Check Credit Report Updates With Experian’s See What’s Changed Feature

Experian’s free credit report service provides updates on your Experian credit report every 30 days. The “See what’s changed” function on the app makes it easy to spot new information in your report. It’s a more user-friendly option than the traditional practice of comparing your current credit report to the last one you checked to identify changes in your data.

To view the “See what’s changed” information for your Experian credit report, click the Reports icon at the bottom of the Experian home screen on the app. Then click the “See what’s changed” button marked with a yellow bell icon.

The “See what’s changed” feature summarizes adjustments in your overall debt level, modifications to individual accounts, the opening or closing of new loans or credit card accounts, and any new inquiries or credit checks related to new applications for loans or other credit.

“See what’s changed” also reports increases or reductions in your total debt levels, changes in your total credit card borrowing limit and, if applicable, the addition or removal of collections accounts, foreclosures and bankruptcy filings.

Each entry in the “See what’s changed” list includes a notation of whether those changes “could help” your overall credit, “could harm” your credit, or “could help or harm” your credit standing. Click any entry to expand it for a more detailed explanation.

Pull Your Credit Report And Scores

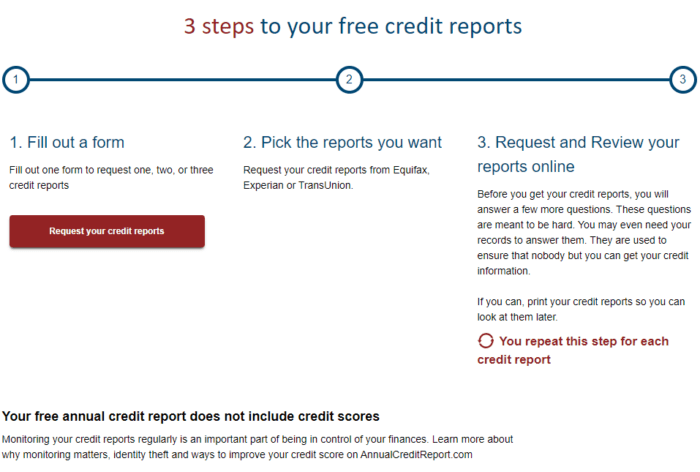

Usually, youre able to get one free credit report from each credit bureau annually at AnnualCreditReport.com. Until April 2021, the three credit bureaus Equifax, Experian, and TransUnion are offering free weekly reports because of the pandemic.

A free FICO credit score usually does not come with your free credit report. Your bank or credit union may offer free FICO Scores or can buy your FICO Score from myFICO. Another option is signing up for sites like Credit Karma or CreditCards.com to get a free VantageScore.

Why Get Your Free Experian Credit Report

Gain credit insights

View the same type of information that lenders see when requesting your credit. See whoâs accessing your data and get tips on how to improve your financial health.

View your score factors

Your credit score is calculated from the information found in your credit report. See the positive and negative factors that impact your FICO® Score.

