Preventing Unauthorized Hard Inquiries

To prevent future unauthorized hard inquiries, consider placing a freeze on your credit report. This option prevents any lenders or creditors from accessing your credit information.

Its great for preventing identity theft because no one can open a new credit account using your financial information since they wont get approved without a credit check. However, it also helps prevent unwanted inquiries if you find this to be an ongoing headache.

Placing a freeze on your credit report and having it removed both incur separate fees in most states, so dont do this if youre planning on applying for a new credit card or loan in the near future. But if you anticipate your financials to remain the same for the time being, this can be a convenient option to keep your credit nice and clean.

Review Your Credit Reports

You should make it a habit to regularly review your credit reports from the three major consumer credit bureaus Equifax, Experian and TransUnion. The may not know which information is incorrect unless you flag it.

To check for incorrect hard inquiries on your credit reports, look for a section labeled something like

- Requests viewed by others

- Regular inquiries

There may also be a separate section for soft inquiries, which should be labeled something like requests viewed only by you. Unlike hard inquiries, soft inquiries wont affect your credit scores.

Not sure how to read the information your credit reports? Learn more about whats on your credit reports and how to read them.

Get Information On The Creditors

Using the credit report provided by the bureaus find the addresses of each creditor whose inquiry you dispute. Of the three major bureaus, Experian lists these addresses. For the others, you need to match the creditors addresses with the Experian report or get the info from official websites. You can also go the long way and call the 800 phone directory and ask for the creditors address or an official number and inquire from them directly.

Read Also: Why Is There Aargon Agency On My Credit Report

What Is A Hard Credit Pull

A hard credit inquiry, or pull, is when a lender or company requests to review your credit report. This inquiry itself becomes noted on your credit report and remains there for up to 2 years. Hard pulls often lower your credit score but not by a huge amount.

When you apply for a credit card or any other type of loan , you give the issuer or lender permission to check your credit report to assess your creditworthiness, notesCNBC contributor Elizabeth Gravier. In essence, your potential lender is looking to see how likely you are to pay back the money you borrowed. The healthier credit history you have, the less risk you demonstrate, and the greater the likelihood youll qualify for that new credit card or loan.

While you dont need to totally avoid hard inquiries, you should be aware that they appear in your credit history.

How Much Does A Hard Inquiry Affect My Score And When Will It Go Away

How long a hard inquiry sticks around on your score and the damage it can do will depend on a few things. To start, having multiple hard inquiries tends to be more damaging for those with relatively short credit histories than for those with longer ones. So if you havent been using credit for very long and only have a few accounts open,;you may want to avoid making too many hard inquiries all at once.

As far as how much these inquiries can affect your score, the general agreed-upon value is that hard inquiries may lower your credit score by a maximum of five points. However, according to FICO, a single hard inquiry may not even lower your credit score at all, meaning not every hard inquiry results in an automatic drop of five points.

All inquiries, both hard and soft, will stay on your credit report for two years from the date of the inquiry, but hard inquiries will only affect your score for the first year. Even though both types of inquiries stay on your credit report for some time, you dont need to sweat the soft ones. Föehl says, While hard inquiries generally impact your credit score and are included in a copy of your consumer report provided to others, soft inquiries do not impact your credit score and are not included. So even though the soft inquiries might be there, no one is going to see them.

Recommended Reading: Is Credit Wise Accurate

Are You Affected By Credit Inquiries As A Co

It could be that you are a co-signer on another persons loan or credit application. In this case, your own credit report and score can be affected. This is because, as a co-signer, you are accepting full responsibility for the debt if the borrower does not pay back the borrowed funds as agreed.

In the case of co-signing for someone else, the information about the loan or account will actually show up on both your and the other persons credit report. So its important to make sure the person you are co-signing for is financially responsible, and that they will make all their required payments on time.

Dont Worry About The Rest

Legitimate hard inquiries can ding your credit score, but not by much and not for long. Hard inquiries … represent potential new debt that doesnt yet appear in the credit report as an account, says Rod Griffin, Experians director of public education.

