What To Do If You Dont Have A Credit Score

If youre a young adult or new to the U.S., you may not have a credit score due to a lack of U.S. credit history. One of the best ways to help establish a credit score is to sign up for a secured or unsecured credit card that requires little or no previous credit history and reports payment activity to the three major credit bureaus Equifax, Experian and TransUnion.

Another great option is to become an authorized user on a family members existing credit card account. The payment and credit usage of that account will then be reported to the credit bureaus under your name, giving you an instant boost. Just make sure the account your added to; is in good standing, meaning no late payments and a low balance.

Read: Joint Account Holder vs. Authorized User on a Credit Card: Whats the Difference?

How Is Fico Different From Vantagescore

Aside from FICO, there’s an entirely separate credit scoring model, called the VantageScore®, which the three major credit reporting agencies released together in 2006. The average VantageScore, according to recent Experian data, is 680.

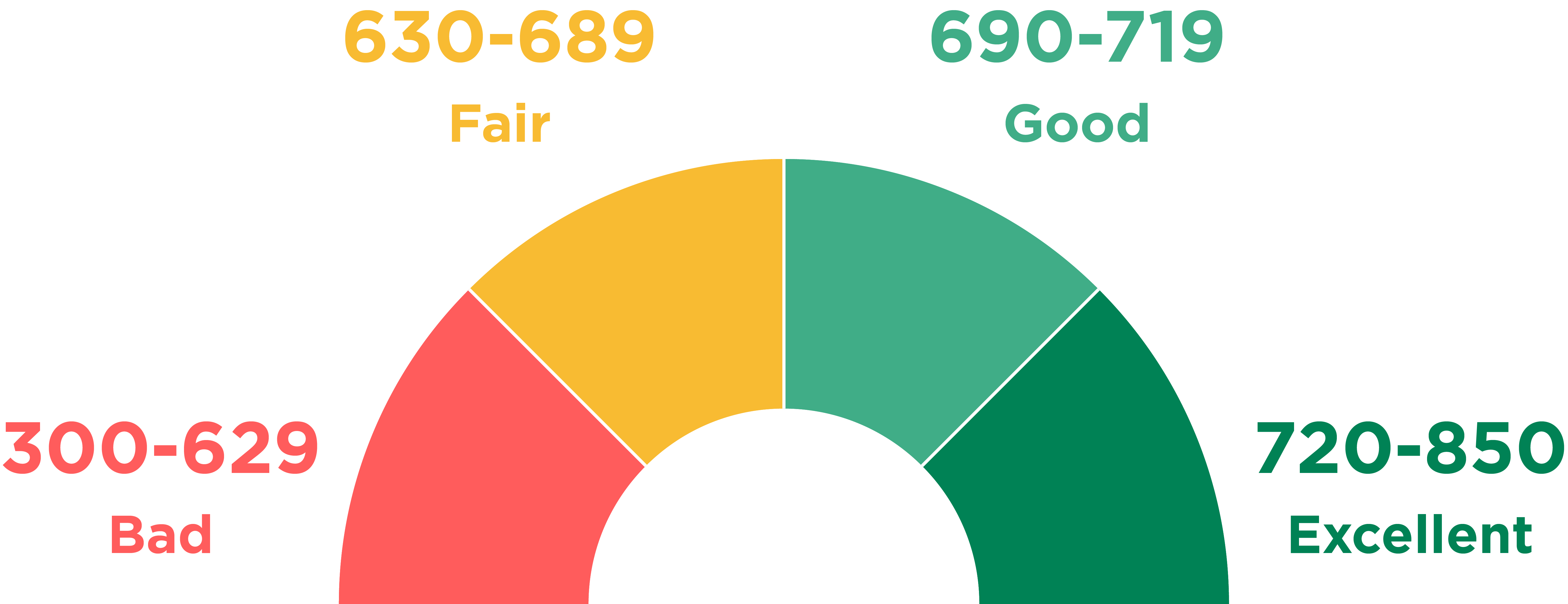

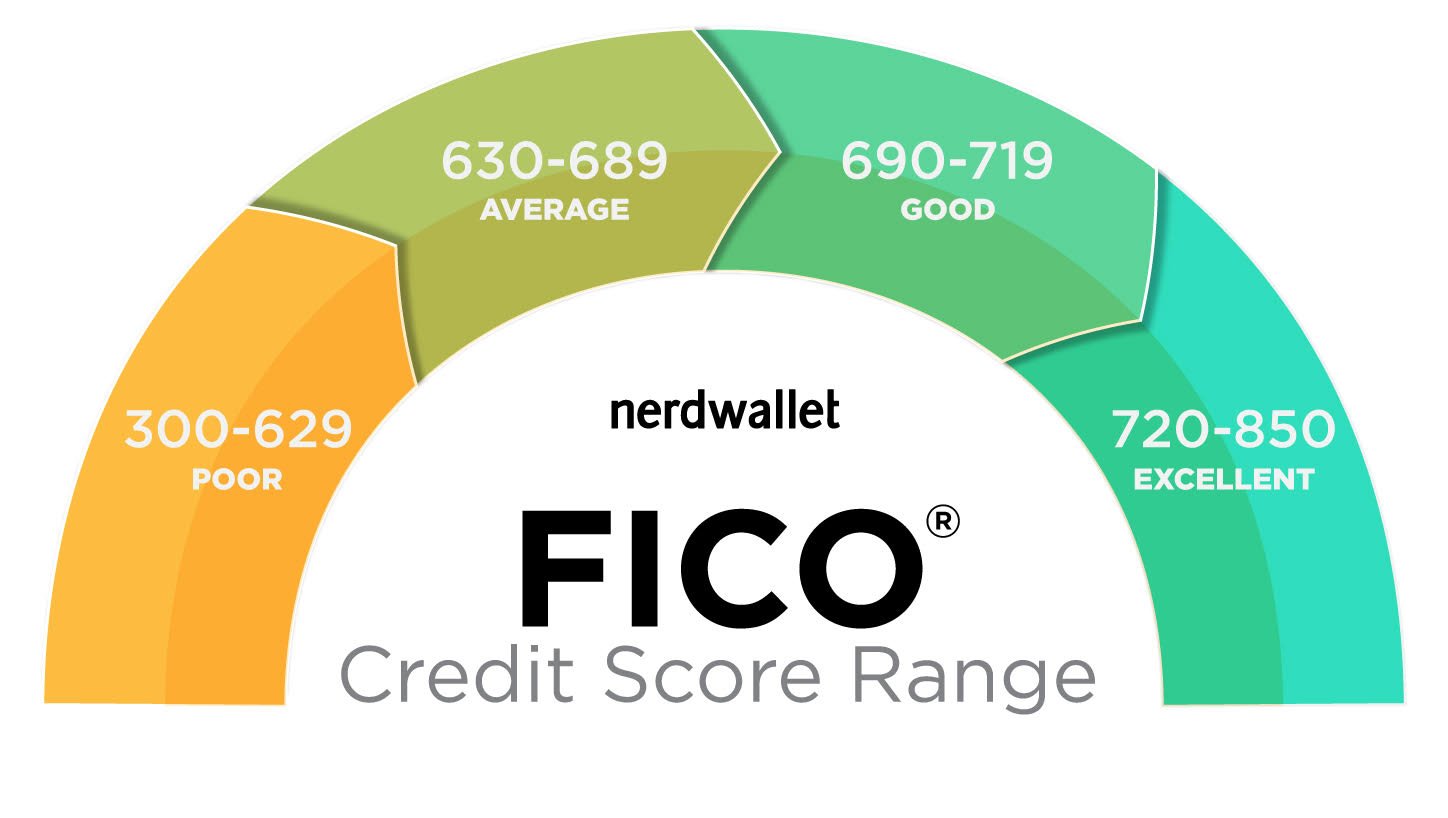

There are several differences between the FICO and VantageScore models. You could have a VantageScore with just one line of credit to your name, even if it’s less than six months old, for instance. But you won’t have a FICO® Score if you don’t. Plus, a good VantageScore starts at 700, as opposed to 670 on the FICO® Score range.

