How To Improve Your Score

Making timely payments in full is key in establishing, or improving, a good score. And since details about your payment history, including late or missed payments, are considered public record and can stay on your credit report for years, you should aim to pay as much of their monthly balance as you can, on time, every time.

The snowball method, in which you pay off the smallest of your debts first, then move on to the next largest, is a popular way to do that. Redd Horrorcks, a self-employed voice actress, using this method, paid $39,000 in credit card debt in five years.

Aside from paying in full and on time, look to reduce your credit utilization rate, too, which is the ratio of how much you’ve spent on your credit card versus the card’s limit. “The smaller that percentage is,”according to Bankrate, “the better it is for your credit rating.”

“Even if you pay balances in full every month, you still could have a higher utilization ratio than you’d expect. That’s because some issuers use the balance on your statement as the one reported to the bureau.” The ideal utilization rate is less than 30 percent of your available credit.

Then, he says, choose one or two go-to cards for most of your purchases: “That way, you’re not polluting your credit report with a lot of balances.”

Keep Your Credit Accounts Open As Long As Possible

Closing credit accounts can negatively impact your credit score as this reduces the number of accounts with a credit history. This is especially worse if the credit account you close is one with a long history. The account will no longer be open and will therefore not count towards the majority of your credit score.

Unused credit accounts which dont have long histories can be closed as they do not add to your credit score. Having access to too much unused credit may also be seen as negative.

Can I Get A Loan With The Lowest Credit Score

A credit score of 300 will likely disqualify from getting any kind of loan. But if your score is in the lower averages, you may be able to take advantage of all kinds of services these range from loans to credit cards that are designed for people with a low score.

If you have a poor credit score, you can benefit from getting a secured credit card. You might need a co-signer, but you can start working to improve your credit score with this card. You put the money in an account, so theres no way to overdraw on the card.

However much money you want access to is what you put into the account. Over time and with on-time payments, you will see your credit score gradually improve. Its worth mentioning that, depending on the bank, you may not necessarily need a higher credit score to qualify for help.

Many banks look at your monthly income, job history, and other income sources to determine your eligibility. Its understandable if your low credit score makes you feel like youre out of options. The truth is, however, that youre not.

Only 5% of consumers in the United States have a credit score in the 300 to 499 range, while 20% of consumers are below 599. Its clear, then, that there are many others like you who struggle with credit issues.

Fortunately, there is some light at the end of the tunnel. Thanks to greater access to credit scores in the modern era, its easier than ever to start an improvement plan. The important thing to remember is that its going to take time.

You May Like: How To Get Credit Report With Itin Number

Monitor Your Credit Reports

Because your credit score is constantly being updated, its important to monitor your report regularly. Doing this will help ensure that all the information on your credit report is accurate. And if there are errors, you can find out about them and have them removed in a timely manner, before they do any damage.

Youre entitled to receive one free copy of your credit report from Experian, Equifax, and TransUnion every 12 months. You can order a copy of your report online at AnnualCreditReport.com.

And for ongoing monitoring of your credit, you can check your VantageScore® at Rocket HomesSM.

Areas With The Lowest And Highest Credit Scores In The Uk

Here are the top 10 areas in the UK that are considered to have the lowest credit scores:

There are several socio-economical factors at play within each of these areas. Lower credit scores areas tend to have higher debts, higher levels of supplemented income from benefits, people who are self-employed or have a history of poor credit.

You May Like: Does Carvana Report To Credit Bureaus

What Credit Score Do You Need To Buy A House In 2021

Credit scores can be a confusing topic for even the most financially savvy consumers. Most people understand that a good credit score boosts your chances of qualifying for a mortgage because it shows the lender youre likely to repay your loan on time.

But do you know the minimum credit score you need to qualify for a mortgage and buy a house? And did you know that this minimum will vary depending on what type of mortgage you are seeking?