Typically, any impact drops off dramatically after a month or two, Griffin says, either because you did not add the debt, so theres no risk, or you did open an account and its now wrapped into other credit factors.

Some companies say they can;remove even legitimate inquiries from your report for a fee but NerdWallet advises against using them. As long as youre not continuing to pile up applications, time will repair any damage to your credit.

Griffin advises keeping perspective because other things influence your credit score more .

Hard inquiries alone will never be the reason a person is declined for credit, he;says. Inquiries may be the proverbial straw that broke the camels back, but they will not be the entire bale of hay.

About the author:Bev O’Shea writes about credit for NerdWallet. Her work has appeared in the New York Times, Washington Post, MarketWatch and elsewhere.Read more

Read Also: Aargon Agency Inc Phone Number

How Hard Credit Inquiry Removal Works

Hard Credit Inquiry Removal is one of the most effective and fast strategies to boost your credit score. Each recent hard credit inquiry can cost you up to 5 points on your FICO score. We can remove hard credit inquiries from your credit report in 24 hrs. Fill out this form and we will get back to you with a quote the same day.

How To Contact The Credit Bureaus To Remove Inquiries

The easiest way to remove questionable inquiries is by contacting the credit bureaus. You can contact any, or all the three bureaus, to remove the inquiries from your credit report.

Removing Inquiries on Experian:

- Experian does not allow for inquiries to be disputed online through their dispute center. The other ways to contact Experian to dispute inquiries are as follows:

- 1-714-830-7000 then press 1, 8 am 10 pm CST weekdays, 10 am-7 pm CST weekends,;

- Experian, P.O. Box 4500, Allen TX 75013

- ;1-972-390-4925

Removing inquiries on Equifax:

- Equifax is the only bureau that allows you to dispute inquiries online, by mail, and by fax. Their phone, mail, and fax details are also given below.

- Online:;Equifax Online Dispute Portal

- ;1-800-846-5279, goes to live agent

- Equifax, P.O. Box 740256, Atlanta, GA 30374-0256

- ;1-888-826-0598

Removing inquiries from Transunion:

- Although Transunion does not allow inquiries to be disputed online, you can reach them via call, mail, or fax.

