What Is The Difference Between Cibil Equifax Experian & High Mark

These are four credit information companies that function under the RBIs approval.They have various similarities and differences that are listed below.

1. CIBIL

-

It is the oldest and most popular in India today and also offers market insights and portfolio reviews for businesses apart CIBIL score and reports for individuals.

-

Its scoring system ranges from 300 to 900, with 900 being the highest and 300 being the minimum CIBIL score.

-

It offers businesses a Company Credit Report and a CIBIL Rank.

2. Equifax

-

It was granted its license in 2010.

-

Its scoring system is on a scale of 1 to 999, with 1 being the lowest and 999 being the highest score.

-

It also offers additional facilities like credit risk and fraud management, portfolio management and industry diagnostics.

3. Experian

-

It received its license for operation in India in 2010, but is an international company in existence since 2006.

-

The Experian score ranges from 300 to 900 with 300 being the lowest and 900 being the highest.

-

It offers several services for consumers and organisations like customer acquisition, collection and money recovery, customer management, data analytics, customer targeting and engagement.

4. High Mark

You can choose any one from these companies to calculate your credit score and so can lenders and other parties.

How To Get An Excellent Credit Score

If your credit score falls within the good, fair or bad ranges and you want to get an excellent credit score, follow these tips to help raise your credit score.

- Make on-time payments. Payment history is the most important factor in your credit score, so it’s key to always pay on time. Autopay is a great way to ensure on-time payments, or you can set up reminders in your calendar.

- Pay in full. While you should always make at least your minimum payment, we recommend paying your bill in full every month to reduce your utilization rate. .

- Don’t open too many accounts at once. Each time you apply for credit, whether it’s a credit card or loan, and regardless if you’re denied or approved, an inquiry appears on your credit report. Inquiries temporarily reduce your credit score about five points, though they bounce back within a few months. Try to limit applications and shop around with prequalification tools that don’t hurt your credit score.

How Is Your Credit Score Calculated

Your credit score is calculated using five factors:

Most of the information is automatically removed after 6-7 years so that student loan payment you missed 20 years ago wont be haunting your score today.

1. Whats your payment history?

This is obviously the most important factor affecting your credit score. Prospective creditors want to know that you are going to pay them back. Your payment history covers all of your consumer debt: credit cards, lines of credit, student loans, car loans, cell phone payments on contract, etc.

- Do you pay your bills on time?

- How frequently do you miss a payment?

- How many times have you missed a payment?

- How old are your missed payments?

2. How much do you currently owe?

When creditors look at how much you owe, theyre trying to determine whether or not you are able to take on more debt. Can you manage with more?

Besides looking at the amount of debt that you currently have, lenders will look at whats called debt utilization ratio: thats the amount of credit youre using compared to the amount thats available to you.

For example, if you have a credit card limit of $5,000 and youre constantly hovering at $3,600, then youre using 75% your available credit on an ongoing basis. To a creditor, that indicates that youre struggling to pay off your existing debt.

- How much in total do you currently owe?

- How much are your payments?

- How much of your available credit do you use on an ongoing basis?

Read Also: Aargon Collection Agency Bbb

What An Excellent/exceptional Credit Score Means For You:

Borrowers with exceptional credit are likely to gain approval for almost any credit card. People with excellent/exceptional credit scores are typically offered lower interest rates. Similar to “exceptional/excellent” a “very good” credit score could earn you similar interest rates and easy approvals on most kinds of credit cards.

Credit Score: Is It Possible To Get

Adam McCann, Financial WriterMar 26, 2021

The most popular credit scores all use a range of 300 to 850. So a credit score of 900 isnt possible with those models, which include VantageScore 3.0 and 4.0 as well as FICO 8 and 9. But some older models, as well as some alternative scores, do go up to 900 . Its good to be familiar with these ratings, but you probably wont encounter them often.

So you should worry far more about where you stand on the standard credit score range. And you can see exactly where that is by checking your latest credit score for free on WalletHub.