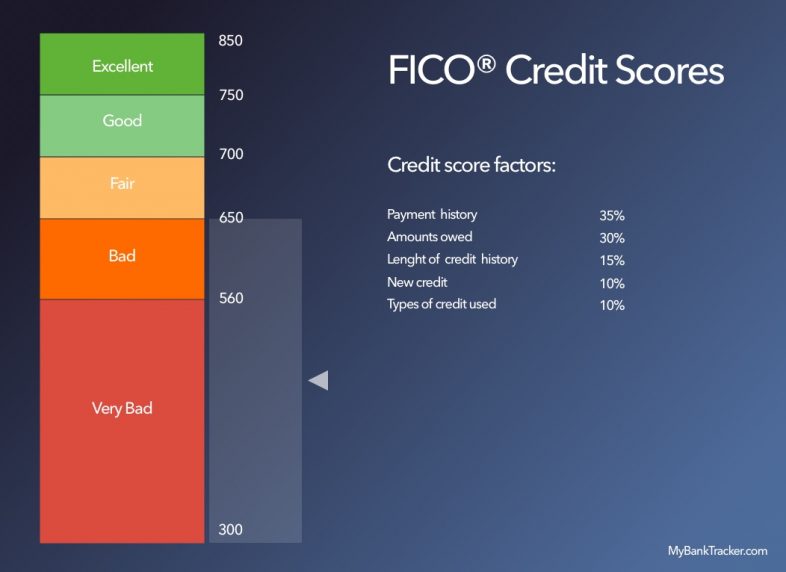

The Importance Of FICO®: One of the most common scores used by mortgage lenders to determine credit worthiness is the FICO® Score . FICO® Scores help lenders calculate the interest rates and fees youll pay to get your mortgage.

While your FICO® Score plays a big role in the mortgage process, lenders do look at several factors, including your income, property type, assets and debt levels, to determine whether to approve you for a loan. Because of this, there isnt an exact credit score you need to qualify.

However, the following guidelines can help determine if youre on the right track.

What Happens If You Have A Low Credit Score

If your credit score is really low, you may have a hard time qualifying for services like credit cards and loans. If you qualify, youll likely have to pay a higher APR or additional fees and charges.

When you apply for a credit card or loan, lenders need to know that you will be a responsible borrower. They want to know if youre someone who will remain committed to making payments. By checking your credit score, lenders can get a pretty good idea if you can be trusted to repay your debts in a timely manner.

With that said, your credit score isnt the only thing businesses look at when you apply for a credit card or loan. They also consider things like your current savings. As such, if you have respectable savings, steady income, and you dont have a lot of debt, you could still get approved for the loan at a decent rate.

If you want to get the best loan options and rates, however, youre going to want to be working to rebuild your low credit score. In doing so, you can effectively improve your chances of being approved by lenders and financial institutions.

And although 300 is the lowest FICO Score, youre likely to need at least double that to get approved for many types of loans. Take Ellie Mae, for example. This mortgage data service company reported in 2018 that only 1% of borrowers who were approved for mortgages carried a FICO Score under 600.

You May Like: What Is Syncb Ntwk On Credit Report

What Is The Highest Credit Score Possible

The highest credit score you can get is 850. Individuals with a score this high have near-perfect credit management, which is why only 1.2% of consumers in the U.S. have achieved this feat.

In comparison, the average credit score in the U.S. is 704. Here is an overview of the FICO credit scoring model:

- 300-579: Very poor

- 740-799: Very good

- 800-850: Exceptional

If an 850 credit score sounds impossible to you, then theres no need to worry. Achieving a perfect credit score isnt necessary or even a goal you should be trying to shoot for.

In order to qualify for the best rates, you just need to have a credit score in the very good range. So while an 850 credit score isnt necessary, you should be aiming for a credit score of 740 or higher.

Understanding Your Credit Scores

First off, you have more than one credit score, and there are a few reasons for that.

There are different scores for specific products. For example, there are special auto and home insurance credit scores. There are also different credit-scoring models, like FICO and VantageScore, which means you could have scores according to each model. Even the same model could give a different score depending on whether it uses data from your Equifax, Experian or TransUnion credit report.

Lastly, there are multiple consumer credit bureaus that provide on which scores are based. So depending on what information each bureau gets from individual lenders and that can differ the data used to compile your reports and build your scores could vary from bureau to bureau.

When you put it all together, that means that each individual could have multiple scores, and sometimes they dont match. Its difficult to pinpoint exactly how many scores you may have, but it could be hundreds.

Even though there are many different credit scores out there, its worth knowing the general range that your scores fall into especially since they can determine your access to certain financial products and the terms youll get.

FICO and VantageScore Solutions create the most widely used consumer credit scores, and these companies update their scoring models from time to time.

Don’t Miss: Does Speedy Cash Report To Credit Bureaus

Ask Your Bank For A Small Overdraft Facility

To Build credit you need credit so one of the ways to improve your credit score or build credit is by having an overdraft. You then need to show good behaviour when you have access to this credit.

You will also have the ability to use your available credit, sticking to the 30% maximum credit utilization golden rule per credit account and thereby showing good credit behaviour which should boost your credit score even further. Always repay your overdraft as soon as you can to avoid any fees.

How Can I Check My Credit Score

Checking your credit score is the first step to improving your credit, since it will give you an idea of where you stand. Its also important to find out what your credit score is to avoid rejected applications which can lower your score. The process for applying for your credit score can be done online or through the mail and you shouldnt have to pay a fee.

