How We Made This List Of Auto Loans For Bad Credit

Buying a car is a big investment, and it often brings other hidden costs, such as road taxes, auto loan interest, and insurance. Therefore, it is important to consider factors associated with an auto loan.

Mostly, customers put a lot of emphasis on the type of car they want to buy. Due to this, they tend to forget how to finance the purchase of the car. As a result, most users ignore the factors like interest rates and sign the auto loan in a hurry without considering each detail.

To ensure customers do not fall into the trap of signing an auto loan at a place with high costs and strict terms, we have created a list of companies that offer a car loan on easy terms.

We realize the importance of a good car loan. Therefore, we paid the utmost attention to each step while selecting car loans for bad credit.

First, we made a list of all companies offering bad credit car loans, which was quite long. Therefore, we decided to visit the portal of each company and look at each of their terms and conditions. After thoroughly reviewing the terms, we narrowed down the list.

Next, we looked at customer reviews to learn about the other side of the company. For example, it is common for people to read customer reviews before other items. However, they tend to forget the importance of reviews for car loans.

After reading customer reviews, we considered multiple factors to form the list containing the most flexible and effective bad credit car loans.

Each of the factors is explained below:

Q5 Can A Car Loan Impact My Credit Score

Yes, auto loans can impact your credit score. However, the auto loan can positively or negatively impact your score, depending on the timing of payments.

When you apply for a loan with different lenders, your application, also known as a credit inquiry, is attached to your credit report. This indicates a certain lender has access to and checks your report during the application process.

This report stays in your credit report for two years. However, the impact of the record is erased from the credit score in a few months.

Lenders report the timing of your payments to the lending bureaus, and this information impacts your credit score for a long time. Moreover, payment history takes up 35% of your credit score. Therefore, you should make payments on time.

But, before you apply for a loan, make sure to go through our buying guide so you get the best deal possible. Out of all of the online platforms we mentioned, we recommend Auto Credit Express due to their decades of experience, easy eligibility criteria, and overall smooth application process.

However, you cannot go wrong if you go with any of the sites we have featured in this article. So, after doing your research, choose one and apply today. Happy shopping!

Can I Get Approved For A Car Loan With A 500 Credit Score

Its possible to get a car loan with a credit score of 500, but itll cost you. People with credit scores of 500 or lower received an average rate of 13.97% for new-car loans and 20.67% for used-car loans in the second quarter of 2020, according to the Experian State of the Automotive Finance Market report.

Recommended Reading: Does Speedy Cash Report To Credit Bureaus

Used Car Dealership Hit With $8 Million Fine For Allegedly Harassing Customers

News Editor, The Huffington Post

Elizabeth Warren‘s brainchild watchdog agency is cracking down for the first time on a used car dealer that also acted as an auto lender for allegedly harassing customers who were late on their payments.

The Consumer Financial Protection Bureau, conceived by Sen. Warren during the financial crisis, fined Phoenix-based DriveTime Automotive Group, Inc., the country’s largest “buy here, pay here” lender, $8 million on Wednesday. As part of a settlement agreement, DriveTime and its finance company, DT Acceptance Corporation, said they would change debt collection practices.

“Buy here, pay here” auto companies sell used cars, but consumer advocates say they operate more like subprime lenders. The companies offer low-income customers with poor credit ratings auto loans with interest rates that can top 30 percent, according to a 2011 Los Angeles Times investigation.

DriveTimes average customer has an annual income of between $37,000 and $50,000, a FICO credit score between 461 and 554 and paid an average of 19 percent in interest on their loan, according to the CFPB.

People who buy cars at these types of dealerships usually return to the lot to make payments, often in cash — hence the term buy here, pay here. The companies also expect some of these buyers to fall behind on their payments, consumer attorneys say, which can benefit the dealer.

According to the settlement, DriveTime employes 290 collectors in order to secure its owed payments.

Best Bank For Refinancing Your Drivetime Loan

Best Auto Loan Refinance Companies of 2021

- Best for Great Credit: Credit Unions

- Best for Checking Rates Without Impacting Your Credit: Capital One.

- Best Trusted Name: Bank of America, Chase or WellsFargo.

- Best for The Most Options: WithClutch.

- Best for Members of the Military: USAA or Navy Federal CU.

- Best for Peer-to-Peer Loans: LendingClub although not recommendable.

- Digital Credit Union and PenFed.

Also Check: Does Removing An Authorized User Hurt Credit

A Closer Look At Carvana Financing

If youre shopping around, here are a few more things tobe aware of when comparing a loan from Carvana to those from other lenders.

- Theres no prepayment penalty for paying more than the minimum due each month or paying off your loan balance early.

- To finance a vehicle through Carvana you must be at least 18 years old, earn a minimum of $4,000 per year, and have no active bankruptcies.

- Its easy to see personalized financing estimates. Once youre prequalified, your financing terms will appear under the picture of every vehicle you view on Carvanas website. But keep in mind that your estimated terms will differ based on the car you choose.

- Youll need to make a down payment, though you can add a trade-in to your purchase to help reduce the amount youll need to put down.

- Carvana offers repayment terms between 36 and 72 months, giving you the flexibility to find a loan term thats right for your budget.

- Carvana also offers the ability to buy an extended warranty and gap insurance.

Drive Time Auto Sales Review

Let’s start the review with the pros and then we will work our way into the cons…

99% Finance RateDo they ever say no? I’m sure they do, but it’s not often. In fact, when I worked in Texas, Drive Time Auto Sales was my biggest competitor when it came to bad credit car sales. They could help customers in ways that my lenders could not.

It was frustrating for me , but good for the customer. See what dealers in your area can offer with this 60 Second No Obligation Auto Loan Application.

Flexible TermsMost buy here pay here dealerships will have one set rate for all customers and don’t budge, but not Drive Time. They offer flexible rates even for customers with bad credit or no credit.

Basically, the more you put down the more they lower your rate. In addition, they’ll give you up to 30 days after you’ve bought your vehicle to add more to your down payment to get an even lower rate. I don’t know of any other buy here pay here dealer that does anything like that.

Report to the Credit BureauNot only will you be able to get a car, but Drive Time will help you to build or even rebuild your credit by reporting your well paid loan each month to the credit bureau.

Additionally, they will take into account your well paid car loan with them and will offer better rates to you the next time you buy from them .

Some buy here pay here dealers will offer this, but they’ll make you pay for it.

On to the Cons…

Read Also: Does Paypal Report To Credit Bureaus

How Do You Get Approved For Drivetime

Approval FAQs It only takes two minutes to get approved online. Simply fill in your name, address, monthly income, date of birth and social security number and you will get your approval and down payment information all from the convenience of your phone. You can also get approved in person at any DriveTime dealership.

When To Sue Your Creditors Or Collection Agencies

Extent of damages incurred by the wronged party as deemed by the courts. Creditors, if you dispute a debt, and they fail to report it as disputed to the credit bureaus. Creditors, if they pull your credit file without permissible purpose. Credit bureaus, if they refuse to correct information after being provided proof. CUSHMAN, v.

Don’t Miss: Paypal Credit Bureau

What To Do After Repossession

If your car has been repossessed, you may be able to get it back. Depending on the terms outlined in your contract, your location, and which lender you are working with, you may be able to get your car back through one of the following options:

- Redeem the vehicle by paying off the entirety of your loan balance, plus any fees associated with the repossession, such as late fees, storage, and towing fees.

- Contact your lender to see if it will reinstate your loan note that the availability of this service will vary depending on the terms of your loan, and you will need to make up all past due payments and fees.

- Repurchase your vehicle at auction.

How A New Auto Loan Can Impact Your Credit

Does it actually matter whether your new loan shows up on your credit report? It might. If youre building or rebuilding your credit, a new auto loan can help you out in a few ways.

First, it adds to your . A car loan is considered an installment loana loan with fixed monthly payments and a predetermined payoff periodwhich is a different type of credit than a revolving credit card account. Having a car loan appear on your report shows creditors that you have experience managing diverse types of credit. It may also boost your credit score: Credit mix accounts for 10% of your FICO® Score, the scoring system used most commonly by lenders.

Your credit score will also benefit from having timely monthly loan payments show up on your credit report. Payment history is the most heavily weighted factor in calculating your score, so you want your monthly payments to count.

What are some typical reasons your new auto loan might not appear on your credit report?

Read Also: Aragon Collection Agency

You May Like: How Long Does Repo Stay On Credit Report

Does Drivetime Do In

Go! DriveTime has financed over 4 million people across the country. Our exclusive In-House financing model allows us to provide flexible options for all. These nearly limitless financing options allow you to shop our massive 13,639 vehicle inventory for the exact used car, truck, van or SUV that best fits your needs.

Re: Must Read If You Have A Drivetime Repo On Cr

Thank you so much for posting this! I am dealing with them now and, unfortunately, I have already sent them a PFD letter in order to get them off all 3 of my credit reports. I thought it was really weird that, right after I sent the letter, they took it off of EX and TU without responding to my letter. For some reason they left it on EQ. They actually did mis-report the repossession to the CRA’s and I had to dispute it with the CRA’s to make them change it back. I’m going to try to get them off EQ now.

wrote:

Thank you so much for posting this! I am dealing with them now and, unfortunately, I have already sent them a PFD letter in order to get them off all 3 of my credit reports. I thought it was really weird that, right after I sent the letter, they took it off of EX and TU without responding to my letter. For some reason they left it on EQ. They actually did mis-report the repossession to the CRA’s and I had to dispute it with the CRA’s to make them change it back. I’m going to try to get them off EQ now.

I’m thinking EQ is just being slow. The order is dated 11/19/2014 and Drivetime has 120 days to delete. It could drop from EQ any day now. Please keep us posted. You are going to dispute EQ even though it might be deleted? I’m not saying that’s a bad move. Did you read the part that they must ensure it does not reappear after deletion? This is good news.

Read Also: Does Snap Finance Report To The Credit Bureau

Exclusive: Drivetime Responds To $8m Fine From Cfpb

The Consumer Financial Protection Bureau made its first enforcement action in the buy-here, pay-here space and handed out an $8 million penalty against one of the largest operations in the business DriveTime Automotive Group.

