Why Isnt My Score The Same Everywhere

You may have a different score with each of the three nationwide credit reporting agencies . Dont be worried if thats the case. We all collect similar information, and a lot of it overlaps, but scores can vary for a number of reasons. For example, lenders can choose to report to one, two or all three agencies. Because of this, the information in your reports can vary, which is partly why your scores can differ too.

There are also many scoring models, and they may weigh certain information in your reports more heavily than other factors. For example, one scoring model may put more emphasis on total credit usage than others. Because there are varied scoring models, youll likely have different scores from different providers. Lenders use many different types of credit scores to make lending decisions. The score you see when you check it may not be the same as the one used by your lender.

How Long Does A Transunion Dispute Take

Once you file a dispute, TransUnion must investigate the error. If it is found to be a mistake, it must corrected within 30 days. Throughout these 30 days, you can opt to receive email notifications to check your TransUnion dispute status.

However, if you receive your TransUnion dispute results to find that the error was not fixed, you have the right to sue.

Place A Credit Freeze

Contact each credit reporting agency to place a freeze on your credit report. Each agency accepts freeze requests online, by phone, or by postal mail.

Experian

PO Box 26Pittsburgh, PA 15230-0026

Your credit freeze will go into effect the next business day if you place it online or by phone. If you place the freeze by postal mail, it will be in effect three business days after the credit agency receives your request. A credit freeze does not expire. Unless you lift the credit freeze, it stays in effect.

Read Also: Credit Report With Itin Number

Mortgage Lenders Pull All Three Reports But Only Use This One

According to Darrin Q. English, a senior community development loan officer at Quontic Bank, mortgage lenders pull your FICO score from all three bureaus, but they only use one when making their final decision.

“A bank will use all three bureaus,” tells CNBC Select. “It’s called a tri-merge.”

If all three of your scores are the same, then their choice is simple. But what if your scores are different?

“We’ll use that median score as the qualifying credit score,” says English. “Not the highest or lowest.”

If two of the three scores are the same, lenders use that one, regardless of whether it’s higher or lower than the other one.

And if you are applying for a mortgage with another person, such as your spouse or partner, each applicant’s FICO 2, 4 and 5 scores are pulled. The bank identifies the median score for both parties, then uses the lowest of the final two.

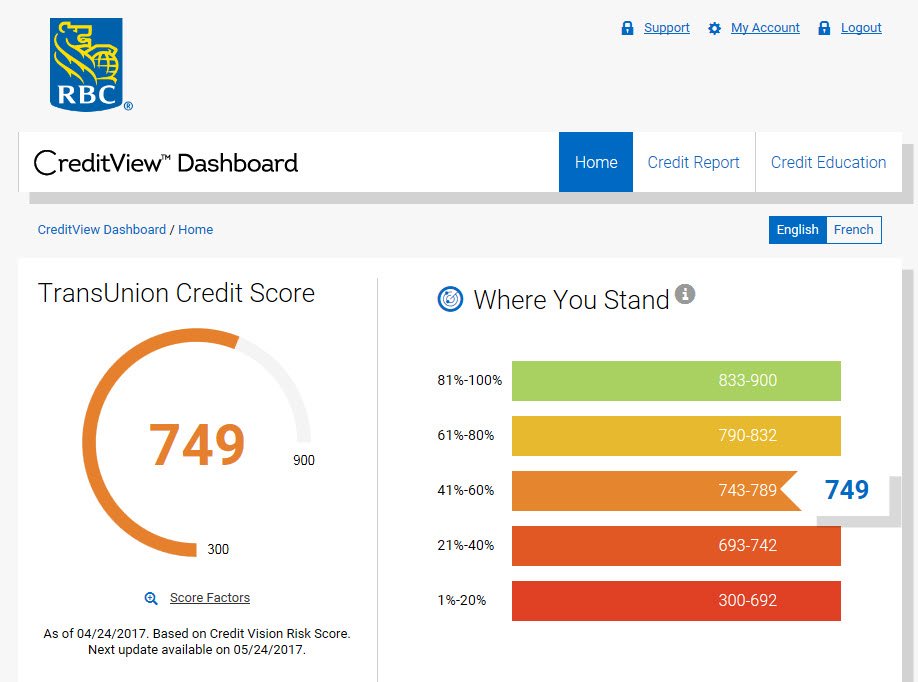

How Is The Transunion Creditvision Risk Score Different From A Traditional Scoring Model

Unlike other scoring models you may have encountered, the CreditVision model uses trended data to provide:

- A score for people with little credit history. If you havent been able to get a score before, you might be able to now because details from your credit in the past two years can be accounted for in the assessment, not just the situation youre in now.

