How To Update Information On Your Credit Report

In a Nutshell

The offers that appear on our platform are from third party advertisers from which Credit Karma receives compensation. This compensation may impact how and where products appear on this site . It is this compensation that enables Credit Karma to provide you with services like free access to your credit score and report. Credit Karma strives to provide a wide array of offers for our members, but our offers do not represent all financial services companies or products.

Negative Information If Any

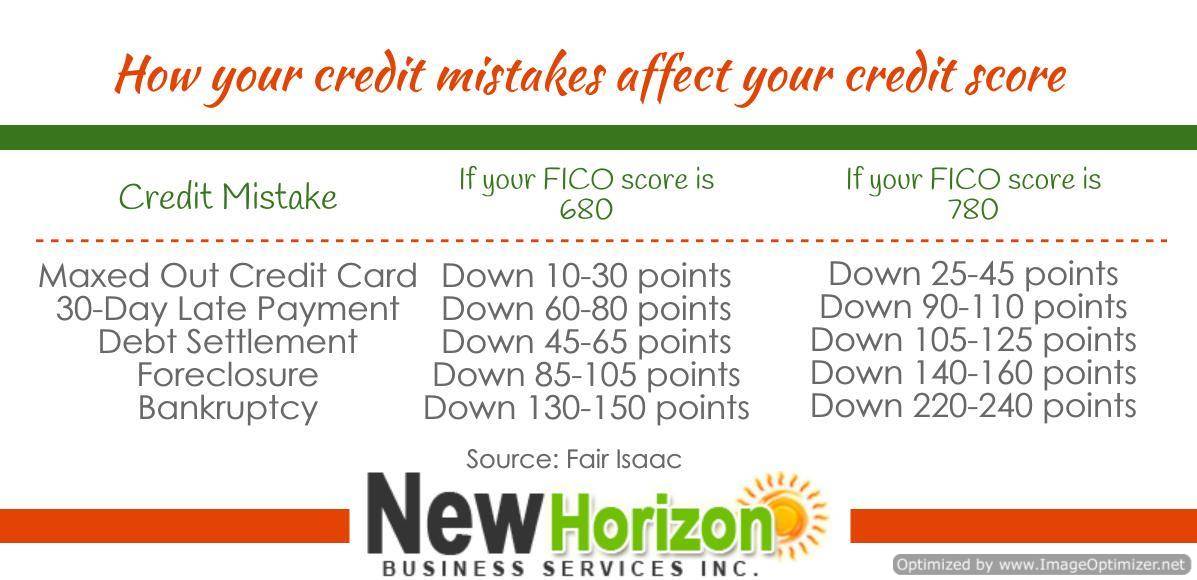

The negative information section will list accounts that haven’t been paid as agreed, collections and public records such as bankruptcies. Negative information generally stays on your credit report for seven years, with the exception of Chapter 7 bankruptcies, which stay on your report for 10 years.

In this section, youll want to make sure any negative information is accurate. If you see incorrect accounts or collections or if something is being listed after it was supposed to have dropped off, dispute the entries immediately to have them removed from your report.

When Does Info On Credit Reports Get Updated

We regularly get questions from readers who are curious about when a new account will show up on their credit reports and how often lenders report information to the bureaus. As a result, we reached out to a selection of the largest credit card issuers for answers. You can find information about their policies below.

| Within 30 days of approval | Monthly |

Recommended Reading: Paypal Credit Bureau

How Do I Get A Copy Of My Credit Report

Everyone is entitled to one free credit report per bureau per year by federal law. You can access yours at AnnualCreditReport.com. You’ll have to answer some security questions to verify your identity and then you can view your reports. You have the choice to view all three reports at the same time or to space them out throughout the year.

If you’ve already used your annual free credit reports for the year, you can purchase additional credit reports from the credit bureaus themselves. Some credit monitoring companies may also offer credit reports to customers who sign up for their services.

