Disposing Of Consumer Reports

When you’re done using a consumer report, you must securely dispose of the report and any information you gathered from it. That can include burning, pulverizing, or shredding paper documents and disposing of electronic information so that it can’t be read or reconstructed. For more information, see Disposing of Consumer Report Information? Rule Tells How.

How To Stay Compliant With The Fcra

Staying compliant with the FCRA is critical for property managers and landlords. Keep these rules in mind as you process applications and perform tenant background checks:

Only Request Credit Reports From Current Applicants

You can only request a credit report for someone applying to live in one of your properties or trying to renew their lease. You cannot request one for an existing tenant because youre worried about their financial situation and want more details.

Obtain Written Permission

You should obtain written permission before accessing applicants credit reports. Keep a copy of their consent to a credit check in your records in case you face any issues down the road.

Tell the Credit Bureau That You Plan to Use the Report for Housing Purposes

You are only allowed to use applicants credit reports to determine whether you want to offer them housing. You cannot pull one for any other reason. Its not acceptable to request one, for instance, if youre trying to decide whether or not to give someone a personal loan or to help you decide whether or not to raise the rent on an existing tenant.

Notify Applicants of Adverse Actions

Write the Adverse Action Notification Correctly

Consider Making Reports to the Credit Bureaus

What Is The Best Credit Check For Landlords

Most landlords do not need to know the exact credit score that a tenant has having an idea of whether the score is generally good or bad is often enough information to make your final decision about a tenant.

After all, the credit score is not the only factor in your decision process.

If you are happy to only be able to see a Pass/Fail result, RentPreps Background Check service is a great option.

You May Like: What Does Credit Score Mean

Your Landlord Checked Your Credit With A Hard Inquiry

When you apply to rent a property, the landlord will probably run a credit and background check on you. Theyll do this for reassurance that youll be a reliable tenant and pay your rent on time each month. Many landlords even have a minimum credit score required to rent an apartment.

A rental credit check can cause a small drop in your credit score if its classed as a hard credit check. However, its more common for rental credit checks to be classed as soft credit checks, which dont affect your credit.

To know for sure whether a tenant credit check will affect your credit score, just ask the landlord or property manager whether theyll run a hard or soft credit check.

Tenant Credit Check: How To Read And Understand The Report

Your choice of tenant can mean the difference between dealing with problems like late payments almost every month potentially even an eviction and a stress-free experience where youre able to earn a passive income. There are several ways to assess a rental application, but one of the most important is to request a tenant credit check as part of their tenant screening report. This gives you a better picture of the applicants financial situation, and its one of the best ways to determine if a tenant is likely to pay rent on time.

You want to be upfront about whether you will be running a credit check, and may even want to include this in your rental listing to prevent applicants who wont qualify from even applying.

Check out our article for more tips and advice on how to create a rental listing.

Also Check: How To Check Your Credit Score Without Lowering It

What To Do If I Have A Criminal Past

Nobodys perfect. If you have past criminal convictions, or have been to prison, it doesnt mean that you dont have a right to rent a property.

Its true that a lot of landlords will automatically reject people with recent criminal convictions or with any serious offence throughout the years.

The way you play your cards will determine if you can negotiate about your DBS check. If your landlord or letting agent never requests one, you can safely keep quiet about it, if not asked.

If you get asked about it during the interview, or you know your landlord is about to do a screening service on you, its best to go for full disclosure. If you preemptively talk about your criminal past and give reasonable explanations for why this will not affect you as a tenant, there is a bigger chance that your landlord will not consider it against you.

Dont Miss: Capital One Authorized User Policy

Can I Get An Apartment With A 540 Credit Score

The credit score you need to rent an apartment is at the discretion of the landlord. The majority want a score of 620, but some landlords will go as low as 540 — again, it all depends on the landlord. If a landlord does make an exception, she may charge a higher deposit for allowing your application to pass through.

Read Also: Can You Have A Perfect Credit Score

What Rental Information Can Appear On Your Credit Report

Generally speaking, rental contracts dont appear on consumer credit reports. That means that your rental payments will usually have no effect on your credit score, either positive or negative.

