How Often Does Chase Credit Journey Update

Because our credit reports and scores are so crucial to our financial part of our lives, just like coffee is, we need to have it as up-to-date as possible! Your credit report will update in real-time, meaning if you apply for a credit card, a hard inquiry shows up on your report. But you will only see these updates reflect on Chase Credit Journey once every 7 days. You got that, on a weekly basis. Hmm, is that often enough?

How To Access Chase Credit Journey

You don’t need to be a Chase cardholder to use Chase Credit Journey. Even if you don’t have a Chase credit card, you can still create an account and view your credit information on the Chase Credit Journey website.

If you are a Chase customer, you can view the Chase Credit Journey dashboard by logging into your Chase account. Click on the My Credit Journey link and the site will redirect you to your dashboard.

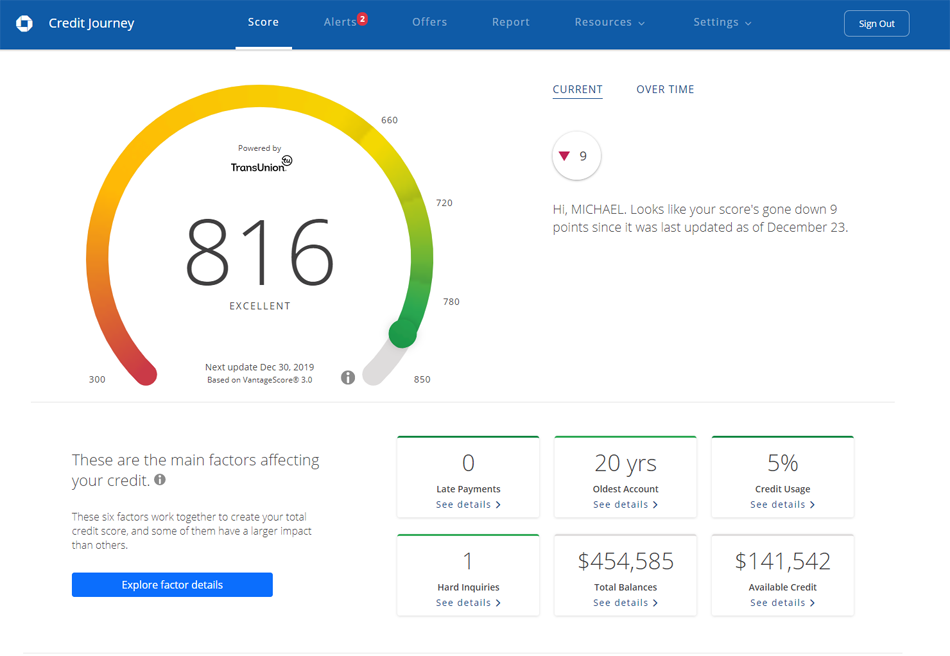

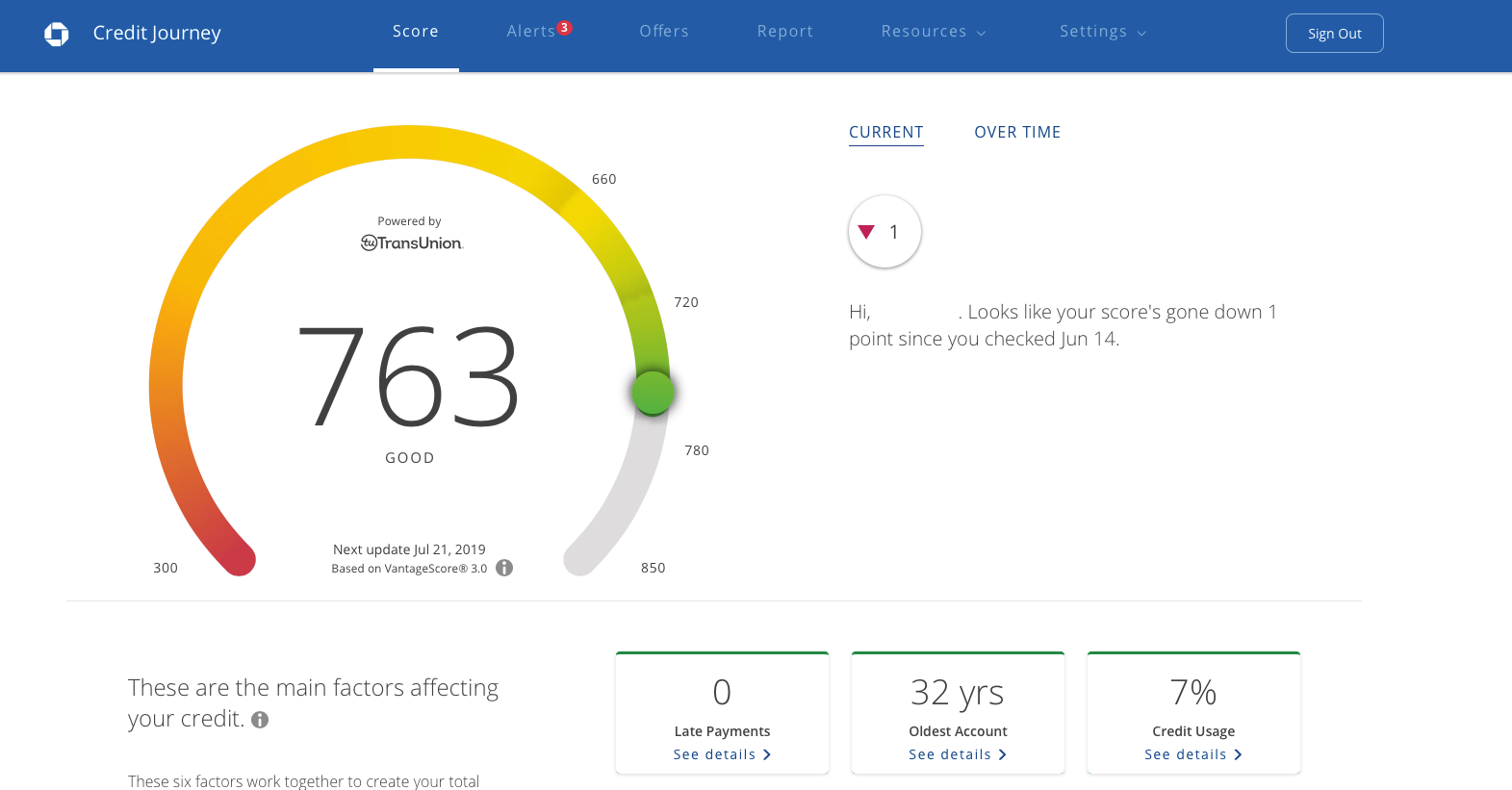

Once youve reached the tool, the main screen shows you your credit score, credit utilization, and available credit. Plus, it allows you to view your oldest account and see how your score has changed over time. It will also tell you the main factors impacting your credit score, such as new accounts, late payments, total balances, and number of hard inquiries.

To view your free credit report, click on Credit report in the “Credit” dropdown at the top of the screen. It will list all your opened and closed accounts, as well as any recent credit inquiries.

Difference Between Credit Reports And Credit Scores

While your credit score and credit report are related, they’re not the same thing. Your credit score is a single three-digit number that signals your credit health to lenders and creditors. Your credit report doesn’t include your credit score. The report, which includes credit activity, is used to calculate your credit score.

Also Check: Bpvisa/syncb

Taking Advantage Of Free Credit Scores

