Can I Use My Synchrony Home Card At Walmart

You may be able to use your Synchrony credit card at Walmart, but only if its Walmart-branded. If you have a Walmart Credit Card you can use it at Walmart and online at walmart.com. WalletHub members have a wealth of knowledge to share, and we encourage everyone to do so while respecting our content guidelines.

A Few Key Considerations Startups Should Make When Choosing A Business Credit Card:

- How much working capital do you need?

- If youre in a partnership or have a co-founder, whose name will be on the application?

- Who will need access to the card?

- How will it impact your personal and business credit scores?

Heres Navs pick for the best credit card for startups:

Capital on Tap Business Credit Card

With no time in business requirement, and credit limits ranging from $1,000 up to $50,000, the Capital on Tap Business Credit Card can be a great business credit card for startups. Business owners with fair credit may qualify, and applying will place only a soft inquiry on your personal credit file. Like most small business credit cards, a personal guarantee is required.

It also offers rewards of:

Does Being An Authorized User Build Credit

Being an authorized user can potentially build credit, especially for teenagers or young adults who may not have had many opportunities to show responsible credit usage.

Without any history to go off, many lenders will not approve credit applications. An authorized user account gives lenders a credit history to go off of. This can open up additional opportunities for accessing credit and lower interest rates.

Note, your credit card issuer must report the account to the credit bureaus, and lenders must use a credit scoring system that incorporates authorized user accounts. There are a multitude of credit scores employed by different lenders, and some scores may not include authorized-user activity in determining your creditworthiness.

Furthermore, an authorized user will most benefit from an account with a long history of timely payments. On the other hand, an account with a lot of missed payments could actually negatively impact your score. If that happens, you can contact the credit bureaus. Some credit bureaus, like Experian, will remove delinquent authorized user accounts from your credit report, since you are not legally responsible for the debt. Experian also reports that they generally do not include negative payment history on an authorized user’s account, but other credit bureaus may include this information.

Also Check: How Many Authorized Users Can Be On A Capital One Credit Card

How Often Capital One Reports To Credit Bureaus

According to Capital One, it âtypicallyâ provides your credit information to all three bureaus once per month.

The company doesnât specify the date or dates it does this various postings in online forums by apparent cardholders donât clarify the matter. Some commentators say Capital One reports at the end of every month, while others assert this happens several days after each statement date.

Capital One also doesnât specify in its literature what exactly it reports, saying only that it âshare credit card account information.â Again combing through online forums and financial media, it seems the company reports your card balance to the bureaus.

Regardless, Capital One says that your credit report will show when exactly the issuer provided your data to each bureau.

The key figure the credit bureaus are interested in is that balance. Armed with this information, plus your credit limit, a bureau can determine your utilization ratio. More on this all-important ratio in a moment.

You May Like: Can You Have A Credit Score Without A Social Security Number

Maintain A Low Balance

Keep a low balance on your credit card by paying off the entire balance every month. The amount owed is the second-largest component of your FICO credit score. By keeping a low , you’re contributing positively to your credit score. Most credit issuers like to see a credit utilization ratio below 35%.

