Are All Bankruptcies The Same When It Comes To Credit

Myth: Bankruptcy affects the credit of all consumers who file equally, regardless of the amount of debt or the number of debts included.

The truth: Bankruptcies are far from created equal. As already stated above, some stay on your credit longer than others.

Creditors also tend to prefer to see Chapter 13 bankruptcies over Chapter 7 bankruptcies. Thats because Chapter 13 bankruptcy requires you to make some payment on your debt, so it demonstrates that you do try to pay your debts whenever possible. However, that doesnt mean Chapter 13 is the right choice for everyone and every situation.

How much debt you have and how much is included in the bankruptcy can also make an overall difference on how your credit is impacted. In short, your credit is going to suffer, but theres no single number that can be provided for how much it will drop.

How Long Do Bankruptcies Stay On Your Credit Report

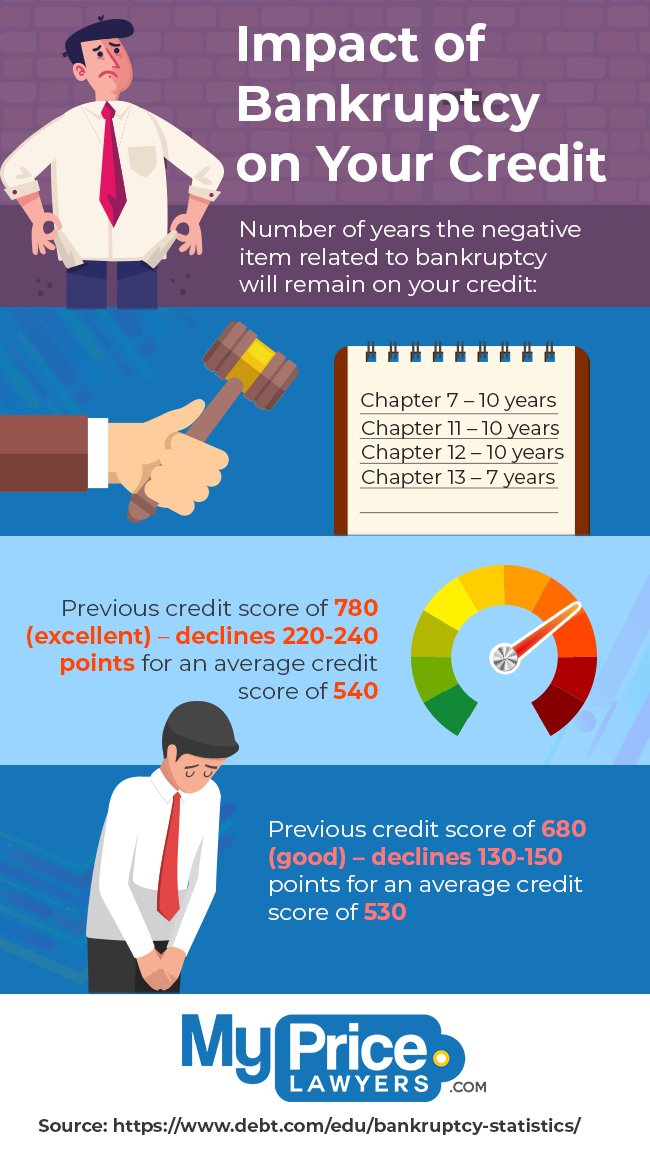

The length of time that a bankruptcy filing stays on your credit report depends on what type of bankruptcy you filed. We took a look at Chapter 7 and Chapter 13, which are the two main types of consumer bankruptcies, and to see how their impacts on your credit score differ.

- Chapter 7 bankruptcy: Also known as liquidation bankruptcy, Chapter 7 is what Harrison refers to as “straight bankruptcy.” It’s the most common form of consumer bankruptcy and is usually completed within three to six months. Those who file for Chapter 7 will no longer be required to pay back any unsecured debt , like personal loans, credit cards and medical expenses, but they may have to sell some of their assets to settle secured loans. Chapter 7 bankruptcies stay on consumers’ credit reports for 10 years from their filing date.

- Chapter 13 bankruptcy: Harrison refers to Chapter 13 as the “wage earner’s bankruptcy.” This form of filing offers a payment plan for those who have the income to repay their debts, just not necessarily on time. About a third of bankruptcies filed are Chapter 13 . Those who file are still required to pay back their debts, but instead over a three-to-five year time frame. Chapter 13 bankruptcies stay on consumers’ credit reports for seven years from their filing date.

Myth #: Each Person Only Has One Credit Score

There are two credit bureaus in Canada: Equifax and TransUnion. Some creditors report to one bureau and not the other, so each bureau may have different information on any one individual. Each bureau also uses their own calculations and algorithms to calculate a credit score. As a result, the same individual may have a different credit score at each credit bureau.

Also Check: Will Paypal Credit Affect Credit Score

Read Also: How Long Are Charge Offs On Credit Report

How Can I Get A Copy Of My 1999 Credit Report

For example, if you suspect that someone opened credit card accounts in your name in 1999, that can help your representative find the report that you need. Request a copy of your current credit report. Here, you can see factors from the past seven years that affect your credit negatively, from collections to delinquent accounts.

