Savings Account To Help You Reach Your Money Goals

The savings account offered by Credit Karma is another free tool. The account offers a high yield option to grow your savings. As of January 2020, the APY for the is 1.80%. It is a highly competitive rate for the current market of high yield savings account.

Overall, the account offers some great features. The best of which is the complete lack of fees. You wont even be required to maintain a minimum balance in order to reap the benefits of this account.

The savings account offered by Credit Karma is worth mentioning. A high yield savings account is a great way to build your savings. But the focus of this article will be the accuracy of their credit monitoring tools.

Estimating Credit Score Changes

While youre waiting for your credit report and score to update, you can use a credit score simulator to estimate how your credit score might change. Credit Karma and myFICO both offer credit score simulators that can show how your credit score might change if the information on your credit report changes, like if you pay off an account or open a new loan, for example.

How Credit Karma Makes Money

Credit Karma’s business model is not entirely altruistic. It is a for-profit business that makes money by giving you a free credit score in exchange for learning more about your spending habits and charging companies to serve you .

Credit Karma places advertisements in front of its users, hoping that they will respond to them by clicking on them. Many of these advertisers are lenders, and Credit Karma may earn a fee if you apply through one of its links.

Your personal data is valuable stuff to advertisers, and they pay more to target it. With more than 100 million users, this is a healthy revenue model for Credit Karma.

Recommended Reading: How To Remove Child Support From Credit Report

More Outstanding Mortgage Advice

- How do home improvement loans work are you planning on remodeling your home? One of the essential decisions youll need to make is how to finance the project. Fortunately, there are now tons of options available. See all of the home renovation loans you can use.

- Mortgage terms buyers and sellers should know see thirty-five different mortgage terms you should at least have a basic understanding of. The more you know about financing, the better off you will be when buying or selling.

- Frequently asked mortgage questions when buying a home, it is vital to ask lots of questions. You must understand the process, especially when it comes to getting a mortgage. See what most people like to ask and the appropriate answers.

Use these additional mortgage resources to get helpful advice before buying your next house.

Who Should Use Credit Karma

There are a lot of people who are too scared to use Credit Karma because they do not want to give their personal information. One of the pieces of information you need when signing up on Credit Karma is the Social Security Number. Not everyone is comfortable with giving these details.

However, its a necessary piece of information if you want to track your credit history and score. If you wish to find out your credit score and monitor it in order to know when you can buy a house or a car, then Credit Karma is the way to go.

Even if you dont give your information to Credit Karma, when you want to buy a new home, you will have to give the mortgage lender your Social Security Number. This will allow him/her to check your credit score. But when that happens, there will be a hard inquiry on your credit report, which will bring down your credit score by a bit.

On the other hand, Credit Karma doesnt end up in a hard inquiry on your report. It is only there to gather information and let you monitor your credit.

So, Credit Karma is a good alternative for first-time homebuyers or just anyone who wants to keep an eye on their credit before they borrow a loan or make a great purchase. You should consider this service and sign up in order to monitor your credit score. On top of allowing you to check your score, Credit Karma also lets you learn more about credit scores, what impacts them and how to improve them.

You May Like: When Do Companies Report To Credit Bureaus

How To Get Started And Use Credit Karma Services

The Credit Karma sign-in page is easy to use. When you go to the website, you’ll need to create an account first. This takes less than five minutes and it’s five minutes well spent.

The Credit Karma site uses two-factor authentication to help keep you secure. Once you have an account set up, you can determine which tools and information you want to use. For example, you can opt for text alerts about tips or credit score changes.

The Credit Karma website uses bold graphics and clear instructions to make finding your way around the platform simple. The wealth of information, tools, advice, and ease of use makes Credit Karma an easy choice for someone looking to improve their credit health.

The assortment of tools on Credit Karma’s website is probably the biggest draw. If you’re facing a big debt or poor credit score, you can see how certain changes will position you in the future.

The credit score simulator provides answers to hypothetical situations. It’s one of the most useful tools on the Credit Karma site.