Note that free credit scores you receive online may differ from the credit scores lenders pull to review your application. Lenders usually use a credit score specific to their industry, while online consumer credit scores are generic and for educational purposes only. Lenders also may use credit scores from one or all three credit bureaus.

A credit score is a snapshot of your credit history at a specific point in time. Credit reports, which provide the information to generate your credit score, change frequently. Changes to your credit report since your last credit score pull can also explain why your credit score may be different.

A free credit score is a great way to stay on top of how your credit score is changing, but purchasing an industry FICO score will give you a better look at what a bank will see if you apply for a major credit card or loan.

How To Check Your Own Credit Reports

We recommend that you retrieve your credit reports for free through AnnualCreditReport.com.

This is not a website that will charge you in the future or collects credit card information for a subscription service.

It is the only government-sanctioned website that provides a free credit report directly from each of the three U.S. credit bureaus Equifax, Experian, and TransUnion per year.

I have pulled my credit reports for free for the past 10 years and here are some things to watch for when you are using the website to pull your own reports:

- Make sure that your personal information is entered 100% accurately or you may be prohibited from accessing your credit reports temporarily.

- The verification process contains trick questions and answers that may not apply to you at all just answer none of the above where appropriate.

- Save or print a copy of your credit report immediately after getting it as you may not be able to view it again if you close your browser window.

- You dont have to pull all three reports at the same time. I like to spread them out every 4 months to keep an eye on my credit.

You can also request your credit report through the phone by calling 1-877-322-8228.

If you prefer mail, you must fill out this form and mail it to:

Annual Credit Report Request ServiceP.O. Box 105281Atlanta, GA 30348-5281

Phone and mail requests will be mailed within 15 days of the request.

