Medical Collections That Are Paid By Insurance

In 2015, the three credit bureaus launched the National Consumer Assistance Plan. It was designed to help improve credit report accuracy and access. A big part of the plan addressed the challenges presented by medical debt collections. One specific provision stipulates that any medical collection account that is paid by an insurer must be immediately removed from the consumers credit report.

This helps people who face medical collections as a result of an insurance payout error. If insurance was supposed to cover a procedure or medical expense, but instead it went unpaid and got sent to collections, then the collection agency must remove it when the error gets fixed.

Its also important to note that the National Consumer Assistance Plan also requires collection agencies to wait 180 days before reporting the collection account. This allows time for insurance payments to process. It also gives you time to handle a medical collection account before it affects your credit.

Wait A Few Months And Dispute The Account Again

If you failed to get the collection removed from your credit report by this step, dont lose hope. Let a couple of months pass by and try to dispute the account for another reason.You can dispute accounts for several diffident reasons, and the older the paid collection gets, the more likely the creditor will ignore the Credit Bureaus requests.

Do Your Research & Check All Credit Reports

To get details on your collection account, review all of your credit reports. You can do this by visiting AnnualCreditReport.com. Normally, you can only get one free copy of each report annually. However, due to the Covid-19 pandemic, you can check your reports from all three credit bureaus for free weekly until April 20, 2022.

Your credit report should list whether the collection is paid or unpaid, the balance you owe and the date of the accounts delinquency. If you dont know who the original creditor is and its not listed on your report, ask the collection agency to give you that information.

Afterward, compare the collection details listed on the credit report against your own records for the reported account. If you havent kept any records, log into the account listed to view your payment history with the original creditor.

Also Check: Is Klarna A Hard Pull

Can You Remove A Collection Entry From Your Report

If you have a collection entry, the simple answer is yes. Its possible to remove it in most cases. And thats something youll want to do. A collection entry appearing on your credit bureau can hurt your credit score and, in some cases, stop you from getting car loans and mortgages.

Before we discuss how to remove a collection entry, it helps to talk about what a collection entry actually means, how much it can lower your credit score and how long it can remain on your credit report if you dont do anything about it.

Can you use some help with your finances? Learn about credit counselling today.

Statute Of Limitations On Debt Collectors

The first thing consumers should do is verify that the debt even exists. In addition to the validation notice that debt collectors must send, there is a statute of limitations on most debts. The statute of limitations varies from state-to-state, from as little as three years to as many as 15. Most states fall in the range of 4-to-6 years.

If the statute of limitations on your debt has passed, it means the collection agency cant get a court judgment against you. It does not mean they cant still try to collect, though if you refuse to pay, they have no legal recourse against you. However, the unpaid debt remains on your credit report for seven years from the last time you made a payment on it.

Many of the problems start with the fact that debt collection agencies often buy debts from several sources and either collect the money or sell the debt a second, third, maybe even fourth time. Along the way, the original contract gets lost and specifics of how much was originally borrowed, at what interest rate, what late payment penalties are involved and how much is still owed, are lost with it.

Consumers need to keep accurate records of all transactions involved with their debt, especially the original contract, record of payments and any receipts. That information is used when filing a dispute letter with the collection agency.

Recommended Reading: How Long Does A Repossession Stay On Your Credit Report

Who Is Revsolve Inc

RevSolve, Inc. is a debt collection agency located in Scottsdale, Arizona. They provide collection services for healthcare providers.

You may see RevSolve listed on your credit report as a collections account. This can happen if you forgot to pay a bill and your account was sent to a debt collector.

Is Pay For Delete Legal

The Fair Credit Reporting Act governs credit reporting laws and guidelines. Anything that a debt collector, creditor, or credit bureau does regarding a credit report will be based on the FCRA, says Joseph P. McClelland, a consumer credit attorney in Decatur, Ga.

Technically, pay for delete isnt expressly prohibited by the FCRA, but it shouldnt be viewed as a blanket get-out-of-bad-credit-jail-free card. The only items you can force off of your credit report are those that are inaccurate and incomplete, says McClelland. Anything else will be at the discretion of the creditor or collector.

Read Also: How To Remove Repossession From Credit Report

How To Remove Items From Your Credit Report In 2021

Weve outlined how to remove negative items from your credit report, the paid services you can opt to use, and additional information to have on hand. It is important to clarify that only incorrect items can be removed. If youve done this already, but your credit score is still low, you will need to repair bad credit over time. Although accurate items cannot be removed by you or anyone else, there are still many credit report errors that can damage your score, and these are worth looking out for.

