Why Good Credit Scores Matter

While credit scores help determine your availability of credit and the rate youll pay to access it, what it really measures is your statistically proven likelihood of defaulting on the money you borrow. The greater the risk, the lower your score and the more youll pay to access credit if you can access any credit at all.

In August 2021, the average interest rate on a subprime credit card or a card for customers with subprime credit was 25.88%, while the APR on a low-interest card was 12.96%.

If you carry an average balance of $3,000 month to month on an average subprime credit card, expect to pay about $64 in interest charges. Compare that to $32 in interest charges for an average low-interest credit card, and youre paying twice as much in interest. Low-interest credit cards are typically only available to people with excellent credit scores, and this example demonstrates the importance of building good credit.

Can I Get A Rewards Credit Card With Fair Credit

You may struggle to get approved for a cash back or travel rewards credit card with fair credit. While you might be able to find a card that earns a limited amount of cash back on purchases, the most-rewarding credit cards generally require good or excellent credit.

If a top-notch rewards card is your ultimate goal, dont be discouraged. You may be surprised by how much good, persistent habits can affect your credit scores.

And thats one nice thing about credit cards. Even the ones that arent the absolute best can help you build credit by reporting your account activity to the three major credit bureaus. This information makes its way into your credit reports and ultimately can impact your credit scores. So, as long as you make on-time payments and follow the other credit-building tips outlined above, you can put yourself in a position to qualify for a better credit card in the future.

Compare offers for on Credit Karma to learn more about your options.

Errors In Your Credit Reports

Our credit reports contain valid information about where we live, our mode of paying bills-electronic or cash-, our police records and financial sensitivities like being sued, suing someone or declaring bankruptcy. This information is sold to insurance companies, credit lenders, employers and other businesses that use this data to gauge our insurance, credit, employment and housing applications. It is recommended by experts to review credit reports intermittently, some organizations follow this stringently.

Why is there a need to review our credit reports you ask? Simply because:

- The data in our reports affect our chances of being granted or rejected a loan and how much we are willing to pay for borrowing a loan.

- To verify that the information is accurate and up to date and complete. This will minimize complications when applying for loans or jobs or when purchasing houses or automobiles.

- To help protect us against identity theft which is basically when someone uses our personal information such as our name, Social Security number or credit card number to open up new credit accounts. Unpaid bills under this account get reported as ours on the credit record. Such inaccurate information can greatly minimize our chances of getting a credit.

Don’t Miss: When Does Paypal Report To Credit Bureau

How Your Credit Score Is Calculated

Although no one knows exactly how your 694 Credit score is calculated, but as per general practices, different details from your credit report are used to formulate your credit score. The data taken from a credit report is usually a combination of five variables, where each variable is the information about credit extended to you through lenders and service providers.

Recommended Article:

Each variable has a percentage that shows its importance in formulating the credit score. If you want your credit score to fall in a Good or Excellent category and not in the Very Poor category, you need to keep these factors in your mind before applying for credit.

The five important variables are:

Whats Considered Good Credit For A Mortgage

Although its possible to buy ahouse with only fair credit, youll get a lower mortgage rate and better loanterms with a higher score.

So whats considered good creditfor a mortgage? FICOs credit tiers are a good starting point, as FICO is thestandard scoring model used by mortgage lenders.

- Exceptional credit:800-850

- Fair credit: 580-669

- Poor credit: 300-579

Fortunately, you dont need anexceptional score in the 800-850 range to get a prime mortgage rate. Mosthome buyers dont have credit anywhere near that high.

In fact, the average credit score for closed mortgage loans in 2020 was just under 750.

Fannie Mae and Freddie Mac give the best rates to borrowers with scores above 740

Mortgage lenders understand thatperfect credit is not the norm, and they arent expecting sky-high scores.

Fannie Mae and Freddie Mac, the agencies that back most home loans, give the best rates to borrowers with scores above 740 which means the average buyer in 2020 qualified for prime rates.

You May Like: Is Chase Credit Score Accurate

The Best Mortgages For Buying A House With Lowcredit

If you have a low credit score, or past red marks on your credit report, the first type of mortgage you should look at is an FHA loan.

FHA loans

FHA loans are mortgages insured bythe Federal Housing Administration. This insurance protects mortgage lenders,making it possible for them to lend to borrowers with lower credit scores andsmall down payments.

In fact, the FHA mortgage programwas specifically designed for credit-challenged home buyers. It allows thelowest credit score of any loan program 500 although you need a 10% downpayment if your score is below 580. Those with a score above 580 onlyneed to put 3.5% down.

Conventional/conforming loans

Conventional loans also allow amodest credit score of 620 with a down payment of just 3%.

However, the cost of privatemortgage insurance can make conventional loans unattractive forlower-credit borrowers with less than 20% down.

Conventional and FHA loans both require mortgage insurance. The difference is that FHA charges the same mortgage insurance premiums for all borrowers, regardless of credit.

Conventional mortgages, on the otherhand, have steeply increased PMI rates for borrowers with low credit and alow down payment. As a result, FHA financing can sometimes be cheaper forborrowers with credit in the low- to mid-600s.

VA loans

For veterans and active-duty service members, a VA mortgage is normally the best bet.

What Credit Score Is Needed To Buy A House

Ah, the dreaded . Its one of the biggest criteria considered by lenders in the mortgage application process three tiny little digits that can mean the difference between yes and no, between moving into the house of your dreams and finding yet another overpriced rental. But despite its massive importance, in many ways the credit score remains mysterious. If you dont know your number, the uncertainty can hang over you like a dark cloud. Even if you do know it, the implications can still be unclear.

Is my score good enough to get me a loan? Whats the best credit score to buy a house? What’s the average credit score needed to buy a house? Whats the minimum credit score to buy a house? Does a high score guarantee I get the best deal out there? And is there a direct relationship between credit score and interest rate or is it more complicated than that? These are all common questions, but for the most part they remain unanswered. Until now.

Today, the mysteries of the credit score will be revealed.

Don’t Miss: Does Klarna Report To Credit

Factors That Can Affect A Credit Score

There are 5 main factors that can affect the calculation of a credit score. If youre interested in improving your credit these are the areas that you should focus on.

History of Payments

This is determined by the payments you have made to lenders or creditors. This ultimately reflects on how frequently you pay your loans or bills on time. Anyone looking to improve their credit scores should always make their payments on time, without fail.

Debt/ Credit Utilization

This shows the amount of outstanding debt a consumer has compared to the amount of available credit they have. For example, if you have a total credit limit of $5,000 and consistently carry a high balance, your credit score may be negatively affected. To help improve your credit scores, pay down your debt and make sure you need your balance to lower than 35% of your available credit.

This factor is straightforward, the longer a credit account has been open, the better it is for your credit scores. If youre considering cancelling a credit card, make sure you cancel a new one and keep the older ones open.

New Inquiries

Every time a potential lender or creditor pulls your credit, your credit score may take a small and temporary hit. If you apply for a lot of new credit within a short period of time, your credit score may drop and other creditors will be able to see that youve recently applied for a lot of credit which they may consider to be a red flag.

Diversity

Loans Canada Lookout

What An Excellent/exceptional Credit Score Means For You:

Borrowers with exceptional credit are likely to gain approval for almost any credit card. People with excellent/exceptional credit scores are typically offered lower interest rates. Similar to “exceptional/excellent” a “very good” credit score could earn you similar interest rates and easy approvals on most kinds of credit cards.

Don’t Miss: Does Snap Finance Report To The Credit Bureau

Canadian Credit Ratings And What They Mean

Lenders and creditors typically use a credit score to determine youre likelihood of making payments on time. Its important to note that your is only one of the factors that lenders will evaluate when approving you for new credit.

- Excellent Individuals with a rate of 780 or over may enjoy the best interest rates on the market. They also will typically always be approved for a loan.

- Very Good This is considered near perfect and individuals with a rate in this range may still enjoy some of the best rates available.

- Good An individual who has a credit score that falls within this range has good credit and will typically have little to no trouble getting approved for the new credit.

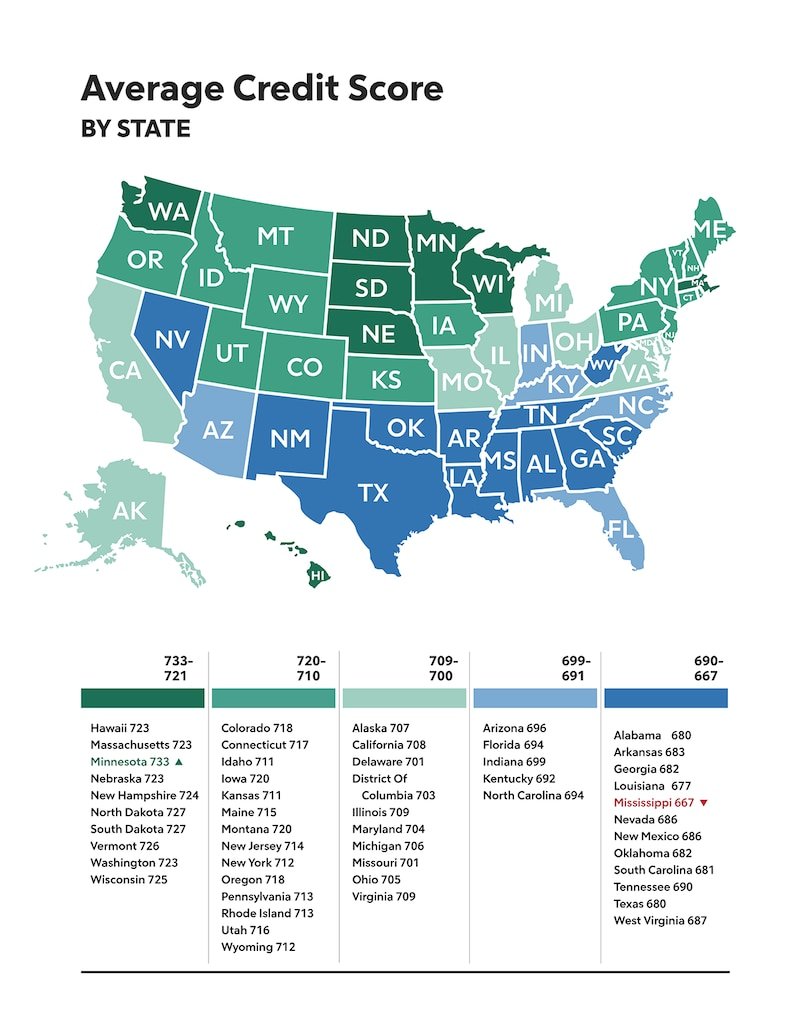

- Average While this is still a good range, individuals with this score may receive slightly higher interest rates than those with higher scores. According to Equifax, at the end of 2012, the average national credit score was 696.

- Poor Scores in this range indicate that the individual is high risk. It may be difficult to obtain loans and if approved, they will be offered higher interest rates.

- Very Poor Scores in this range are rarely approved for anything, but credit can be repaired.

- Terrible Individuals whose credit scores are less than 500 may not get approved for new credit and should seek credit improvement help.

Loans Canada Lookout

Shopping For The Best Rates On Loans And Credit Cards For A Credit Score Under 694

If you are ever on the market for high-priced items, such as home appliances, it is very common for people to walk into the store and get offered a discount or an otherwise excellent financing deal.. .but only if they open up a credit card account with that store.

Why do stores offer these credit cards? The reason why is because theres usually a high interest rate or multiple fees that go along with them. Those rates and fees can be found on the small fine print of the credit card deal, but of course, the store doesnt tell you.

A golden rule of credit cards is that you should only apply for credit that is a necessity for your financial life. When applying for a credit card from a retail store, youre probably only going to use it once, twice, or three times maximum. You could just as easily be using an existing credit card that you already have.

Heres why this is so critical: applying for multiple credit cards within a few months of each other will be very harmful to your overall credit score. Never apply for a credit card that you dont need.

Now, when you do decide to apply for credit cards and loans in general, there are a few factors that you will want to remember, including:

You May Like: How Personal Responsibility Affects Credit Report

Ways To Help Build Your Credit

If your credit score falls below the Canadian average of 667, donât stress. Many individuals fall into this category, and there are concrete steps you can take to build your credit. Here are just a few of the steps you can take:

1. Pay your bills on time!

Paying your bills on time â every time â is one of the best things you can do to improve your credit score. Your payment history is the largest factor that impacts your credit score, and it makes up 35% of your score. Use a free bill tracking app to monitor your bills, or try setting up monthly automatic payments so you donât miss your bills. If you have any past due accounts, try to pay off the oldest ones first.

2. Keep your credit utilization under 30%

Your credit utilization is the second largest factor that impacts your credit score. Itâs the amount of credit youâve used versus the total amount of credit you have available. You should aim to keep your credit utilization below 30%. This means if you have a credit card with a limit of $3,000, then you should keep the balance below $1,000.

3. Regularly monitor your credit score

Rewards Can Lower The Cost Of Your Credit Card

One of the advantages of being in the 650 to 699 credit score range is that some cards offer rewards. If a card pays 1.5% cash back, and you charge an average of $500 per month, youll earn $7.50 per month or $90 per year. If you dont carry a balanceand dont pay interestitll be like earning an extra $90 per year. Or at a minimum, it will cover the annual fee, making the card essentially free to use.

You May Like: Sync/ppc On Credit Report

How To Improve Your 654 Credit Score

The average FICO® Score is 704, somewhat higher than your score of 654, which means you’ve got a great opportunity to improve.

70% of U.S. consumers’ FICO® Scores are higher than 654.

What’s more, your score of 654 is very close to the Good credit score range of 670-739. With some work, you may be able to reach that score range, which could mean access to a greater range of credit and loans, at better interest rates.

The best approach to improving your credit score starts with a check of your FICO® Score. The report that’s delivered with the score will use details from your unique credit report to suggest ways you can increase your score. If you focus on the issues spelled out in the report and adopt habits that promote good credit scores, you may see steady score improvements, and the broader access to credit that often comes with them.

The Right Credit Score

You may have visited this article thinking you have a FICO score somewhere in the 680-689 range.

The truth is, depending on where you checked your score, you may not be using the same score the auto lenders use.

In the U.S. today most people receive a free credit score with their credit card services or other financial institution supported websites such as Chase Credit Journey.

The problem with these credit scores is that they are usually a FAKO score, not a FICO score.

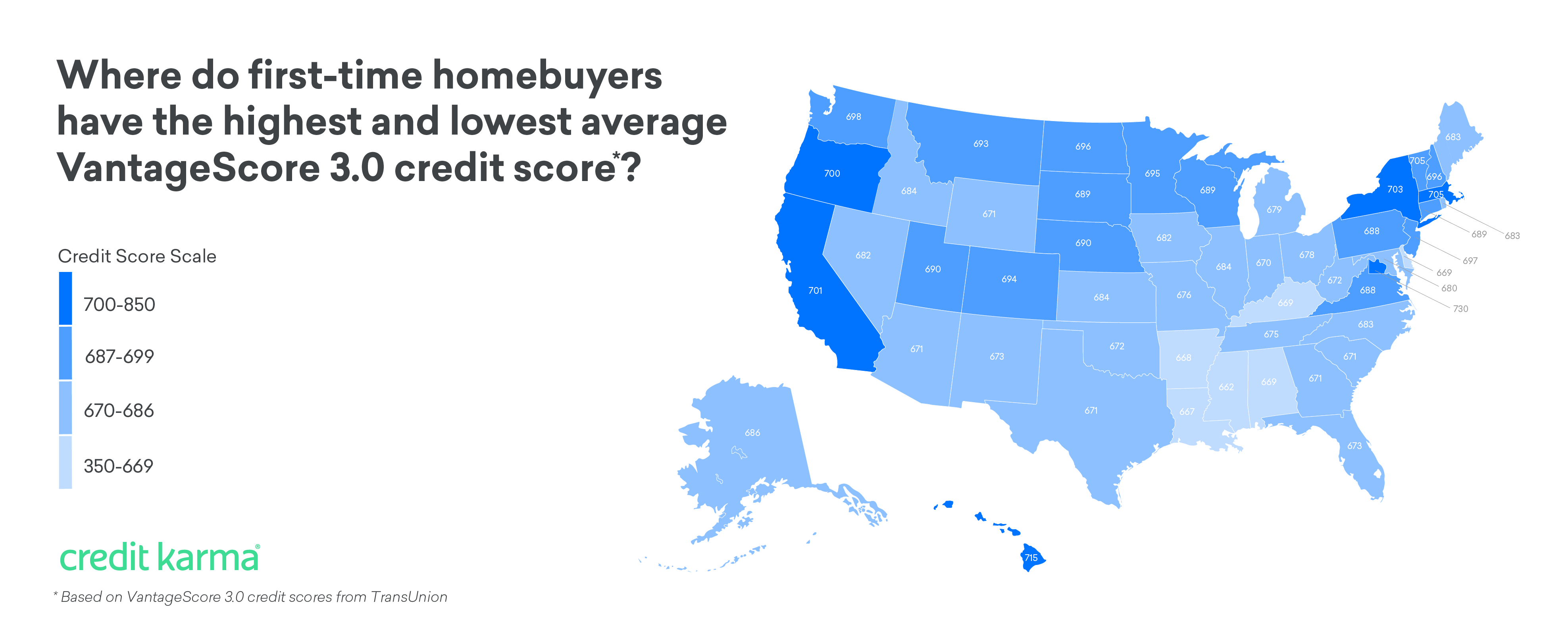

FAKO scores, such as Vantage, intended use is for educational purposes and not to be relied upon for financial decisions.

The largest producer of FAKO scores is the VantageScore 3.0 .

Whats the difference?

Well, both FICO and Vantage pull your credit history from the big three credit agencies Experian, Equifax, and TransUnion, to calculate your credit scores.

However, the credit scores that FICO generates from your account history at the three credit bureaus are used to assess the risk of a borrower by 90% of lenders in the U.S.

The VantageScore 3.0 is given away free on websites like Credit Karma and in 2018 was prohibited from being used by Fannie Mae and Freddie Mack for real estate mortgages.

Consequently, as you can imagine, the Vantage credit score can be volatile and inaccurate.

For example, according to CreditCards.com, the average VantageScore in Riverside, CA is 692, whereas the median FICO score in CA is 712 to 722, making the first number hard to believe.

Also Check: How To Remove Repossession From Credit Report

What Is The Minimum Credit Score To Qualify For A Mortgage

There is no official minimum credit score since lenders can take other factors into consideration when determining if you qualify for a mortgage. You can be approved for a mortgage with a lower credit score if, for example, you have a solid down payment or your debt load is otherwise low. Since many lenders view your credit score as just one piece of the puzzle, a low score wont necessarily prevent you from getting a mortgage.

Is 680 A Good Credit Score For A House Or Apartment

Related Articles

Your credit score can have a big impact on your ability to rent a property, qualify for a mortgage and secure a favorable interest rate. However, just because your credit score isn’t perfect doesn’t mean you won’t be able to buy a new house or find a new apartment. With a credit score in the high 600s, you should be able to do both. However, you may have to pay a little more.

You May Like: How To Remove Repossession From Credit Report