What Is The Vantagescore Model

The VantageScore Model was originally developed in 2006 and the VantageScore Model 3.0 debuted back in 2013. There is currently a 4.0 model as well but it has not been as widely adopted as it has only been out since 2017. VantageScore Model 3.0 is used for other credit services like , Chase Journey, etc.

The VantageScore Model Credit Karma uses is pretty similar to the FICO model but it has some key differences. It uses the same FICO range of 300 to 850 for the score and stresses many of the same factors as FICO it just gives them different weight and has some slightly different criteria for calculating them.

Here are the 3.0 factors according to :

- Payment history

How Can I Raise My Fico Score Fast

Reduce the amount of debt you oweKeep balances low on credit cards and other revolving credit: high outstanding debt can negatively affect a credit score.Pay off debt rather than moving it around: the most effective way to improve your credit scores in this area is by paying down your revolving debt.More items

Do You Qualify For A Mortgage

You can check your own credit score online, and talk with a lender to see whether you qualify for a mortgage based on your current score.

Popular Articles

Step by Step Guide

Also Check: Capital One Authorized User Build Credit

How To Get Your Real Credit Score

Modified date: Aug. 16, 2021

Editor’s note –

A reader recently wrote in asking about credit scores. She wanted to understand why the credit score she received from the credit bureaus was different than the score used by her bank. Heres her question:

Q:I enjoy reading your blog. I have one question regarding the credit scores. I checked my credit scores with the three credit bureaus, and I was happy to see that my scores were all up well above 600 for each of the bureaus.

Then I went to my credit union. To my big surprise, the manager, after checking my scores based on their system, was well below what I saw with the bureaus.

She told me the credit score we as consumers see with the bureaus is always higher than what lenders such as credit unions and banks see. My question for you is is this really true? If so, how can we as consumers get our real credit score before going to the lender?

A: So whats going on here? Several things. First of all, lets think about credit scores generally. How are they calculated? You need two things to calculate a credit score: data and a credit scoring formula.

The data comes from the credit bureaus TransUnion, Experian, and Equifax. Each bureau compiles data about your bill paying habits, late payments, credit limits, credit utilization, inquires, and more. To calculated a credit score, this data must be paired with a formula.

The most widely recognized formula comes from FICO. We need these two things to generate a .

Why Is Your Credit Score Lower Than Credit Karma Told You

February 23, 2021 by First Residential Mortgage

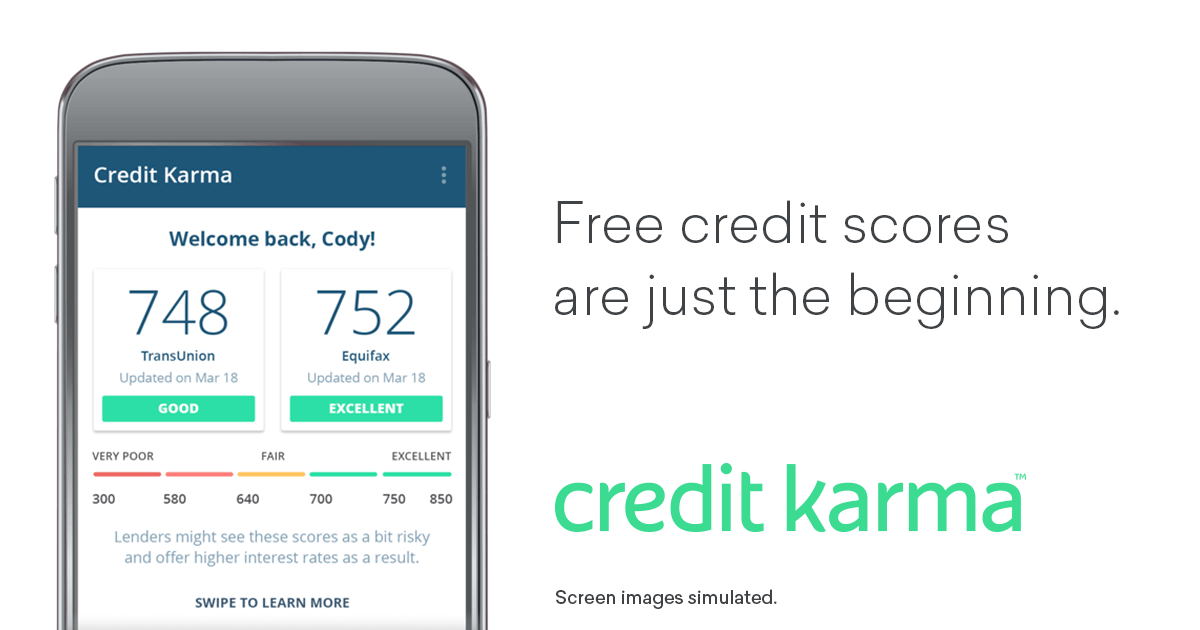

Did you recently try applying for a mortgage or another loan after you looked up your credit score using the free tool provided by Credit Karma?

