What If I Dont Want Wells Fargo To Display My Fico Score Anymore

You can opt out of the service at any time. On the FICO® Score screen, select the I no longer want Wells Fargo to display my FICO® Score link. If you decide to start the service again in the future, you can select View Your FICO® Credit Score on the Account Summary and follow the instructions to opt back in.

What Is A Credit Score

A credit score is a numerical representation of financial health, telling lenders at a glance how responsible you are with credit and debt. Generally speaking, a higher credit score suggests that you borrow and pay back what you owe on time. A lower credit score, on the other hand, may hint that you struggle with managing debt obligations.

So where do credit scores come from? They’re generated by companies like Equifax, Experian, and TransUnion based on information that’s included in your credit reports. A is a collection of information about your financial life, including:

- Your identity

- Existing credit accounts

- Public records, including judgments, liens, or bankruptcy filings

- Inquiries about you from individuals or organizations that have requested a copy of your credit file

Credit reports are maintained by . Equifax, Experian, and TransUnion are the biggest in the U.S. These companies compile credit reports based on information that’s reported to them by creditors as well as information that’s available as part of the public record.

If I Dont Agree With My Fico Score What Should I Do

Your FICO® Score is provided to Wells Fargo by Experian® based on information within your credit report on the calculation date . If you feel this information is inaccurate, your next step should be to request a free credit report from annualcreditreport.com. If theres incorrect information within any of your credit reports, follow each bureaus instructions on how to dispute that information. If theres incorrect information about your Wells Fargo accounts, please call the Wells Fargo phone number in your credit report.

Also Check: Check My Credit Score With Itin Number

Where To Park Cash

Dear Liz: I turned 72 in December and took my first required minimum distribution. With the goal of purchasing property next year, should I put the funds $6,000 in my Roth IRA or just put it in my bank savings account? Also, should I convert my traditional IRA to a Roth or just leave it alone?

Answer: To contribute to an IRA or Roth IRA, you must have earned income such as wages, salary or self-employment income. If you dont have earned income, your contribution would be considered an excess contribution that could incur a 6% penalty for each year the money remained in the account.

You dont have to be working to convert a traditional IRA to a Roth, but theres typically not much reason to do so at this point unless you intend the money to go to your heirs and want to pay the income taxes rather than have them do so. Even then, you should run this idea past a tax pro or a financial planner since conversions can create other problems, such as higher Medicare premiums.

Online eyewear sites are pushing prices for glasses down. But the markups for most frames and lenses remain exorbitant.

Other Credit Scores Or Fico Scores

While FICO Scores are used by 90% of top lenders, there are other credit scores made available to consumers. Other credit scores may evaluate your credit report differently than FICO Scores. When purchasing a credit score for yourself, most experts recommend getting a FICO Score, as FICO Scores are used in 90% of lending decisions.

Don’t Miss: Will Paypal Credit Report To Credit Bureaus

How To Check Your Credit Scores

Now that weve made all this fuss about FICO scores, you probably want to know what yours are, right?

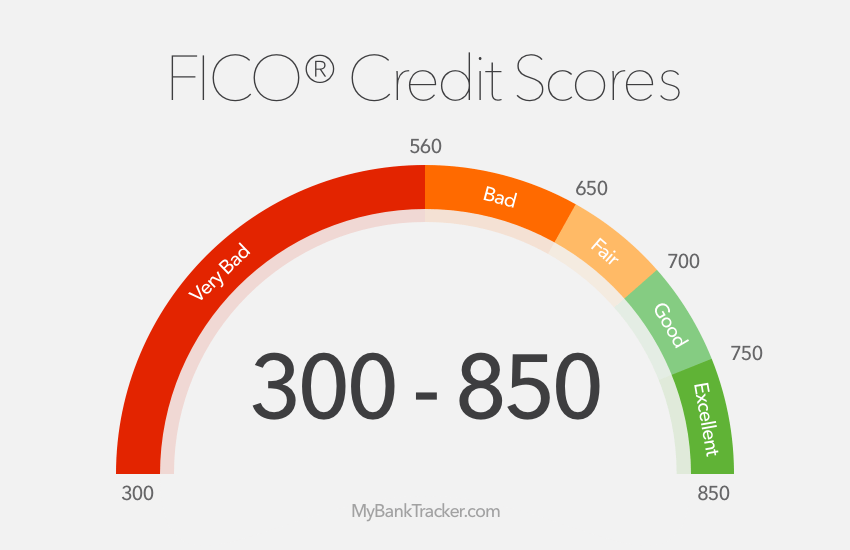

These ranges are somewhat subjective, since lenders base their decisions on more than just credit scores.

To see where you fall, try the Discover Credit Scorecard, which gives a free FICO score to anyone who signs up for an account.

Or, for more options, heres a list of all the places you can get your FICO scores for free. It also includes websites where you can get other free credit scores, like your VantageScores.

Insider tip

While youre at it, you should probably check your credit reports. Theyre what your credit scores are based on, so if theyre not correct, your credit scores wont be either. You can get one free credit report per year, per bureau at AnnualCreditReport.com. You can also use services like to monitor two of your VantageScore 3.0 credit scores on a regular basis.

Fico Score Vs Credit Score: Which Is Better

Whether a FICO credit score is better than another credit score depends largely on how the scores are calculated and how they’re being used. Again, FICO scores focus on payment history, credit utilization, credit age, credit mix, and credit inquiries to give lenders an idea of how likely you are to pay back the money you borrow. Other credit scoring models may consider different factors to make the same determination.

VantageScores, for example, break down like this:

- Extremely influential: Credit usage, balance and available credit

- Highly influential: Credit mix and experience

- Moderately influential: Payment history

- Less influential: Age of credit history

- Less influential: New accounts

VantageScores range from 300 to 850 like FICO, while assigning different weights to payment history, credit usage, and other activity. So in terms of which score is better, a lender might prefer to use FICO scores if they want to gauge how likely someone is to repay their debt. But if they’re more interested in how much debt someone has and their credit utilization, they may use VantageScores.

Recommended Reading: Is Credit Wise Score Accurate

How Does A Bankruptcy Impact My Fico Score

A bankruptcy is considered a very negative event by FICO® Scores. As long as the bankruptcy is listed on your credit report, it will be factored into your scores. How much of an impact it will have on your score will depend on your entire credit profile. As the bankruptcy item ages, its impact on a FICO® Score gradually decreases. Typically, here is how long you can expect bankruptcies to remain on your credit reports :

- Chapter 11 and 7 bankruptcies up to 10 years.

- Completed Chapter 13 bankruptcies up to 7 years.

These dates and time periods refer to the public record item associated with filing for bankruptcy. All of the individual accounts included in the bankruptcy should be removed from your credit reports after 7 years.

What Is A Fico Score Fico Score Vs Credit Score

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

A FICO score is a three-digit number, typically on a 300-850 range, that tells lenders how likely a consumer is to repay borrowed money based on their credit history.

Read Also: What Mortgage Company Uses Factual Data

What Is A Bad Credit Score And Why Does It Matter

There are hundreds of credit scores out there, but the two most common credit scoring models are created by FICO and VantageScore. FICO considers a credit score between 300 and 579 to be poor, while VantageScore considers a poor credit score to be between 500 and 600, according to the credit bureau Experian. Under the VantageScore model, a credit score between 300 and 499 is considered to be very poor, while FICO doesnt have a separate very poor category. Keep in mind that your score may also vary with each of the three consumer credit bureaus Equifax, TransUnion, and Experian who all collect and report information independently of each other.

Having a bad credit score can affect your life in many ways. Any time youre applying for a mortgage, a car loan, any lease, its going to affect your payment. Youre going to end up paying a higher interest rate, says Jessica Weaver, CFP, CDFA, CFS, and author of Confessions of a Money Queen.Bad credit can even affect employment and housing, Weaver adds. Some employers check your credit score during the hiring process, and landlords use your credit score to determine if youre eligible to rent.

You might be denied a loan or a altogether if you have bad credit, says Nathan Grant, senior credit industry analyst at Credit Card Insider. Even if you are approved, youre going to get worse terms for financing that you can get and lower credit limits, he adds. Bad credit can also affect your insurance rates.

What Is A Fico Score

FICO® is more than just a credit scorein fact, its a whole company. FICO® stands for Fair Isaac Corporation, which is a data analytics firm that focuses on providing credit scoring services to lenders who need to vet potential borrowers. To date, the FICO® score is the most-used credit score model in the United States.

The goal of your FICO® score is to rank consumers based on how likely they are to pay their debts. They do this by calculating your risk according to factors like your credit mix, credit limit use, and the length of your credit history. Then, they compile the results into a three-digit credit score, known as the FICO® score.

Read Also: What Is Serious Delinquency On Credit Report

Does The Fico Score Im Seeing Reflect My Most Recent Payments

Scores reflect data from your Experian® credit report at the time it was calculated and may be from a previous period. All lenders have their own reporting schedule, so you should allow 30-60 days from the time of any payments or other activity for that activity to be reported in your credit report and then reflected in your FICO® Score. If you believe your FICO® Score is incorrect or doesnt reflect your most current activity, the first thing you should do is check your credit report. You can check your credit report from each of the three consumer reporting bureaus once per year for free at annualcreditreport.com. If you see an error or a particular lender has not reported your latest activity to the credit bureau, follow each bureaus instructions on how to dispute the information or contact the lender directly. If you see an error associated with a Wells Fargo account, call us at 1-855-329-9605, Mon Fri, 7:00 a.m. 7:00 p.m. Central Time.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity, this post may contain references to products from our partners. Heres an explanation forhow we make money.

