What Does This Mean When I Apply For Credit

Any application for credit might be subject to further checks to prove your identity. As this is often a manual check, if youre applying for credit your application could be delayed.

Having a marker under this section wont automatically mean your application will be rejected. Its there to protect you from being a victim of fraud.

Full Credit Report Services

Remember

You can apply for your credit record as often as you like without harming your chances of getting credit.

You can get free 30-day trials of more comprehensive credit checking services from Experian and Equifax. These include your full credit report.

However, you normally have to give your credit or debit card details when you sign up to the free trial. Money will be taken from your account unless you cancel in time.

What’s In My Fico Scores

FICO Scores are calculated using many different pieces of credit data in your credit report. This data is grouped into five categories: payment history , amounts owed , length of credit history , new credit and credit mix .

Your FICO Scores consider both positive and negative information in your credit report. The percentages in the chart reflect how important each of the categories is in determining how your FICO Scores are calculated. The importance of these categories may vary from one person to anotherwe’ll cover that in the next section.

You May Like: What Is Cbna On Credit Report

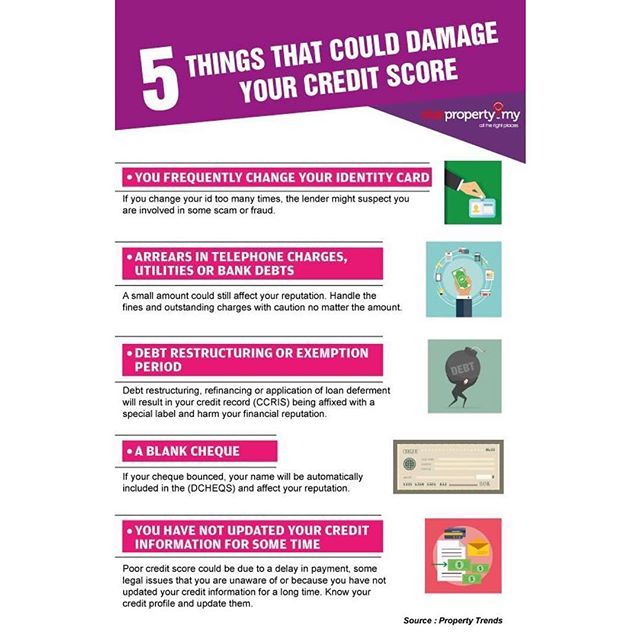

Strategies That Will Get You A Better Credit Score

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

Your is one of the most important measures of your financial health. It tells lenders at a glance how responsibly you use credit. The better your score, the easier you will find it to be approved for new loans or new lines of credit. A higher credit score can also open the door to the lowest available interest rates when you borrow.

If you would like to improve your credit score, there are a number of simple things that you can do. It takes a bit of effort and, of course, some time. Heres a step-by-step guide to achieving a better credit score.

How Can You Check Your Credit Scores

Reading time: 2 minutes

-

There are many different credit scores and credit scoring models

-

You can purchase credit scores from a credit bureau or get one free from some banks and credit unions

Many people think if you check your credit reports from the two nationwide credit bureaus, youll see credit scores as well. But thats not the case: credit reports do not usually contain credit scores. Before we talk about where you can check your credit scores, there are a few things to know about credit scores, themselves.

One of the first things to know is that you dont have only one credit score there are many different scores used by lenders and other organizations. Credit scores are designed to represent your credit risk, or the likelihood you will pay your bills on time.

Score providers, such as the credit bureaus Equifax and TransUnion along with companies like FICO, use different types of credit scoring models and may use different information to calculate credit scores. Credit scores provided by the two nationwide credit bureaus may also vary because some lenders may report information to both, one or none at all. And lenders and creditors may use additional information, other than credit scores, to decide whether to grant you credit.

So how can you check your credit scores? Here are a few ways:

In addition to checking your credit scores, its a good idea to regularly check your credit reports to ensure that the information is accurate and complete.

Don’t Miss: Opensky Locked Account

Does Getting A New Credit Card Hurt Your Credit

Getting a new credit card can hurt or help your credit, depending on your situation. It can help to increase your credit mix and improve your credit utilization percentage, but it will add a new hard inquiry to your account and make your average credit age youngerboth of which could lower your score. For those in the credit-building stage, adding a new credit card will most likely lower your score in the short term but also lead to a stronger credit score in the long term.

How To Get A Free Credit Report

Order a copy of your credit report from both Equifax Canada and TransUnion Canada. Each credit bureau may have different information about how you have used credit in the past. Ordering your own credit report has no effect on your credit score.

Equifax Canada refers to your credit report as credit file disclosure.

TransUnion Canada refers to your credit report as consumer disclosure.

Also Check: Paypal Credit Score Check

The Pros And Cons Of Social Ranking Systems

The usage of social ranking systems in todays highly sociable and interconnected world seems like the perfect mechanism to allow complex adaptive systems to function autonomously.

