Are There Any Free Options For Checking A Business Credit Score

If you want to get a peek at your business credit score and gain access to important credit-tracking tools, then there are a few free options to consider. Keep in mind that free business credit reports tend to be lighter in terms of what they include, but they can provide a good place to start.

Free options to check your business credit score include:

- Dun & Bradstreet CreditSignal: This free service from Dun & Bradstreet lets you gain access to your business credit score and receive notifications when someone accesses your business credit profile. You can also sign up for free email alerts that let you know when a change occurs to your credit score. Note that most of the benefits of this free program only last for 14 days, at which point they suggest upgrading to one of their paid options.

- Nav: Nav also offers a free option that lets you access your Dun & Bradstreet, Experian and Equifax business credit reports and scores. This service includes a summary of your business credit reports, credit-building tools and even your personal credit score from Experian.

- Tillful: Tillful is a mobile app that lets you monitor your business credit score for free while accessing all of your business accounts in one place. The app itself is also free to utilize, and you can use it to monitor your credit, your spending and your overall financial picture in one place.

Business Lines Of Credit

Preferred credit score: 550+

A business line of credit is a type of loan where a lender approves your business for a certain amount of money. You then tap into that fund as needed to address business expenses as they arise.

If, for example, you are approved for a line of credit worth $100,000, you can draw from that fund up to that limit. Most lenders wonât restrict you on how to use a business line of credit, which means that you can use it for things like payroll, lease payments, interest payments, purchase of inventory, paying utility bills, and so on. Any amount that you repay goes back into the fund and you can borrow it again. This makes a line of credit a type of revolving fund.

How does a small business line of credit work? Click here for everything you need to know.

Most lenders will require a minimum credit score of 550 before approving your business for a line of credit. Furthermore, your personal credit history will determine the limit set on your line of credit. If you have a good score, youâre more likely to get a high limit on your credit line. You may also get excellent terms like a low interest rate.

