Wait Out The Credit Reporting Time Limit

If all else fails, your only choice is to wait for those negative items to fall off your credit report. Fortunately, the law only allows most negative information to be reported for seven years. The exception is bankruptcy, which can be reported for up to 10 years. The other good news is that negative information affects your less as it gets older and as you replace it with positive information. The wait may not be as difficult as youd think. Consumers can request their own credit report for free every 12 months from the three major reporting agencies. So, to be sure, you should request a report after the aging period to confirm.

It is important to note, however, that while the credit reporting agency will generally delete the negative information from the report after the seven-year aging period, information may still be kept on file and can be released under certain circumstances. Those circumstances include when applying for a job that pays over a certain amount, or applying for a credit line or a life insurance policy worth over a certain amount. Depending on where you live there may be more favorable regulations under state law, such as a shorter statute-of-limitations. You should contact your state’s Attorney General’s office for more information.

In the meantime, you can improve your credit by making timely payments on accounts you still have open and active.

Review Your Credit Reports

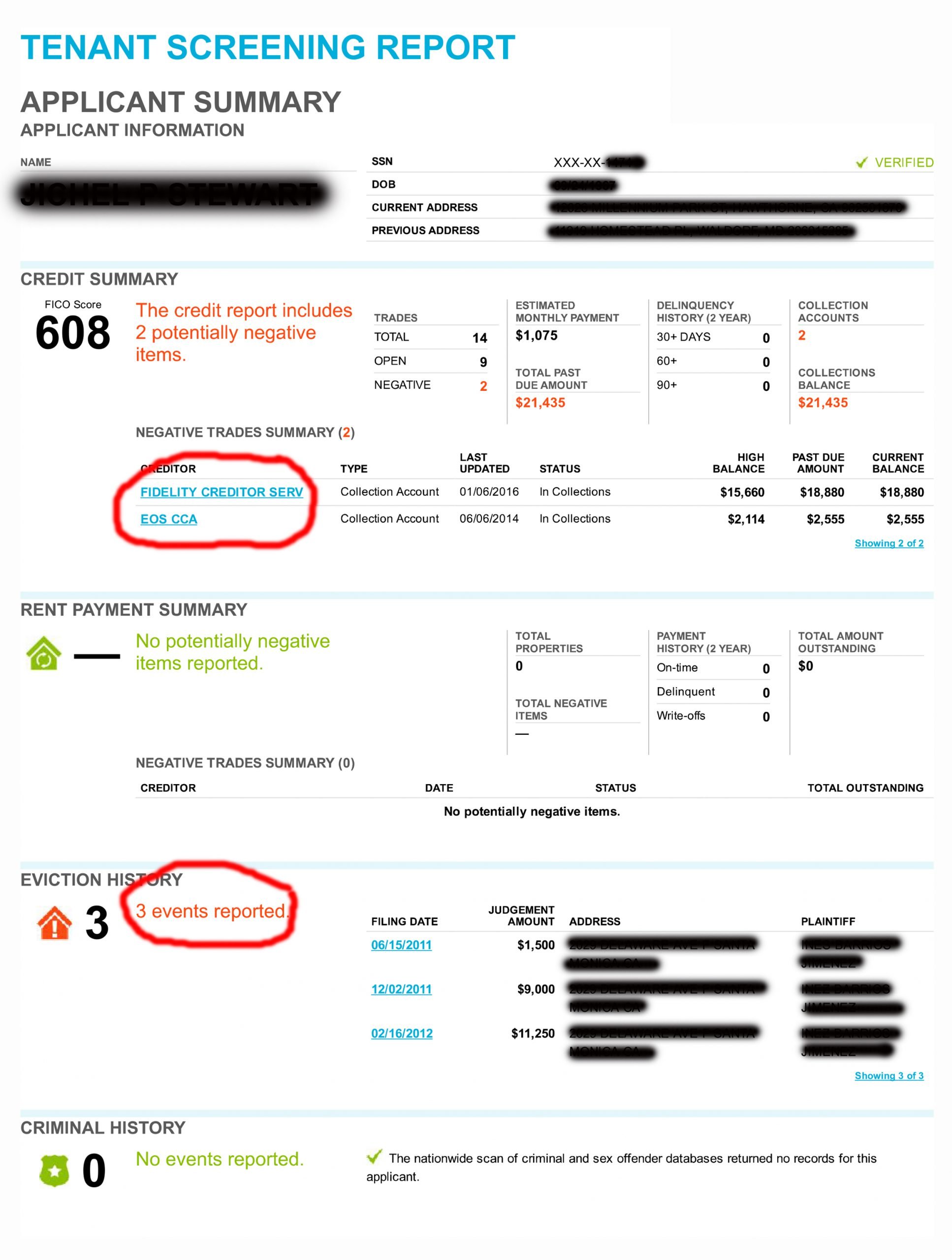

You can also review and monitor your credit reports to watch your progress and make sure no unexpected collection accounts show up there. You can get your Experian credit report for free every 30 days, and take advantage of our free credit monitoring service, which can alert you to score changes and suspicious activity. If you find or are notified of something odd, you can use the Experian Dispute Center to submit a dispute online for free.

Negative History Vs Too Much Debt

As I mentioned, negative payment history will lower your credit score, but so will carrying high balances relative to your credit limit. If you cannot repay your debts as they come due, it may be time to talk with a Licensed Insolvency Trustee to help you eliminate debt so you can work to build a better credit report for future lenders to see.

Recommended Reading: Does Increasing Your Credit Limit Help Your Credit Score

When Are Collection Accounts Removed

A collection account will be automatically removed from your credit report seven years after the original account went delinquent.

The original delinquency date is when your account first became 30 days past due, kicking off the series of missed payments that ended with your account going to collections. That date doesn’t change once your account is closed and sent to collections.

Making a payment doesn’t reset the timeline for when the account will be deleted from your credit reportalthough it may reset the statute of limitations on the debt, meaning how long the debt can legally be collected. A collection agency buying your account from another collection agency doesn’t reset the timeline either, although you may see a new account open date when the collection agency takes over your account.

Bottom Line: Leave It To The Professionals