Wondering what happens to your credit score if you close out a credit card or get denied for a credit application? You can input the numbers and find out.

Wondering how going into foreclosure impacts your score? Or letting an account go past due? You can find out.

Why Is It Important To Track Your Credit Score

A high credit score can open your life to a world of opportunities. You will have an easier time getting access to large loans such as mortgages or car loans with better terms and rates that are available only for people with great credit scores.

Having a bad credit score makes it much harder for you to get a loan, and in the case, that one is granted to you they are often accompanied by higher rates. Paying higher rates on loans means more money towards debt and less money towards investing for your future self.

If you want to take out a loan to make a large purchase, youll need a strong credit score to do so. Using a lender to buy a house or car can be difficult If you have a bad credit score. A bad credit score can be due to poor care towards your credit or a mistake like a creditor accidentally reporting a defaulted loan on your credit report. This is why its highly important to monitor your credit score because a mistake like that will drop your credit score and lead to trouble trying to secure loans in the future.

Don’t Miss: Does Opensky Report To Credit Bureaus

Open A Secured Credit Card

If youre having a hard time getting a loan or opening up a traditional credit card, look into a secured credit card.

In the world of finance, secured debt is debt that is held with collateral. This means secured credit card holders have a lot at stake if they default. The most common forms of secured debt include mortgages and car loans, but secured credit cards also exist. These cards work exactly as traditional credit cards do, but users have to put down collateral or a security deposit to get the card issued. If you fail to make your card payment, the company then has the ability to take your collateral or deposit.

Work With The Right Mortgage Company

One of the most significant decisions when purchasing a home for the first time will be picking the right lender. Numerous homebuyers dont put in enough effort to choose the right mortgage company.

The mistake that is often made is just focusing on the interest rate offered and not the loans total cost.

Lenders can make a particular loan product look enticing by the advertised rate they are offering. Sometimes the cost, however, when compared to other loan programs, is not the best.

At the initial stages of procuring financing, make sure you ask the lenders lots of questions. Getting the answers you desire will go a long way towards being happy in the long term.

As a first-timer, there are a plethora of exceptional first-time buyer loan products available to choose from. Whether you are looking for a low or no down payment loan, youll have plenty of outstanding choices.

Just as essential as finding the right fit with a mortgage company is finding a real estate agent you find dependable and trustworthy.

An excellent agent can be a valuable resource in finding a loan specialist. It is one of the many services a real estate agent provides to their buyer clients.

Don’t Miss: Does Affirm Show Up On Credit Report

How To Get Lower Interest Rate On Credit Card

Category: Credit 1. How to Lower Your Credit Card Interest Rate | Credit Karma Call and make your request Paying off big credit card balances can get expensive. Make it more manageable by learning how to negotiate a lower Best for low fees: SunTrust Prime Rewards CrEvaluate your current situation

How Often Does My Credit Report Information Update

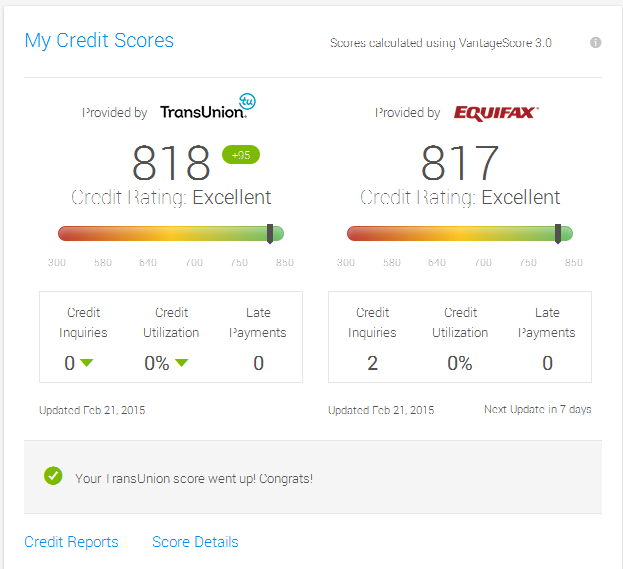

Updates from TransUnion are available through your Credit Karma account every 7 days. All you have to do is log in.

Below your current score, youll see the date of your last update and when your next update will be available.

Keep in mind that the information on your credit report may not change every time its updated on Credit Karma. It usually takes about 30 days for creditors to report new information to the credit bureaus, and the frequency of updates can vary by creditor.

Since we dont receive credit report information from creditors directly, we dont know when a specific creditor will update your information. But by checking in regularly, you can keep track of updates and keep an eye out for errors at the same time.

Don’t Miss: What Credit Score Does Carmax Use

Why Did My Credit Karma Credit Score Not Change

Your Credit Karma score may not have changed because the credit bureaus have not reported your information, your changes were not substantial enough, or the negative knocks on your credit have canceled out the changes.

If you trying to increase your credit score to get a payday loan, an auto loan, or any other type of loan, you know it is extremely validating when you make a positive change and your credit score increases as a result. If you have a bad credit score, there are few better feelings than seeing your credit score increase.

However, it can be very frustrating when you make a positive change to increase your credit , but your credit score does not even move a single point. Lets look at why your credit score on Credit Karma may not have changed, even after you’ve made steps to increase your credit score.

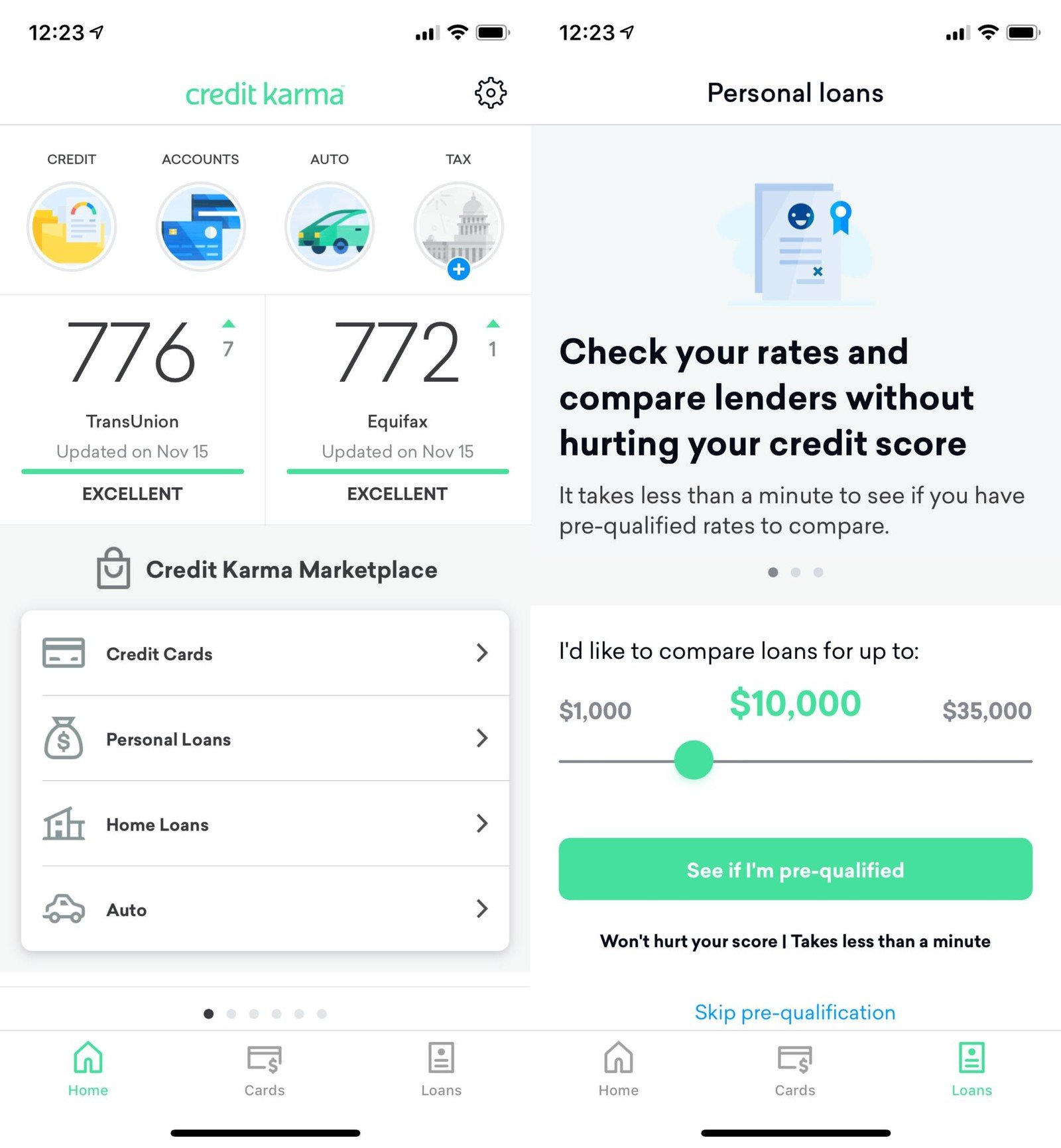

Using The Credit Karma App

If you love to access your financial information on your phone, you can use the Credit Karma App. The mobile app is free to download for iOS and Android users. The app has tools and features that allow you to stay on top of your finances and check your credit score for free.

You can also file your state and federal tax returns with Credit Karma tax and put away cash with Credit Karma Savings.

With the app installed on your phone, you will have the ability to receive credit alerts if the company gets a crucial change to your credit reports from either Equifax or Transunion.

For example, if your credit card bill got paid off. Their free credit monitoring tool helps you keep up to speed on your finances and any unwelcome surprises.

Don’t Miss: Does Speedy Cash Report To Credit Bureaus

What Is Credit Karma Tax

When most people think of Credit Karma, it is because of their credit score monitoring and improvement tools. Many people have never heard of Credit Karma tax until they get in and start using the site.

Like their credit scoring tools, Credit Karma tax is free to use. Like you would expect, the service is used to help you to prepare your taxes.

As you might expect, preparing a Credit Karma tax return probably would not be the best for folks who have complicated taxes. Their tax review would be more appropriate for those who have a fairly straightforward tax situation.

With any free software, its not going to be best for everyone, but the tax software can satisfy a significant number of people.

One thing worth noting is that their tax program cannot be used everywhere. There are forty states as well as DC that allow their service.

Why Is It Important To Monitor Your Credit Score

A good credit score can make your financial life easier. Youll have easier access to large loans such as a mortgage or auto loan with better terms. These terms can save you money over the long term and allow you to work towards your other financial goals such as retirement or building a safety net before deciding to work for yourself.

On the flip side, a bad credit score can lead to difficulty obtaining large loans with favorable terms. If you are able to secure a loan with bad credit, then you will likely be paying higher rates. Your higher payments can add up and make it more difficult to save for your other financial goals.

If you have plans to make a major purchase with the help of a loan, then you will want a good credit score. Consider whether or not you see a home purchase or auto loan in your future. If you do plan on making a major purchase with the help of a lender, then you will likely need a good credit score to make that transaction flow as smoothly as possible.

With that, is incredibly important to monitor your credit score. Not only can your actions have a big impact on your , but also mistakes on your credit report can lead to a misleading score. For example, if a creditor accidentally reports a defaulted loan on your credit report, it could lead to a big drop in your credit score through no fault of your own. That could lead to problems securing a mortgage or auto loan down the line.

Don’t Miss: Does Speedy Cash Report To Credit Bureaus

Credit Karma High Yield Savings Account

The Credit Karma savings account is another free tool that offers a high-yield option to grow your savings. With an APY of 1.80%, its one of the best rates in the market for high-yield savings accounts.

