How To Get Inquiries Deleted From Credit Report

Asked by: Maia Torp

One way is to go directly to the creditor by sending them a certified letter in the mail. In your letter, be sure to point out which inquiry were not authorized, and then request that those inquiries be removed. You could also contact the 3 big credit bureaus where the unauthorized inquiry has shown up.

your scores may not improve much

around 5 pointsphysically call the companies that placed the inquiries on the telephone and demand their removal18 related questions found

What Are Hard Inquiries And Soft Inquiries

Hard inquiries show up on your credit report. Soft inquiries do not. Applications usually count as hard inquiries. Offers usually count as soft inquiries.

A hard inquiry is often the result of an application for credit, like a home mortgage or an auto loan. Youve probably applied for either of those at some point in your life.

You can probably recall the volume of paperwork as something resembling a college textbook. When filling out these applications, the lender is required to provide you with a disclaimer. They are going to run a check on your credit and that it may appear on your credit report.

Its important to note that not EVERY hard inquiry will appear on your credit report. For instance, if you are shopping around for auto loans, the credit bureaus will typically be able to deduce that you are in the market for a loan.

They will know you are searching for approvals and/or comparing rates. According to TransUnion, if you have multiple inquires in a span of around 45 days, they will only count them as one hard inquiry.

Soft inquiries are the reason you may be getting a lot of unsolicited credit card offers in the mail. Lenders will scour millions of credit reports in order to determine who to send offers to. That kind of activity wont appear on your credit report, since you had nothing to do with it.

Recommended Reading:

How Many Times Can A Lender Pull Your Credit

When borrowers apply for a mortgage loan, their mortgage lenders run their credit at least once. Whether these lenders check their borrowers’ credit more than once during the lending process is a matter of personal preference. There are no firm rules in place forcing lenders to run a credit check more than once.

Read Also: What Is Cbcinnovis On My Credit Report

Removing Collection Accounts From A Credit Report

Whether your attempts to pay for delete are successful can depend on whether youre dealing with the original creditor or a debt collection agency. As to the debt collector, you can ask them to pay for delete, says McClelland. This is completely legal under the FCRA. If going this route, you will need to get that in writing, so you can enforce it after the fact.

What to keep in mind, however, is that pay for delete with a debt collector may not remove negative information on your credit history that was reported by the original creditor. The creditor may claim that its contract with the debt collection agency prevents it from changing any information that it reported to the credit bureaus for the account. That said, some debt collection agencies take the initiative and request that negative account information be deleted for customers who have successfully paid their collection accounts in full.

Before taking this step, consider how collection accounts may be impacting your credit score. The FICO 9 credit scoring model, for instance, doesnt factor paid collection accounts into credit score calculations. So if youve paid off or plan to pay off a collection account, then you may not need to pursue pay for delete if your only goal is improving your credit score.

Notify The Credit Bureaus

You can place a credit freeze which restricts access to your credit reports on your account by contacting each of the three major credit bureaus: Experian, TransUnion and Equifax.

The bureau you place the freeze with wont contact the others, so youll need to contact all three credit bureaus yourself.

You May Like: Does Les Schwab Report To Credit Bureaus

Check Your Credit Report Regularly

It isn’t common to find inaccurate information on your credit report, but it can happen. To avoid letting fraudulent and other erroneous information go unchecked, make it a goal to check your credit report regularly. Review what’s listed and watch out for anything you don’t recognize.

Also keep an eye on your credit score , and watch out for sudden drops that could indicate fraudulent activity, such as a bogus account opened in your name that’s gone unpaid.

It’s not always possible to prevent identity theft, but as you keep track of your credit history, you’ll be in a better position to stop a difficult situation from getting much worse.