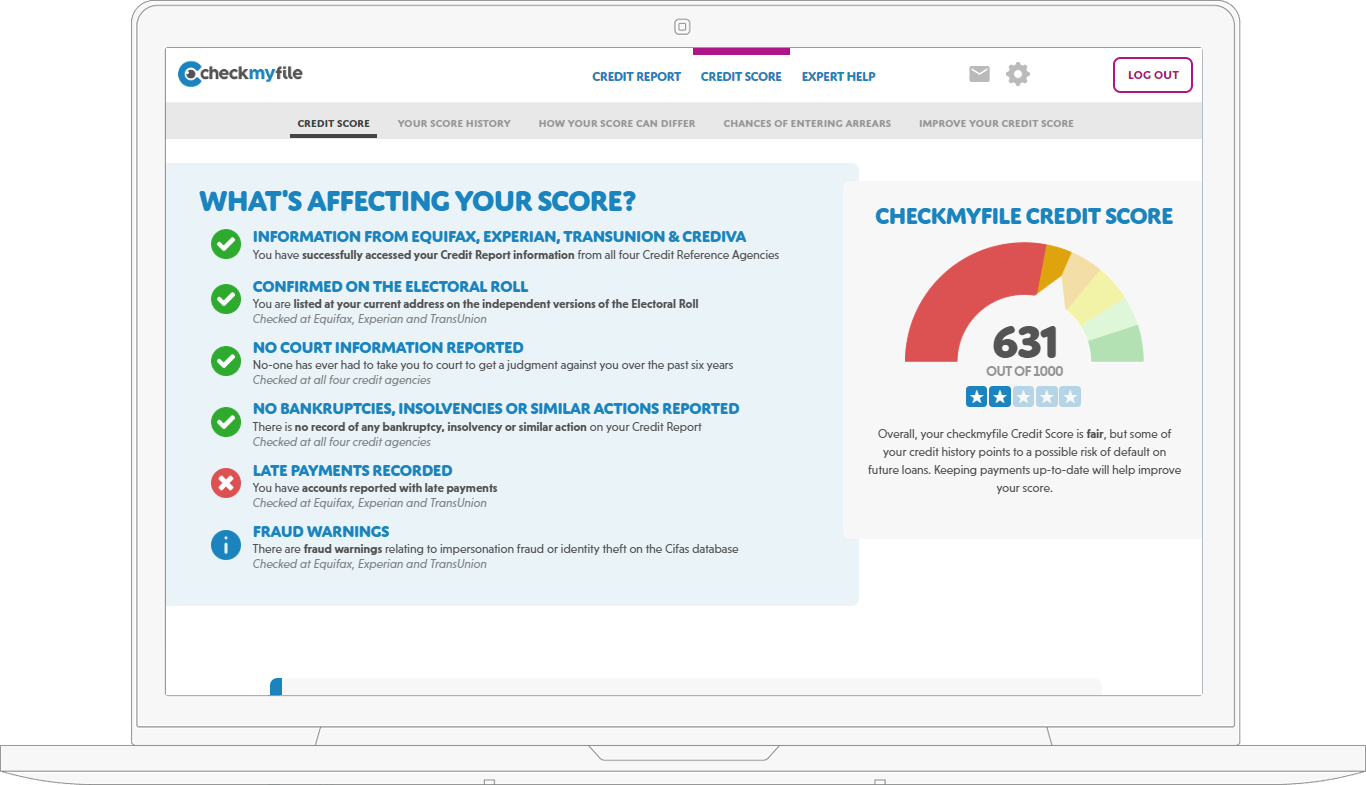

What Is Credit Monitoring

Canadas credit bureaus, as well as many credit card issuers and financial institutions, offer credit monitoring services. These services provide you with a notification after certain updates to your credit file, such as a credit inquiry.

You could consider using this service if you think youve been the victim of fraud or if you have been affected by a data breach. This can help you see if somebody is trying to apply for credit in your name.

You usually need to pay for these services.

You May Like: Does Acima Report To Credit

Business Credit Score In Action

What if Company A was considering taking on Company B as a client and wanted to know the likelihood that Company B would pay its invoices in full and on time? No business wants to do hours and hours of work for a client, then not get paid. Company A could check Company Bs business credit score first, then agree to do business only if Company Bs credit score showed that it had a strong history of paying its suppliers. Company A could even purchase a subscription service to monitor Company Bs credit score on an ongoing basis. If the score dropped significantly, Company A could lower its risk by discontinuing business with Company B or requiring payment in advance.

Similarly, Company C, a wholesale supplier, might want to check the business credit score of Company D, a manufacturer, before shipping out a truckload of goods with an invoice granting Company D 30 days to pay. If Company D has a high credit score, this arrangement would seem low-risk, but if it has a low credit score, Company C may want to ask for payment up front, before shipping any goods.

Improving Business Credit Scores

Once your company obtains a DUNS number, the following are some suggestions that will help your business establish a good credit score:

- As a sole proprietor, your personal financial information is combined with your business’s financial information. As a result, any missteps in your personal credit could damage your company’s credit score. Structuring your business as an LLC or corporation will help separate your personal credit from your business credit.

- Pay vendors and suppliers in a timely manner. Use your EIN when applying for credit trade accounts with your vendors and pay the amount in full prior to the due date.

- Build your company’s credit scores by using your EIN to apply for a business credit card. Make any necessary purchases and repay the amount in full prior to the due date. Alternatively, you can use your EIN to apply for a small business loan, which you should repay in full prior to the due date. As another option, you can use your EIN to apply for a small business loan, which you should repay in full prior to the due date.

- Contact any businesses that your company has credit with and ask where they report that your company has made its payments on time. This lets you know which business credit reports you need to monitor. If you discover that not many of these businesses are reporting your good credit, consider opening accounts with companies that do report your business’s good credit to reporting agencies.

Recommended Reading: Does Paypal Credit Report To Credit Bureaus

Financial Information In Your Credit Report

Your credit report may contain:

- non-sufficient funds payments, or bad cheques

- chequing and savings accounts closed for cause due to money owing or fraud committed

- bankruptcy or a court decision against you that relates to credit

- debts sent to collection agencies

- inquiries from lenders and others who have requested your credit report in the past three years

- registered items, such as a car lien, that allows the lender to seize it if you don’t pay

- remarks including consumer statements, fraud alerts and identity verification alerts

Your credit report contains factual information about your credit cards and loans, such as:

- when you opened your account

- how much you owe

- if your debt has been transferred to a collection agency

- if you go over your credit limit

- personal information that is available in public records, such as a bankruptcy

Your credit report can also include chequing and savings accounts that are closed for cause. These include accounts closed due to money owing or fraud committed by the account holder.

