Undergo Va Appraisal And Underwriting

Underwriters from your lender assess your finances and make sure you qualify for a VA loan. The VA will also require an appraisal before they approve the loan. VA appraisals are stricter than conventional loans. During a VA appraisal, the appraiser will check that the home meets the VAs MPRs and is sanitary, structurally sound and move-in ready with minimal repairs.

Mortgage Overlays: Credit Requirements Vary Bylender

A mortgage overlay isan additional mortgage guideline imposed by a lender, which goes beyond theloans official minimum standard.

For example, FHA allows FICO scores as low as 500, but some lenders set their minimums at 620.

According to FannieMae, the majority of mortgage lenders apply mortgage overlays. The most commonoverlay relates to credit scores.

About half of lenderssurveyed apply overlays to the minimum credit score requirements of a mortgageloan. Your 500 FICO score, therefore, may not get you FHA-approved, even if theFHA allows it.

This is why its smartto re-apply for a mortgage if youve recently been denied. Your loan may havebeen turned down, but that could be because of an overlay. Theres a chance you could be approved by a lenderwith looser guidelines.

Apply at a differentbank, you may get better results.

How mortgage lenders pull credit

When you apply for amortgage, lenders pull a credit report from all three credit bureaus on you.Their decisions to lend, and the terms of your loan, depend on theresult of those reports.

Lenders qualify youbased on your middle credit score.

For example, if your scores are 720, 740, and 750, thelender will use 740 as your FICO. If your scores are 630, 690, and 690, thelender will use 690 as your FICO.

When you apply with aspouse or co-borrower, the lender will use the lower of the two applicantsmiddle credit scores.

Can You Get A Mortgage With No Credit Canada

The average bank or trust company in Canada will not approve you with a score of less than 600 and it usually means the loan will go to a higher bidder. Getting a bad credit mortgage could be your first option if your score is below 550. The image you project of being responsible as a borrower and spender will result in the perception of that.

Don’t Miss: Increase Fico Score 50 Points

What A Credit Score Change Means For Your Money

Americans’ credit scores jumped in 2020. The average FICO score reached 710, Experian’s 2020 Consumer Credit Review highlights. But there is still room for improvement.

While a 710 score is “good,” anything between 740 and 799 is “very good,” and an 800 or above is “excellent.” While a good score isn’t bad considering the economic woes brought on by the pandemic, an excellent score would be even better.

Healthy credit is essential in this current lending environment.Andy TaylorCredit Karma

Say you want to borrow $200,000 to buy a home, just below the U.S. median, and you apply for a 30-year fixed-rate loan. Your credit score is 760 and you get a 3% rate. Excluding insurance and taxes, that payment would be around $772 a month, and you’d pay $78,053 in interest over the loan’s lifetime, according to FICO’s loan savings calculator.

If your score were 660, in “fair” territory, that monthly payment would be $837, another $65 a month, and a total of $101,230 in interest.

The difference in interest: $23,177.

Keep in mind that houses are selling fast and mortgages are still at pandemic lows. The average contract interest rate on 30-year fixed-rate mortgages was 2.92% earlier this month.

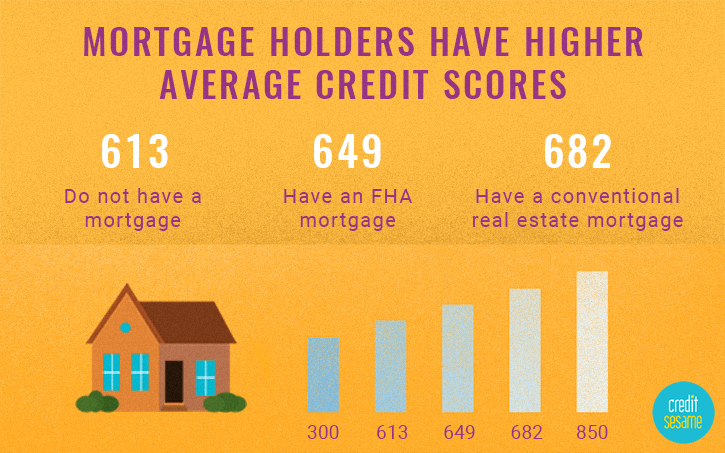

A Review Of Credit Karma Members Shows The Average Vantagescore 30 Credit Score Across The Us For Those Who Opened Any Type Of Mortgage Tradeline In The Past Two Years Is 717

Looking at VantageScore 3.0 credit scores from TransUnion for tens of millions of Credit Karma members who had a mortgage tradeline open on their credit report in the past two years, we also studied the average VantageScore 3.0 credit score among homebuyers state by state.