File A Dispute With The Credit Bureau

If you file a dispute with the credit bureau, you can do so online, by mail, or over the phone. You can go directly to the credit reporting agencys website and file a dispute online this is the most convenient method.

However, if the credit bureau needs to contact the creditor to confirm and verify the information you are disputing, there will likely be a delay in resolving the issue. Your best option then is to file a dispute directly with the creditor.

Provide specific information regarding the error and the evidence that proves it was an error. For example, if it turns out that you made a late payment on a loan, but your payment was made on time, include a copy of your credit report with the error circled in red, then a copy documents that prove you paid on time. Request that the matter be investigated and removed from your report.

Don’t Miss: Does Opensky Report To Credit Bureaus

If You Havent Paid The Debt: Pay For Delete

Debt collectors may be willing to take the collections account off your credit report in exchange for payment on the debt. The collections account will be deleted, but negative information about late payments to the original creditor will persist.

Achieving a pay for delete is rare youre more likely to get one if a major life event led to the debt going into collections, such as a loss of job or illness.

If the collector does agree, it can be a win-win: The collector gets payment on the debt, and you get the account off your credit report. Note that you may be able to negotiate paying less than the full amount.

Get the agreement between you and the debt collector in writing to ensure the deal is upheld.

More about debt and credit from NerdWallet

The Fdcpa & State Collection Laws

You have rights under the Fair Debt Collection Practices Act regarding timelines and statutes of limitations, so its critical to learn them before you take action.

If you dont, you could inadvertently reset the clock on your collection account. So settle in and get ready to go in-depth on everything you need to know about getting a collection account removed from your credit reports.

Recommended Reading: What Credit Report Does Comenity Bank Pull

Recommended Reading: Creditwise Score Accuracy

Highlight Errors In Personal Information

Common personal information errors include your name incorrectly listed on the account, listed addresses where you have never lived or used as a mailing address, and inaccurate employer information.

There are disputes that creditors do not have to investigate. These disputes are information that identifies you the identity of past or present employers consumption report requests information from public archives information relating to active service or fraud alerts and information that another creditor institution has provided to the credit bureau.

Look At Your Credit Report

Credit repair starts with regularly reviewing your credit report. Thanks to the Fair Credit Reporting Act the three major credit bureaus are required to provide free credit reporting on an annual basis. You can get a free copy of your credit report once a year if you request one. Equifax has started offering six copies per year starting in 2020 and running through 2026, but you must visit the Equifax website to get the additional copies.

You can request a free credit report from each of the national credit bureaus at annualcreditreport.com or you can call 1-877-322-8228 to get your free copy. The three major credit bureaus may report your credit information differently, so make sure to review each carefully for inconsistencies. Take a good look at your credit card accounts and medical collection accounts to compare the information noted on each report. If you find an account you donât recognize, you can dispute the account.

Also Check: Transunion Credit Report Without Ssn

How Long Does It Take Before A Bill Goes To Collections

There’s no set time period for creditors to send your debt to collections. Once you miss a payment, you’re considered delinquent, but most creditors will make several attempts to contact you and work with you to bring your account back into good standing before they send you to collections. The more you can communicate with your creditors, the better your chances are of keeping collections off your credit report.

What A Debt Collector Can’t Do

A debt collector can’t do the following:

- suggest to your friends, employer, relatives or neighbours that they should pay your debts, unless one of these individuals has co-signed your loan

- use threatening, intimidating or abusive language

- apply excessive or unreasonable pressure on you to repay the debt

- misrepresent the situation or give false or misleading information

A debt collection agency can’t add any collection-related costs to the amount you owe other than:

- legal fees

- fees for non-sufficient funds on payments that you submitted

Recommended Reading: Paypal Credit Soft Pull

If You Dispute A Debt

If you dispute the legitimacy of something in your debt collector’s file, you must give the collector written notice. Simply calling the collector won’t cease collection activities.

If possible, send your dispute letter by certified mail so you know it was officially received by the collector. The collector then has 30 days to determine whether or not the disputed item is correct.

If the disputed item is correct… The debt collector can continue collection activities.

If the disputed item is incorrect… It must be corrected. The debt collector must notify anyone who has already received a report containing the incorrect item. If, at the end of 30 days, the debt collector has not been able to determine whether the item is correct or not, they must make the change you requested and notify anyone who received a report containing the incorrect item.

Removing Bad Credit History With Credit Repair

Hiring a firm is another option for paying to delete bad credit information. Credit repair agencies essentially do the work for you by contacting the credit reporting agencies and providing objections to errors contained in the report or requesting that items that are untrue or incorrect be removed from the report, says McClelland. In this instance, youre not necessarily paying off any outstanding balances. However, you will pay a fee to the credit repair firm to act on your behalf in having negative information removed.

