Contents Of A Credit Analysis Report

A credit report includes different types of information that lenders and other interested parties can use to verify the identity and creditworthiness of a potential borrower. The main components of a credit report include the following:

1. Identity Information

A credit report includes a section on the basic identification information of an individual, including the name, physical location, employment, date of birth, and Social Security number. The report may include a list of previous addresses, places of employment, and any misspellings of the name.

The identifying information is not used to assess the Credit ScoreA credit score is a number representative of an individual’s financial and credit standing and ability to obtain financial assistance from lenders. Lenders use the credit score to assess a prospective borrowers qualification for a loan and the specific terms of the loan. of an individual. Lenders or institutions may request the credit report to verify the identity of a potential borrower and prevent cases of identity theft.

2. Credit Accounts

The credit accounts section contains information about the past and current credit accounts that have been reported by past lenders and creditors. Ideally, the section contains information on the different types of credit accounts associated with an individual.

3. Credit Inquiries

4. Bankruptcy and Repossessions

Request Your Free Medical History Report

You have the right to get one free copy of your medical history report, also known as your MIB consumer file, each year. You can request a copy for:

- Yourself

- Someone else, as a legal guardian

- Someone else, as an agent under power of attorney

You can request a medical history report online from MIB or by phone at 1-866-692-6901.

Not everyone has a medical history report. Even if you currently have an insurance plan, you won’t have a report if:

- You haven’t applied for insurance within the last seven years

- Your insurance policy is through a group or employer policy

- The insurance company isnt a member of MIB

- You didnt give an insurer permission to submit your medical reports to MIB

Consent And Credit Checks

In general, you need to give permission, or your consent, for a business or individual to use your credit report.

In the following provinces a business or individual only needs to tell you that they are checking your credit report:

- Prince Edward Island

- Saskatchewan

Other provinces require written consent to check your credit report. When you sign an application for credit, you allow the lender to access your credit report. Your consent generally lets the lender use your credit report when you first apply for credit. They can also access your credit at any time afterward while your account is open.

In many cases, your consent also lets the lender share information about you with the credit bureaus. This is only the case if the lender approves your application.

Some provincial laws allow government representatives to see parts of your credit report without your consent. This includes judges and police.

Recommended Reading: What Is Syncb Ntwk On Credit Report

How Long Does Negative Information Stay On Your Credit Reports Ive Heard Seven Years

Positive or neutral information can stay on your credit reports indefinitely, though in practice some credit reporting agencies will remove accounts that are older. Experian, for example, no longer reports accounts that are more than ten years old if the account is closed and there is no activity on it.

Accounts such as credit cards and mortgages can stay on a credit report for many years if they are open and active.

With negative information, however, federal law limits how long that information may be reported:

So how can you be sure that these items will be removed when the time has come?

Each of the credit bureaus hard codes their credit reporting systems to look for the purge from dates. As these dates hit their 7 or 10 year anniversary they will no longer be reported. Unless you believe that an account is being reported past those time limits, there is no need to remind the credit bureaus that an item is to be removed. It is done automatically. Still, its a good idea to check your free credit report each year to make sure that is the case.

What If The Cifas Marker Is There By Mistake

If you think a Cifas warning has been put on your credit file in error, you can contact the lender who put it there to see if theyll remove it.

Be aware that credit rating agencies are unlikely to remove any entry on your report if they believe the reason the marker was put on your credit file was justified. Lenders are legally obliged to report any fraudulent attempt on your account to the credit reference agencies.

Find out more about Cifas markers on the Cifas website

Read Also: Repo On Credit Report

What Is A Credit History

Sometimes, people talk about your credit. What they mean is your credit history. Your credit history describes how you use money:

- How many credit cards do you have?

- How many loans do you have?

- Do you pay your bills on time?

If you have a credit card or a loan from a bank, you have a credit history. Companies collect information about your loans and credit cards.

Companies also collect information about how you pay your bills. They put this information in one place: your credit report.

Lesson Learned Mr Sanjay Sallaya

So, lets illustrate the whole exercise with the help of an example of Mr. Sanjay Sallaya, who is a liquor Barron and a hugely respected industrialist, who also happens to own a few sports franchises and has bungalows in the most expensive locals. He now wants to start his own airline and has therefore approached you for a loan to finance the same.

The loan is for a meager $1 million. So, as a credit analyst, we have to assess whether or not to go forward with the proposal. To begin, we will obtain all the required documents which are needed to understand the business model, working plan, and other details of his new proposed business. Necessary inspection and enquires are undertaken to validate the veracity of his documents. A TEV, i.e., Techno-Economic Viability, can also be undertaken to get an opinion from the experts in the aviation industry about the viability of the plan.

When we are finally satisfied with the overall efficacy of the plan, we can discuss the securities that will collaterally cover our loan . Mr. Sanjay Sallaya being a well-established industrialist, holds a good reputation in the business world and, therefore, will hold good recommendations. Such a proposal, if it meets all other aspects, can be presented for sanction, comfortably, and generally enjoys good terms from the banks side as the risk associated with such personalities is always assessed to be less.

also, check out the difference between Equity Research vs. Credit Research

Also Check: How Accurate Is Creditwise Credit Score

What Happens If I Have A Low Credit Score

- Youll be paying more for interest if you are granted credit.

- It will be more difficult to obtain credit when you need it.

- Banks will generally require more documentation

Having a mortgage and car loan wont hurt, but regardless, be sure to make all your required payments on time. As for old credit accounts, the popular belief is to keep them. My recommendation is to keep the oldest one, and not worry about the others. I keep the old credit card account open for this purpose I also keep it as a backup, and because Ive had it for 20+ years.

What Is My Credit Report

Think of your credit report as your financial CV. It contains information that helps lenders confirm your identity and decide whether youre a reliable borrower.

This includes details of credit accounts youve held , your current and previous addresses, and any financial connections for example, the name of the person you share a joint account with.

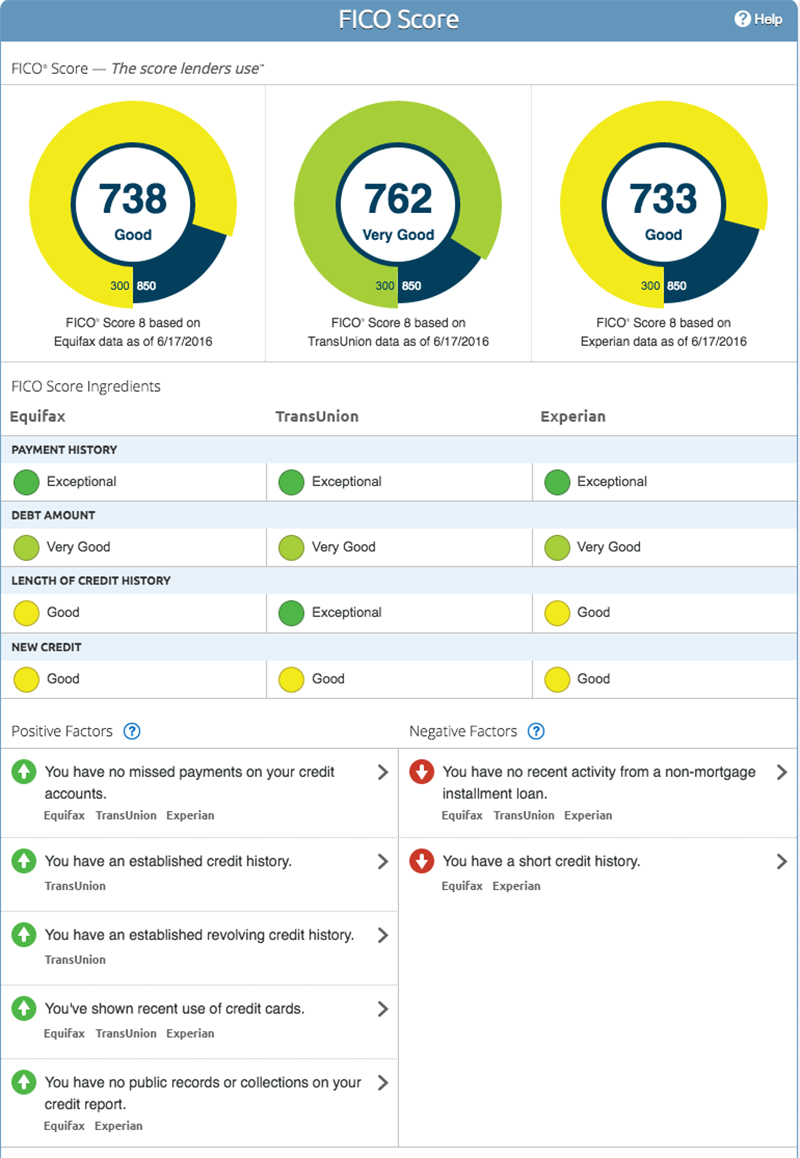

There are likely to be three slightly different versions of your credit report, because lenders dont always share the same information with all three major credit reference agencies – Experian, Equifax and TransUnion .

Read Also: Does Paypal Credit Affect Your Credit Score

Why Is A Credit Report Important

Your credit reports are what your credit scores are based on. You have three reports, one for each of the three major credit bureaus — Equifax, Experian, and TransUnion. While these reports are more or less the same, some lenders only report information to one or two of the bureaus instead of all three, so there can be some variation.

Your credit score is a three-digit number that’s based on the information in your credit reports. Think of it like a grade of your financial responsibility. Lenders use your credit reports and scores when deciding whether they want to work with you. A good credit score and a report without any concerning information will get you the best interest rates and increase your odds of getting approved. Conversely, a bad credit score and a report with several black marks is more likely to get you denied. If lenders do work with you, they’ll probably charge you higher interest rates to hedge their bets.

An increasing number of companies, apart from banks and financial institutions, are also starting to look at credit reports as a way of measuring a person’s responsibility. Some employers pull credit reports on prospective employees, especially if that employee will be working in a role managing company or customer funds. Some landlords look at credit reports for prospective tenants before approving them, and even some cell phone and cable providers run a quick credit check when you sign up for their services.

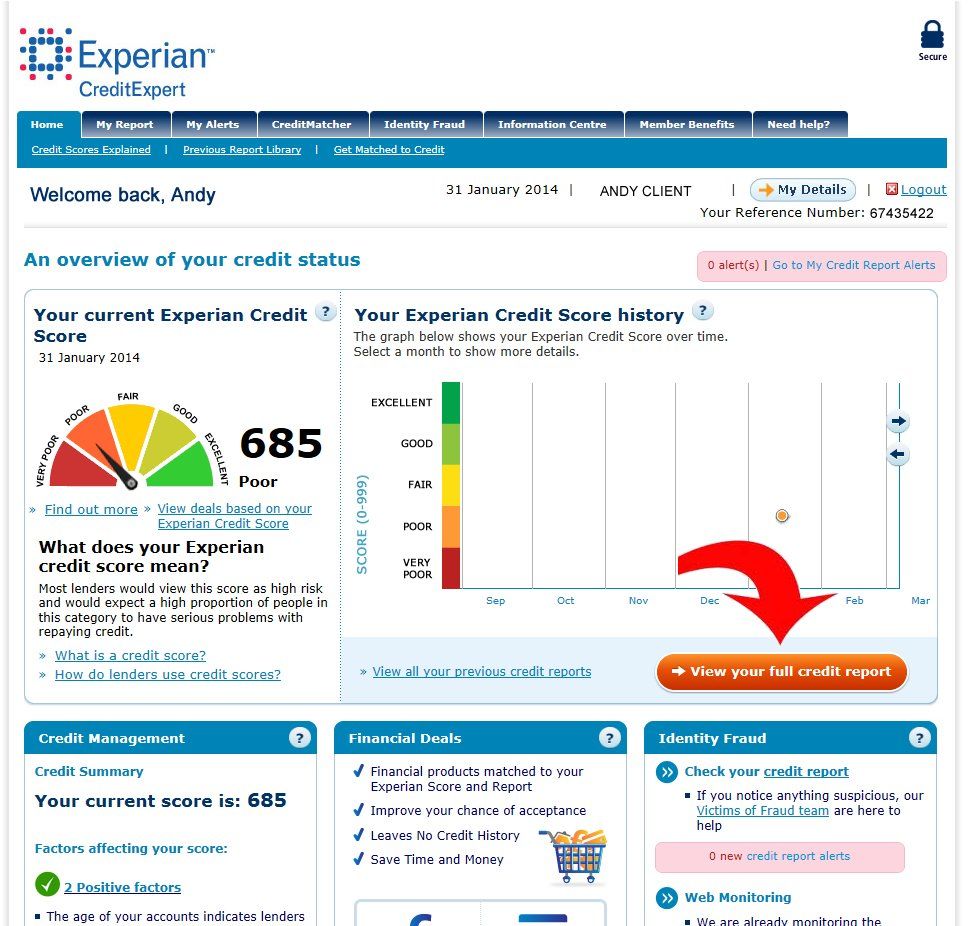

Understanding Your Experian Credit Report

Staying on top of your credit history is important to your financial well-beingand knowing what is in your credit report is the first step. Depending on where you obtain your Experian credit report, you may notice that the information is presented differently or in varying formats.

All Experian credit reports contain the information you need to assess your entire credit history. Below are the types of information you may see on your Experian credit report. The categories or order of information shown in this guide may differ from the version of your credit report you’re looking over.

Potentially negative items in your report include information on any account that was not paid as agreed, including late payments, accounts that have been charged off or sent to collections and accounts settled for less than the full amount owed. Bankruptcies are also considered negative and will appear in the public records section of your report.

Experian doesn’t make judgments about the information in your credit report, negative or otherwise. The list of potentially negative items is provided as a service to direct your attention to what Experian thinks lenders are likely to consider negative when reviewing your credit history. For example, if you have missed payments in the past, potential lenders and others viewing your credit report are likely to view this as a sign of risk.

You May Like: Affirm Minimum Credit Score

Why Don’t My Free Credit Reports Include Credit Scores

Your credit report and your credit score are not the same thing. Your credit report contains information that a credit reporting company has received about you. Your credit score is calculated by plugging the information in your credit report into a credit score formula. You may have multiple credit scores based upon who provided the score, and whether the company providing the score used their own scoring model or used a model available from a third party.

Federal law gives you the right to ask for a copy of your credit report from each nationwide credit reporting company every year for free. However, the law does not require the credit reporting companies to provide a free credit score.

Hard Pulls Vs Soft Pulls

When you apply for credit of any kind, you effectively authorize a business or individual to do what is called a hard pull or hard inquiry on your credit report. There likely will be a negative effect on your credit score from hard pulls, especially if several occur over a short period of time.

Hard pulls are another issue. Hard pulls are viewed as an indication that you need financial help to complete whatever transaction you are making, thus it has a negative effect on your credit score. The effect usually is slight, maybe 5-to-7 points, but if your credit score is on the borderline, it may drop to the wrong side of that line after a hard pull and affect the interest rate you are charged.

This should not discourage you from shopping at several lenders for auto or home loans. Fair Isaac Corporation calls this rate shopping, and allows a 45-day window where the numerous hard inquiries are treated as just one.

Also Check: How To Remove Inquiries Off Credit Report

What Is A Credit Analysis Report

A credit analysis report is a document prepared by a credit bureau, and it contains information about the credit history of an individual. The report breaks down how borrowers pay their bills, the amount of unpaid debt, and the duration they have been managing the credit accounts.

When compiling the credit analysis report, a credit bureau is interested in accounts that have not been paid, delinquent accounts that have been forwarded to collection companies, and borrowers who have filed for bankruptcy or had their assets repossessed. The information is provided to lenders when evaluating a borrowers loan application to determine their CreditworthinessCreditworthiness, simply put, is how “worthy” or deserving one is of credit. If a lender is confident that the borrower will honor her debt obligation in a timely fashion, the borrower is deemed creditworthy., based on their past credit payment history.

What Can You Do With This Information

As you can see, a credit report is quite straightforward although it can contain quite a bit of information. The good thing about a tool like Credit Simple is that it allows you to have all of this information at your fingertips and dig through it systematically.

Going through your report with a fine-tooth comb can help you in a number of ways. You can:

- Identify areas where you could improve. If you see that late payments are hurting your score more than you thought they were, its likely to propel you to make changes.

- Identify errors in your report. If you see something reported that you dispute, you can bring this up with the lender or the credit bureau. Credit Simple lets you lodge a dispute right through the tool.

- Negotiate better terms. If you see that you have a good score, you can have more confidence in negotiating with your lender for better terms like lower interest rates and reduced fees.

The information in this blog post is general in nature and does not constitute personal financial or professional advice. It is not intended to address the circumstances of any particular individual. We do not guarantee the accuracy and completeness of the information and you should not rely on it. Before making any decisions, it is important for you to consider your personal situation, make independent enquiries and seek appropriate tax, legal and other professional advice.

Also Check: What Credit Report Does Paypal Pull

Is There A Place Where I Can Explain Some Of The Negative Information On My Credit Report

Absolutely. You have the right to attach a 100-word explanation , called a consumer statement, to your credit report. It can be used to explain why, for example, you have a few late payments on your report. Anyone who looks at your credit report will see this statement. You can add your consumer statement online.

What Are The Top Ways To Rebuild Your Credit Score Quickly

A low score is a result of poor credit management, or life events such as divorce or serious illness. Your credit history reflects that you are missing or have missed payments and/or you have too much debt. These two occurrences will make it very hard to earn a high score because they drive about 65% of the points in your credit scores.

The only way to rebuild your credit scores is to address why they are low in the first place. Sounds obvious but youd be surprised how many people take a shot in the dark approach at rebuilding their credit scores. Or, they are guided by misinformation and/or unscrupulous individuals that promise a better credit score in exchange for a fee. Formulating a plan to rebuild your credit scores is not difficult. Heres how to do it:

Recommended Reading: Unlock Credit Experian

Negative Information If Any

The negative information section will list accounts that haven’t been paid as agreed, collections and public records such as bankruptcies. Negative information generally stays on your credit report for seven years, with the exception of Chapter 7 bankruptcies, which stay on your report for 10 years.

In this section, youll want to make sure any negative information is accurate. If you see incorrect accounts or collections or if something is being listed after it was supposed to have dropped off, dispute the entries immediately to have them removed from your report.

What Is Credit Reporting And How Does It Affect Me

In Canada there are two major credit reporting agencies Equifax and TransUnion. Most people commonly refer to these agencies as the credit bureaus. Credit reporting agencies do exactly that: they report credit history. They can also be referred to as an information service as they provide copies of your credit report to potential lenders. This allows the banks and other lenders to determine how much risk they are taking when they loan you money. Whenever anyone lends money they are taking a risk that it will not be repaid.

To get any significant credit, you need a good borrowing history.

Approximately once each month every major lender in Canada sends a report about their borrowers to the credit bureaus. Also, the federal Superintendent of Bankruptcy reports a list of everyone who filed a consumer proposal or bankruptcy to the credit bureaus, as well as a list of everyone who has been discharged. The credit bureaus collect this information, summarize it, and sell it to their members, the lenders.

When you apply for credit you normally sign an application that provides the lender consent to access your credit history. Generally this consent allows then access not only the first time you apply, but anytime afterwards as well, as long as your account is open. It is also this consent that allows the lender to provide the bureau information on your payments etc. once you have been approved.

Read Also: Does Barclaycard Report To Credit Bureaus