Don’t Miss: Speedy Cash Closing

Get Alerts When Something Changes

If you have a Chase credit card, you can also set up alerts based on a wide variety of triggers, such as when your available credit is less than a certain amount, when your payment due date is approaching, and when transactions of certain types are charged to your credit card.

You can also opt in for Chases free identity monitoring, which includes:

- Dark web monitoring .

- Data breach monitoring .

- Social Security number trace monitoring .

- Identity verification .

Chase Credit Journey Benefits

Besides for your credit report and score, Chase Credit Journey has additional features, listed below.

Read Also: Credit Carmax

What Is Your Current Credit Limit

How much credit is Chase currently giving you? You can log into your Chase account to check the credit limit on each of your Chase credit cards. Your total credit limit should appear alongside the rest of your credit card information . If you have trouble finding your credit limit, you can always calculate it by adding your current balance to your available credit.

Chase Credit Journey: Check Your Credit Score For Free

Last updated Jul 21, 2021| By Kat Tretina

FinanceBuzz is reader-supported. We may receive compensation from the products and services mentioned in this story, but the opinions are the author’s own. Compensation may impact where offers appear. We have not included all available products or offers. Learn more about how we make money and our editorial policies.

Your credit score is a big deal. It affects everything from what credit cards youre eligible for to what interest rates youll receive on a loan.

Have no idea what your score is? Dont panic youre not alone. According to a recent survey of 5,000 people, 54% of respondents said they dont check their credit scores.

Luckily, Chase offers an easy and free way to check your credit score: the Chase Credit Journey tool. Heres how Chase Credit Journey works and how you can use it to monitor your credit.

Read Also: Apple Card Shopping Cart Trick

Maintain A High Credit Score

Applying for credit sparingly ensures your score can be as high as possible. Each inquiry can drop your score by at least 10 points . Your score will gradually recover, but continual inquires suppress your score and give the impression to lenders that youre risky.

Ideally, you should try to have at most three hard inquiries on your credit report at any given time. Not going above three inquiries in a rolling 24-month period gives you some flexibility when you need to unexpectedly apply for a new loan, credit card, or job.

Key Things To Know About The Chase Freedom Flex Credit Score Requirements:

- A good credit score of 700+ gives good approval odds. Around 43% of people have credit scores of 700+ and if youre not one of them, taking a few months to improve your credit could be the difference between being approved and rejected.

- Chase Freedom Flex approval depends on income and debt, too. The more money you have at your disposal, the more you can afford to put toward paying off credit card bills. But debt hurts your chances. If too much of your money is already earmarked for other debt obligations, your odds of getting approved for Chase Freedom Flex will be lower.

- Dont rely on anecdotal evidence. Even if someone reports getting approved for Chase Freedom Flex with a credit score under 700, it doesn’t mean you will get the same treatment. It depends on your overall credit profile, including income, credit score, and .

Don’t Miss: Does Opensky Help Build Credit

Your Income And Expenses Matter Too

Dont forget that your credit is not the sole factor in determining your qualification for a new credit line.

Chase also asks for your annual income and monthly housing expenses. After all, the bank doesnt know if you can repay your balance without knowing how much free cash flow you have on a regular basis.

Without a doubt, a higher income and lower expenses mean that youre more financially capable of paying off your debt.

Ive been approved for two Chase credit cards and Ive never had to show proof of income and expenses. Looking through several financial forums, it does not appear that Chase makes it a point to verify these two pieces of financial information.

Ask a Question

Advertiser Disclosure: Many of the offers appearing on this site are from advertisers from which this website receives compensation for being listed here. This compensation may impact how and where products appear on this site . These offers do not represent all account options available.

Editorial Disclosure: This content is not provided or commissioned by the bank advertiser. Opinions expressed here are authors alone, not those of the bank advertiser, and have not been reviewed, approved or otherwise endorsed by the bank advertiser. This site may be compensated through the bank advertiser Affiliate Program.

Simulate Changes To Your Score

The score simulator tool available through Credit Journey lets you plug in a wide variety of financial actions and see how they might affect your credit score.

For example, you can simulate:

- Being approved for a new credit card.

- Consolidating credit card debt onto a new card.

- Being approved for an installment loan.

- Getting declined for a loan.

- Taking out a mortgage.

- Paying off all your credit card balances.

- Maxing out your credit cards.

- Paying off all your installment loans.

- Making on-time payments for 6 to 24 months.

- Missing a payment on a credit card.

- Having an account in collections.

The tool estimates the number of points that will be added or subtracted from your score based on the actions you input into the simulator tool.

