Most Versatile: Identity Guard

The parent company of Identity Guard has served over 47 million customers over more than 20 years in business. The credit monitoring keeps a close eye on your credit files from all three of the major credit bureaus. You can choose between the Value, Total, and Ultra Plans either for yourself or your family. Plans include $1 million of identity theft insurance, a U.S.-based case manager to work with you if your identity is stolen, a mobile application to access your membership information, alerts when your personal information is detected on the Dark Web, monthly credit score, three-bureau credit monitoring, and account takeover alerts.

Plans range from $13.33 to $20 for individual and $20 to $26.67 for family protection. If you decide not to keep your subscription, make sure you cancel before the trial ends to avoid being charged. TheBalance.com readers receive a 20% discount.

What You Can Do To Detect Identity Theft

Heres what you can do to spot identity theft:

- Track what bills you owe and when theyre due. If you stop getting a bill, that could be a sign that someone changed your billing address.

- Review your bills. Charges for things you didnt buy could be a sign of identity theft. So could a new bill you didnt expect.

- Check your bank account statement. Withdrawals you didnt make could be a sign of identity theft.

- Get and review your credit reports. Accounts in your name that you dont recognize could be a sign of identity theft. Heres how you can get your free credit reports.

If you discover that someone is misusing your personal information, visit IdentityTheft.gov to report and recover from identity theft.

Best Free Credit Monitoring Services

See our methodology, terms apply.

Who’s this for? is a free credit monitoring service that doesn’t require you to enter a credit card number to sign up and provides a great range of features.

Plus it’s open to anyone regardless of whether you’re a Capital One cardholder. If you’re a Capital One customer, CreditWise features are integrated into the Capital One mobile app, so there’s no need to also download the CreditWise app.

Consumers receive an updated VantageScore credit score from TransUnion every week and credit report updates from TransUnion and Experian in real time. Unlike other free services, CreditWise stands out by offering dark web scanning and social security number tracking.

As an added tool, you can use the credit score simulator to check the potential effect that certain actions, such as paying off debt or closing a credit card, may have on your credit score.

Don’t Miss: Is 766 A Good Credit Score

Protect Your Information From Scammers Online And On Your Phone

If youre logging in to an online account, use a strong password.

Add multi-factor authentication for accounts that offer it. Multi-factor authentication offers extra security by requiring two or more credentials to log in to your account. The additional credentials you need to log in to your account fall into two categories: something you have like a passcode you get via text message or an authentication app, or something you are like a scan of your fingerprint, your retina, or your face. Multi-factor authentication makes it harder for scammers to log in to your accounts if they do get your username and password.

Do not give your personal information to someone who calls, emails, or texts you. It could be a scammer trying to steal your information.

Watch 5 Ways To Help Protect Your Identity.

Avoid Credit Bureaus’ Products

If you are buying credit monitoring, NerdWallet recommends avoiding the offerings from credit bureaus themselves. Here’s why:

-

These may not offer much identity theft coverage, despite costing as much as other companies’ offerings.

-

In addition, credit bureau monitoring plans typically have an arbitration clause in their terms of service. When you sign up, you must waive your right to a class-action lawsuit and agree to binding arbitration, which widely is considered to be against a consumers best interests.

The inability to sue is particularly bad in case of a data breach, such as the 2017 Equifax incident, because a credit bureau could fail you in two ways: by not providing adequate monitoring and by failing to safeguard the consumer information it collects on you.

You May Like: What Company Is Syncb Ppc

What Do I Do Next Ongoing Steps To Take

As weve talked about in some of my other blog posts, identity theft can be a long-term problem where follow-up instances of theft can crop up over time. However, there are a few steps you can take to minimize the damage and ensure it doesnt happen again. I cover several of those steps in detail in this blog here, yet lets take a look at a few of the top items as they relate to SSN theft:

Consider placing a fraud alert.

Look into an all-out credit freeze.

A full credit freeze is in place until you lift it and will prohibit creditors from pulling your credit report altogether. This can help stop thieves dead in their tracks since approving credit requires pulling a report. However, this applies to legitimate inquires, including any that you make, like opening a new loan or signing up for a credit card. If thats the case, youll need to take extra steps as directed by the particular institution or lender. Unlike the fraud alert, youll need to notify each of the three major credit bureaus when you want the freeze lifted.

