Discount For Family Members Couples And Active Military

Lexington Law is now offering $50 off the initial set-up fee when you and your spouse or family members sign up together. The one-time $50.00 discount will be automatically applied to both you and your spouses first payment.

Active military members also qualify for a one-time $50 discount off the initial fee.

Public Records And Your Credit Reports

Not all public records are included on credit reports. In fact, some types of public records were included in the past but have since been removed thanks to policy changes.

Heres an overview to help you understand which types of public records might show up on your reports now and cause potential credit damage.

How Removing Public Records Differs From Filing A Dispute

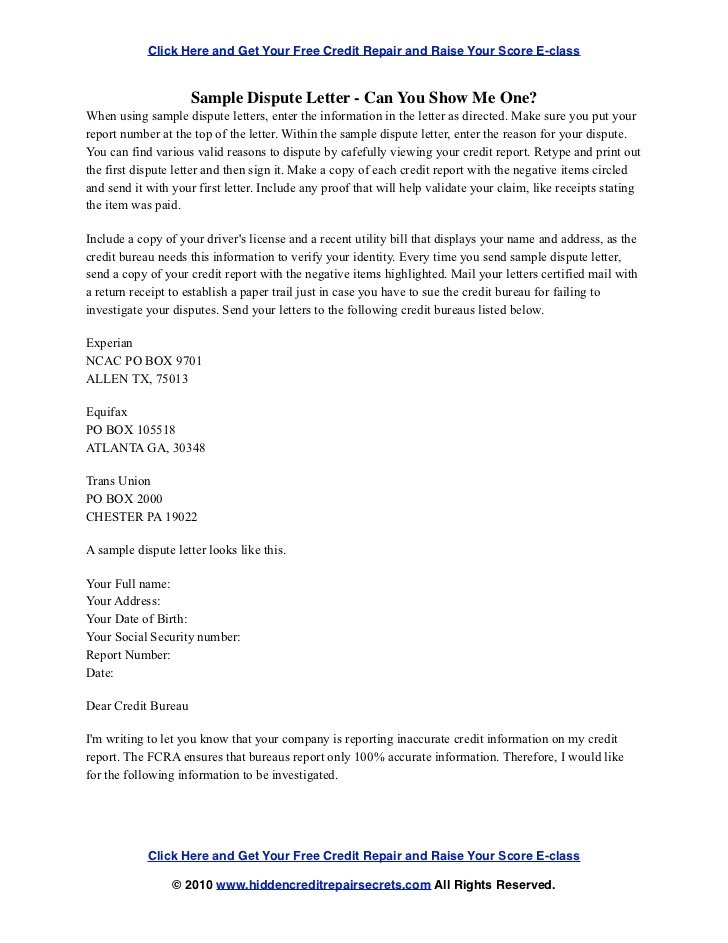

If youve ever had to remove a fraudulent address, account, or activity from your credit report, you probably already know the relatively simple process of filing a dispute with an individual credit bureau. The major credit bureaus, Equifax, Experian, and TransUnion, each have simple ways to file minor disputes online or over the phone. But, its always best to send a dispute letter.

When it comes to public records, things are a little bit more complicated because the court is involved as well as the credit bureaus. Because financial disputes that come through the court system are public record , they almost always appear on your credit reports, as well.

So if youre trying to remove a public record entirely, youd need to reach out to the court directly and ask them to expunge the record. This can be a time-consuming and effort-intensive battle.

The easier option is to attempt to remove the public record from your credit report. This is done by disputing the public record directly with the reporting credit bureau. The Fair Credit Reporting Act allows you to dispute any record on your credit report that you believe is inaccurate or even questionable. However, keep in mind that even if you successfully remove a public record from your credit report, itll still be on file with the court system.

Also Check: Does Klarna Affect Your Credit Score

How Can I Rent If An Eviction Is Still On My Public Record

You can still rent if you have an eviction on your public record, but itll be more difficult. There are a few things that may improve your chances of getting a rental agreement.

- Explain the eviction: Be honest and upfront. If the landlord understands what happened, they might give you a better chance. If youve rectified the situation with your previous landlord, make sure the new landlord knows that.

- Provide references: To show youre a trustworthy renter, offer references in addition to the background check.

- Offer to pay more upfront: Consider paying the security deposit, first months rent and even second months rent at the time of signing a rental agreement.

- Get a co-signer: A co-signer reassures the landlord that you have someone legally and financially backing you.

- Improve your credit: A good credit score can be evidence of your ability to pay bills on time.

- Show youre financially viable to pay your rent: Provide proof of income and other successful payments, like payments on an auto loan.

Once youre accepted as a tenant, continue to prove yourself with timely payments and by properly caring for the property. You can rebuild your rental history and make it easier to rent in the future.

Tips To Overcome Derogatory Credit

Your credit score benefits from having positive information, so your score may start improving long before the derogatory items are removed from your credit report if you’re paying other accounts on time.

Your recent credit history affects your credit more than old derogatory credit items, so having open accounts with on-time payments will help improve your credit score.

You may not be able to have excellent credit until the derogatory items are completely removed from your credit report, but with good credit, youll still be able to qualify for many credit cards and loans.

