Something Was Recorded On Your Credit Report

Think back on your payment history have you missed a credit card payment in the last few months? Were there any bills that you may have missed in previous months?

Missed payments are typically not reported to the credit bureaus until theyre at least 30 days late, so your score wont be impacted until after that time. Your score will be hurt by a payment thats more than 30 days late, but a delinquency, referring to a payment that is over 30 days late 60, 90, or even 180 days can devastate your score.

Derogatory marks such as tax liens, charge-offs, collections, foreclosures or bankruptcies have drastic impacts on your credit too, and it may take weeks or months for them to show up on your report. If youve experienced any of these, it may take time for your score to change.

Ask For A Higher Credit Limit

On the same pattern of low utilization, a higher credit limit will make your ordinary credit card utilization rate seem lower than it normally is. All you need to do is call your credit card company. If you are in good standing with the company, they typically will not have any issues increasing your limit. Make sure you ask if they are able to do this without a hard credit inquiry to prevent your score from decreasing at all. Most companies will happily work with you on this matter.

The Better Story How To Increase Credit Score Fast

Fast forward to this year

I got a credit card

Started rebuilding my credit

Both of us landed new remote jobs

And I came up with a financial plan for our family.

I wont go into the whole financial plan in this post, but one of the goals was to help hubby increase his credit score.

So How did we do it?

I added him as an authorized user to one of my credit cards. We checked his credit score 1 week later, and it was 150 points higher on Transunion. 50 Points higher on Equifax. Woot!

Surprisingly, it was that simple.

DISCLAIMER This strategy isnt for everyone

Honestly outside of my parents and my husband, there isnt anyone else Id really consider using this strategy with. You may not have either of those as an option right now. If not, no worries. This strategy may not be the best option for you, but there are plenty of other ways to increase your credit score fast. Im researching and experimenting with different methods and Ill be sharing my wins and losses right here, weekly. So subscribe for updates.

Why this strategy worked to increase his credit score fast

Your available credit / credit utilization, makes up about 30% of your credit score.

Simply put, the more credit you have available to use, the better. So having a credit card with a low balance or no balance is great for your credit.

That process was slow and steady and it required patience. Once Id put in the groundwork though, it made it easy for us to see a huge increase in hubbys credit score

You May Like: What Credit Report Does Comenity Bank Pull

Make All Your Payments On Time

Your payment history is the factor that impacts your credit score the most. When you pay credit cards or loans on time, that goes on your credit file and improves your payment history. On the other hand, if you’re late by 30 days or more, that goes on your credit file and hurts your payment history.

Now, your credit score probably isn’t going to skyrocket just because you made a few payments on time. But it will get better and better as those on-time payments start to add up.

The only way to consistently improve your credit is to pay on time, every time, so make sure you don’t miss any payments. You may want to set up auto-pay or payment reminders to help.

Hold Off On New Purchases

Wait a full billing cycle after paying off a credit-card bill before you charge any new purchases. That way you can time when the credit-card company reports your balance to the credit bureaus. By waiting, your account will show a low balance, which keeps your debt-to-income ratio lower. Card companies often calculate credit scores shortly before the bill is due. Yet toward the end of the billing cycle is when cardholders usually have the most charges. You want your report to show that much of your available credit limit is unused as this will help raise your credit score.

Recommended Reading: Can You Remove Hard Inquiries Off Your Credit Report

Form A Relationship With A Local Bank Or Credit Union

Another option is to open a checking and savings account at a local bank or credit union. This way you can form a relationship that may eventually include a mortgage, car loan, and sometimes credit cards. A branch manager who is familiar with your personal history, job situation, and financial goals can help you work on qualifying for the credit products you want. While checking and savings accounts wont help you build a credit history, it can go a ways in helping you obtain credit products with a limited history.

Use A Secured Credit Card

Another method that can be used either to build credit from scratch or improve your credit is by using a secured credit card. This type of card is backed by a cash deposit you pay it upfront and the deposit amount is usually the same as your credit limit. You use it like a normal credit card, and your on-time payments help your credit. Choose a secured card that reports your credit activity to all three credit bureaus. You may also consider looking into alternative credit cards that don’t require a security deposit.