The two scoring models also differ in the ways they weight certain financial behaviors. The latest VantageScore version is more similar to FICO® Score 9 than FICO® Score 8, which is still most widely used: It doesn’t factor in paid collection accounts and reduces the impact of medical collections on credit scores. VantageScore also considers your historical credit utilization, such as how frequently you pay off your balances in full, rather than capturing it only as a snapshot like a FICO® Score does.

I Know My Rangeis It Good

That massively depends. The definition of good will depend on the lender and the type of loan youre getting. Remember that different lenders have different criteria and different types of loans have different requirements.

You may be a perfect fit for a banks credit card but not their auto loan product. This is because their credit standards for credit cards are different than that of their auto products.

Your credit score is important and maintaining your credit file in good order is critical. However, many lenders weigh other things higher.

For example, your debt to income ratio is an extremely good indicator of your ability to repay a loan. Lenders will total up the debt you have and compare it to your income. The lower the ratio the better, meaning you have more monthly capital to put toward new debt.

Read Also: How To Report To Credit Bureau As Landlord

Fico Credit Scores Vs Other Credit Scores

While FICO scores dominate the credit scoring business, theyre not the only product out there. The three major credit bureaus launched a competitor, VantageScore, in 2006. Its scores originally ranged from 501 to 900, but VantageScore 3 adopted the same 300-to-850 range as the FICO score. Like the FICO score, it is calculated using information from your credit reports, but it weights the various factors differently.

As with FICO scores, there are several different VantageScores, the most recent being VantageScore 4.0. Some credit card issuers, such as American Express, and other companies that offer free credit scores to their customers provide VantageScores rather than FICO scores.

How To Earn A Very Good Credit Score:

As with borrowers in the excellent/exceptional credit score range, borrowers labeled as “very good” by their FICO;Score will have a solid history of on-time payments across a variety of credit accounts. Keeping them from an exceptional score may be a higher than 30% debt-to-credit limit ratio, or simply a short history with credit.

Read Also: Does Klarna Affect Your Credit Score

How Fico Scores Change

There are multiple iterations of FICO scores, with slight discrepancies between each of them. You can find all 28 FICO scores here.

Approximately every five years, FICO updates its scoring models to create an algorithm that more accurately reflects how responsible consumers are. Factors that may have seemed significant at one point may be disregarded, while others may be deemed more important.

When FICO creates a new scoring algorithm, it can take several years before lenders start using it. For example, FICO 9 was released in 2014, but FICO 8 is still the most common version used by credit bureaus. Most mortgage lenders use even older versions when approving borrowers.

Understanding FICO Scores

Did you know lenders pull different FICO scores when you apply for a car loan vs a home loan? ;And yet another for credit cards? ;And the scores can vary ;Learn more about your FICO credit scores in this guide.

FICO is supposed to release an update later in 2020, but it will likely take several years before lenders and credit card companies start using it to evaluate borrowers.;

FICO score updates can have a small update on your credit score, depending on the update and whats already on your report. For example, unpaid medical bills sent to collections have a lesser impact on credit scores using the FICO 9 model.

If you had an unpaid medical collection, then this update would benefit you.

Is Experian Better Than Credit Karma

While Experian compiles your credit report and determines your credit score, Credit Karma simply shows you credit scores and report information from Equifax and TransUnion.

Think of it this way Credit Karma is like a newspaper that writes about the credit scores other companies give you. But we have no influence over your scores.

Read Also: Does Paypal Credit Report To The Credit Bureau

What Is My Real Credit Score

Companies can choose which score to purchase and use when reviewing applications and managing customers’ accounts, which is one reason there’s competition in the credit scoring world. With this in mind, there isn’t a single, “real” credit score.

For example, when you’re shopping for an auto loan, you may try to get offers from several lenders. One lender might use a FICO® Score 8, another a FICO® Auto Score 2, and a third a VantageScore 4.0. Your scores may vary, but each is very real in the sense that the lender is using it to determine if you qualify for a loan and the rates and terms to offer you.

Generally, you won’t know which of your three credit reports or which credit score a lender will use. However, because credit scores all rely on the same underlying data, building positive credit can help you get good credit scores regardless of the model. Conversely, negative items, such as late payments or a bankruptcy, could hurt all of your credit scores.

Why Is My Credit Score Low

Lower credit scores arent always the result of late payments, bankruptcy, or other negative notations on a consumers credit file. Having little to no credit history can also result in a low score.

This can happen even if you had established credit in the past if your credit report shows no activity for a long stretch of time, items may fall off your report. Credit scores must have some type of activity as noted by a creditor within the past six months.If a creditor stops updating an old account that you dont use, it will disappear from your credit report and leave FICO and or VantageScore with too little information to calculate a score.

Similarly, consumers new to credit must be aware that they will have no established credit history for FICO or VantageScore to appraise, resulting in a low score. Despite not making any mistakes, you are still considered a risky borrower because the credit bureaus dont know enough about you.

Also Check: Speedy Cash Change Due Date

What Makes Up The Fico Credit Score

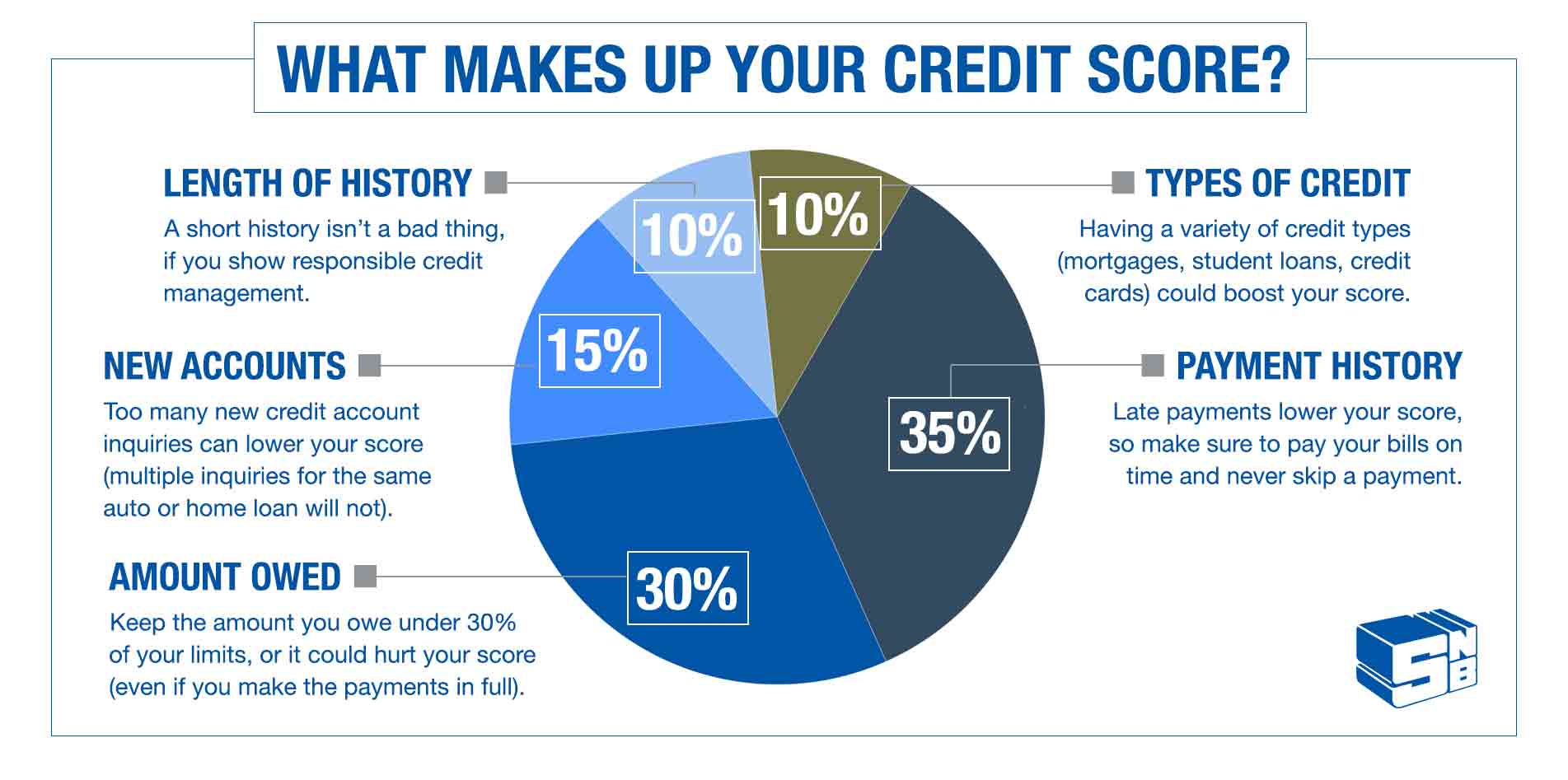

Even though there are slight differences between various FICO models, the main tenets remain the same. The FICO credit score is made up of the following factors:

- On-time payments: 35%

- Recent applications: 10%;

- Having both installment and revolving credit: 10%

If you want to improve your FICO score, pay your bills on time, watch how much available credit is left on your credit cards and avoid opening new accounts.

Be aware that it can take time for your credit score to improve, especially if you filed for bankruptcy or had an account go to collections.

Effects Of A Credit Score On Credit Cards & Loans

Your credit score affects the three most common credit accounts credit cards, car loans and mortgages. Lets take a closer look.

Youll probably get a credit card with any credit score. What will vary dramatically is the type of credit card you will qualify for. Those with excellent credit stand to get the lowest interest rates on a majority of credit cards, which may be as low as less than 10% also. More notably, you will qualify for some of the best rewards credit cards with extra incentives like cash back, hotel stays and airline miles.

If your credit is good, you still qualify for a variety of credit cards. While the rewards cards may not be accessible, you could get 0% introductory APRs, ideally usable for balance transfers.; The interest rate however, could be slightly higher, spiraling to the mid-teens.

Average credit qualifies you for some of the cards with higher interest rates of 20% or above but with certain privileges given by cards to those with good credit.

Bad credit will get you a secured credit card that needs a security deposit which is equal to or greater than the chargeable amount. The credit card issuer can also take away the deposit in case of payment defaults. Even if you get an unsecured card, the credit limit will in all probability be extremely low.

Mortgages

Car loans

How to Build Excellent or Good Credit?

Use credit cards for students: These teach you financial responsibility and come with more lenient terms and reduced fees.

Don’t Miss: Why Is There Aargon Agency On My Credit Report

Length Of Credit History

As a general rule of thumb, the longer an individual has had credit, the better their score. However, with favorable scores in the other categories, even someone with a short credit history can have a good score. FICO scores take into account how long the oldest account has been open, the age of the newest account, and the overall average.

How Can You Improve Your Credit Score

To improve your credit score, you should address each of the factors that go into calculating your score. According to MyFICO.com, those factors are:

5 categories that make up your credit score

Payment History

As you can see from the graphic, the single most important factor is your payment history: Not paying your bills on time can do serious damage to your credit score. Even if youve had some late payments in the past, you can improve your score going forward by paying each and every bill on time.

Amounts Owed

The second most important factor is what you owe. This is calculated as a percentage: the amount you owe divided by the total amount of credit you have available. Its best to keep this under 30% even better if you can keep it under 10%.

So if your total credit line is $10,000, its good to owe less than $3,000 and great if you owe less than $1,000.

Length of Credit History

The next most important factor is the length of your credit history. This is determined by the date you opened your oldest credit account thats still active. Since you cant go back in time and open an account any earlier, the most important thing you can do in this area is to make sure you dont close any of your old accounts.

New Credit and Credit Mix

Finally, accounting for 10% each of your credit score, are your new credit and credit mix.

You May Like: Syncb/ppc On Credit Report

How To Find Out Your Fico Score

The Fair Isaac Corp.s myFICO website offers a free FICO estimator. By accurately completing a series of questions regarding your financial history, its possible to determine an estimate of what your current score is.

Additionally, many financial institutions are part of the FICO Score Open Access program, which allows the institutions to offer customers free access to their FICO scores.

More Accurately Assess Consumer Credit Risk

The FICO® Score is used by lenders to help make accurate, reliable, and fast credit risk decisions across the customer lifecycle. The credit risk score rank-orders consumers by how likely they are to pay their credit obligations as agreed. The most widely used broad-based risk score, the FICO Score plays a critical role in billions of decisions each year.

Also Check: Does Paypal Credit Report To Credit Bureaus

Is A Fico Score The Same As A Credit Score

As with all credit risk scores, FICO® Scores predict the likelihood that someone will fall 90 days behind on a bill within the next 24 months. FICO® does this using complex algorithms based on information in your from each of the national credit bureaus: Experian, TransUnion and Equifax.

FICO® periodically releases new versions of its scores, and it creates different versions of its scores to work with each bureau’s databases, which is why there are many FICO® Scores. Other companies, including VantageScore®, also create credit risk scores that similarly analyze consumer credit reports to calculate scores.

FICO® and VantageScore credit scores range from 300 to 850, and group consumers by . For example, a FICO® Score of 800 to 850 is considered “exceptional.” However, even if they use the same range and information from the same credit report, each scoring model takes a unique approach that may result in a different score.

FICO® also creates other types of scores that are based in part, or entirely, on your credit reports. For example, FICO® offers and bankruptcy scores, which try to predict the chance you’ll file an insurance claim or declare bankruptcy, respectively.

Why Does My Credit Score Show Different On Sites

Your score differs based on the information provided to each bureau, explained more next. Information provided to the credit bureaus: The credit bureaus may not receive all of the same information about your credit accounts. Surprisingly, lenders arent required to report to all or any of the three bureaus.

Read Also: Credit Score 584

What Is Fico Score 9and How Does It Differ From Ficos Previous Credit Scoring Models

Now, heres when things get a tad trickier. But lets try to explain things as plainly as possible: theres no one uniform FICO credit scoring model thats used to calculate scoresthere are, as of writing, 10 FICO credit scoring models in total. They are knownand writtenas FICO Score 2, FICO Score 4, etc, or simply just as FICO 2, FICO 4, and so on.

To elaborate further, each FICO credit scoring model determines credit scores slightly differently, and its been stated by CNBC that FICO Score 2, 4, and 5 are commonly used by banks when it comes to home mortgages. But for auto loans and card lending for instance, FICO Score 8 is the wider used model according to ValuePenguinat least for now it is.;

It can take a long time before lenders and credit decision-makers switch to a newer credit scoring model released by FICO. This brings us nicely onto FICO Score 9…;

FICO Score 9 is a credit scoring model introduced to lenders in 2014 and consumers in 2016. Its the second-latest FICO credit scoring model, as 10 was introduced in early 2020. What makes FICO Score 9 particularly interesting, though, are the changes when it comes to paid collection accounts, unpaid medical accounts, and home rental payments:

Ultimately, FICO Score 9 includes what the folks at FICO call enhancements to make sure this credit scoring model is as predictive as possible when it comes to credit scores.;

What Information Credit Scores Do Not Consider

FICO® and VantageScore do not consider the following information when calculating credit scores:

- Your race, color, religion, national origin, sex or marital status.

- Your age.

- Your salary, occupation, title, employer, date employed or employment history.

- Where you live.

- Soft inquiries. Soft inquiries are usually initiated by others, like companies making promotional offers of credit or your lender conducting periodic reviews of your existing credit accounts. Soft inquiries also occur when you check your own credit report or when you use from companies like Experian. These inquiries do not impact your credit scores.

You May Like: Speedy Cash Repayment Plan

How Many Different Credit Scores Are There

Thats a loaded question! Since we have already said that FICO and VantageScore are the ones most widely accepted as being accurate, we will focus on those two. But as I mentioned above, there are hundreds variations of scores used in scenarios as varied as approving casino credit to pricing your auto insurance policy.

Where this all gets very confusing is when we start talking about the versions of each score. FICO in particular can be hard to nail down since your score depends on only one credit report. This means you have a different FICO score from each of the three bureaus in every version. FICO also has industry-specific versions, making it all the more confusing. And dont forget those four versions of VantageScore.

Recommended Reading: Mprcc On Credit Report

What Is A Good Credit Score For My Age

Your age doesnât directly influence your credit scores. But as FICO and VantageScore show, the age of your credit accounts is one factor that affects how scores are calculated.;

That could be a reason peopleâs credit scores tend to increase as they get older. Their accounts have simply been open longer. But credit scores can rise or fall no matter how old you are. And having good credit scores comes down to more than just your age.

Recommended Reading: Why Is There Aargon Agency On My Credit Report