Raise your credit scores instantly

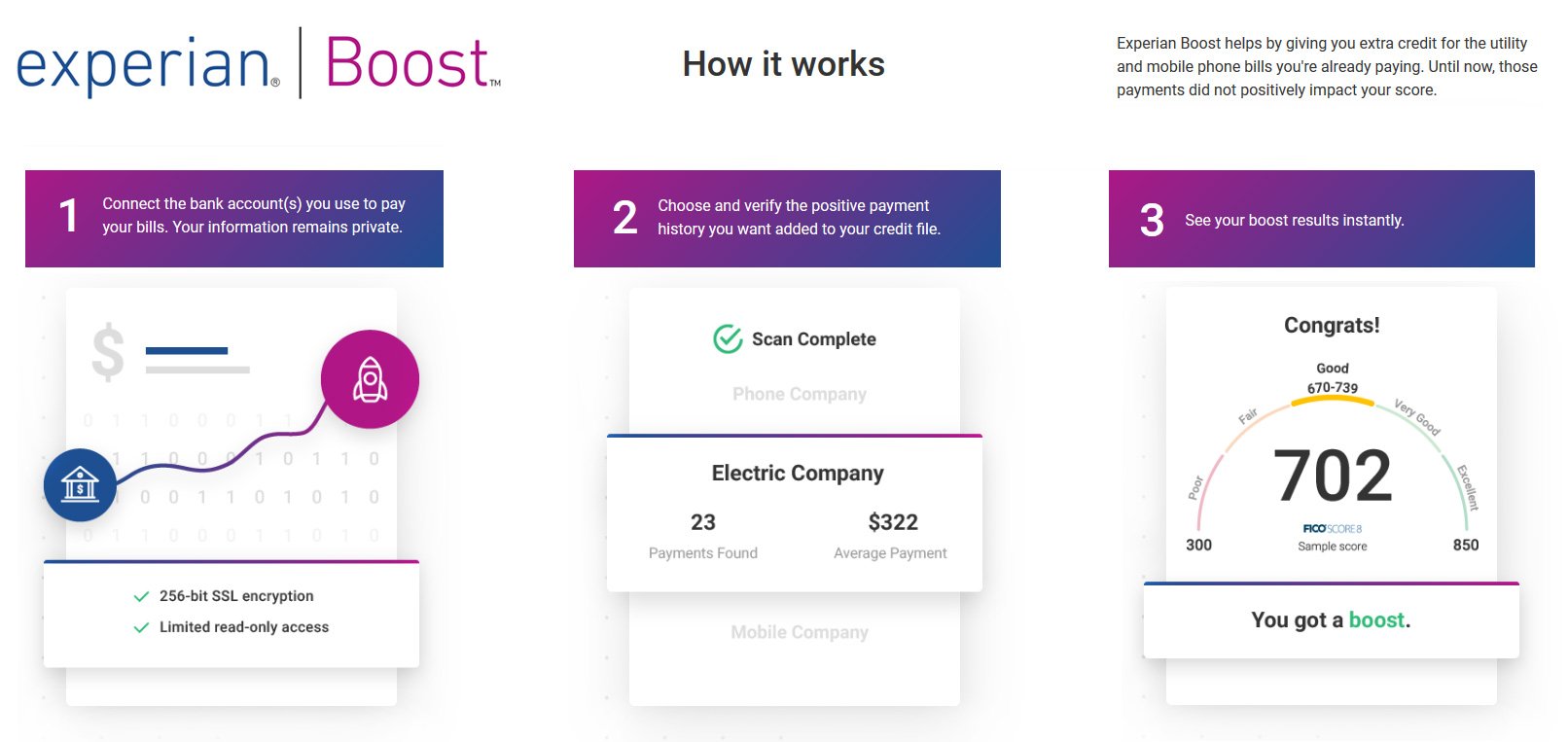

Get credit for your phone and utility bills by adding positive payments to your Experian credit file.

Average users who received a boost improved their FICO® Score 8 based on Experian Data by 12 points. Some may not see improved scores or approval odds. Not all lenders use credit information impacted by Experian BoostTM.

Read Also: Does Credit Check Affect Credit Score

What Is Experian Boost

On-time payment history is the most important factor in your credit score accounting for 35% of your total credit score, followed by credit utilization which makes up 30% of your credit score. This product allows consumers to add additional on-time payments to their Experian credit report by linking their bank account. Additional on-time payment history can help increase your credit score.

Using Experian Boost to boost your credit scores isnt complicated. The first thing youll need to do is connect the account that you use to pay your qualifying utility, cell phone and video streaming service payments. After connecting the bank account, users can choose which positive payment histories from these services to add to their Experian credit report.; If applicable, you may see the results of Experian Boost instantly.

Those most likely to benefit have thin credit histories, meaning they dont have many credit accounts to report on-time payments to their credit report. According to Experians website, average users who received a boost improved their FICO Score based on Experian Data by 13 points. Remember that results may vary, and are dependent on factors like your existing credit profile.

Read More: What Is a Good Credit Score?

Services You Can Use Independently

Note that your landlord may need to verify your rent payments. Some services may not be able to report your payments if your landlord wont verify.

-

Rent Reporters: There is a one-time enrollment fee of $94.95, which includes up to two years of reported rental payments, then the service is $9.95 per month. It reports to TransUnion and Equifax.

-

Rental Kharma: Initial setup is $50, including six months of past history, and the service is $8.95 per month. It reports to TransUnion.

-

LevelCredit: Previously known as RentTrack, LevelCredit charges a $6.95 monthly fee to have your rent and utility payments reported to Equifax and TransUnion. A look-back of up to 24 months is available on your current lease for a fee.

-

Rock the Score: There is an enrollment fee of $48, and ongoing service costs $6.95 per month. There is a $65 fee for reporting up to two years of rental history. It reports to TransUnion and, if the landlord is a property manager, Equifax.

-

Esusu Rent reports your rental payments to the three major credit bureaus. You can sign up as an independent renter for a $50 annual fee on the Esusu Rent mobile app.

-

PaymentReport: A $49 enrollment fee gets you two years of rental history reported to Equifax and TransUnion. Ongoing reporting is free.

Also Check: Is 779 A Good Credit Score

Select The Accounts You Want Included In Your Credit Report

If Boost finds at least three payments made to a utility account, this account is eligible to be included in your credit report.;Boost then presents all eligible accounts to you so you can pick which ones you want to have included in your Experian credit report.

