How Will You Attack Your Settled Account

You know what a settled account is and how it can affect your credit score.

If the account affects your credit score negatively and causing it to drop, its time to start thinking about ways to remove the account from your report.

How to remove settled accounts from credit reports may seem like a long and grueling process, but once the account has been removed you wont be a high risk for financial institutions.

As we have stated, if the account appears to just be hanging out and not affecting your score in a positive or negative way, its best to just let it on your report.

To be honest, showing this payment history can help your credit score as long as you were on time.

Now its time to decide if you will let the settled account stay on your report or if you will take steps to remove it.

For more finical tips and information be sure to check outour website.

Resolve Your Debts Today – See How Much You Can Save

Contact Your Credit Card Issuer

Contact your credit card issuer by phone or in writing and ask to cancel your credit card account.

You can find the customer service telephone number on:

- your credit card

You can find the mailing address on:

- your monthly statement

- the issuers website

Ask for confirmation in writing that your account has been closed. Once you receive this confirmation, destroy the credit card. Keep the confirmation for your records.

Doing the following does not cancel your credit card account:

- cutting up your card

- not using it

Cancel Experian Over Phone

If all else fails, the most reliable way to cancel is by calling them at 6171894. Here are their hours:

- Mon-Fri: 6am-6pm PST/9am-9pm EST

- Sat-Sun: 8am-5pm PST/11am-8pm EST

Dont forget to keep a record of your cancellation just in case the subscription isnt canceled and you have to contact Experian again. If you cancel through email or online, you should have an email record. If you cancel over the phone, write down the cancellation confirmation number, the date you called in, and the representatives name and email the information to yourself for future reference.

If you enjoyed this, dont be shy about for it!!

Don’t Miss: How Can I Get A Repo Off My Credit

Wait For Accounts To Drop Off

If you choose not to take steps to remove closed accounts, you’ll be happy to hear that these closed accounts won’t stay on your credit report forever. Depending on the age and status of the account, it may be nearing the credit-reporting time limit for when it will drop off your credit report for good. If that’s the case, all you might have to do is wait a few months for the account to fall off your credit report, and then for your credit report to update.

Most negative information can only be listed on your credit report for seven years from the first date of deliquency.

If the closed account includes negative information that’s older than seven years, you can use the credit report dispute process to remove the account from your credit report.

No law requires credit bureaus to remove a closed account that’s accurately reported and verifiable and doesn’t contain any old, negative information. Instead, the account will likely remain on your credit report for ten years or whatever time period the credit bureau has set for reporting closed accounts. Don’t worrythese types of accounts typically don’t hurt your credit score as long as they have a zero balance.

How Did Experian Deal With Fraud And Identity Theft

Fraud and theft are the same. you have any questions about you Experian member? Call us at 18666171894 at 6 am Monday to Friday. to 8 p.m. Pacific time to 5. Peaceful afternoon time. International callers who have difficulty dialing these numbers must contact Ask their phone service provider for help.

Also Check: Does Paypal Working Capital Report To Credit Bureaus

How This Site Works

We think it’s important you understand the strengths and limitations of the site. We’re a journalistic website and aim to provide the best MoneySaving guides, tips, tools and techniques, but can’t guarantee to be perfect, so do note you use the information at your own risk and we can’t accept liability if things go wrong.

- This info does not constitute financial advice, always do your own research on top to ensure it’s right for your specific circumstances and remember we focus on rates not service.

- We don’t as a general policy investigate the solvency of companies mentioned , but there is a risk any company can struggle and it’s rarely made public until it’s too late .

- Do note, while we always aim to give you accurate product info at the point of publication, unfortunately price and terms of products and deals can always be changed by the provider afterwards, so double check first.

- We often link to other websites, but we can’t be responsible for their content.

- Always remember anyone can post on the MSE forums, so it can be very different from our opinion.

MoneySavingExpert.com is part of the MoneySuperMarket Group, but is entirely editorially independent. Its stance of putting consumers first is protected and enshrined in the legally-binding MSE Editorial Code.

Closed Accounts May Stay On Your Credit Reports For Up To 10 Years

One of the factors used to calculate your credit scores is length of credit history the longer the better. Old accounts in good standing remain on your credit reports for up to 10 years, which may increase the average age of your accounts and improve your scores.

But when the account falls off after 10 years, the length of your credit history may decrease, which could cause a temporary drop in your scores.

On the flip side, if you have a closed account with a negative history, such as delinquencies, the derogatory information in many cases will remain on your reports for seven years. While its there, it will negatively affect your credit history, but the impact on your scores can diminish over time.

