Ideal Credit Score To Avail A Personal Loan

Your credit score is a significant factor determining your eligibility for a personal loan since it is a collateral-free loan. The minimum CIBIL score for a personal loan is between 720 and 750. Having this score means you are creditworthy, and lenders will approve your personal loan application quickly. They may also offer you your chosen loan amount at a nominal interest.

While you may still be able to get a personal loan with a credit score between 600 and 700, the lower your score, the lower your approved loan amount will be. A credit score below 600 is considered inadequate for personal loans in most cases.

Formulating A Plan To Improve Your 682 Credit Rating

First aid foremost, you need to understand that it takes time for you to build up your credit score. Dont expect it to be improved in the next week or the next month, even if you do everything necessary to improve it.

If you have any negative factors on your credit report right now, including a late payment, a bankruptcy, or an inquiry, you may want to pay the bills now and then wait. Remember that time is your ally, not your enemy. In the end, there is no quick fix for rebuilding a credit score. It takes time.

In formulating a plan to rebuild your credit rating, you need to understand how specific actions that you take will harm or hurt your credit score. For example, will working with your creditor to close an existing account in favor of rebuilding a new one with more favorable terms hurt or harm you?

Here are two factors for you to consider: a change to your credit report will affect your credit score , and your score is based entirely on the figures that are already in your report.

A major question that people have is how long it will take for them to improve their credit score. But heres what these people are missing: there isnt anything you can do to boost your actual score. Instead, you can do many things to rebuild your history of credit, and the healthier your credit history, the more elevated your credit score will be.

Credit Score Credit Cards

Unfortunately, one with fair 682 credit score will not qualify for just any credit card, such as ones that offer big initial bonuses. The general approval process will also be more difficult for those with less than good credit. However, individuals within this credit range typically qualify for the following cards: ones with zero financing, no foreign fee, or no annual fees airline/hotel cards and store cards. Based on this, there are several credit card options available for those with average credit to turn to, but most come with annual fees and only allow a low credit limit.

You May Like: When Do Things Fall Off Your Credit Report

How Can You Maintain A Good Credit Score

A good credit score comes with responsible credit behaviour. Here are some of the factors which will help you in maintaining a good credit score:

- Consistent Repayment: Credit score calculations lay nearly 35% weightage on your payment history. If you want to maintain a good credit score all the time, your repayment record should be 100% positive. For this, you must ensure to never miss a repayment.

Recognize That Your Rates Can Increase

Currently, credit card companies cannot raise your credit rate for at least one year after you have opened your account, unless any of the following circumstances apply:

- A six month introductory rate exists

- You are late paying your bill by sixty days

- You have a card with a variable rate that is tied to an index and that index increases

You need to recognize that your credit rates will increase in the future, at least after the initial twelve months, and you need to establish with your potential creditor exactly when your rates will increase, by how much, and if there is anything you can do to lower your rates.

Also Check: Navy Federal Auto Loan Reviews

Car Loan Credit Score Faqs

Can I get a car with a 500 credit score?

You could be able to get a bad credit car loan with a 500 credit score. Having a high down payment, getting a good deal on the car and having a cosigner can all improve your likelihood of being approved.

What is a good credit score to buy a car?

Experian reports that nearly 56% of auto loans go to people with a credit score of 661 and above.

What credit score is needed to buy a car without a cosigner?

People with prime credit scores likely dont need an auto loan cosigner.

What is a good credit score for an auto loan?

The higher your credit score, the better the rate youll get for any loan. A credit score above 660 will typically allow you to qualify for an auto loan without a hassle. A credit score of 760 and above will typically allow you to qualify for auto maker special financing that can offer low-APR loans and rebates.

Will a car loan improve my credit score?

Yes, a car loan will improve your credit score if you make the payments on time and in full until you trade in the car, sell it or pay off the loan.