Below, you can learn more about credit scores with unusually high ranges as well as which number you should really target on the standard credit score range.

Don’t Miss: Which Business Credit Cards Do Not Report Personal Credit

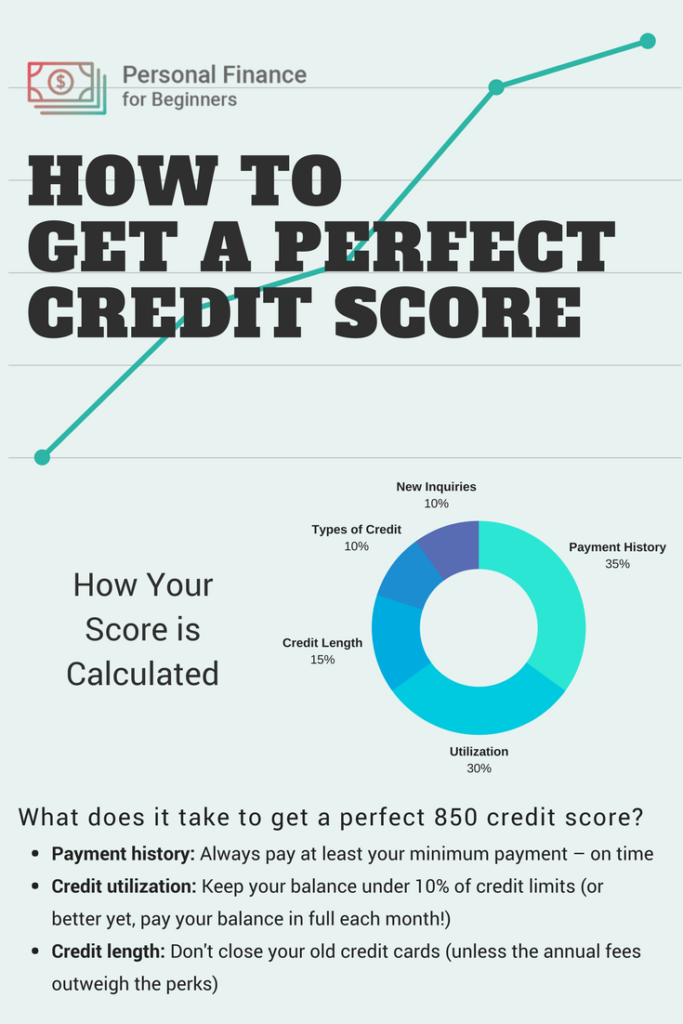

How Your Score Is Calculated

Whether you want the perfect credit score or increase your score just enough to qualify for better interest rates, it is helpful to understand how your credit score is calculated.

After you understand what factors influence your score, you can take specific actions to increase your score.

There are five major factors that impact your credit score :

- Payment history

- Types of credit

- Recent credit inquiries

Each of these factors tells some type of story about the potential risk you offer to a potential lender.

Do you forget to make your payments?;Did you just open your first ?;Are you seeking a new credit card because youve maxed out your existing ones?

Vantagescore Credit Score Ranges

VantageScores are also between 300 to 850. The ratings are as follows:;

- Very Poor credit 300 to 499

- Poor credit 500 to 600

- Fair credit 601 to 660

- Good credit 661 to 780

- Excellent credit 781 to 850;

Heres how VantageScores are computed:;

- Overall credit usage, available credit and outstanding balances Extremely influential

- Payment history Moderately influential

- Age of credit history Less influential

- New accounts Less influential

Don’t Miss: Aargon Collection Agency Scam

Tip : Dont Get Discouraged

Even if you never reach 850, merely having excellent credit is an amazing achievement. It will save you boatloads of money over the course of your life. And it wont ever stand in your way like a bad score. Plus, you may find consolation in the fact that having excellent credit means your score is higher than over 60% of people, according to WalletHub data.