What do the different social ranking systems mentioned above have in common? They all allow agents of the system to evaluate the qualities, experiences, and behaviors of others to distinguish between those who benefit the system and those who dont.

Another commonality is the categorization of people and the effect categorization has on identity, popularity, power, and resource allocation. Finally, all these systems have a script in place that lays out the prescribed norms, values, and behaviors that govern the system .

However, one must wonder what the effects of social categorization are on social integration and how social ranking systems can affect behavior in the long run.

One must wonder what the effects of social categorization are on social integration and how social ranking systems can affect behavior in the long run.

To View Your Score In Online Banking:

- Sign in to Online Banking

- Scroll down to the box on the right-hand side labelled My Services

- In the My Services box, select View Your Credit Score

- Review the legal disclaimer and select Continue

- Review the CreditView Dashboard agreement and select I Accept & Continue

Your credit score appears, along with various tools, calculators and educational information about credit reports, credit monitoring, credit cards, mortgages and much more.

Also Check: Paypal Credit Report To Credit Bureau

Pick A Free Credit Score Service

There are quite a few free credit score tools. If you have any , there’s a good chance the card issuer offers a tool you can use.

Remember though that we’re not just looking for any score. We’re looking for your FICO® Score. Many services provide your VantageScore, which isn’t used as often and can be much different.

Here are two services that provide your FICO® Score 8 :

Both services require you to sign up, but they’re free to use. You don’t need to have any Discover credit cards to use its credit score service.

Do Credit Card Inquiries Hurt My Credit Score

Too many , can raise a red flag when a potential lender is reviewing your credit report during the application process. This is true for a couple of different reasons.

First, credit card inquiries arent usually lumped together as part of rate shopping. The other worrisome part for lenders is that it can take time for a new line of credit to show up on your credit report. Lenders may not feel confident that all of your current accounts and balances are listed on your credit report.

You could potentially have new credit cards and outstanding balances, making the lenders debt to income ratio calculations inaccurate. Theres just no way for them to know. So, its ideal to stop applying for credit cards well before you need to apply for other types of loans.

The good news is that soft credit inquiries dont have any effect on your credit score at all. Thats why shopping for credit through pre-approvals is a safe way to find the best rates and terms. It allows you to get rates from as many lenders as youd like without hurting your credit.

Future potential lenders cant see soft inquiries on your credit report. They dont use that information when evaluating your application.

Don’t Miss: When Do Closed Accounts Fall Off Credit Report

What Is A Credit Rating

A credit rating is a measure of how dependable you are in repaying your debts. Most credit-reporting agencies will give you a rating on a scale of 1 to 9, others will assign letters corresponding to the type of credit you’re using. For example, a rating of “1” means you pay your bills within 30 days of the due date, while a rating of “9” can mean that you never pay your bills at all.

An “R” rating is also included in your credit score. This rating is assigned by lenders based on your past history of borrowing and paying off debts, and it can range from 1 through 9. An R1 rating is the best, meaning you pay your debts on time, within 30 days, and an R9 is the worst.

Your credit rating is not established by the government or by financial institutions – it is established by you. If you don’t pay your bills on time or fail to repay a loan, you may be reported to a credit bureau.

Who Can See And Use Your Credit Report

Those allowed to see your credit report include:

- banks, credit unions and other financial institutions

- offer you a promotion

- offer you a credit increase

A lender or other organization may ask to check your credit or pull your report”. When they do so, they are asking to access your credit report at the credit bureau. This results in an inquiry in your credit report.

Lenders may be concerned if there are too many credit checks, or inquiries in your credit report.

It can seem like you’re:

- urgently seeking credit

- trying to live beyond your means

You May Like: Increase Credit Score By 50 Points

What Do I Need To Sign Up For A Credit Karma Account

In addition to creating a username and password, Credit Karma may ask you for your Social Security number. This information allows us to confirm your identity with the consumer credit bureaus to ensure that we show you accurate data.

You must be at least 18 years old to sign up for a Credit Karma account.

Keep Old Accounts Open And Deal With Delinquencies

The age-of-credit portion of your credit score looks at how long youve had your credit accounts. The older your average credit age, the more favorably you appear to lenders.

If you have old credit accounts that youre not using, dont close them. Though the credit history for those accounts would remain on your credit report, closing credit cards while you have a balance on other cards would lower your available credit and increase your credit utilization ratio. That could knock a few points off your score.

And if you have delinquent accounts, charge-offs, or collection accounts, take action to resolve them. For example, if you have an account with multiple late or missed payments, get caught up on what is past due, then work out a plan for making future payments on time. That wont erase the late payments but can improve your payment history going forward.