Perhaps you faced an unwelcome surprise. The lender might have turned you down or offered you a lower rate than youd projected.

There is a specific explanation for why this happensand you are not the only borrower to have this experience.

Lets find out why the credit score that was pulled while processing your application for a mortgage was lower than the score Credit Karma pulled up online.

As CNBC explains, Consumers tweeted about going to apply for a credit card or loan thinking they have good or excellent credit, only to soon find that the credit score that the card issuer or lender pulled was lower than what they saw on Credit Karma.

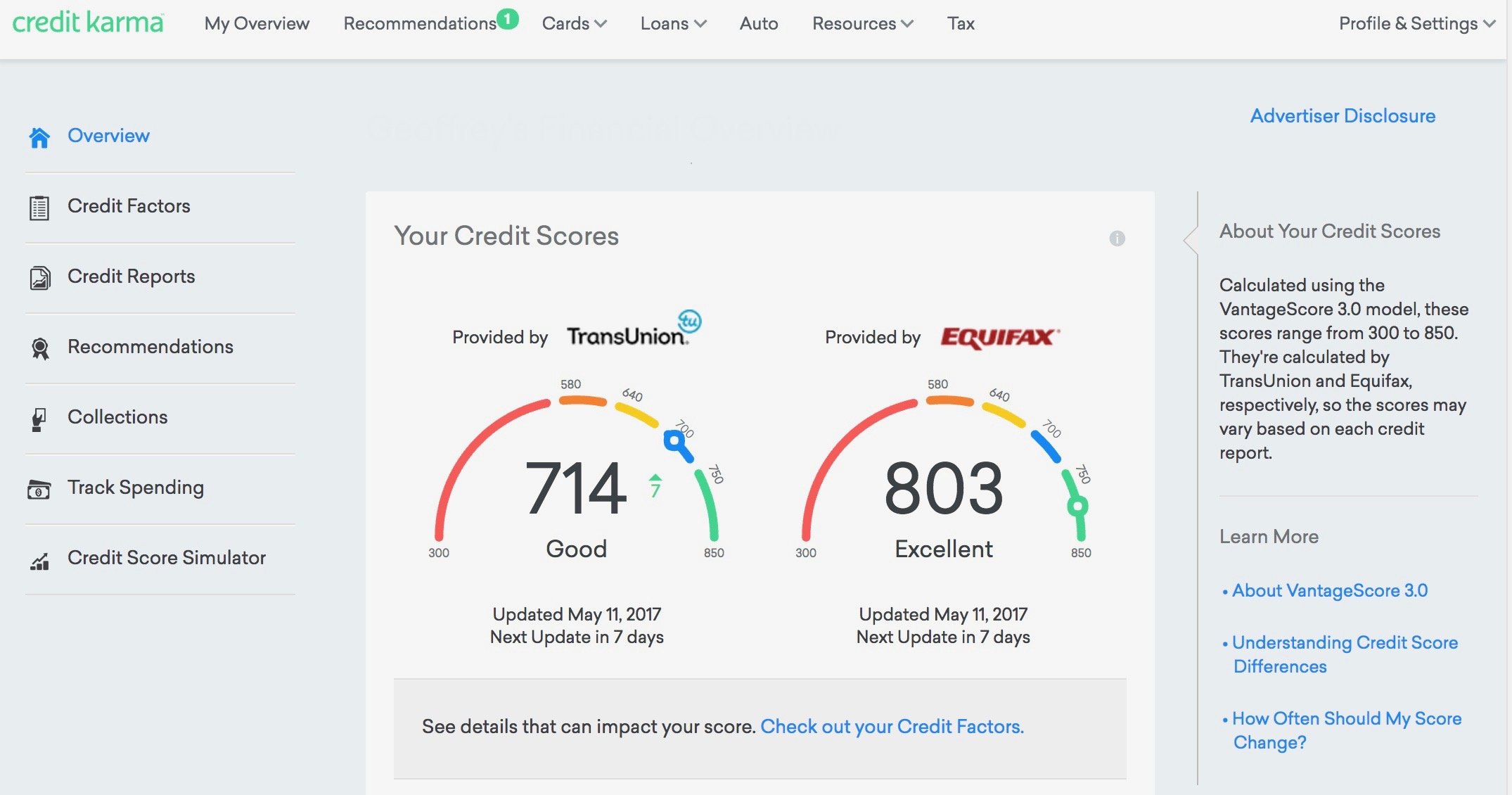

Here is what is going on here. Credit Karma pulled up your VantageScore credit score. But the lender pulled up your FICO credit score.

Most customers know they have a FICO score, but many do not know they also have a VantageScore credit score as well as other credit scores.

Read Also: What Card Is Syncb/ppc

Whats In My Credit Reports

Your are records of your past dealings with creditors and other credit history. They include information such as your name, addresses, employers, the history and status of various credit accounts, and inquiries from companies checking your reports. If applicable, youll also find information from public records, such as bankruptcies, tax liens and civil judgments.

Should I Use Credit Karma

Many folks are afraid to use Credit Karma because it requires things like a social security number to sign up. This is totally personal preference if someone is comfortable with giving out personal information in exchange for a convenient way to track their credit score. Without a social security number, it would be impossible for anyone to know what your credit history is like.

Many folks who are considering a home purchase will be giving their social security number to their mortgage lender to run their credit score. When the mortgage lender runs the credit score it will count as a hard inquiry on your credit report. When you give Credit Karma your social security it will not count as a hard inquiry as you are only using the Credit Karma service to gather information.

For all home buyers monitoring your credit is essential to your ability to buy a home. First-time homebuyers especially since they likely have not had the opportunity to build up as much of credit history as someone who is older.

At the end of the day, if you’re looking to monitor your credit score you should sign up for Credit Karma.

You May Like: What Credit Score Does Les Schwab Require

If It Doesn’t Say Fico Score It’s Probably Not A Fico Score

“62% of consumers who received a non-FICO credit score mistakenly believed they received a FICO Score.” BAV Consulting Survey3

There’s simply no substitute for FICO Scores. Remember, before the creation of FICO Scores there was no industry-standard to make sure access to credit was more fair and accurate. When you want to know where your credit stands, it just makes sense to get the scores your lenders will use.

A note of caution: some sites may try to sell a credit score and pass it off as a FICO Score. If it doesn’t clearly say FICO Score, it’s probably not a FICO Score.

What’s The Difference Between Fico Scores And Non

Not all credit scores are FICO Scores.For over 25 years, FICO Scores have been the industry standard for determining a person’s credit risk. Today, more than 90% of top lenders use FICO Scores to make faster, fairer, and more accurate lending decisions. Other credit scores can be very different from FICO Scoressometimes by as much as 100 points!

What’s in a name? When it comes to FICO Scores versus other credit scores, the answer is “quite a lot.”

FICO Scores are used by 90% of top lenders to make decisions about credit approvals, terms, and interest rates. Chances are when you apply for a mortgage, an auto loan, credit card, or a new line of credit, the bank or lender is looking at your FICO Score.

The reason? Lenders know what they are getting when they review a FICO Score. FICO Scores are trusted to be a fair and reliable measure of whether a person will pay back their loan on time. By consistently using FICO Scores, lenders take on less risk, and you get faster and fairer access to the credit you need and can manage.

FICO Scores use unique algorithms to calculate your credit risk based on the information contained in your credit reports. While many other companies design their credit scores to look like a FICO Score, the mathematical formulas they use can vary greatly.

Read Also: Opensky Payment Due Date

Why Is My Fico Score Lower Than My Credit Score

Your credit score can impact many things in life. Besides affecting your ability to get a loan, buy a house, or buy a vehicle, your can affect what you pay for insurance and if you can get a cell phone.

If youre wondering why your FICO score is lower than your credit score, the answer depends on what credit scoring model is being used and what factors that scoring model looks at.

Credit scores are used to give lenders an idea of your , or, in other words, how likely you are to pay your bills on time. Credit scores range from 300 to 850, with 300 being the lowest and 850 the highest.

Youll have better luck getting a loan with a than 500. If you’re able to get a loan with a low score, that loan will probably come with a higher interest rate.

The Apps Spread Your Data Around

Where does all that data go?

TransUnion says it sells your data to third-party companies. Only California residents can opt out, by selecting a Do Not Sell My Personal Information option. The privacy policies for the other four companies state that while they dont sell the information, they can use it to market products or services to users.

To track exactly where the data goes, CR staff members were able to observe . Fitzgerald and his team noted that not all companies on the receiving end were listed in the apps privacy policy disclosures.

The common practice of sharing data this way in its own right raises privacy concerns. But credit apps escalate the problem, Fitzgerald says, due to the quantity of the information they gather, the amount of time over which they gather it, and the length of time that they retain it. This data, whether sold or simply shared, could, in theory, be used for a broad range of uses, he says.

