S To Remove A False Eviction From Your Credit Report

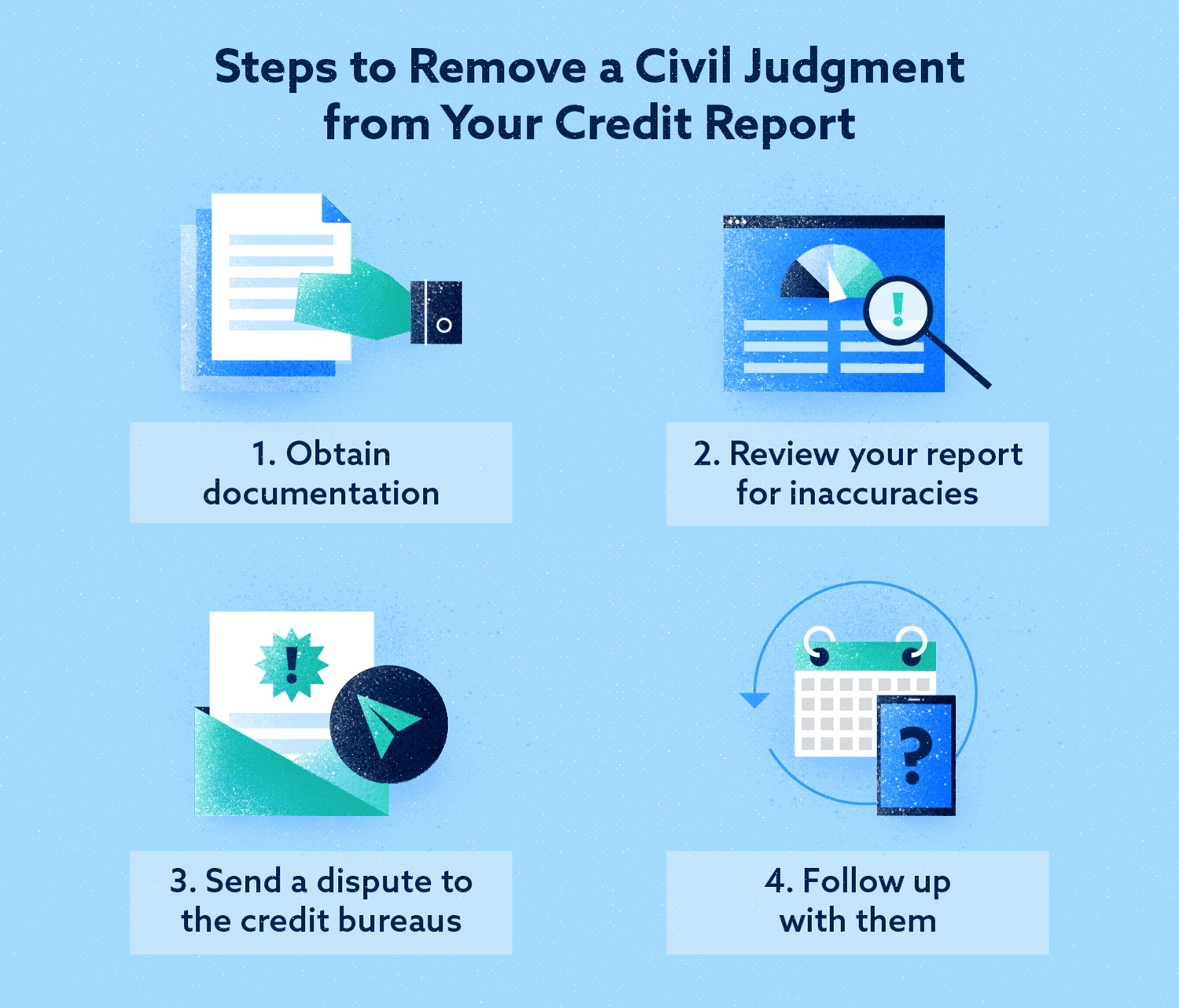

A false eviction notice made by your landlord could result in an incorrect judgment or collection appearing on your credit report, damaging your credit. If your landlord has issued an incorrect or false eviction notice, here are the steps you can take to have the information removed from your credit report:

Get a copy of your credit report

Contact the credit bureaus

Follow up as needed

Get a copy of your credit report

As soon as you find out that your landlord has issued a false eviction notice, youâll want to request a copy of your credit report to see how it appears. You can for free by signing up for Borrowell.

