Different Types Of Credit Inquiries

There are different types of credit inquiries that can take place on your credit report, including hard credit inquiries and soft credit inquiries. A hard credit inquiry can be a primary component of the underwriting process for all types of credit.

Soft credit inquiries, however, are often used more for marketing purposes not just during a loan or credit approval process. Its important to understand the differences between hard and soft credit inquiries because some inquiries can impact your credit report and .

Hard Credit Inquiries

A hard credit inquiry takes place when a company or entity has a legitimate business reason to look into your credit. In this case, the lender or creditor is seeking information about whether or not you will be reliable in paying the money back.

Your credit report will provide the lender or creditor with a report card of sorts in terms of your payback history, as well as other information such as how much credit you already have and what type of credit you carry .

There are a number of lenders and creditors that will typically use hard credit inquiries. These can include:

- Mortgage companies

- Lenders

When conducting a hard credit inquiry, the information that the lender or creditor has access to via your credit report can include the following:

Soft Credit Inquiries

A soft credit inquiry may be requested for a number of different reasons. One way that creditors often use soft inquiries is for marketing to potential customers.

What Happens When You Close An Account

When you close an account, it’s no longer available for new transactions, but you’re still required to pay off any balance you still have due by paying at least the minimum due each month by the due date

After the account is closed, the account status on your credit report gets updated to show that the account has been closed. For accounts closed with a balance, the creditor continues to update account details with the credit bureaus each month. Your credit report will show the most recently reported balance, your last payment, and your monthly payment history.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Read Also: How To Unlock My Experian Credit Report

