Financial Information In Your Credit Report

Your credit report may contain:

- non-sufficient funds payments, or bad cheques

- chequing and savings accounts closed for cause due to money owing or fraud committed

- bankruptcy or a court decision against you that relates to credit

- debts sent to collection agencies

- inquiries from lenders and others who have requested your credit report in the past three years

- registered items, such as a car lien, that allows the lender to seize it if you don’t pay

- remarks including consumer statements, fraud alerts and identity verification alerts

Your credit report contains factual information about your credit cards and loans, such as:

- when you opened your account

- how much you owe

- if your debt has been transferred to a collection agency

- if you go over your credit limit

- personal information that is available in public records, such as a bankruptcy

Your credit report can also include chequing and savings accounts that are closed for cause. These include accounts closed due to money owing or fraud committed by the account holder.

Get Your Credit Score And Report For Free

If you’ve ever applied for credit or a loan, there will be a credit report about you.

You have a right to get a copy of your credit report for free every 3 months. It’s worth getting a copy at least once a year.

Your credit report also includes a credit rating. This is the ‘band’ your credit score sits in .

Usually, you can access your report online within a day or two. Or you could have to wait up to 10 days to get your report by email or mail.

Contact these credit reporting agencies for your free credit report:

Since different agencies can hold different information, you may have a credit report with more than one agency.

Some credit reporting agencies may provide your credit score for free check with them directly.

Alternatively, you can get your credit score for free from an online credit score provider, such as , Finder or Canstar. This usually only takes a few minutes.

Typically, you agree to their privacy policy when you sign up, which lets them use your personal information for marketing. You can opt out of this after you sign up.

Avoid any provider that asks you to pay or give them your credit card details.

Your Annual Credit Report Is Now Available Weekly And Its Still Free

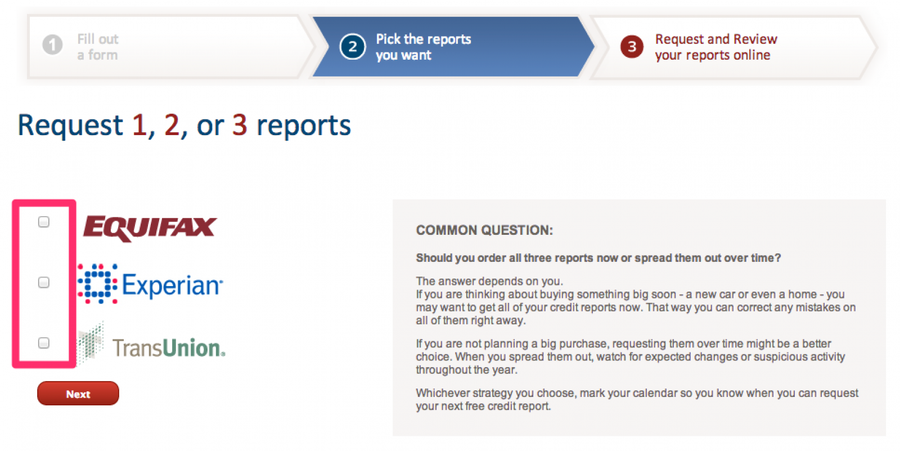

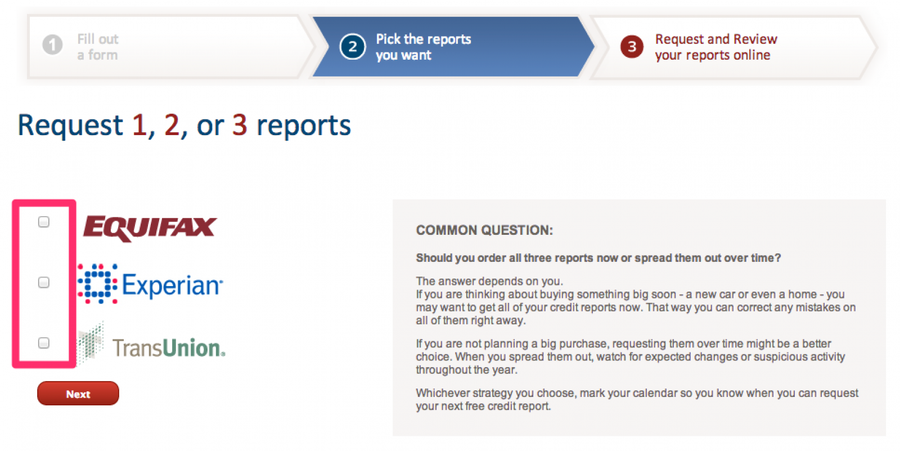

The three national credit reporting agenciesTransUnion, Experian and Equifaxare required by federal law to provide you with a free annual credit report. In fact, AnnualCreditReport.com was created by the credit reporting agencies as a one-stop-shop to provide you with your annual credit reports.

In response to the COVID-19 health crisis, TransUnion is pleased to offer you one free weekly credit report online through April 20, 2022 at AnnualCreditReport.com. Reviewing your credit reports regularly helps you ensure the information reported is accurate. It also gives you an opportunity to monitor your account history to combat identity theft.

You May Like: How To Get A Repossession Off My Credit

How Often Should You Get A Copy Of Your Credit Report

Monitoring your credit report every year is recommended by the Consumer Financial Protection Bureau. Credit expert John Ulzheimer suggests incorporating a cadence of three payments monthly. www.annualcreditreport.com allows you to get free annual credit reports from the three major bureaus every week between April 2015 and April 2022.

What Are The Penalties For Not Complying With Fcra

Each violation may carry a fine of between $100 and $1,000. If damages are incurred, actual and punitive damages may also be imposed in addition to attorney’s fees. Criminal charges may apply if somebody knowingly and willfully obtains information from a consumer reporting agency under false pretenses.

Recommended Reading: How To Dispute An Eviction On Your Credit Report

Who Creates Your Credit Report And Credit Score

There are two main credit bureaus in Canada:

- Equifax

These are private companies that collect, store and share information about how you use credit.

Equifax and TransUnion only collect information from creditors about your financial experiences in Canada.

Some financial institutions may be willing to recognize a credit history outside Canada if you ask them. This may involve extra steps. For example, you may request a copy of your credit report in the other country and meet with your local branch officer.

Correcting Your Credit Report

If there is incorrect information in your credit report, you may ask the credit reporting agency to investigate. For most items, you must do so in writing and can use a trackable method like certified mail to ensure that it is received. Certain items may be disputed directly online when viewing your credit report. If an item is available to be disputed online, all dispute options available will appear next to that item. The credit reporting agency must investigate your claim within 30 business days by asking the creditor in question to review its records, unless the agency believes that the dispute is “frivolous or irrelevant.” Within 5 business days of its receipt of your request, a credit reporting agency must notify the creditor that you are disputing the information.The credit reporting agency is required to correct, complete, or delete any information that is erroneous, incomplete, or unverified.

Most negative information that is more than 7 years old may not be included in your credit report. There are several exceptions to this rule the primary one is bankruptcy, which may be reported for up to 10 years. These rules do not apply if the credit transaction is for $50,000 or more, or if the report is being provided in connection with employment in a job that involves an annual salary of $20,000 or more.

Recommended Reading: Can I Get A Credit Report With An Itin Number

How Your Credit Score Is Calculated

Your credit score is calculated based on what’s in your credit report. For example:

- the amount of money youve borrowed

- the number of credit applications youve made

- whether you pay on time

Depending on the credit reporting agency, your score will be between zero and either 1,000 or 1,200.

A higher score means the lender will consider you less risky. This could mean getting a better deal and saving money.

A lower score will affect your ability to get a loan or credit. See how to improve your credit score.

Contacting The Credit Agencies Directly

If you prefer, you can call the major credit agencies directly and request a credit report at no charge. However, the FCRA-mandated Annual Free Credit Reports are only available through the website and phone number above. In other words, you might have to pay if you contact a directly.

The only way to get your annual free credit report is to use AnnualCreditReport.com or the phone number above. If you go any other route, you may have to pay or subscribe to a private service.

If you need additional credit reports , numerous companies try to sell subscription services or paid reports. That said, you might not need those services.

