Tips For Building Business Credit With Credit Cards

If one of your goals is a good business credit rating, consider getting a business credit card. Many entrepreneurs think their business has to be well-established and profitable to qualify, but that is not always the case. Card issuers are often more interested in the personal credit score of the owner who applies, and will often consider income from a variety of sources, not just the business itself.

To build strong business credit using a business credit card, make sure you:

This article was originally written on February 6, 2018 and updated on April 1, 2021.

Where We Got The Data

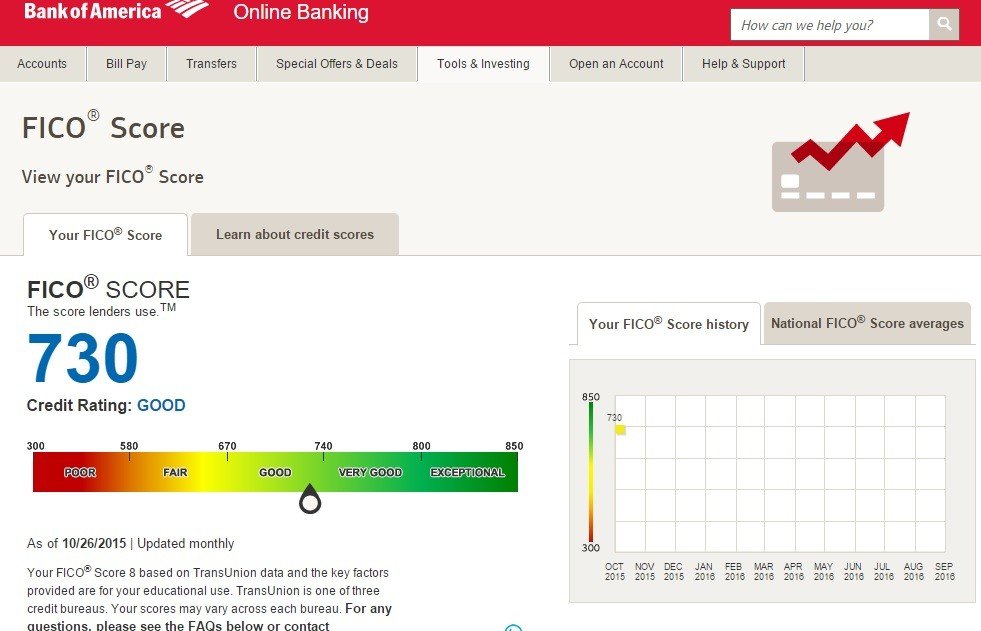

Applying for a credit card is already an unclear process a lot of the time, so youre probably not surprised to hear that banks dont tell you or us which credit bureaus it uses to make lending decisions. That means we can only gather this information from people who actually applied for cards from Bank of America.

When you apply for a credit card, the lender will pull a copy of your credit report from a credit bureau. Credit bureaus keep a record of the number of hard pulls on your credit for two years. Each hard pull reduces your credit slightly. This is because applying for a lot of loans at once is a sign of poor financial health.

Because you can see hard pulls appear on your credit report, you can know which credit bureau a lender pulled your report from. The pull will simply show up in one report, but not the others.

We used the CreditBoards.com database to gather much of this data. People submit their credit application results on the website so others can gauge their odds of getting approved for a card. We chose to use just the last two years results to give you the most up-to-date information.

Bofa Securities Inc Further Information

“Bank of America Merrill Lynch” is the marketing name for the global banking and global markets businesses of Bank of America Corporation. Lending, derivatives and other commercial banking activities are performed globally by banking affiliates of Bank of America Corporation, including Bank of America, N.A., member FDIC. Securities, strategic advisory, and other investment banking activities are performed globally by investment banking affiliates of Bank of America Corporation , including, in the United States, Merrill Lynch, Pierce, Fenner & Smith Incorporated, BofA Securities, Inc. and Merrill Lynch Professional Clearing Corp., all of which are registered as broker-dealers and members of FINRA and SIPC, and, in other jurisdictions, by locally registered entities. BofA Securities, Inc. and Merrill Lynch Professional Clearing Corp are registered as futures commission merchants with the CFTC and are members of the NFA. Investment products offered by Investment Banking Affiliates: Are Not FDIC Insured May Lose Value Are Not Bank Guaranteed.

Recommended Reading: Why Is My Credit Score Different On Different Sites

Increase Your Credit Limit

Relatedly, increasing your credit limit means your existing debts will be a smaller percentage of your total available credit. This will improve your credit score.

Most credit card companies let you request a limit increase online, though some will make a hard pull on your credit, lowering your score.

Place A Credit Freeze

Contact each credit reporting agency to place a freeze on your credit report. Each agency accepts freeze requests online, by phone, or by postal mail.

Experian

PO Box 26Pittsburgh, PA 15230-0026

Your credit freeze will go into effect the next business day if you place it online or by phone. If you place the freeze by postal mail, it will be in effect three business days after the credit agency receives your request. A credit freeze does not expire. Unless you lift the credit freeze, it stays in effect.

Don’t Miss: Is 819 A Good Credit Score

Why Does This Matter To Consumers

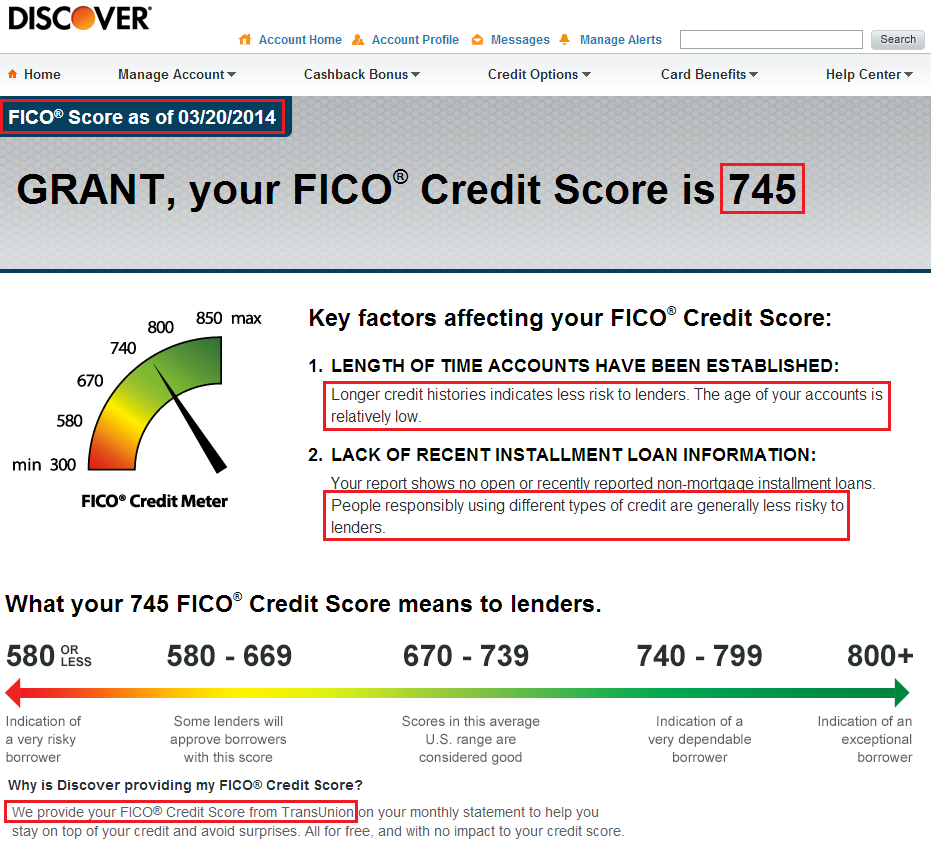

If it were up to a credit card applicant to decide, they obviously would want a card issuer to pull a report that contains the most favorable information most notably their credit score.

However, an applicant has no say in the matter. Therefore, a card issuer could pull your report from Experian, for example, and it shows a credit score of 680, while your Equifax report puts your score at 700 and your TransUnion report puts it at 710.

As such, the Experian report indicating a credit score of 680 might lead to less desirable terms, such as a higher APR for a credit card.

Ted Rossman, industry analyst for CreditCards.com, says which credit bureau is used also might come into play if youve set up a credit freeze with one bureau but not the two others.

Furthermore, he says, one or more credit bureaus might supply inaccurate information such as a late payment on a credit card account when you actually had no late payments that could hinder your ability to get credit.

EDITORIAL DISCLOSURE All reviews are prepared by CreditCards.com staff. Opinions expressed therein are solely those of the reviewer and have not been reviewed or approved by any advertiser. The information, including card rates and fees, presented in the review is accurate as of the date of the review. Check the data at the top of this page and the bank’s website for the most current information.

What Is A Credit Score

It’s a three-digit snapshot of your credit file at one of the three major consumer reporting agenciesEquifax, Experian and TransUnionthat is compiled at a particular time. It provides financial companies with information to make lending decisions. It also influences your interest rate & other loan terms.

Don’t Miss: Is 517 A Good Credit Score

Will My Business Credit Card Activity Affect My Personal Credit

Most small business credit cards require the business owner/cardholder to personally guarantee the debt. That means that if the balance isnt paid off through the business, the owner will be on the hook for the entire amount. That also means business account activity may spill over to the owners personal credit reports, depending on each card issuers policy.

Some card issuers only report activity to the cardholders personal credit reports if the owner defaults. Others will report all activity, whether it is positive or negative.

Hypothetical Or Past Performance

Hypothetical or simulated performance results have inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not actually been executed, the results may have under or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated trading programs in general are designed with the benefit of hindsight. Past performance is not indicative of future results no representation is being made that any account will or is likely to achieve profits or losses similar to those shown.

You May Like: What Credit Score Do You Need For Amazon Prime Visa

Bank Of America Business Credit Card Benefits

In addition to the perks associated with each individual card, here are the benefits youll receive with all Bank of America® small-business credit cards:

-

Employee cards: Get cards for your employees and set individual spending limits.

-

Cash management tools: Download transactions into QuickBooks, make automatic payments and take advantage of other online services to manage your finances.

-

$0 liability guarantee: Zero liability for unauthorized transactions. Additional terms and conditions apply.

-

Chip cards: Insert your card or tap to pay where you see the contactless symbol.

-

Overdraft protection: Optional service to link your Bank of America® business checking account to prevent overdrafts, declined purchases or returned checks.

-

Paperless statement option: Opt for online statements instead of paper statements.

-

Online and mobile banking: Manage your account 24/7, no matter where you are.

-

Travel and emergency services: Access to a minimum of $100,000 in travel accident insurance, auto rental insurance, emergency ticket replacement and lost-luggage assistance associated with your card.

When Do Credit Card Companies Report To Credit Bureaus

One reason theres so much confusion about when report to credit bureaus is that theres no clear-cut, universally applicable answer .

The good news? There are trends to look at that can help inform us as consumers.

Your balances are normally reported to credit bureaus on your statement date, says Tina Endicott, vice president of marketing and business development at Partners Financial Federal Credit Union. However, she notes, it may take a few days or even a week for the bureau to update your information.

This may depend on the bureau. Experian, for example, claims that your credit report shows the balance on your credit card at the moment it is reported by your lender . But different bureaus may update at different speeds and frequencies.

And while you can generally expect that your credit card activity will be reported to the bureaus at the end of your billing cycle, its not a hard-and-fast rule.

How often credit card companies report to the nationwide consumer reporting agencies depends on the , explains Nancy Bistritz-Balkan, director of public relations and communications at credit bureau Equifax.

It can be anywhere from quarterly to daily for an individual consumers information, depending on the choices and practices of the lender or creditor, she says. Most lenders and creditors report information at least once a month.

Recommended Reading: Does Moneylion Report To Credit

How Often Do Credit Reports And Scores Get Updated

The next logical question is, when your credit card issuer sends the information to a credit bureau, when does it appear on your credit report?

Generally, you can count on your information to be added to your credit report as soon as the bureau receives it. According to TransUnion, when the credit bureaus receive information regarding your accounts, they typically add it to your credit report right away.

Your credit scores are calculated based on the data in your report every time a creditor requests them. However, you probably shouldnt expect any dramatic changes every time your credit issuer reports your most recent payment. Building credit can be a lengthy process that requires patience, but if you pay on time every time, youll see the results.

Your credit score isnt guaranteed to change with every timely payment.

Brian Martucci, credit expert at Money Crashers

Credit scores update when the information used to calculate them changes enough to produce a different result, Brian Martucci, credit expert at Money Crashers, explains. In other words, your credit score isnt guaranteed to change with every timely payment.

That might not be the case with late payments. Whenever a delinquency appears on your credit file, it can significantly hurt your credit. The longer the debt goes unpaid, the more damage it can do to your scores.

See related: How long does a late payment stay on your credit report?

Bank Of America Business Advantage Travel Rewards World Mastercard Credit Card

Our pick for: Travel rewards

This is the business version of the issuer’s excellent no-annual-fee travel card. The Bank of America® Business Advantage Travel Rewards World Mastercard® credit card pays solid rewards on every purchase and gives you wide flexibility in redeeming your points for any travel purchase, without the restrictions of branded airline and hotel cards. Read our review.

Also Check: How To Get My Credit Score Up Fast

Why Isn’t The Account Showing Up

Issuer and credit bureau policies can give you a good basic understanding about why a tradeline may or may not be included on your authorized users credit reports. But aside from the exceptions laid out in these policies, here are a few other reasons an account might be MIA:

Your issuer doesnt report any authorized user activity. While its common for issuers to report authorized user accounts, its not mandatory. In some cases, although rare, lenders may choose not to report authorized user accounts, says Rod Griffin, the director of consumer education and awareness at Experian, in an email.

You left out required information when creating the account. Under the National Consumer Assistance Plan, an initiative launched by the three major credit bureaus, lenders reporting to credit bureaus must report certain information about authorized users, including their date of birth. While you might be able to add someone to your account without providing this information initially, it wont be reported to credit bureaus unless you include this information. For example, AmEx notes that you can add an additional cardholder without providing their date of birth or Social Security number, but if that information isnt added within 60 days, the additional card would be closed.

About the author:Claire Tsosie is an assistant assigning editor for NerdWallet. Her work has been featured by Forbes, USA Today and The Associated Press. Read more

What Is Rapid Rescoring

Rapid rescoring may be useful if youre trying get approval for a credit product, typically a mortgage, and your credit score is close, but not at a lender requirement. If youve recently made positive credit moves but theyre not yet reflected on your reports, lenders can request the information be added. This can result in your report and score being updated within a few days instead of having to wait for the next cycle. Its important to note that:

- You arent able to request a rapid rescore on your own.

- A lender must request one on your behalf and theres usually a fee for the service.

- A rapid rescore cant fix previous mistakes or make negative information disappear.

If youve been working hard to improve your credit health, it can be frustrating to feel your positive progress hasnt been recognized. Ultimately, you may just need to wait for your lender to provide the updated information. In the meantime, keep that momentum going with additional healthy credit habits. If youre looking for other ways to improve your credit health, gives clear, actionable recommendations based on your credit data to help you earn the credit score you want.

What You Need to Know:

There are various types of credit scores, and lenders use a variety of different types of credit scores to make lending decisions. The credit score you receive is based on the VantageScore 3.0 model and may not be the credit score model used by your lender.

*Subscription price is $24.95 per month .

Recommended Reading: How Bad Is A 500 Credit Score

Business Credit Report Vs Personal Credit Report

Aside from the personal credit report of each individual, every business has a credit report that records the credit accounts connected with it. When applying for a business credit card, the business report is often referenced in the card approval process to augment information on the business. Things like size and age of the business can be gleaned from the report.

The business credit report is not typically used in the decision for approval since the data there is fuzzy and lacking. Even someone who doesnt have any reporting on their business can get approved for a business credit card based on their personal credit worthiness. After getting a business card, most banks will report the new business and associated account to the business credit bureau, and a business credit report is thus established.

While most banks will report a business credit card on your business credit report, many will not report it on the all-important personal credit report .

Even reporting on the business credit report is inconsistent, though. Some banks will report to all bureaus while others will only report to one. Amex officially says that they report business cards to the business, but from what Ive heard, they dont report at all to business bureaus .

Check Your Credit Reports For Updates

It may take some time for your credit reports to be updated. Creditors can take up to 45 days to send a credit bureau new information, according to TransUnion. If the information isnt updated after 45 days, contact the credit bureaus or data furnisher again to see why inaccurate information is still being reported.

Recommended Reading: How Long Do Medical Collections Stay On Your Credit Report

How Long Will Negative Information Remain On My Credit File

It depends on the type of negative information, but here’s a breakdown:

- Late payments: seven years.

- Bankruptcies: seven years for a completed Chapter 13 & 10 years for Chapter 7 and 11.

- Foreclosures: seven years.

- Collections: about seven years, depending on the debt’s age.

- Public records: usually seven years, although unpaid tax liens can stay there indefinitely.

Which Credit Cards Can Help Me Build Business Credit

Advertiser & Editorial Disclosure

Small business credit cards offer myriad benefits: rich rewards and cards with limits that are often higher than on personal cards. Plus, theres an added bonus that small business owners dont always recognize at first: A business credit card may help you build business credit.

In fact, getting one of these cards may help put your business on the map when it comes to building business credit, provided the card issuer reports information to commercial credit agencies. Not all cards have the same policy when it comes to reporting to business credit bureaus, though, and its important to understand how each one works.

Don’t Miss: How Long Does A Repo Stay On Your Credit Report

Why You Can Trust Bankrate

At Bankrate, we have a mission to demystify the credit cards industry regardless or where you are in your journey and make it one you can navigate with confidence. Our team is full of a diverse range of experts from credit card pros to data analysts and, most importantly, people who shop for credit cards just like you. With this combination of expertise and perspectives, we keep close tabs on the credit card industry year-round to:

- Meet you wherever you are in your credit card journey to guide your information search and help you understand your options.

- Consistently provide up-to-date, reliable market information so you’re well-equipped to make confident decisions.

- Reduce industry jargon so you get the clearest form of information possible, so you can make the right decision for you.

At Bankrate, we focus on the points consumers care about most: rewards, welcome offers and bonuses, APR, and overall customer experience. Any issuers discussed on our site are vetted based on the value they provide to consumers at each of these levels. At each step of the way, we fact-check ourselves to prioritize accuracy so we can continue to be here for your every next.