Also Check: How Personal Responsibility Can Affect Your Credit Report

Also Check: Does Paypal Credit Report To Credit Bureaus

Keep An Eye On Your Credit Report And Score

Canceling a credit card may or may not affect your credit score, but it’s important to go through the process thoughtfully and carefully to make the process go as smoothly as possible.

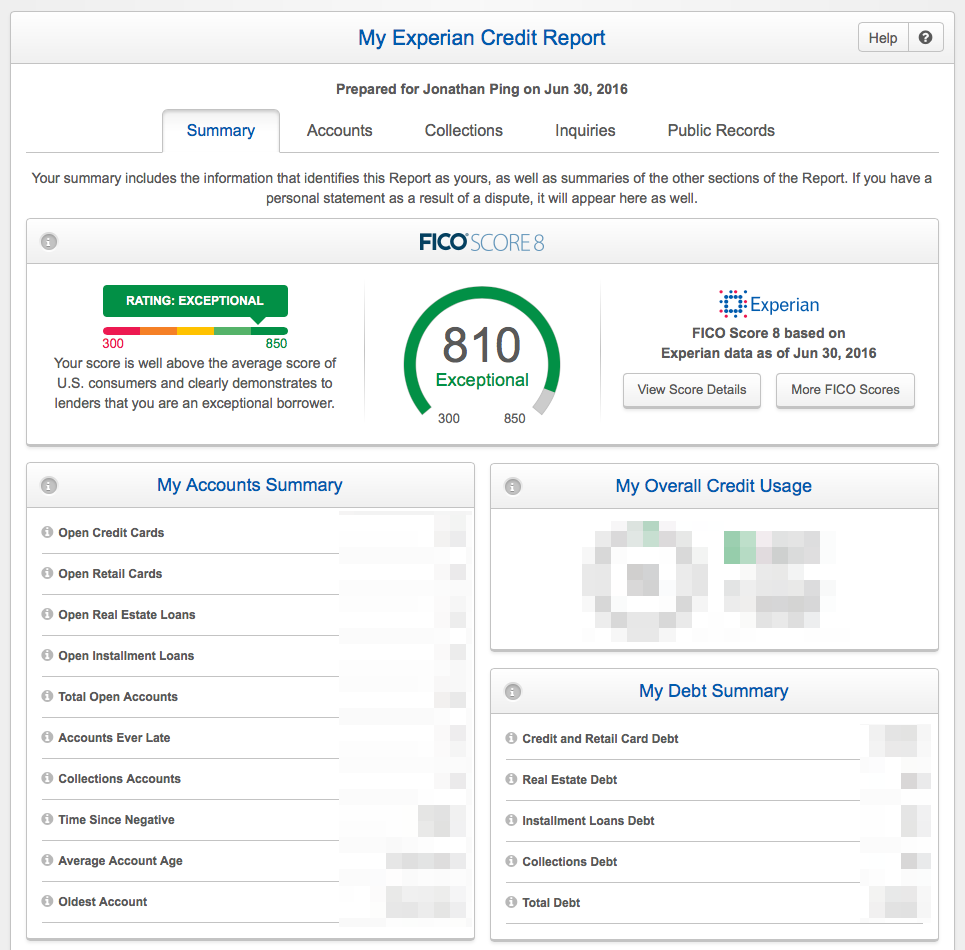

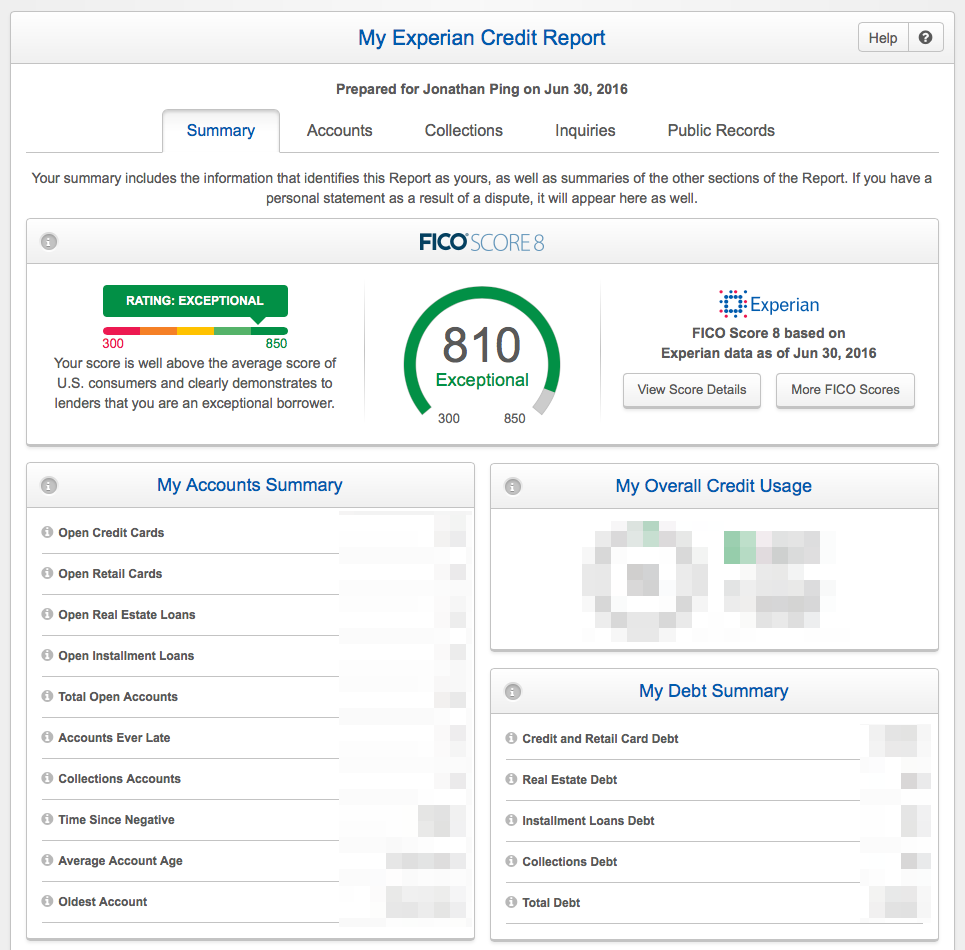

After you close the account, check your credit report to confirm that the information regarding that closed account is accurate.

Also, keep an eye on your to see how it changes once the closure goes into effect. It may take a month or so to update but check regularly to understand its impact and take further steps as needed to get your score back to where you want it to be.

Will They Make Me A Counteroffer

If you’re considering closing your account, you can always call your card issuer and let them knowthey may make an offer to try to get you to stay. They may say you’re qualified for bonus rewards if you keep the account open and spend a certain amount within a set time period. Or you may score a lower interest rate or have your annual fee waived. There’s no guarantee you’ll get an offer, but it doesn’t hurt to find out.

Read Also: Does Removing An Authorized User Hurt Their Credit Score

How To Remove Closed Accounts From Your Credit Report

If you need to attempt to remove a closed account from your especially one that includes inaccurate information or negative itemsthere are three ways to do so. You can either dispute inaccurate information with the , write a formal goodwill letter to request removal or simply wait until the account is removed after a period of time. Each of these approaches can be useful depending on your particular situation.

Read on to learn more about when to try each of these different methods for getting a closed account off your credit report.

Dont Miss: Speedy Cash Collections

Should I Negotiate Or Pay Avante Usa

While it can be tempting to pick up the phone to negotiate with Avante collections or even pay the balance in full, these approaches will not help the damage done to your credit score.

Once a collections account is posted to your credit history, it will impact your credit score for up to seven years unless you can get it removed.