However, this isnt always true. There are several situations in which rental information can end up on your credit report:

Landlord Credit Check: What Can They See

Nervous about what a potential landlord might see on your application? There are many ways a landlord can run your credit and criteria can vary. When a landlord runs a credit check, they are trying to stack you up against other applicants to find out how is the most suitable tenant.

Even if you have terrible credit right now, you can get your finances back on track and climb your way to credit and financial greatness.

Don’t Miss: How Long Do Defaulted Student Loans Stay On Credit Report

How Much Does A Credit Check Cost

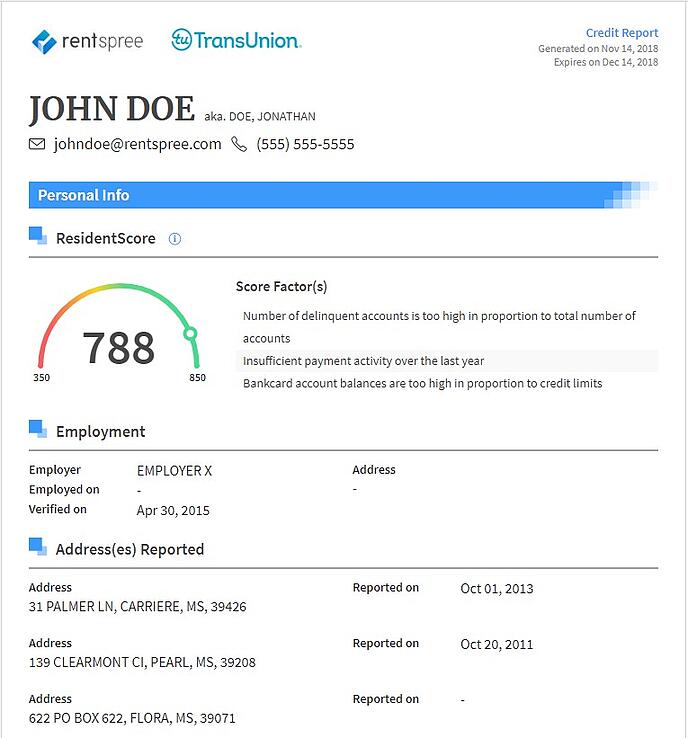

The cost of a credit check varies depending on the provider and the scope of the report. For instance, Experian offers a basic credit check and credit score for $14.95. Transunion charges $25 for its SmartCheck Basic, which includes a criminal background check and a Credit-Based ResidentScore . RentPrep offers a full credit report, background check, and the companys proprietary ResidentScore for $38.

Landlords can charge applicants for the cost of credit checks and other screening reports, but the amount may be limited by state law. For instance, California law in 2021 prohibits landlords from charging more than $53.33 for a screening fee.

What Information Is Included In A Tenant Screening Report

Tenant credit reports can contain the following information: 34

- Entries on the national terrorist watchlist

- Entries on FBI and police wanted lists

- A risk score or recommendation based on criteria selected by the landlord

In other words, tenant reports include credit information in addition to a variety of other details that arent included in regular consumer credit reports. Negative rental items like evictions can stay on your tenant credit report for up to 7 years.5

Landlords must tell you if they reject you based on your tenant report

By law, landlords are required to inform you if the information contained in a consumer credit report or tenant screening report caused them to take adverse action against you, such as rejecting your application to rent an apartment or charging you a higher rental deposit. 6