Why Is A Credit Report Important

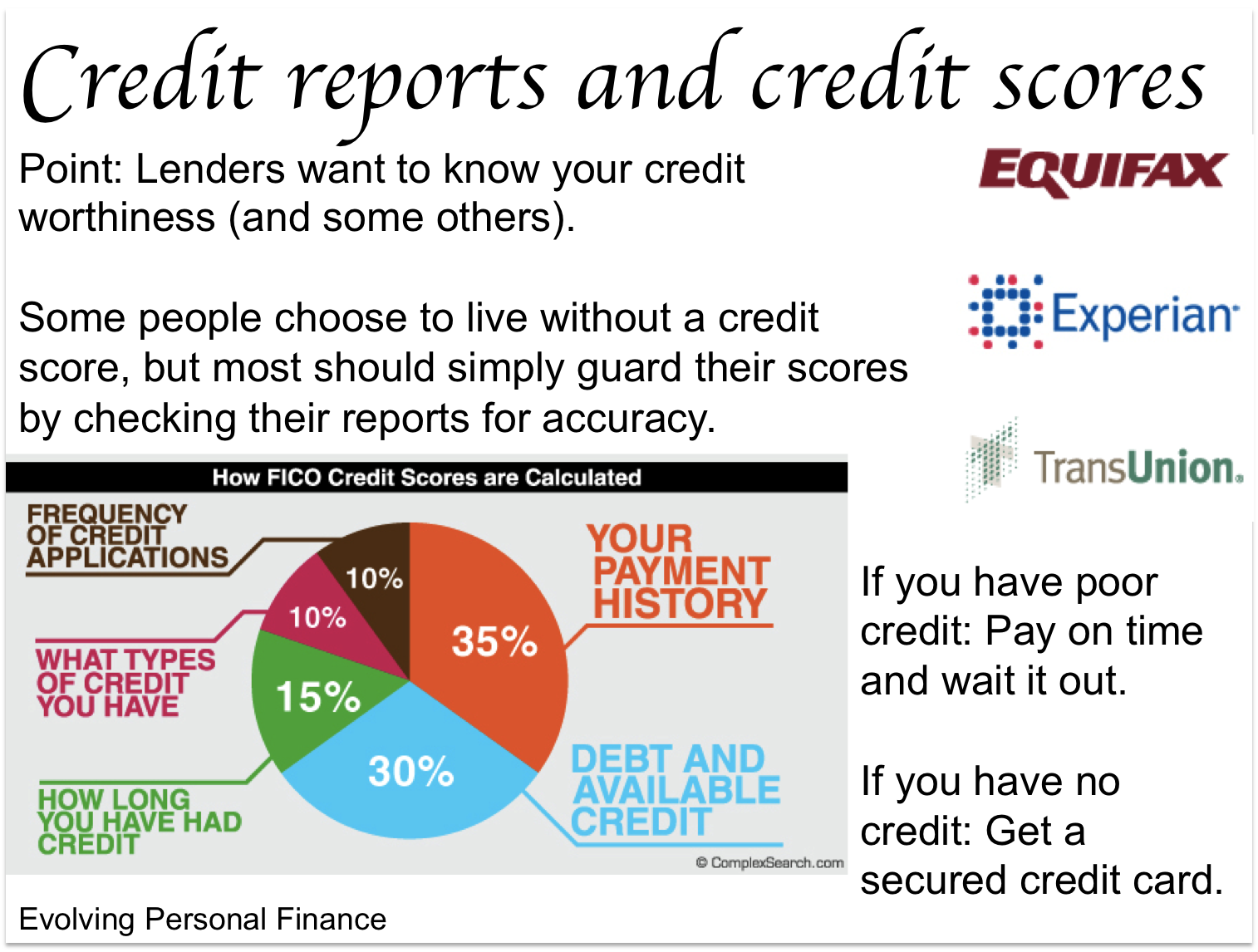

Your credit reports are what your credit scores are based on. You have three reports, one for each of the three major credit bureaus — Equifax, Experian, and TransUnion. While these reports are more or less the same, some lenders only report information to one or two of the bureaus instead of all three, so there can be some variation.

Your credit score is a three-digit number that’s based on the information in your credit reports. Think of it like a grade of your financial responsibility. Lenders use your credit reports and scores when deciding whether they want to work with you. A good credit score and a report without any concerning information will get you the best interest rates and increase your odds of getting approved. Conversely, a bad credit score and a report with several black marks is more likely to get you denied. If lenders do work with you, they’ll probably charge you higher interest rates to hedge their bets.

An increasing number of companies, apart from banks and financial institutions, are also starting to look at credit reports as a way of measuring a person’s responsibility. Some employers pull credit reports on prospective employees, especially if that employee will be working in a role managing company or customer funds. Some landlords look at credit reports for prospective tenants before approving them, and even some cell phone and cable providers run a quick credit check when you sign up for their services.

Also Check: Why Is There Aargon Agency On My Credit Report

How To Get A Copy Of Your Credit Report From All Three Major Credit Bureaus

You can order one free copy annually of your credit report from Equifax, Experian and TransUnion by requesting it online with each bureau. Or get your hands on all three reports at once by ordering them at AnnualCreditReport.com.

Youre also entitled to a free copy of your credit report from a credit bureau that provided a report to a creditor that declined your credit application.

Why Does Information Differ Between Credit Reports

When you check your credit reports with each bureau, the information listed may vary between reports. A side-by-side comparison may show more inquiries on one report versus another, or different balances listed. This can happen since creditors aren’t required to report your account to any or all bureaus. However, most creditors report to at least one bureau.

For instance, a creditor may check your credit with Experian. This results in an inquiry on your Experian credit report, but may not appear on your Equifax or TransUnion reports.

Learn more: Keeping track of your credit report doesn’t have to be a manual process if you sign up for a credit monitoring service. CNBC Select ranked the best free and paid credit monitoring services that automatically provide daily alerts for new information on your credit report, access to your credit score and more.

You May Like: Who Is Syncb Ppc

How To Get A Credit Report

The Fair Credit Reporting Act requires Experian, Equifax and TransUnion to provide you a free copy of your credit report once, every 12 months.

There is a charge for credit scores, but the credit report is free.

To get a free credit report, go online to www.annualcreditreport.com or call 1-877-322-8228 and request it. This is the only website authorized to fill orders for free credit reports. Once there, each agency must supply you one credit report every 12 months. You could receive all three reports at once, or spread them out over 12 months depending on the purpose you have.

If you want to examine the three together and compare all the information contained in each report to be sure its accurate , you should request all three at the same time.

Since the information on all three should essentially be the same, you may want to ask for one report every four months and verify each time that the information remains accurate.

If you already received a free report from each of the bureaus and want to check your credit report again, you can contact any of the three reporting agencies and order one for a small charge, usually under $10.

Other Accounts Included In A Credit Report

Your mobile phone and internet provider may report your accounts to your credit bureau. They can appear in your credit report, even though they arent credit accounts.

Your mortgage information and your mortgage payment history may also appear in your credit report. The credit bureaus decides if they use this information when they determine your credit score

A home equity line of credit that is added to your mortgage may be treated as part of your mortgage in your credit report. If your HELOC is a separate account from your mortgage, it is reported separately.

You May Like: How To Remove Repossession From Credit Report

What’s In Your Credit Report

Your credit report contains personal information, credit account history, credit inquiries and public records. This information is reported by your lenders and creditors to the credit bureaus. Much of it is used to calculate your FICO Scores to inform future lenders about your creditworthiness.

Although each of the credit bureausExperian, Equifax and TransUnionformat and report your information differently, all credit reports contain basically the same categories of information.These four categories are: identifying information, credit accounts, credit inquiries and public records.

Inquiries On Your Credit

This section lists times when someone checked your credit. Youll see inquiries when you applied for new credit or limit increases, as well as ones related to things like housing or utility applications. Entries may be separated by type:

-

Hard inquiries happen when you authorize a potential creditor to check your file as part of an application. These can cause a small, temporary dip in your credit scores.