Contact the credit bureaus

Once you confirm that an action taken by your landlord appears on your credit report, such as an entry for a collection account, youâll want to contact the credit bureaus to start the formal dispute procedure.

There are two major credit bureaus in Canada: Equifax and TransUnion. Youâll want to contact both of them, as itâs possible the collection account could appear on one, but not the other.

Send a dispute letter

You can initially contact the credit bureaus by phone for further information however, youâll want to follow up by providing something in writing. Youâll want to do that so that thereâs a paper trail.

Both credit bureaus have specific steps you must take to dispute information that appears on your credit report. Youâll want to research those steps to start with each credit bureau.

Provide evidence

Negotiations With Landlords Attorney

If the basis of the eviction was for nonpayment of rent, the tenant will owe the past due rent plus interest. In order to clear the judgment, the tenant will need to pay the back rent, plus interest, and other court costs and fees. If the basis of the eviction was for some other issue, there are still costs and fees accruing that the tenant may be obligated to pay. The goal is to negotiate a deal that works for both the landlord and tenant. Once all parties have come to an agreement, a stipulation will be drafted by the tenant lawyer or nonprofit advisor that details the agreed upon terms

How To Get An Eviction Off Your Record

An eviction not only makes it harder to rent in the future, but it also affects your credit history

Getting a lease with a new landlord can be challenging if you have an eviction on your record. After seven years, the eviction may get dropped from public records, but this mark can sometimes stay on your rental history forever. An eviction can impact your credit history, rental history, and your ability to rent in the future. If an eviction has happened to you and youre unsure what to do so that you can move forward with your life, youre in the right place. Learn how to get an eviction off your record.

You May Like: Opensky Credit Card Delivery

Protect Your Credit And Your Reputation As A Tenant

When facing an eviction, finding a new place to live is just one challenge. While an eviction may not directly hurt your credit, it could lead to problems down the line. To learn more about your legal rights, how to approach your landlord, or how to respond to an eviction, ask a lawyer.

This article contains general legal information and does not contain legal advice. Rocket Lawyer is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.

Can An Eviction Make It Harder For Me To Rent In The Future

Yes. Some landlords report to tenant screening services, like Experian’s RentBureau or TransUnion’s SmartMove. Even though your credit report may not read “eviction”, a check with one of these services will reveal your eviction record. If the screening service has incorrect information about your rental history, you should contact them to dispute the information. If someone rejects your lease application because of one of these rental reports, they must give you the name and contact information of the company that made the report.

An eviction will make it difficult to rent in the future. The best way to avoid an eviction is to pay your rent on time and comply with your lease.

Recommended Reading: Does Paypal Report To Credit Bureau

Violating The Leases Terms

This typically happens when the tenant had done something that they had specifically agreed not to do when they rented the apartment. These may include letting another person move in without prior permission, making excessive noise, and so on.

In such cases, the tenant is given a certain amount of time to fix this issue, or they have to face eviction.

What Is An Eviction In Legal Terms

While the situations above describe reasons for a tenants removal from the property, eviction from a technical standpoint entails the landlord suing a renter for refusal to leave.

A few places allow landlords to employ self-help eviction tactics, like changing the locks on the property, but this is illegal in most places. If your landlord does this to you, make sure you check to see if this is legal. Otherwise, its time to contact the authorities.

Instead of locking you out, the landlord must usually go through the court system to file a lawsuit against you and obtain a writ of possession.

A law enforcement officer then posts the eviction notice on the property, giving a specific deadline of when it must be vacated. If the tenant is still there on the posted date, the law enforcement officer will physically remove the tenant and their belongings.

Recommended Reading: When Does Open Sky Report To Credit Bureaus

Although True Expungement Does Not Exist In California There May Be Options To Clean Your Record Depending On Your Situation

How to get an eviction removed from your record california. Dear chp, an eviction will not show up on your credit report, but any collection accounts may remain on your credit report for up to seven years from the original delinquency date, which is the date of the first late payment that led to the collection status. The law related to cleaning your record is complicated. California law states that your landlord must legally end the tenancy before they can evict you.