Recommended Reading: How Long Do Judgements Stay On Credit Report

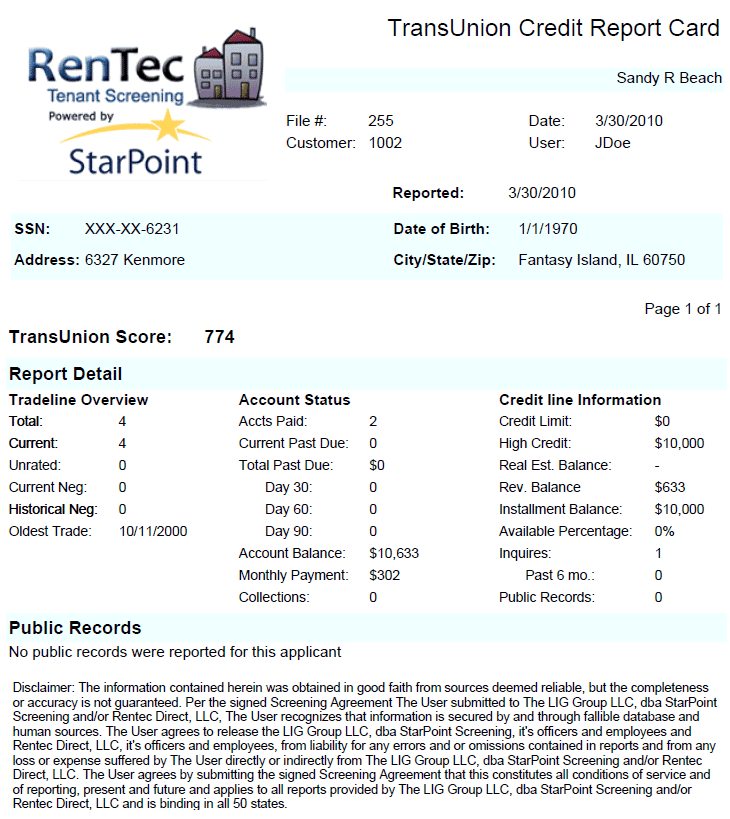

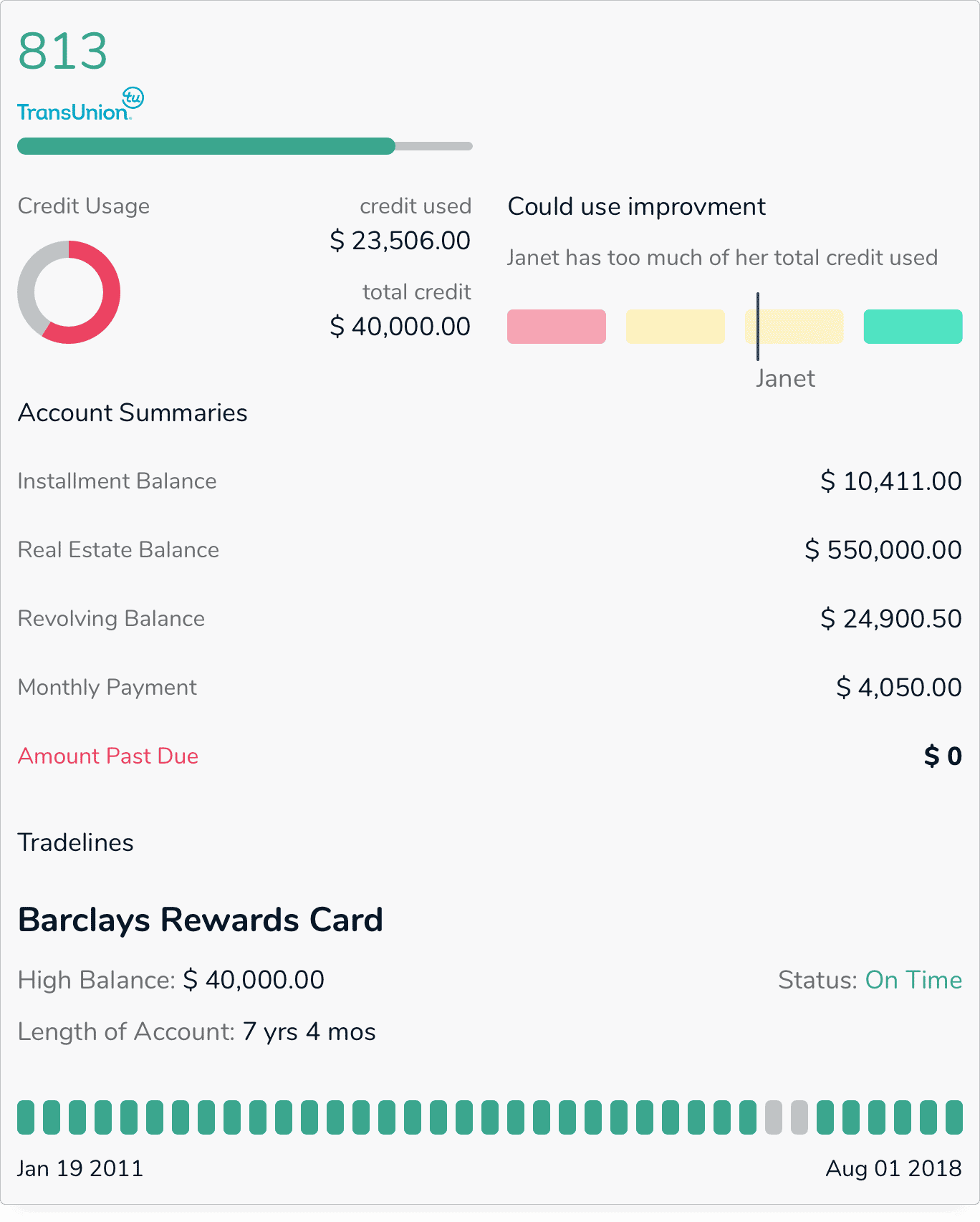

What Is A Tenant Credit Report

A tenant credit report shows important financial information and can help a landlord understand how a tenant has historically handled their finances and credit accounts.

Through Avail, landlords can request TransUnion credit reports from prospective tenants. These reports show a tenants credit score, as well as an individuals detailed payment history for things like credit cards, auto loans, student loans, and mortgages.

How Long Does A Tenant Credit Check Take

With most services, it can take 2-10 days to get approval to run a credit check on prospective tenants. After youre approved, the results of the credit report are typically available within an hour.

Zillow Rental Manager provides screening results without the wait after the applicant has submitted the application and youve verified your identity, the tenant credit report is available within minutes.

Recommended Reading: How To Correct Mistakes On Credit Report

Rental History Reveals All

Landlords can run credit checks to learn more about a prospective tenants past rentals. The rental history of a tenant is used to determine a tenants behavior in future rental situations. Any landlord who reports a tenants payment history to a credit bureau, will show up on a credit check. Landlords can check a credit report to see if any money is owed to a previous landlord. A landlord can use rental history data to see where a tenant has lived and make inquires concerning those rental agreements.

Why Tenant Credit Reports Are Important

At the simplest level, credit reports help you verify that a tenant is who they claim to be and that they do not have any glaring credit issues.

Tenant applications that are left unvetted could be full of lies that mislead you, and that would lead you to put the future of your property and business into unknown hands. In order to conduct business smartly, its important to use credit reports to verify:

- Tenant national criminal history

- If tenant credit score is acceptable

There is more information that can be gleaned from credit reports, but these facets are enough to give you a good idea of whether or not a tenant is being honest with you. Some red flags may not be issues if the tenant is upfront with you about such issues, but hidden problems can easily be discovered with a quality tenant credit report.

Also Check: Is Using Your Overdraft Bad For Credit Rating

Learn Why Landlords And Property Managers Often Run Credit Checks On Potential Tenantsand Ways To Help Improve Your Score

Your credit scores can be important when youâre looking to rent an apartment. Thatâs because the landlord or property manager may pull your credit as part of the screening process. Your credit history can show them how youâve managed money in the past and help them determine whether you might be a responsible tenant.

A credit score in the 600s typically places you in either the âfairâ or âgoodâ credit score range and could be a starting point for some landlords and property managers. Meeting their minimum requirements doesnât necessarily guarantee approval. But knowing what they look for could help you position yourself as a great rental candidate.

Where To Find No Credit Check Apartments Near Me

Finding a no-credit-check apartment will take some work, as they are in the minority of available units.

Youll need to spend some time scouring apartment listings and going through the process of elimination that removes apartments that require credit checks, scams, and units that wouldnt be a good fit for you.

Fortunately, Apartment List makes this easy for you. We match you with units that suit your preferences. From there, you can reach out to your favorite apartment matches to ask about their flexibility around credit checks and explain your credit situation.