You May Like: Remove Student Loans From Credit Report

Why Do I Have Three Different Fico Scores

In addition to the FICO and VantageScore which we have already gone over, you also have a distinct and individual credit score with each of the credit reporting agencies. Equifax, Experian, and TransUnion may not be getting all of your payment information. Your credit score will be similar between each of these agencies. But some lenders do not report to all three bureaus or they may have misreported information. This is important to note because you may be denied if a lender only pulls from one reporting bureau and the information is not correct.

You may have noticed this on your own credit report. My husband paid off his truck in 2020. Equifax showed the loan as having been paid off, Experian did not show the truck at all and TransUnion didnt update the information showing he paid it off. Now that debt still appears on his TransUnion credit report. His TransUnion score will not reflect that loan being paid off.

In addition, FICO itself has several different scores it offers based on the type of credit applied for.

Fico Auto Score Vs Regular Fico Score

FICO auto scores are ultimately derived from your regular FICO score. The main difference is that FICO adjusts the calculation based on auto-industry-specific details. In other words, your auto loan payment history will weigh more heavily on your FICO auto score than your regular FICO score.

However, the same factors that influence your regular FICO score, including credit utilization rate, overall payment history, and more, will still affect your FICO auto score.

Read Also: How To Get A Car Repossession Off Your Credit

Fico Vs Vantagescore: The Differences

FICO Score and VantageScore are the two major credit scoring models and have both similarities and differences.

VantageScores are generic scores, designed to be used by a variety of different creditors. The base FICO Score is generic, but FICO also creates specialized credit scoring models for specific industries such as credit card issuers, mortgage lenders, and auto lenders.

Both FICO and VantageScore release new versions of their credit scoring models from time to time, with updates intended to improve accuracy. The latest versions of VantageScore are 3.0 and 4.0. The latest versions of FICO Score are 9 and the 10 Suite however, FICO Score 8 is still the version most creditors use.

FICO creates different versions of each of its credit scoring models for each of the three major consumer credit bureaus . VantageScores credit models can be used by any of the three bureaus.

Both base FICO Scores and the latest versions of VantageScore range from 300 to 850. FICO Scores and VantageScores consider the same basic factors when calculating your credit score:

- Payment history: Whether you pay bills on time

- The percentage of your available credit you actually use

- Length of credit history: How long youve had credit

- The variety of credit types you have

- How often and how recently youve applied for credit

How Does Refinancing Impact My Fico Score

Refinancing and loan modifications may affect your FICO® Scores in a few areas. How much these affect the score depends on whether its reported to the consumer reporting agencies as the same loan with changes or as an entirely new loan. There are many reasons why a score may change. FICO® Scores are calculated using many different pieces of credit data in your credit report. This data is grouped into five categories: payment history , amounts owed , length of credit history , new credit and credit mix . If a refinanced loan or modified loan is reported as the same loan with changes, two pieces of information associated with the loan modification may affect your score: the new credit inquiry and changes to the amounts owed. If a refinanced loan or modified loan is reported as a new loan, your score could still be affected by the new credit inquiry and an increase in amounts owed, along with the additional impact of a new open date which may affect the credit history category. In the end, a new or recent open date typically indicates that it is a new credit obligation and, as a result, may impact the score more than if the terms of the existing loan are simply changed.

Also Check: How To Get A Repossession Off My Credit

How Do I Get A Fico Score

On your credit card statement, you may already have access to a free FICO score. Some credit card companies, such as Bank of America, provide free FICO scores to consumers on a monthly basis, while Discover has gone a step further and made FICO scores available to anybody.

You may also pay to receive a FICO score on the companys website, especially if you want a version different than the free ones provided by a credit card.

Many personal finance websites, like CreditKarma, provide a free VantageScore credit score, which is FICOs major rival. This provides you with another way to keep track of your score: VantageScores tend to trend closely to FICO scores since they consider many of the same characteristics and utilize the same credit bureau data.

Is The Fico Score Im Seeing The Same Score Wells Fargo Uses When I Apply For A New Account

Depending on the product you are applying for, the same FICO® Score type may be used however, some product applications will use a unique scoring model that is different than what you are seeing.

The FICO® Score provided here is for educational purposes and may differ from the scores used to make underwriting decisions. Typically, creditors and lenders, including Wells Fargo, use more specific industry credit scores that are customized for the type of credit product youre applying for. For example, auto lenders typically use a credit score, such as a FICO® Auto Score, that is specifically designed to better predict the likelihood that you would not default on an auto loan. Mortgage lenders use a score developed specifically for mortgage loans. Or, your credit or lender might also use a proprietary credit score thats developed for use by just that company.

Read Also: Carmax Finance Rates 2015

Does A Fico Score Alone Determine Whether I Get Credit

No. Most lenders use a number of factors to make credit decisions, including a FICO® Score. Lenders may look at information such as the amount of debt you are able to handle reasonably given your income, your employment history, and your credit history. Based on their review of this information, as well as their specific underwriting policies, lenders may extend credit to you even with a low FICO® Score, or decline your request for credit even with a high FICO® Score.