What Is A Good Credit Score Range

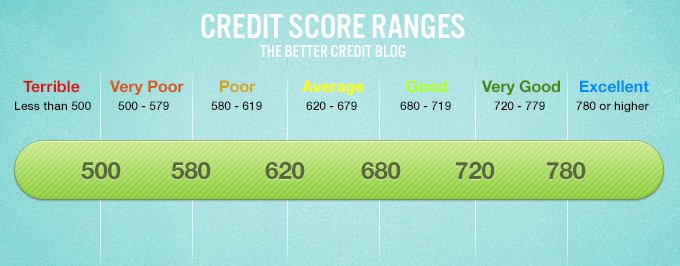

Good credit score = 680 739: Credit scores around 700 are considered the threshold to good credit. Lenders are comfortable with this FICO score range, and the decision to extend credit is much easier. Borrowers in this range will almost always be approved for a loan and will be offered lower interest rates. If you have a 680 credit score and its moving up, youre definitely on the right track.

According to FICO, the median credit score in the U.S. is in this range, at 723. Borrowers with this good credit score are only delinquent 5% of the time.

Recommended Reading: Reporting A Death To Credit Agencies

Average Credit Score By Region

Want to know what your neighbourâs credit score looks like? Experian released the average credit scores by location. The worst credit scores in the UK on average are:

1) Kingston-upon-Hull – 696

2) Blaenau Gwent â 702

3) Blackpool â 709

4) Merthyr Tydfil â 712

5) Middlesbrough â 713

6) Northeast Lincolnshire â 717

7) Knowsley â 722

9) North Ayrshire â 737

10) St. Helens â 744

And the best average credit scores can be found in:

1) Isles of Scilly â 881

2) Wokingham â 877

7) St Albans â 871

8) South Cambridgeshire â 867

8) Brentwood â 850

10) West Oxfordshire â 844

You can find out what the average credit score is where you live by heading over here.

Improving Your 682 Credit Score

A Credit Repair company like Credit Glory can:

An industry leader like Credit Glory can guide you through this process. Give them a call @ 885-2800, or chat with them, today â

You May Like: Does Walmart Do Klarna

Can I Buy A House With A 672 Credit Score

If your credit score is a 672 or higher, and you meet other requirements, you should not have any problem getting a mortgage. Credit scores in the 620-680 range are generally considered fair credit. There are many mortgage lenders that offer loan programs to borrowers with credit scores in the 500s.

Ideal Credit Score To Avail A Business Loan

If you are applying for a collateral-free business loan, having a credit score of 700 or more is ideal. If you are applying for a secured business loan, your loan application may be approved with a lower credit score, say between 600 and 700 too. Both these scenarios are true when you are applying for a business loan as an individual, be it a self-employed professional such as a CA or engineer or doctor or self-employed non-professional such as a trader or manufacturer.

Additional Read: How to ensure your Business CIBIL score stays above 700

However, if you are applying for a business loan as an entity, be it a Partnership, Limited Liability Partnership, Private Limited, or a closely held limited company, your business credit score matters apart from your personal credit score. In such cases your CIBIL rank or Equifax business credit score is checked by the lender.

Recommended Reading: Apple Card Shopping Cart Trick

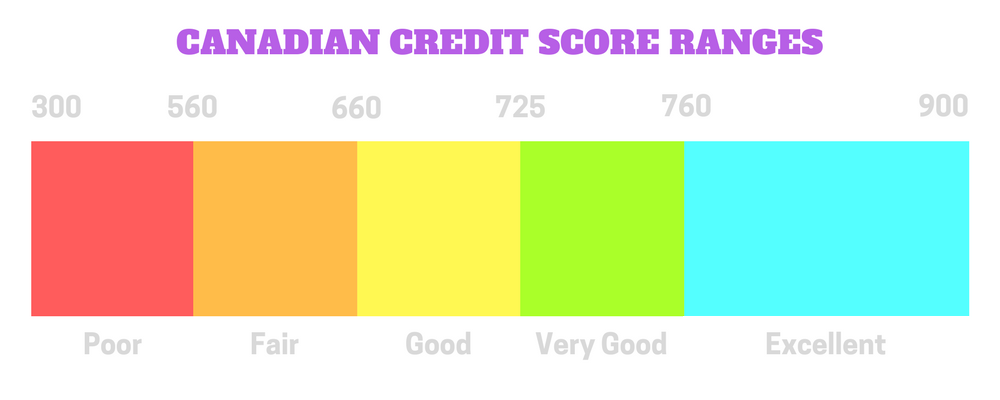

Is 682 A Good Credit Score Canada

Content on BetterCreditBlog.org is based on in-depth research & analysis. Lenders use these credit score ranges as a way to quickly, consistently and objectively evaluate your potential credit risk. The is one of the best credit cards for 700 credit scores, thanks to its low introductory interest rate and generous cash-back program. As of March 2020, 5% of Americans have a credit score of at least 820 In March 2020, 38% of Americans had a geo-credit score of A to E, corresponding to a traditional credit score of at least 740 In August 2019, 42% of people in the States aged 55 to 59 had a credit score of at least 740 The average VantageScore 3.0 was 682 in 2019 That means a 680 credit score is high enough to qualify you for most loans. It’s a solid level and you’ll have no problem getting approved for loans or credit cards.

First, to put the 882 credit score in perspective, credit scores range from 300-850. Túi ng ngh HUIJIA HJ-X003 15icnh. How To Read and Understand Your Credit Report, how to remove collections from your credit report. Opinions are our own. My credit score is 707, my husband is 565. Heres how to find out exactly where your credit score falls in the range of FICO scores. By this point, you should have a few credit cards in your wallet, a couple of paid off cars, and a mortgage. The pay out will be enough to cover my car loan with a little extra. Taxes .

How Your Credit Scores Are Set

Canadian credit scores are officially calculated by two major credit bureaus: Equifax and TransUnion.

They use the information in your credit file to calculate your scores. Factors that are used to calculate your scores include your payment history, how much debt you have and how long youve been using credit.

Pro Tip: You can view sample credit scores summaries from each bureau to get a sense of what to expect.

Don’t Miss: Minimum Credit Score For Amazon Credit Card

What A Good Credit Score Can Get You

Having good credit matters because it determines whether you can borrow money and how much you’ll pay in interest to do so.

Among the things a good credit score can help you get:

-

An unsecured credit card with a decent interest rate, or even a balance-transfer card.

-

A desirable car loan or lease.

-

A mortgage with a favorable interest rate.

-

The ability to open new credit to cover expenses in a crisis if you don’t have an emergency fund or it runs out.

A good credit score helps in other ways: In many states, people with higher credit scores pay less for car insurance. In addition, some landlords use credit scores to screen tenants.

So having a good credit score is helpful whether you plan to apply for credit or not.

If your credit score is below about 700, prepare for questions about negative items on your credit record when shopping for a car. People with major blemishes on their credit are routinely approved for car loans, but you may not qualify for a low rate. Read about what rates to expect with your score.

You dont need flawless credit to get a mortgage. In some cases, credit scores can be in the 500s. But credit scores estimate the risk that you wont repay as agreed, so lenders do reward higher scores with lower interest rates. Read about your mortgage options by credit score tier.

Landlords or property managers generally aren’t looking for immaculate scores, they are interested in your credit record. Learn more about what landlords really look for in a credit check.

How To Turn A 683 Credit Score Into An 850 Credit Score

There are two types of 683 credit score. On the one hand, theres a 683 credit score on the way up, in which case 650 will be just one pit stop on your way to good credit, excellent credit and, ultimately, top WalletFitness®. On the other hand, theres a 683 credit score going down, in which case your current score could be one of many new lows yet to come.

Everyone obviously wants his or her credit score to be on an upward trajectory. So whether you need to turn things around or increase the pace of your improvement, youd better get to work. You can find personalized advice on your WalletHub credit analysis page, and well cover the strategies that everyone can use below.

Read Also: Aargon Payment

Length Of Credit History

Lenders like to see that you can manage credit positively over a long period of time. This is generally measured by how long your current credit accounts have remained open.

Theres no shortcut to increasing the length of your credit history. But in the long run, keeping your old credit card accounts open, even after you get a new credit card, can help your credit age like a fine wine. At the very least, try to avoid closing your oldest credit account.

As someone with fair credit, you may be in the market for your first credit card. If thats the case, it pays to think ahead. Consider shopping around for a credit card that has no annual fee, so theres no pressure to close it if and when you graduate to a better card. You can compare offers for cards with no annual fee on Credit Karma to explore your options. Many of the cards available to people with fair credit tend to charge annual fees, but you might be able to find one that doesnt.

How To Improve A 682 Credit Score

Its a good idea to grab a copy of all three of your credit reports from Equifax, Experian, and TransUnion to see what is being reported about you. If you find any negative items, you may want to hire a credit repair company such as Lexington Law to help you dispute them and possibly have them removed.

Lexington Law specializes in removing negative items. They have over 28 years of experience and have removed over 7 million negative items for their clients in 2020 alone.

They can help you with the following items:

- hard inquiries

- bankruptcies

Recommended Reading: Does Barclay Report Authorized Users

Staying The Course With Your Good Credit History

Having a Good FICO® Score makes you pretty typical among American consumers. That’s certainly not a bad thing, but with some time and effort, you can increase your score into the Very Good range or even the Exceptional range . Moving in that direction will require understanding of the behaviors that help grow your score, and those that hinder growth:

Late and missed payments are among the most significant influences on your credit scoreand they aren’t good influences. Lenders want borrowers who pay their bills on time, and statisticians predict that people who have missed payments likelier to default on debt than those who pay promptly. If you have a history of making late payments , you’ll do your credit score a big solid by kicking that habit. More than one-third of your score is influenced by the presence of late or missed payments.

Utilization rate, or usage rate, is a technical way of describing how close you are to “maxing out” your credit card accounts. You can measure utilization on an account-by-account basis by dividing each outstanding balance by the card’s spending limit, and then multiplying by 100 to get a percentage. Find your total utilization rate by adding up all the balances and dividing by the sum of all the spending limits:

| Balance | |

|---|---|

| $20,000 | 26% |

42% Individuals with a 692 FICO® Score have credit portfolios that include auto loan and 29% have a mortgage loan.

Where To Go From Here

Its important to pay down your balances and keep your credit utilization under 30%. Its also wise to have a mix of installment and revolving accounts.

Of course, you also want to make sure you are making your payments on time from here on out. Even one late payment can be very damaging to your credit.

Length of credit history also plays an important role in your credit score. You want to show potential creditors that you have a long, positive payment history.

Building excellent credit doesnt happen overnight, but you can definitely speed up the process by making the right moves.

Give Lexington Law a call for a free credit consultation at and get started repairing your credit today! The sooner you start, the sooner youll be on your way to having excellent credit.

Categories

Recommended Reading: How To Delete Inquiries Off Credit Report

Getting A Mortgage With A 682 Credit Score

Youre eligible for any type of standard mortgage if you have a credit score of 682. The following are all the mortgages you can get:

- FHA loan: Your credit score qualifies you for maximum financing on a mortgage backed by the Federal Housing Administration . Its worth noting that you wont be eligible for an FHA-backed loan if you had a foreclosure in the past three years or filed for chapter 7 bankruptcy in the past two years. 10

- Conventional mortgage: Most lenders will consider giving you a mortgage because your credit score is above 620, which is the minimum score required by the Federal National Mortgage Association and Federal Home Loan Mortgage Corporation . 1112

- VA loan: The US Department of Veteran Affairs backs VA home loans, which are exclusively for members of the military and their families, and they dont impose a minimum required credit score. 13They instead leave it up to lenders, most of whom will be willing to issue you a mortgage with a credit score of 682.

- USDA loan: As long as you have two tradelines that have been open for 12 months in the past two years, youll meet the credit requirements for a USDA loan because your credit score is above 640. 14However, you wont be eligible if you have an outstanding judgment, and you might have a hard time qualifying if your credit history shows a foreclosure, bankruptcy, or debt settlement in the past 36 months.