Read Also: Does Paypal Credit Report To Credit Bureaus

Maximizing Length Of Credit History

Your length of credit history is calculated based on your average age of all open credit accounts. The way to maximize this ratio is by keeping your oldest credit cards active.

If you have to close a credit card, always choose a credit card that has been opened for the least amount of time.

If you close a credit card that has been opened for a very long time, this can have very negative results on your personal credit score.

Join An Account As An Authorized User

You can also improve credit by joining a trusted family member’s or friend’s credit card account as an . You’ll be able to use the card to make purchases, and the card’s payment history will show up on your credit report. That makes it crucial to pick someone whose credit you will benefit from. Work with the primary cardholder to pay them for your purchases, as they’ll be ultimately responsible for any balance on the card.

You May Like: How To Report A Death To Credit Bureaus

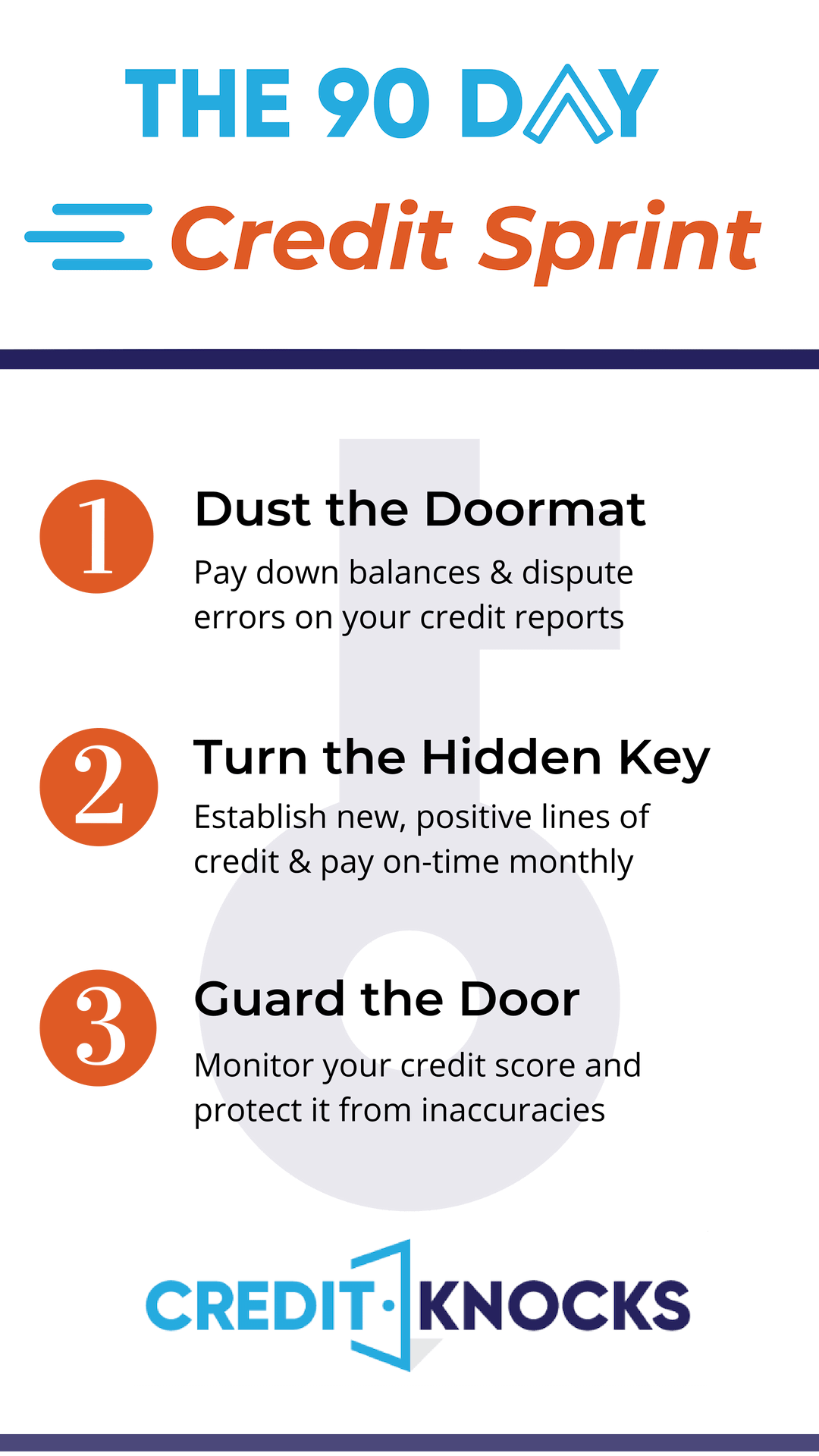

Taking The Right Steps To Raise Your Credit Score In A Month

There are a few things that can cause your credit score to rise quickly, including:

- If you get a bonus or another large sum of money and use it to pay off a credit card balance. Youll likely see an increase in your credit score the next month when that creditor reports your new zero balance.

- If you had a late payment showing that gets corrected and removed from your credit report, you should see your score improve.

- If you had something negative incorrectly reported on your credit report and you contact the financial institution or lender to prove it wasnt something you did, they will remove it and you should see your score increase.

Since paying bills on time and maintaining a low credit utilization are both major factors in your credit score, taking actions in those areas is most likely to quickly and impactfully affect your score.

Something Fell Off Your Credit Report

Thankfully, missed payments and derogatory marks wont stay on your credit report forever. The greater the age of those marks on your credit score, the less impact they have, so you may see your score recover over time while your behavior is kept consistent.

Late payments over 30 days will remain on your credit report for seven years, while derogatory marks like bankruptcy can remain on your report for up to 10 years. Over time your score will recover, and once these marks fall off your credit report, you may see an instant boost in score.

Also Check: Carmax Lenders

Re: How To Raise Credit Score By 50 Points Fast

Awesome-thanks!!! I am hearing 3 different things these days as to utilization. 1-Keep balances under 30%, 2-Pay off balances every month or 3-keep 10% utilization. So confusing!!! Will it hurt if we pay off balance by the end of each month?? I am afraid that cards won’t give him credit increases if we only use 10%. Thoughts?

Become An Authorized User

If you have a relative or friend with a long record of responsible credit card use and a high credit limit, consider asking if you can be added on one of those accounts as an . The account holder doesnt have to let you use the card or even tell you the account number for your credit to improve.

This works best for if you have a thin credit file, and the impact can be significant. It can fatten up your credit file, give you a longer credit history and lower your credit utilization.

Read Also: Does Opensky Report To Credit Bureaus

Ask For Higher Credit Limits

When your credit limit goes up and your balance stays the same, it instantly lowers your overall credit utilization, which can improve your credit. Call your card issuer and ask if you can get a higher limit without a hard credit inquiry, which can temporarily drop your score a few points. If your income has gone up or you’ve added more years of positive credit experience, you have a decent shot at getting a higher limit. Some issuers may also be willing to work with you during the COVID-19 crisis.

Improving Your Score Is Worth The Effort

Even though there arent any word-for-word scripts for improving your scores, these tips have proven to be useful. After reading our article, you should be well equipped to make real progress in your finances.

The question of how long it takes to increase your credit score by 50 points does not have a definitive answer. It will depend on where you start, your income, and your determination. But in the end, you will be glad you did it you can max out your rewards, improve your chances for loan approval, get lower interest rates on mortgages and other loans, etc.

Overall, good credit opens up opportunities that you might not have access to yet. But achieving this goal is not always easy. If you want to become educated on the topic of credit and personal finances, you can do it with DebtQuest USA. There are a lot of meticulous details that an average person doesnt know, and our goal is to close that knowledge gap.

Also Check: What Credit Score Does Carmax Use

Dispute Credit Report Errors

A mistake on one of your credit reports could be pulling down your score. Fixing it can help you quickly improve your credit.

You’re currently entitled to a free report every week from each of the three major credit bureaus: Equifax, Experian and TransUnion. Use AnnualCreditReport.com to request those reports and then check them for mistakes, such as payments marked late when you paid on time or negative information thats too old to be listed anymore.

Once you’ve identified them, dispute those errors to get them removed. The credit bureaus have 30 days to investigate and respond. Some companies offer to dispute errors and quickly improve your credit, but proceed with caution before you choose this option.