Also Check: Credit Score Of 611

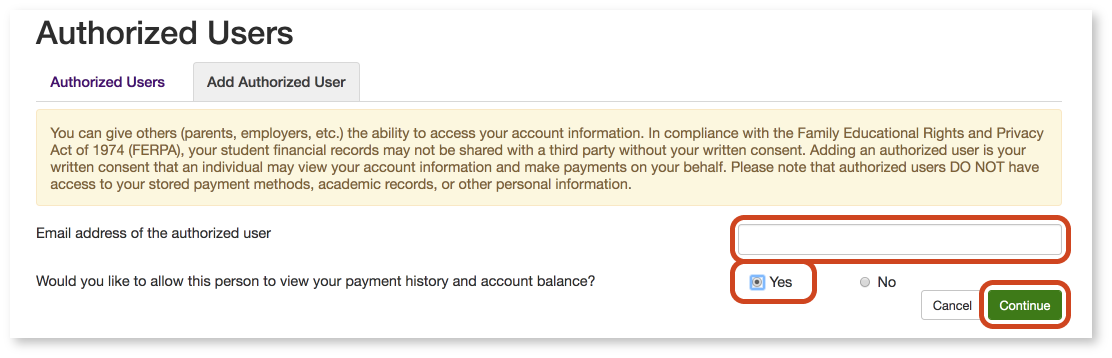

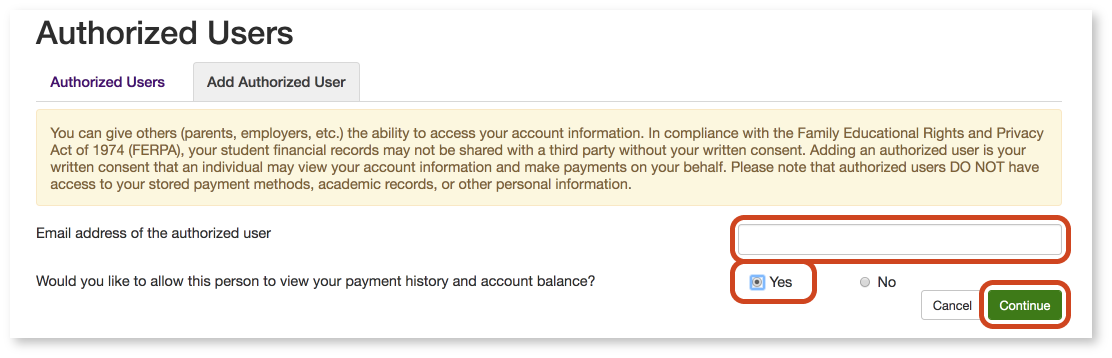

How To Add An Authorized User To Your Citi Account

Citibank allows cardholders to add authorized users to their credit cards online, over the phone or through the Citi mobile app. Additionally, if there is a Citi branch nearby, you can walk in and have an employee add one for you. The following steps will explain how to add an authorized user to a Citi credit card through the banks online portal:

Can A Walmart Credit Card Help Build Credit

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

Walmart Inc. offers two kinds of credit cards, Walmart Rewards Mastercard, which can be used anywhere Mastercard is accepted, and a Walmart MoneyCard, which is a store credit card.

The Walmart Rewards Mastercard and its in-store credit card are issued by Capital One, and cardholders can earn rewards for shopping at Walmart. When used properly, both cards can help you build your credit history and credit score.

By reviewing the terms and conditions of the Walmart Rewards Mastercard and Walmart MoneyCard, you can verify that your account activity is reported to the three credit bureaus . Data, such as your account balance and list of late payments, will appear on your , which the credit bureaus use to calculate your credit score.

Learn the strategies below to help you build your credit with these two credit cards.

You May Like: How To Report Death To Credit Bureaus

Can An Authorized User Hurt The Account Owners Credit

There are also some potential disadvantages. If the authorized user doesnât use the account responsibly, it can hurt the account holderâs credit.

Negative actions, like missed payments, could affect both the primary cardholder and the authorized user. And because multiple people have access to the account, thereâs the risk of miscommunication or overspending. And that could affect the original cardholderâs .

Making sure youâre on the same page when it comes to responsible credit card use could help you avoid mistakes that reflect poorly on both partiesâ scores.

Becoming An Authorized User On Someone Elses Credit Card Can Be A Simple And Effective Tactic If Youre Still Working To Establish Your Credit

While its certainly not a substitute for building up your own credit history, it may be a good way to give your credit a nice boost as youre getting started.

The flip side? Your credit can also be hurt if the primary account holder doesnt stay on top of their payments.

Before taking the plunge, heres what you need to know about becoming an authorized user on a credit card.

Also Check: Is 694 A Good Credit Score

What Does It Mean To Be An Authorized User

Being an authorized user means you can use someone elses credit card in your name. You can make purchases and use the card as if it were your own, but youre not the primary account holder.

To make you an authorized user, the primary account holder simply adds your name to their credit card account, giving you authorization to use it. Youll receive a credit card tied to the account, though you wont have all the privileges of the primary account holder. For example, you probably wont be able to make changes to the account, like requesting a credit increase or adding more authorized users.

As an authorized user, youre not legally responsible to pay the credit card bill or any debts that build up. This is still the primary account holders responsibility.

Reasons Your Teen Should Get A Credit Card

You might think your teen is far too young to use a credit card. But youll find two big reasons why it could be a good idea for them to have one.

1. It can teach your teen how to use a credit card responsibly for the future.

After adding your teen as an authorized user, you have control over their account and can see how they use their card. With insight into their spending, you can more effectively teach them solid financial habits. Its better for them to learn from you now than figure everything out on their own later.

2. It can help your teen build credit early.

Most people start with a brand-new credit history when theyre ready to get a credit card. This usually means theyre limited to student cards and secured cards, both of which typically come with limited features. You can help your teen build an impressive credit history before they reach adulthood. Just add them as an authorized user on your account and consistently make payments on time. When they turn 18, their credit may be strong enough to expand their card options considerably.

3. Its convenient for parents and kids.

Sometimes you could forget to give your kid cash for meals at school, transportation or supplies. Getting your kid a credit card can help you avoid unpleasant situations and avoid cash theft. And for some cards, you can set spending limits to ensure your child doesnt spend over their budget.

4. You can earn more rewards.

You May Like: 688 Credit Score Credit Card

How To Remove Capital One Collections From Your Credit Report

To remove a Capital One Collections from your credit report, you first need to know who currently owns the debt.

In other words, has Capital One sold your unpaid credit card debt to another collection agency, or is the debt still with Capital One?

You can find out who owns your Capital One debt by getting a current copy of your credit report and taking a look to see who is listed as the creditor on the entry.

Visit annualcreditreport.com to download copies of your credit reports from each of the three credit bureaus.

Because of the Covid-19 pandemic, you can get a free credit report each week through April of 2021.

When Do Credit Card Companies Report To Credit Bureaus

One reason theres so much confusion about when report to credit bureaus is that theres no clear-cut, universally applicable answer .

The good news? There are trends to look at that can help inform us as consumers.

Your balances are normally reported to credit bureaus on your statement date, says Tina Endicott, vice president of marketing and business development at Partners Financial Federal Credit Union. However, she notes, it may take a few days or even a week for the bureau to update your information.

This may depend on the bureau. Experian, for example, claims that your credit report shows the balance on your credit card at the moment it is reported by your lender . But different bureaus may update at different speeds and frequencies.

And while you can generally expect that your credit card activity will be reported to the bureaus at the end of your billing cycle, its not a hard-and-fast rule.

How often credit card companies report to the nationwide consumer reporting agencies depends on the , explains Nancy Bistritz-Balkan, director of public relations and communications at credit bureau Equifax.

It can be anywhere from quarterly to daily for an individual consumers information, depending on the choices and practices of the lender or creditor, she says. Most lenders and creditors report information at least once a month.

You May Like: What Credit Report Does Paypal Pull

Read Also: How Often Do Companies Report To Credit Bureaus

Adding A Child As An Authorized User Can Build Their Credit

Once a child is no longer a minor, they’re eligible to apply for their own cards but that doesn’t mean they’ll get approved. Without a credit history or score, most rewards credit cards are out of reach, even if the child has an income. While some issuers offer student credit cards that don’t require lengthy credit history, they often come with fewer rewards and lower spending limits.

Quick tip:

When you add your child as an authorized user, most major issuers will report the credit card account to the three main credit bureaus then the account, and its history, will usually reflect on the user’s credit file. However, some issuers won’t report until the child reaches a certain age, and bureaus have varying policies on when they will include authorized user accounts on a report.