Contact the credit bureaus:

Also Check: How To Get Credit Report With Itin

Inaccuracies In Consumer Reports

A 2015 study released by the Federal Trade Commission found that 23% of consumers identified inaccurate information in their credit reports. Under the Fair and Accurate Credit Transactions Act , an amendment to the FCRA passed in 2003, consumers are able to receive a free copy of their consumer report from each credit reporting agency once a year. The free report can be requested by telephone, mail, or through the government-authorized website: annualcreditreport.com.

If a consumer’s rights under the FCRA are violated, they can recover:

The statute of limitations requires consumers to file suit prior to the earlier of: two years after the violation is discovered or,five years after the violation occurred.

Consumer attorneys often take these cases on a contingency fee basis because the statute allows a consumer to recover attorney’s fees from the offending party.

What Should I Look For In My Credit Report

When reviewing your credit report, check that all the information listed is up-to-date and accurate. Heres a brief breakdown on the kinds of things to verify within each credit report:

- Personal Information: Social Security number, name and address

- Inquiries: everyone who has reviewed your credit report in the past 2 years

- Public Records: bankruptcies, which can stay on a credit report for up to 10 years

Read Also: Does Pre-approval Affect Credit Score

Talk To A Qualified Credit Counselor

Before taking out a home equity loan, you should be careful and consider the pros and cons. You should explore alternatives with a credit counselor that do not put your home at risk of a forced sale. If you are unable to make payments on time, you could end up losing your home.

Contact a qualified credit counselor through the National Foundation for Credit Counseling .

Other Accounts Included In A Credit Report

Your mobile phone and internet provider may report your accounts to your credit bureau. They can appear in your credit report, even though they arent credit accounts.

Your mortgage information and your mortgage payment history may also appear in your credit report. The credit bureaus decides if they use this information when they determine your credit score

A home equity line of credit that is added to your mortgage may be treated as part of your mortgage in your credit report. If your HELOC is a separate account from your mortgage, it is reported separately.

You May Like: Which Bureau Does Care Credit Pull

Does Requesting A Credit Report Hurt Score Canada

A credit score that is assigned to you directly as a result of obtaining your own credit report will not be affected. In credit file disclosures with Equifax Canada, you have to disclose your current credit profile. It is TransUnion Canada which refers to your credit reports as consumer disclosures.

How A Credit Score Is Calculated

Its impossible to know exactly how much your credit score will change based on the actions you take. Credit bureaus and lenders dont share the actual formulas they use to calculate credit scores.

Factors that may affect your credit score include:

- how long youve had credit

- how long each credit has been in your report

- if you carry a balance on your credit cards

- if you regularly miss payments

- the amount of your outstanding debts

- being close to, at or above your credit limit

- the number of recent credit applications

- the type of credit youre using

- if your debts have been sent to a collection agency

- any record of insolvency or bankruptcy

Lenders set their own guidelines on the minimum credit score you need for them to lend you money.

If you have a good credit score, you may be able to negotiate lower interest rates. However, when you order your credit score, it may be different from the score produced for a lender. This is because a lender may give more weight to certain information when calculating your credit score.

Also Check: Credit Wise Is Not Accurate

What To Look For On Your Credit Report

Lenders use codes to send information to the credit bureaus about how and when you make payments.

These codes have two parts:

- a letter shows the type of credit you’re using

- a number shows when you make payments

You may see different codes on your credit report depending on how you make your payments for each account.

| Letter |

|---|

What Is Credit Monitoring

Canadas credit bureaus, as well as many credit card issuers and financial institutions, offer credit monitoring services. These services provide you with a notification after certain updates to your credit file, such as a credit inquiry.

You could consider using this service if you think youve been the victim of fraud or if you have been affected by a data breach. This can help you see if somebody is trying to apply for credit in your name.

You usually need to pay for these services.

Also Check: Carmax For Bad Credit

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Fix Mistakes In Your Credit Report

When you get your credit report, check that:

- all the loans and debts listed are yours

- details such as your name and date of birth are correct

If something is wrong or out of date, contact the credit reporting agency and ask them to fix it. This is a free service.

Some companies may try to charge you to get all negative information removed from your credit report. The only thing they can ask the credit reporting agency to remove is wrong information. And you can do that yourself see .

If there are loans or debts in your report that you know nothing about, it could mean someone has stolen your identity. See identity theft for what to do.

Read Also: Century Link Collections

Financial Information On Your Credit Report

Your credit report may contain the following financial information:

- non-sufficient funds payments, or bad cheques

- chequing and savings accounts closed for cause due to money owing or fraud committed

- bankruptcy or a court decision against you that relates to credit

- debts sent to collection agencies

- inquiries from lenders and others who have requested your credit report in the past three years

- registered items, such as a lien on a car that allows the lender to seize it if you dont make payments

- remarks, including consumer statements, fraud alerts and identity verification alerts

Your credit report contains factual information about your credit cards and loans, such as:

- when you opened your account

- how much you owe

- if you made your payments on time

- if you missed payments

- if your debt has been transferred to a collection agency

- if you went over your credit limit

- personal information thats available in public records, such as a bankruptcy

Summary Of Moneys Guide On How To Get Your Credit Report

- AnnualCreditReport.com is the best place to start to get your free credit reports from Equifax, Experian and TransUnion all in one spot.

- Because of the pandemic, Equifax, Experian and TransUnion are all offering free weekly credit reports also available through AnnualCreditReport.com until April 20, 2022.

- If you have exhausted all of your free credit reports from the major bureaus, you may contact them directly to purchase additional reports. They legally cant charge you more than $13 per report.

- While Equifax, Experian and TransUnion are the most popular credit bureaus, theyre not the only places to provide credit reports. According to the CFPB, you are also eligible for free annual credit reports from dozens of other credit-reporting agencies, most of which specialize in a niche credit topic.

Chris Huntley contributed to this article.

Also Check: 623 Credit Score Credit Card

It Can Affect Your Finances

Financial institutions look at your credit report and credit score to decide if they will lend you money. They also use them to determine how much interest they will charge you to borrow money.

If you have no credit history or a poor credit history, it could be harder for you to get a credit card, loan or mortgage. It could even affect your ability to rent a house or apartment or get hired for a job.

If you have good credit history, you may be able to get a lower interest rate on loans. This can save you a lot of money over time.

How To Get A Free Credit Report

Order a copy of your credit report from both Equifax Canada and TransUnion Canada. Each credit bureau may have different information about how you have used credit in the past. Ordering your own credit report has no effect on your credit score.

Equifax Canada refers to your credit report as credit file disclosure.

TransUnion Canada refers to your credit report as consumer disclosure.

Recommended Reading: Verizon Late Payment Credit Report

What About Free Credit Scores

There is no such thing as a free government credit score. Again, federal law currently provides free reportsbut not the scores that scoring models generated from the information in your reports. You won’t need to sign up for to access the scores either.

While going through the process of getting your free reports, you can buya credit score from each credit reporting agency if you want tothey will make it very easy to do so, and youll see several offers.

What Is The Website Address To Get A Free Credit Report From The Government

What is the website address to get a free credit report from the government?

I heard of a website to go to to get a free credit report from the government, but forgot what it was. Im just trying to stay away from the sites that claim to offer free credit reports, but come to find out that there are hidden fees, and that you have to enroll in credit monitoring.

Answer : I recommend that you try this web page where one can get from the best companies: .

Related :

I heard of a website to go to to get a free credit report from the government, but forgot what it was. Im just trying to stay away from the sites that claim to offer free credit reports, but come to find out that there are hidden fees, and that you have to enroll in credit monitoring.

I heard of a website to go to to get a free credit report from the government, but forgot what it was. Im just trying to stay away from the sites that claim to offer free credit reports, but come to find out that there are hidden fees, and that you have to enroll in credit monitoring.

I heard of a website to go to to get a free credit report from the government, but forgot what it was. Im just trying to stay away from the sites that claim to offer free credit reports, but come to find out that there are hidden fees, and that you have to enroll in credit monitoring.

Recommended Reading: Does Carmax Report To Credit Bureaus