Contact The Company Who Performed The Hard Inquiry

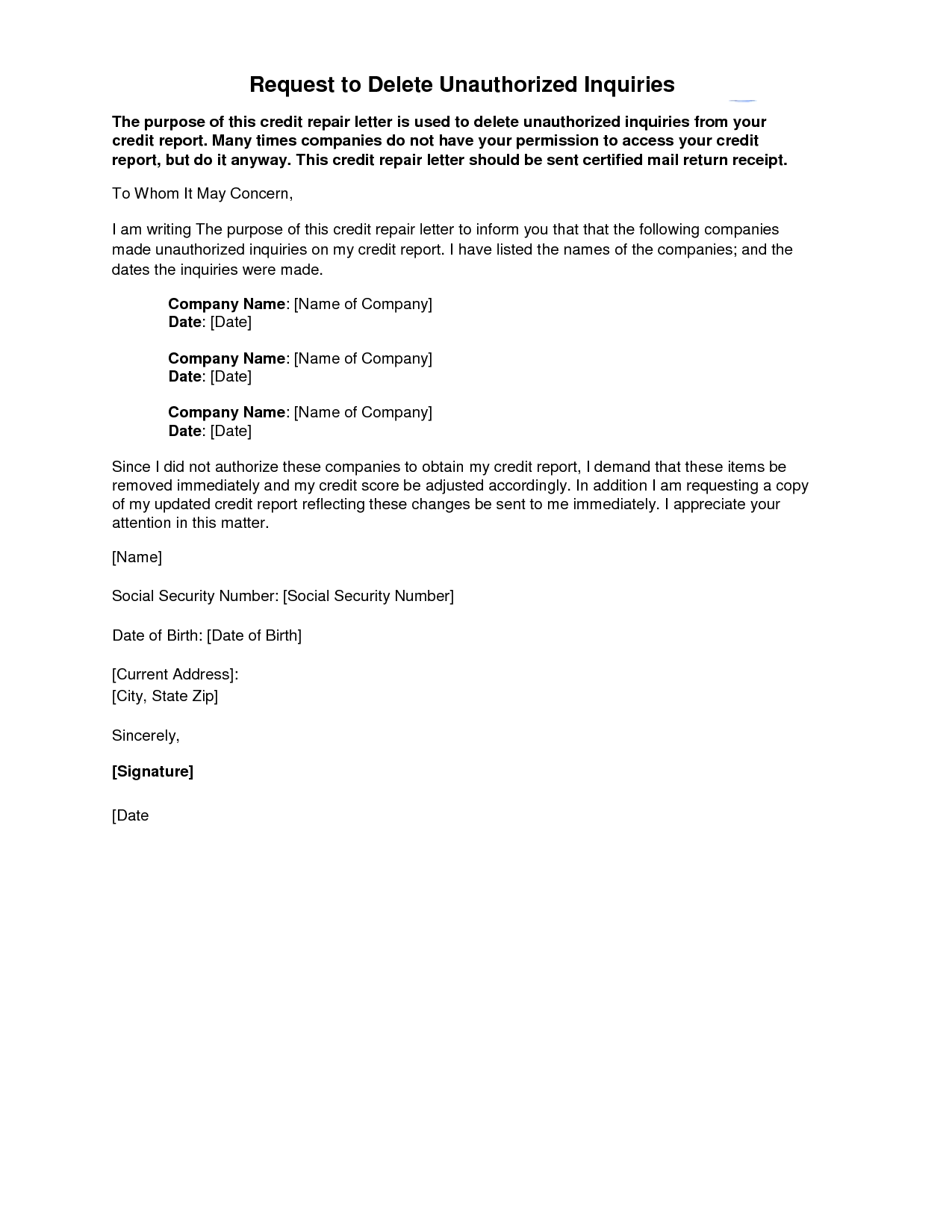

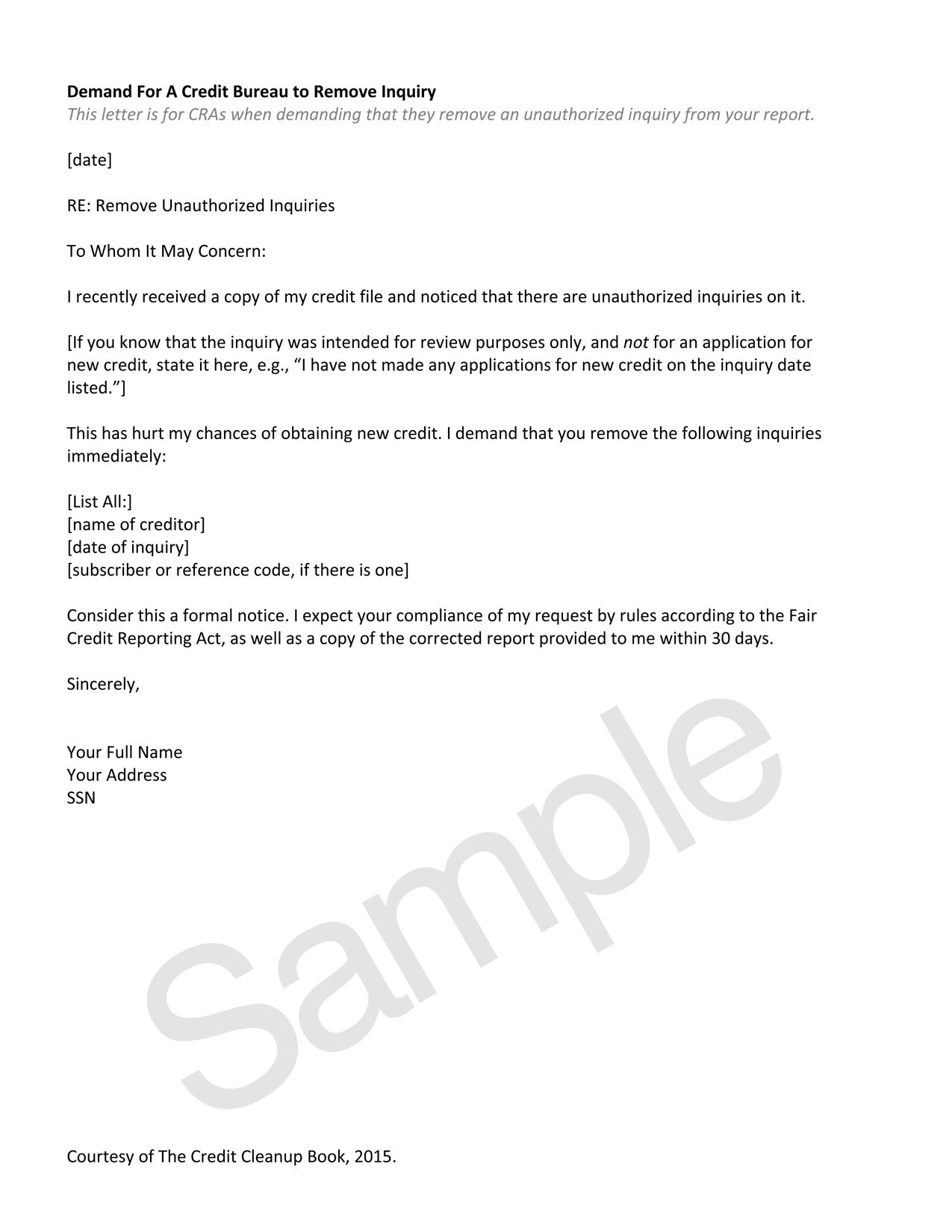

One method to get the hard inquiry off your credit report is to contact the company who pulled your credit report. The best way is to send a letter via certified mail and include the following details.

- Information about the hard inquiry including the date your credit report was accessed and company name

- State that you are disputing this entry because you did not authorize this hard inquiry

- State that you want them to remove the hard inquiry

- Ask them to send you documentation that the hard inquiry has been removed

- Ask them to send you proof if they believe that the hard inquiry was done with your authorization

- Include a copy of your credit report and highlight the entry you are disputing. If you have other supporting documents that will prove that the entry is unauthorized, inaccurate, or fraudulent, include these as well.

You can also use this sample letter from the Federal Trade Commission or FTC:

FTC SAMPLE LETTER TO A CREDITOR

Read Also: Syncb Ppc Card

Paying To Remove Negative Credit Info Is Possible But May Not Succeed

A bad credit score can work against you in more ways than one. When you have poor credit, getting approved for new loans or lines of credit may be difficult. If you qualify, then you may end up paying a higher interest rate to borrow. A low credit score can also result in having to pay higher security deposits for utility or cellphone services.

In those scenarios, you may consider a tactic known as pay for delete, in which you pay to have negative information removed from your credit report. While it may sound tempting, its not necessarily a quick fix for better credit.

Can You Remove Inquiries From Your Credit Report

When compared to other items that impact your credit score such as late or missed payments credit inquiries are the least important item to remove. However, there can still be some very good reasons for disputing and ultimately removing such an inquiry.

As an example, if you dont recognize a credit inquiry on your credit report, you could have been a victim of identity theft. In this case, it would be important to get the information removed, especially if its having a negative impact on your credit score.

Before you do so, though, remember that only hard credit inquiries conducted without your permission can be disputed. Therefore, if you willingly applied for a loan or credit and the corresponding inquiry has shown up on your report, you likely wont be able to have that particular credit inquiry removed.

If an item can be disputed, there are a couple of ways you can proceed. One way is to go directly to the creditor by sending them a certified letter in the mail. In your letter, be sure to point out which inquiry were not authorized, and then request that those inquiries be removed.

You could also contact the 3 big credit bureaus where the unauthorized inquiry has shown up. Because not all lenders and creditors report all information to all 3 of the bureaus, its possible that a particular inquiry will only show up on 1 or 2 of your credit reports.

Also Check: When Does Usaa Report To Credit Bureaus

Can I Remove An Inquiry From My Credit Report

You cant remove a legitimate inquiry from your credit report.

The only inquires that can be removed from your credit report are those that are incorrect or erroneous, like if a lender made a hard pull on your credit without proper authorization from you. In these cases, you can submit a request to have the inaccurate details removed from your report.

How long do credit inquiries stay on my credit report?

For a legit credit inquiry, youll simply have to wait two years to have a hard inquiry taken off your credit report though itll only impact your credit score a year at most. On the other hand, a soft pull on your credit can only be seen by you and has no affect on your credit score.

How To Remove Credit Inquiries 4 Easy Steps

When you apply for loans, lenders will ask you for an up-to-date copy of your given by a credit bureau. If you have applied for various credit cards, then a number of inquiries could appear on your . A new credit is always associated with the higher risk, but the score is mostly not affected by the inquiries from short-term mortgage, auto, or student loan. Generally, these are considered a single inquiry and have a little impact on your scores.

Read Also: Aargon Agency Payment

How To Remove Hard Inquiries From Report

When you apply for new credit, the hard inquiry associated with your application stays on your personal credit report for 24 months. Federal law requires hard inquiries to stay on your report for a specific period of time so you know who has had access to your credit file.

You cant force a credit bureau to remove a legitimate hard inquiry from your report early. But you can dispute any item on your credit report thats incorrect or that you want a credit bureau to verify.

The credit bureaus have incentives to correct inaccurate information when you dispute italthough you shouldnt expect mistakes to be fixed overnight. First, the Fair Credit Reporting Act requires the credit bureaus to investigate information you dispute and correct inaccuracies. The credit reporting agencies want to follow the FCRA so they dont face potential consequences of non compliance, like lawsuits or fines.

Next, the credit bureaus are also motivated to correct credit reporting errors, like unauthorized hard inquiries, because having accurate information makes for a better product. The credit bureaus sell credit reports to lenders. The more accurate the reports, the more valuable they are to the people who buy them.

Do you have unauthorized inquiries on your credit report? You may be able to get a credit bureau to remove them by following these steps.

Is It Important To Remove Credit Inquiries

Many people tend to overfocus on removing inquiries when their reports are full of late payments, collection accounts, or even a foreclosure. In these cases, you might want to hold off on your efforts to remove inquiries until after you have successfully removed some of the bigger problems on your credit report. But, if you are tackling your other credit issues, it doesn’t hurt to tackle this problem, too. On a scale from 1 to 10, with 10 being the worst thing on your report, credit inquiries are a mere 1 on the problem scale.

Don’t Miss: Credit Score Needed For Les Schwab Account

How To Dispute A Credit Inquiry

Now is the time to do some maintenance on your credit report to make sure no errors or false inquires have slipped through the cracks. Heres how to get started:

Review your credit report

Start by getting a inquiries and reference against the inquiries you know youve made any recent loan or credit card applications. Flag any unfamiliar inquiries that you dont recall approving.

Follow up on suspicious inquiries

If youve identified an inquiry you dont remember approving, nows the time to contact the lender associated with it. Find out what the inquiry was made for to figure out whether you approved it or not.

Submit a credit report dispute letter

If youve followed up on unfamiliar inquiries and still feel that authorization was not properly given, you can submit a request to the credit reporting agency for incorrect details to be removed using a . Make sure your request is to the credit reporting agency who provided you with your credit report, as details may vary between them. For example, if you got your credit report from Equifax, youd submit a request to Equifax to have the error removed and then check with TransUnion and Experian to see if the same false inquiry is listed.

Wait for an outcome

The credit bureau you filed a request with will then review the details before providing you with an outcome. If youre unsuccessful, the listing will remain. If your request was successful, itll be removed.

Did you know?

How Long Do Inquiries Stay On My Credit Report

All credit inquiries are listed on your credit report for two years. After that, they should fall off naturally. On the plus side, an inquiry only affects your credit score for one year. Once that period is up, your score should rebound a few points.

Again, its no big deal if you just have a few hard inquiries listed on your credit report. But if you have a long list of them, you might want to try getting one or more of the inquiries removed.

This is especially true if you dont remember authorizing the inquiry. To dispute a hard credit inquiry, you must contact each credit bureau that lists it.

You May Like: How Long For Things To Fall Off Credit Report

Focus Your Credit Repair Efforts On More Serious Items

While having too many credit inquiries can hurt your credit score, they are the smallest scoring factor. In fact, each hard inquiry typically deducts about five points from your credit score.

We find that most people spend too much time worrying about credit inquiries. They usually have worse negative items on their credit report that have a much bigger impact on their credit score.

But if you apply for credit cards every month, either out of necessity or as a rewards bonus hack, you can really start to cause some damage.

Use This Letter To Ask For Removal Of Credit Inquiries

If you have recently aquired copies of your credit reports, you may notice an “Inquiries” section toward the end of each of the reports. These credit inquiries will be broken into two types soft inquiry and a hard inquiry. You will want to have any unauthorized hard inquiries removed from your credit reports as these may be affecting your credit score. The Fair Credit Reporting Act allows only authorized inquiries to appear on your credit report. Inorder to remove a credit inquiry, you must challenge whether the inquiring creditor had proper authorization to pull your credit file. Remember, this letter is only an example and you MUST edit it to fit your particular situation.

Check out all of our sample credit repair letters to handle a variety of credit repair situations. Also, visit our bookstore where you can purchase eBooks on credit repair, debt settlement, and 95 sample letters all available for instant download.

Date

Re: Request to Remove Unauthorized Credit Inquiry

Dear Sir or Madam,

I recently received a copy of my credit report and I notice there is an unauthorized credit inquiry made by . I do not recall authorizing this credit inquiry and I understand you shouldn’t be allowed to put an inquiry on my file unless I have authorized it. I am requesting you initiate an investigation into inquiry to determine who requested this credit inquiry.

If you find that I am in error, then please send me proof of this.

Thank you in advance,

Recommended Reading: Syncbppc

Therefore If You Suffer From Bad Credit And A Lot Of Hard Credit Inquiries Life May Get Tough

Various financial institutions, real estate agencies, and even potential employers use your credit score to make a final decision. So, what can someone do to help eliminate bad credit? Well, this is where hiring a credit repair firm like may come in handy, where professionals work with you to help to:

- save you money

Recommended Reading: What Is Cbcinnovis On My Credit Report

Why Hire Credit Repair Co For Hard Credit Inquiry Removal

When you sign up for a credit repair service like Credit Repair Co, you are allowing professionals with years of experience in the field of financing and budgeting to take charge of working with credit bureaus and creditors on your behalf. Not only does this help you step-by-step in improving your credit score. It also helps you resolve financial issues. They even offer a 3 year warranty for making sure that your credit remains clean.

Read Also: What Is Syncb Ntwk On Credit Report

How Can You Determine Whether A Credit Inquiry Was Authorized

There may be a number of ways you can determine if a credit inquiry on your report was authorized. Sometimes, it may be a case of mistaken identity.

Occasionally, the name of the inquiry on your report may be different from the name of the entity pulling your report, says Ken Chaplin, senior vice president at TransUnion.

For example, if you applied for a retail store credit card, the entity listed on your report might be under the name of the bank issuing the card, not the name of the store.

Or, you may have forgotten that you authorized an inquiry. If you contact the company listed beside the inquiry on your credit report, it should be able to provide proof that you authorized the hard pull.

An unauthorized hard inquiry could be an indicator of identity theft and warrants swift attention, Chaplin says.

With the ID monitoring feature, you can use your email address to search for any accounts that are in any public data breaches. If your information has been exposed in a breach, well let you know some tips and tools to help you take the right next steps.

Well also continue to monitor your identity and credit for free.