In general, as long as your own credit score and account history are positive, adding your children as authorized users may give them a much-needed boost when they’re legally able to apply for credit. But bear in mind that any changes they make are your responsibility, and any changes positive or negative to your account could impact your authorized users, too.

Is It Smart To Add An Authorized User To Your Credit Card

Before adding an authorized user to a credit card, consider whether it makes sense in your situation. Figure out why you want to add someone as an authorized user and whether adding them will help you reach your goals.

Consider whether you can trust the authorized user. You might want to add your child as an authorized user to your credit card, but do you trust them to make wise spending choices? Have they shown they can be responsible? Before adding anyone to your account, review their past and current financial habits.

Its also important to have good communication with someone when you add them as an authorized user. If you add your significant other, make sure you touch base on major purchases. This way you dont reach your credit limit too quickly, and you stay on the same page.

Next, consider the fees your account might charge to add additional users. You might not want to pay for another card in the authorized users name, even if you decide the authorized user is responsible and can be trusted.

Additionally, consider the type of control you have over the account as the main cardholder. For example, American Express cards allow you to set spending limits for authorized users, a benefit that can be especially helpful if youre adding your child. See if your account has ample tracking functions as well. It can be helpful to break out your authorized users spending from your own so you see exactly where your money is going.

Don’t Miss: What Credit Bureau Does Ox Publishing Report To

Wells Fargo Business Platinum Credit Card

The Wells Fargo Business Platinum Credit Card offers a choice between cash back or rewards points. Choose the cash back option and earn 1.5% cash back on qualifying purchases. Choose the rewards points option to earn 1 point on every $1 spent and receive 1,000 bonus points every billing cycle when you spend at least $1,000 on qualifying purchases. Theres no annual fee and a 0% introductory rate for the first nine months.

Note:

Minimum Age For Credit Card Authorized Users

The major credit card issuers allow you to add minors as authorized users, but several have minimum age limits. Most big banks will report authorized user accounts to the main credit bureaus, including the issuers listed below.

| Wells Fargo | None |

Occasionally banks have even offered bonus rewards for adding authorized users, and some allow you to do it online.

Also Check: What Fico Score Does Carmax Use

What Type Of Refund Does Walmart Provide

Some companies do not refund cash when items are returned. They would instead refund store credits that could be used by the individual to buy another item at the store. Some could refund the actual price of the item that was returned.

There are companies that will neither return cash or credit. The return policies of these companies are rigorous, and they only allow for the replacement of the item, the original unit of it.

Walmart allows for a refund of the purchase price. It also gives room for the replacement of the item. It is quite commendable as its liberal return and refund policy gains the trust of its customers in favor of the business.

Secured Credit Cards And Student Credit Cards

You cannot add authorized users to secured credit cards or student credit cards. Because these cards have low credit limits, they are a less-risky way to build credit. Only making small purchases and paying your balance in full each month are the best way to maximize these card options. These two types of credit cards can improve your credit score quicker than being an authorized user on another credit card.

Recommended Reading: How Do I Unlock My Experian Credit Report

Which Card Issuers Allow Authorized Users

Each of these card issuers allows authorized users under 21 years old, though the minimum age varies. These issuers also report authorized user activity to credit bureaus, which can help the authorized user build a healthy credit score and history.

| Banks |

|---|

We strive to ensure our content is clear and honest. We may rely on information that is provided to us. To ensure you have the most up to date information, you should verify relevant information with the product or service provider and understand the information they provide. If you are unsure, you should get independent advice before you apply for any product or commit to any plan.

Finder.com is an independent comparison platform and information service that aims to provide you with information to help you make better decisions. We may receive payment from our affiliates for featured placement of their products or services. We may also receive payment if you click on certain links posted on our site.

Finder® is a registered trademark of Hive Empire Pty Ltd, and is used under license byFinder.com LLC.