How To Increase Your Chances Of Getting Approved For Paypal Credit

Getting approved for a PayPal Credit account requires a little planning. When applying for new credit, its essential to know your credit scores and whats on your credit reports.

PayPal wants to see a strong credit history, steady income, and low credit utilization. If youre using too much of your existing revolving credit, its a sign that you may not pay them back. Youll also want to make sure you havent applied for too much credit in the recent past. Having too many credit inquiries can lessen your chances of getting approved.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Key questions to figure out before you sign on to BNPL include:

S To Effectively Build Your Credit Score

If you are looking for ways to build your credit score, then your best bet is staying away from PayPal Credit and using a different product. If you desperately need to take out credit, consider taking out a credit card that is specifically made to build your credit score.

The electoral roll is the registry of voters. Being on the electoral roll will allow you to vote in elections, and lets the credit bureaus know where you are living. It also serves as an identity verification step that helps combat identity fraud whenever you sign up for a credit product.

You can sign up to the electoral roll on Gov.uk and it just takes a few minutes!

Think about it: if youâve never had a credit card before, how will mortgage lenders or credit companies know how you manage your debt? They donât. Thatâs why one of the best ways of building a credit score is signing up for a credit card and building credit history.

Each time you apply for credit, you are leaving a footprint on your credit report. Thatâs why you want to try reducing the number of loans you apply for as much as possible. If your application gets denied, this can lower your credit score even more.

Read Also: What Is The Best Credit Rating Agency

How Pay In 4 Works

Pay in 4 is for purchases between $30 and $600. Each purchase qualifies for the same buyer protection benefits as other PayPal purchases do. The payment frequency is 4 interest-free payments with a payment every 15 days. You pay the full balance in 6 weeks.

The first payment is a down payment due when you make a purchase.

There isnt a prepayment penalty if you pay back the balance early.

Read Also: What Does Filing For Bankruptcy Do To Your Credit Score

How Do You Get Accepted For Paypal Credit

Theres no use sugarcoating itregardless of how good your credit score is, theres no guarantee that youll get approved.

Although your credit score plays an integral role in the verification process, PayPal also considers other factors, including income and existing debt.

Thankfully, you can get the results in a matter of seconds once you finish your application on the website.

Recommended Reading: Does Closing Checking Account Affect Credit Score

Other Buy Now Pay Later Services

There are several other buy now, pay later services. We have reviewed quite a few, including Klarna, Affirm, Afterpay and Sezzle. Here are how some of the most popular options stack up to PayPal Pay in 4 and Pay Monthly:

Buy Now, Pay Later Services Compared

| Features | ||

|---|---|---|

| Everywhere online & in store w/ wireless pay | Everywhere online & select in-store retailers | Select online & in-store retailers |

Does Afterpay Run Your Credit Score

No credit check is required to use AfterPay, and no interest is charged. Customers can sign up for a free AfterPay account, shop at select online retailers, and then use AfterPay to make purchases. Requirements include: … Customers may pay in four installments every two weeks until the entire purchase is paid off.

Don’t Miss: How To Get Car Finance With Poor Credit Rating

Double Check Your Application

Even if youve got the best credit score, messing up on your application can lead to you getting denied. So make sure to fill out all the requested information carefully and then, before you submit, be sure to double check every single item to make sure its correct and complete. You dont want a minor mistake on the form to be the one thing standing between you and the awesome perks of that store card!Whether youre just trying to make your shopping experience more rewarding or looking for a good way to start building your credit, Synchrony Bank has some great options for just about every credit score. Start by looking into one of the cards mentioned above but if none of those meet your needs, theyve got nearly 100 other cards to choose from so you will definitely find something that works for you!

Paypal Credit Approval Odds

Your PayPal Credit approval odds will vary depending on your credit score and your employment status and income level.

Keep in mind, you cannot have two PayPal Credit accounts if you apply for a second account while making a purchase, PayPal will continue to charge purchases to your existing account and will not open a new account in your name.

Also Check: How To Get Student Loans Off My Credit Report

What Is A Mortgage Refinance And When Is It Done

It is simple to understand what a home refinance is and how it works. Actually, it is a refinancing of the mortgage loan. If the house were free of encumbrances, it would not be a refinancing, but rather a mortgage loan would be requested, which is a different financing option.

Therefore, when we have a mortgage on a house but we want to modify this mortgage for whatever reason, we will apply for a second loan that can pay off the first one and, in this way, continue paying for the house, generally with better conditions.

There are very different scenarios in which one can apply refinancing, the reasons will depend on each user, but the most common would be the following:

- Improve the mortgage conditions: this is one of the most common. Mortgages, being long-term products, may vary in their viability. For example, the interest rate drops make them expensive. In this context, mortgage refinancing is quite common.

- Solving a payment problem: when mortgage repayment problems arise, refinancing can be a tool to improve this situation. Through refinancing, it is possible, in some cases, to increase the amortization term decreasing the monthly payment and the pressure on the applicants economy.

How Does Paypal Credit Work What Is It

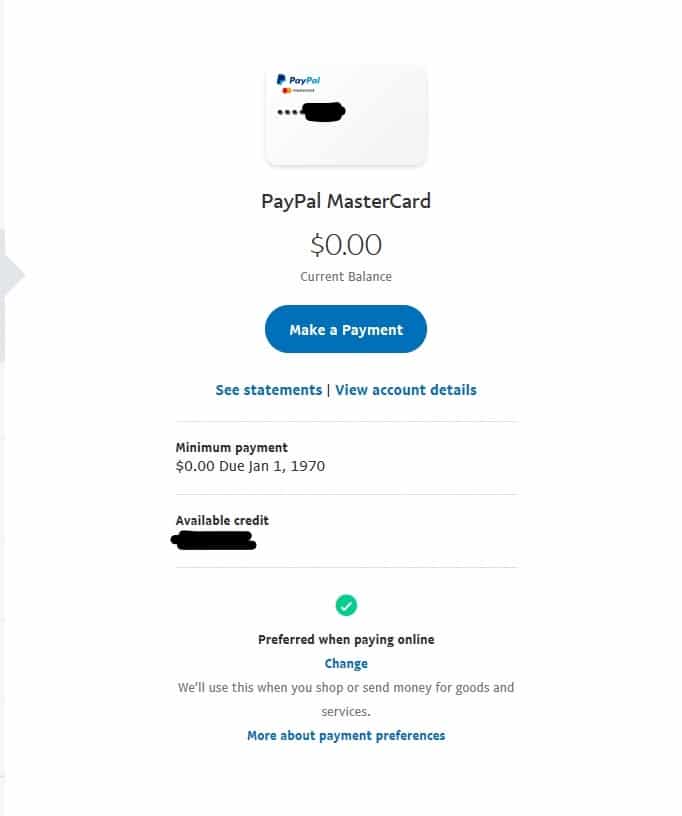

Synchrony Bank has a line of credit for PayPal Credit. Approved PayPal users can use this virtual line of credit, which works like a credit card and lets you pay for online purchases over time instead of all at once.

Approved PayPal users can use PayPal Credit as a payment option whenever they check out with PayPal, whether they are shopping online or in a store that accepts PayPal. Even though they do the same thing, PayPal Credit and PayPals Pay in 4 feature are not the same things. Pay in 4 is more like point-of-sale financing, while PayPal Credit is more like a credit card.

With PayPal Credit, youll already have gone through the verification process, and you can use your unlimited line of credit whenever you want. Also, you have more choices about how and when to pay off your debt. In the case of Pay in 4, you choose financing when you check out, and youll be given a detailed plan for making payments.

You May Like: How Bad Is A 600 Credit Score

How Does The Paypal Cashback Mastercard Compare To Other Credit Cards

View more cards

Verdict: A great choice for consumers looking for a cashback card with bonus categories

The Blue Cash Preferred® Card from American Express is an outstanding offer for a cashback credit card that offers 6% Cash Back at U.S. supermarkets on up to $6,000 per year in purchases , 6% Cash Back on select U.S. streaming subscriptions, 3% Cash Back at U.S. gas stations and on transit , 1% Cash Back on other purchases. Terms apply. Cash back can be redeemed for statement credits.

It comes with all the bells and whistles you’d expect from Amex, including a low intro APR of 0% on purchases for 12 months from the date of account opening, then an APR of 17.74%-28.74% Variable.

However, when you weed through the bonus categories offered by this card, consumers only earn 1% cash back on all other purchases not included in those spending categories. For those who prefer to earn simple flat rate rewards on every purchase rather than higher rates in a few select categories, the PayPal Cashback Mastercard® is the better choice. For consumers who prefer bonus categories, the Blue Cash Preferred® Card from American Express is the way to go.

