Build Your Credit Mix

We generally dont recommend taking out a potentially expensive loan just to build your credit scores. But its true that having a mix of different types of credit can benefit your scores over the long term. Types of credit include revolving credit and installment credit .

But theres a wrinkle: Applying for new credit can lead to a hard inquiry on your credit reports, which can have a negative impact on your scores. While this impact is typically minor, too many hard inquiries in a short time period can be a red flag to lenders. Thats why its important to have a general sense of how likely it is that youll be approved before you apply for a credit card or loan.

Who Calculates Your Credit Score

Your credit score is calculated by a credit reference agency . There are 3 CRAs in the UK: Equifax, Experian and TransUnion. At ClearScore, we show you your Equifax credit score, which ranges from 0 to 700.

Each CRA is sent information by lenders about the credit you have and how you manage it. Other information, such as public records like the electoral roll and court judgments, are also sent to the CRAs and form part of your credit report.

How To Get A 700 Credit Score

While theres no exact formula to achieve a specific score, you can aim to get within a general score range. Even taking the different credit scores and definitions of good credit into account, there are general principles that can help you build and maintain healthy credit. Sticking to these principles over time can raise your scores, making you a better credit risk in lenders eyes.

Here are some actionable tips to help you stay on top of the important factors that can affect your credit.

Don’t Miss: What Credit Bureau Does Paypal Use

Keep Your Credit Utilization Rate Low

Your credit utilization rate is the percentage of your available credit that you use. The usual recommendation is to keep your credit utilization rate below 30% in other words, using less than 30% of your available credit at any given time. Generally speaking, the less available credit you use , the better.

If you check your credit reports and find that you have a credit utilization rate higher than 30%, you have options to lower it, such as paying down debt or increasing your credit limits. To increase your credit limits, youll need to ask your current lenders for a limit increase but be aware that this could result in lenders doing a hard inquiry on your credit when they make their decision.

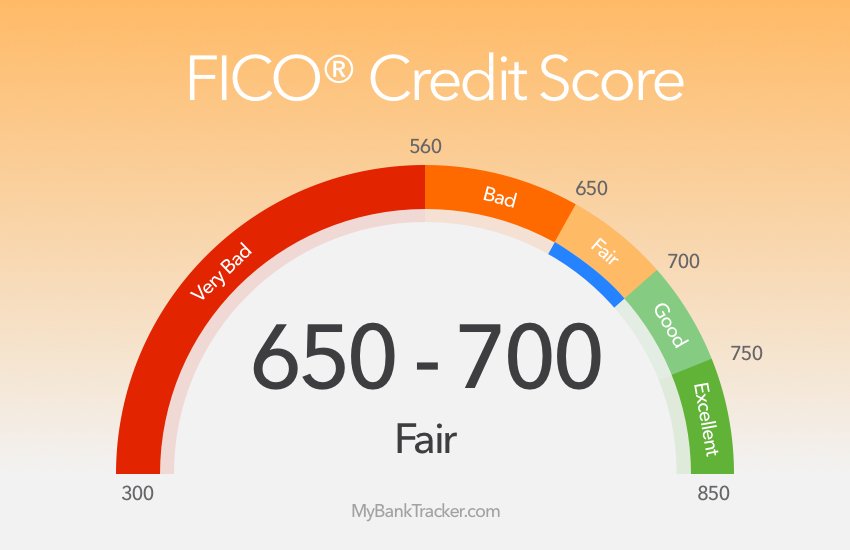

Is A 700 Credit Score Good

As you can see from the credit score range chart, FICO views a 700 as right between good/average credit and actually good credit. So technically a 700 would be a good score. Remember though, that one score of 700 does not automatically mean you have good credit. Person A in the story above has more average credit based on the 3 numbers, while person B has good credit. The issue however, is that everyone is always hoping to have better credit. So even though person B has good credit even with their low score being 700, they also had a score of 750, which made them hope that they could fall into the excellent credit category and get excellent interest rates. This is why it is important not to compare to others . In comparison to person A, person B should be happy, but if person B doesnt settle for the good range then person B can work on raising their credit score averages to an even higher level.

You May Like: What Company Is Syncb Ppc

Capital One Venture Rewards Credit Card

The cards annual fee is $0 for the introduction in the first year. Afterwards, you will be paying $95 as the yearly fee. The APR ranges between 17.24% 24.49% of which it is variable. Again, there is a 0% introductory APR on this card.

Also, you will receive 50,000 bonus miles when you spend $3,000 on purchases in the first three months. The points will be worth $500, which can be useful for travel expenses. Another benefit is unlimited 2X miles per dollar on every purchase you make every day. Lastly, enjoy free foreign transactions. Note that the card is basically for travel and benefits come upon using it as you travel. Learn more.

Auto Loans For Good Credit

The best rates for auto loans are typically available to people with good-to-excellent credit, but what good credit means to auto lenders can vary. Beyond the base credit-scoring models like FICO and VantageScore, there are also industry-specific scores that lenders could check, such as FICO® Auto Scores.

Even though you may not know which specific score a lender will use, its still a good idea to have an understanding of your overall credit health when shopping around. You can check your credit from Equifax and TransUnion for free on . You can also periodically get a free credit report from each of the three main consumer credit bureaus from annualcreditreport.com.

And yes, its important to shop around! Take some time to compare offers to find the best terms that could be available to you. In particular, the rates offered at car dealerships may be higher than rates you might be able to find at a bank or credit union, or with an online lender.

If youre shopping around for auto loan rates, consider getting preapproved to boost your negotiating power when youre at the dealership. A preapproval letter can be a great way to show car dealers youve done your homework and wont accept a subpar financing offer. Just be aware that it can result in a hard inquiry, which can temporarily ding your credit.

And if you already have a car loan but youve improved your credit since you first got it, you might be able to find a better rate by refinancing.

Recommended Reading: How To Remove A Repo From Credit

How To Raise Your Credit Score

While a 700 credit score can help you qualify for a mortgage, you might get better loan terms by boosting your score which could save you thousands of dollars over the life of the loan.

If youve been monitoring your credit, you have a good idea of where your credit score stands.

Here are some ways you can improve your credit scores:

- Pay down your debt balances.

- Always make payments on time. Automatic payments or monthly alerts can help.

- Become an authorized user on someone elses credit card account.

- Only open credit accounts that you need.

- If some of your accounts are delinquent or you have a large amount of debt, consider contacting a credit counseling agency.

Why Does It Take Time To Build Excellent Credit

When you are just starting to build a credit score, time doesnt work in your favor. Lenders want to see good behavior over time, which is much of what FICO scores take into account:

Proof that you make payments on time and dont carry large balances on credit cards makes you a less risky, more trustworthy credit user in the eyes of lenders. Those responsible behaviors carry more weight when demonstrated over time, too, which is why building a good credit score from scratch doesnt happen overnight.

Also Check: Is Creditwise Good

What Is A 700 Credit Score

Contents

A credit score of 700 or more is generally considered favorable for a score ranging from 300 to 850.On the same scale, a score of 800 or more is deemed good.The majority of people have credit scores ranging from 600 to 750.The average FICO® Score in the United States in 2020 was 710, up seven points from the previous year.Creditors may be more confidence in your ability to repay future obligations if your score is higher. When reviewing consumers for loans and credit cards, creditors may define their own standards for what they regard to be good or negative credit ratings.

This is dependent on the types of borrowers theyre looking for.Creditors may also consider how current events may affect a customers credit score and change their requirements accordingly.

Some lenders design their own unique credit rating programs, however the FICO® and VantageScore® credit scoring models are the most widely utilized.

What Does A 700 Credit Score Mean And How It Affects Your Life

Having a 700 FICO score means that you are in a good position when trying to obtain credit. You will not have to use expensive dealer finance when trying to buy a car, you will be in a very strong position when applying for a mortgage and you will be able to get a large monthly limit on any credit cards.

However, you probably will not have access to the most exclusive offers and lowest cost finance rates which would be reserved for those in the excellent credit score group. They would not only be able to obtain cheaper finance, but also take out that finance over a longer period which reduces the size of the monthly payment that needs to be made.

Therefore, if you have a credit score of 700 it is worth trying to push it higher. Financial institutions use computer programs to make lending decisions. Moving your credit score higher means that the automated decision making in place will allow the credit professional you are dealing with to advance you more credit at a lower rate.

Financial institutions have a fixed amount of money they can lend to borrowers in each credit score category. This is known as their Risk Appetite. The limits and measures here are approved by the lenders Board of Directors so these limits are firm and cannot be changed easily.

The lending limits are generally higher the better the credit score of the borrower, so someone wishing to borrow a large amount had better have the best credit score possible.

You May Like: What Is Aargon Agency

Recommended Reading: Check Credit Score With Itin

Mortgages And A 700 Credit Score

As mentioned, mortgages can be significantly harder to qualify for, especially if you dont have stellar credit. Most traditional mortgage lenders want you to have a credit score of at least 680 before theyll approve you for a decent loan and rate. To be eligible for the best mortgage conditions possible, a minimum credit score 750 is ideal.

Dont forget that your credit score is only one piece of the puzzle when it comes to getting approved for a mortgage. You will need to pass the stress test, have an adequate down payment of at least 5%, have a manageable debt to income ratio, just to name a few requirements.

Lower Your Credit Utilization Rate

A high ratio of debt to credit can negatively affect your credit score. You can either pay off this debt or apply for a credit increase to reduce your utilization rate. Another way to do this is by paying your credit cards off early each month so that your posted balance is lower than your spending for the month.

You May Like: Affirm Virtual Card Walmart

Best Mortgage Types For A 700 Credit Score

FICO says a 700 score is, near or slightly above the average of U.S. consumers.

And, says FICO, most lenders consider this a good score. That includes mortgage lenders.

So provided you have a steady income and manageable existing debt burden, you stand a good chance of being approved for most types of home loans.

When choosing the right one for you, think about your priorities. Do you want:

- The lowest rate?

- No mortgage insurance?

- An extra-large loan?

Each loan type offers unique benefits to help you meet one or more of these goals.

Here are some of your best options:

Conventional mortgage

A conventional mortgage is often best for those with a credit score of 700 or higher. .

Benefits of a conventional loan include:

- Buy a house with as little as 3% down

- Low rates, especially with a higher credit score

- Higher loan limits than FHA

- Option to avoid mortgage insurance or cancel it later

The big benefit of choosing a conventional loan over an FHA loan is that mortgage insurance can be canceled later on, which will reduce your monthly payments.

And if you make a 20% down payment with a conventional loan, you wont have to pay for mortgage insurance at all.

Pretty much all lenders offer conventional loans, so youll have your pick of the market and the flexibility to shop for lower rates.

VA loan

For those who do qualify, VA loans are often the best possible deal.

Jumbo loan

USDA loan

FHA loan

Blue Cash Preferred Card From American Express

Earn up to 6% cash back on everyday expenses with the Blue Cash Preferred® Card. Right now, the card offers 6% cash back on groceries and streaming services, 3% cash back on transportation expenses and gas and 1% cash back on other purchases. Along with that, the card has an intro APR of 0% for the first 12 months and users can earn a $300 statement credit if they spend $3,000 in purchases in the first 6 months. After the first year, users must pay an annual fee of $95. To get this credit card, youll need to have a credit score of about 700 or higher.

Also Check: What Is Syncb Ntwk On Credit Report

Frequent Credit Card Use Is Required To Take Full Advantage Of Rewards

Depending on the rewards offer, earning them can be a bit complicated. It may be easy in the first year, due to a generous sign-on bonus. But the ongoing rewards arent always so easy.

Take travel rewards, for example. If a travel rewards card offers two points for every $1 you spend, youll have to spend $1,000 per month to earn 2,000 points. In one years time, you can earn 24,000 points spending at that level, equal to $240 in travel purchases.

But the critical connection is being able to spend at that level every month. If you dont normally use a credit card, you may not accumulate a meaningful number of points.

Dont Apply For Lots Of New Credit Cards

When you apply for a new credit card or loan, the issuing bank will check your credit, which is considered a hard inquiry. Hard inquiries will cause your credit score to dip temporarily. Itll bounce back as time passes and more positive behavior is reported. However, if you are already starting from scratch, even a slight dip of five to 10 points can be significant. Plus, credit bureaus keep tabs on how many times you apply for new lines of credit. Too many hard inquiries on your credit report can be a sign that you are desperately seeking credit and pose a risk to lenders.

You May Like: How To Get A Repo Off Your Credit

Where To Go From Here

Its important to pay down your balances and keep your credit utilization under 30%. Its also wise to have a mix of installment and revolving accounts.

Of course, you also want to make sure you are making your payments on time from here on out. Even one late payment can be very damaging to your credit.

Length of credit history also plays an important role in your credit score. You want to show potential creditors that you have a long, positive payment history.

Building excellent credit doesnt happen overnight, but you can definitely speed up the process by making the right moves.

Give Lexington Law a call for a free credit consultation at and get started repairing your credit today! The sooner you start, the sooner youll be on your way to having excellent credit.

Categories

Credit Score Mortgage Rate: What Kind Of Rates Can You Get

With a credit score of 700, youll likely qualify for a mortgage and get a good interest rate potentially saving thousands of dollars over someone with a lower score.

Kim PorterUpdated April 28, 2021

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as “Credible.”

While people with higher credit scores tend to get better terms on their mortgage, you dont have to aim for the highest score possible.

Every mortgage program has its own minimum credit score requirements, and with a 700 credit score, youre likely to qualify for a loan and snag a good interest rate.

Heres what you need to know about credit scores of 700 or higher:

Don’t Miss: Does Klarna Affect Your Credit Score

Only Charge What You Can Afford

Credit cards are a tool, not an excuse for a shopping spree. If you open a card to start building a credit score, use it for small purchases that fit your budget and pay the card off in full each month. Regular use and full payment are important, because your credit utilization ratiothe proportion of debt compared to available creditis the second biggest factor impacting your credit score.

Capital One Venture Card

If youre an avid traveler, the Capital One Venture can help you to save on your next adventure. A credit card for people with at least a 700 credit score, the Venture card allows clients to use Venture miles for any charge that has to do with travel. That means miles can be used for more than just airfare. They can be used for things like hotel or cruise reservations, train tickets, travel agent fees and more. Theres an annual fee of $95, but users can rack up savings quickly with 2 miles earned for every $1 spent. Theres typically an initial bonus when you sign up, too. At the time of this writing, new users can earn up to 100,000 bonus miles by spending $20,000 on purchases in the first 12 months.

You May Like: When Do Companies Report To Credit Bureaus