6 Things That Can Hurt Your Credit Score

Also Check: Next Credit Karma Update

Free Fico Scores Become More Common

Barclaycard and Discover were among the first major credit card issuers to provide free FICO scores through online banking and monthly statements.

Other major credit card issuers, including American Express, Bank of America, and Citi, also offer free FICO credit scores to credit card customers.

They make up part a growing list of card issuers that empower customers with this crucial piece of personal financial knowledge.

When you notice a major drop in your credit score that wasnt caused by any action on your part, its an alert that warrants investigation.

Your FICO score doesn’t give details about your credit accounts so you’ll have to turn to your credit reports for this type of information.

You can get your credit report from each of the three major credit bureaus — Equifax, Experian, and TransUnion — per year for free through AnnualCreditReport.com .

Tip: Don’t have free access to FICO credit scores? You can use free credit-monitoring sites like Credit Karma, Credit Sesame, and Quizzle, all of which provide monthly non-FICO credit scores. You can still use these scores to track the changes in your credit.

As more and more financial institutions give out free FICO scores to credit card customers, it is quickly becoming a standard credit card perk.

Are You Eligible For An Increase

There are two main factors that help determine your eligibility for a Chase credit limit increase, including your account history and credit score. If youve only had a Chase credit card for a few months, you probably wont be eligible for a credit limit increase. Chase determines your credit limit when you first open a card, and you should wait at least six months before requesting an increase.

Its also a good idea to check your credit score before contacting Chase. Your request is more likely to be successful if you have good or excellent credit. If you find yourself below the threshold, you should take steps to build your credit score before asking for an increase. You should also keep in mind that a credit limit request may come with a hard pull to your credit .

Also Check: How To Remove A Repo From Credit

Does Checking Your Credit Score Hurt Your Credit

Its a common myth that checking your credit score hurts your credit, but this is not true. Its likely that this idea grew out of the fact that when your credit is checked by banks or utility companies when youre opening an account, it shows up on your credit report and can result in a 10-20 point ding on your score. When this happens, its known as a hard inquiry or hard pull. The number of these types of inquires youve had in the recent past is also a small part of your credit score.

But when you take a look at your own credit score its what is know as a soft pull or soft inquiry and wont have a negative impact on your credit score.

Summary Of How To Check Credit Inquiries

If you check credit inquiries on a regular basis, you have a better way of maintaining a high credit score. Even if you dont apply for new credit often, you should still check the number of credit inquiries on your credit report at least once a year.

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That’s $750 when you redeem through Chase Ultimate Rewards®.

- Enjoy benefits such as a $50 annual Ultimate Rewards Hotel Credit, 5x on travel purchased through Chase Ultimate Rewards®, 3x on dining and 2x on all other travel purchases, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Ultimate Rewards®. For example, 60,000 points are worth $750 toward travel.

- With Pay Yourself Back, your points are worth 25% more during the current offer when you redeem them for statement credits against existing purchases in select, rotating categories.

- Get unlimited deliveries with a $0 delivery fee and reduced service fees on eligible orders over $12 for a minimum of one year with DashPass, DoorDash’s subscription service. Activate by 03/31/22.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

The comments on this page are not provided, reviewed, or otherwise approved by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

Recommended Reading: How Many Points Is A Repo On Credit Score

How Often Should You Check Your Credit Report

Experts recommend that you check your credit report at least once a year. Taking a full deep dive with a credit report to ensure no inaccuracies, make sure you know where you stand and use a monitoring service that keeps you informed. We can help you stay informed with a credit monitoring service. Sign up for Chase Credit Journey to help monitor your credit.

If you’re planning to make a major purchase soon, or even in the somewhat distant future, you should regularly check up on your credit report. You want to make sure your report is as accurate as possible to get the best interest rates.

Enjoy 24/7 access to your account via Chases . Sign in to activate a Chase card, view your free credit score, redeem Ultimate Rewards® and more.

Chase Credit Journey Alternatives

Overall, Chase Credit Journey is a good option for anyone looking for a free credit score option. However, it isnt the only free credit score service available. If youre looking for some alternatives, here are a few you can consider:

- is another popular option for free credit scores. The company also tracks your Vantage 3.0 credit score and provides credit-building tips and resources. The company will also recommend lending products that might be a good fit for you based on your credit history.

- is a credit monitoring services that provides a free credit report. This service will give you insight into some of the biggest factors impacting your credit scores, like your credit utilization and payment history.

- TransUnion: TransUnions credit score services arent free, but its one of the most accurate credit monitoring services available. Youll receive updates on a daily basis and have the option to lock your Equifax and TransUnion credit reports with the click of a button.

Also Check: How To Remove Repo From Credit Report