For rates and fees of Blue Cash Preferred® Card from American Express, please click here

Is It Easy To Get Approved For Afterpay

How to qualify: Afterpay doesn’t have a minimum credit score requirement. According to the company, loan approval depends on whether there are sufficient funds available through your debit or credit card, how long you’ve been using Afterpay, the purchase price and whether you have other outstanding loans with Afterpay.

Read Also: How To See Your Credit Score For Free

When It Comes To Getting A Mortgage There Are Enough Numbers Flying Around To Make Any Mathematician Happy Lenders Will Look At A Number Of Items Which Can Include Your Credit History Your Income And How Much Debt You Have Among Other Things

But one number is perhaps one of the most important numbers of all. Your FICO® scores can impact whether you get a loan or not, and if so, at what interest rate. Thats why its important to understand the nuances of your FICO® scores. Luckily, its not rocket science. Heres the scoop on how your FICO® scores can affect your mortgage.

You May Like: Which Credit Score Is Correct

Who The Paypal Cashback Mastercard Is Best For

The PayPal Cashback Mastercard® is best for existing PayPal customers who want a straightforward way to earn cashback on all of their everyday purchases.

If a cardholder is a heavy online shopper, the Cashback Mastercard may also be a good choice because they can easily earn cash back from using the card as a payment option when they pay online using PayPal, then credit the cash back to their PayPal balance for future purchases.

Also Check: When Do Credit Cards Report Late Payments

Can Businesses Use Paypal Credit

Short Answer:

Yes, your customers can pay using PayPal Credit as long as your business accepts PayPal payments. But when it comes to using PayPal Credit for business purchases, there are better options available.

Long answer:

Businesses that accept PayPal at checkout can offer customers the option to pay with PayPal Credit, either online or in-store. If you accept PayPal as a payment form, PayPal Credit is already available to customers who check out with PayPal at no additional cost to your business.

When a customer makes a purchase using PayPal Credit, PayPal deposits the full amount of the purchase into your account just as with any other PayPal transaction, so there is no added risk to you as a PayPal merchant accepting a PayPal Credit payment is the same as accepting any other PayPal payment. However, if you make PayPal sales online, you can promote PayPal Credit financing options on your website, which might be of added benefit to businesses that sell large-ticket items online.