- A more accurate score for people with a lot of credit history. Youll see your profile based on your credit decisions and behaviour over time, not just the latest records.

Don’t Miss: Can You Remove Hard Inquiries Off Your Credit Report

Your Annual Credit Report Is Now Available Weekly And Its Still Free

The three national credit reporting agenciesTransUnion, Experian and Equifaxare required by federal law to provide you with a free annual credit report. In fact, AnnualCreditReport.com was created by the credit reporting agencies as a one-stop-shop to provide you with your annual credit reports.

In response to the COVID-19 health crisis, TransUnion is pleased to offer you one free weekly credit report online through April 20, 2022 at AnnualCreditReport.com. Reviewing your credit reports regularly helps you ensure the information reported is accurate. It also gives you an opportunity to monitor your account history to combat identity theft.

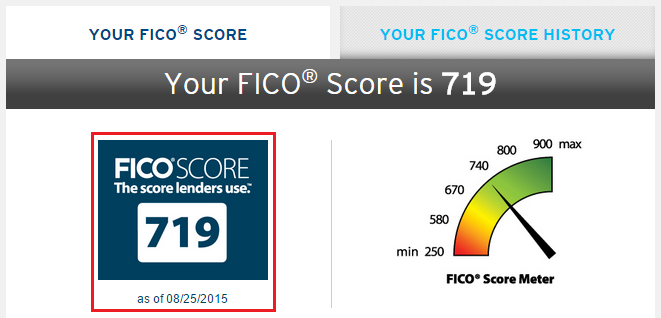

Fico Is The Most Widely

Since there are so many free credit score options out there, you should know that FICO is the most widely used credit score among lenders. In fact, 90% of lenders check FICO Scores rather than any other types of credit scores. So if youre looking to take out a loan anytime soon, we recommend checking your FICO Score.

FICO actually has multiple scoring models, such as FICO Auto Score and FICO Bankcard Score, used in different lending industries. The most popular score across industries is the FICO Score 8, while the FICO Score 9 is the most recently released FICO scoring model.

You can purchase your FICO credit score and report from each credit bureau individually for $19.95 or all three credit bureaus scores and reports for $59.85. Purchasing your credit score through FICO will include your FICO Score 8, as well as other important industry-specific scores.

Don’t Miss: Unknown Address On Credit Report

Transunion Credit Score Range

Lenders and financial institutions place prospective borrowers on a credit score range to determine whether they qualify for a loan or other transaction, as well as the specific terms theyll offer if you do qualify.

The range you fall into depends on the credit scoring system the credit reporting company uses. Since TransUnion uses the VantageScore credit scoring system, your score will fall into one of the following ranges:

- Excellent: 750 to 850

- Poor: 550 to 649

- Very poor: 300 to 549.

When you have a poor credit score, youre considered a higher risk for lenders and financial institutions. If you qualify for a loan, youre likely to be offered unfavorable terms, such as a large deposit or down-payment requirement and a high interest rate. On the other hand, individuals with excellent credit scores may qualify for exclusive terms or benefits.

Transunion Vs Equifax: Which Is Most Accurate

No credit score from any one of the credit bureaus is more valuable or more accurate than another. Its possible that a lender may gravitate toward one score over another, but that doesnt necessarily mean that score is better.

And while a lender may prefer credit reports and scores from a specific bureau, keep in mind that each situation and application is different, with multiple variables to take into consideration.

Don’t Miss: Syncb Ppc On Credit Report

Dispute Transunion Credit Report Errors

If your TransUnion credit report contains errors you have the right to file a dispute. TransUnion will have 30 days to investigate your dispute and correct any errors. Unfortunately, credit reporting agencies do not always fix their mistakes. They may continue to report the wrong information on your credit report. They may correct it once only to report it again the next time your credit is checked.