If you have charge-offs or collection accounts, decide whether it makes sense to either pay off those accounts in full or offer the creditor a settlement. Newer FICO and VantageScore credit-scoring models assign less negative impact to paid collection accounts. Paying off collections or charge-offs might offer a modest score boost. Remember, negative account information can remain on your credit history for up to seven yearsand bankruptcies for 10 years.

Recommended Reading: Protectmyid Deluxe Reviews

How Is My Credit Score Shown

Your credit score is shown as a number. Every credit reference agency uses a slightly different system and scale – but a higher number always means better credit.

When you use MoneySuperMarkets , the score you get will be out of a maximum of 710. Well also let you know what that number means, on a scale from very poor to excellent.

If you want, you can also see a free credit report, which will give you a detailed breakdown of your credit history, along with any outstanding debts and overdrafts you might have. That way, you can see whats affecting your credit score and well give you great tips to help you get it into even better shape.

What Does My Credit Score Mean

Making sense of your credit score can be fairly straight-forward no matter which credit reference agency its from. Thats because all three CRAs base their ratings on similar financial criteria. So while the number may vary from one agency to another, the actual rating is usually pretty consistent. Heres a simple guideline for assessing your credit score:

- Experian scores range from 0-999. A score of 721-880 is considered fair. A score of 881-960 is considered good.

- Equifax scores range from 0-700. 380-419 is considered a fair score. A score of 420-465 is considered good.

- TransUnion has an scores range from 0-710. A credit score of 566-603 is considered fair. A credit score of 604-627 is good.

Read Also: Syw Mc/cbna

Make The Most Of A Thin Credit File

Having a thin credit file means that you dont have enough credit history on your report to generate a credit score. An estimated 62 million Americans have this problem. Fortunately, there are ways to fatten up a thin credit file and earn a good credit score.

One is Experian Boost. This relatively new program collects financial data that isnt normally in your credit report, such as your banking history and utility payments, and includes that in calculating your Experian FICO credit score. Its free to use and designed for people with limited or no credit who have a positive history of paying their other bills on time.

UltraFICO is similar. This free program uses your banking history to help build a FICO score. Things that can help include having a savings cushion, maintaining a bank account over time, paying your bills through your bank account on time, and avoiding overdrafts.

A third option applies to renters. If you pay rent monthly, there are several services that allow you to get credit for those on-time payments. For example, Rental Kharma and RentTrack will report your rent payments to the credit bureaus on your behalf, which in turn could help your score. Note that reporting rent payments may only affect your VantageScore credit scores, not your FICO score. Some rent-reporting companies charge a fee for this service, so read the details to know what youre getting and possibly purchasing.

Get Your Credit Score From A Credit Bureau

Thanks to the Fair Credit Reporting Act , the three major Equifax, Experian and TransUnion are required to provide you with a free credit report once per year, upon request. But they arent legally required to provide your credit score.

Still, you can get your credit score from all three bureaus, though it wont be free in every case.

Equifax and Experian will provide you with your credit score for free, while TransUnion requires you to sign up for a monthly subscription that includes a bulk of other services.

All three credit bureaus have several subscription tiers and product packages, so if all youre trying to do is check your credit score, be sure youre selecting the most barebones option available. Otherwise, youll be shelling out for unwanted add ons.

Here are the most basic plans at all three bureaus:

The free plans from Experian and Equifax also come with basic credit tracking features and tips to boost your score. TransUnions basic plan includes similar credit tracking and educational features, as well as identity theft insurance, credit monitoring for all three bureaus, and more.

The free credit scores from Experian and Equifax are updated monthly. TransUnions plan says credit score updates are available daily.

Recommended Reading: How To Check Hard Inquiries Credit Karma

Summary Of Money’s Guide On How To Check Your Credit Score

- You actually have numerous personal credit scores, not just one. The most popular credit scores are variations of the VantageScore and FICO score.

- A variety of free credit-score providers are out there, including credit card providers, banks, the credit bureaus themselves, dozens of credit-scoring websites and certain credit counseling agencies.

- Some companies still try to get you to pay for your personal credit score. With so many free options available, that is no longer necessary in most cases.

- Businesses also have credit scores, but they work quite differently from personal credit scores.

- Its hard to get your businesss credit score for free. Youll likely need to purchase an individual business credit report, which includes your business credit scores, or sign up for a credit-score subscription plan for your company.

- Different variations of your business credit score are available via business credit-scoring websites and major credit bureaus.

Your Credit Card Provider

Many credit card providers also offer cardholders the ability to check their credit scores for free. Oftentimes, these tools include access to view your score history and see what led to recent changes. Some providers also let customers forecast how their scores would react to variables like on-time payments, credit limit increases and taking out a mortgage.

Keep in mind, however, that most providers require cardholders to opt in to this service, so make sure you sign up if you want to access your score.

Heres a look at popular credit card providers with credit score tools.

Also Check: How To Get A Repossession Off Your Credit