- 1-800-916-8800: then press;0,;8 am-11 pm EST, Monday through Friday

- Transunion, P.O. Box 2000, Chester PA 19016

- 1-610-546-4657

- 1-800-916-8800:; 8am-11pm EST, Monday through Friday

Read Also: Does Klarna Build Credit

File A Dispute With The Credit Reporting Agency

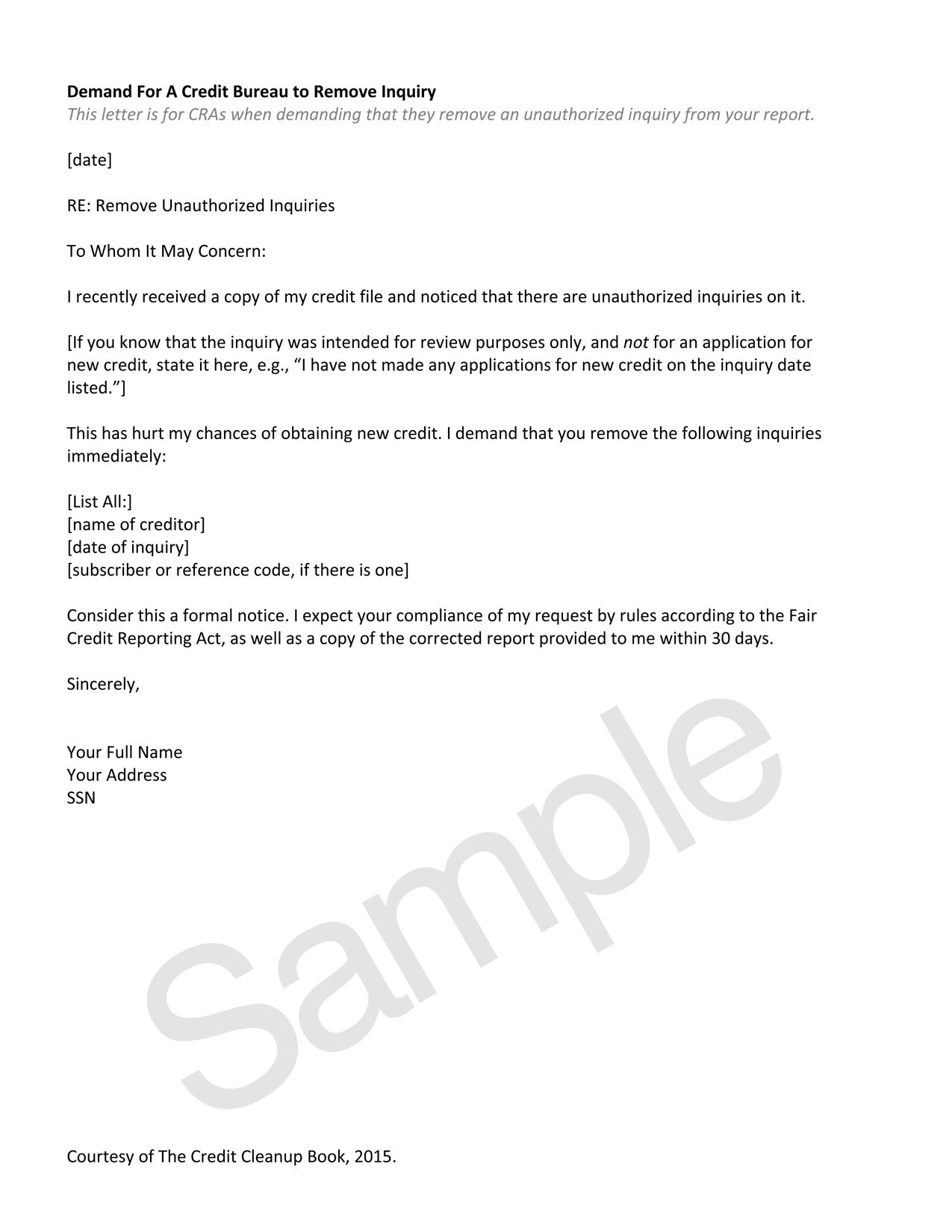

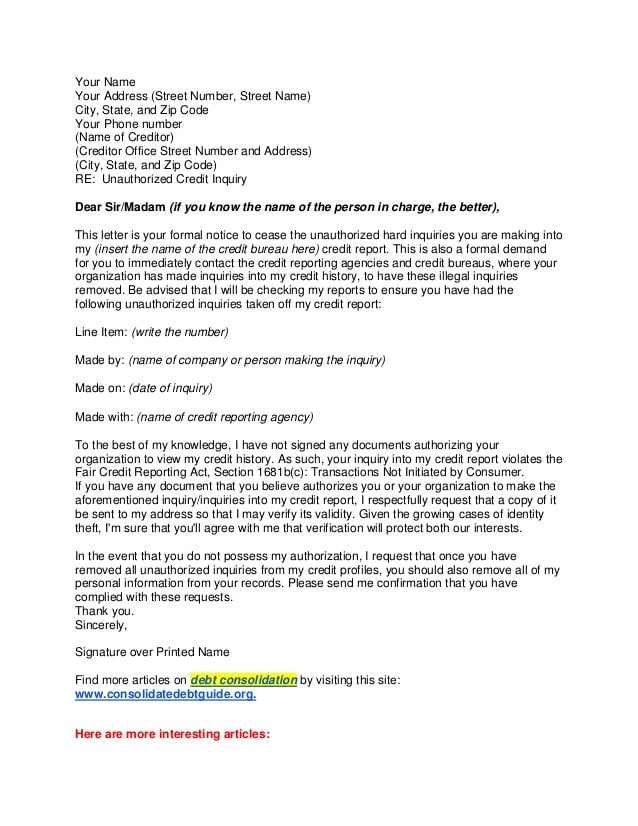

Initiate a claim directly with the credit bureau by writing a dispute letter. The purpose of this letter is to notify them that you believe certain information in your credit file is inaccurate.

