What Can I Do If I Slip Up

If you’re less than 30 days late

You probably were charged a late payment fee and perhaps a higher APR, but your credit won’t suffer as long as you pay before the 30-day mark.;If youve never or rarely been late, call the creditor and ask if it will forgive the fee.

If you’re more than 30 days late

Bring your account current as soon as possible.;Thirty days late is bad, but its not as bad as 60, which is not as bad as 90. The sooner you can catch up, the less damage to your credit. When your account is current, you can write a goodwill letter asking the creditor to remove the negative mark.

If it’s an error

Credit reports sometimes include mistakes. If you spot incorrect information like a payment marked late when it wasn’t,;dispute the error to ask the;credit bureau;or;the creditor involved to take it off;your credit reports.

I Havent Paid A Bill What Kind Of Mark Will Appear On My Credit History

There are different types of marks that can go on your ;if you miss a bill.

- A late payment is recorded if a bill is paid after the due date has passed.

- A missed payment is when you entirely fail to pay a bill.

- You can get a default after several missed payments – anything from three to six on your account.

You will receive a written notice advising you of the default, you’re given 14 days to respond. The creditor can then close your account and demand all payment in full. This default will lie on your credit score for six years.;

Borrowing With Poor Credit

Your scores will be lower if late payments remain on your credit reports, but that doesnt mean you cant borrow money. The key is to avoid predatory lenders who charge high fees and interest rates.

A cosigner may be able to help;you get approved for certain types of loans. Your co-signer applies for a loan with you and promises to make the payments if you stop paying on time. Lenders evaluate their credit scores and income to determine their ability to repay the loan. That may be enough to help you qualify, but its risky for the co-signer, because their credit could take a hit if you make late payments.

Recommended Reading: Does Paypal Credit Report To Credit Bureaus

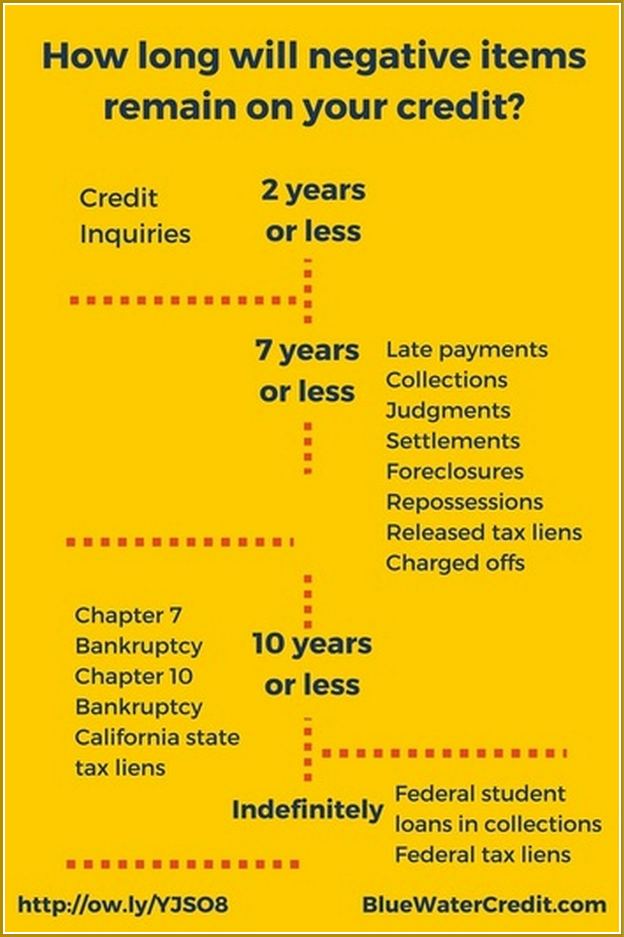

How Long Do Late Payments Stay On A Credit Report

3. Request Pay-For-Delete. If your late payments have been sent to a collections agency, you can also try sending your creditor a pay-for-delete letter. This is a letter requesting that the charges be deleted from your credit report in exchange for you paying the account in full.

The effect of late payments on your credit score is perhaps one of the biggest consequences of late rent payments. If your property management company reports late rent payments to the credit bureaus, your credit score will take a hit.

A late student loan payment could result in your servicer reporting the delinquency to the three major credit bureaus. After 30 days Some federal student loan servicers may charge a fee as soon as you miss a monthly payment, while policies for private lenders vary widely, so check with them if you think youll be late.

Heres what you need to know: The Fair Credit Reporting Acts Section 611 allows for consumers to challenge questionable items on their credit reports. This includes late payments charge-offs, collections, tax liens, bankruptcies, judgments, foreclosures, or any personal identification information.

Upon completing its investigation, the credit reporting agency must send you a letter with the conclusion and a free copy of your credit report. 6. Add a statement of dispute to your credit report.

Recommended Reading: Is 611 A Good Credit Score

First I Contacted The Creditor

I logged into my Amazon store credit card account; I started a chat with customer service. I know I couldnt actually admit to forgetting to update my linked bank account. So, I told the agent that a late payment was reported to my credit report, and I did not think it was right.

Maybe not the most moral thing Ive ever done, but I needed to see what would happen. I was told that they would have their department look into it and get back to me with their decision.

Also Check: Does Klarna Affect Your Credit Score

How Does A Late Payment Affect Your Credit

A late payment can have a negative impact on your credit scores, although the severity of your score drop depends on the type of credit score and your overall credit profile. In general:

- A late payment will lead to a more severe point drop if you currently have an excellent credit score rather than a poor or fair score.

- Missing multiple payments in a row can be worse for your credit than missing one payment.

- Having late payments on multiple accounts can be worse than a late payment on a single account.

- The negative impact of late payments on your credit .

Actively working to improve your credit could also help you recover from previous late payments. For example, making your payments on time and lowering your , or the amount of available credit you’re using, can show future creditors that you’re able to manage and repay loans.

After A 2 Minute Chat They Agreed To Remove The Late Payment

About 5 days after telling Capital Ones customer service department, the late payment was inaccurate; I received a letter in the mail stating that the late payment would be removed from my credit report within 30-60 days. Easy enough. Thats why I suggest contacting the creditor directly is the first and best option you have when it comes to removing late pays from your credit report.

You May Like: Sync/ppc On Credit Report

Can I Still Get A Mortgage If I Have A Late Or Missed Payment

Your mortgage chances will definitely take a hit – but by how much depends what you missed your payment on, how long it was and how big a deposit you have.

There are two types of borrowing: secured;borrowing, a loan that is linked to a secure asset like a mortgage or a car payment, and unsecured borrowing, such as;a phone or utility bill, or;credit card.

Missed payments to unsecured loans are seen as less serious than delays with secured loan payments. If you have just one or two late payments to unsecured debts over the past six years, your mortgage application is unlikely to be affected.

But, any more than that, you may be expected to put down a larger mortgage deposit;or pay a higher mortgage interest rate.

A first-time buyer with a small deposit looking to get a 95% mortgage;may struggle to borrow at such a high loan-to-value with a series of missed payments.;

This is because the lender is already taking a risk by allowing you to borrow such a significant proportion of the property’s value, and there’s a risk that if house prices drop, you could fall into negative equity;and the lender may not be able to recover its loan.;

It prefers small-deposit borrowers to have a clean credit record to make up for this risk. Any blemish on your credit could impact negatively on your mortgage chances.;

Late Credit Card Payments Can Stay On Your Credit Report For A Long Time And They May Affect Your Credit Score

Late credit card payments, also called delinquencies, generally appear on credit reports for seven years. And in many cases, those reported delinquencies can affect credit scores.;

But thereâs plenty more to knowâlike when payments are considered late and when theyâre actually reported. So keep reading to explore some of the details and to learn steps you can take to avoid missing payments.

Don’t Miss: Zebit Report To Credit Bureau

Your Rights To Access Credit Information

You can access credit information a bank holds about you and request to amend any incorrect information at the time of application.

You can also ask another credit provider to correct your credit report, but its usually faster for you to go directly to the CRB or credit provider that listed the information.

Types Of Late Payments On A Credit Report

For creditors, a single late payment may signify a broken trust. A missed payment can identify you as more of a credit risk than before. Thats why payment history is usually the most heavily weighted factor in calculating FICO® credit scores, accounting for about a third of the formula. FICO® puts late payments into various categories, including how severe it is, how recent it is and how frequently youve paid late. The more severe the category, the more damaging it is to your score. Generally, a late payment from many years ago wont hurt as much as the one reported today.

You May Like: Creditwise Score Accuracy

What To Expect After Sending A Goodwill Letter

There is no guarantee that a person can get the creditor to remove late student loan payments from their record. However, it’s a good idea to try.

The information has already been reported, so it may take time before the new loan information shows up on the report. Lenders must send back a letter stating if they are going to remove it from the loan and from the credit bureau agency.

File A Complaint With The Cfpb

The CFPB, Consumer Financial Protection Bureau, accepts credit reporting complaints as of September 22nd, 2012. Now consumers have the chance to file complaints against bands and lenders about inaccurate credit reporting on a Federal level.

You can file a complaint against the creditor directly or against the credit bureaus here.

You May Like: Does Speedy Cash Report To Credit Bureaus

Other Rights Related To Ccr Data

Direct marketing – Personal information in your credit report cannot be used by a credit reporting body or a credit provider for direct marketing. But credit providers can ask credit reporting bodies to use your credit information to pre-screen you for direct marketing purposes. You can tell a credit reporting body not to do this.;

Preventing identity fraud – If you think you have been a victim of fraud or have transactions you dont recognise you should contact CommBank. You can also inform the credit reporting body that you are a victim of fraud and not to use or give anyone your credit information.

You can also read our Privacy Policy;or visit;;for consumer education on CCR.