Your only hope would be to get the case sealed. Removing an eviction from your public record actually isn’t that difficult. Reduce the impact of your california criminal record.

An eviction expungement is a process whereby the judge seals your eviction record. If the eviction case is removed from the court record , then the eviction records report will come up clean, with no evictions listed. If you have an eviction record that will show up in your background check, you can petition the court in the county where the case was filed to have the record expunged, or sealed.

It stays on your ud report permanently and can not be removed. If you ever get stuck, consider getting legal help. If there was a judgement and that was on your credit report it only stays on 7 years but the ud report is what all property managers and landlords look at first and foremost.

If the landlord served you an eviction notice without a legal or valid basis, prove that. However, thats not always possible.

Does An Eviction Show Up On My Credit Report

No, but an eviction can still make it difficult to rent in the future. An eviction case is a matter of public record. If an eviction case against you shows up on a public consumer report, any potential landlord may assume you were evicted. This is true even if you won your eviction case.

Also, any rent or court fees you owe may go to collections. This will appear on your credit report for seven years.

Don’t Miss: Does Capital One Report To Credit Bureaus

If You Believe You Were Wrongfully Evicted Take It To Court

Eviction laws vary by state, so check with the agency that governs renter’s rights in your state by searching “landlord tenant laws.” Let’s say your property manager didn’t follow proper eviction procedures, or you can prove that you didn’t violate the terms of your lease agreement. You may be able to petition the court to remove the eviction from your public record. The legal aid organization in your area may be able to help with your case if your income is below a certain threshold.

Can An Eviction Be Disputed

If you’ve already spoken to the landlord that reported the eviction and they have no record of it or state that the debt is no longer owed, you should then contact the tenant screening company to find out how to dispute the information in their file.

If you haven’t already done so, you can request a free copy of your Experian credit report to see if there is a collection account for any eviction-related debt on your report. You can also obtain a free copy of your credit report from each of the three major reporting companies at AnnualCreditReport.com. From now through April 2022, you can order your free report from Experian, TransUnion and Equifax once a week.

If you find inaccurate information on your credit report, you can dispute the information immediately online with Experian.

Thank you for asking.

Read Also: Does Being Removed As An Authorized User Hurt Your Credit

Does It Matter What Type Of Loan You Want

If your credit took a hit because of the debts you incurred that led to the eviction, you might need to pursue no credit check or low-credit home loans. FHA loans, VA loans, and USDA loans are examples of reputable home loan options for those who donât have high credit scores. You can still apply for mortgage loans with conventional lenders, but theyâll likely charge less-favorable interest rates than government-backed lenders will.

These government-backed loans tend to be easier to qualify for if you have a lower credit score, but every lender supported by those loans has its own unique lending standards. Some lenders have rules that an eviction will cause them to deny a loan application, even if they provide government-insured loans such as an FHA loan.

Cash offers are 4x more likely to be accepted

Orchard can help you make a stronger, all-cash offer. Enter your current address to see if you qualify.

How To Avoid Eviction In The First Place

As always, prevention is the better option. You can avoid getting evicted from the property youre renting by taking the right measures. These include making timely rental payments, maintaining the property, and following the terms of your rental agreement.

If you find yourself facing financial hardship and you think you wont be able to meet the payment deadline, talk to your landlord right away. Landlords are humans, too. They understand that things dont always go your way. Most of them appreciate tenants who are honest and upfront, especially when it comes to paying rent. Your landlord can help you out by creating a new payment scheme thats more suitable for your current financial situation.

Communication is key here. Landlords prefer long-term tenants rather than go through the hassle of finding and screening new tenants. In most cases, landlords are willing to helpyou just have to take the first step and talk to them.

Don’t Miss: What Credit Bureau Does Usaa Use

How To Remove An Eviction Record

If you are a tenant and you fail to pay your rent, or you violate your lease agreement, your landlord can evict you. An eviction is a legal process that involves the landlord taking the tenant to court, and if the landlord wins the case, the tenant has to immediately move out of the occupied apartment. Unfortunately, being evicted from your apartment can seriously damage your . However, there is a way to remove an eviction record and improve your credit score.