For more tips and info, check out WalletHubs Guide to Building Credit.

How Can I Get The Highest Credit Scores Possible

Theres no magic formula for achieving the highest score. A perfect credit score based on one scoring model and one credit report may not translate into a perfect score with another because of the different weighting formulas and algorithms.

That said, there are definitely steps you can take to get the best credit scores possible.

Read Also: Does Speedy Cash Report To Credit Bureaus

What Does A Low Credit Score Mean

A low credit score doesnt mean youll never be able to borrow. Some places might still lend you money, although at a higher interest rate. This is one of the ways youll find your credit score really matters: the better your score, the less you pay on interest.

In other words, a good credit score helps you save money.

Become An Authorized User

If you dont have a lengthy credit history, ask a family member who has excellent credit to add you as on their oldest credit cards. Your score can increase if the credit card issuer reports information to the credit bureaus for authorized users. However, the downside is that your score can decrease if the primary cardholder misses a payment and its reported on your credit report.

Don’t Miss: What Is Syncb/ppc

Why You Dont Need A Perfect Credit Score

The pursuit of a perfect credit score is noble, perhaps, but the reality of achieving an 850 score does little to help you compared to other exceptional credit scores.

One of the main reasons to raise your credit score is to save money through lower interest rates. Most lenders, though, dont offer lower rates for having the highest credit score on a scoring model. Theres little difference between an 800 and 850 in the eyes of a lender when determining your creditworthiness.

If you aim for a credit score within the 800 to 850 range which FICO considers exceptional youll have access to the most competitive rates on the market.

Do Perfect Credit Scores Really Matter

Ultimately, perfection doesnt matter nearly as much as having credit reports that reflect several years of managing credit wisely. If you have a FICO Score 8;above 740, chances are good that youll qualify for the best credit card offers, lowest interest rates and best rewards programs offered by most credit card companies.

Theres very little difference to lenders between, say, an 800 FICO Score 8 and the perfect 850. People with excellent credit scores are likely to;get the best possible terms;on any loan or credit card account, provided theres enough credit history and income to back it up.

Is there any advantage to perfect credit scores? Those extra points can offer a bit of protection if you happen to miss a payment or ding your score with high credit utilization or multiple credit inquiries. But its easier to avoid those unnecessary penalties in the first place and focus on managing your credit responsibly.

Have we answered all your questions about achieving the highest credit scores? Was anything confusing? You can always hit the orange Ask button at the top right of this page with any questions or feedback were here to help!

You May Like: Why Is There Aargon Agency On My Credit Report

How Your Credit Score Is Determined

All the leading credit rating agencies rely on similar criteria for deciding your credit score. Mostly, it comes down to your financial history how youve managed money and debt in the past. So if you take steps to improve your score with one agency, youre likely to see improvements right across the board.

Just remember that it may take some time for your credit report to be updated and those improvements to show up with a higher credit score. So the sooner you start, the sooner youll see a change. And the first step to improving your score is understanding how its determined.

Here are some of the factors that can harm your credit score:

- a history of late or missed payments;

- going over your credit limit

- defaulting on credit agreements;

- bankruptcies, insolvencies and County Court Judgements on your credit history;

- making too many credit applications in a short space of time

- joint accounts with someone with a bad credit record

- frequently withdrawing cash from your credit card

- errors or fraudulent activity on your credit report thats not been detected

- not being on the electoral roll

- moving house too often

How Is A Canadian Credit Score Calculated

While we dont know the exact formula for how each of the two Canadian credit bureaus calculates;your credit score, we do know the five most important factors that affect it.

- History of payments. Do you make all your credit and loan payments on time all the time?

- Debt level. How much debt do you carry month to month? Are you using up more than 30% of your total limit?

- How long have you been a credit user? The longer the better for the health of your credit.

- New inquiries. Every time a potential lender or your score drops a few points. Too many pulls within a short period of time is a bad sign.

- Diversity. Are you responsibly using more than one type of credit account?

Recommended Reading: How To Get Credit Report Without Social Security Number

Factors That Affect Credit Scores

So, you can see credit-scoring models and credit reports are two big factors that determine your credit score. But if you donât know what information from your credit report is being used, itâs not much help.;

Here are a few factors the CFPB says âmake up a typical credit scoreâ:

- Payment history: How well youâve done making payments on time.;

- Debt: How much current unpaid debt you have across all your accounts.

- A ratio that reflects how much of your available credit youâre using compared with how much you have available. is usually expressed as a percentage.

- Loans: How many loans and what kinds they are, such as revolving credit accounts and installment loans. Sometimes this is called your credit mix.

- How long youâve had your accounts open. But remember, what qualifies as your oldest line of credit depends on whatâs being shown in your credit reports.

- New credit applications: How many times youâve applied recently for new credit. The effect on your scores might be minor, but a lot of new hard credit inquiries could still give a negative impression to lenders.

How Does FICO View Those Credit Factors?

FICO is pretty specific about what it views as the most important credit factors: Payment history makes up about 35% of its scoring. About 30% is based on the total debt. The other primary factors are credit history , credit mix and new credit .

How Does VantageScore View Those Credit Factors?

Highest Credit Score Possible

850 is the highest possible credit score any one can have. Credit scores are three digit numerical value calculated on the basis of your credit report. And generally 300 to 850 is the range of credit score. Mostly FICO and Vantage Scores are preferred by the lenders.

The higher credit score you have, the more will be your chances for getting a loan at the good rate of interest. 670 or above is considered as the decent credit score by lenders. The best rate of interest and terms of loan is offered to those who have highest credit score.;

Don’t Miss: Carmax Auto Finance Defer Payment

The Financial Burden Of Debt And How To Minimize It

In todays world, there are several things you can do in order to have the a high credit score. The first thing is avoiding overspending.

Buying what you need without going into debt will help your credit score stay high because you dont have a ton of outstanding loans or bills.

Every time you spend more than $100 on anything that isnt an emergency, think about how much damage that could be doing not just to your wallet but also to your credit score as well! If this sounds too difficult for now, at least try paying off any borrowed money as soon as possibleit will make everything easier later on.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Also Check: Does Klarna Report To Credit

What Is The Perfect Credit Score

Want to have a perfect credit score?

We will tell you everything related to credit score. And will show you the ways through which you can get the perfect score.

The highest credit score you can have is 850. At some places you can see that score is 900 as well. Commonly the credit score ranges from 300 to 850. FICO and Vantage Scores are the most common versions of valuing credit score. Any score above 670 is considered to be a great score.

According to researches, only 1.6% of U.S. citizen had a perfect Fico score. Credit scores are important for you to have. It determines your credit worthiness. Having a decent score can get you good rates from lenders for taking a credit.

You May Also Like:;Does checking credit score lower it?

Sure You Can But Holding Onto It Can Be Fleeting

You may have been able to check your credit score lately using a number of free services including from your bank or mortgage lender. But, what good is knowing your FICO score if you dont understand what the number means on the overall reporting scale? Maybe you have a 740 FICO score. If the maximum score is 750, youre pretty much a credit genius. If the max is over 1,000, youre sporting a C averagenot really all that impressive.

So what is the highest credit score possible, and how do you achieve it?

Read Also: Does Speedy Cash Report To Credit Bureaus

What To Focus On When It Comes To Your Credit Score

If a lender provides you with a credit score when youve applied for a loan, or if you obtain a free FICO® Score from Experian, the score will come with a report, based on your unique credit history, that indicates the top credit scoring factors benefiting your credit score and the top factors preventing it from being higher than it is. You can use this personalized information to help focus your efforts as you work toward a better credit score.

The report will detail which factors matter most to you, but the following factors, listed in order of influence, play a large part in determining everyones credit scores: