Average Credit Score By Age

Millennials have an average credit score of 680, while baby boomers have an average credit score of 736.

The average FICO Score tends to improve with age.

The average credit scores coincide with the financial situations facing younger generations. Its usually around the millennial age range that major expenses and debt begin to rack up such as weddings and first mortgages, among others. Despite their ages, millennials hold an average of $4,322 in .

The other age group whose average credit score skews lower is Generation Z . A contributing factor to this is the limited access to credit this age group faces. Following the 2009 CARD Act, it became significantly harder for 18- to 21-year-olds to open new credit card accounts. As a result, many young adults dont begin building a credit file until later in life driving averages down.

Americans of all ages owe debt. In fact, U.S. household debt spiked to $14.35 trillion in the third quarter of 2020 the latest available data amid the coronavirus pandemic, according to the Federal Reserve Bank of New York. And that debt is growing while more people remain out of work. The federal unemployment rate was 3.5% in February 2020 before spiking to 14.8% in April 2020.

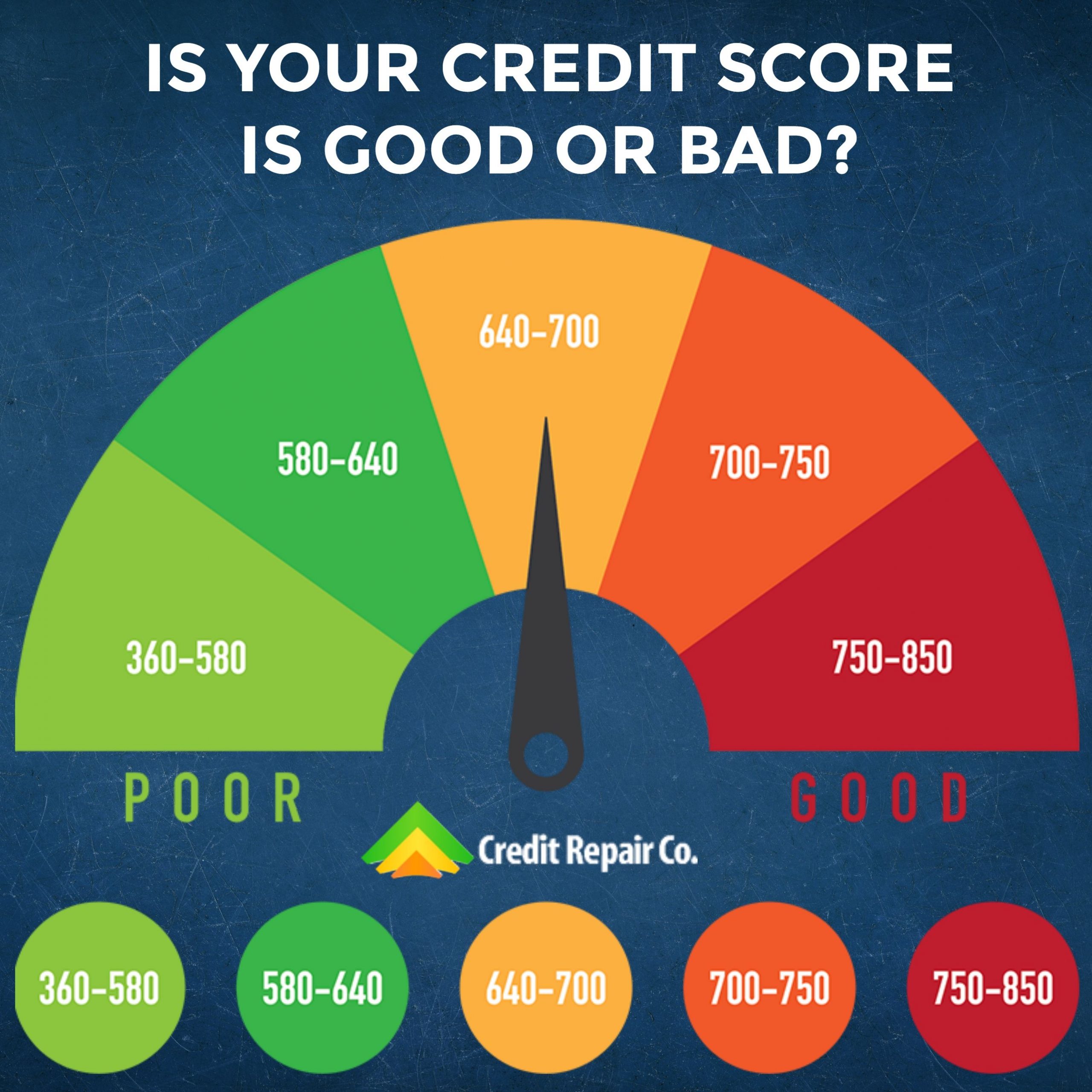

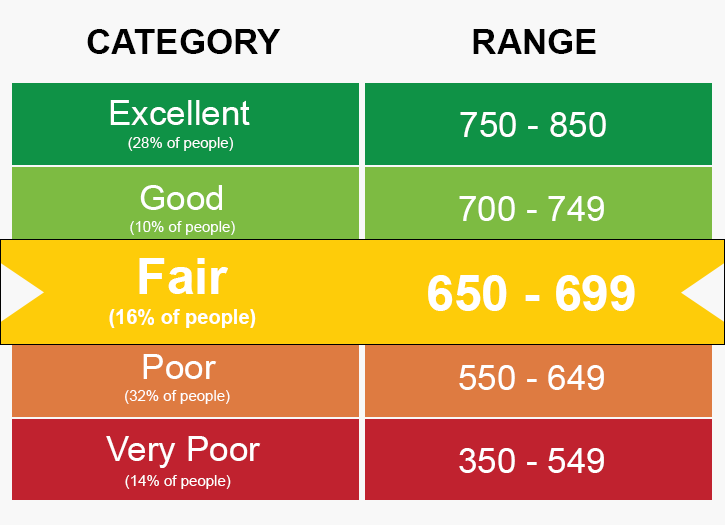

Is A Fair Credit Score Good Or Bad

Youve just been notified that your FICO® score falls between 580 and 669. Now youre wondering what that means. Can you get a loan? Will you be turned down? Is your credit score the reason for either? Is the fair credit score number good or bad?;

The answer is complicated. Nowhere is the line between good and bad more blurry than a fair credit score.; And if your credit score falls in the 580 to 669 range, congratulations! Youre in the blur. A score as low as 500 could get you an FHA mortgage, but a score of 620 or above opens the door to conventional mortgages. Furthermore, that same 620 score for an auto loan is considered non-prime.;

So its only natural to seek some clarity to that blur, learn just what it means to have a credit score in the Fair range, and discover how lenders interpret that score.

| FICO Score Range | Percentage of Americans in that range |

|---|---|

| 800-850 |

- 16 percent of Americans have a FICO score below 580.

- 67 percent of Americans have a FICO score above 669.

Experian: 620 Credit Score: Is it Good or Bad?

How To Improve Your Credit Score:

Another common question when dealing with credit scores is What can I do to improve my score? There are many ways to improve your credit score to the higher end of the scale. Some of these methods include:

