You Can Now Freeze Your Credit For Free Heres Why You Should Do It

Jon Byman

Thereâs no sure-fire way to prevent someone from stealing your identity and damaging your credit in the process. But freezing your credit will go a long way toward making sure youâre protected and giving you peace of mind. And you can freeze your credit for free. You may want to consider doing it as doing so will mean that even if a criminal gets your information, it will be difficult or impossible for that person to open a fraudulent account in your name.

In 2018, a new law made it free to freeze your credit. Prior to the new law, each of the three credit bureaus could charge you if you wanted to put a freeze in place . Then, you often had to pay again to unfreeze or thaw your credit if you wanted to do something that required a credit check, like applying for a new loan. However, after the massive Equifax data breach in 2017, consumer advocates called on Congress to provide free access to credit freezes.

How To Unfreeze Your Credit Report With Transunion

Similar to Equifax®, you can create an online account, which allows you to freeze and unfreeze your credit with TransUnion®. You will need to create a PIN during the credit freezing process, but you only need your PIN if you want to lift your freeze by phone. If you lose your PIN, you can still unfreeze your report online as long as you have the password and name connected to the account. You can create a new PIN online for an added layer of security, and won’t need the old PIN to set up a new one.

What Is A Credit Report Freeze

Each time you apply for credit of some sort, the creditor will pull a credit report against you to get an accurate picture of your credit history. They want to know what your FICO score is and if you have a bad or good habit of paying all your bills on time. When the credit check is made, it can hit one or all three primary credit bureaus .

When your credit reports are unfrozen, anyone with access to your personal information can request credit on your behalf. This is primarily how identity theft occurs a bad actor pretends to be you and applies for a new source of credit like a credit card. Because they have all of your personal information, including Name, Address, Social Security Number, and mailing address, the three credit bureaus will review your credit file and approve the credit request based on your current rating.

However, if you have a in place with all three credit bureaus, no new requests for credit will be approved, even if they have all of your private information. The good news is, setting up a credit freeze is free. Just follow the steps below for all three major credit bureaus.

Don’t Miss: Bp Visa/syncb Pay Bill

Who Can Access My Credit Report If Its Frozen

As a reminder, a freeze on your credit report will prevent lenders and creditors from accessing your credit history. So, dont expect to get approved for a personal loan, auto loan, home loan, or a new credit card as long as the freeze is in place.

Entities that can access your credit report even with a credit freeze in place include the following:

- The company that provides or monitors your credit report

- The government and courts

- Companies investigating individuals for possible fraud

- Collection agencies

Ideas On Freezing Your Credit Against Identify Theft

![How to Freeze Credit Report in 5 Minutes [Easy Online Process]](https://www.knowyourcreditscore.net/wp-content/uploads/how-to-freeze-credit-report-in-5-minutes-easy-online-process.jpeg)

You can likewise carry out the technique through downloading my, Trans, Union app, accessible in the Apple or Google Play App Shop. The app provides you the capability to “Briefly Lift Freeze” your own self. You merely get into the days you desire the airlift to occur, so the file can easily be accessible to loan providers. Over the phone, a customer support agent may help you along with the process at 888-909-8872. Or even, you can easily post your elimination requests to the firm straight. Trans, Union Trans, Union LLC, P.O. Package 2000, Chester, PA 19016. how to unfreeze credit report. Experian has a “Freeze Center” dedicated to aiding you to remove or even remove a safety and security freeze.

Defending your credit history is vital since your credit history can impact your financial life in many methods. A credit freeze is actually a protection solution you may look at if you want to stop unwarranted individuals from accessing your debt documents. Icy and also unfreezing your credit history is a relatively basic procedure, but it assists to comprehend how it functions to understand when it is actually the right action. A debt freeze can easily get your credit history files from unauthorized access . It’s currently free of charge to ice up as well as unfreeze your credit scores records along with the three significant credit reporting bureaus. A debt freeze doesn’t prevent people who actually have access to your credit rating from seeing your credit score report.