Don’t Miss: How To Help Credit Score

What If I Decide The Charge Is Valid

Now, even if you feel the claim by the collections agency is valid after reviewing it and you realize that the charge is something that you owe, there are still ways to mitigate the damage to your credit report. However, once you ascertain that the charge is valid, youll want to negotiate a payment to the agency. Once it has been cleared, its unlikely that the agency will resubmit the charge to the reporting companies.

How Can I Remove An Eviction From My Public Record

You can remove your eviction from your public record bypetitioning the court, winning your case or disputing an inaccurately reported eviction.

While the process is more difficult, its not impossible.

Petition the court: In the county where the case was filed, you can petition the court to have the eviction expunged from your record.

Win your case: If the landlord served you an eviction notice without a legal or valid basis, prove that. A judge is more likely to rule in your favor if you demonstrate that the eviction was unfounded and not the result of you breaking your lease.

Prove that you didnt violate the lease: Make it evident you didnt break the terms of your lease. For example, prove that you paid your rent and that you left the property in a satisfactory condition. Provide evidence when possible. Documentation, such as cleared rent checks and photos, can support your case.

Ensure proper procedures are followed: Keep an eye on the landlords process of carrying out the eviction. Laws vary by state, but theres always a specific procedure a landlord must follow when filing the eviction and serving the eviction notice to you.

Make yourself familiar with your states laws governing eviction suits. Be sure to document how your landlord fails to abide by the required legal process.

You May Like: What Does Charged Off Account Mean On My Credit Report

So How Do I Get Rid Of Negative Public Records

Unfortunately, its not that easy.

The three major credit bureaus wont accept certain poorly sourced public records, and theyre proactively removing some tax liens and civil judgments if they cant verify whos responsible for repayment, along with some recent medical debts.

But theres no legal recourse for you to remove other, accurate public records from your credit reports.

If you spot an error on your TransUnion® credit report, Credit Karmas Direct Dispute tool may be able to help you challenge it. Since 2015, weve helped members remove more than $7.9 billion in erroneous debts.

You may also dispute errors on your Experian® and Equifax® credit reports directly through their websites.

Types Of Derogatory Credit Items

Different derogatory items affect your credit score in different wayssome items are given more importance than others. For example, a single late payment will hurt your credit score, but not as much as bankruptcy, which impacts your credit score almost more than anything else. Multiple derogatory items will also cause your credit score to drop.

These are the types of derogatory credit items that can appear on your credit report:

- Late payments, resulting from credit card and loan payments that are more than 30 days late

- Charge-offs, resulting from debts that have fallen more than 180 days past due and have been written off as uncollectible

- Debt collections, resulting from debts that have been sold or assigned to a third-party debt collector

- Foreclosure, resulting from delinquent mortgage payments

- Repossession, resulting from delinquent auto loan payments

- Debt settlement, resulting from an agreement between you and a creditor to reduce the outstanding balance and cancel the remainder

- Bankruptcy, resulting from the legal process of having your debts discharged in court

You May Like: Is 643 A Good Credit Score

How To Remove A Bankrupcty On Your Credit Report

If you find a fraudulent bankruptcy reported in your credit history, youll need to reach out to the court and ask for a written statement that you have not, in fact, filed for bankruptcy. Once you receive this statement, youll forward copies to the credit bureau via Certified Mail along with a letter of dispute.

If you have filed for bankruptcy, you may be able to find an inaccuracy or error in the way the bankruptcy is reported. You can then file a dispute with each of the three major credit bureaus on that basis. Its possible that some technicality may require them to unlist the bankruptcy entirely. But, chances are itll stay on your credit report for the standard seven years if its legitimate. That said, it cant hurt to try!

Finally, if you reach out to the court for a written statement and find they do have a bankruptcy on file, even though you havent filed for one, youll need to take further steps with them to resolve the issue. The court will likely ask for documentation and records to prove the miscommunication and ultimately expunge the public record. At this point, you can proceed with filing your dispute with the credit bureaus.

What Happens If My Attempts At Removal Are Not Successful

Have you exhausted all options with a public record entry on your credit report? Does it just not look like youre going to succeed?

There are things you can do to improve your credit score. The first thing to do is develop a financial strategy. That will help you prevent any future judgment or any other types of delinquencies on your credit report.

You can cut expenses like cable, data plans, dining out, and other non-essentials. You can seek to increase revenue by taking on overtime or a second job. Anything you can do to get your revenue and expenses into a healthy balance will help you in the long run.

Its OK to borrow money within reason, since lenders want to see successful borrowing history. But you should avoid taking on loans that can hurt you if you run into temporary financial trouble like a lost job or medical emergency.

Make sure you make all your loan payments and credit card payments on time, and again, you need to do whatever it takes to satisfy any unpaid judgments or tax liens.

If it starts to feel overwhelming, you might want to consult with a reputable credit repair company, tax attorney or bankruptcy attorney. When it comes to public records, it often makes sense to leave the legal and technical challenges to the experts who have devoted a lifetime to solving these kinds of problems. You can think of it as an investment in your financial future, and it can help you avoid even more stumbling blocks down the road.