Our findings: Average credit scores ranged from 683 to 739 . The range of scores was even wider when broken down by city.

Read Also: How Long Does It Take Opensky To Report To Credit Bureaus

Documents That You Will Need To Provide

When you make an appointment with the mortgage lender, you will need to furnish personal documents. These documents will vary from lender to lender. While your mortgage lender may contact you with the types of documents to bring, be prepared to furnish the following documents when you meet with your mortgage lender:

Social Security Numbers

You will need to bring the Social Security cards for all of the borrowers on the mortgage loan.

Pay StubsYou will need to verify the stated income on your application. Plan on bringing paystubs for the past six months

Your Home Address

Bring in a listing of all of your home addresses for the past two years.

Checking and Savings Bank Account Statements

You will need to bring in checking and savings account statements for the past three months.

The Address of Your Bank Branch

Furnish the address of your local bank branch. This is the one that you visit to make deposits and withdrawals and not the address of the banks headquarters.

Income Tax Returns

You will need to bring your federal income tax returns for the previous two years. If you are self-employed, you will need to bring in1099 tax returns and balance sheets.

Proof of Rental and Utility Payments

You need to show a good track record and payment history for your rent and utility payments. Plan to bring canceled checks. If you use a credit card, bring your credit card statement with the listings of the rent and utility bill payments on it.Proof of Additional Income

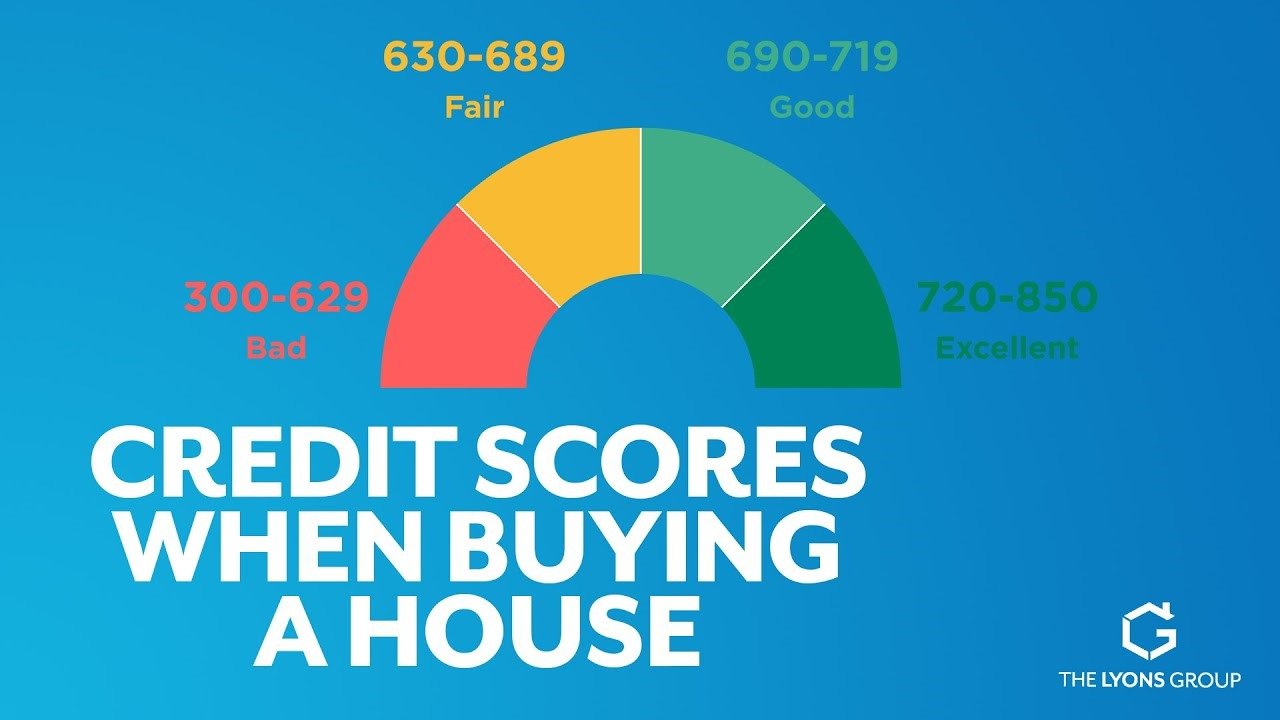

What Is The Least Credit Score To Buy A House

Typically, you must meet the following credit criteria in order to apply for conventional loans: 620 or higher. As a result of your low score, lenders may not be able to approve your application or, if you have low credit scores, be required to pay higher interest rates, which can lead to higher monthly payments.

