The Truth About Raising Your Credit Scores Fast

While a lucky few may be in a situation where they can raise their credit scores quickly, the bottom line for most of us is that building credit takes time and discipline, especially if youre trying to rebuild bad credit. Thats because your credit scores are complex and made up of several interconnected factors .

So trust us: While some credit repair agencies may promise to raise your credit scores fast, theres no secret that will help boost your credit scores quickly.

But if you start developing healthy habits now, you can build credit over time all by yourself.

Get Credit For Paying Monthly Utility And Cell Phone Bills On Time

If you are already responsible about making your utility and cell phone payments on time, then you should check out Experian Boost. It’s a free and easy way for consumers to improve their credit scores. The way Experian Boost works is simple: Connect your bank account to Experian Boost so it can identify your utility, telecom and streaming service payment history. Once you verify the data and confirm you want it added to your Experian credit file, you’ll get an updated FICO score delivered to you in real time.

Visit Experian to read more and register. By signing up, you will receive a free credit report and FICO score instantly.

Pay Your Bills On Time

If youve missed payments, catch up. If need be, set up automated reminders when payments are due. Or better yet, set up automatic payments from your bank account. Paying on time every month is the most crucial aspect of improving your credit score and easiest to control. Card companies reward consumers who are reliable with payments and punish those who dont.

You May Like: What’s The Minimum Credit Score For Care Credit

How To Use A Credit Card To Build Credit

At Experian, one of our priorities is consumer credit and finance education. This post may contain links and references to one or more of our partners, but we provide an objective view to help you make the best decisions. For more information, see our .

In this article:

Starting To Build Credit With A Credit Card

To start building credit with a card, you’ll need to either open a credit card of your own or become an authorized user on someone else’s credit card. Getting a card of your own can be difficult if you’ve never had credit before, or if you have poor credit. However, there are options.

- Secured credit cards are often a stepping stone if you’re starting to build or rebuild your credit. These cards function like normal credit cards, but you’ll have to send the card issuer a refundable security deposit when you open your account. Secured cards may have high fees and don’t necessarily offer great cardholder benefits, but responsible use can help you qualify for better credit cards later.

- A student credit card can also be a good first option if you’re a student. Student cards tend to have low credit limits however, there are student cards available that have few fees and offer rewards on purchases.

You can also ask a friend or family member to add you as an on one of their credit cards. When they do, their credit card company can report the account to the bureaus under your name as well. You’ll get your own card and can make purchases, as long as the primary cardholder agrees.

Having another person’s card as part of your credit history can help you build creditas long as the primary user manages their card well. Your credit won’t be helped if the primary cardholder doesn’t make payments on time, for example.

Don’t Miss: Credit Check Experian Usaa

How To Use A Credit Card To Earn Cash Back And Rewards

Earning rewards from a credit card is the fun part. But first, you should consider what your top spending categories are, then pick a card that will provide the best returns for you. Everyone’s spending habits are different some people may spend a lot on travel, while others only spend on groceries or takeout.

Raising Your Score Depends On Your Starting Point

Your credit score isnt just a judgment call its determined through a formula considering five different factors. Listed in order of importance, each of the following factors can raise or lower your :

- Payment history

- New credit

With a history of consistent payments being the most influential factor, a great opportunity is offered to those new to credit cards. Every month you pay your cards bill on time will bump your credit score up, so set a routine and you can grow your creditworthiness quickly as long as you can avoid missing a credit card payment.

Your credit utilization ratio is how much of your total credit limit you use. Typically, you want to keep this figure between 10 and 30 percent to stay in good standing. Opening up new card accounts or getting a credit limit increase can help build credit by decreasing this ratio, but that isnt all it takes. By making the effort to pay off your outstanding balances youll help your credit utilization, thus improving your credit score.

The length of credit history is fancy-talk for the average age of your credit accounts. The longer the account has been open, the better, so you may want to avoid closing an old account to keep yourself out of poor credit. There are cases where canceling a credit card account is the right move, but as a general rule youll benefit from keeping old ones open.

Learn more:How to check your credit score

Also Check: How Often Does Capital One Report To The Bureaus

Dont Change Houses And Jobs Frequently

Lenders want evidence that youâre a stable character. They want to see you have staying power â that youâre not here one day, gone the next. Put simply, they want evidence of stability so try not to change jobs and addresses too frequently.