Does Business Credit Offer The Same Protections As Personal Credit

While there are a lot of similarities between managing your personal credit and your business credit, theres also a major divide when it comes to protections and accuracy. To begin with, business credit is not regulated under the Fair Credit Reporting Act.

Theres no law that covers business credit reporting, and theres also no industry standard, says Detweiler. Each of these commercial credit bureaus is out there trying to get customers to report, and they are all working with the vendors individually.

If there is inaccurate information on your business credit report, you will have to work with each bureau individually to make it right. If you have a D-U-N-S Number with Dun & Bradstreet, you can file updates and disputes using the companys online management portal. But if your concerns are with Experian or Equifax, you will be forced to print out your report, circle the disputed item, write a letter explaining why the information is incorrect, and provide supporting documentation for your claim.

Moreover, the Credit Card Accountability Responsibility and Disclosure Act of 2009 applies only to consumer credit cards, not business credit cards. If you end up paying any of your cards late, your business credit can be reported as being days over term, which can reduce your credit score and hurt your chances of securing financing and deals with other businesses.

Don’t Miss: What Credit Report Does Comenity Bank Pull

Business Credit Reports Can Help Your Lenders Investors And Even Potential Business Partners Understand How Healthy Your Business Is But Unlike Personal Credit Reports Youre Not Legally Entitled To Free Business Credit Reports

The Fair Credit Reporting Act, which gives you the right to free personal credit reports from each of the three major credit bureaus once a year, doesnt establish the same access to business credit information. That can make it difficult to monitor your businesss credit standing without spending money.

Although there isnt a way to get ongoing access to all your business credit reports for free, there are a few places you can get partial business credit information for free or do a one-time pull of your full reports. Using a mix of these free business-credit-monitoring services can help you keep track of where your business stands.

What Is A Business Credit Score

A business credit score is a number that indicates whether a company is a good candidate to receive a loan or become a business customer. Credit scoring firms calculate business credit scores, also called commercial credit scores, based on a companys credit obligations and repayment histories with lenders and suppliers any legal filings such as tax liens, judgments, or bankruptcies how long the company has operated business type and size and repayment performance relative to that of similar companies.

Also Check: How To Report Death To Credit Bureaus

What Information Will You Need To Check Your Score

To access your business credit score with Nav or the D& B CreditSignal program, youll need to provide information such as your business name, your ZIP code and your email address. Youll also need to verify your identity by providing your home address, your date of birth, your phone number and your Social Security number.

Further, you may also need to answer some security questions based on your loan history, your work history or previous addresses you may have had.

How Do I Find My Business Credit Score

Anyone can go to one of the reporting agencies and lookup your business’s score though they may have to payto do so. Several business credit reporting agencies trackbusiness credit scores. Three of the major ones are Dun& Bradstreet, Equifax Business and ExperianBusiness.

Considering this, can I check my business credit score for free?

Personal range from 350 to 800,while business credit bureaus use different scales. Now that you know whatthe number on your business credit score means, here are 5different ways you can check your business credit scorefor free.

Also Know, how do I build credit for my LLC? To establish business credit, you may first need to takethe following steps:

Just so, does Credit Karma do business credit?

A line of , a business credit card,or term loan are all important tools to helping yourbusiness grow, and they can be difficult to accesswith a feeble business credit score. Knowing where to go tocheck that scorea forBusinessis vital, and is apersonal monitoring service.

Can I check my credit score for free?

You May Like Also

Recommended Reading: How To Report A Death To Credit Bureaus

Breaking Down Business Credit Score

If a company wanted to take out a loan to purchase equipment, one factor the lender would consider is the businesss credit score. It would also look at the businesss revenue, profits, assets and liabilities, and the collateral value of the equipment it wanted to purchase with the loan proceeds. In the case of a small business, the lender might check both the businesss and owners credit scores, since the personal and business finances of small business owners are often closely intertwined.