Monitor your credit reports.

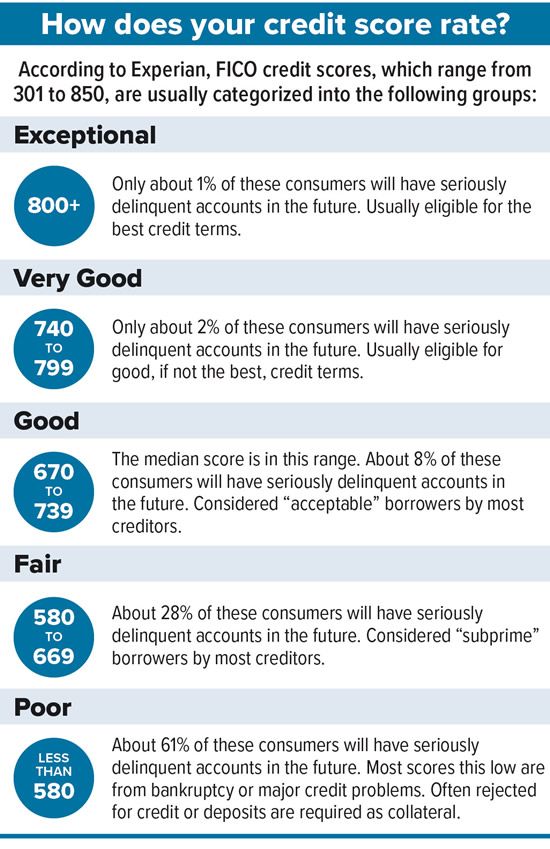

Once every 12 months, you can access a free credit report from Experian, TransUnion, and Equifax. Doing so will allow you to spot any future discrepancies and offer you options for correcting them.

Sign up for an identity protection service.

What Credit Monitoring Services Dont Do

Credit monitoring services are informational: They dont prevent identity theft, nor do they stop people from opening new accounts or making unauthorized payments in your name. They also dont report identity theft people will need to contact the FTC if they suspect someone is using their personal information. Credit monitoring services dont prevent your information from being stolen in data breaches, fix errors found in your credit report, freeze your credit in case of fraud or warn you if anyone filed a tax return in your name.

Recommended Reading: When Does Usaa Report To The Credit Bureaus

Report Identity Theft To The Police Department

Once youve reported the identity theft to the FTC, go to your local police department to file a detailed police report. File reports in each jurisdiction where the thief committed fraud, and consider filing one with the state police.

The police officer who takes your report should attach a copy of the FTC report. If the police are reluctant to help you file an identity theft report, ask to file a miscellaneous incident report instead, or get in touch with your local attorney generals office for further guidance.

What Is A Credit Freeze

When you freeze your credit, your credit-report file is locked. This makes it impossible for lenders and identity fraudsters to open the account or inquire about your credit history until you remove the freeze. Freezing your credit file therefore provides you with protection against the kind of fraud often perpetrated by identity thieves. It also prevents unauthorized access to your personal data.

If you freeze your credit file after your personal data has already been compromised, the freeze can only help you to prevent future breaches of the file. It cant help you fix the breach that has already occurred. A scammer who is already privy to your account number and other personal data can still use your card to make purchases. Even worse, the scammer can sell the stolen information to other bad guys online.

To avoid such breaches, make sure that your personal data is always secure so that when you eventually can obtain a credit card freeze, it will be useful. To be as safe as possible , it is imperative that you protect all your personal data from theft as thoroughly as you can.

Also Check: How To Unlock My Experian Credit Report

Place A Fraud Alert On Your Credit Reports

If you believe youre a victim, you may want to place a fraud alert on your credit report, advises the Consumer Financial Protection Bureau.

Its free to place a fraud alert on your credit reports, and people do this even if they only suspect their information has been compromised. Youll only have to contact one of the credit reporting bureaus for a fraud alert that bureau is required to contact the others with your request.