Don’t Miss: What Credit Report Does Paypal Pull

How Delinquent Debts Are Reported On Your Credit Reports

After your debt has been transferred or sold to a debt collector, it will probably appear twice in your credit history. According to the credit reporting agency Experian, this is how it works: The debt starts as a current, never late account. As you get behind on the payments, it is typically reported as being 30 days late, 60 days late, 90 days late, and so forth.

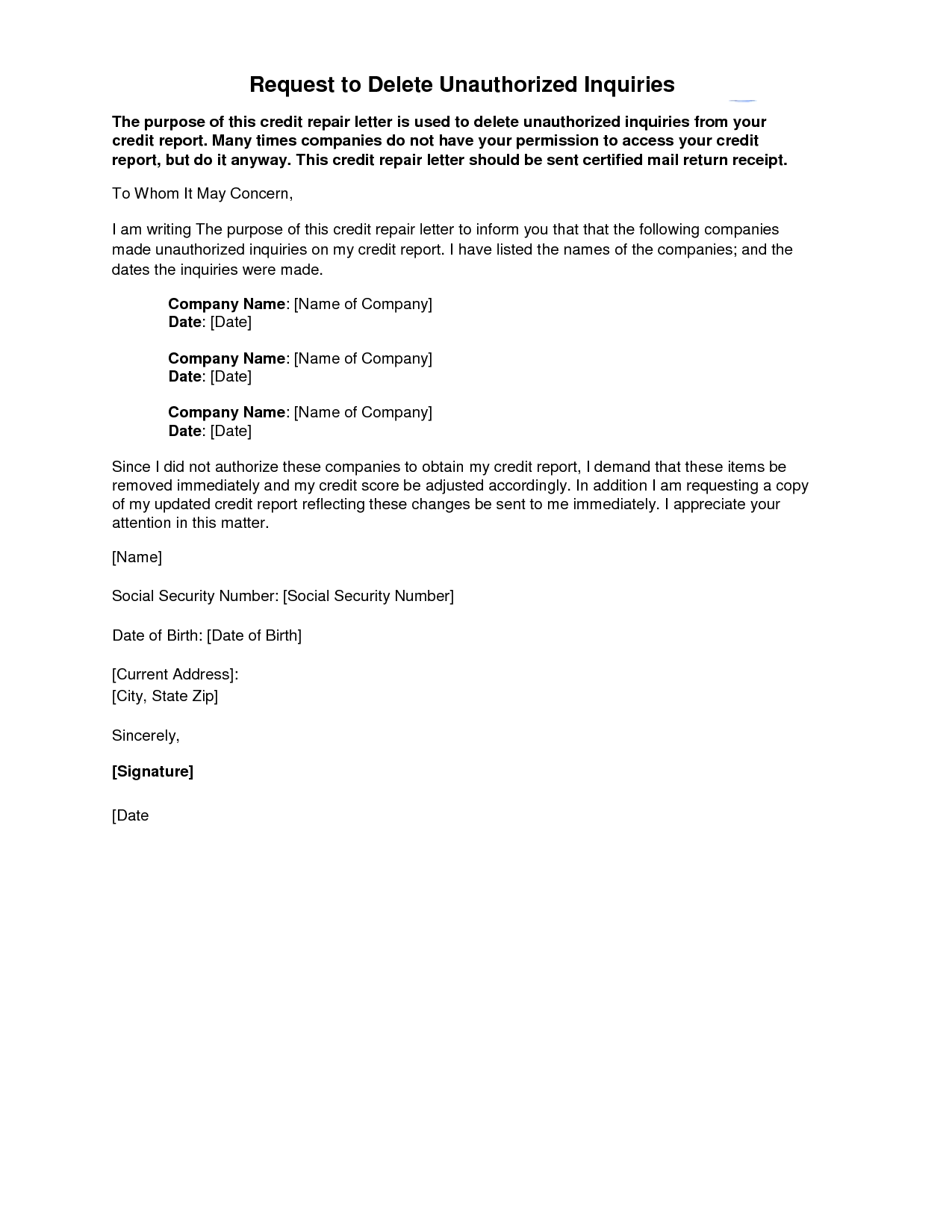

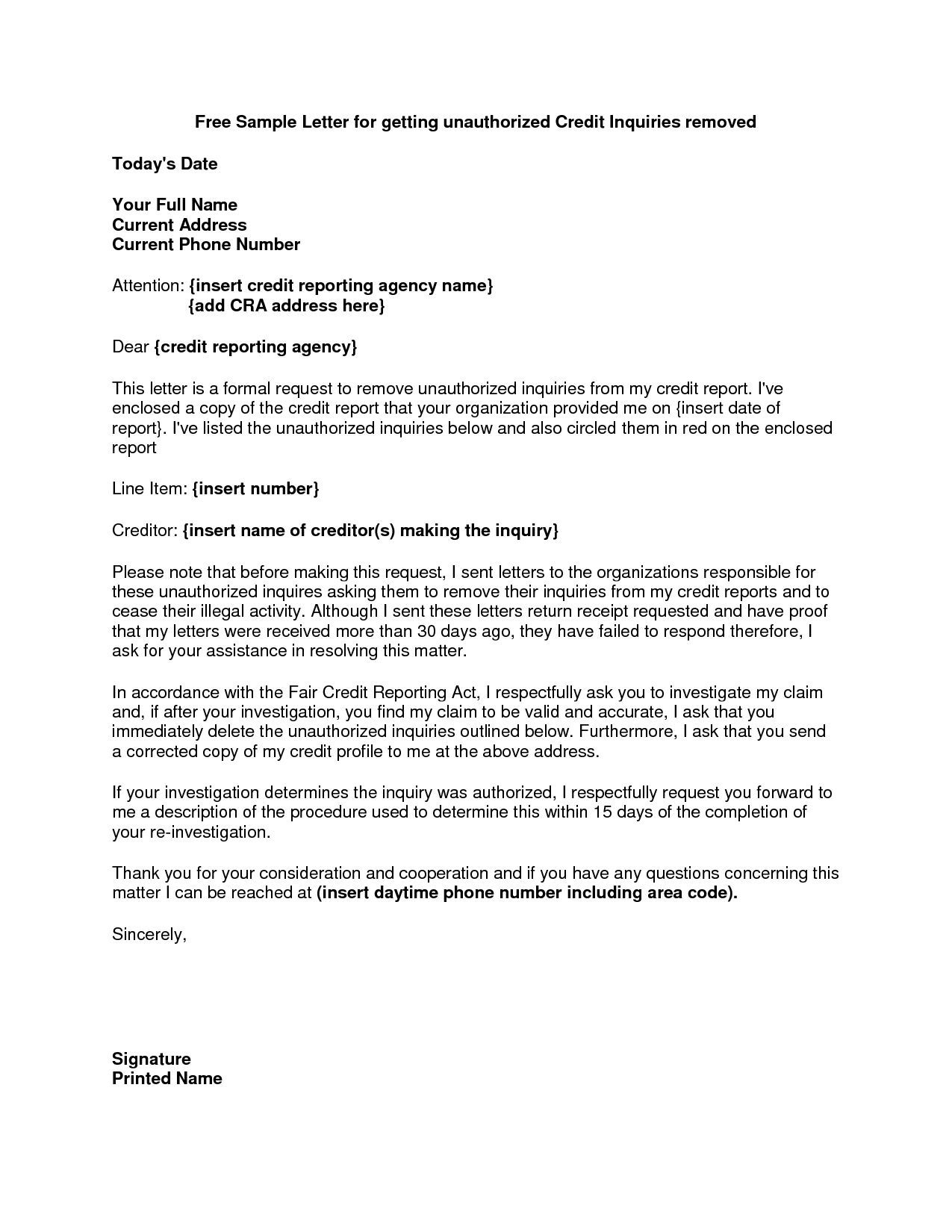

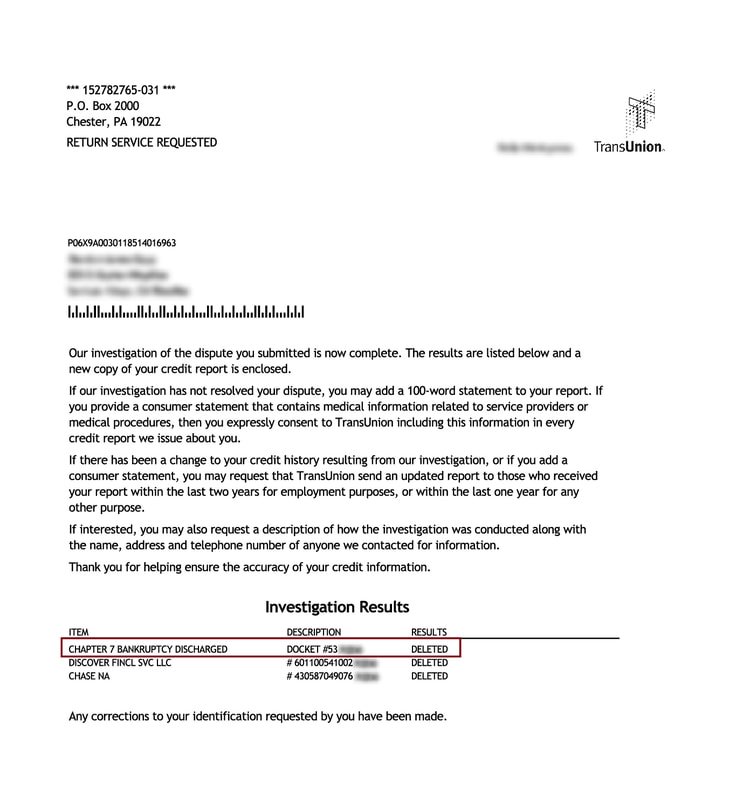

Sample Letter To Collection Agency To Remove From Credit Report

Sample letters to the collection agency to remove negative items from your credit report have become a very popular tool with debtors and consumers who are struggling with debt. Unfortunately, it is not an unrealistic request. You are entitled to the same privacy as any other person who has access to your credit report. There are laws in place to protect you from unfair credit practices by creditors. You can dispute items on your credit report if you feel these are inaccurate or if the information is outdated.

How To Write A Letter To Remove Negative Credit Image collections from sample letter to collection agency to remove from credit report , source:expocar.info

A sample letter to the collection agency to remove negative items from your credit report is an effective method for any consumer to follow if they feel their rights have been violated. A credit dispute letter to the agency can be a lengthy process, but it is often effective. Once you write and dispute inaccurate information on your credit report, the creditor will often take down your statement. This can take a long time if the credit agency only accepts dispute letters. However, if you follow this process, it may give you the results you need quickly.

sample credit report dispute letter from sample letter to collection agency to remove from credit report , source:savetemplate.com

Don’t Miss: How To Unlock My Experian Account

Repairing Bad Credit Yourself

If you would rather not pay for delete or pay a credit repair firm, there are a few steps you can take to begin getting your credit back on track:

- Review your credit reports for negative information thats inaccurate. Initiate a dispute of inaccuracies or errors online with the credit bureau thats reporting the information.

- Consider having someone you know with a strong credit history add you to one of their credit cards as an authorized user. This can transplant that persons positive account history to your credit report.

- Research credit builder loans and secured credit cards as additional credit-building options.

- Get in the habit of paying your bills on time monthly. Payment history has the most significant impact on credit scores.

- Weigh the pros and cons of debt settlement to resolve collection accounts or charge-offs. Debt settlement allows you to pay off debts for less than whats owed.

- Focus on paying down balances on any credit card or loan accounts that you have open to improve your .

How To Decide If You Should Pay A Debt Collection Agency

There’s no silver bullet in a debt collection case. While ignoring a debt collector may be an option in some cases, it’s not available to some debtors.

Here are some general considerations.

If you refuse to pay a debt collection agency, they may file a lawsuit against you. Debt collection lawsuits are no joke. You can’t just ignore them in the hopes that they’ll go away. If you receive a Complaint from a debt collector, you must respond within a time frame determined by your jurisdiction. For most areas in the US, that time frame is 14-30 days.