How To Increase Your Credit Score: Why Does This Matter

You may wonder, Why do I need a good credit score?

Maybe right now, you dont really need to have a credit history perhaps youre not even thinking about how to improve your credit score. But at some point, you will be faced with a fantastic opportunity, and you might not be able to access it due to the lack of good credit.

What if you need to lease a car or apply for a loan or credit card to finance your business?

Youll realize that your credit score is low, and lenders wont let you borrow money or offer you lower terms and rates. Youll miss out on the amazing opportunities thatll allow you to grow your business.

Amazingly, improving your credit score can save you hundreds or thousands of dollars for the typical auto loan or credit card. For a business owner, a good credit score can save you tens of thousands of dollars in interest rates on long-term loans.

What if you could boost your personal credit score by 60 points in 60 days?

Wouldnt you be all in and ready to take steps to make positive changes in your credit score?

You May Like: What Credit Score Does Carmax Use

Keep Credit Cards Open

If you’re racing to improve your credit profile, be aware that closing credit cards can make the job harder. Closing a credit card means you lose that cards credit limit when your overall credit utilization is calculated, which can lead to a lower score. Keep the card open and use it occasionally so the issuer wont close it.

Tips That Can Help Raise Your Credit Scores

Because , building credit takes time. Depending on your individual situation, there may be ways to raise your scores quickly like paying down all your debt in a very short span of time. But if youre starting out with bad credit, even a drastic measure like that may not have the immediate effect youre looking for. No matter what, the most impactful thing you can do for your credit is to create some consistent habits. Here are some tips that can help you raise your credit scores over time.

You May Like: What Credit Score Do You Need For Amazon Prime Visa

Pay Your Car Insurance Monthly: +20 Points

Paying for your car insurance each month can make your payments more affordable on a regular basis. But did you know that it can also improve your credit score?

Experian revealed that by opting to pay your car insurance monthly, you could see your credit score increase by 20 points. This is because lenders like to see that you can manage payments over a long-term basis.

Every time you meet a repayment on time, youâre proving that you can be trusted with money â and signing up for a long-term payment plan can show that youâre a responsible borrower.

Itâs worth remembering though, that if you can afford to stump up the total cost for a year, you could save some cash in the long run so it boils down to whatâs more important for you.

Lower Your Credit Utilization Rate

The fastest way to get a credit score boost is to lower the amount of revolving debt youre carrying.

The typical guidance from personal finance experts is to use no more than 30% of your credit limit, which applies both to individual cards and across all cards. For example:

- On a card with a $500 credit limit, spend no more than $150.

- On a card with a $700 credit limit, spend no more than $210.

- On both cards , spend no more than $360.

How much will this action impact your credit score?

Reducing your balances is the single most effective way to boost your credit score. Provided you have no derogatory marks on your credit reports, such as late payments or delinquencies, you are guaranteed to see a big jump in your scores quickly if you knock down your balances to $0 or close to zero.

Still, if your utilization is currently over 30%, and simply paying the debt off immediately isnt a viable option, there are a few other ways to lower your credit utilization rate.

You May Like: How To Remove Repossession From Credit Report

Use Your Secured Credit Card Sparingly At First

As you get used to using credit, youll want to use your card sparingly at first.

Dont rush in and begin charging items until you get a grasp on what you can truly pay back.

You dont want to end up with a revolving balance you cant afford to pay off every month, and you definitely dont want to pay interest on your purchases!

How To Improve Your Payment History

We said earlier that there is very little you can do to change your payment history but its possible you could improve it. First, you would need to get your credit reports from Experian, Equifax and TransUnion. They are required by law to provide you with your credit report free once a year. You could call or write each of these companies and request your credit report or go to the site www.annualcreditreport.com and get all three simultaneously. Then second, you would need to go over your reports very carefully looking for negative items such as.

- Late payments

- Liens

Don’t Miss: How To Remove Verizon Collection From Credit Report

Top Credit Card Wipes Out Interest Into 2023

If you have credit card debt, transferring it to this top balance transfer card secures you a 0% intro APR into 2023! Plus, youll pay no annual fee. Those are just a few reasons why our experts rate this card as a top pick to help get control of your debt. Read The Ascent’s full review for free and apply in just 2 minutes.