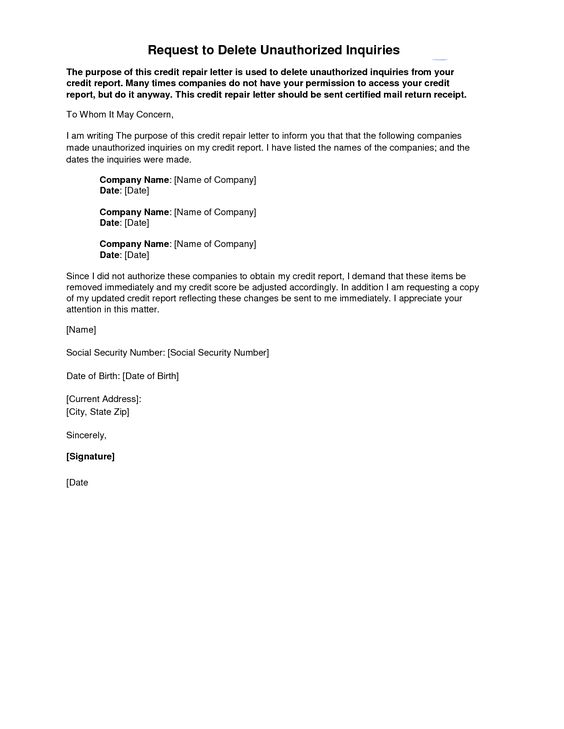

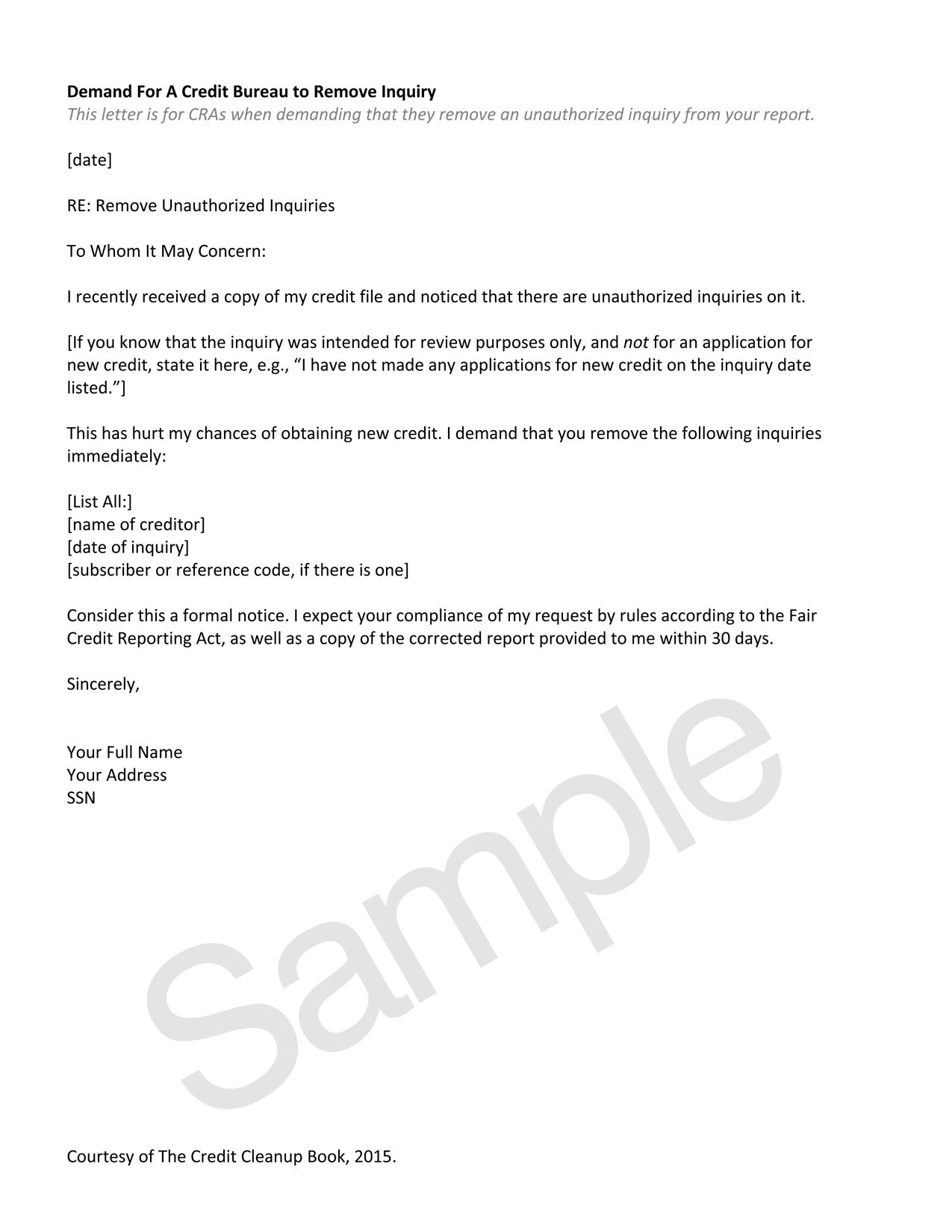

How To Write A Credit Inquiry Removal Letter

Sometimes companies and individuals make hard inquiries that you did not authorize. In those cases, there is a way to remove the hard inquiry and improve your credit as a result. Its called a credit inquiry removal letter or a credit inquiry dispute letter.

Even if a hard is questionable and you are not sure if you made it or not, you can dispute it as the burden of proof is on the credit bureaus and your creditors.

We have prepared a sample letter to send to the credit bureaus requesting an investigation of an unauthorized inquiry appearing on your credit report.

Errors By The Credit Provider

A credit provider may have reported information wrongly. For example, they:

- incorrectly listed that a payment of $150 or more was overdue by 60 days or more

- did not notify you about an unpaid debt

- listed a default while you were in dispute about it

- didn’t show that they had agreed to put a payment plan in place or change the contract terms

- created an account by mistake or as a result of identity theft

To fix this kind of error:

- Contact the credit provider and ask them to get the incorrect listing removed.

- If the credit provider agrees it’s wrong, they’ll ask the credit reporting agency to remove it from your credit report.

If you can’t reach an agreement, contact the Australian Financial Complaints Authority to make a complaint and get free, independent dispute resolution.

If you’re struggling to get something fixed, you can contact a free financial counsellor for help.

Also Check: Check Credit Score Without Social Security Number

Removing Bad Credit History With Credit Repair

Hiring a firm is another option for paying to delete bad credit information. Credit repair agencies essentially do the work for you by contacting the credit reporting agencies and providing objections to errors contained in the report or requesting that items that are untrue or incorrect be removed from the report, says McClelland. In this instance, youre not necessarily paying off any outstanding balances. However, you will pay a fee to the credit repair firm to act on your behalf in having negative information removed.

What Is A Credit Inquiry

A credit inquiry takes place when a bank, lender, or other credit-issuing institution views your credit report before offering you a loan or credit card.

There are other instances where a credit inquiry may also be used, which can include:

- A landlord or property management company checking your credit before approving you for an apartment lease

- A cell phone company inquiring about your credit before approving you for a contract

- A potential employer who wants to make sure your credit is in favorable standing before offering you a job

Hot Tip: While some situations will require that you actually apply for a product or service before they can check your credit, there are other instances where you dont have to give your approval for a credit check.

You May Like: Does Paypal Credit Report To Credit Bureaus

How To Request Pay For Delete

To ask for pay for delete, youll need to send a written letter to the creditor or debt collection agency. A pay for delete letter should include:

- Your name and address

- The creditors or collection agencys name and address

- The name and account number youre referencing

- A written statement saying how much you agree to pay and what you expect in return with regard to the creditor removing negative information

Youre essentially asking the creditor to take back any negative remarks that it may have added to your credit file in connection with late or missed payments or a collection account. By paying some or all of the outstanding balance, youre hoping that the creditor will show goodwill and remove negative information from your credit report for that account.

