Bankruptcys Impact On Your Credit Score

When you file bankruptcy and get relief from your bill problems, you no longer owe any money to your creditors. You no longer have to suffer with the continuing delinquencies.

If you take some simple steps to rebuilding your credit after bankruptcy, your credit score will start to rise pretty quickly. After as little as 18-24 months, your credit report will be a thing of beauty.

In fact, according to a report released by the Federal Reserve Bank of New York in May 2015:

The individuals who go bankrupt experience a sharp boost in their credit score after bankruptcy, whereas the recovery in credit score is much lower for individuals who do not go bankrupt.

Reach Out To The Courts

Now you will want to reach out to the court with the same question. How did they verify your bankruptcy?

If the court responds they never verified the bankruptcy which is the most common scenario ask to get the statement in writing.

Related: 7 Steps How To Buy A House With Bad Credit With Good And Bad Income

Overview Of Aluasoul Alcudia Bay

Check-in:Check-out:

- Maximum capacity of extra beds in a room is 1.

- Maximum capacity of cots in a room is 1.

Find a cancellation policy that works for you

From 6 April 2020, your chosen cancellation policy will apply, regardless of Coronavirus.

We recommend booking a free cancellation option in case your travel plans need to change.

Please check your booking conditions

For bookings made on or after 6 April 2020, we advise you to consider the risk of Coronavirus and associated government measures. If you dont book a flexible rate, you may not be entitled to a refund. Your cancellation request will be handled by the property based on your chosen policy and mandatory consumer law, where applicable. During times of uncertainty, we recommend booking an option with free cancellation. If your plans change, you can cancel free of charge until free cancellation expires.

Also Check: Syncb Bp

Bankruptcy: How Long Does It Stay On Your Credit Report

Being declared bankrupt can trigger many emotions, and there are consequences that will impact you immediately and longer term. In this article, we cover how bankruptcy can impact your credit score, how long it will stay on your credit report and how it can impact your ability to borrow money in future.

Faqs When Booking At Aluasoul Alcudia Bay Adults Only

-

Where is Aluasoul Alcudia Bay Adults Only located?

Aluasoul Alcudia Bay Adults Only is located at Carrer De La Gavina, 4, 1.6 km from the centre of Alcúdia. Hidropark is the closest landmark to Aluasoul Alcudia Bay Adults Only.

-

When is check-in time and check-out time at Aluasoul Alcudia Bay Adults Only?

Check-in time is 14:00 and check-out time is 12:00 at Aluasoul Alcudia Bay Adults Only.

-

Does Aluasoul Alcudia Bay Adults Only offer free Wi-Fi?

Yes, Aluasoul Alcudia Bay Adults Only offers free Wi-Fi.

-

Does Aluasoul Alcudia Bay Adults Only offer free parking?

No, Aluasoul Alcudia Bay Adults Only does not offer free parking.

-

Does Aluasoul Alcudia Bay Adults Only offer free airport shuttle service?

No, Aluasoul Alcudia Bay Adults Only does not offer free airport shuttle service.

-

How far is Aluasoul Alcudia Bay Adults Only from the airport?

Aluasoul Alcudia Bay Adults Only is 46 km from Palma de Mallorca Son Sant Joan. Aluasoul Alcudia Bay Adults Only is 93.9 km from Menorca/Mahon.

-

Does Aluasoul Alcudia Bay Adults Only have a pool?

Yes, Aluasoul Alcudia Bay Adults Only has a pool on-site.

Read Also: Does Klarna Hurt Your Credit Score

How To Remove A Bankruptcy From Your Credit Report

Bankruptcy can be scary, but its important that you arm yourself with as much information as possible to navigate the process.

In this article, well walk you through some of the most commonly asked questions around bankruptcy, how it can affect your credit score, and how to get a bankruptcy removed.

Working With Credit Repair Companies

The method outlined above is one path for how to remove bankruptcies from credit reports. However, it can be very complicated and time-consuming. Depending on your situation, contacting the top credit repair companies may be better than attempting to solve the problem on your own.

A credit repair company is a professional organization. They can help remove incorrect or inaccurate items from your record and advise on improving your score.

One of the specialties of these organizations is getting bankruptcies dropped from credit reports. As with any field, it is crucial to contact a trusted company. As bankruptcy cases are public records, some companies may contact you on their own. Make sure to avoid scammers who promise perfect results at no cost. It is common for the vulnerable to find themselves targeted in this way.

Professionals can make the process easier and are knowledgeable about the dispute process. That said, they cannot guarantee results. There need to be legitimate grounds in the form of an error to drop a bankruptcy from a credit report. Therefore, its crucial to make sure you are willing for a credit company to take your case and to check the terms of their services.

Don’t Miss: How To Get Credit Report With Itin Number

How Long Can Bankruptcy Affect Your Credit Scores

Bankruptcy can affect your credit scores for as long as it remains on your credit reports. Thats because your scores are generated based on information thats found in your reports.

But the impact of bankruptcy on your credit scores can diminish over time. This means your credit scores could begin to recover even while the bankruptcy remains on your credit reports.

After the bankruptcy is removed from your credit reports, you may see your scores begin to improve even more, especially if you pay your bills in full and on time and use credit responsibly.

To Remove A Bankruptcy From Your Credit Report Youll Need To Find Evidence That The Bankruptcy Was Reported Incorrectly Otherwise It Will Only Come Off After Seven Or 10 Years Depending On The Type Of Bankruptcy

Beyond the stress and inconvenience that comes with filing for bankruptcy, it can have a long-standing impact on your credit report and score.

Fortunately, that negative impact can be mitigated with the right help.

You May Like: Affirm Credit Score

Can A Bankruptcy Come Off My Credit Report Early

A legitimate bankruptcy record cannot be removed from your credit report, but a bankruptcy can come off your report if it is inaccurately entered or otherwise incorrect.

The FCRA makes provisions for challenging anything on your credit report that is incorrect, has remained on your credit report beyond the maximum time allowed, or cannot be substantiated by the creditor who reported it.

In the case of bankruptcies especially because they remain on the credit report for so many years its not uncommon for errors to creep in.Some of the most common errors we find include:

- Debts that were discharged in the bankruptcy are still showing a balance.

- Individual accounts included in the bankruptcy are still appearing on the report after seven years. In both Chapter 7 and Chapter 13 bankruptcies, the individual affected accounts can only impact your report for seven years starting from original delinquency date, not the filing date of the bankruptcy in which they were discharged.

- The bankruptcy is still showing up on a report more than 10 years after the filing date.

- Any sort of material error in how the bankruptcy was reported, from the spelling of names to accurate addresses, phone numbers, dates, etc.

If any of these or other errors appear on your credit report, you have the right to challenge those errors. The reporting agency must remove them if the reporting agency cannot substantiate the item.

Ask The Courts How The Bankruptcy Was Verified

Next, you will need to contact the courts that were specified by the credit bureaus.

Ask them how they went about verifying the bankruptcy. If they tell you they didnt verify anything, ask for that statement in writing.

After you receive the letter, mail it to the credit bureaus and demand that they immediately remove the bankruptcy as they knowingly provided false information and therefore are in violation of the Fair Credit Reporting Act.

If all goes well, the bankruptcy will be removed.

Read Also: Bp Visa/syncb

Can You Remove Bankruptcy From Your Credit Report

In the modern world, your value is measured based on your credit report.

Its the only way a potential creditor knows about your financial situation. Many employers check your credit before offering you a job. Insurance companies use credit scores to determine the rates you pay. And thats just scratching the surface of the ways your credit report affects your life.

After bankruptcy, your to show that you dont owe the debt anymore. Anything else is considered inaccurate under federal law.

Thats why you should review your credit reports regularly after your bankruptcy case is finished, and take the simple steps to repair your own credit.

Most people also want to remove the bankruptcy from their credit records because they worry about the impact it will have on their ability to get a new mortgage, car loan, or job.

Before you start to panic, here are the facts.

Bankruptcy: How It Works And How You Can Get It Off Your Credit Report

In recent years, many businesses and individuals have closed down because of underlying debts. More than 700,000 Americans declared bankruptcy in 2017. And more so in the last half of 2020 because of the pandemic. It is reported that the number of bankruptcies in the latter year has exceeded the number of filings seen in any other year since 2012.

But what is bankruptcy? Will filing for bankruptcy help you in settling your debts? How will it affect your status in the credit community? Will you still be able to make a loan or mortgage despite your record? Here are the things that you need to know about this proceeding.

Read Also: Does Snap Finance Report To The Credit Bureau

About Aluasoul Alcudia Bay Adults Only

Providing an outdoor pool, outdoor tennis courts and a rooftop terrace, AluaSoul Alcudia Bay Adults Only is located a short drive from Alcudia and Pollenca. Close to restaurants and shops, the hotel p…

|

Palma de Mallorca Son Sant Joan |

Distance to airport |

|---|

|

Wi-Fi available in all areas |

|

Cancellation/pre-payment |

Policies vary by room type and provider. |

|---|---|

Contact Number |

Reporting Debts As Discharged In Bankruptcy

While it might be daunting to think about a bankruptcy filing showing up on your for ten years, it might not be as bad as you think. A bankruptcy discharge can help you clean up debt much faster than you’d be able to do yourself.

For instance, instead of a delinquent or unpaid debt lingering on your report for years, it will show as being discharged as part of your bankruptcy. In fact, creditors won’t be able to report your debt in a variety of ways that could cause your credit to suffer, such as allowing the obligation to show as:

- currently owed or active

- having a balance due, or

- converted to a new type of debt .

Such reporting labels are often the reason creditors deny applicants credit. In some cases, applicants must pay off such debt as a condition of loan approval. Instead, when you pull your report, each qualifying debt should be reported as:

- having a zero balance, and

- discharged, “included in bankruptcy,” or similar language.

Unfortunately, some creditors don’t update information to the credit reporting agencies. This tactic could be a way to get you to pay up, even though you no longer legally owe the debt. If your credit report shows an improperly labeled discharged debt, you’ll want to take steps to correct the problem.

Read Also: How To Remove Repossession From Credit Report

Professional Help From A Credit Repair Company

Any time you try to dispute a negative item on your credit report, whether its a bankruptcy or a credit card late payment, its bound to be a long, arduous journey.

To save yourself a major headache, consider hiring a professional credit repair company. Theyll not only review your bankruptcy entries, but everything else on your credit report as well, so you can benefit from a holistic strategy for repairing your credit.

Can A Chapter 7 Be Removed From Credit Report Before 10 Years

A chapter 7 bankruptcy can only be removed from your credit report before the 10 year period if there are any inaccuracies in the information thats reported. You cannot remove a bankruptcy from your credit report simply because you dont want it to be there. Most people will have to wait the 10 years before the bankruptcy falls off their credit report on its own.

Also Check: Does Paypal Credit Report To The Credit Bureaus

Correcting Misreported Discharged Debt

Disputing errors is relatively straightforward. You’ll do so by using the online procedure provided by each of the three major credit reporting agencies.

A creditor who repeatedly refuses to report your discharged debt properly might be in violation of the bankruptcy discharge injunction prohibiting creditors from trying to collect on discharged debts. If you take steps to remedy the misreporting, and the creditor refuses to fix the error, talk to a bankruptcy attorney.

Can You Improve Your Credit Score After Bankruptcy

There is no quick fix to restoring your credit score and credit rating after bankruptcy, but there are general steps you can take to improve your credit score. Consumer Action Law Centre cautions that Australians in debt may be at risk from debt vultures, with approximately 1.4 million to 1.9 million Australians paying for debt management or credit repair services in the 12 months to December 2020. These companies are almost entirely unregulated and can target Australians who are in financial hardship with debt advice and services, CALC says.

You May Like: Does Removing An Authorized User Hurt Their Credit Score

How Long Does A Bankruptcy Stay On My Credit Report

There are differences in severity between a Chapter 7 and a Chapter 13 bankruptcy. According to the Fair Credit Reporting Act , a Chapter 7 bankruptcy can remain on your credit history for up to 10 years from the filing date and a Chapter 13 bankruptcy can remain for a maximum of 7 years.

The FCRA states only the legal maximum amount of time bankruptcies can appear on your report and not the minimum. This means a bankruptcy can be removed earlier than the legal maximum, but it must be proven that it is misreported, unsubstantiated or otherwise found inaccurate. A bankruptcy cannot be removed simply because you do not want it there.

