What If Ginny’s Is On My Credit Report

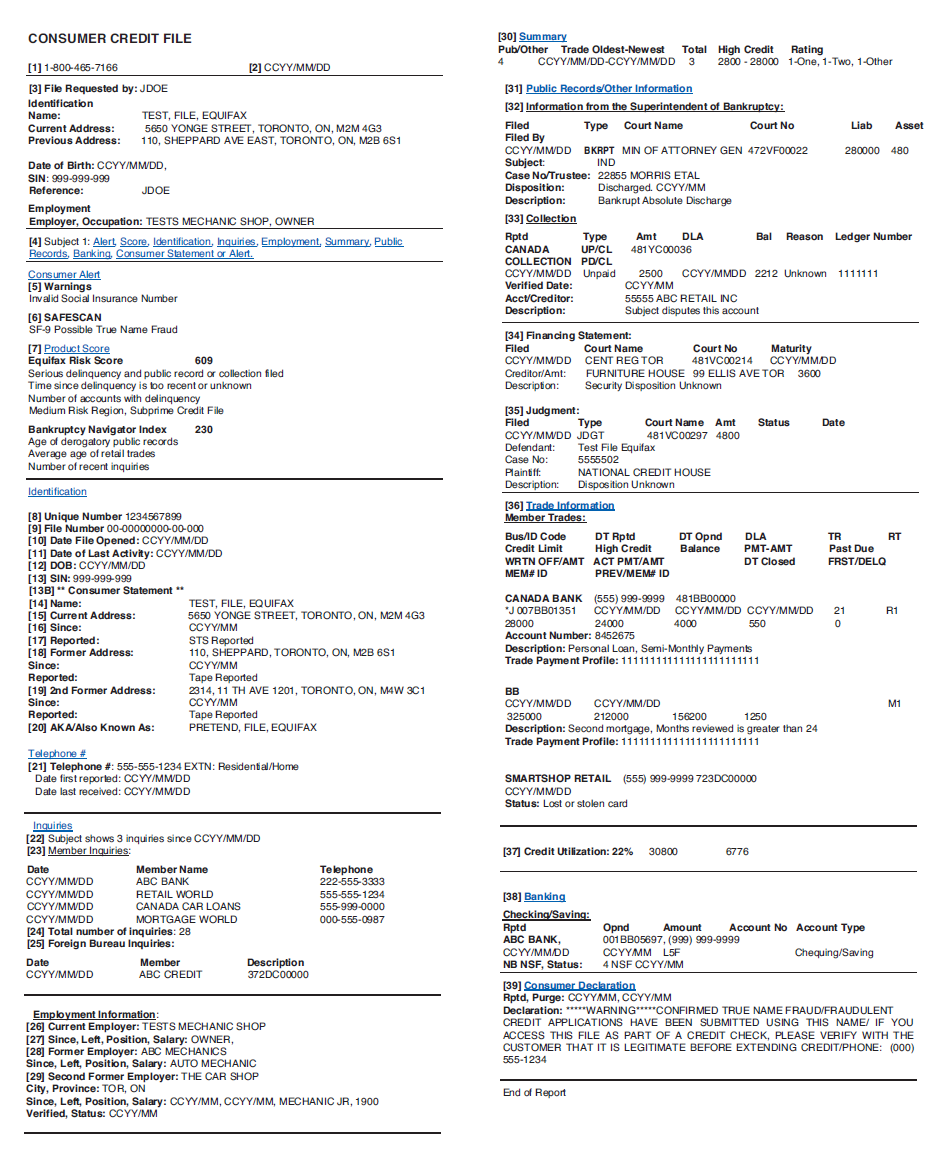

Based on our experience, some debt collectors may credit-report, which means one may mark your credit report with the debt they are trying to collect. In addition to or instead of the debt collector, the original creditor may also be on your credit report in a separate entry, and its important to properly identify these entities because you will want both to update your credit report if or when you pay off the debt.