- ;;;;;Cleaning up your credit report

- ;;;;;Paying down your balance

- ;;;; Negotiating outstanding balance

- ;;;; Making payments on time

Credit.org offers consumers help in managing multiple payments. With a Debt Management Plan, you have the possibility of joining these payments into one lump sum with a lower interest rate. Learn more by reaching out to one of our today!

Don’t Miss: Opensky Billing Cycle

A Fico Score Of 670 Or More Is Perceived As Good While Above 800 Is Exceptional Conversely A Fico Score Of 580 669 Is Only Fair And A Score Of 579 Or Below Is Considered Poor The Majority Of Credit Scores Lie Between 600 And 750

The two most common credit scoring models are FICO Score and VantageScore. They both use the 300 to 850 score range and analyze much of the same information, though the VantageScore classifications are slightly different from the ones FICO uses . Your financial history, including your credit usage and recent inquiries, is collected in order to generate your credit score.

Both FICO and VantageScore provide your primary score, which is their prediction of your ability to make debt payments based on your past tendencies. However, you can also get an industry-specific FICO score for something like a mortgage. These often range from 250 to 900 and estimate how likely you are to pay a particular type of debt, including credit card debt and other loans.

A good credit score is crucial for obtaining loans and other financial resources because it indicates to lenders that you are a low . Now that you know what your credit score means, its important to learn what affects your credit score and how to improve it.

How To Improve Your Credit Scores

To improve your credit scores, focus on the underlying factors that affect your scores. At a high level, the basic steps you need to take are fairly straightforward:

- Make at least your minimum payment and make all debt payments on time. Even a single late payment can hurt your credit scores and it’ll stay on your credit report for up to seven years. If you think you may miss a payment, reach out to your creditors as quickly as possible to see if they can work with you or offer hardship options.

- Keep your credit card balances low. Your is an important scoring factor that compares the current balance and credit limit of revolving accounts such as credit cards. Having a low credit utilization rate can help your credit scores. Those with excellent credit scores tend to have an overall utilization rate in the single digits.

- Open accounts that will be reported to the credit bureaus. If you have few credit accounts, make sure those you do open will be added to your credit report. These could be installment accounts, such as student, auto, home or personal loans, or revolving accounts, such as credit cards and lines of credit.

- Only apply for credit when you need it. Applying for a new account can lead to a hard inquiry, which may hurt your credit scores a little. The impact is often minimal, but applying for many different types of loans or credit cards during a short period could lead to a larger score drop.

Also Check: Aargon Collection Agency Bbb

Why Having A Good Credit Score Is Important

In general, having good credit can make achieving your financial and personal goals easier. It could be the difference between qualifying or being denied for an important loan, such as a home mortgage or car loan. And, it can directly impact how much you’ll have to pay in interest or fees if you’re approved.

For example, the difference between taking out a 30-year, fixed-rate $250,000 mortgage with a 670 FICO® Score and a 720 FICO® Score could be $72 a month. That’s extra money you could be putting toward your savings or other financial goals. Over the lifetime of the loan, having a good score could save you $26,071 in interest payments.

Additionally, credit scores can impact non-lending decisions, such as whether a landlord will agree to rent you an apartment.

Your credit reports can also impact you in other ways. Some employers may review your credit reports before making a hiring or promotion decision. And, in most states, insurance companies may use credit-based insurance scores to help determine your premiums for auto, home and life insurance.

Do I Want A Fair Credit Score

You want the best credit scores possible in order to help save yourself money when you need to take out a loan or get credit. Fair credit scores mean you are seen as sub-prime by lenders, which means you are likely going to get less favorable terms than someone with a higher credit score. That can mean higher interest rates and even outright rejection.

Improving your credit scores over time, moving from fair to good and beyond, will boost the chances that you’ll qualify for credit with more favorable terms. In general, having good credit scores may help improve your financial situation. Here are some reasons why you would want to earn higher credit scores:

Also Check: Why Is There Aargon Agency On My Credit Report

Fair Vs Good Credit: Whats The Difference

Consider taking some time to improve your fair score and get it into the good range. Borrowers with fair credit scores are still considered by credit cards and banks to be subprime borrowers. Youll usually be able to find a loan or open a credit card if you have a fair score. However, you wont get the best interest rates, and you might not be able to get the best credit card rewards.;

This can result in paying hundreds or even thousands of dollars more in interest compared to someone who has a better score. Creditors might also only be willing to loan you a small amount of money, which can make buying a car or home more difficult.;

Only 8% of borrowers who have a credit score in the good range will become seriously delinquent on one of their accounts, according to data from Experian. The numerical difference between a fair score and a good score might not seem like much, but going with an applicant who has a slightly higher score can greatly reduce risk. Improving your score as little as 20 points can make a major difference when it comes to the types of loans youre able to get and the interest rates lenders offer you.;

What Are The Best Credit Cards For Average Credit

There is a wide selection of credit cards for average credit. These include some popular names, like and their .

However, Credit One isnt the only bank offering credit cards for subprime credit. Several smaller banks also cater to those with fair credit, with cards like the Total Visa, Reflex Mastercard, and First Access Solid Black Visa being popular options.

Two cards worth highlighting are the Milestone® Gold Mastercard® and the Indigo® Platinum Mastercard®. Both cards offer an unsecured line of credit and are ideal for those with a fair or bad credit. Both cards feature a fixed-rate APR and monthly reports to the major credit bureaus making them ideal for building credit.

Indigo® Platinum Mastercard®

You May Like: Aargon Collection Agency Address

What A Fair Credit Score Means For You:

Borrowers within the “fair” credit score may push interest rates higher for their lines of credit. Borrowers in this range may incur higher charges associated with a loan or line of credit. It may be difficult to obtain a 30-year mortgage at the lower end of this range and you may expect higher interest rates. Auto loan APRs may have higher rates and credit cards may have lower limits and higher APRs.

Are Fair And Average Credit Scores The Same

The average Americans score is up to a 700 on the FICO score range. Thats more than 30 points above the top end of fair so they definitely dont mean the same thing. Typically, the bottom of the score range is considered bad, then fair, good, very good, and excellent. Most Americans, then, have good credit.

Your credit can affect many aspects of your life, even beyond interest rates for financial products. Some employers may request to access your credit report during the job application process.

Potential landlords can do the same when youre trying to rent a new house or apartment. Another hidden cost of having below-average credit is higher insurance premiums.

Clearly, its vital to know how to build and maintain credit, regardless of where you currently fall on the spectrum.

See also:What Is the Average Credit Score in America?

Don’t Miss: Does Zzounds Report To Credit Bureau

What Does A Credit Score Mean

Your credit score is a numerical representation of your credit report that represents your creditworthiness. Scores can also be referred to as credit ratings, and sometimes as a FICO® Credit Score, created by Fair Isaac Corporation, and typically range from 300 to 850.

FICO® Scores are comprised of five components that have associated weights:

- Payment history: 35%

- Length of credit history: 15%

- How many types of credit in use: 10%

- Account inquiries: 10%;

Lenders use your credit score to evaluate your credit risk generally, the higher your credit score, the lower your risk may be to the lender. To learn more, view how your credit score is calculated.

Did you know? Wells Fargo offers eligible customers free access to their FICO® Credit Score plus tools, tips, and much more. Learn how to access your FICO Credit Score.

Why Is My Credit Score Low

Lower credit scores arent always the result of late payments, bankruptcy, or other negative notations on a consumers credit file. Having little to no credit history can also result in a low score.

This can happen even if you had established credit in the past if your credit report shows no activity for a long stretch of time, items may fall off your report. Credit scores must have some type of activity as noted by a creditor within the past six months.If a creditor stops updating an old account that you dont use, it will disappear from your credit report and leave FICO and or VantageScore with too little information to calculate a score.

Similarly, consumers new to credit must be aware that they will have no established credit history for FICO or VantageScore to appraise, resulting in a low score. Despite not making any mistakes, you are still considered a risky borrower because the credit bureaus dont know enough about you.

Don’t Miss: How To Get Credit Report Without Social Security Number

Monitor Your Credit Report And Score

Checking your credit score right before you apply for a new loan or credit card can help you understand your chances of qualifying for favorable termsbut checking it further ahead of time gives you the chance to improve your score, and possibly save hundreds or thousands of dollars in interest. Experian offers free credit monitoring for your Experian report, which in addition to a free score and report, includes alerts if there’s a suspicious change in your report.

Keeping track of your score can help you take measures to improve it so you’ll increase your odds of qualifying for a loan, credit card, apartment or insurance policyall while improving your financial health.

The Main Factors Involved In Calculating A Credit Score Are:

- Your payment history

- Your used credit vs. your available credit

- The length of your credit history

- Public records

- Number of inquiries into your credit file

If you look at your credit scores based on data from both national credit reporting agencies Equifax and TransUnion you may see different scores. This is completely normal. Each credit bureau has multiple scoring algorithms and lenders typically request only one of them when making decisions. While all score versions have the same purpose , there are some differences in the calculations.

You May Like: Cbcinnovis Inquiry

How To Read Your Credit Report

Your credit report contains both personal information and financial information. Your credit report illustrates who you are as a borrower, both the good and the bad. Checking it allows you to keep an eye on your accounts, make sure there are no errors, and even potentially prevent the damaging effects of fraud. Your credit report is the report card of your financial life and understanding how to read it can help you take control of your finances and be prepared for any of your future credit needs.;

How To Access Your Report

You can request a free copy of your credit report from each of three major credit reporting agencies Equifax®, Experian®, and TransUnion® once each year at AnnualCreditReport.com or call toll-free 1-877-322-8228. Youre also entitled to see your credit report within 60 days of being denied credit, or if you are on welfare, unemployed, or your report is inaccurate.

Its a good idea to request a credit report from each of the three credit reporting agencies and to review them carefully, as each one may contain inconsistent information or inaccuracies. If you spot an error, request a dispute form from the agency within 30 days of receiving your report.

Don’t Miss: Why Is There Aargon Agency On My Credit Report

Vantagescore Credit Score Ranges

Launched in 2003, VantageScore is a joint venture between the three major credit reporting agenciesEquifax, TransUnion and Experian. Although FICO Scores are the most popular choice among lenders, VantageScore credit scores deserve your attention too.

VantageScores use a 300 to 850 credit score range. Just like FICO Scores, the higher your credit score on the VantageScore scale, the lower the risk you represent to lenders.

Utilizing A Credit Monitoring Service Like Moneylion

You can raise your score by helping alert you to identity theft early. When you use a credit monitoring service, you get an alert every time someone makes an inquiry on your credit report or opens a new loan or account under your name.;

Theres a good chance that youre the victim of identity theft if the new item wasnt created by you. While using a credit monitoring service wont stop identity theft from occurring, it does allow you to nip fraudulent items fast so theyre less likely to seriously impact your score.

When you open a Credit Builder Plus membership with MoneyLion, you get access to 24/7 fraud protection and credit monitoring. If you arent already using a credit monitoring service, sign up with MoneyLion today to add another layer of protection to your credit.;;

You May Like: What Credit Report Does Paypal Pull