Getting Auto Loans With A 723 Credit Score

There is no credit score too low to get an auto loan, and youll be able to get one when your credit score is 723. However, if you want the best interest rates on the market, youll probably need to wait until you get your score a bit higher.

According to a 2020 quarterly report by Experian, people with credit scores of 661780 had average interest rates of 5.59% on their used car loans and 3.69% on new car loans, whereas people with credit scores of 781850 received average rates of 3.80% and 2.65%. 8Although this is a relatively small difference, waiting until your score improves could still potentially save you hundreds of dollars on a car loan.

If youre set on getting an auto loan right now, then pay as large of a down payment as you can afford and consider getting prequalified or applying for a preapproval from your bank or credit union to increase your bargaining power.

How To Fix A 723 Credit Score

In summary your credit score determines your ability to borrow. Its important that you manage it. If you have 723 credit score then your focus should be on driving it higher. To do this follow these simple tips:

- Pay down your debt If you have debts but also have savings then you need to ask yourself do you need all that cash in the short term? Could it be used better if it was spent on paying down debt? This would be an excellent use of your funds in a low interest rate environment and would have the beneficial affect of moving your 723 credit score even higher.

- Get a credit report Like everything else in life mistakes can happen in any area and that includes the record of your debt repayments. Its possible to get a credit report to see if all the information that lenders have on you is correct. If it is not and there are records which indicate that you missed a payment which you never missed, or you applied for finance at an institution you have never even heard of then you need to correct that. Correcting those errors will also drive that score towards excellent.

- Avoid short term debt Before you take on short term debt do a simple mental exercise. Consider an item you wish to buy, look at the price, now ask yourself what the real price is if you use short term finance given the high interest rates that can apply. In some cases, this can mean that the item will cost you twice as much as the list price. At that price is it still something that you wish to buy?

Improving Your 723 Credit Score

A Credit Repair company like Credit Glory can:

An industry leader like Credit Glory can guide you through this process. Give them a call @ 885-2800, or chat with them, today â

Also Check: How To Remove A Public Record From Your Credit Report

How Long Does A Consumer’s Credit History Need To Be To Establish A Vantagescore And Fico Score

In order to earn a VantageScore you must have at least one credit account that has been active for a minimum of one month, and at least one credit account that has been reported to credit bureaus in the last two years. With a FICO® score, you should have at least one credit account that has been active for at least six months and has been reported to the credit bureaus during that time.

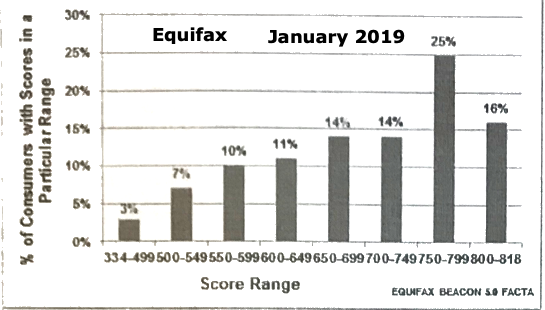

What Is A Good Credit Score In Canada

A good credit score in Canada is typically one that is 680 or higher. Of course, there are many different types of credit scores , and keep in mind that the credit scores a lender sees are usually different from those that you might have access to. Additionally, your Equifax credit scores might be different from your TransUnion scores. The image below illustrates the different credit score ranges in Canada and can help you determine if your credit score is a good credit score.

Don’t Miss: How To Check Your Credit Score With Itin

Can I Get A Personal Loan Or Credit Card W/ A 723 Credit Score

Like home and car loans, a personal loan and credit card isn’t very difficult to get with a 723 credit score.

You donât need to apply for a secured card with Discover or Capital One, who may make you pay $500-$1000 just for a deposit.

You can get even better terms on your personal loan or credit card by repairing your credit and waiting a few short months until your score improves.

A 723 score means you likely have a few-no negative items on your report. Removing any outstanding negative items is usually the quickest way to fixing your report.

We recommend speaking with a friendly credit repair expert online to help guide you through this process. Your consultation is completely free, no-pressure, and will set you on the right path toward boosting your score.

Dealing With Negative Information Which Impacts Your 723 Credit Score

If your credit score is a negative in your life, then there are several things you can do if you want to improve it.

Firstly, you can enhance your 723 credit score by simply paying all your bills on time. Making late payments, partial payments or trying to negotiate with lenders all work to drive your score lower. To make sure you can pay your bills on time you should ensure that you have a monthly budget. Stick to it, pay your bills first and your credit score will improve over time.

In addition to paying your debts on time, taking on as little debt as possible in the first place will keep your credit score in good health. Lenders can only lend you so much. If you have a lot of debt your repayment capacity will decrease and your credit score will follow. Again, budget so you do not need to borrow.

If you do need to borrow then make sure you pay off the debt as quickly as possible. Dont just make the minimum repayment, this again will aid an increase in your credit score.

Another aspect of your 723 FICO score is one not many people know about. Every time you apply for credit that application is logged.

The more applications you make the more it looks like you cannot manage your finances and always need a constant stream of loans to meet your day to day obligations. So again, if you do need credit, only apply when your going to draw it down and make as few applications as possible.

You May Like: Pay Aargon

Why Is It Wise To Begin Building A Strong Credit Score Well In Advance Of Applying For An Auto Or Home Loan

Look at it this way. If you want to buy a house or a car, do you really want to first wait around for weeks or months while you wait for your credit bureau to fix problems that youve found? You want to get this done now, long before youre applying for a loan.

You might not think fixing credit report errors is a big deal, but raising your credit score can definitely save you money. Take Simpsons example of interest rates on a 30-year fixed loan of $200,000 based on credit scores:

Simpson sets the scene of two home buyers purchasing a house. One person with a credit score of 625 with an interest rate of 4.316%, which sounds pretty good, and another person with a credit score of 765, and an even better interest rate of 2.727%. In this scenario, the person with the credit score of 625 would pay $178 more a month than the homeowner with a credit score of 765.

Not only is that a lot more per month, over the course of a 30-year loan, the person with the 625 credit score is paying $63,927 more in interest charges over the person with the 765 credit score.

In short, a person will have an easier time renting an apartment, securing a lower interest rate on a loan, and will be better prepared for the future with a higher credit score, Simpson says. It is important to start early in establishing credit.

Why Is My Experian Score So Much Lower

This is due to a variety of factors, such as the many different credit score brands, score variations and score generations in commercial use at any given time. These factors are likely to yield different credit scores, even if your credit reports are identical across the three credit bureauswhich is also unusual.

Read Also: Does Eviction Notice Go On Credit Report

What A Fair Good Or Excellent Credit Score Means For You

The better your credit score, the more choices youll have when it comes to applying for a loan or credit card. Thats the bottom line.

If you have a fair credit score and are approved for a credit card, you may be offered a slightly higher interest rate. Your initial credit limit may also be on the lower side. But if you make your payments on time and demonstrate financial stability, you might be able to have your limit increased after 6-12 months.

If you have a good credit score, your chances of being approved for loans and credit cards increases. Youre also more likely to be offered a more competitive interest rate, as well as a more generous credit limit.

Finally, an excellent credit score makes borrowing money and getting credit cards much easier. Its also more likely to get you the best available interest rates and generous credit limits.

What Is A Credit Score

Before we get into discussing the differences between credit scoring models, its important to first understand what a credit score is. In short, a credit score is a number that quickly tells a lender whether you’re a good credit risk or a shaky one.

If your credit score is high, youll likely receive better terms on the loan, such as receiving a low interest rate. On the other hand, if your credit score is low, you may receive less favorable terms, like a high interest rate.

Don’t Miss: When Does Capital One Report To Credit Bureau

Whats A Good Credit Score

So, what is a good credit score, anyway? Lets start at the beginning.

According to the Government of Canada, a credit score is a 3-digit number that represents how likely a credit bureau thinks you are to pay your bills on time.1 It can be an important part of building your financial confidence and security.1 For example, building a good credit score could help you get approved for loans and larger purchases, like a home.1 You may also be able to access more competitive interest rates.1

There are two main credit bureaus in Canada: Equifax and TransUnion.1 These are private companies that keep track of how you use your credit.1 They assess public records and information from lenders like banks, collection agencies and credit card issuers to determine your credit score.1

Is 723 A Good Credit Score To Buy A House

FICO credit score723FICO scoregood credit score

. In this manner, is 723 a good credit score to buy a car?

In fact, the traditional school of thought is that good credit goes from a score of 660 to 719, while excellent spans from 720 to 850. What Does a 723 Credit Score Get You?

| Type of Credit | |

|---|---|

| Auto Loan with 0% Intro Rate | MAYBE |

| Lowest Auto Insurance Premium | NO |

Additionally, can I get a mortgage with a credit score of 700? Mortgage interest rates with a 700 credit score. Generally, you need a of 620 or better to qualify for a conventional Fannie Mae loan or an FHA loan with a 3.5 percent down payment. If you’re interested in a no-down payment USDA loan, the minimum rises to 640.

Consequently, is a 723 credit score good?

A 723 FICO®Score is Good, but by raising your score into the Very Good range, you could qualify for lower interest rates and better borrowing terms. A great way to get started is to get your free report from Experian and check your to find out the specific factors that impact your score the most.

What kind of loan can I get with a 700 credit score?

Student loans, car loans, and mortgages can all be refinanced at a lower rate if you have a recently improved . Refinance old debts.

Read Also: How Long To Increase Credit Score 50 Points

S To Improve Your 723 Credit Score

Improving your 723 credit score can take a lot of work, but following these steps can make all the difference. It will take time, but you can see your credit score go up within a year, which could save you countless amounts on interest rates. Dedicating the effort to improving your credit is worth the investment.

What An Excellent/exceptional Credit Score Means For You:

Borrowers with exceptional credit are likely to gain approval for almost any credit card. People with excellent/exceptional credit scores are typically offered lower interest rates. Similar to “exceptional/excellent” a “very good” credit score could earn you similar interest rates and easy approvals on most kinds of credit cards.

Recommended Reading: How To Report To Credit Bureau As Landlord

Can You Get A Personal Loan With A Credit Score Of 723

Most lenders will approve you for a personal loan with a 723 credit score. However, your interest rate may be somewhat higher than someone who has Very Good or Excellent credit.

Its best to avoid payday loans and high-interest personal loans as they create long-term debt problems and just contribute to a further decline in credit score.

See Also:12 Best Personal Loans for Good Credit

What Does A 723 Credit Score Get You

| Type of Credit |

|---|

| 31.08% |

*Based on WalletHub data as of Oct. 7, 2016

As you can see, the majority of us are in the top two tiers of the credit-score range. A lot of people dont know where they stand, though, considering that 44% of consumers havent checked their credit score in the past 12 months, according to the National Foundation for Credit Counseling. If youre one of them, you can change that by checking your credit score on WalletHub.

Recommended Reading: Unlock Experian Account

What Is Considered A Good Credit Score

The credit score range for both FICO® and VantageScore is 300 to 850 however, the way the scores classify consumers are slightly different. For example, in the FICO® system, a very poor score range is anything 579 and below, while VantageScore’s very poor credit score range is up to 549. In order to be considered a very good credit risk, people must have a 740 to 799 FICO® Score and a 700 to 749 VantageScore. With FICO®, the top tier score range is between 800 and 850 and 750 to 850 in the VantageScore system.

How Does Outstanding Debt Affect Your Credit Score

The amount of outstanding debt impacts your credit score. Lenders normally check this in the form of the credit utilisation ratio. This refers to the amount of money you are using out of the total credit available to you. The higher the ratio, the lower your credit score. However, this doesnt mean debt is bad for you. In fact, you will be able to build your credit score only when you take on debt. The key is to pay it off in a timely fashion and not go over your credit cards or bank accounts limit.

You May Like: Affirm Delinquent Loan

Do Pay Down Your Credit Card Debt

Your credit utilization rate, also referred to as credit utilization ratio, is a significant factor in determining your credit score.

You must keep your credit utilization below 30%. Below that 30%, further improvements will earn you only a few points. But a few points is a lot in these circumstances. By coincidence, 30% is also the proportion of your score that credit card balances influence.

How To Earn An Excellent/exceptional Credit Score:

Borrowers with credit scores in the excellent credit range likely haven’t missed a payment in the past seven years. Additionally, they will most likely have a credit utilization rate of less than 30%: meaning that their current ratio of credit balances to credit limits is roughly 1:3 or better. They also likely have a diverse mix of credit demonstrating that many different lenders are comfortable extending credit to them.

Recommended Reading: Credit Score Needed For Les Schwab Credit

What Does A Credit Score Of 723 Mean

good credit scoreA 723 credit score is a good credit score.The good-credit range includes scores of 700 to 749, while an excellent credit score is 750 to 850, and people with scores this high are in a good position to qualify for the best possible mortgages, auto loans and credit cards, among other things.

Mortgage Rates For Good Credit

Your credit scores are just one factor to consider when youre looking to get a great mortgage rate. Having good credit can help you get a better rate, but so can factors such as

- The type of mortgage loan youre looking for

- The total cost of your home

- Your debt-to-income ratio

- The size of your down payment

The average credit score it takes to buy a house can also vary greatly by location.

Once you have a general picture of your overall credit as well as how much house you can afford and the type of loan you want its a good idea to shop around. This can give you a better idea of what different lenders could offer you.

Compare your current mortgage rates on Credit Karma to learn more.

Recommended Reading: Credit Score For Affirm Approval