Also Check: When Do Companies Report To Credit Bureaus

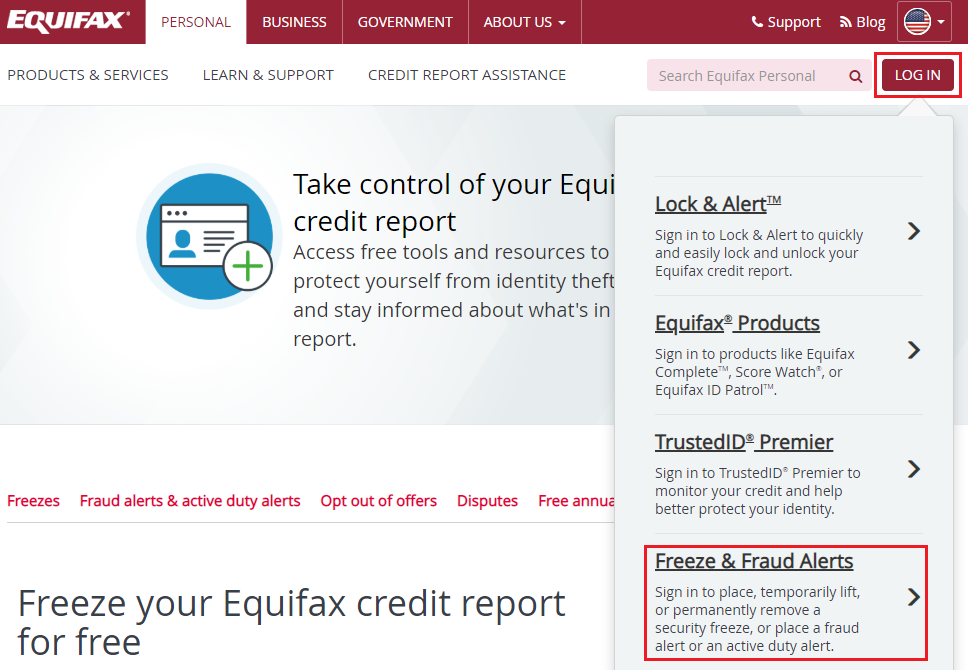

Login To Your Account

Equifax uses myEquifax as its consumer account system to control credit freezes. The myEquifax logo looks a little different than the other Equifax branding, which is expected. Equifax is a credit bureau, not a design studio. Login to your myEquifax account here: .

If you see a We are temporarily unable to complete this request screen like this one when signing in, Equifaxs system is down. You will not be able to complete your freeze request online or by phone. The only way to complete your freeze is to call Equifax at 888-298-0045 from 9am-5pm Eastern Time, Monday through Friday. Equifax may have expanded hours for COVID-19 support. After the phone system fails to freeze your credit automatically, press 0 to be connected to a human agent who will confirm your information and process the freeze.

Equifaxs system can be down for many days at a time. If Equifaxs system uptime is unacceptable to you, we invite you to file a CFPB complaint, call your congressperson, or tweet at Equifaxs executives.

How To Unfreeze Credit With Experian

Experian is the only credit bureau that requires a PIN to unfreeze your credit.

An Experian credit freeze lift can be for a specific time there’s no maximum. The online form warns, however, that you can’t change the date range for unfreezing your credit once you’ve submitted it.

Experian also offers a single-use PIN that can help ensure your information is seen only by a creditor you authorize, so it isn’t exposed needlessly. Experian gives you the PIN, and you give it to the entity checking your credit.

Contact info:Experian Experian Security Freeze, P.O. Box 9554, Allen, TX 75013 888-397-3742.

Also Check: Syncb/ppc Account

How To Lock Your Credit Report At Transunion

TransUnions credit lock program is called TrueIdentity, and its also free. Like with Equifax, you can lock and unlock your credit quickly on a smartphone or computer. The program also gives you access to your TransUnion® credit report, free monitoring alerts and up to $25,000 in identity theft insurance. TransUnion also has a premium product, called Credit Lock Plus, that allows you to lock your credit reports with both TransUnion and Equifax but it costs $19.95 a month. You can sign up for the free TrueIdentity program on TransUnions website.

When To Use A Credit Freeze

You should freeze your credit if you believe youve been the victim of identity theft or if your personal or financial information has been exposed in a data breach. Freezing your credit can help keep predators from opening new accounts in your name.

But this isnt the only time you should consider a credit freeze. If you want to help protect yourself from identity theft, you should keep your credit frozen at all times unless you are actively applying for a new credit card or loan. When you are applying for credit or debt, you can unfreeze your credit temporarily.

Make sure, though, that you freeze your credit at all three credit bureaus.

Also Check: Can A Repo Be Removed From Credit Report

Recommended Reading: How To Remove Repossession From Credit Report

Should I Temporarily Unfreeze My Credit Report

There are two ways to temporarily unfreeze credit:

- If you’re applying for a loan, you could ask your lender which bureau they use and unfreeze just that account for a specified date range, or you can unfreeze indefinitely and refreeze once the process is done. Just make sure not to forget to refreeze.

- You can lift a freeze for a specified number of days .

Temporarily unfreezing your credit is safer than permanently unfreezing credit, as it can still protect you against identity theft. Also, if you do a temporary unfreeze, you won’t need to worry about remembering to freeze your credit again.

Who Can View My Equifax Credit Report If I Have A Security Freeze Or Credit Report Lock

Locking or freezing your Equifax credit report will prevent access to it by certain third parties. Locking or freezing your Equifax credit report will not prevent access to your credit report at any other credit bureau. Entities that may still have access to your Equifax credit report include:

- Companies like Equifax Global Consumer Solutions, which provide you with access to your credit report or credit score, or monitor your credit report as part of a subscription or similar service

- Companies that provide you with a copy of your credit report or credit score, upon your request

- Federal, state, and local government agencies and courts in certain circumstances

- Companies using the information in connection with the underwriting of insurance, or for employment, tenant or background screening purposes

- Companies that have a current account or relationship with you, and collection agencies acting on behalf of those whom you owe

- Companies that authenticate a consumers identity for purposes other than granting credit, or for investigating or preventing actual or potential fraud and

- Companies that wish to make pre-approved offers of credit or insurance to you. To opt out of such pre-approved offers, visit www.optoutprescreen.com.

Who We Are

Don’t Miss: Paypal Credit Minimum Score

What Is A Credit Report Freeze And Why Do You Need It

Also known as a security freeze, a credit report freeze prevents entities from accessing your credit report. Many consumers use this service to protect them against the threat of credit fraud due to possible identity theft, such as when their sensitive information has been compromised.

After you request a credit report freeze online or offline, the credit bureau must set it in place within one business day. If you submitted a request by mail, the freeze will take effect within 3 business days after its receipt. If creditors and lenders cant check your credit report then thieves will also have a hard time opening accounts under your name without your knowledge or authorization.

What Is The Best Way To Get A Credit Freeze Removed

The quickest and easiest way to remove a credit freeze is to contact each credit bureau online or by phone, and to use the PIN code or password you were assigned when you activated your credit freeze. If you’ve frozen your credit at all three national bureaus , you’ll need to thaw it at each bureau separately.

Recommended Reading: Does Qvc Check Your Credit

How To Freeze Your Transunion Credit Report

TransUnion offers its own . If you havent frozen your credit yet, select Add Freeze under Freeze My Credit on this page.

Youll need to once again fill out the same type of information as with Experian. However, TransUnion allows you to easily create an account with their freeze system, which allows you to lock and unlock it in the future.

But, to freeze your credit for the first time, fill out the form and select Submit & Continue to Step 2. Step 2 is where you create your login details, and Step 3 is where you verify your identity through your email.

Youll receive a confirmation that your TransUnion security has been frozen and the PIN that youll need to save in a safe place.

How To Unfreeze Credit

Unfreezing credit, sometimes called thawing, can be done on a temporary or permanent basis.

Itâs free to unfreeze your credit, but the process is different at each bureau. Hereâs what they say:

- Equifax: You can manage and unfreeze your account in multiple ways. But it might make sense to use the same method you used to place the freeze. You can , call 888-298-0045 or use the same form to submit a request through the mail.

- Experian: Make sure you have the PIN you were given when you placed your freeze. Itâs crucial whether youâre removing a freeze online or over the phone . If you donât remember your PIN, youâll have to go through the verification process again. You can also submit through the mail, but youâll need to provide the same information and documents used to freeze your credit.

- TransUnion: The bureau says that the simplest way to remove a freeze is to do it online. You may also be able to do it over the phone or through the mail. You can call TransUnion at 888-909-8872 to find out more.

You May Like: How To Remove Repossession From Credit Report

Read Also: Does Paypal Report To Credit Bureaus

How To Check If My Credit Report Is Frozen

Through April 20, 2022, Experian, TransUnion and Equifax will offer all U.S. consumers free weekly credit reports through AnnualCreditReport.com to help you protect your financial health during the sudden and unprecedented hardship caused by COVID-19.

In this article:

Freezing your credit reports can be a good way to prevent a fraudster from using your information to open a credit account in your name. However, you want to remember to unfreeze your reports before you apply for a loan, credit card or rentalotherwise, your application could be denied because the lender can’t review your credit.

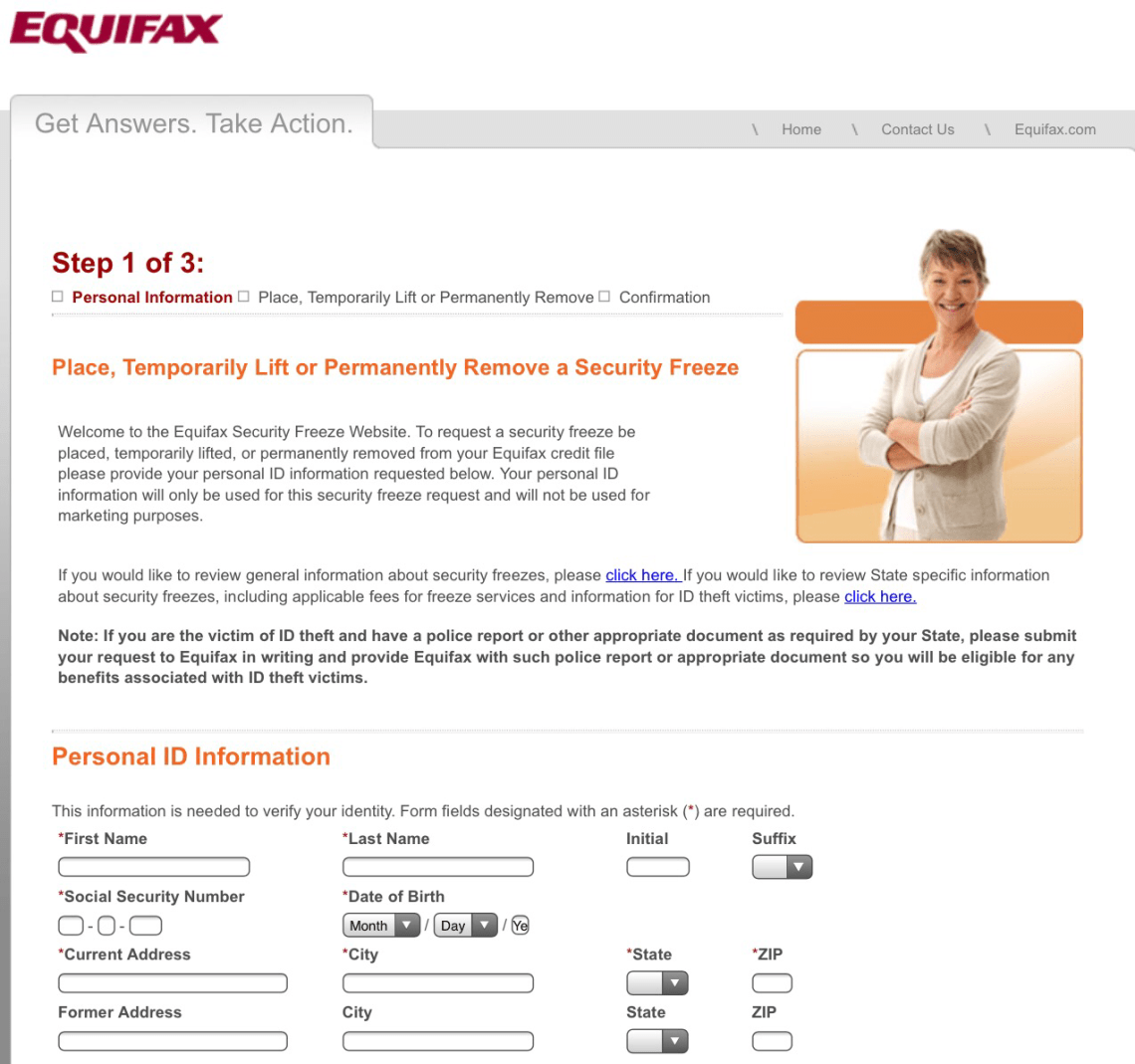

How Do You Freeze Your Credit At Each Bureau

To freeze your credit, which is different from locking your credit, contact each of the three major consumer credit bureaus Equifax, Experian and TransUnion and request a credit freeze.

When you make the request, youll need to provide your name, address, birth date and Social Security number. Youll then be asked a few questions to verify your identity and get a PIN that you can use to unfreeze and refreeze your as needed.

Note that a new federal law requires all three bureaus to offer freezes for free as of Sept. 21, 2018, according to the Federal Trade Commission.

Heres how to place a credit freeze at each of the three bureaus.

Recommended Reading: Does Paypal Credit Report To Credit Bureaus

Identity Theft: What It Is What To Do

Reading time: 6 minutes

Highlights:

- It may be helpful to familiarize yourself with the warning signs of potential identity theft

- If you believe your information has been stolen and used fraudulently, there are some steps you can take

- Consider placing a fraud alert or security freeze on your credit reports – both are free

Identity theft occurs when someone gets or steals your personal information. The information can then be used to open credit accounts in your name or receive benefits, such as employment, insurance or housing. Identity theft may impact your credit reports and credit scores.

Request A Credit Report Freeze

To put a freeze on your Equifax credit report, select the Freeze option in the left column on your account homepage, and then click the Place a freeze button.

Accept the terms of use on the next page to continue your freeze request. Dont rush through the process, thoughyou need to save some of the info on the verification page for future use.

Accept the terms and click Next to get to the confirmation page. After you hit Submit, your credit freeze should be processed within a few seconds.

Recommended Reading: Aargon Agency Hawaii

What Freezing Your Equifax Credit Report Wont Do

Be aware that a credit report freeze doesnt offer protection from all types of fraud. Thieves may be able to open accounts with businesses that dont use a major credit bureau. They may also be able to commit other types of fraud like taking over a credit card account or filing taxes in your name.

Businesses that you already have a relationship with will still be able to access your credit information, too. Freezing your credit report at Equifax wont affect your credit score. Youll still be able to use your credit accounts and monitor your credit.

How Do You Unfreeze Your Transunion Credit Report Online

You need to log in to your TransUnion account online using your username and password. If you dont have an account set up yet, you can create an account so that you can manage your TransUnion credit information. After logging in, you have the option to lift the credit report freeze permanently or temporarily.

You May Like: How Accurate Is Creditwise Credit Score

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.