How Do I Know If I Have Too Many Credit Inquiries

There is no concrete number of how many credit inquiries is too many. If youre concerned about the number of inquiries on your credit report, the first step is to get a free copy of your credit reports. Its not so much about the number of inquiries, but more so the time between them.

For example, if youve applied for five credit cards in a period of three months and have five hard inquiries as a result, its likely to be considered as a negative detail on your report. In contrast, having five hard credit inquiries listed over a period of five years will have far less of an impact or perhaps no impact at all.

What to do if you think you have too many inquiries on your credit report

If youve looked at your credit report and think the number of credit inquiries listed could have a negative impact on your credit score, you can start to improve your credit score in other ways.

Recommended Reading: Does Titlemax Report To Credit Agencies

Work With A Credit Counseling Agency

Several non-profit credit counseling organizations, like the National Foundation for Credit Counseling , can help dispute inaccurate information on your credit report. The NFCC can provide debt counseling services, help review your credit reports, work with lenders, and help create a debt management plan free of charge.

As always, be wary of predatory credit organizations or companies. Make sure to find a reputable counseling agency and keep a lookout for any red flags, like hidden fees or lack of transparency.

When looking for a credit counselor, the Federal Trade Commission advises consumers to check out each potential agency with:

- The Attorney General of your state

- Local consumer protection agencies

- The United States Trustee program

Look For Unauthorized Or Incorrect Hard Inquiries

You can request to remove hard inquiries from your credit reports if

If you did apply for a credit account or authorize a hard inquiry, you cant remove it from your reports. It remains on your credit reports as part of an accurate representation of your credit history. If thats the case, it should fall off your reports after about two years.

Also Check: Does Opensky Report To Credit Bureaus

Check Your Credit Report Regularly

It isn’t common to find inaccurate information on your credit report, but it can happen. To avoid letting fraudulent and other erroneous information go unchecked, make it a goal to check your credit report regularly. Review what’s listed and watch out for anything you don’t recognize.

Also keep an eye on your credit score , and watch out for sudden drops that could indicate fraudulent activity, such as a bogus account opened in your name that’s gone unpaid.

It’s not always possible to prevent identity theft, but as you keep track of your credit history, you’ll be in a better position to stop a difficult situation from getting much worse.

Repairing Bad Credit Yourself

If you would rather not pay for delete or pay a credit repair firm, there are a few steps you can take to begin getting your credit back on track:

- Review your credit reports for negative information thats inaccurate. Initiate a dispute of inaccuracies or errors online with the credit bureau thats reporting the information.

- Consider having someone you know with a strong credit history add you to one of their credit cards as an authorized user. This can transplant that persons positive account history to your credit report.

- Research credit builder loans and secured credit cards as additional credit-building options.

- Get in the habit of paying your bills on time monthly. Payment history has the most significant impact on credit scores.

- Weigh the pros and cons of debt settlement to resolve collection accounts or charge-offs. Debt settlement allows you to pay off debts for less than whats owed.

- Focus on paying down balances on any credit card or loan accounts that you have open to improve your .

Don’t Miss: What Is Syncb/network On My Credit Report

Disputing Inaccurate Hard Inquiries Yourself

It’s important to check your credit reports regularly for accuracy. If, while doing this, you’ve noticed a hard inquiry on your credit report that you believe is the result of identity theft, you can file a dispute with each of the three national credit reporting agencies and petition to have them update the inaccurate information.

The first step is to review your Experian credit report through our Dispute Center and verify your information. Next, confirm that the inquiry was not a result of identity theft.

There may be situations where you don’t recognize the name of a company that checked your credit or you don’t remember applying for a loan with a company you do recognize. Here are a few scenarios when inquiries you don’t recognize may be legitimate:

If you don’t recognize the company name that performed the hard inquiry, contact the company for more information. When you check your credit report through the Experian Dispute Center, the hard inquiry will be accompanied by the company name and typically the mailing address and a phone number.

If you have verified that the hard inquiry is due to identity theft, then the dispute would be handled over the phone with Experian specialists. You can register with or log in to our Dispute Center to find our support options. There is no charge to use this service.

How To Remove Hard Inquiries From Report

When you apply for new credit, the hard inquiry associated with your application stays on your personal credit report for 24 months. Federal law requires hard inquiries to stay on your report for a specific period of time so you know who has had access to your credit file.

You cant force a credit bureau to remove a legitimate hard inquiry from your report early. But you can dispute any item on your credit report thats incorrect or that you want a credit bureau to verify.

The credit bureaus have incentives to correct inaccurate information when you dispute italthough you shouldnt expect mistakes to be fixed overnight. First, the Fair Credit Reporting Act requires the credit bureaus to investigate information you dispute and correct inaccuracies. The credit reporting agencies want to follow the FCRA so they dont face potential consequences of non compliance, like lawsuits or fines.

Next, the credit bureaus are also motivated to correct credit reporting errors, like unauthorized hard inquiries, because having accurate information makes for a better product. The credit bureaus sell credit reports to lenders. The more accurate the reports, the more valuable they are to the people who buy them.

Do you have unauthorized inquiries on your credit report? You may be able to get a credit bureau to remove them by following these steps.

Don’t Miss: Aargon Agency Phone Number

How To Prevent Unauthorized Credit Inquiries

There are also ways you can prevent an unauthorized credit inquiry from even taking place, which means you hopefully wont have to remove an unauthorized inquiry in the future. One strategy is to make your credit report inaccessible to lenders and creditors with a credit freeze.

A will place a lock on your credit report. This means that a lender or creditor will not be able to access your credit report in order to view your information. Implementing a credit freeze can also help keep hackers and identity thieves from opening new credit and/or applying for loans in your name.

Hot Tip: It is important to note that when you have a credit freeze in place, it can hinder your own ability to obtain new credit. For this reason, you can temporarily lift a credit freeze. All 3 of the big credit bureaus have programs available for putting a freeze on your credit.

What If The Information Is Rightbut Not Good

If theres information in your credit history thats correct, but negative for example, if youve made late payments the credit bureaus can put it in your credit report. But it doesnt stay there forever. As long as the information is correct, a credit bureau can report most negative information for seven years, and bankruptcy information for 10 years.

Don’t Miss: Opensky Credit Card Delivery

Combining Multiple Hard Inquiries

Its important not to apply for too many types of credit at one time.

However, the credit scoring models understand that people make multiple hard inquiries to compare terms and rates. So, if youre shopping around for one type of credit, like a mortgage, and make multiple inquiries in a short period of time, they only count as a single hard inquiry.

Lenders have become increasingly lenient in this regard because they know that todays consumers are more likely to perform their due diligence before making a major financial decision. This is true for credit cards or an auto loan as well. They do not impact your credit scores as long as they occur within a 30-45 day period.

Not All Suspicious Inquiries Are Fraudulent

Some inquiries may seem suspicious: You might not recognize the name of the company that made the inquiry, or there may be more inquiries than you expect. But those situations dont necessarily indicate a mistake or fraud.

For example, you may have used a loan broker that shopped around to try to find you the best rate possible on your loan. Each application the broker submitted on your behalf could lead to an authorized inquiry, even if you only took out one loan.

Don’t Miss: Is 672 A Good Credit Score

How You Can Check Your Credit Reports

You can get a free copy of your credit report from each major credit reporting agency every 12 months at AnnualCreditReport.com.

Get Free Weekly Credit Reports During the Coronavirus Crisis

Equifax, Experian, and TransUnion are offering free weekly online credit reports, so that you can manage your credit during the COVID-19 crisis.

How To Remove Inquiries From Your Credit Report

Because inquiries on your credit report can cause your credit score to drop a bit, you might be inclined to remove them. However, hard inquiriesthose that are made because you applied for more creditcan not be removed unless they are inaccurate or fraudulent.

Since hard inquiries have only a small effect on your credit score and they go away after two years, you shouldn’t waste your time trying to get them taken off your report. The wiser action is to limit the number of credit applications you make over a short period of time.

Read Also: When Does Usaa Report To Credit Bureaus

How To Remove A Credit Inquiry From Your Credit Reports

If you’re trying to improve your credit score, check your credit report. If there are incorrect hard inquiries on your credit report, you may be able to get them removed.

If youre wondering how to remove a credit inquiry from your credit report, there are a few points to think about before you start the process.

First, it helps to know there are two types of : hard and soft. Both types of inquiries will appear on your credit report, but hard and soft inquiries are different: Only hard inquiries can affect your credit score soft inquiries dont.

So, when you want to remove an inquiry from your credit report, its the hard inquiries youll be focused on.

Youll be looking for issues like reporting errors or unauthorized hard inquiries which can indicate an identity thief has used your Social Security number or other personal I.D. to determine if you can remove inquiries from your report and whether its worth doing so.

You can seek to remove inaccurate hard inquiries from your credit report by filing a dispute or a credit inquiry removal letter with the three major credit bureaus.

But you cant remove hard inquiries from your credit report if theyre accurate. In these cases, youll have to wait for any accurate information about hard inquiries to fall off your credit report, which usually occurs automatically after two years.