Looking to change your home loan? Use our home loan selector tool or call .

Pay Off Debt And Accounts

Paying off student loans and other debt can help raise your credit score. One smart way to start hacking away at that debt is to make smaller, bi-weekly credit card payments vs. one monthly payment.

Scheduling automated payments can help you pay down that credit card debt more quickly, which is one of the fastest ways you can boost your scores. And if youve got any accounts on your credit report that are in collections, lenders may settle for a lesser amount if you approach them with a plan to pay the debt back.

Don’t Miss: Carmax Financing Rates

Reasons To Pay Off Your Credit Card In Full

Theres often an assumption that carrying a balance can improve your credit score. However, this assumption is wrong: Carrying a balance will not improve your credit score and will only cost you more money in the form of interest. If you can, you should pay off your balance all at once each month instead of keeping a balance on your cards. If you do this, you will:

How To Pay Your Credit Card Bills While Increasing Your Credit Score

Making full on-time payments is the best way to increase your credit score. If you cant afford to do it, try to pay at least the minimum amount due on all your credit cards. Paying a custom amount is still better than paying only the minimum required amount.

If you have many credit cards with unpaid balances you have several options to choose from. You can use a for a balance transfer or a personal loan. Otherwise, the Avalanche and the Snowball strategies are the best approaches to your problem.

The important thing is to take action as soon as possible.

Pin it for later!

Don’t Miss: What Is Factual Data On Credit Report

Things To Consider Before Requesting A Credit Limit Increase

Before you request your credit limit increase, you should consider a few factors. The more things you prepare and the more you take into account, the better your chances are that you’ll get what you want. As a guide, here are some things to look out for when you’re considering the right moment to request a credit limit increase.

| Timing | Pay attention to when you decide to ask since timing can be everything. If there’s been a shakeup in your employment, good or bad, that can affect how good things are for getting your credit limit increased. This can also be a reminder to strike when the iron is hot and not to put something like this off since you could quickly lose your opportunity unexpectedly. |

| Hard Pulls | Credit limit increase requests might result in a hard pull on your credit report depending on who you’re asking. If this happens, it may hurt your credit score. As counterintuitive as it might seem, you need to be sure of your credit before you can start to consider a limit increase. |

| History | Your history of good payments is key to getting that limit increased. In many ways, loans are a risk the lender takes on the person they loan to. Making yourself seem like a good investment is one way to increase your chances of getting granted. Making payments on time is one of the best ways to do that. |

If all of this checks out, though, you might be well on your way to a credit limit increase.

How to Request a Credit Limit Increase on Your Own

Ask For A Higher Credit Limit

Call your credit card company and request a higher spending limit. This will lower your credit utilization and make it easier to stay under the 30% spending recommended for card users. Ask the card issuer to do a soft pull on your credit report to make this happen. If you have been a steady payer, this should be an easy way to improve your credit score.

Read Also: What Credit Report Does Chase Pull

How Many Points Can Credit Score Increase In A Month

For most people, increasing a credit score by 100 points in a month isn’t going to happen. But if you pay your bills on time, eliminate your consumer debt, don’t run large balances on your cards and maintain a mix of both consumer and secured borrowing, an increase in your credit could happen within months.

How To Increase Credit Score To 800

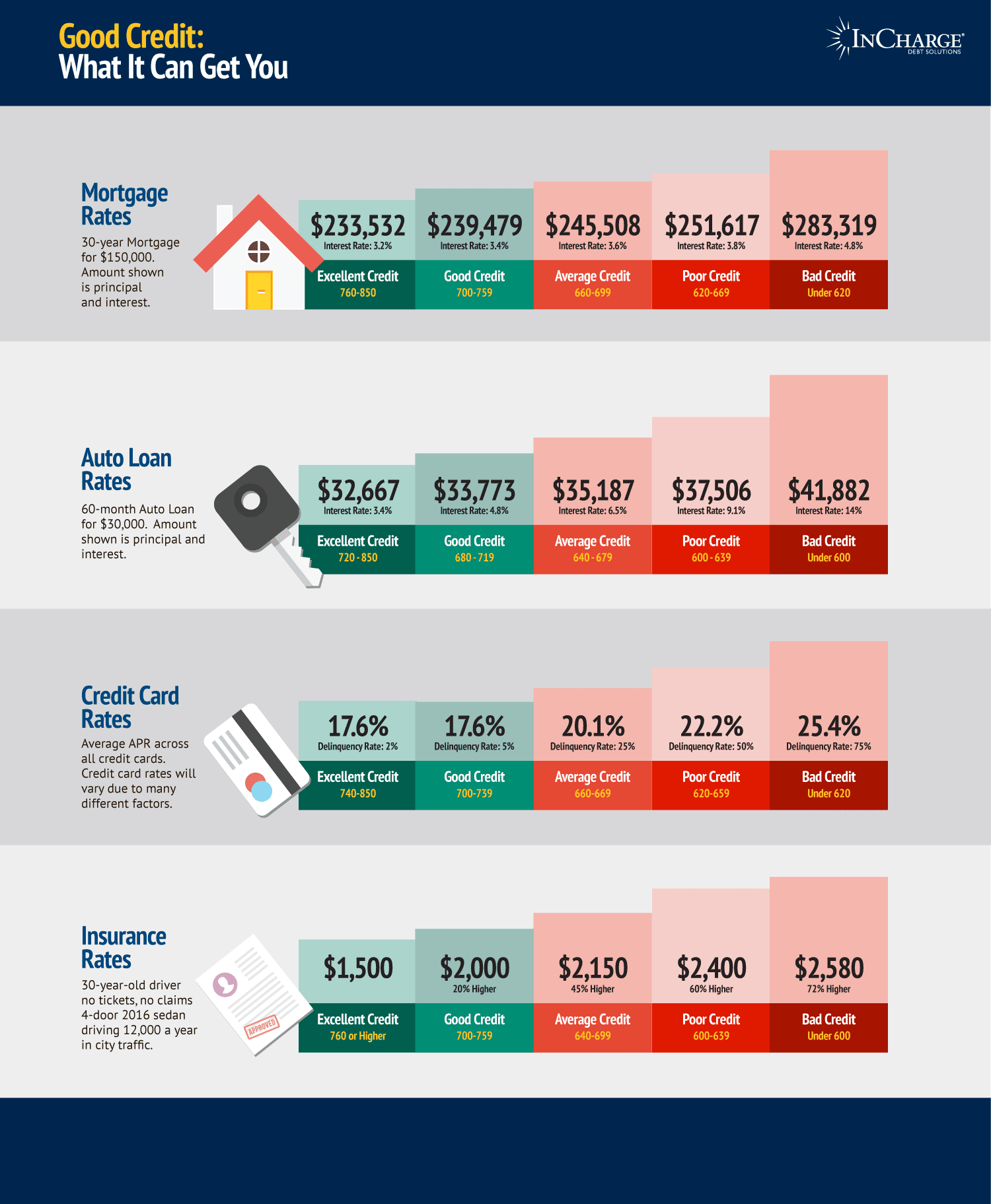

Generally speaking, lenders typically like to see a credit score of at least 650 before they qualify a borrower for a loan. However, a score of 650 might not afford borrowers with the best interest rates, making their loans more expensive to pay down.

When it comes to getting approved for loans and securing the lowest interest rate possible, a higher credit score is best. If you can get your credit score to 800, youll likely be able to take advantage of the best rates and should have no problem getting approved for a loan, as long as all of your finances are in order and there are no other red flags that might worry your lender.

In addition to the above-mentioned tactics, consider the following measures to get your credit score to 800:

- Pay down the balance of your credit cards that are currently at or near their limit.

- Pay down higher-interest debt first .

- Consolidate your debt to pay it off more quickly and transfer the balance of a higher interest-rate card to a lower interest rate card.

- Have a mix of debt which can increase your credit score.

For more ways of improving your credit, .

Final Thoughts

Depending on your particular situation, it may take just a matter of a couple of months to inch your credit score back up. Regardless of where you fall on this spectrum, its important to take steps right now to improve your credit score so you can enjoy better rates and an easier time getting approved for a loan.

Rating of 4/5 based on 23 votes.

Also Check: Is 590 A Bad Credit Score

Dont Apply For New Accounts Too Often

When you apply for a new line of credit, a hard inquiry is recorded on your credit report. This type of inquiry has the potential to lower your score temporarily. A hard credit inquiry will remain on your credit report for 24 months and may impact your credit score for the first 12.

Research your likelihood of approval to ensure youre a good candidate before you apply for a new credit card. You dont want to risk lowering your score for a denied application. You should also refrain from applying for several credit cards within a short time frame or before taking out a large loan like a mortgage.

Credit scoring models do let you rate shop without a credit score penalty for certain types of loans. FICO considers multiple applications for a mortgage, auto or student loan within a designated time frame as a single hard inquiry. According to FICO, this span can vary from 14 days to 45 days. VantageScore counts all inquiries within a 14-day period as one.

Keep in mind, checking your own credit report is considered a soft inquiry and wont hurt your score. Hard inquiries and soft inquiries arent the same when it comes to credit scoring.

Clever Ways To Improve Your Credit Score Fast

Playful girl biting credit card, thinking of doing online shopping, standing over yellow background

getty

Your credit score is a critical piece of your financial life.

If you want a good rewards credit card, youll need a good credit score. If you want to get a low mortgage interest rate, youll need a good credit score.

There are also other non-obvious places where a good credit score can help – like when you want to get a new cell phone or when youre getting car insurance.

Building credit can be a long process where good behavior helps increase your score gradually. Achieving good credit can take years but there are a few steps you can take to give your score a boost.

These wont work for everyone because many solve specific problems but review the list to see if you can take advantage of any of these ideas.

You May Like: Zebit Approval Odds

How To Build Credit Without A Credit Card

While opening and using credit cards can be a good way to build credit, they’re not the only option. Loans and other types of accounts can also help if they’re reported to the credit bureaus.

When you’re starting out, you could look into , which are designed specifically for this purpose. Other common loans, such as student, auto and mortgage loans can also help you build credit.

As with credit cards, making payments on time with loans is the most important factor in building credit. Your remaining balance can also impact your scores, but it’s not as important as utilization rates on credit cards.

Other types of accounts, such as utility and phone plans, often don’t get reported to the bureaus or impact your credit. However, Experian Boost is a free service that allows you to add your phone and utility accounts to your Experian credit report so they can help you build credit. There are also rent reporting services that you may be able to use to add your rent payments to your credit reports. As mentioned, there are several other ways to build credit, with no credit history.

Equifax Financial Health Index

The Equifax Financial Health Index uses information from Open Banking or the information that customers supply themselves, which they combine with existing credit record information, to develop a fuller picture of customers financial circumstances.

The Financial Health Index lets you add information to your credit records about:

- savings and investments.

The Index can also fill in credit information gaps, by including information such as rent and utilities payments.

There are other credit reference agencies joining the market, such as Credit Kudos, which also take Open Banking into account.

You May Like: Opensky Billing Cycle

Ask For Higher Credit Limits

When your credit limit goes up and your balance stays the same, it instantly lowers your overall credit utilization, which can improve your credit. If your income has gone up or you’ve added more years of positive credit experience, you have a decent shot at getting a higher limit.

Impact: Highly influential, because utilization is a large factor in credit scores.

Time commitment: Low. Contact your credit card issuer to ask about getting a higher limit. See if it’s possible to avoid a hard credit inquiry, which can temporarily drop your score a few points.

How fast it could work: Fast. Once the higher limit is reported to credit bureaus, it will lower your overall credit utilization as long as you don’t use up the extra “room” on the card.

Check Your Credit Score For Free

Knowing where you stand and watching your progress can be important. With Experian, you can check your FICO® Score for free. Your account gives you a breakdown of which factors are impacting your score the most, so you can take a focused approach to improving your score. Your credit score will also automatically be tracked and updated each month.

Recommended Reading: What Happens If You Don’t Pay Speedy Cash

How To Raise Credit Score By 200 Points

A few points on your credit score can mean the difference between getting approved for a loan at a reasonable interest rate and being denied a loan altogether. If your credit score is currently under the 600-mark, its time to take some steps to give it a boost. Here are some ways you can effectively raise your credit score by 200 points:

Dont use more than 30% of your credit card limit Just because your company allows you to spend a certain amount of money on your credit card doesnt mean you should max out your card every month. To get your credit score up, keep your credit card spending to no more than 30% of your credit limit. Doing so will increase your score as you pay your card on time every month.

Settle old debt Creditors are sometimes willing to negotiate with borrowers to eliminate certain negative items from their credit in order to receive payment. You may be able to do this with your creditors it doesnt hurt to ask. Settling your old debt can do wonders for your credit score and will even help you avoid any issues in the future.

Make all debt payments in full Any secured credit cards or lines of credit should be paid off in full whenever possible. This will help you give your credit score a boost.