So Are Bill Me Later Programs Worth It

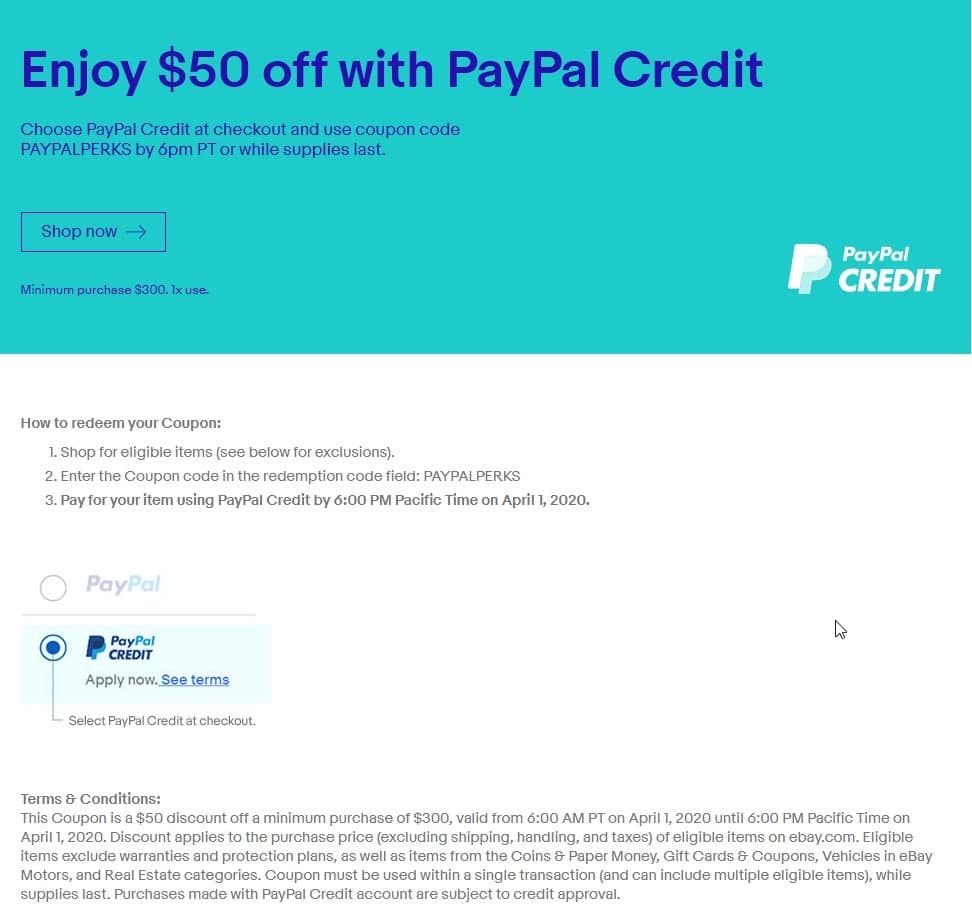

If you already have a Paypal account, you may be wondering if this payment option is worth it. Paypal Credit is very similar because they offer six months with no interest on purchases over $99 . This Paypal service can be attractive to some, but it can also be dangerous if you donât trust yourself to pay off the balance by the end of the six month period.

Paying off your entire balance within six months means you wonât pay interest on the purchase. However, if you still have a Paypal balance after six months, you will be charged interest all the way back to the transaction date. That will make the purchase much more expensive when going with this payment method.

So how do you choose whether to use a credit card or a service like Paypal Credit? For most, it will come down to the convenience for online shopping. Instead of looking for your credit card and entering your information, you can quickly log into your Paypal Credit account and checkout with this payment method.

Paypal Credit also makes a case that they are the safer way to make a transaction online. Because they process transactions through a third-party, there is an extra level of security, something you donât have when using a credit card.

Read Also: What Is Your Credit Score When You Have No Credit

The Ways In Which Paypal Credit Affects Your Credit Score Uk

When You Apply For Paypal Credit

Your credit score will be verified when you apply for PayPal Credit. If you are accepted, PayPal will conduct a thorough credit check, which will be recorded on your credit report. One hard check should have little effect on your , but it will reduce it by a few points.

If You Ever Miss Any Payments

If you do not repay what you owe, PayPal Credit will likely affect your credit score. PayPal will refer your case to a debt collection agency if you fail to pay your payment for an extended period of time. The agency will report the debt to the credit agencies, and you will see a credit account on your credit report, which will affect your credit score.

If You Increase Your Credit Limit

PayPal Credit may conduct a hard or soft in particular instances. If you seek an increase in your credit limit, PayPal will conduct a soft check that will not appear on your credit report. After three months, PayPal may make you an offer to increase your credit limit.

Keep in mind that if you increase your credit limit without increasing your expenditure, your credit utilisation rate will decrease, which will boost your credit score.

If You Terminate Your Account

Closing your account may temporarily hurt your because you will have less credit available in your accounts. If you shut your account without paying off your outstanding balance, your credit score will suffer even more.

Is 7 Credit Cards Too Many

As with almost every question about credit reports and credit scores, the answer depends on your unique credit history and the scoring system your lender is using. “Too many” credit cards for someone else might not be too many for you. There is no specific number of credit cards considered right for all consumers.

Also Check: Do Late Fees Affect Credit Score

What Credit Score Do You Need For A Home Refinance

No exact measure logically tells us that the higher the credit score, the easier it is to obtain any financing, and mortgage refinancing is no exception.

Typically, the minimum FICO score needed to avoid problems when applying for a refinance would be 620. A score that could be considered good could be around 680. Finally, a score of 720 is considered excellent for a refinance and would probably smooth out any application.

It is important to understand that below the minimum score of 620, it is also possible to obtain a refinance. However, the fundamental problem will be that it will be more expensive, with interest applied, and will probably require additional guarantees to the mortgage. Of course, it will also be more rigid on issues such as income stability.

What Is Bill Me Later

PayPal uses its credit line to allow shoppers to purchase items now and pay later. Unlike a credit card, Bill Me Later charges no interest on purchases of $99 or more as long as you pay off the full amount within six months. Your purchase will be broken into six monthly installments, making it easier for you to make large purchases on sites like eBay. At the end of the six months, if you haven’t paid the full amount, you’ll be charged interest at an APR of 25.99 percent going all the way back to the posting date.

Read Also: Does Robinhood Affect Credit Score