Heres how a fraud alert works: When credit card issuers and other lenders pull your credit reports, theyll be notified that you may be the victim of identity theft and should contact you before opening an account in your name.

Identity Theft Protection Services

An identity theft protection service generally provides its customers with more than credit monitoring services.

While a free credit monitoring service may point out that there is activity on your credit report, an identity theft protection service could monitor for suspicious or fraudulent activity involving your identity via bank accounts, criminal databases, and other places your Social Security number is used. Such services sometimes also help fix the problem, should your identity be stolen. An identity theft protection service may also alert consumers whose personal information is spotted on the dark web because an identity thief is selling it.

You may find that these services are available to you through your bank or insurance company, often for an additional fee, or you can seek out an independent service.

If your identity is stolen, it could take months or even years to unravel the mess it creates. You can take steps on your own to fix it, or you can sign up for an identity theft protection service that offers restoration help.

If you become a victim of identity theft, there are many important steps to take, including filing a police report and placing an initial fraud alert on your credit by contacting one of the three main credit reporting agencies. A fraud alert tells potential lenders to reach out to you directly to verify the applicants identity before opening new accounts in your name, according to the FTC.

Don’t Miss: Does Speedy Cash Report To Credit Bureaus

Should You Pay For Credit Monitoring

Free services may be sufficient if you only have a few accounts and credit cards, and dont have too many assets at risk. As you progress and use multiple credit cards, build up your retirement savings, get employee stock options, and start a family, you may need a more robust credit monitoring and identity protection service.

If your identity has been stolen in the past, using a credit monitoring service is a smart decision. Since your information has already been compromised, a credit monitoring service can ensure your information isnt used again to open up fraudulent accounts.

Premium credit monitoring services provide extra protection, including up to $1 million in identity theft insurance. Some plans will even reimburse you for funds stolen from your 401 or employee stock options plan and will help protect your childrens information as well. While they have a higher cost, these services can be well worth the investment for the security they provide.

What Should I Do If My Identity Is Stolen

If you become the victim of identity theft, place a fraud alert on your credit reports, freeze your credit, review your credit reports, contact the Federal Trade Commission, make a list of all stolen items and keep records, contact your creditors and key agencies, and change your accounts passwords.

Disclosures

ProtectMyID® Essential, ProtectMyID® Deluxe and ProtectMyID® Platinum are provided by Experian®. To be eligible to enroll in either ProtectMyID Essential, ProtectMyID Deluxe or ProtectMyID Platinum, you must be 18 years of age or older and a current AAA member. A valid email address and access to the internet is required for ProtectMyID Essential. Products subject to change or termination at any time without notice. Certain terms, conditions, and restrictions apply. Pricing subject to sales tax where applicable.

ProtectMyID® Essential, ProtectMyID® Deluxe and ProtectMyID® Platinum are monitoring products designed to help you identify and resolve identity theft incidents. These products are provided in addition to any precautions you should reasonably be expected to take yourself, including protecting your account numbers, passwords, social security number and other personally identifying information. ProtectMyID Essential, ProtectMyID Deluxe and ProtectMyID Platinum cannot stop, prevent, or guarantee protection against incidents of identity theft.

1) 2019 Identity Fraud Study, Javelin Strategy & Research

2) 2018 Javelin Identity Fraud Report

Read Also: Is Chase Credit Score Accurate

Other Identity Guard Features

Along with monitoring all three credit bureaus for signs of fraud, Identity Guard helps protect its subscribers with IBM Watson. A supercomputer the size of ten standard refrigerators constantly scours public and dark web data, processing trillions of data points per second. As an Identity Guard subscriber youll be alerted right away if Watson finds your credit card number, SSN or other private personal information.

To help keep your data safe as you use the web, Identity Guard Premier also provides anti-phishing and safe browsing tools.

Overall the main features of Identity Guard Premier are:

In sum, Identity Guard is a best buy for comprehensive identity theft protection. It costs about $20/month for an individual and $30/month for families.

Identify And Guard Unprotected Assets

Its especially important to lock down your retirement and investment accounts, which unlike most checking and savings accounts dont automatically get regulatory protection from fraud losses, leaving your life savings exposed and vulnerable.

A few years ago, Checkbook reviewed the websites of nine major investment firms, and found two that lacked specifics about any policies that might protect your assets from theft. Meanwhile, companies that explicitly offer such coverage often have dozens of requirements to qualify for reimbursement if theres a problem.

Enable MFA for these accounts and use your password manager to create and use strong, unique passwords for them. Once a month, check account activity and immediately report possible theft or fraud.

You May Like: How To Remove Child Support From Credit Report

S To Take If You Suspect That Youre The Victim Of Identity Theft

The point is that if you suspect fraud, you need to act right away. With identity theft becoming increasingly commonplace, many businesses, banks, and organizations have fraud reporting mechanisms in place that can assist you should you have any concerns. With that in mind, here are some immediate steps you can take:

1) Notify the companies and institutions involved

Whether you spot a curious charge on your bank statement or you discover what looks like a fraudulent account when you get your free credit report, let the bank or business involved know you suspect fraud. With a visit to their website, you can track down the appropriate number to call and get the investigation process started.

2) File a police report

Some businesses will require you to file a local police report to acquire a case number to complete your claim. Even beyond a business making such a request, filing a report is still a good idea. Identity theft is still theft and reporting it provides an official record of the incident. Should your case of identity theft lead to someone impersonating you or committing a crime in your name, filing a police report right away can help clear your name down the road. Be sure to save any evidence you have, like statements or documents that are associated with the theft. They can help clean up your record as well.

3) Contact the Federal Trade Commission

4) Place a fraud alert and consider a credit freeze

5) Dispute any discrepancies in your credit reports

Best Overall Paid Service

-

Identity insurance

Yes, $1 million for all plans

See our methodology, terms apply. To learn more about IdentityForce®, visit their website or call 855-979-1118.

Who’s this for? IdentityForce® UltraSecure and UltraSecure+Credit offer the most extensive security features that monitor your information on a variety of sites and services, including the dark web, court records and social media .

Consumers receive alerts for potential fraud on your bank, credit card and investment accounts, as well as the use of your medical ID, social security number and address.

For a complete credit monitoring and identity protection service, opt for UltraSecure+Credit. This plan provides the added benefit of three-bureau credit monitoring and credit score updates. You can also track how your score changes over time and simulate how certain actions can impact your score .

UltraSecure costs $9.99 per month or $99.90 per year and $17.99 per month or $179.90 per year for UltraSecure+Credit. For a limited time, you’ll get 25% off all plans, including Family plans .

Recommended Reading: Does Paypal Credit Report To Credit Bureaus

How To Report Identity Theft To Social Security

8 MIN READ

In the hands of a thief, your Social Security Number is the master key to your identity.

With a Social Security Number , a thief can unlock everything from credit history and credit line to tax refunds and medical care. In extreme cases, thieves can use it to impersonate others. So, if you suspect your number is lost or stolen, its important to report identity theft to Social Security right away.

Part of what makes an SSN so powerful in identity theft is that theres only one like it. Unlike a compromised credit card, you cant hop on the phone and get a replacement. No question, the theft of your SSN has serious implications. If you suspect it, report it. So, lets take a look at how it can happen and how you can report identity theft to Social Security if it does.

Best For Families: Experian Identityworks

Experian IdentityWorks

Experian, one of the three major credit bureaus, offers IdentityWorks credit monitoring service that monitors all three of your credit reports. In addition to monitoring your three credit reports and credit scores for changes that signal identity theft, IdentityWorks provides a number of other credit and identity monitoring services. It scans the Dark Web for your personal information, notifies you if a sex offender moves into your neighborhood, detects when crimes are booked in your name or reported in the court system, detects when payday loans are opened in your name, alerts you to a change of address in the U.S. Postal Service, watches for account takeover and alerts you when any accounts are opened using your social security number.

Choose a plan for one adult starting at $9.99 one adult and up to 10 children, starting at $14.99 or two adults and up to 10 children, starting at $19.99. Plans include a 30-day trial subscription, so you can decide whether you want to keep the service or cancel.

Don’t Miss: Does Paypal Credit Report To Credit Bureaus