This highlights a fundamental problem with the apps tested for this research: It is impossible for an average person to get a clear sense of where all this data is sent and how it is used.

You May Like: Removing Old Addresses From Credit Report

Should I Even Bother With The Credit Karma Score

Since most major lenders utilize the FICO model, you need to be very cautious about relying solely on your Credit Karma score. As I have shown, in some instances, this score can be really different from your FICO score like when you only have a couple of months of credit history or when you have closed a lot of credit card accounts.

Sometimes a lender might have a hard cut off for approvals or for certain interest rates. For example, if your score is below 700 your interest rate could go up another 1% or 2%. Or if your score is below 650 you might not be able to get approved for a certain loan or card.

In those cases, when you were dealing with hard cutoffs, it becomes very important that you get a truly accurate and up-to-date score. This is especially true if you are dealing with a large sum of money like in the case of a mortgage.

In those situations you would want to stray away from Credit Karma and do what you can to obtain an official FICO score. It will also benefit you to try to figure out exactly which credit score model your lender uses, since there are many different versions of FICO score.

And some point you might actually run into a lender that uses the Vantage score model . If they are pulling from Equifax for TransUnion then Credit Karma could be very useful for that lender.

Should You Worry About Changes In Your Credit Score

Changes in your credit score are completely normal, so theres no need to worry about small fluctuations! That being said, its good to check your credit report at least once a month so you can monitor these changes when they occur.

You may want to take note of large changes in your score as they could be an indication that something bigger is happening for example, if you have unauthorized accounts opened in your name, or youve been a victim of identity theft.

Recommended Reading: Does Carvana Report To The Credit Bureaus

How Accurate Are Credit Karma Scores

- Banks Editorial Team

Curious about your credit score? Then you may be wondering about Credit Karma. The personal finance website promises to help you manage your finances and offers a free credit report and score to encourage you to register for a free account. But how accurate are Credit Karma scores? Keep reading to find out.

How Many Credit Scores Do You Have

Many borrowers think they only have three credit scores one for each bureau . But even though the consumer information comes from the three main bureaus, different scoring algorithms are used to develop the score. Thats why there are hundreds if not thousands of credit scores. Some are industry-specific, like in the auto industry.

Add to the confusion that scoring models are updated all the time. The moral of this story is if youre getting a mortgage dont think your Credit Karma score is accurate.

Recommended Reading: Does Capital One Report Authorized Users To Credit Bureaus

Closing Old Credit Card Accounts You No Longer Use

Another factor that impacts your credit is the average length of your credit history, which plays a 15% role in your score. This is an important point to know and understand since it may seem like a good idea to close old accounts you dont use regularly.

Also be aware that closing old accounts can reduce the amount of available credit you have, thus boosting your utilization in the process.

Instead, consider keeping old credit card accounts open and put your cards somewhere for safekeeping. That way, your accounts can add to the average length of your credit history and available credit, which can only help your credit score over the long haul.

Can Credit Karma Help Me Improve My Credit Score

- Banks Editorial Team

Theres a lot of chatter about Credit Karma in the personal finance world, and for a valid reason. The online platform features useful tools to help you meet your credit and financial goals. But can Credit Karma help you improve your credit health?

Keep reading to learn how Credit Karma works, how it impacts your credit rating and a viable alternative to help raise your credit score.

Read Also: What Is Syncb Ntwk On Credit Report

Age And Type Of Credit

This is different from the FICO model because account history and the types of credit are two of the three least important factors for FICO. One of the big differences for the VantageScore Model is that it does not consider closed accounts when determining the age of your accounts. FICO will continue to count your closed accounts until 10 years after they are closed.

So your average age of accounts will often be significantly lower with the VantageScore Model. This is why people like me who have opened up and closed a lot of cards have a significantly lower VantageScore Model Score than FICO the average age of our accounts is significantly lower and it carries more weight.

Why Are My Credit Scores Different

There are a few reasons why you might get different credit scores from FICO and each of the three major credit-reporting agencies. Here are some of the most common situations:

We recommend you periodically check your credit reports for errors, which could affect your scores. You can check your Equifax® and TransUnion® credit reports for free on Credit Karma, and your Experian® report on www.AnnualCreditReport.com.

Don’t Miss: Carmax Financing 650 Credit Score

Why Dealers Dont Care About Your Online Credit Score

Ultimately, the next time youre at a dealership and you happen to flash them your Credit Karma score after they pull your credit, dont be surprised if they dont bat an eye at it. The scoring models are different and the score that they pull is more in line with what the actual lenders are looking at in order to prove that youre creditworthy enough to lend a large sum of money to.