The three major business firms are Equifax, Experian, and Dun and Bradstreet, and each uses a slightly different scoring method. Unlike consumer credit scores that follow a standard scoring algorithm and range from 300 to 850, business credit scores generally range from 0 to 100. Regardless of the specific method used, a business will have a good credit score if it pays its bills on time, stays out of legal trouble, and doesnt incur too much debt.

Check And Improve Your Business Credit Score

Being denied company credit can be bad news for your business, especially if you need finance in order to grow.

If your business has been refused credit or struggled to secure new finance, youll know how that can impact your plans. But is relying on your personal finances really the answer?

With My Business Profile, you get full visibility of your business credit profile, enabling you to understand whats affecting your company credit score and preventing you from being able to obtain that all important company

Recommended Reading: Navient Credit Reporting

What Are Business Credit Reports

The business credit reports showcase the overall data and information related to business. It includes subsidiaries, risk scores, bankruptcies or liens, ownership information, and company finances. Once you incorporate and get a federal tax identification number, your business credit score starts operating.

Below is the list constitutes in your business credit reports:

- Risk scores.

- Trade, Banking, and collection history.

- Companys background information. It includes subsidiaries and ownership.

Furthermore, Equifax, Dun & Bradstreet, and Experian are the three business credit bureaus that generate business credit scores. You can purchase your business credit reports from the credit bureaus. In addition, it requires fees to check the reports.

Should I Get A Business Card That Doesn’t Affect Personal Credit

If you can imagine making a few slip-ups with business credit, you might want to get a card that doesnt report to consumer credit bureaus as a precaution. But generally, it’s a better idea to apply for the card that offers the rewards and benefits youre most interested in, instead of focusing on the cards reporting policy.

Its important to be mindful of how your business credit card affects your personal credit. But dont make the mistake of thinking you can get rid of all your personal liability by choosing a business credit card that doesn’t report to consumer credit bureaus. If you want to protect your personal assets, your best bet is to borrow sparingly and pay your bill on time, every time.

Read Also: What Credit Score Do You Need For Affirm

How Can I Improve My Credit Score

Building business credit doesnt have to be difficult, but it can be confusing at times. Not all the bills you pay will show up on your credit reports, for example, and accounts that dont report dont help you build credit. Heres the simplest way to build business credit: Open accounts that report to business credit, such as vendor accounts and business credit cards.

Open accounts that report to business credit, such as vendor accounts and business credit cards.

- Add accounts you already pay to your business credit reports.

- Pay accounts that report on time or before theyre due.

- Keep debt under control. If possible, avoid maxing out credit lines.

Why Do Lenders Look For A Good Credit Score

Lenders run credit checks to assess the kind of borrower you are. Your credit score gives them an idea of how you have historically managed personal credit. If you have a good credit score, it means that you are a diligent borrower, which makes you less of a risk.

On the other hand, if your credit score is on the lower side, it means that you might lack the ability to make payments for your small business loan. This makes you a high-risk borrower.

In short, lenders look for a good personal credit score because it indicates that you properly manage debts and financial obligations. Youâre reliable and can be trusted to handle debts without defaulting or even missing monthly payments.

The lender is less likely to lose any money in taking you up as a debtor, and for that reason, theyâre often more than happy to give you favorable terms to accompany the loan debt. That includes low interest rates and affordable fees. Your personal credit score carries even more weight if your business credit history is short.

Want to build your business credit? Hereâs a step-by-step guide on how to do it.

That said, your personal credit score is not the only thing that a lender will look at when reviewing your business loan application. Theyâll also check your revenue, cash flow, years in business, debt-to-income ratio and so on. You can refer to the later sections of this article for further requirements for a small business loan.

Recommended Reading: Does Klarna Report To Credit

Reading Your Credit Reports And Scores

Business credit reports show similar types of information as a personal credit report with regard to a business debt repayment, but they also show public records like bankruptcies and tax liens.

Here how a typical business credit report is broken down:

- Number of trade experiences, balances outstanding, payment habits, credit utilization and trends over time

- Public Records: Recency, frequency and dollar amounts associated with liens, judgments or bankruptcies

- Demographic Information: Years on file, Standard Industrial Classification code and business size

Each bureau will use this data to help generate a business credit score, which generally ranges from zero to 100. Thats different than personal FICO scores, which range from 300 to 850.

The closer your business credit score is to 100, the better. A score near 75 is ideal.