How Do You Check Your Credit Score In Canada

Nearly half of Canadians dont know where to check their credit scores.

In Canada, your credit score is calculated by two different credit bureaus: Equifax and TransUnion. You can request a free copy of your credit report by mail at any time though your credit score is not included on the reports.

Both of these bureaus can provide you with your credit score for a fee, and also offer credit monitoring services. For more information visit TransUnion or Equifax.How do you improve your credit score?

When you understand how your credit score is calculated, its easier to see how you can improve it. Thats the good news: no matter how bruised your score is, there are a few relatively easy ways that you can change your behaviours and improve it.

1. Make regular payments

One of the easiest ways to improve your credit score or to build it from the ground up is to make consistent, regular payments on time over time. These are things that potential lenders love to see: consistency, dependability, regularity and history.

When it comes to credit cards, the best financial advice is always to pay it off every month so youre never running a balance. Making regular payments is one of the best habits to get into because youre always paying down your debt.

2. Close your newer accounts

3. Accept an increase on your credit limit

Just be careful you’re not getting into more debt in an attempt to improve your credit score.

4. Use different kinds of credit when possible

Smart Tips To Improve Your Cibil Score

-

Dont be a co-signer for a loan unless you dont need to borrow around the same time

-

Avoid acquiring too many debts over a short period of time

-

Ensure you repay all your EMIs and credit card bills on time

-

Use debt consolidation loans as and when necessary so that your dues arent handed over to a debt collection agency

-

Be cautious about borrowing loans without a proper repayment plan in place

-

Always negotiate your rate of interest with lenders to keep your costs down

-

Dont borrow the entire amount you receive a sanction for

-

Choose a shorter loan tenor to repay your loan fast and at a lower interest payment

-

Talk to a CA or financial planner to get help on saving taxes and managing your money more efficiently

-

If you dont have any credit history, borrow a small personal loan and repay it on time to build a credit score

Now that you know everything from A to Z about your CIBIL credit score, be smart about your financial practices. Try to keep your CIBIL score high and youll be able to access funds on your terms.

What Does It Mean If Your Credit Score Is Low

A lower credit score means you might be seen as a high risk borrower. For example, if your credit report shows that youâve defaulted on a previous debt, your credit score is likely to be lower.

If you have a lower score, lenders might offer you credit at a higher interest rate or reject your credit application altogether. But don’t worry, there are plenty of steps you can take to improve your score.

You May Like: Does Opensky Report To Credit Bureaus

Credit Score: Is It Possible To Get

Adam McCann, Financial WriterMar 26, 2021

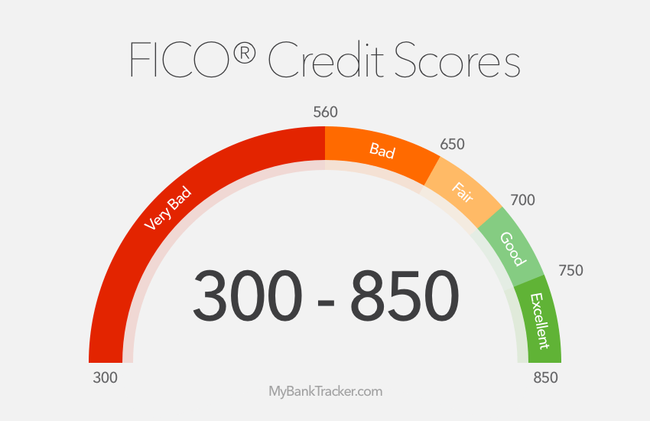

The most popular credit scores all use a range of 300 to 850. So a credit score of 900 isnt possible with those models, which include VantageScore 3.0 and 4.0 as well as FICO 8 and 9. But some older models, as well as some alternative scores, do go up to 900 . Its good to be familiar with these ratings, but you probably wont encounter them often.

So you should worry far more about where you stand on the standard credit score range. And you can see exactly where that is by checking your latest credit score for free on WalletHub.

Below, you can learn more about credit scores with unusually high ranges as well as which number you should really target on the standard credit score range.

What Is The Difference Between Cibil Equifax Experian & High Mark

These are four credit information companies that function under the RBIs approval.They have various similarities and differences that are listed below.

1. CIBIL

-

It is the oldest and most popular in India today and also offers market insights and portfolio reviews for businesses apart CIBIL score and reports for individuals.

-

Its scoring system ranges from 300 to 900, with 900 being the highest and 300 being the minimum CIBIL score.

-

It offers businesses a Company Credit Report and a CIBIL Rank.

2. Equifax

-

It was granted its license in 2010.

-

Its scoring system is on a scale of 1 to 999, with 1 being the lowest and 999 being the highest score.

-

It also offers additional facilities like credit risk and fraud management, portfolio management and industry diagnostics.