Tips

-

You can remove an eviction record by settling the debt with your landlord and ensuring that they remove the eviction record from your . Otherwise, an eviction may remain on your credit report for seven years.

Where Can You Go For Help

Because eviction laws differ from state to state, its best to research the relevant laws where you live. If youre not sure where to start or think your landlord is mishandling the eviction process, look up your local Legal Aid chapter.

If you qualify under your chapters low-income guidelines, you can receive free legal assistance. Theyre likely to have specific expertise with eviction defense.

You can also try negotiating directly with your landlord. If you just need a bit more time to come up with your rent money, consider telling them about your financial situation.

Most landlords want to avoid lengthy and potentially expensive court proceedings. So if youve been a good tenant but are in a rough spot with your money, it cant hurt to try being open and working out an agreement.

Recommended Reading: Can Public Records Be Removed From Credit Report

What Happens When You Get An Eviction Notice

The specific requirements may vary by state, but what typically happens is that youll receive a summons and complaint delivered by a law enforcement official, such as someone from your local Sheriffs office.

This notice not only tells you when and where to arrive for your court hearing but also what the landlord is suing you for. It could be for you to simply leave the property, or the landlord might also be seeking past due rent payments.

Its important to go to the court hearing if you want to defend yourself against your landlord. If you dont go, the landlord usually wins by a default judgment.

Youll be held liable for the consequences laid out in the summons: eviction and potentially back rent plus court fees for all parties involved. However, in some states, you might be able to prevent the eviction entirely if you can pay the owed rent and court fees at the hearing itself.

Can An Eviction Be Reversed

If youâve received an eviction notice, you do have the opportunity to reverse it. You can do so by talking with your landlord and putting together an agreement to bring your rent current. Or, you can stop violating other lease terms that could beleading to the eviction.

Evictions can cost landlords thousands of dollars. Many might be willing to just accept the keys and a small payment to let you out of your lease because it saves them money. Always try to communicate and negotiate with your landlord to keep an evictionoff your record.

If the eviction goes to court, you can either defend yourself or pay a lawyer to do so. Your landlord will receive a summary judgment if you donât respond to the court filing

If you have questions about evictions, your credit report, and buying a house, a Clever Partner Agent can help you. Reach out to be connected with an agent today.

Read Also: What Is Syncb Ntwk

Who Can See If I Have An Eviction On My Record

Evictions first require the landlord to obtain a civil judgment against you. The civil judgment is recorded on your public record and can remain there forever if no action is taken to have it removed. Public records, as the name suggests, are available to the public. Pulling individual public records is impractical however, since credit reports contain a “Public Records” section, the civil judgment will often show up there. Also of note, even if seven years have passed and the eviction is gone from your public records, the civil judgment may still show up on your credit report.

Following Up With Your Landlord

Verify that the landlord removed the eviction record from your credit report. After 30 days have passed, order a copy of your credit report from the three major credit bureaus. Look under the Public Records section to see if the eviction record appears on your credit reports. If the eviction is still listed on your credit reports, you will need to submit a formal dispute to each credit bureau to have the information removed.

Don’t Miss: Is Creditwise Good

Review Your Credit Report

First things first, you have to review your credit report to figure out exactly where you stand credit-wise. Thereâs a chance there is incorrect information on your report, so youâll want to dispute any discovered errors as soon as possible, especially if you plan to buy a home soon. To do this, file a dispute with the credit reporting agency that provided the report with errors you will also need to contact the lender who reported incorrect information to the credit bureau.

Removing Evictions From Reports

You have no legal right to get an accurate item removed from your credit file. Most negative facts, such as a landlord’s judgment against you, are removed after seven years, though. If the judgment or the collection agency account is still on the report after seven years, ask the credit bureau, in writing, to remove it.

If the reference to eviction is truthful and recent, you’ll need to make arrangements with the landlord to pay off the balance, or come to some type of settlement agreement. Once this has been done, you can petition a judge to have any rental eviction that appears on a civil record expunged. Make sure you submit a notarized letter from your landlord that the debt has been satisfied.

Also Check: What Credit Score Do You Need For Amazon Prime Visa