You May Like: How To Get A Closed Account Off Your Credit Report

Is 699 A Good Credit Score

A 699 FICO®Score is Good, but by raising your score into the Very Good range, you could qualify for lower interest rates and better borrowing terms. A great way to get started is to get your free credit report from Experian and check your credit score to find out the specific factors that impact your score the most.

Get What You Need From Rentpreps Screening Services

Here at RentPrep, we offer two different screening services. Both of these services include some type of credit report that can help you make a decision about whether or not to accept a tenants application for your property.

The first service that can be ordered via RentPrep is the TransUnion Full Credit Report, formerly known as SmartMove. This report gives you the exact credit score of a tenant, and it must be ordered with the tenants involvement. The full report includes:

- Full credit report including ResidentScore

- SSN verification

- Option to have applicants pay

- Option judgments and liens search

With this report, you can easily see a lot of different information about all prospective tenants, and that information should be able to inform your decision.

Can a landlord order a credit report for the tenant without needing to be directly involved? You can if you use RentPreps Background Check service. This affordable service checks SSNs, addresses, evictions, bankruptcies, judgments, liens, and gives a pass/fail ranking for each screened tenant based on your guidelines.

Which of these services will work best for you is going to depend on your exact needs or the number of tenants that you want to screen.

Also Check: How To Cancel My Experian Credit Report Account

How Do I Get A Copy Of My Credit Report

- You can get a free copy of your credit reports from the big three nationwide consumer reporting agencies TransUnion, Experian, and Equifax free every week until April 20, 2022 at annualcreditreport.com. You can do this any time, to check your credit information before you apply for new rental housing. If you find errors, you can dispute them.

Why Do I Need To Run A Credit Check On Prospective Tenants

A credit check is just one part of an applicants background, but this basic screening may give you a foundational understanding of their financial health. Note: It is strongly recommended that you consider reaching out to legal counsel that is familiar with both credit reports and tenancy laws.

According to a SmartMove® survey, 84% of landlords cited payment problems as their top concern. A credit check is a prudent method of inquiry that may reveal what to reasonably expect from your renter in terms of their financial behavior.

Recommended Reading: How To Have A Perfect Credit Score

Why You Can Trust Bankrate

At Bankrate, we have a mission to demystify the credit cards industry regardless or where you are in your journey and make it one you can navigate with confidence. Our team is full of a diverse range of experts from credit card pros to data analysts and, most importantly, people who shop for credit cards just like you. With this combination of expertise and perspectives, we keep close tabs on the credit card industry year-round to:

- Meet you wherever you are in your credit card journey to guide your information search and help you understand your options.

- Consistently provide up-to-date, reliable market information so you\’re well-equipped to make confident decisions.

- Reduce industry jargon so you get the clearest form of information possible, so you can make the right decision for you.

At Bankrate, we focus on the points consumers care about most: rewards, welcome offers and bonuses, APR, and overall customer experience. Any issuers discussed on our site are vetted based on the value they provide to consumers at each of these levels. At each step of the way, we fact-check ourselves to prioritize accuracy so we can continue to be here for your every next.

Can I Get An Apartment With A 500 Credit Score

In short, yes! A credit score of 500 is low, but it’s not insurmountable. It would be best if you planned some extra time for your apartment hunt with scores this low, but you can still rent an apartment. … With a low credit score in the 500 range, you should expect to pay slightly more for an apartment.

Recommended Reading: How To Get Rid Of Inquiries On Your Credit Report

What Does A Rental Background Check Consist Of

This is part 8 of our Landlords guide to Tenant Screening. If youve landed here directly dont worry we cover everything you need to know about rental background checks below.

A rental background check is like an x-ray that allows you to see beneath the surface of a potential tenant.

This image might ring a bell for nostalgic Simpsons fans.

Perhaps you remember the time Homer went to the doctors for an x-ray.

The purpose of the rental background check is to see any issues that might be hiding beneath the surface.

Its a simple way to identify red flags and avoid problematic tenants.

In this post, we will answer the question, What does a rental background check consist of?

For the purpose of simplicity, we will use one of our SmartMove reports as an example for reference in this post.

But before we get ahead of ourselves. lets start with

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Also Check: How To Remove Repossession From Credit Report