If a debt collection agency wins their lawsuit, they have several options available. For example, debt collectors may garnish earnings to collect a debt. A garnishment is a court order that takes money directly from a debtor’s earnings. This money goes towards repaying the debt they owe. Consider this possible outcome before ignoring a debt collector’s payment demands.

Here’s one more thing to keep in mind. Interest on your unpaid debt will continue to pile up as time passes. If you don’t pay a debt collection company, the amount of money you allegedly owe will keep increasing.

A piece of advice: pay the right person. If you receive a letter from a debt collector demanding money, do your research. Often, debt collection agencies sell debt to one another. Don’t just assume you’re paying the right debt collector. Make sure your debt hasn’t changed hands.

Consider these factors and situations

You may want to pay a collection agency

Recommended Reading: How Can A Landlord Report To Credit Bureau

What Is Enhanced Recovery Company Llc

Enhanced Recovery Company is a debt collection agency located in Jacksonville, FL with 2,500 employees. This massive financial conglomerate specializes in collecting past or overdue debt that you owe to credit card companies, lenders, financial institutions, student loan providers, or utility companies.

How Long Do Collection Accounts Stay On Your Report

Paid or unpaid collection accounts can legally stay on your credit reports for up to seven years after the original account first became delinquent. Once the collection account reaches the seven-year mark, the credit reporting companies should automatically delete it from your credit reports.

If your collection account doesnt fall off of your credit report after seven years, you can file a dispute with each credit bureau that lists it on your report.

Also Check: Can You Remove Hard Inquiries Off Your Credit Report