-

Soft inquiries, which dont affect your credit scores, happen when you check your own credit or a potential creditor sees if it wants to send you a promotional offer.

Both types of inquiries will include the name and address of the organization, as well as the date. Make sure that all hard inquiries were authorized by you and that they fall off your report after two years.

Also Check: Is 626 A Good Credit Score

One Email A Day Could Help You Save Thousands

Tips and tricks from the experts delivered straight to your inbox that could help you save thousands of dollars. Sign up now for free access to our Personal Finance Boot Camp.

By submitting your email address, you consent to us sending you money tips along with products and services that we think might interest you. You can unsubscribe at any time. Please read our Privacy Statement and Terms & Conditions.

How Do I Order My Free Annual Credit Reports

The three national credit bureaus have a centralized website, toll-free telephone number, and mailing address so you can order your free annual reports in one place. Do not contact the three national credit bureaus individually. These are the only ways to order your free credit reports:

- Complete the Annual Credit Report Request Form and mail it to:

Annual Credit Report Request Service

P.O. Box 105281

Atlanta, GA 30348-5281

Also Check: Does Zebit Report To Credit Bureaus

How To Read A Credit Report

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Regularly reviewing your credit reports lets you check for errors that might be lowering your credit scores, and it can tip you off to potential identity theft. You can use the dispute process to get mistakes removed, which may help you qualify for credit or get better terms.

How Often Is My Credit Report Updated

Your credit report is updated frequently, as new information is reported by lenders and older information is gradually removed per federal retention requirements.

However, it’s important to also know that most lenders report changes in account status, such as payments you’ve made or whether you’ve fallen behind, on a monthly basis. If you make a payment on one of your accounts, it’s possible that the payment won’t appear on your credit report for up to 30 days.

You May Like: Zebit Report To Credit Bureau

Checking Your Nationwide Specialty Credit Reports

Several nationwide specialty credit reporting agencies also exist. These agencies keep records on particular types of transactions, like tenant histories, insurance claims, medical records or payments, employment histories, and check writing histories. These agencies must give you a free report every twelve months if you request it. To get a specialty credit report, you’ll have to contact each agency individually.

How to Stop Getting Prescreened Credit Card and Insurance Offers

Under the FCRA, credit reporting agencies are allowed to include your name on lists that creditors and insurers use to make offers to you, even though you didn’t initiate the process. ). The FCRA also provides you the right to opt out of receiving these offers , which prevents the agencies from providing yourcredit file informationfor these offers. ). You can opt out for five years or permanently.

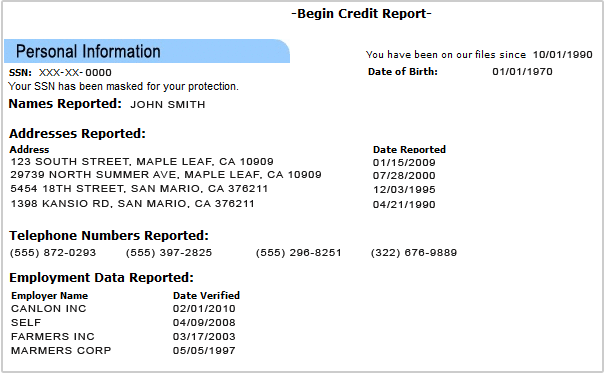

What’s On Your Credit Report

Personal Information including your name, current and previous addresses, current and previous employers, your Social Security Number, your telephone number, and your date of birth are on your report. Age cannot be used as a factor in employment or credit decisions. Your date of birth is collected in most cases to verify identity. Your credit report does NOT include gender, ethnicity, religion, political affiliation, medical history, criminal records or your credit score.

includes information about credit accounts that were opened in your name or accounts for which you are an authorized user. Accounts may include retail credit cards, loans from a financial institution or finance company, mortgages and home equity loans, and bank credit cards. It generally does NOT include information about your experience with checking or savings accounts. For each account, your credit file includes the creditor’s name, your account number, how much you borrowed, how much you still owe, your credit limit, dates the accounts were opened, updated, or closed, and your repayment history. Repayment history categories include: paid as agreed, 30 days or more late, 60 days or more late, 90 days or more late, and closed by lender due to default.