Although its possible to DIY your debt settlement and its removal from your credit report, its a risky venture. Your best option is to reach out to a professional to secure your financial future and professionally settle your debt. Either way, make sure the account in question gets paid off. An account listed as paid as agreed on your credit report will always look better than one that you left unpaid.

If youve already settled and youre trying to fix your credit, the same goes for . Getting professional help is your best bet for fixing your credit if settlement causes it to dip.

You dont have to repair your credit on your own. We can help!

You May Like: Syncb Ppc Account

An Account Has Closed

When you pay off a loan, your credit score could be negatively affected. This is because your credit history is shortened, and roughly 10% of your score is based on how old your accounts are. If youve paid off a loan in the past few months, you may just now be seeing your score go down.

Your score could be negatively impacted by a closed credit card, too. Not only is your credit history shortened, but your credit limit would also decrease and your credit utilization ratio would be impacted.

Often youll be the one authorizing a credit card to close, but card companies can close them without your knowledge. The Equal Credit Opportunity Act allows creditors to close a card due to inactivity, delinquency or default with no notice. If they close an account for any other reason, they only have to give you 30 days notice after closing the account, so you could have a closed credit card that you dont know even know about.

What Can You Do To Improve Your Credit Before Negative Information Is Cleared

You do not have to wait for negative information to age enough to be removed to start a process of rebuilding your credit.

Your first step is to get a copy of your credit report and look for both negative and incorrect information. False information on your report can also lower your credit score. An example is if a creditor incorrectly reports a late payment.

Check your report for errors and file a dispute resolution with each credit reporting company to fix any incorrect information.

Next, consider the other factors that might be affecting your credit score:

- If you are not paying your bills on time, catch up on all payments.

- If you carry high credit card balances relative to your credit limit, pay them down or talk with a Licensed Insolvency Trustee about debt relief options if you cant do that on your own.

- If you have a lot of low-credit debt like payday loans or high-interest loans, this is something else that will be considered a negative by any potential lender. Again, talk with a trustee if you cant pay these off.

- Dont apply for credit too often. Too many loan applications will lower your score. If you apply at more than one lender in a very short window to shop around for better interest rates, TransUnion says their algorithm accounts for this and wont lower your score. However, applying for two or three credit cards in a matter of weeks will certainly hurt.

Recommended Reading: Usaa Credit Card Approval Odds

Can You Remove Collections Accounts From Your Credit Report

You can’t get a correctly reported collection account removed from your credit report early.