3. Experian

-

It received its license for operation in India in 2010, but is an international company in existence since 2006.

-

The Experian score ranges from 300 to 900 with 300 being the lowest and 900 being the highest.

-

It offers several services for consumers and organisations like customer acquisition, collection and money recovery, customer management, data analytics, customer targeting and engagement.

4. High Mark

You can choose any one from these companies to calculate your credit score and so can lenders and other parties.

Don’t Miss: Does Speedy Cash Report To Credit Bureaus

How To Get An Excellent Credit Score

If your credit score falls within the good, fair or bad ranges and you want to get an excellent credit score, follow these tips to help raise your credit score.

- Make on-time payments. Payment history is the most important factor in your credit score, so it’s key to always pay on time. Autopay is a great way to ensure on-time payments, or you can set up reminders in your calendar.

- Pay in full. While you should always make at least your minimum payment, we recommend paying your bill in full every month to reduce your utilization rate. .

- Don’t open too many accounts at once. Each time you apply for credit, whether it’s a credit card or loan, and regardless if you’re denied or approved, an inquiry appears on your credit report. Inquiries temporarily reduce your credit score about five points, though they bounce back within a few months. Try to limit applications and shop around with prequalification tools that don’t hurt your credit score.

Benefits Of Knowing The Maximum Credit Score

As we mentioned before, knowing the maximum credit score is important because it gives you a framework for whats possible and it helps you understand how much improvement you need to make in order to break into that Excellent threshold.

If youre like most of the U.S. population, you have some room for improvement. Lets look at some of the ways you can improve your credit score.

Read Also: Itin Number Credit Score

Why Can I See My Fico Score But Others On My Account Cant See Theirs

You can see your FICO® Score because you are the primary account holder of an eligible account.

Others may not be able to view their scores if:

- They recently opened a new account

- Theyre an authorized user on someone elses account

- They have a billing statement in someone elses name

- They do not have an eligible account in Wells Fargo Online®

Ways To Improve Your Credit Score

If youre looking to improve your score, there are some basics that you can work on. Those are:

If you put some of these strategies into play, its not difficult to move from one credit ranking to another.

Recommended Reading: Can I Get A Repossession Off My Credit

Is It Necessary To Have The Highest Credit Score

Any credit score thats 800 and up is exceptional, with the highest credit score possible being 850. But is having the highest score necessary?

Fortunately, no, its not. Thats a great goal to aim for, but its also pretty uncommon. It takes a lot of credit history to reach an 850 score.

Of the individuals surveyed by FICO®, the average age of their oldest account was 30 years old. That means its going to be harder for young adults to achieve such a high credit score, merely because they just dont have time on their side.

And a credit score of 740 or higher is considered excellent. So reaching this score is a good goal, as it will be enough to help you qualify for the lowest rates on a loan or mortgage.

Ways To Help Build Your Credit

If your credit score falls below the Canadian average of 667, donât stress. Many individuals fall into this category, and there are concrete steps you can take to build your credit. Here are just a few of the steps you can take:

1. Pay your bills on time!

Paying your bills on time â every time â is one of the best things you can do to improve your credit score. Your payment history is the largest factor that impacts your credit score, and it makes up 35% of your score. Use a free bill tracking app to monitor your bills, or try setting up monthly automatic payments so you donât miss your bills. If you have any past due accounts, try to pay off the oldest ones first.

2. Keep your credit utilization under 30%

Your credit utilization is the second largest factor that impacts your credit score. Itâs the amount of credit youâve used versus the total amount of credit you have available. You should aim to keep your credit utilization below 30%. This means if you have a credit card with a limit of $3,000, then you should keep the balance below $1,000.

3. Regularly monitor your credit score

Don’t Miss: Minimum Credit Score For Amazon Visa

What Is The Average Canadian Credit Score

Rachel Surman

â¢7 min read

Article Contents

Your credit score is that magic number that helps you reach major milestones in your life. There are many reasons why your credit score is important. Lenders look at your credit score before approving you for credit cards, car loans, and mortgages, so you should know what your score is before applying. Itâs also good to know where you stand compared to others in the country.

According to 2021 data from over 1 million Borrowell members, the average Canadian credit score is 667. Having a credit score above this average will make it easier to qualify for credit products, so you should use this as a benchmark to compare your own credit score. If your score is below this average, there are different ways you can improve your credit score.

In 2020, the average credit score of Borrowell members was 649. This means that during the COVID-19 pandemic, the average credit score of our members improved by 18 points. Government relief measures, along with cautious spending and improved financial habits, have helped many Canadians cover their bills and improve their credit scores during the past year. This is a great result!

Not sure where you stand? You can use Borrowell to check your credit score in Canada.

Who Calculates Your Credit Score

Your credit score is calculated by a credit reference agency . There are 3 CRAs in the UK: Equifax, Experian and TransUnion. At ClearScore, we show you your Equifax credit score, which ranges from 0 to 700.

Each CRA is sent information by lenders about the credit you have and how you manage it. Other information, such as public records like the electoral roll and court judgments, are also sent to the CRAs and form part of your credit report.

Don’t Miss: Is Paypal Credit A Hard Inquiry

Why Is Having A High Credit Score Important

While its not necessary to have an 850 score, its important to maintain a high credit score. This will make it easier for you to buy a home, purchase a car and even get a job.

Your credit score shows your history of repaying your debts and making your monthly payments on time. If you have an excellent or even perfect credit score, the lender assumes youre not a risky investment because they assume that you will treat new credit as you have credit in the past and pay it back responsibly.

But, if your credit history shows that you dont pay your bills on time, some lenders may be hesitant to extend you a line of credit. They may be more concerned that this pattern will repeat itself, and they will be out that money.

Many workplaces are increasingly looking to hire employees with high credit scores. Thats because a good credit score demonstrates a history of financial responsibility.

How To Keep A Great Credit Score

It may come as no surprise that many of the same strategies used to improve your credit score are the ones used to maintain a great credit score.

These strategies, of course, are directly related to the factors that contribute to your overall score. For example, paying your bills on time accounts for roughly 35 percent of your credit score. Signing up for automatic payments to avoid missed or late payments can be a way to keep your high credit score.

Similarly, your credit utilization , accounts for 30 percent of your credit score. When you keep your balances low, this improves your credit utilization and therefore helps keep your score high.

For more detail on the factors that impact your score and how to maintain them, be sure to explore this recent article on credit score factors.

Don’t Miss: Speedy Cash Collection Agency

What Is A Good Credit Score

What is considered a good credit score? :59

Reading time: 3 minutes

-

Theres no magic number to reach when it comes to receiving better loan rates and terms

Its an age-old question we get, and to answer it requires that we start with the basics: What is a, anyway?

A credit score is a number, generally between 300 and 900, that helps determine your creditworthiness. Credit scores are calculated using information in your , including your payment history the amount of debt you have and the length of your credit history.

Its also important to remember that everyones financial and credit situation is different, and theres no magic number to reach when it comes to receiving better loan rates and terms.

There are many different credit score models used today by lenders and other organizations. These scores all have the same goal: to predict a consumers likelihood to pay their bills. There are some differences around how the various data elements on a credit report factor into the score calculations.

Although credit scoring models vary, generally, credit scores from 660 to 724 are considered good 725 to 759 are considered very good and 760 and up are considered excellent. Higher credit scores mean you have demonstrated responsible credit behaviour in the past, which may make potential lenders and creditors more confident about your ability to repay a debt when evaluating your request for credit.

How Do Your Actions Impact Credit Scores?

What A Fair Credit Score Means For You:

Borrowers within the “fair” credit score may push interest rates higher for their lines of credit. Borrowers in this range may incur higher charges associated with a loan or line of credit. It may be difficult to obtain a 30-year mortgage at the lower end of this range and you may expect higher interest rates. Auto loan APRs may have higher rates and credit cards may have lower limits and higher APRs.

Also Check: 1?800?859?6412

How To Get Your Credit Report In Canada

A credit report is a record of a borrowers credit history including active loans, payment history, credit limit and how much they still owe on each of their loans. Your credit activity, which is found on your credit report, impacts your credit score.

There are two national credit bureaus in Canada: Equifax and TransUnion. Once a year, you can request a free copy of your credit report by mail, though if you want instant results online, there will be a charge.

Read How to Check Your Credit Score 101 for detailed information on how to get your free credit report.

What Percentage Of The Population Has A Credit Score Over 800

According to both FICO and VantageScore, only around 1% of their reported scores are 850. As for people who have scores above 800, the percentage is a little higher. The most recent data from FICO shows around 20 percent of scores reported at over 800 points. For VantageScore the number is a little lower, coming in at 17 percent.

Recommended Reading: What Is Syncb Ntwk On Credit Report

Why Is My Credit Score Low

Lower credit scores arent always the result of late payments, bankruptcy, or other negative notations on a consumers credit file. Having little to no credit history can also result in a low score.

This can happen even if you had established credit in the past if your credit report shows no activity for a long stretch of time, items may fall off your report. Credit scores must have some type of activity as noted by a creditor within the past six months.If a creditor stops updating an old account that you dont use, it will disappear from your credit report and leave FICO and or VantageScore with too little information to calculate a score.

Similarly, consumers new to credit must be aware that they will have no established credit history for FICO or VantageScore to appraise, resulting in a low score. Despite not making any mistakes, you are still considered a risky borrower because the credit bureaus dont know enough about you.