Don’t Miss: Can I Get A Credit Report With An Itin Number

Do I Need To Get My Credit Score

It is very important to know what is in your credit report. But a credit score is a number that matches your credit history. If you know your history is good, your score will be good. You can get your credit report for free.

It costs money to find out your credit score. Sometimes a company might say the score is free. But if you look closely, you might find that you signed up for a service that checks your credit for you. Those services charge you every month.

Before you pay any money, ask yourself if you need to see your credit score. It might be interesting. But is it worth paying money for?

What Information Is On A Credit Report

by Kailey Hagen | Dec. 2, 2019

Many or all of the products here are from our partners. We may earn a commission from offers on this page. Its how we make money. But our editorial integrity ensures our experts opinions arent influenced by compensation. Terms may apply to offers listed on this page.

Everyone should know about their credit report information.

You probably think you’re done with report cards once you’re finished with school, but there’s one that follows you from the day you open your first credit card or loan account until the day you die — your credit report. Your credit report information is a record of how you manage borrowed money, and it can affect your chances of getting loans, , apartments, and even jobs.

It’s a pretty big deal, so you ought to know what yours is saying about you. Here’s everything you need to know about your credit report information and how you can check yours.

Don’t Miss: Does Balance Transfer Affect Credit Score

Financial Information In Your Credit Report

Your credit report may contain:

- non-sufficient funds payments, or bad cheques

- chequing and savings accounts closed for cause due to money owing or fraud committed

- bankruptcy or a court decision against you that relates to credit

- debts sent to collection agencies

- inquiries from lenders and others who have requested your credit report in the past three years

- registered items, such as a car lien, that allows the lender to seize it if you don’t pay

- remarks including consumer statements, fraud alerts and identity verification alerts

Your credit report contains factual information about your credit cards and loans, such as:

- when you opened your account

- how much you owe

- if your debt has been transferred to a collection agency

- if you go over your credit limit

- personal information that is available in public records, such as a bankruptcy

Your credit report can also include chequing and savings accounts that are closed for cause. These include accounts closed due to money owing or fraud committed by the account holder.

Whats The Purpose Of My Credit Report

Your credit report shows your credit history and tells a story of your financial health and responsibility to potential lenders like credit card companies, banks, and often even landlords and cell phone companies. Credit reporting empowers you to participate in the credit economy and have potential offers of credit extended to you.

You May Like: What Is Syncb Ntwk On Credit Report

How Credit Bureaus Get Information

A credit bureau is a clearinghouse for credit information about consumers. There are more than 1,000 local and regional credit bureaus around the country that gather information about your credit habits directly from your creditors. Typically, these smaller local and regional bureaus are affiliated with one of three large national credit bureaus — Equifax, Experian and TransUnion .

For example, let’s say you apply for a credit card and provide the card company with all of your personal information, such as your name and address, your previous address , your employer, other credit cards you have, etc. The credit card company then contacts a and reviews your credit report. If the company approves your application for a credit card, then the information you’ve supplied is forwarded to the CRA. That credit card company also reports your payment history to the CRA, so that becomes part of the report. The CRAs also access information about you from public record information such as court records.

You can find the contact information for all three national credit bureaus in the United States.

While the report itself only relays the history of your dealings with creditors, potential creditors can learn a lot from this. Read on to find out how professionals interpret your credit report.

What Information Do I Have To Give

To keep your account and information secure, the credit bureaus have a process to verify your identity. Be prepared to give your name, address, Social Security number, and date of birth. If youve moved in the last two years, you may have to give your previous address. Theyll ask you some questions that only you would know, like the amount of your monthly mortgage payment. You must answer these questions for each credit bureau, even if youre asking for your credit reports from each credit bureau at the same time. Each credit bureau may ask you for different information because the information each has in your file may come from different sources.

You May Like: What Credit Score Do You Need For Affirm