THE GOOD NEWS IS

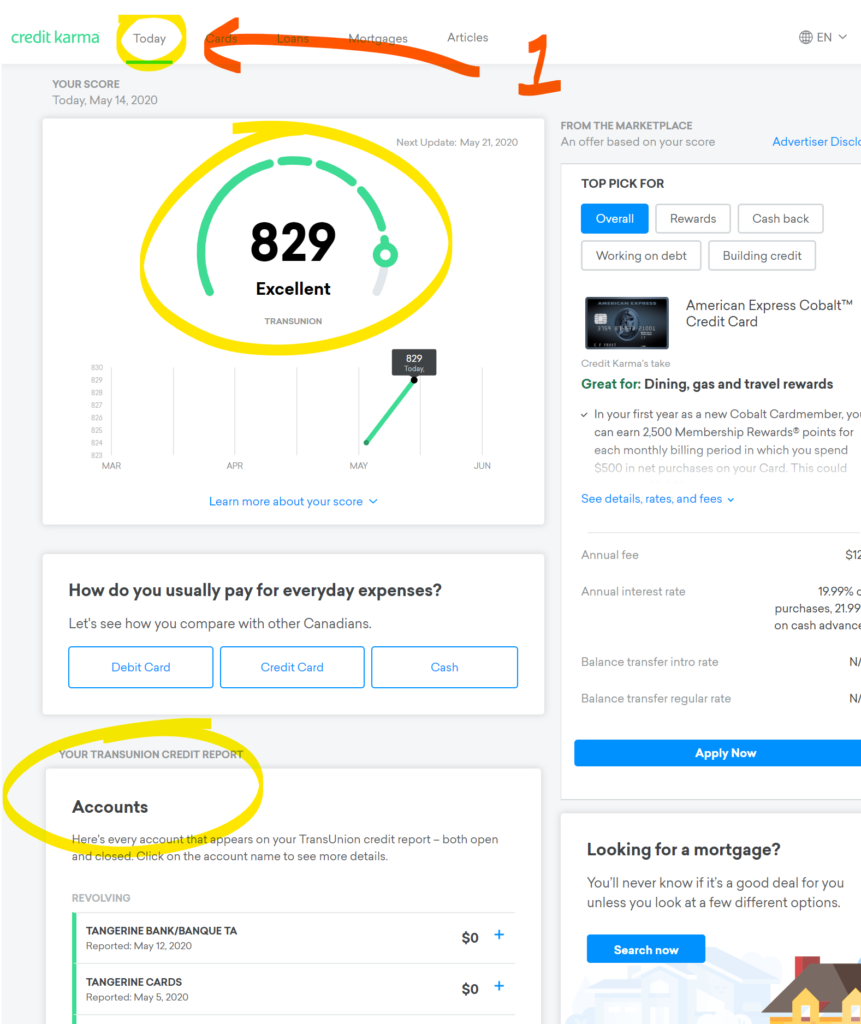

If Ginny’s is on your credit report, we can help you dispute it. Mistakes on your credit report can be very costly: along with causing you to pay higher interest rates, you may be denied credit, insurance, a rental home, a loan, or even a job because of these mistakes. Some mistakes may include someone elses information on your credit report, inaccurate public records, stale collection accounts, or even being a victim of identity theft. If you have a mistake on your credit report, there is a process to dispute it, and my office will help you obtain your credit report and dispute any inaccurate information.

REMEMBER

Will Not Admit Or Fix Mistakes With Payments To Your Account

JUST AN UPDATE: since I am still paying these ppl off, just wanted to add that as of today, they still have not acknowledged or posted my payment for this month and my bank sends payment electronically and payment arrived on the 12th according to my bank. They received last month’s payment and posted it correctly, but as of today they claim they haven’t gotten it. They only accept faxes or regular mail, not emails with screen shots. Only company I know of that isn’t in this century. I opened this account as a way to build my credit back up. At first everything was fine. Then in Nov and Dec of 2020, the payments that I made, the way I had been making them, were not applied to my account. The only reason I gave 2 * is because their customer service ppl are nice. Credit Department is rude,, and even though you Prove by bank statements etc that you did in fact pay, they REFUSE to admit or fix their mistake. They ruined my credit, it’s worse now than when i started. The faxes I sent at the beginning of the year? 5 in total. They never got. So they say even though I have confirmation. I paid on my account thru them for Jan and Feb but it takes 5 to 7 days for them to process the payment. I will say it again. DO NOT UNDER ANY CIRCUMSTANCES BUY OR ACCEPT CREDIT FROM THIS COMPANY!