Making The Minimum Monthly Repayment

If you missed a payment, it may be recorded as missed on your credit report. For a credit card, you need to make at least the minimum repayment to make sure your repayment history information shows that youve paid on time.;

Your account statement will show when your repayment is due and when the payment you made was received by us. If the payment was received by us on or before the due date, the payment will be shown on your credit report as being paid on time.;

Don’t Miss: Removing Repossession From Credit Report

How Long Can A Debt Legally Stay On Your Credit Report

about seven yearsDebt can remain on your credit reports for about seven years, and it typically has a negative impact on your credit scores. It takes time to make that debt disappear. Fortunately, the debt will have less influence on your credit scores over time and will even fall off your credit reports eventually.

The Late Payment Occurred More Than Seven Years Ago

If a late payment is correctly reported, it should fall off your credit reports after seven years.

Lets say youve missed a payment by 30 days, then 60 days and then 90 days. Even though this one late account can lead to multiple negative marks on your credit reports, the original delinquency is the one that starts the clock. That means the entire sequence should disappear seven years from the first date the payment was late.

If you see a late payment thats more than seven years old, it could be a mistake, and you may want to dispute it.

Read Also: Is 586 A Good Credit Score

What Happens If I Make A Late Repayment

If you pay your credit card or loan repayments more than 14 days past the due date this can be recorded on your credit report as part of your repayment history information as a late payment. Only licensed credit providers such as banks and financial institutions are able to disclose repayment history information to a credit reporting body like Equifax. Telco and utility companies are not licensed credit providers and cannot supply or receive this information.

However, a default can be recorded on your credit report by any credit provider if you miss a payment which is more than $150 and is more than 60 days overdue. Before listing a default the credit provider must have taken steps to collect the whole or part of the outstanding debt. ;This means they have sent you are written notice setting out the amount overdue and seeking payment and a separate written notice advising you that the debt may be reported to a credit reporting body. A default remains on your credit report for five years.

To try and prevent this, pay bills on time, set up direct debits to pay your minimum credit card balance and schedule loan repayments for your pay day. Talk to your credit provider straight away if you are having trouble meeting your repayments they may have procedures in place to help borrowers experiencing financial hardship.

If you are struggling with debt ASIC;MoneySmart also provides more information about managing debt.

How Late Payments Impact Your Credit Score

Evan Miersch

â¢9 min read

Article Contents

Your payment history is the biggest factor that impacts your credit score, as it makes up 35% of your score. Missing one bill payment can decrease your credit score by as much as 150 points, according to Borrowell internal data. A single late payment could prevent you from qualifying for prime credit cards, low-interest loans, and attractive mortgage rates.

Lenders look at your credit score when qualifying you for products. Late payments will impact your credit score and raise red flags to lenders. In order to keep your credit score healthy and maintain your financial reputation, itâs important that you stay on top of your bill payments.

There are other factors that impact your credit score, including your credit utilization and the number of hard credit checks made on your credit report. That said, paying bills on time is crucial for keeping your credit score healthy.

Read Also: Does Zzounds Report To Credit Bureau

You Have Defaulted On An Account

An account is in default when the borrower has missed payments and the account is then closed by the lender. There is no set number of;missed payments that result in a default being recorded. This is down to the individual lender, but when they believe a debt can no longer be recovered they record a default.

If a debt cannot be recovered many lenders sell the account to a debt collection agency. This will show negatively on your credit file and will remain on it for a period of six years from the default date, regardless of any settlement. After this time it is removed from your report automatically even if the full amount has not been settled.

Although a default will be removed from your report after 6 years the lender may still pursue you for the debt, unless the debt is statute barred. A statute barred debt is a debt which is seen as unenforceable as the creditor has not chased it in the period allowed. If you have not been chased for payment, have not made payment or signed any acknowledgement of a debt in writing for 6 years in England and Wales and 5 years in Scotland then it could be statute barred.

Fire A Dispute With The Credit Bureau

You can dispute anything on your report with the three major credit bureaus. The credit bureau must launch an investigation into the disputed account. They will send a request to the creditor asking for validation of the late payment. This is basically what credit repair companies do to increase the clients credit scores.

If the creditor fails to respond within 30 days, the late payment will be deleted. However, large banks and lenders have departments that handle credit disputes. They are usually very good at responding with all the information the credit bureau needs.

This makes having late payments removed by disputing with the credit bureaus quite difficult. However, its not impossible.

Don’t Miss: How To Get Credit Report Without Social Security Number

Bills Sent To Collections

If you miss a credit card payment or other bill payment and fail to pay your bill and any associated late fees, you may find yourself with another negative item on your credit report.

When account holders fail to pay a bill, the credit card company or lender may choose to charge off the account and assign it to a collections agency. This process can take months to occur, and therefore may not affect your credit score right away. However, it will stay on your report for 7 years from the date of your first missed payment. If youve paid off your collections account before those 7 years are up, the account and the missed payment will leave your report at the 7-year mark. Otherwise, the collections account will continue to appear on your report even after the original missed payment is removed.