Boost only includes positive payment history in your credit report. It cannot detect any late payments you might have made, or payments you might have skipped.

This is an advantage to the consumer, but a disadvantage to the lender who relies on complete and accurate information to make credit risk decisions.; Some lenders may not recognize accounts added by Boost because they consider the information incomplete.

Pros Of Experian Boost

Experian Boost cant help everyone, but there are some potential benefits for people who can take advantage of it:

- Its free: A lot of credit monitoring companies charge for their services. And while Experian does have some premium features you have to pay for, you can get FICO score access, a free Experian credit report, and Experian Boost for free.

- Its easy: It doesnt take much to enroll. And, according to Experian, it only takes about five minutes to get your boost.

- You get instant results: If youre eligible to get a boost, youll see your results immediately. Other strategies for improving your credit can take several months before you see a potential change.

- It can make a difference for many: If you have poor or limited credit, it can be tough to get approved for loans and credit cards. In the right situation, Experian Boost can add valuable information to your credit file and potentially increase your score enough to make a difference in your approval odds and interest rates.

Read Also: How To Up Credit Score

Best Credit Repair Companies: Frequently Asked Questions

What do you mean by Credit Repair?

Just as a house or a car is repaired by replacing bad areas, credit repair is removing mistaken, unverified, or erroneous entries on your credit reports.

You can do this for yourself, or you can hire a credit repair agency like to do it for you.

Do credit repair services really work?

Yes, can be a great way to remove negative data and errors from your credit report that may be dragging down your FICO score unfairly.

Credit repair services are best used by those with poor or fair credit scores – people with above-average FICO scores are unlikely to see a huge change.

How quick is the repair process?

Credit repair is gradual, so youll have to have some patience. While some credit services recommend you remain with the program for 6 months or so, many people see positive results within 45 – 60 days.

Is credit repair worth the money?

Thats for you to decide. If you want to improve your credit in the fastest, most convenient way, you might consider one of the credit repair services. A lot of past clients would rather spend the money than spend their time and effort improving their credit manually.

Can I have my bankruptcy removed?

Probably not. Certain negative items, including bankruptcies and judgments, are difficult, if not impossible, to remove.

Nonetheless, you can improve your FICO score via other methods.

Whats a FICO score? And what does it have to do with credit?

Common methods include:

And much more.

Credit Reports 9141 Extension

Coloradans have a right to receive two free copies of credit reports from Lenders are not required to report information to all three credit bureaus.

May 18, 2021 WHAT DOES FREEZING MY CREDIT DO? When you freeze your credit, the credit reporting bureaus cant give any information to anyone who makes;

Jul 15, 2021 We explain why consumers have three credit reports, why you have many you can get a copy of your credit report from all 3 bureaus in;

Apr 2, 2021 Where To Get Your 3 Credit Reports. Youre entitled to one free report from each bureau every 12 months via annualcreditreport.com. We recommend;

Get the total view of your credit. Includes your Experian, Transunion, and Equifax credit reports and FICO Scores with a 7-day trial membership for $1.

Step 3 Dispute Your Credit Reports Errors. Under the Fair Credit Reporting Act, both the credit reporting bureau and the company that reports the information;

All of your creditors will report your information to at least one of these You can obtain your score from the credit bureaus, usually for a small fee.

That may be enough to prompt you to review reports from Equifax, Experian, and TransUnionthe nations three major credit reporting agenciesand dispute credit;

consumers to receive free copies of their credit report annually. Reports can be ordered at any time from one of the three major credit bureaus:.

Don’t Miss: What Does Charge Off Mean On Credit Report

Is Experian Boost Worth It

Experian Boost is a free service that can help you raise your FICO® Score in a matter of minutes. For anyone who has worked to improve their credit scores over months or even years, seeing those credit scores go up instantly can be extremely rewarding.

Having a good credit score not only makes you feel good, but it can also help you save money and expose you to new financial opportunities. Your improved FICO® Score may help you get a favorable interest rate on a new loan, which could save you hundreds or even thousands of dollars over the life of the loan. Your improved credit score may also make you eligible for a new type of credit. These positive outcomes make Experian Boost worth it for many consumers.

Is Experian Boost Safe

Anytime youre dealing with your finances, you want to take precautions.

Experian Boost is safe.;The system uses use 256-bit SSL encryption, which is government-level security.

Experian will review your bank records to find qualifying payments made to utility and phone companies. You will have to give Experian access to your account.

Theyre limited to;read-only;access. That means they dont store your login information and cant make any changes to your account.