Compare Store Credit Cards

If this card isnt right for you, check out your other store credit card options. Consider where you shop the most, and what rewards rate and other benefits might serve you. Compare cards to find the best fit for your wallet.

Finder only provides general advice and factual information, so consider your own circumstances, or seek advice before you decide to act on our content. By submitting a question, you’re accepting ourfinder.com Terms of Use andPrivacy and Cookies Policy.

Recommended Reading: Capital One Rapid Rescore

Approval With No Credit Check

If you have less than perfect credit, you may want to get a Comenity credit card because its possible to get approved with no credit check. Before you do, though, think about what you hope to get out of the card.

Are you trying to rebuild your credit by lowering your credit utilization ratio and making on-time payments?

If so, opening a new account may be helpful to your personal situation. But, if you struggle with debt and arent paying off your credit cards each month, then it may be best to hold off on getting a Comenity Bank credit card.

Whats The Deal With Fingerhut And Ginny’s Geez They Are Relentless

Over a year ago I applied for a F-Hut account because people were saying they are willing to help people with low or no credit. They approved me for $180.00 but before I agreed to apply I asked if they report monthly to the 3B’s the rep said yes so i went ahead, and like I said i got a pproved for a measely $180.00 and anyone who has dealt with F-Hut knows your required to pay $30.00 up front for your purchase before it ships. So basically I only have $150.00 in credit. Then the rep says i will have the chance to get a revolving account with them once i make all the payments but the kicker is if i decide to pay off the entire balance in one payment i am no longer eligible for the revolving account. I was shocked to hear that what company wouldnt want to have an item paid off completely right away. Then it hit me. There would be no interest charges applied and they couldnt make any money off me.

Recommended Reading: Ccb/mprcc

Choose More Sensible Shopping Alternatives

Fingerhuts online catalog features a huge variety of items that you can order now and pay for later. But by the time youve paid off your purchase, there will be much more cash out of your pocket than necessary. Through Fingerhut, youll pay more for your item itself than you would if you purchased at another store and youll pay interest on top of that, too.

If you dont have the cash in hand today, take a step back and look at your budget to understand why. Are you overspending? Do you really need the item youre trying to buy, or is an impulse purchase? Is there something else youd rather do with your hard-earned money than spend on material goods, like saving up for a goal or investing for your future?

If you decide you do want to buy items like the ones you can find on Fingerhut, it still makes sense to choose other alternatives for your shopping needs. In the long run, its much cheaper to buy what youre looking for through other retailers. You can still shop online and get better deals on overall price.

Use coupon sites to look for codes and discounts, and check out online shopping portals like Amazon and eBay to hunt for the best deals. Set up price alerts to be notified when things go on sale and plan purchases carefully to make the most of the money you want to spend.

How Do I Apply For Montgomery Ward Credits

How do I apply for Montgomery Ward Credit?

. Regarding this, what credit score is needed for Montgomery Ward?

The card limits your purchases to the Montgomery Ward online store. Approval is fairly easy, with poor accepted. Compare store cards.

| Recommended minimum credit score | 300 |

|---|

Subsequently, question is, how do I get a Montgomery Ward catalog? If you would like a free Montgomery Ward catalog mailed to your home, you’ll need first to visit Montgomery Ward’s Request A Catalog page. On that catalog request page, fill out the form with your first and last name, plus the full mailing address for where the catalog should be shipped.

Simply so, is Montgomery Ward affiliated with Fingerhut?

CHICAGO _ Retailer Montgomery Ward& Co. and catalog merchandiser Fingerhut Companies Inc. The new venture, which will be owned equally by Montgomery Ward and Fingerhut, will mark Montgomery Ward’s return to the general merchandise catalog business after closing the operation in 1985.

Is it easy to get Stoneberry credit?

Welcome to Stoneberry Credit where we make shopping affordable and easy! You can now order all of your favorite items for as little as $5.99/month*. No Formal Application Process Applying for Stoneberry Credit is as easy as placing an order!

Don’t Miss: What Is Syncb Ntwk On Credit Report

Mastercard For Bjs Members

My BJs Perks MasterCard is a fee-free credit card available for members of BJs Wholesale Club. Most locations are on the East Coast, so if you live near one, consider taking advantage of their cash bank program, especially if you shop often and like to buy in bulk. Its a pretty comprehensive credit card, especially considering that theres no annual fee.

Youll earn cash back on different types of purchases, which can then be used towards future BJs purchases. For instance, depending on which membership level you choose, you get either 3% or 5% cash back on any of your BJs purchases.

Additionally, all cardmembers get 10-cents off each gallon at BJs gas stations. Youll also get 2% cashback from dining out just about anywhere as well as from gas purchases made at any other gas station.

When you shop anywhere else with your BJs MasterCard, youll get a cool 1% in cash back. So again, as long as you stay on top of your monthly balances, you can quickly see some savings with this credit card.

Other Credit Cards From Comenity Bank

In addition to retail store cards, Comenity Bank provides consumers with specialty credit cards of other types as well. For example, for medical purchases, you can choose from a selection of medical-related cards. In addition, some purchases can be eligible for deferred interest, while other cards can help finance elective health-related procedures.

Your Tuition Solution credit card helps to pay for private school and other educational costs. There are also Comenity credit cards for certain auto manufacturers like Lexus and Toyota and hotel cards from Red Roof Inn and Westgate Resorts.

Heres the complete list:

Also Check: Does Paypal Working Capital Report To Credit Bureaus

Re: Whats The Deal With Fingerhut And Ginny’s Geez They Are Relentless

And it was for that very reason that I applied in the first place because they were and still are willing to help people with less than perfect credit establish themselves its when i hear comments from customer service reps telling me not to pay the entire balance off right away or i wont be eligible for a credit card that brings suspicion on them. Tactics like that deter me from wanting to do business with them. Yes I also agree that some merch in F-Hut can be cheaper and possibly more available in stock than Amazon but I have seen many items in the catalogs listed higher in price than in some department stores. As far as Ginny’s goes I never heard of them until I got the catalog one day so i google the company’s reviews and see what other people are saying. This habit of reading reviews has saved me from many wrong decisions when considering purchasing merch and even appliying for credit.

Thanks for replying to my post. Have a Blessed Evening

Farmers Insurance Visa Card

This is another fee-free credit card with strong benefits, and it doesnt matter where you live. You earn points on each purchase you make. You can then redeem the points for statement credits, travel, gift cards, and more. Another major benefit of this Comenity card is the 0% APR for the first 12 months, after which rates run between 13.99% and 20.99%.

So how do you earn points? You get 3 points for each $1 spent on Farmers products, gas, or home improvement. Plus, you get 1 point per dollar spent on anything else you charge to your Farmers Visa.

Points never expire, and theres no maximum to how much you can earn. If your most expensive purchases tend to be gas or home repair items, consider this card.

Its also a good option if you tend to carry a small balance from time to time because you wont be charged interest for the first year. Just be sure to pay off your debt in its entirety before your introductory period is up otherwise, your balance will be subject to a potentially high interest rate.

Also Check: Paypal Credit Report To Credit Bureaus

Is Fingerhut Overpriced

Fingerhut is a company that offers a chance for credit to people who may have low credit scores. You can find the items they offer for less money in other stores, but you may not have the credit to do so. You will pay more if you buy products from Fingerhut, but there are reasons that you might make this choice.

If you are looking to build credit, Fingerhut offers you this opportunity. They extend credit to people who are looking to rebuild their credit. They will report to the credit bureaus, and it can help you to increase your credit score. Some people take advantage of this opportunity.

The reality is that you will pay more for the items than you would on another website, but there are situations where it is worthwhile. If you are trying to build your credit or you need something and other stores wont extend you credit, Fingerhut can offer an alternative.

Can Ginny’s Sue Me

Yes, Ginny’s can sue you. Ginny’s can hire a lawyer to file a breach of contract lawsuit against you for the underlying debt, fees, and costs. If youve been sued by Ginny’s, do not ignore the lawsuit you may have defenses. If you ignore the lawsuit, default will be entered and the agency may seek to garnish your wages. If you receive notice of a lawsuit, contact an experienced attorney as soon as possible, even if you intend to represent yourself pro se. If Ginny’s has threatened to sue you, contact Agruss Law Firm as soon as possible were here to help.