Don’t Miss: How To Unlock Experian Credit

Open A New Credit Card Account

Opening a new credit account will be your next option if your current credit card provider will not increase your credit limit. You essentially accomplish the same things as your available credit limit increases.

You must repay your balances on your credit card account every month and avoid using over 30% of your available credit. This is a good option if you want to improve your credit score.

How Does It Work

Although there are many different , your main FICO score is the gold standard that financial institutions use in deciding whether to lend money or issue a credit card to consumers. Your FICO score isnt actually a single score. You have one from each of the three credit reporting agenciesExperian, TransUnion, and Equifax. Each FICO score is based exclusively on the report from that credit bureau.

The score that FICO reports to lenders could be from any one of its 50 different scoring models, but your main score is the middle score from the three credit bureaus, which may have slightly different data. If you have scores of 720, 750, and 770, you have a FICO score of 750.

A perfect score of 850 will give you bragging rights, but any score of 800 or up is considered exceptional and will give you access to the best rates on credit cards, auto loans, and any other loans.

You May Like: What Is Synchrony Bank Ppc

Minimum Credit Score By Mortgage Loan Type

The minimum credit score you need to qualify for a mortgage in 2021 depends on the type of mortgage youre trying to obtain. Scores differ whether youre applying for a loan insured by the Federal Housing Administration, better known as an FHA loan one insured by the U.S. Department of Veterans Affairs, known as a VA loan or a conventional mortgage loan from a private lender:

|

Type of loan |

|

|

FHA loan requiring 3.5% down payment |

|

|

FHA loan requiring 10% down payment |

500 – Quicken Loans® requires a minimum score of 580 for an FHA loan. |

|

VA loan |

Your Credit Score: Everything You Need To Know

Your credit score can have a major impact on your life. Not only do creditors typically check your score when deciding whether or not to approve your loan application and what interest rate to charge you if you are approved, but landlords, insurance companies, and even employers often check it as well. Having a good score can help you achieve your goals quickly and at the lowest possible cost.

What is a credit score?Your credit score is a mathematical assessment of the likelihood you will repay what you borrow. It is based on the information in your credit report, which tracks your credit-related activity. Types of credit include credit cards, store cards, personal loans, car loans, mortgages, student loans, and lines of credit.

For each account, your report shows who it is with, your payment history, the initial amount borrowed or credit limit , the current amount owed, and when it was opened/taken out. Your report also shows if you have experienced any credit-related legal actions, such as a judgment, foreclosure, bankruptcy, or repossession, and who has pulled your report .

There are three major credit bureaus that compile and maintain credit reports: Equifax, Experian, and TransUnion. Theoretically, all three of your reports should be the same, but it is not uncommon for creditors to report to only one or two of the bureaus.

The following are the factors that are used to calculate your FICO score:

Improving your score Following these habits can boost your score:

You May Like: Can Lexington Law Remove Repossessions

Get A Secured Credit Card

Secured credit cards can be used to improve your credit score as they allow you to show you can make credit repayments, they add to your available credit which will improve your score and they allow you to show a low credit utilization which will improve your credit score.

Getting approved for most credit cards will be difficult if you have a low credit score but a secured credit card can help you overcome this.

Secured credit cards will approve you if you pay a deposit as part of your secured credit card application.

This deposit is usually your credit limit or a percentage of your credit limit. Secured credit cards arent very common in the Uk.

Capital one was known to offer one and you should contact them to see if this is still available.

You should be aware that secured credit cards will have low credit limits and high APRs. This can lead you to fall into serious debt if you fail to keep up your monthly credit repayments.

How To Improve Your Credit Score

- Use credit often. It might seem counterintuitive, but the more you use your card the faster you can build up your score, so long as you keep up with payments.

- Make payments on time. Your payment history accounts for roughly 35% of your credit score so its important to be consistent.

- Pay your balance off each month. Pay off your balance in full every month to improve your score and save money on interest.

- Mix up your credit types. Make on-time payments on a variety of debts, including credit cards, mortgages, loans and leases.

- Avoid applying for too much credit. Make sure you only apply for credit you absolutely need, since every credit check on your account will drag down your score.

- Keep a low balance on multiple cards. Avoid consolidating your debts onto one card because it can max out your limit and damage your score.

- Dont cancel old credit cards. Instead of cancelling a card you no longer want, you should freeze your account but keep it open. This maintains your total credit amount and the length of your credit history.

- Correct errors in your credit report. Contact the credit bureau if you notice an error on your report and ask it to fix it.

You May Like: Is Chase Credit Score Accurate