Don’t Miss: Remove Payday Loans From Credit Report

But What Is A Credit Score Exactly

Definition:Credit scores are three-digit numbers that represent how a person has in the past borrowed money and paid it back. Such figures are determined on the basis of details contained inside credit reports of an individual. There are different kinds of models for scoring. The FICO credit score ranges from 300 to 850. The better the higher.

If in the past you were responsible for your borrowing you should have a strong ranking. It would boost the odds of securing a loan. At the other hand, former credit-problem lenders appear to have lower ratings.

Such three-digit numbers help mortgage lenders understand the probability of an individual paying back a loan obligation. These are used to determine the possible risk faced by lending money to a particular borrower and to prevent or minimize losses due to the default of the borrower.

How To Solve Common Credit Issues When Buying Ahouse

If your credit score orcredit history is standing in the way of your home buying plans, youll need totake steps to improve them.

Some issues like errorson your credit report can be a relatively quick fix and have an immediateimpact on your score. Other issues can take much longer to resolve.

You should start checking your credit early on, ideally 6-12 months before you want to buy a house. This will give you time to identify issues with your score or report and work on solving them before you apply for mortgage pre-approval.

Here are tips on solvingsome of the most common credit issues faced by home buyers.

Don’t Miss: Free Credit Report With Itin Number

Avoid Applying For New Credit

Virtually every time you apply for credit, the lender runs a hard inquiry on your credit report. In most cases, you’ll see your credit score drop by five points or fewer with one inquiry, if at all. But if you have multiple inquiries in a short period, it could have a compounding effect and lower your credit score even more.

Also, adding new credit increases your DTI, which is a crucial factor for mortgage lenders.

Is Your Credit Score High Enough To Buy A House

If your credit score is above 580,youre in the realm of mortgage eligibility. With a score above 620 you shouldhave no problem getting credit-approved to buy a house.

But remember that credit is only onepiece of the puzzle. A lender also needs to approve your income, employment, savings,and debts, as well as the location and price of the home you plan to buy.

To find out whether you can buy ahouse and how much youre approved to borrow get pre-approved by a mortgagelender. This can typically be done online for free, and it will give you averified answer about your home buying prospects.

Popular Articles

Don’t Miss: Credit Score To Qualify For Care Credit

Considering A Federal Housing Administration Loan

An FHA loan is one option to think about if your score is low or if you have trouble paying high down payments. FHA loans are backed by the Federal Housing Administration and are less risky for lenders. These loans require lower minimum down payments and credit scores in comparison to other conventional loans, so this may be an option for you if youre having trouble securing other types of loans.

A score between 500 and 580 requires a minimum down payment of at least 10 percent. A score of at least 580 requires a minimum 3.5 percent down payment.

What Is A Certificate Of Eligibility

A COE is a document that shows your mortgage lender that youre eligible for a VA home loan. To get a COE, you need to demonstrate proof of service. The proof you need to submit varies based on whether youre an active-duty military member, a veteran, a surviving spouse, etc.

If youre eligible, Rocket Mortgage® can help you secure your COE.

You May Like: Tri Merge Credit Report Mortgage

How Your Credit Score Is Calculated

|

How Your Credit Score is Calculated |

|

|

Payment History 35% |

Payment history is how well you pay your bills on time. This includes late payments and collection accounts. |

| 30% |

The amount of available credit you’re using is called your . Try to keep your credit utilization ratio below 25%. |

|

Length of Credit 15% |

The longer your accounts stay open, the better your score will be. Don’t close credit cards is possible. |

|

Types of Credit 10% |

A mix of credit accounts such as credit cards, auto loans, mortgages will help improve your credit score. |

| 10% |

When a lenders pulls your credit it creates a hard inquiry. Multiple inquiries hurt your score count against you for 12 months. |

Tip #: Pay Off Outstanding Debt

One of the best ways to increase your credit score is to determine any outstanding debt you owe and pay on it until its paid in full. This is helpful for a couple of reasons. First, if your overall debt responsibilities go down, then you have room to take more on, which makes you less risky in your lenders eyes.

Lenders also look at something called a credit utilization ratio. Its the amount of spending power you use on your credit cards. The less you rely on your card, the better. To get your credit utilization, simply divide how much you owe on your card by how much spending power you have.

For example, if you typically charge $2,000 per month on your credit card and divide that by your total credit limit of $10,000, your credit utilization ratio is 20%.

You May Like: When Does Wells Fargo Report To Credit Bureaus

What Credit Score Do You Need To Buy A House

Its possible to get an FHA loan with a credit score of 580 or 500, depending on the size of your down payment. VA, USDA, and conventional loans do have a set minimum credit score but lenders will generally require a credit score of at least 620.

Of course, remember that the minimum square will tell you whats required to qualify, but a lower credit score also usually means higher interest rates.

This table outlines the minimum credit scores typically needed to buy a house based on the type of loan: conventional, FHA, VA or USDA.

| Loan Type |

- Co-borrowers who do not plan to live in the home

- Down payment gift money, but no down payment of their own

- Properties that are in need of repair

Without FHA, millions of homeowners would be stuck renting years longer than they should. Yet, there is still room for FHA to expand its capacity to serve more aspiring homeowners.

How Does Credit Score Affect Mortgage Rates

Banks generally offer the lowest interest rates to those with the best credit scores, and, as a result, APRs, or annual percentage rates, are lower for borrowers with higher scores.

The average credit score in the U.S in 2020 was 710.

Most lenders consider any score above 740 to be very good. If youre above 760, lenders might offer incentives like credits and rebates because they can be more sure you wont default. Combined with a lower interest rate, this can save you a lot of money in the long run.

A couple of percentage points might seem minor, but it can add up to significantly higher costs in your monthly mortgage payment and over the life of the loan. Below, compare average rates for a 30-year fixed mortgage for a $300,000 loan .

Keep in mind that your mortgage rate is determined by multiple factors your credit score is just one of these. Lenders also consider your income and employment status, which dont affect your credit score one way or the other.

| FICO score | |

|---|---|

| 4.393% | $1,501 |

Average rates for a 30-year fixed mortgage by credit score, according to FICO, as of Dec. 15, 2021.

Read Also: Carmax Finance Rate

What Is The Minimum Credit Score To Get A Mortgage

Several different types of mortgage loans exist, and each one has its own minimum credit score requirement. Even so, some lenders may have stricter criteria in addition to credit score they use to determine your creditworthiness.

Here’s what to expect based on the type of loan you’re applying for:

If your credit score is in great shape, you may have several different loan types from which to choose. But if your credit score is considered bad or fair, your options may be limited.

How Your Credit Score Affects Your Mortgage Rate

Your credit score is directly tied to the interest rate you receive on a loan. Bad credit often leads to higher mortgage rates and increased closing costs, leading to a higher monthly payment. Borrowers with a higher credit score will get the best interest rates and loan terms.

- 579 and lower If you are approved for a mortgage with this low of a score, you will have a credit score as much as 2% higher than the current lowest rate.

- 580-619 You can expect an interest rate as much as 1% higher than the lowest rates available.

- 620-679 With a credit score in this range, your interest rate will be slightly affected. Rates could be .5% higher than someone with great credit will receive.

- 680-739 This is the range most homebuyers are at your rate will not be affected much at all in this range.

- 740 and higher You will be offered the best rates mortgage companies have to offer.

Recommended Reading: Care Credit Score Needed 2021

What Is Considered A Good Credit Score

Once you know your score and the steps youre willing to take to repair it, you can then decide on a plan to see how aggressively you should try to improve your score. Though a higher score is always better, most consumers aim to get their credit score into the good threshold or above.

While ranges will vary slightly between the FICO® and VantageScore 3.0 score models, 850 is the highest possible credit score for both. The credit score ranges for FICO® impact may include:

- Exceptional: Applicants with exceptional credit get access to the best interest rates, most beneficial offers and can even secure special individualized perks and offers from lenders.

- Very Good: Applicants with very good credit will have a variety of options to choose from when it comes to products and pricing.

- Good: According to data from Experian, borrowers in the good range have only an 8% chance of becoming seriously delinquent in the future. Most borrowers are in the good range of credit.

- Fair : Fair borrowers may see higher interest rates and lower ranges of credit than their peers with good or higher scores.

- Poor : Lenders see borrowers with poor credit scores as very high risk. Borrowers with poor credit may pay a fee or deposit in exchange for credit or a loan or they may be flat-out refused by lenders. If you have poor credit, you may want to create and carry out a credit repair plan immediately.