CFPB officials said late Wednesday that DriveTime harmed consumers by making harassing debt collection calls and providing inaccurate credit information to credit reporting agencies.

The bureau said DriveTime must pay $8 million as a civil money penalty, end its unfair debt collection tactics, fix its credit reporting practices and arrange for harmed consumers to obtain free credit reports.

Consumers who purchase a car at a buy-here, pay-here dealer deserve to be treated fairly, CFPB director Richard Cordray said. DriveTime harassed and harmed countless consumers, many of whom were economically vulnerable.

Our action forces DriveTime to pay the price for its illegal debt collection tactics and for neglecting the accuracy of consumers credit information, Cordray continued.

In an exclusive statement to BHPH Report sent today, DriveTime executive vice president and general counsel Jon Ehlinger shared the companys reaction to the actions handed out by the bureau.

We are pleased to have a resolution to the Consumer Financial Protection Bureau investigation, and appreciate and acknowledge the professionalism shown throughout the process by the CFPB and its enforcement staff, Ehlinger said.

Breakdown of Actions

More Details About Enforcement Action

Re: Bridgecrest / Drivetime

I really dont think anyone can answer that for you

I am actually surprised they agreed on PFD in a first place.

CRA will not entertain removal of the account based of PFD letter provided by you because it’s contrary to their policies and instructions they give reporting wise.

If they dont delete, you have a basis for civil complaint based on your letter, but that’s not done with CRA.

Maybe just continue calling, writting letters etc till you get someone to respond to you.

Hopefully it gets removed for you soon

Read Also: Does Removing An Authorized User Hurt Their Credit Score

Is Carvana Financing The Right Fit For You

A Carvana auto loan can be a good option if youre interestedin purchasing a used car, and if youre comfortable with a buying process thattakes place entirely online. Since there are no minimum credit scorerequirements or prepayment penalties, it could also be a good fit if yourcredit history has a few dings or if you plan to pay off your car loan early.

Consider getting prequalified so you can compare Carvanasoffer with other lenders offers to find the best deal for your financialsituation.

How Does Drivetime Work

The salespeople at DriveTime are salaried employees, relieving pressure on their part to make a sale. Instead, they are focused on providing customers with the most useful information possible. The DriveTime website has a wealth of resources on credit scores, auto financing and personal savings goals. You can search for the nearest DriveTime location on their website to view cars in person.

You May Like: Does Paypal Credit Report To Credit Bureaus

Q2 What Is An Acceptable Credit Score For A Car Loan

Your credit score plays an important role while applying for any type of loan. Fortunately, when it comes to auto loans, there is no minimum requirement set by the lenders.

Lenders do not give that much importance to the credit score because an auto loan is a secured loan. So, the lender knows they can easily take over your collateral if you stop making monthly payments or do not repay on time. This sense of security for the lender makes it easier for people with bad credit to get loan approvals.

Moreover, lenders consider your credit situation as a whole rather than only emphasizing the credit score. As a result, the lender will check if you do not have accrued tax debts, past-due bills, or collections accounts.

The networks we have listed above claim their lenders provide personal loans to people with bankruptcies. This means there is always a chance you will get an auto loan with bad credit.

Moreover, you might think your credit score is bad. However, at times it is not as bad. According to FICO, credit scores range from 350 to 850. Therefore, your score is bad only if it is below 580. Otherwise, it is fine and will help you easily find a loan.

The good news is that some lenders in the market lend to people with a credit score below 580. So, your bad credit score will not stop lenders from approving your loan request. However, the loan terms will be decided based on your credit score.

The Average Interest Rates For Car Loans With Bad Credit

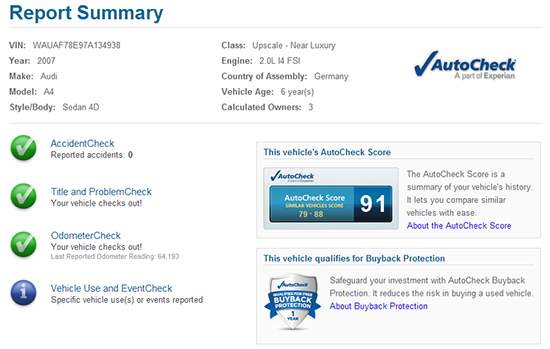

Experian, one of the country’s three main credit bureaus, issues quarterly reports that study data surrounding the auto loan market. Their State of the Automotive Finance Market report from the fourth quarter of 2020 found that the average interest rates for both new and used auto loans look like this:

| Average New Car Loan Interest Rate | Average Used Car Loan Interest Rate | |

| Super prime | ||

| 14.20% | 20.30% |

As you can see, your credit score has a major influence on the interest rate you can qualify for. Auto lenders base interest rates on several factors, including the length of the loan, the vehicle’s age and mileage, and the state you live in but your credit score is by far the most important factor.

Your interest rate ultimately determines your monthly payment and the total cost of financing. So, unfortunately, a bad credit score means you end up paying more in the long run.

You May Like: How Much Does Overdraft Affect Credit Rating