Let Nature Take Its Course

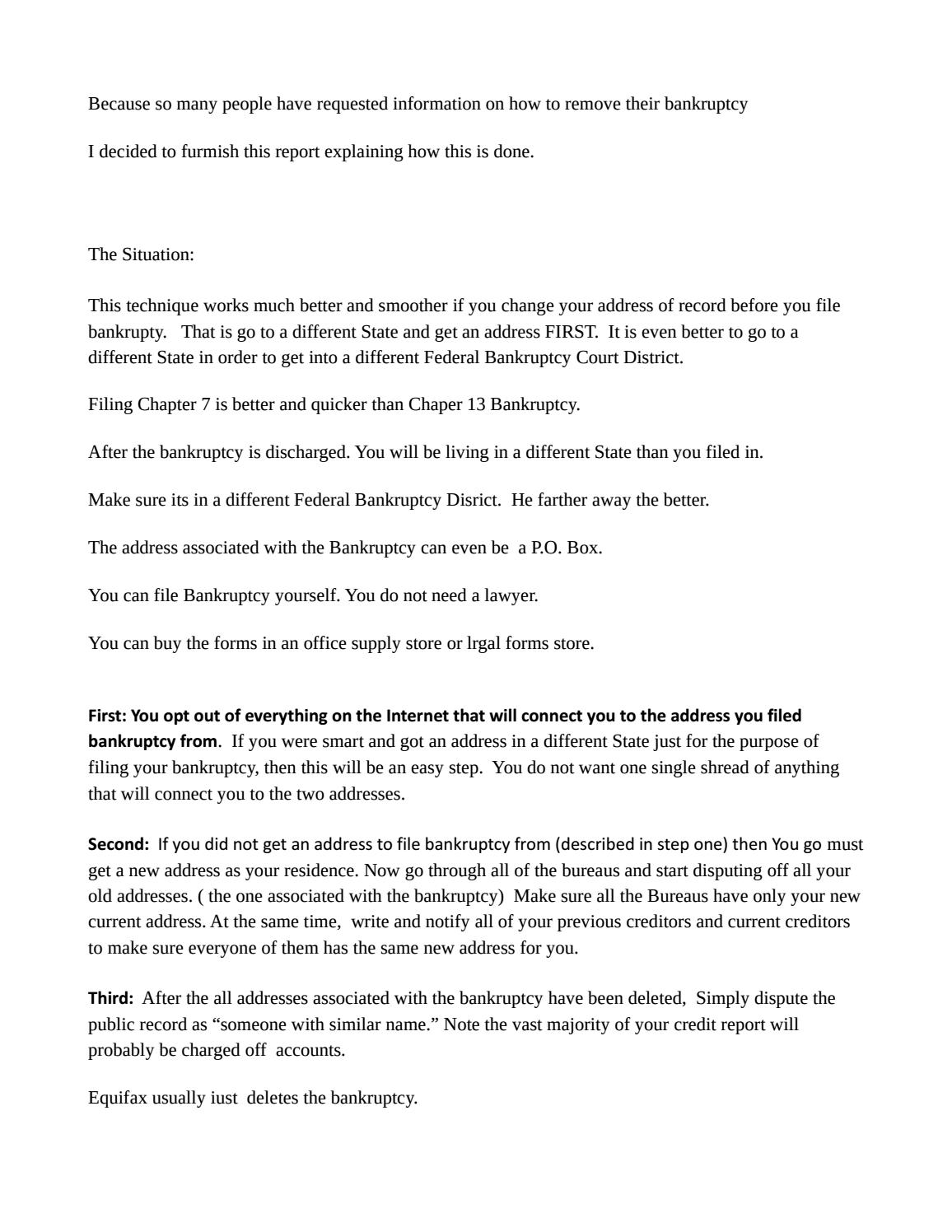

![Steps To Build Your Credit Score [Infographic]](https://www.knowyourcreditscore.net/wp-content/uploads/steps-to-build-your-credit-score-infographic-all.jpeg)

Make sure your credit report is accurate. Once youve corrected any errors, sit back and start working on improving your financial situation. Your bankruptcy will come off your report in due course. In the meantime, do what you can to make sure it doesnt impact your life and ability to get new credit.

Its far more important that worrying about the impact of your bankruptcy on your credit report or score.

Read Also: Shopify Capital Eligibility Review Changed

Discount For Family Members Couples And Active Military

Lexington Law is now offering $50 off the initial set-up fee when you and your spouse or family members sign up together. The one-time $50.00 discount will be automatically applied to both you and your spouses first payment.

Active military members also qualify for a one-time $50 discount off the initial fee.

How To Remove A Dismissed Bankruptcy

Verified bankruptcies can’t be removed from your credit report. However, you can remove them if they’re inaccurate. Finding & disputing these mistakes can be tricky. Here’s how you can do it.

- Check your credit report for errors – Before you can dispute an error, you have to find it first. You can find common errors in personal info, account status, and balance & data mistakes.

- Verify information – According to the FTC, 20% of the population has at least one error on their credit report. Inaccurate negative marks hurt your score. That’s why it’s important to verify the info on your report.

- Dispute inaccuracies – Once you have found errors, you can dispute them. This means gathering evidence, writing a dispute letter to all 3 credit bureaus, & waiting.

- Work w/a credit repair professional – Finding and disputing errors yourself is a hassle. Teaming up with a credit repair expert simplifies the process. They know what to look for & help you avoid costly mistakes, so you can easily boost your credit.

You May Like: Does Balance Transfer Affect Credit Score

How A Bankruptcy Filing Affects Your Credit Score

When you file for bankruptcy, your credit score will drop. The range of the drop is usually 130 to 240 points. Typically, people who have a higher credit score of over 700 points lose more points. If you already have a poor credit score, the deduction of these points may not really affect you that much.

When you have a bankruptcy on your credit score, it can be difficult to get approval for new credit and get the best deals people with excellent credit scores enjoy. For example, if you are planning to get a cell phone plan with bad credit, you will not be eligible to get the best deals available that require no deposit or no upfront fees. If you have bad credit due to a bankruptcy, you may have to settle for a no credit check cell phone plan where you have to buy the device in full and prepay your usage.