Fortunately, you can try some possible steps to hopefully get the Avante collection agency removed from your credit report.

You May Like: Mprcc On Credit Report

Experian Credit Disputes And Queries

While the credit information company, Experian, makes every effort to ensure that the information contained in a credit report is up to date and accurate, there can be times when the information you have and the information in the report dont match. The thing to remember is that in such cases, you are provided the option to dispute the information and get it corrected. To ensure that the complaints about a credit report are taken care of in the best way possible, you can either call up the customer care of initiate the process using the form. The main thing to remember here is that before you can go asking for a dispute settlement, you need to get your Experian credit report to check it for errors.

Follow Through On Verification Cancellation And Monitoring

Like with steps six through eight mentioned in the previous section, you will want to keep an eye on your deceased loved ones accounts. Additionally, its just as importantif not more importantto ask for details regarding the cancellation and to continue checking for unapproved charges to your loved ones account.

Also Check: When Does Opensky Report To Credit Bureaus

Hire A Credit Repair Professional

Not a born negotiator? Perhaps you hate confrontation. Whatever your reason may be, credit repair experts like Lexington Law are there to bear the burden of dealing with Avante USA.

They are used to handling debt collectors like Avante collections, plus their trained associates specialize in all matters of credit repair.

Lexington Law can answer any questions or concerns you may have related to Avante USA and any other credit-related issues.

Still not sure if its the right fit for you? You can start with a free consultation before deciding how you want to proceed.

The Experian Credit Report Query Form

In order to initiate a correction you will need to follow a set process. This process starts with the Experian Credit Information Report Query Application Form. This form is available on the companys website and can be printed out. Things you need to know about this form are:

You will need an ERN to use this form. The ERN is the Experian Report Number that is assigned to your credit report and is meant for them to ensure the correct report is being referred to.