You wont even have to maintain a minimum balance in order to take advantage of this account, plus there are no fees!

Where To Consolidate Credit Card Debt

Category: Credit 1. Best Debt Consolidation Loans for July 2021 | Bankrate Debt consolidation loan vs. balance transfer credit card Use your loan through Upgrade to pay on high interest credit cards, make a large purchase, PenFed Credit Union Personal · Payoff Personal Loans · Discover Personal Loans Jan 31,

Don’t Miss: When Does Paypal Credit Report To Credit Bureau

Is Credit Karma Really Free

Short answer: Yes!

When you choose to follow through with one of Credit Karmas recommendations, they will receive a small commission. With those commissions, Credit Karma can continue to offer free services.

Be sure to do your due diligence before applying for any loans that Credit Karma may be advertising.

File Your Taxes With Credit Karma

Did you know that you can file your taxes with Credit Karma, too? You can file both your state and federal taxes for free. You can trust that Credit Karma will make sure they’re accurate before filing.

They emphasize that the process to file is easy on their site. In fact, you can snap a photo of your W-2, upload it, and you’re on your way! Also, you can transfer a previous year’s returns from another popular tax prep site to simplify the process.

If Credit Karma makes a mistake that causes a penalty, they offer a one thousand dollar back guarantee. While so many online tax filing sites hit you with fees, a free service like this one stands out. A lot like the rest of the Credit Karma website, it’s easy to use!

Read Also: Is 524 A Bad Credit Score

Question : Will Your Credit Score Get Lowered If You Use Credit Karma

Since Credit Karma deals with soft inquiries, your credit score wont get lowered if you use their services.

Soft inquiries are used as a personal reference, therefore they dont impact your credit score.

On the other hand, hard inquiries can affect your credit score. They get placed on your credit reports every time you apply for a new credit line.

How Do You Check Your Credit Karma Score

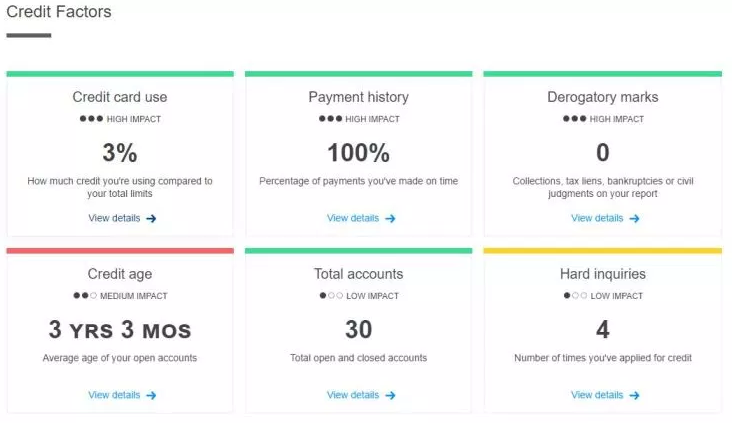

Once you create a Credit Karma account and log in, your Credit Karma dashboard will show your TransUnion and Equifax scores. You can click on either score for a more detailed breakdown, including the impact of your payment history, credit card use, credit age, hard inquiries, derogatory marks, and total number of accounts.

Recommended Reading: Creditwise Is Not Accurate

What Affects Credit Score Update Timing

The timing of credit score updates is based on the timing of changes to your credit report. Since your credit score is calculated instantly using the information on your credit report at a given point in time, all it takes to raise your credit score is a positive change to your credit report information.

At the same time, having negative information added to your credit report can offset positive changes you might have seen to your credit score. For example, if you receive a credit limit increase but a late payment is also added to your credit report, you may not see your credit score improve. In fact, your credit score could fall.

Seriously negative information can weigh your credit score down, making it take longer to improve your credit score. For example, it can take longer to improve your credit score if you have a bankruptcy, debt collections, repossession, or foreclosure on your credit report.

The more recent negative information is, the more it will impact your credit score.