Don’t Miss: How To Get A Debt Collection Removed From Credit Report

Why You Can Trust Bankrate

At Bankrate, we have a mission to demystify the credit cards industry regardless or where you are in your journey and make it one you can navigate with confidence. Our team is full of a diverse range of experts from credit card pros to data analysts and, most importantly, people who shop for credit cards just like you. With this combination of expertise and perspectives, we keep close tabs on the credit card industry year-round to:

- Meet you wherever you are in your credit card journey to guide your information search and help you understand your options.

- Consistently provide up-to-date, reliable market information so you’re well-equipped to make confident decisions.

- Reduce industry jargon so you get the clearest form of information possible, so you can make the right decision for you.

At Bankrate, we focus on the points consumers care about most: rewards, welcome offers and bonuses, APR, and overall customer experience. Any issuers discussed on our site are vetted based on the value they provide to consumers at each of these levels. At each step of the way, we fact-check ourselves to prioritize accuracy so we can continue to be here for your every next.

What Bills Doesnt Experian Boost Track

Experian Boost doesnt track every recurring bill. One example is bills that you pay with online bill pay and your bank mails a paper check to the utility. Enrolling in auto-pay where the utility automatically debits your bank account monthly can let Experian Boost track your bill.

You wont receive credit for recurring bills like rent payments or medical bills either.

Don’t Miss: How To Get Your Free Credit Report From Experian

How Does Inflation Affect Your Credit

Inflationthe tendency for the cost of goods and services to increase over timehas been in the news in recent months, prompting some to worry about its potential impacts on their personal finances and credit. Inflation has no direct effect on credit reports, credit scores or your ability to qualify for loans or credit, but it can influence credit indirectly if it affects your household budget. Here’s a rundown of how inflation and credit are relatedbut mostly unrelatedto one another.

How Many Points Does Experian Boost Give You

First and foremost, Experian Boost doesnt guarantee a minimum credit score increase. Experian mentions the average user sees a 13-point increase on their FICO® Score 8.

The FICO® Score 8 is one of the most commonly used credit scoring models for lenders. As a result, the score that Experian Boost shares can be more accurate than other free credit score sites that use the VantageScore. Some lenders may use an industry-specific credit score that emphasizes your previous experience with similar loans such as auto loans.

People with no credit history or low credit scores can see the highest increase. One testimonial mentions receiving a 47-point increase. This large of an increase is less common, but its possible if you dont have a lengthy credit history.

If you already have good credit scores in the 700s or low 800s, you may only see an increase of a few points. For instance, my Experian credit score increased five points, from 807 to 812 after adding one utility and two telecom payments.

FICO® Score 8 Credit Score Ranges

Experian Boost will calculate a FICO® Score between 300 and 850. A higher score indicates a more robust credit history.

Below are the credit score ranges for the FICO® Score 8:

- Very Poor: 300-579

- Very Good: 740-799

- Excellent: 800-850

It can take up to six months of payment history to get credit scores. Linking your monthly bills can help you establish a payment history sooner so you can qualify for credit accounts that report to the credit bureaus.

Read Also: Do Medical Bills Show Up On Credit Report

Sign Up For Experian Boost

Its free to sign up for Experian Boost. When I did, it immediately produced a credit report, an updated FICO score and an overview of my financial profile. Here is what was included there:

- Payment history

I then scrolled to the bottom of the page and clicked the Experian Boost button. That took me to a page that showed icons for electric, water and wireless bills.

You Can Now Receive 3 Free Credit Reports Each Week Cnbc

The three major credit bureaus Experian, Equifax and TransUnion are offering free credit reports to all Americans on a weekly basis so you can protect your;

Do You Need All Three Scores? Because of their reporting methods, it is common to have different credit scores across all three bureaus. In order to get;

Under the Fair Credit Reporting Act, you are also entitled to a free annual credit report each year from each of the three major consumer credit bureaus. To;

Credit Sesame automatically pulls in your credit information every month from TransUnions VantageScore, including your free credit score and your debts, and;

Mar 2, 2021 To access your free credit reports, visit AnnualCreditReport.com. Youll need to answer some questions to prove your identity in order to see;

Read Also: Does Debt Consolidation Affect Your Credit Score

Crush Your Credit Card Balances

Your a ratio that compares your credit limits to your credit balances is another component that highly influences your credit score. Experts recommend not using more than 30% of your available credit.

Its important to keep your credit card balances at a manageable level. Maintaining high account balances on your credit report shows lenders that you may be a credit risk and it can drop your score.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Read Also: What Credit Report Does Paypal Pull

What Is Experian Boost And How Does It Work

Experian Boost is a free service designed to help you raise your credit score by incorporating more of your monthly payments into your credit file.

Of the five factors that make up your credit score, on-time payments account for the largest percentage .;Those payments are what Experian Boost uses to give your credit score an instant lift.

Heres a step-by-step guide to increasing your credit score with Experian Boost: