How To Access Your Credit Report For Free

Every consumer has more than one credit report because Canada has two main credit bureaus Equifax and TransUnion. Both bureaus produce credit reports and lenders will access both files. Credit bureaus charge for instant service, but if you are patient, you can receive your credit reports for free by mail.

Prepare photocopies of two pieces of government ID and download request forms from TransUnion and Equifax. You should receive your credit report within a week or two.

Mistakes On Credit Reports After Completion Of A Consumer Proposal

Unfortunately, it is not uncommon to find mistakes on your credit report after youve completed the consumer proposal. Its advisable to get the inaccuracies resolved as soon as you can, so your credit report reflects the correct and most updated picture. After all, upon completion of a consumer proposal, youre looking forward to a fresh and optimistic start and rebuilding your credit. Both Equifax and Transunion have processes in place to correct erroneous information on your credit report in Canada.

So be sure to examine your credit reports and check whether creditors are reporting any previously owed figures as fulfilled or still pending. If you find any discrepancies, you can initiate a rectification by submitting a correction request to Equifax or TransUnion . The request must include a completed Credit Investigation Request Form along with any pertaining documents as evidence to substantiate your request.

How Many Hard Inquiries Is Too Many

The effect of a hard inquiry on your credit scores ultimately depends on your overall credit health. In general, adding one or two hard inquiries to your credit reports could lower your scores by a few points, but its unlikely to have a significant impact.

Having a lot of hard inquiries within a short time frame though will likely have a greater impact on your scores. This is because lenders and in effect, credit-scoring models look at multiple credit applications in a short amount of time as a sign of risk. Though there can be exceptions when youre shopping for specific types of loans, like car loans, student loans or mortgages.

Recommended Reading: How To Unlock Experian Account

How To Check Your Credit Score

To check your credit score and credit report, visitEquifax Canada orTransUnion Canada. It’s best to check your credit report with both credit bureaus, since some lenders might only pull your credit report from one or the other.

According to Loans Canada, TD Canada Trust, CIBC, HSBC, Desjardins, and Meridian Credit Union exclusively use Equifax Canada.

Banks that solely use TransUnion include RBC, Laurentian Bank, and Vancity.

Some banks freely choose between either or both Equifax and TransUnion, and this includes BMO, Scotiabank, Tangerine, and National Bank.

Besides Equifax and TransUnion, you can also get your credit score online for free from third parties. Some of Canadas major banks also allow clients to check their credit score for free. It would be a good idea to check your credit score and review your credit report with different free credit score providers, as they will use only one credit bureau.

For example, if you only check your credit score from a free provider that uses Equifax, you might not be getting the full picture of your credit if your mortgage lender uses only TransUnion. Data can differ between credit bureaus, as creditors might choose to only report to one bureau, so checking from multiple sources can help alert you to any discrepancies early.

Q: What Are Consumer Proposals

Consumer proposals are legal agreements set up by licensed insolvency trustees. These trustees create proposals for your creditors where they agree, letting you pay off a percentage of your debt.

Equifax is known to remove consumer proposals from credit reports three years after paying off all debts included in your proposal.

Meanwhile, TransUnion removes consumer proposals from credit reports either:

- After three years of paying off all debts included in the proposal, or

- After six years of you signing the proposal

Also Check: Does It Hurt Your Credit Score To Increase Your Credit Limit

What If I See Something On My Report That Shouldnt Be There

When you get and read your credit report from Borrowell, you might see something that doesnât look right! If itâs regarding a specific item, we recommend contacting the credit grantor or collections agency. If itâs regarding incorrect personal information, such as your date of birth or your address, please contact Equifax directly. You can reach them here: +1-866-828-5961. Here at Borrowell, we canât change or modify any information on your credit report.

Q: How Long Does Good Credit Information Stay On My Credit Report

There is good news to this article, dont worry. Good credit remains on your report for much longer, unlike bad credit does. It will keep any on-time, paid-off credit account in good standing on your information for as long as twenty years.

The majority believe it is terrible to have past credit history on your account for long periods. Contrary to that popular belief, thats not the case. Instead, this is precisely the type of information you would want to reflect on your account since it shows lenders your vast financial experience and how responsible you are in loan management. On your credit report, you should strive for a long, positive, and ongoing credit history.

Also Check: How To Remove Items From Credit Report After 7 Years

Ontario Debt Collection Statute Of Limitations

Home \ Debt \ Ontario Debt Collection Statute of Limitations

Join millions of Canadians who have already trusted Loans Canada

Managing and controlling your debts are very important things in life. You never want to take on more debt than you can afford and always want to make sure your regular payments are within your budget. Its all too easy to get caught up adding more debts than you can afford.

Already in debt? Here are some loans and programs to help you get out.

Of course, you could just opt to never take out a loan and never rack up debt, but for most people, that would mean never getting a house or a car. Plus, loans can be a great way to get extra cash whenever you need it, and it is easy to find affordable loans in todays marketplace. As long as you do your research and have a budget laid out, getting a loan shouldnt be an issue.

However, problems can begin to arise when you start to become delinquent on your debts and stop making payments. Not only will you begin to incur a variety of fees, the debt will begin to affect your and . On top of this, there is a chance that the lender could enlist the services of a debt collection agency to push you to pay off your debts. So, before we go any further, what exactly is a debt collection agency?

What happens if you stop paying your credit card bills? Find out here.

When Your Debt Disappears From Your Credit Record

Debt does eventually disappear from your credit history, in most cases. Equifax and TransUnion only keep record of delinquent amounts for six to seven years from the last payment or default date, according to CreditCards.com Canada.

However, nothing prevents a collection agency from digging up forgotten debt and reporting them to the credit bureaus again, said Gowling.

Around two years ago, he saw a case in which a company started demanding payment for an Eatons card.

WATCH: 5 things you can do to improve your credit score

You May Like: Is 672 A Good Credit Score

Contact The Credit Bureaus

Both Equifax Canada and TransUnion Canada have forms for correcting errors and updating information. Fill out the form to correct errors:

Before the credit bureau can change the information on your credit report, it will need to investigate your claim. It will check your claim with the lender that reported the information.

If the lender agrees there is an error, the credit bureau will update your credit report.

If the lender confirms that the information is correct, the credit bureau will leave your report unchanged.

In some provinces, the credit bureau is required to send a revised copy of your credit report to anyone who recently requested it.

Equifax And Transunion Credit Reports

Both Equifax and TransUnion maintain a bankruptcy record on your credit report for a period from the date of your discharge or last payment.

For first-time bankrupts, TransUnion maintains the information for the maximum length of time permitted by provincial law , while Equifax retains the information for 6 years for every province.

You May Like: Zzounds Paypal

Whats A Typical Bad Credit Mortgage Term Length

Bad credit mortgages are only meant to be used as a temporary stopgap measure while you get your finances in order. You wouldnt want to stay with a bad credit mortgage lender for long either. Thats why youll usually see bad credit mortgages with term lengths from 6 months to 2 years. Youll need to have an exit plan when applying for a bad credit mortgage so that you can transition back to aB lenderor A lender.

How Long Does A Consumer Proposal Stay On Your Credit Report

A consumer proposal can remain on your credit report a maximum of 6 years from the date you file based on the new guidelines from TransUnion and Equifax. A lot less time than bankruptcy. Bankruptcies, on the other hand, remain on your account for longer, and increases every time you file one.

Keep in mind that if you pay your consumer proposal faster, the length of time it appears on your credit report is shortened. This is another advantage that you dont get when you file for bankruptcy. At David Sklar & Associates, we work with you to weigh both options and identify the best solution for you.

A consumer proposal that is completed in five years, will be removed from your credit report one year later .

A consumer proposal that is completed in two years, will remain on your credit report an additional 3 years from the date you completed payment .

A consumer proposal paid immediately as a lump sum, will be removed three years after the completion of the proposal.

You May Like: How To Remove Repossession From Credit Report

Take Your First Step Towards A Debt Free Life

If you are overwhelmed by debt and live in the Toronto area, call us at 416-498-9200 to book a FREE, confidential appointment. We will review your financial situation in detail and discuss all of your options with you. Alternatively, you can fill out the form below and our team will reach out to you.

What Is Included In A Credit Report

Although the two credit bureaus vary in which information gets included in your credit reports, the following is a list of common elements that appear in your reports:

- Personal Information This includes your name , current and previous addresses, social insurance number, date of birth, and current and previous employment data.

- A record of your repayment of past and existing debts.

- Public Records Any public documents or judgments that may have an impact on your credit risk, such as court rulings, bankruptcy records, consumer proposals, or tax liens.

- A record of each time an inquiry is made to the credit bureau about your credit.

- Additional Relevant Information Anything else that may be pertinent to a creditor in their risk assessment such as banking information and collections records, though this varies between credit bureaus.

Don’t Miss: Syncb Ppc What Is This

How Long Does Information Stay On My Equifax Credit Report

Reading time: 3 minutes

Highlights:

-

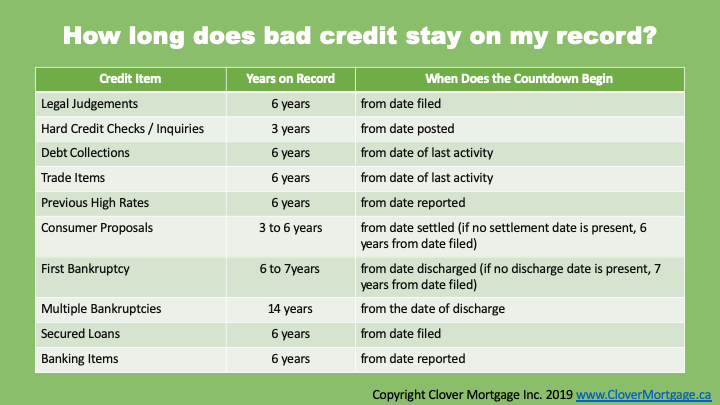

Most types of negative information generally remain on your Equifax credit report for 6 years

-

Closed accounts that were paid as agreed remain on your Equifax credit report for up to 10 years after they were reported as closed by the lender

-

Hard inquiries may remain on your Equifax credit report for 3 years

When it comes to credit reports, one of the most frequently asked questions is: How long does information stay on my Equifax credit report? The answer is that it depends on the type of information and whether its considered positive or negative.

Generally speaking, negative information such as late or missed payments, accounts that have been sent to collection agencies, or a bankruptcy stays on credit reports for approximately six years. Here is a breakdown of some the different types of negative information and how long you can expect the information to be on your Equifax credit report:

Here are some examples of “positive” information and how long it stays on your Equifax credit report:

- Active accounts paid as agreed. Active credit accounts that are paid as agreed remain on your Equifax credit report as long as the account is open and the lender is reporting it.

- Closed accounts paid as agreed. If the last status of the account is reported by the lender as paid as agreed, the account would stay on your Equifax credit report for up to 10 years from the date it was reported by the lender as closed to Equifax.

Get A Cosigner For A Credit Card Or Loan Or Become An Authorised User

If you cant get a credit builder loan, credit builder card or secured credit card then your next bet to help you improve your credit score will be to get yourself a cosigner on a credit card or loan.

You should really only do this if you are likely to repay your or loans on time and in full every month.

If you fail to make your credit card repayments on time then this may affect your co signers credit score too. If you make these repayments on time your credit score will rise and the payments will be registered on your credit file for at least 6 years.

Getting a cosigner on a credit card or loan creates a financial relationship between yourselves. This means any negative behaviour from them might affect your credit score negatively and vice versa.

A cosigner essentially allows you to qualify for credit and in some cases cheaper credit. A cosigner will also be legally responsible for any debt owed on the account if you default.

Another way to help improve your credit score is by becoming an authorised user on someone elses credit card.

The difference between authorised users and cosigners isnt that much. Becoming an authorised user on someone elses credit card will help you improve your credit score if the main card holder makes all their repayments in full and on time each month as well as keeping their credit balance low.

some credit card companies might not take you into account and may not collect this data and hence report it on your credit report.

Don’t Miss: Does Paypal Credit Report To Credit Bureaus

Debts Dont Just Go Away

If you have no wages to garnishee, or no assets to seize, there many be no benefit to a creditor or debt collection agency taking you to court and suing you. So yes, you could just ignore the debt and not suffer direct financial consequences. The debt didnt go away, you still owe the money. If a bank or credit card company cant take collection action against you, its as though the debt has no impact on your financial life. But the debt is still there, and is still owed.

The key point here is that you have a job, or assets, doing nothing is not a good strategy because you have something worth protecting.

Errors To Watch Out For On Your Credit Report

Once you get your report, check for:

- mistakes in your personal information, such as a wrong mailing address or incorrect date of birth

- errors in credit card and loan accounts, such as a payment you made on time that is shown as late

- negative information about your accounts that is still listed after the maximum number of years it’s allowed to stay on your report

- accounts listed that you never opened, which could be a sign of identity theft

A credit bureau cant change accurate information related to a credit account on your report. For example, if you missed payments on a credit card, paying the debt in full or closing the account won’t remove the negative history.

Negative information such as late payments or defaults only stays on your credit report for a certain period of time.

Don’t Miss: Will An Eviction Show Up On My Credit Report

How Long Does Bankruptcy Stay On Credit Report In Canada

How long a bankruptcy will stay on your credit report in Canada depends on the number of bankruptcies youve already filed. If this is your first bankruptcy, it will remain on your credit for six years after filing.

If this is your second time filing for bankruptcy, it will stay on your credit report for 14 years. If you file for bankruptcy three times or more, it remains on your credit for life. The Canadian Government outlines these timelines.

How Long Do Collections Stay On Your Credit Report

If a creditors information regarding an accounts delinquency is valid, the collections record will exist for seven years starting on the date it is filed.

Heres how it typically works: When a creditor considers an account neglected, the account may be handed over to an internal collection department. Sometimes, however, the accounts debt is sold to an outside debt collection agency. This often happens when you are about six months behind on payments.

Around 180 days after the original due date of the payment, the creditor might sell the debt to a collections agency, says Sean Fox, president of Freedom Debt Relief. This step indicates that the creditor has decided to give up on getting payment on its own. Selling to the collections agency is a way to minimize the creditors loss.

At that point, you will start to hear from a debt collector, who now has the right to collect the payment. Depending on the type of debt you have, a variety of countermeasures exist on behalf of creditors to prevent major financial losses.

Unsecured debts, like credit card debt and personal loans, are generally sent to a collections agency, or can even be handled internally. If you fail to pay a secured debt, like an auto loan or a mortgage, foreclosure and repossession are the most common approaches for creditors to begin regaining losses.

Dont Miss: How Often Does Capital One Report To The Credit Bureau

Read Also: Ntwk Credit Card