The Fair Credit Reporting Act requires creditors to report accurate information about every account. This means they have a legal obligation to review, investigate, and respond to your claim. This process is free and can take up to 30 days to complete.

You can begin a dispute with any one of the credit bureaus through their websites or via mail. The leading credit reporting agencies are Equifax, Transunion, and Experian. Its essential to have documentation and to be precise about the information you are challenging.

Each of the three major credit bureaus has an online section dedicated to walking consumers through the process of disputing a claim online. It would be best to dispute the entry with each credit bureau to make sure the removal is complete across the board. After receiving the initial claim, the credit bureau will contact the source of the erroneous information and dispute it on your behalf.

How to file a dispute letter:

Get A Free Copy Of Your Credit Report

The Fair Credit Reporting Act promotes the accuracy and privacy of information in the files of the nations credit reporting companies. Monitoring your credit report is a necessary practice to keep in check any negative information. Consumers should obtain their free credit report and review it at least once a year to catch any irregularities on time and keep track of disputed items.

Consumers are entitled by law to a free annual credit report from each of the three main reporting bureaus: Equifax, Experian, and TransUnion, and you can access all three of them through one single website:

AnnualCreditReport.com is the only authorized website through which you can gain free access to your credit report from the three major bureaus. Be wary of other sites that promise the same, as they may have hidden fees, try to sell something, or collect personal information.

| Mail: Download, print, fill out, and mail to: |

| Annual Credit Report Request Service P.O. Box 105281 Atlanta, GA 30348-5281 |

Equifax made headlines in 2017 due to a massive data breach, but it remains one of the top 3 services to get your credit report. The company provides a few different service levels if you want to monitor your credit score monthly . Monitoring packages start at $14.95 per month, and the $19.95 per month options include, ironically, a host of identity-theft protection options.

Don’t Miss: How To Get Credit Report Without Social Security Number

Not All Suspicious Inquiries Are Fraudulent

Some inquiries may seem suspicious: You might not recognize the name of the company that made the inquiry, or there may be more inquiries than you expect. But those situations dont necessarily indicate a mistake or fraud.

For example, you may have used a loan broker that shopped around to try to find you the best rate possible on your loan. Each application the broker submitted on your behalf could lead to an authorized inquiry, even if you only took out one loan.

How To Minimize The Impact Of Hard Inquiries On Your Credit

It’s important to do some comparison shopping when you’re looking for a new credit card or loan. You may not be able to avoid new hard inquiries on your credit report, but there are a few ways to reduce the impact of shopping around:

- Time your applications strategically. If you’re shopping for a mortgage or an auto loan, make all of your applications within a 14-day window. If you stick within this timeframe, all of your applications will be calculated as just one hard inquiry.

- Apply selectively. Reduce the number of applications you submit by getting selective about where you apply. Compare rates and fees first, and see if the lender offers prequalification. Prequalification can allow you to get quotes on interest rates, fees and loan amounts without a hard inquiry.

- Practice good credit habits. Virtually all other credit activities have a bigger effect on your credit scores than hard inquiries. Even if you have to add multiple hard inquiries to your reports, you can keep your credit rating high by staying current on loan payments and keeping your credit card balances to a minimum.

Read Also: Lending Club Review Bbb

Can You Dispute Hard Inquiries

If you do not recognize a hard inquiry for your credit history, you might be a victim of identity theft, and you should contact the credit bureaus right away. The credit bureaus are required by law to inform you if a hard inquiry is made in your name. A hard pull that you dont know about could mean someone is trying to take out loans using your identity.

Otherwise, if a hard inquiry is legitimate, i.e., you know you approved the request, there is no way to dispute it.

Why Credit Inquiries Could Hurt Your Credit Score

The type of credit inquiries you have could impact your credit report and credit score. For example, a hard credit inquiry could reflect negatively, and may even bring your overall credit score down.

This is because those who have recently applied for a new loan and/or additional credit can be viewed as a more risky borrower. This is particularly the case if you already carry large loans or credit balances.

Hot Tip: In most instances, a hard credit inquiry will remain on your credit report for up to 2 years. However, there are instances where negative information may remain on your credit report for 7 to 10 years.

Also Check: Paypal Working Capital Requirements

Is It Possible To Remove A Hard Inquiry

I started this column out by saying that removing accurate and timely information from your report is generally not possible. This is true for hard inquiries as well. If you did apply for creditagain, whether or not you were approvedthose inquiries will show up on your credit report and affect your credit score.

However, there is one big fat exception to this: identity theft. In the case of identity theftwhere someone else applied for credit in your name without your knowledge or approvalthose inquiries can and should be removed.

This can be a detailed process, but the Federal Trade Commission has listed out the necessary steps here. As with all disputes, keep good records and in the case of identity theft, be sure to get a police report documenting the theft.

Applying For Credit Hard Inquiries

When applying for new credit you will generally give your name, address, phone number and social security number. These are needed to accurately identify the correct credit record to pull.

Your credit application will require your signature, giving the lender or a financial consultant permission to access your credit file. You may be familiar with this approach if you have ever bought a car.

If you walk into the dealership, they will ask you to fill out a credit application before they allow you to test drive. You may be subject to multiple hard inquiries using this approach, as the dealership will shop around for the best deal for you. Events like this results in a hard pull.

After I bought my car from a national dealership, I viewed my credit report and saw eight entries. I immediately panicked because I was not aware that the dealers finance personnel petitioned that number of lenders.

After some research, I found that the FICO scoring models treated multiple inquiries for one type of loan as one inquiry, indicating that you were shopping around for the best rates. This method prevents your score from taking a complete nosedive.

How long do hard inquiries stay on your report? Hard inquiries impact your score for about a year, but generally fall off your report within 2 years.

Don’t Miss: Does Carmax Check Credit

Hard Vs Soft Credit Inquiries

Hard inquiries are the only type of credit pull that can affect your credit score, and they’re the only ones that businesses will see on your credit report. Credit inquiries that don’t affect your score and don’t appear on your report are called soft pulls. Examples of soft inquiries include you checking your own report and a potential employer accessing it during a background check. And credit card issuers may do soft inquiries when they are preparing promotional card offers.

Credit inquiries carried out by insurance companies when you’re seeking quotes for various kinds of policies are considered soft inquiries and do not show up on your credit report.

Review Your Credit Reports For Free

Your first step in reviewing hard inquiries is to pull your own credit reports.

But dont worry, you wont be dinged for checking your credit because as a consumer you are entitled to a free report annually from each of the credit bureaus.

The three credit agencies are Equifax, Experian and TransUnion. But you can also visit;MyFICO for obtaining your reports and your credit score.;

Its tempting to not look at your credit too often, but trust me, knowledge is power!

Youre not only evaluating your current score, but youre confirming if the hard inquiries listed are legitimate.

Also Check: What Is Aargon Agency

Maintaining Good Credit Score

One of the most important ways to maintain your credit score is to check your credit regularly. This will allow you to closely monitor your credit and identify any significant impactors that you may need to address. Aside from credit inquiries, there are other factors that will significantly impact your credit score. These include your consistency and regularity of payments made to your credit cards and accounts, how much of your credit itself you typically use, the age of your accounts and your credit, and the types of accounts you hold. Managing these other variables may impact your credit much more than hard inquiries do, as they only play a small portion of your overall score.

It is crucial that you are mindful of your credit score. It is a key component of what you are capable and eligible to afford in terms of large financial expenses. Hard inquiries, even though they are only a part of the entire credit score, still play a role in your reports and you should ensure that you monitor these in order to keep yourself and your credit free from fraud or other detrimental issues.