About Rick Miller

Also Check: How Much Does A Hard Inquiry Affect Credit Score

How Can I Remove A Civil Judgment From My Credit Report

After you have successfully legally removed your eviction from your public record, you will still need to inform the credit bureaus. The credit bureaus will not remove the civil judgment from your credit report automatically after youve removed it from your public recordmake sure you notify them.

You need to take the following steps to remove the civil judgment from your credit report:

What Kind Of Information Is Included In A Public Record

If you file for bankruptcy, the amount the court found you legally responsible to pay will be listed. There will also be an exempt amount. This is the amount the court says you are not responsible to pay.

Lastly, there will be an asset amount for the number of personal assets the court used to make its decision. These will all be listed in the bankruptcy and are the kind of public records that can significantly lower your credit ratings and affect your borrowing power.

Some other things that you might find in your public records might be things you consider personal, things like if you have had financial counseling, a financial statement, garnishments, and financial marital claims from a divorce. However, all of these things affect your income, and so they affect your credit.

Recommended Reading: What Is The Ideal Credit Score To Buy A House

Contact The Credit Bureaus

Both Equifax Canada and TransUnion Canada have forms for correcting errors and updating information. Fill out the form to correct errors:

Before the credit bureau can change the information on your credit report, it will need to investigate your claim. It will check your claim with the lender that reported the information.

If the lender agrees there is an error, the credit bureau will update your credit report.

If the lender confirms that the information is correct, the credit bureau will leave your report unchanged.

In some provinces, the credit bureau is required to send a revised copy of your credit report to anyone who recently requested it.

How Long Do Public Records Stay On Your Credit Reports

The Fair Credit Reporting Act is the federal law which sets rules about the information allowed on your credit reports. Among those rules, the FCRA sets time limits or expiration dates for credit reporting.

In general, most negative information isnt allowed to stay on your credit reports forever.

- Bankruptcies can stay on your credit reports for up to ten years from the filing date.

- Judgments are no longer shown on credit reports.

- Tax liens are no longer shown on credit reports.

Bankruptcy

There are two different types of bankruptcies Chapter 7 and Chapter 13 and there are different reporting rules governing each.

Completed Chapter 13 bankruptcies can remain on your reports for seven years. However, Chapter 13s can take a few years between the bankruptcy filing and completion . To accommodate for this fact, the FCRA caps the total amount of time a Chapter 13 can remain on your credit reports at ten years from the date filed.

The credit reporting rules for Chapter 7 bankruptcies are less complicated. Chapter 7s can stay on your credit reports for up to ten years from the date you filed.

Judgment

Currently, civil judgments do not appear on your credit reports at all.

Yet this change was due to a settlement the credit bureaus made . The FCRA still allows judgments to remain on credit reports for seven years from the filing date.

Tax Lien

Again, you wont find tax liens on your credit reports due to current credit bureau policy.

Don’t Miss: What Is A Good Credit Score Number

Hire A Credit Repair Specialist To Deal With The Bankruptcy

This is obviously a lot of work, and it may seem a bit overwhelming. You may feel like its too much to handle with everything else going on in your life.

In that case, you may want to procure the services of a quality credit repair company. You could also hire a good bankruptcy attorney.

Granted, its never a good feeling when you pay out of pocket to fix something that wasnt your fault.

Taking it on by yourself can be a big challenge, though. It will cost you in terms of time and money.

Someday, fraud and cybercrime might be a thing of the past. But, for now, its a part of life that many of us have to deal with at one time or another.

Time Limits For Negative Information

By law, are only allowed to list negative items for a certain amount of time. For most negative information, the time limit is seven years or seven years plus 180 days for a charge-off. Bankruptcy, however, can stay on your credit report for up to 10 years.

An account closed in good standing may remain on your credit report much longer than seven years.

Normally, you dont have to do anything to remove old debts from your credit report after the time limit has run out. The;credit bureaus;will automatically delete the negative items from your credit report once they’re scheduled to be deleted. However, if old accounts are still on your credit report, you can use a dispute process to have them removed.

Note that the credit reporting time limit applies to negative items. There’s no law requiring credit bureaus to remove old accounts that do not contain negative information. Instead, the credit reporting time for these is based on credit bureau reporting guidelines.

Recommended Reading: Will A Sim Only Contract Improve Credit Rating

Ways: How To Dispute An Eviction On Credit Report

Read over your eviction notice thoroughly to know which type of eviction you were served. Depending on which one you may have some wiggle room like simply offering to pay your debt.

Catch It Before It Hits Collections

You have a good chance of getting this done if you have a Pay or quit and Cure or quit eviction.

If The Information is True: Can I Remove An Eviction From My CR?

Nope. Unfortunately, evictions are public records.;

They are in the same boat as Tax Liens, Civil Court Judgments, Bankruptcies, and Collections. Thats why its best to catch it/ speak to your landlord or property management before going to collection agencies if you can.

You never know what they can do for you until you ask.

How long do evictions stay on your record;

In most states, an eviction will come off your .;

Related: Is CreditRepair.com Legit?

Good Luck!