Even if you pay off the debt, the collection account will stay on your credit report for up to seven years. The timeline depends on when your debt first went delinquent, not whether you still owe the money.

However, if you notice an error with the collection account, you can file a dispute with each of the credit bureaus to have the account corrected or removed from your credit reports.

For example, if the collection agency doesn’t send an update to the credit bureaus once you’ve paid off or settled the account, you may want to file a dispute.

If a collection account is removed from your credit reports early, the original account and late payments that led to the collection activity can remain. Those can continue to impact your credit, and the late payments will remain on your report for seven years from the date of first delinquency.

If You Discharged Debts In Bankruptcy Here’s How They Should Be Listed On Your Credit Report

Updated By Cara O’Neill, Attorney

In short, yes. Not only will a bankruptcy filing remain on your credit report for seven to ten years, but you can expect information about the debts discharged in bankruptcy to continue to appear on your credit report, too. In this article, you’ll learn what shouldand should notshow up on your credit report after you receive a bankruptcy discharge, and what to do if your credit report contains incorrect information.

Recommended Reading: Does Snap Finance Report To The Credit Bureau

Reporting Time Limit Vs Obligation To Pay

The expiration of the credit reporting time limit doesn’t mean you no longer owe a debt. The credit reporting time limit does not define how long a creditor or collector can go after you for an unpaid bill. As long as a legitimate debt remains unpaid, the creditor can attempt to collect from you by calling, sending letters, and any other legal action.

Protecting Your Credit During The Coronavirus Pandemic

This blog was originally posted on March 19, 2020 and has been updated on April 7, 2021 to reflect new information.

If you are having trouble paying your bills, you may be worried about what will happen to your credit reports and scores. You can use the information below to manage and protect your credit during the COVID-19 pandemic.

Recommended Reading: Is 626 A Good Credit Score

You May Like: What Is The Highest Credit Score A Person Can Have

Does Debt Settlement Negatively Impact My Credit

When you settle debt, it means your lender has agreed to take less than you actually owe. This is a bad sign for future lenders. To them, it looks like youre risky to lend to because they may not get all of their money back. This is why its a negative item on your , even though it seems positive because you got out of debt.

Mistakes On Credit Reports After Completion Of A Consumer Proposal

Unfortunately, it is not uncommon to find mistakes on your credit report after youve completed the consumer proposal. Its advisable to get the inaccuracies resolved as soon as you can, so your credit report reflects the correct and most updated picture. After all, upon completion of a consumer proposal, youre looking forward to a fresh and optimistic start and rebuilding your credit. Both Equifax and Transunion have processes in place to correct erroneous information on your credit report in Canada.

So be sure to examine your credit reports and check whether creditors are reporting any previously owed figures as fulfilled or still pending. If you find any discrepancies, you can initiate a rectification by submitting a correction request to Equifax or TransUnion . The request must include a completed Credit Investigation Request Form along with any pertaining documents as evidence to substantiate your request.

Don’t Miss: Syncb/ppc Closed Account

How Does A Late Payment Impact My Credit Score

If youve recently missed your payment, you still have some time before it affects your credit score. Late payments arent reported on your until theyre at least 30 days past due. After that, itll be placed into one of these buckets:

- 30 days past due

- 150 days past due

- Charged-off

If youre late on making a payment, your provider will report it based on this schedule. The later it is, the more damage it will cause to your credit score. For example, a 150-day late payment will drop your credit score more than a 30-day late payment. This is why even if youre late, its best to pay it off as soon as possible so that it doesnt harm your score more.

In addition to how late your payment is, a few other factors related to late payments can affect your credit score, including the:

- Balance you owe with each late payment

- Number of late payments on your report

- Time elapsed since you made the late payment

- Number of other on-time payments youve made

Related:How To Review Your Credit Report

Student Loan Default: Seven Years

Failure to pay back your student loan remains on your credit report for seven years plus 180 days from the date of the first missed payment for private student loans. Federal student loans are removed seven years from the date of default or the date the loan is transferred to the Department of Education.

Limit the damage: If you have federal student loans, take advantage of Department of Education options including loan rehabilitation, consolidation, or repayment. With private loans, contact the lender and request modification.

Don’t Miss: Does Rent A Center Report To The Credit Bureau

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity, this post may contain references to products from our partners. Heres an explanation forhow we make money.