You will need to fill in all the sections that are mandatory.

You can check the box that relates to your query, if its about personal details, or use the space provided by them to inform them about problems with your credit history.

The report will have to be accompanied by copies of an identity and address proof and the copies will need to be self-attested.

If the form is not filled up properly or if the supporting documents are not signed or correct, the application wont be processed.

Read Also: Credit Score Needed For Les Schwab Credit

Send A Goodwill Letter To The Lender

If you feel like going directly to a credit bureau isnt the right attack, then you can send the lender a goodwill letter directly.

This letter is a polite way to ask if a lender will remove the settled account from your credit history.

This differs from a dispute because you are asking nicely to have the settled account removed and not stating any inaccuracies.

Sending a goodwill letter is ideal for people that defaulted on a loan due to personal injuries or illnesses.

Keep in mind that creditors will look at the history of the account and try to see if you made any attempts to get caught up after one of these circumstances.

They may use this information to make a decision on your account.

At this point, you can offer to make the full payment or try to find amiddle ground.

With the lender by settling on an amount that is less than whats owed.

After finding a way to pay in full or at least some, the lender should remove the account from your credit report.

Keep in mind the negative effects of the account will be removed since it is considered to be paid, but the ragged payment history will still be available on your account.

How To Cancel A Credit Card Without Destroying Your Credit Score

Explore all of your options, understand your DTI and follow the right process to prevent major dings on your credit report.

If you find yourself with too many credit cards or you’ve been racking up too high a balance on them, you might be mulling closing a credit card. While doing so might make your life easier, there are some complications to consider.

Contrary to what TV sitcoms might have taught you, canceling a credit card involves more than just shredding the physical card and tossing it in the trash. Further, it could hurt your credit score by impacting your length of credit history and credit utilization rate. We’ll walk you through how to cancel a credit card without destroying your credit, when closing your credit card is a good idea and alternative routes to consider.

Read Also: Remove Repo From Credit

What Happens When An Account Is Closed

When you pay off or close an account its not available for purchases or payments.

An account can be closed for many reasons such as paying off the amount borrowed or closing an unwanted line.

Once the account is closed, its then settled and will appear on your credit report as such.

When an account is closed with a balance, the creditor will still report the status and account details to the credit bureaus on a monthly basis.

The information that is reported is the balance, monthly payment history, and the date of your last payment.

How Do I Maintain Experian Credit Report

International callers who have difficulty dialing these numbers must contact Ask their phone service provider for help. How you want to discussion? How I’m being criticized over the phone! Experian I believe that the best way to do this can be to provide consumers who receive a personal credit report model.

You May Like: What Is Syncb Ntwk On Credit Report

How To Remove Settled Accounts From Credit Reports

How to settle the outstanding account and remove it from a credit report can be tricky because some accounts can only be removed in specific situations.

You must also look at if the account is affecting your score negatively or if its just hanging out and showing your payment history.

If the account has no direct effect on your score, its a good idea to leave it alone.

Settled accounts that provide payment history can actually be helpful in the long run and make your credit score rise.

This will show that you have a good history of payments and arent a risk to any finical situation.

As for the accounts that affect your score negatively, there areways to remove them before the 7 years are up.

How Do Icancel My Experian Subscriptions Through An App:

As a member of the Experian account, it may be tricky in cancelling manually your subscription through email, phone number or online mode. You can choose another option for cancelling Experian subscription UK. Use the DoNotPay app to cancel the subscription.

You need to follow the instructions to complete the cancellation process:

Don’t Miss: Does Paypal Credit Report To Credit Bureaus

Keep An Eye On Your Online Account

Again, the account has been closed, but it is possible for transactions to show up. This is especially common in the case of refunds. If you return an item you purchased with the card or the card issuer refunds a portion of your annual fee, it can show up as a credit. If this happens, contact the card issuer to ask for a refund check.

Is There An Annual Fee Or Security Deposit

If you’re paying an annual fee on a credit card you don’t use much, and don’t feel you’re getting enough value from the card’s rewards or perks, it may make sense to cancel it.

But if the annual fee is the only reason you want to cancel the card, call your issuer and ask them if they can either waive the fee or convert the card to another one that doesn’t carry an annual fee. This may allow you to keep the account open at no additional cost.

If you have a secured credit card and you’ve improved your credit score enough that you qualify for an unsecured card, consider asking the card issuer if you can get your deposit back but keep the account open.

If you can’t get the card’s annual fee waived, have it converted it to one with no annual fee or get your deposit back, canceling the card may be your best option.

Read Also: What Credit Report Does Comenity Bank Pull