Recommended Reading: What Is Credit Bureau Report

What Are The Best Credit Cards From Comenity Bank

Each Comenity credit card typically comes with some sort of incentive. Most frequently, youll be given a discount on your first purchase, usually ranging between 10% and 20%. After that, you may be sent certain offers and discounts throughout the year.

Depending on the store credit card, some may have better benefits than others. After all, not all participating stores are owned by the same company, so theyll each have a different strategy for their cardmember perks.

If thats your primary reason for opening one or more Comenity Bank store credit cards, do your research in advance to find out which ones give the best rewards. Here are a few of our favorite Comenity Bank cards in terms of the biggest benefits offered to cardholders.

Re: Ginnys/seventh Avenue/swiss Colony Accounts No Showing

Some creditors do not even have credit reporting agreements with the CRAs, and report nothing.

Others save expenses and reporting fees by only reporting once an account becomes derogatory, and thus use reporting not to assist consumers in building credit history, but only as a tool to assist in collection of delinquent debts.

Read Also: Who Is Syncb/ppc

Re: Can Ginny’s Do This

Some information must be consistent in reporting with all CRAs, while other information does not.

The basic requirment of the FCRA is not that all information must be reported in order to be accurate, it is that what is reported cannot knowingly be inaccurate.

It is permissible to report all delinquencies to one CRA, but only some or none to others.

However, some info is by its nature factual, such as a DOFD, and thus must be the same regardless of who reported to.

As for deliquencies after sale of the debt, first thing is to be certain that the debt was in fact sold.

Service reps may incorrectly interpret the showing that it has been referred to a debt collector as meaning the debt was sold.

Additionally, if the debt was sold and still delinquent, its current status would remain that of delinquency, however no more additional delinquencies coould accrue.

Thus, is their “reportinging” of delinquency after sale reflected only in its current status, or does the payment history actually show the reporting of new and addiitional delinquencies?

Can you post a copy of the payment history my month?

What Parents Need To Know

Parents need to know that Ginny & Georgia is a series about a mother and daughter. It may seem similar to the beloved Gilmore Girls, complete with the initials, a bookish teen girl , an outgoing young mom . an adorable Northeastern town, pop culture chatter, and lots of junk food. But the resemblance ends there: This series is significantly more mature and faster paced. Within a short time after arriving in the fictional Wellsbury, Mass., 15-year-old Ginny loses her virginity, smokes pot for the first time, and shoplifts with new friends. She also intentionally burns herself and has scars from cutting. All the teens in the show seem to smoke pot and talk about sex frequently. Words like “p—y,” “bitches,” “twats,” “a–hole,” “d–k,” and “s–t” are used often. We also see mom Georgia drink wine, smoke pot, use a vibrator, steal when her credit card is declined, and charm her way into a job in the single mayor’s office. And in flashback, viewers see abuse that Georgia escaped as a teen.

You May Like: What Is Cbcinnovis On My Credit Report

Is It Any Good

This manic, mystery-fueled mother-daughter drama reels in viewers with more sex, drugs, and violence in the first episode than we saw in seven seasons of the Gilmore Girls we’re not in Stars Hollow anymore. “Over the top” is an understated way to describe Ginny & Georgia, which goes out of its way to tell us “We’re like the Gilmore Girls, but with bigger boobs.” Before viewers are an hour into the series, the family meets Georgia’s new neighbor/instant BFF Ellen , her hunky stoner son Marcus and his twin Maxine, an instant crew of partying high school friends, the handsome mayor and his staff, Joe who runs the local restaurant/hangout, the gossipy PTA moms, son Austin’s bully … and we haven’t even touched on the flashbacks to Georgia’s violent past or Ginny’s self-harm.

When the show allows for a little breathing room, viewers are likeliest to focus on Ginny, the most compelling character. Newcomer Antonia Gentry is reminiscent of Linda Cardellini’s Lindsay in Freaks and Geeks: She’s smart, she knows it, and she’s yearning to be less of a “good girl.” Ginny is also half-Black in a very White high school and town, and the writers lay the groundwork for her wrestling with her biracial identity.