Reporting Debts As Discharged In Bankruptcy

While it might be daunting to think about a bankruptcy filing showing up on your for ten years, it might not be as bad as you think. A bankruptcy discharge can help you clean up debt much faster than you’d be able to do yourself.

For instance, instead of a delinquent or unpaid debt lingering on your report for years, it will show as being discharged as part of your bankruptcy. In fact, creditors won’t be able to report your debt in a variety of ways that could cause your credit to suffer, such as allowing the obligation to show as:

- currently owed or active

- having a balance due, or

- converted to a new type of debt .

Such reporting labels are often the reason creditors deny applicants credit. In some cases, applicants must pay off such debt as a condition of loan approval. Instead, when you pull your report, each qualifying debt should be reported as:

- having a zero balance, and

- discharged, “included in bankruptcy,” or similar language.

Unfortunately, some creditors don’t update information to the credit reporting agencies. This tactic could be a way to get you to pay up, even though you no longer legally owe the debt. If your credit report shows an improperly labeled discharged debt, you’ll want to take steps to correct the problem.

Don’t Miss: What Is Syncb Ntwk On Credit Report

Work With A Credit Counseling Agency

Several non-profit credit counseling organizations, like the National Foundation for Credit Counseling , can help dispute inaccurate information on your credit report. The NFCC can provide debt counseling services, help review your credit reports, work with lenders, and help create a debt management plan free of charge.

As always, be wary of predatory credit organizations or companies. Make sure to find a reputable counseling agency and keep a lookout for any red flags, like hidden fees or lack of transparency.

When looking for a credit counselor, the Federal Trade Commission advises consumers to check out each potential agency with:

- The Attorney General of your state

- Local consumer protection agencies

- The United States Trustee program

Will Paying Off My Debt Remove A Late Payment From My Credit Report

Paying off your debt is an option to consider if your lender or collections agencies wont negotiate with you. However, simply paying off the debt wont remove it from your credit report. It can remain on your credit report for seven years.

That being said, its better to have a debt reported as paid instead of a Having a charge-off mark in your credit history is a signal that you are a high risk to lenders and can make it difficult to apply for new credit accounts in the future.

Also Check: How To Get Credit Report Without Social Security Number

How Do I Remove A Delinquent Account From My Report

As previously stated, delinquent accounts are typically removed seven years after the date of the original delinquency. Even if the debt is sold to a collection agency, the original date of delinquency is normally when you defaulted on the original creditor. Unfortunately, these accounts dont always disappear on schedule, so you may have to put in a little extra work to take them off.

If you realize that a reported delinquency wasnt removed when it shouldve been, you should retrieve a copy of your credit reports from the three major credit bureaus.

The credit reports might not be identical, so its a good idea to know if the delinquency hasnt fallen off one or all of them. If you believe a credit bureau has included a delinquency that is inaccurate or outdated, you can file a dispute with the credit bureau.

How Often Do You Have To Pay Hoa Dues

This is more common in condominium developments, where, for example, the owner of a 4,000 square foot penthouse unit might pay proportionately more than the owner of a 400 square foot studio unit in the same building. In most developments, the dues are collected semi-annually, quarterly, or monthly.

Read Also: How To Report To Credit Bureaus As A Landlord

Get A Free Copy Of Your Credit Report

The Fair Credit Reporting Act promotes the accuracy and privacy of information in the files of the nations credit reporting companies. Monitoring your credit report is a necessary practice to keep in check any negative information. Consumers should obtain their free credit report and review it at least once a year to catch any irregularities on time and keep track of disputed items.

Consumers are entitled by law to a free annual credit report from each of the three main reporting bureaus: Equifax, Experian, and TransUnion, and you can access all three of them through one single website:

AnnualCreditReport.com is the only authorized website through which you can gain free access to your credit report from the three major bureaus. Be wary of other sites that promise the same, as they may have hidden fees, try to sell something, or collect personal information.

| Mail: Download, print, fill out, and mail to: |

| Annual Credit Report Request Service P.O. Box 105281 Atlanta, GA 30348-5281 |

Equifax made headlines in 2017 due to a massive data breach, but it remains one of the top 3 services to get your credit report. The company provides a few different service levels if you want to monitor your credit score monthly . Monitoring packages start at $14.95 per month, and the $19.95 per month options include, ironically, a host of identity-theft protection options.