If this is happening to you, we can help. Assert your consumer rights and get a free case review now, or call us at 1-877-735-8600.

How To Check Your Credit Report

It’s easy to check your credit report:

- Request your free credit report from Experian at any time.

- Check your at any time

- Visit annualcreditreport.com to request one free credit report from each of the 3 major credit reporting agencies every 12 months.

Who Can Check My Credit Report?

The Fair Credit Reporting Act limits who can view your credit report and for what reasons. Generally, the following people and organizations can view your credit report:

Also Check: Credit Karma Rapid Rescore

What Is The Best Credit Report Site

Category: Credit 1. Best Credit Monitoring Services of August 2021 CNBC Best overall paid service: IdentityForce® · Runner-up: Privacy Guard · Best for families: Experian IdentityWorks · Best for most accurate credit score: FICO® 2021s Best Credit Report Site · WalletHub · Annual Credit Report · Quizzle · Credit

How Does Information Get On My Credit Report And Is It Updated On A Regular Basis

When you have an account with a lender, theyll typically submit account updates to at least one of the three major credit reporting agencies TransUnion, Equifax and Experian. Since lenders dont always report to all three agencies, the information on your credit reports may vary.

Its also important to note that lenders report at different times of the month, so you might see slight differences in your reports, and therefore your credit scores, at any given time.

Also Check: Does Zzounds Report To Credit Bureau

Other Places To Check Your Credit Score

Although other scores arent used as often by lenders, they are still useful for tracking changes to your credit and are offered for free.

If you dont have a credit card or other product that provides free access to your score, it doesnt hurt to track one of the other scores, even though it isnt a FICO score.

You can also use these scores to check if you are making progress on your credit, and if there is a major decline or suspicious activity on your credit report, you can catch it right away. Then, you can at least investigate the activity and fix any issues.

Some of the other credit scores you might want to keep an eye on include the following:

Why Do I Have Different Credit Scores

Wave 11 of our Consumer Financial Hardship Study found that more than half of Americans check their credit scores at least monthly. When checking your scores, it may be confusing to see that your score with a bank, lender, credit monitoring service and even TransUnion can all be different. You probably dont need to be concerned. There are reasons for score differences, and you can better understand why when you know what credit scores are and how theyre rated.

Don’t Miss: How To Report A Death To Credit Bureaus

How Often Is My Credit Report Updated

Your credit report is updated frequently, as new information is reported by lenders and older information is gradually removed per federal retention requirements.

However, it’s important to also know that most lenders report changes in account status, such as payments you’ve made or whether you’ve fallen behind, on a monthly basis. If you make a payment on one of your accounts, it’s possible that the payment won’t appear on your credit report for up to 30 days.

Whats The Transunion Creditvision Risk Score

The CreditVision Risk Score ranges on a numbered scale from 300 to 900 points, and the higher the score you have, the better.

This type of rating system might look familiar, but what sets this TransUnion model apart from other credit scoring models is its use of trended data.

Traditional credit models calculate scores based on your credit status at the exact moment in time that a lender accesses your credit.

On the other hand, the CreditVision Risk Score looks at historic and trended information over the past 24 months. This includes a historic look at your balances, payment behaviours and how many credit applications youve made.

In other words, this long-term, comprehensive view of each account on your report provides a more accurate assessment of your financial profile.

You May Like: Aargon Collection Agency Payment

What Is The Credit Rating Scale

Credit scores are rated on a scale of 300 850. The higher your score, the better your history of managing debt and repaying credit or loans. Whats considered a good credit score may vary by lender and type of product. Different credit cards, auto loans and mortgages can have different approval requirements.

The Cost Of A Transunion Credit Report Error

An error on your credit report can not only lower your credit score, but it can also result in the following:

- Higher interest rates for your home mortgage, credit card, and private student loans

- Higher insurance premiums for your home and car

- Loss of a job opportunity

- Denial of loan and credit applications

In extreme cases, an error on your credit report could even affect your U.S. government clearance. In fact, TransUnion lost a class action lawsuit in 2017 after consumers were flagged as terrorists on their credit report.

Don’t Miss: How Do I Unlock My Credit Report

What To Do With Your Free Credit Report

The first thing you should do when you receive your free credit report from Transunion is review it for errors or mistakes. If you find any erroneous items on the report, such as unauthorized inquiries, youll want to send a dispute letter to the credit bureau. A successful dispute can get an error removed from your credit report, and improve your overall credit score.

In the meantime, you might consider contacting a good credit repair company to help you if your score is low. These companies can help you make lasting improvements to your credit score.

Knowing whats on your credit report is helpful if youre planning to make big financial moves in the future. By requesting a free annual report from TransUnion, or becoming a TransUnion member, you can have a full picture of your financial standing. This could help you learn how to improve your score, increase your creditworthiness, and anticipate what types of terms you may be eligible for.

What Does A Credit Report Include

The information that appears on your credit report includes:

- Personal information: Your name, including any aliases or misspellings reported by creditors, birth date, Social Security number, current and past home addresses, phone numbers, and current and past employers.

- Accounts: A list of your credit accounts, including revolving credit accounts, such as credit cards, and installment loans, such as mortgages or auto loans. The list includes creditor names, account numbers, balances, payment history and account status .

- Public records: Bankruptcies.

- Recent inquiries: Who has recently asked to view your credit report and when.

Note that your credit report does not include information about your marital status , income, bank account balance, or level of education. Your credit report could include your spouse’s name if reported by a creditor. After a divorce though, the only way to remove a spouse’s name from your credit report is to dispute the information.

Each of the three credit bureaus may also have different information about you. Creditors are not required to report information and may not furnish data at all, and if they do, it may only be to one or two of the credit bureaus.

Read Also: Does Snap Finance Report To The Credit Bureau

How To Obtain A Free Credit Report From Transunion Canada

Canadians can obtain a credit report at no charge from TransUnion. How do I get my credit report for free? In Canada there in 2 ways:

Free Canadian Credit Reports and History by mail or fax

Once you have completed the steps above, you can fax the request to 05 527-0401 or send a mail to:

TransUnion CanadaP.O. Box 338, LCD 1Hamilton, Ontario

For Quebec Residents only. Mail your completed form to:

CONSUMER RELATIONS CENTRELaval, QC, H7V3P7Tel 335-0374

If you need access now and cant wait for the snail mail version. Click on the button below and fill out the form.

Free Canadian Credit Reports and History by phone

Give TransUnion Canada at one of the following numbers. Be prepared to answer questions about your credit, credit card and loan information. The credit bureau will use this information to verify your identity.

TransUnion Canada

- T4 slip

- Notice of Assessments

- GST/HST Refunds

- Child Tax Benefits

Together these combined pieces must contain your name, current address, date of birth and signature.

Other useful information

- TransUnion also requires both sides of the ID be photocopied.

- There are 2 . It is recommended that you request a report from Equifax Canada as well at no additional charge.

Online Credit Report and Score

Why Looking For Mortgage Lenders That Use Transunion Is Pointless

Looking for mortgage lenders that use only Transunion is essentially pointless.

Most mortgage lenders will use all three credit bureaus and looking for a particular mortgage lender who only uses Transunion will mean that you are marginalising yourself from a host of other mortgage lenders who use other credit bureaus and may offer you better mortgage rates.

The other reason why looking for only mortgage lenders who use Transunion is that all credit bureaus will usually hold similar data if not the same data and hence you may not find any advantage in looking for mortgage lenders who use only Transunion.

If you are adamant that looking for a mortgage lender who uses only Transunion will be beneficial to you then a mortgage broker could potentially help you in finding such a mortgage lender.

Also Check: Sample Notification Of Death Letter To Credit Reporting Agencies

How Long Will Information Stay On My Credit Report

The good news is that in Canada your positive credit information can stay on your credit reports for up to 20 years.

In addition, derogatory marks can stay on your credit for up to 14 years, but this will depend on the negative mark and the province where you live. Heres how long each derogatory mark may stay on your reports: