, including car loans, credit cards, or a mortgage based on the negative entry on their credit report. However, there is a way to remove bankruptcy from your credit file after it is filed. Heres what you need to know.

Is Your Credit Rating Really Worth Stressing About

Are you current on all your debt payments? Yes? No? Maybe?

If youâre behind on any debt payments, your credit score could probably be better. So, rather than worrying about possibly making your already bad credit worse, think about how a bankruptcy discharge could help you build credit.

So, what happens to my credit score if I file bankruptcy?

Like all negative information reported to the credit bureaus, filing any type of bankruptcy will have a negative impact on your credit score. Since a bankruptcy filing is public record, they will find out, even if theyâre not directly notified by the bankruptcy court.

But, unlike other things that have a negative effect on your FICO score, a bankruptcy filing is often the first step to building a good credit score.

Read Also: Bp/syncb Pay Bill

How Long Does Bankruptcy Stay On A Credit Report

The most common type of bankruptcy about 70% of those filed each year is Chapter 7 bankruptcy and it remains on your credit report for 10 years. The other type, Chapter 13 bankruptcy, clears from your credit report after seven years.

Chapter 7 lasts longer on your record because, after you liquidate assets and pay what you can, the rest of the debt is written off. Chapter 13 bankruptcy involves a plan to continue paying off at least part of your debt in three to five years, so it leaves your credit report sooner.

Getting the bankruptcy removed from the credit report early wont happen simply because you dont want it there. It requires proving that it didnt belong there in the first place, meaning that it is the result of identity theft or a clerical mistake that you can prove to be the case.

If you find a fraudulent bankruptcy on your record, you need to challenge it with all three credit bureaus Equifax, TransUnion and Experian by filing a . The Fair Credit Reporting Act requires that the agencies investigate and resolve your dispute within 30 days. To maintain evidence supporting the start of that 30-day deadline, informing the agencies by certified mail is recommended. The credit bureaus will notify you of their findings.

Can A Chapter 7 Be Removed From Credit Report Before 10 Years

A chapter 7 bankruptcy can only be removed from your credit report before the 10 year period if there are any inaccuracies in the information thats reported. You cannot remove a bankruptcy from your credit report simply because you dont want it to be there. Most people will have to wait the 10 years before the bankruptcy falls off their credit report on its own.

Don’t Miss: How Can I Check My Credit Score Without Ssn

So Is Chapter 13 The Better Choice

It all depends on your particular circumstances and what works best for you.

While its true Chapter 13 bankruptcy lets you remove your bankruptcy from your credit report early, its not a given. You may not be able to get your bankruptcy discharged.

So before you decide what type of bankruptcy you seek, you should consider the different options and whats the most realistic.

Removing A Bankruptcy From A Credit Report On Your Own

Only the credit bureaus have the ability to remove an item from your credit report, including bankruptcies. If you dispute an item on your credit report and a credit bureau cant verify that its accurate, it must delete the account from your report.

However, disputed items can also be verified and remain on your report. It may help to have a professional guide you through your options if this happens to you.

Read Also: Does Opensky Report To Credit Bureaus

Does Bankruptcy Wipe Your Credit Report Clean

Myth: All bankruptcy debts will be wiped clean from your credit report.

The truth: While bankruptcy may help you erase or pay off past debts, those accounts will not disappear from your credit report. All bankruptcy-related accounts will remain on your credit report and affect your credit score for up to seven years or as long as they normally would, though their impact will diminish over time.

Follow Up On The Verification

Next, if the dispute process doesnt work, its time to follow up with the credit bureau again. This time, however, youre going to send a procedural request letter.

What exactly is that?

Its a letter that asks the credit bureau who they verified the bankruptcy with. In most cases, the bureau will state that they reached out to the actual court system.

But heres the catch.

Courts typically dont verify bankruptcies for any type of credit agency. Heres where the next step comes in.

Also Check: How To Raise Credit Score With Credit Card

You May Like: Does Rent A Center Report To The Credit Bureau

How Does Chapter 7 Bankruptcy Affect Your Credit

If you file a Chapter 7 bankruptcy, youll probably have to wait the full 10 years for the derogatory mark to drop off your credit reports. Debts included in your bankruptcy can also negatively impact your credit reports any discharged debts are likely to be listed as included in bankruptcy or discharged, with a balance of $0.

How Can I Rebuild My Credit After Bankruptcy

The most important thing you can do to improve your credit score after a bankruptcy is remove the bankruptcy from your credit report.

Equally important is learning and changing your personal finance habits so that it doesnt happen again. This might involve reviewing your income and expenses or building your emergency fund to prevent future financial hardships.

The most important ongoing habit you can begin is to pay all of your bills on time because your payment history accounts for the largest portion of your credit score. Even a single 30-day late payment can cause a significant dip, so imagine how bad it could be if you regularly miss a payment.

Your other best bet for rebuilding your credit after bankruptcy is to avoid accruing new debt.

Depending on the type of bankruptcy filing, you probably had much of your debt discharged. So even though the bankruptcy itself is a major negative item on your credit report, consider the rest a blank slate.

Avoid racking up additional debt because that also has a significant impact on your credit score.

You may also want to get a secured credit card. Its a credit card designed for people who want to rebuild their credit. The credit card issuer will give you a credit limit based on the security deposit you pay upfront. By making monthly payments on time, you can start to rebuild your credit immediately.

You May Like: Letter To Remove Student Loans From Credit Report