Do I Still Have To Pay The Debt

If youre wondering how long something stays on your credit report, its important to keep this in mind: Your debt isnt simply erased once it falls off your credit reports. If you never paid off the debt and the creditor is within the statute of limitations, they may try to collect the money. The creditor can call and send letters, sue you or get a court order to garnish your wages.

Even outside the statute of limitations, collection companies can still try to collect the debt. Stale debts represent a thriving business, as they are often sold and resold for pennies on the dollar. Even a partial payment makes a call or letter worthwhile for the collector.

The only sure way to get rid of a debt is to pay what you owe, or at least an agreed-upon part of what you owe. If youre looking to put your debt behind you and move on with a clean slate, contact the collectors listed on your credit report. Before making the phone call, make sure you know:

- The debt is legally yours.

- How much you owe the creditor.

- What you can realistically afford to pay per month or in a lump sum.

If you negotiate a payment for less than the full amount owed, be sure to get the payment agreement in writing from the collector before you send in any payment.

Also Check: What Is My True Credit Score

When Does Bankruptcy Leave Your Credit Report

Covid-19 is still going strong, and so is the economic fallout. Most banks are expecting billions in fourth-quarter losses. The retail and hospitality industries have seen store closures and bankruptcy filings, and many expect personal bankruptcies to rise. Filing personal bankruptcy means you get immediate relief from debt and collections calls, but the downside is that you negatively impact your credit for several years. If you are considering bankruptcy and want to know more about the longer-term impact on your credit, keep reading.

There are two types of individual bankruptcy filings: Chapter 7 and Chapter 13.

Debts With Zero Balance

Your creditors are still allowed to list discharged debts on your credit report, but not as active or having any amount owed. Your bankruptcy-related debts can be listed as existing, but with zero balance. This is a way to make it clear that there are debts in your past, but you are not required to pay them and the debts hold no value to be resold to debt collectors.

You May Like: How Often Does Your Credit Score Change

Can You Get Bankruptcy Off Your Report Faster

Whats interesting is that theres no minimum amount of time before bankruptcy can be removed from your credit report 10 years is only the maximum. So get a free credit score and credit report and look really closely for mistakes. If you find any errors with your personal information, debts, creditors, timelines or other information, file a dispute with the credit bureau. Any entries related to your bankruptcy must appear on your credit report correctly, and mistakes could force a credit bureau to remove the bankruptcy from your report. Bankruptcies automatically fall off your credit report after the designated amount of time. If you notice that a bankruptcy doesnt come off your credit report after the expiration date, you should file a dispute with the credit bureaus.

Read Also: Trump Personal Bankruptcies

Is Your Credit Rating Really Worth Stressing About

Are you current on all your debt payments? Yes? No? Maybe?

If youâre behind on any debt payments, your credit score could probably be better. So, rather than worrying about possibly making your already bad credit worse, think about how a bankruptcy discharge could help you build credit.

So, what happens to my credit score if I file bankruptcy?

Like all negative information reported to the credit credit bureaus, filing any type of bankruptcy will have a negative impact on your credit score. Since a bankruptcy filing is public record, they will find out, even if theyâre not directly notified by the bankruptcy court.

But, unlike other things that have a negative effect on your FICO score, a bankruptcy filing is often the first step to building a good credit score.

Also Check: What Is Epiq Bankruptcy Solutions Llc

Recommended Reading: Is 705 A Good Credit Score

Will A High Credit Score Help You During A Bankruptcy

Myth: A clean credit historyone with no late payments or other issuesand a high credit score means youll be less impacted by a bankruptcy.

The truth: Bankruptcy will have a huge negative impact on your credit, and a previously positive payment history doesnt change that. In fact, if you have a higher score, you could stand to lose more than if you already have a low score.

A bankruptcy also temporarily wipes out all the goodwill you might have developed with your timely payments. Some lenders may have rules about offering credit when a recent bankruptcy shows up on your credit historyno matter how good your score used to be.

How To Avoid Bankruptcy

A bankruptcy isnt anyones first choice, but we know sometimes it feels like your only option. But it is possible to avoid bankruptcy. It starts with taking care of your Four Walls: food, utilities, shelter and transportation. Once youve got your home in order, its time to get aggressive by selling everything in sight, getting on a tight budget to cut unnecessary expenses, and snagging a side hustle to throw even more money at your debt. And you can always sit down with a financial coach who will guide you through your specific situation. Rememberits never too late to get help.

If youre ready to cut credit from your life and say never again to bankruptcy, Ramsey+ will show you how. Youll learn how to pay off your debt, save and invest so you never have to worry about money again. Start a free trial today!

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners.

Recommended Reading: How To Boost Credit Score Quickly

Correcting Misreported Discharged Debt

Disputing errors is relatively straightforward. Youll do so by using the online procedure provided by each of the three major credit reporting agencies.

A creditor who repeatedly refuses to report your discharged debt properly might be in violation of the bankruptcy discharge injunction prohibiting creditors from trying to collect on discharged debts. If you take steps to remedy the misreporting, and the creditor refuses to fix the error, talk to a bankruptcy attorney.

How To Reestablish Your Credit

After declaring bankruptcy, you’ll want to look at ways you can earn a score in a range that will qualify you for better financing options and that begins with rebuilding your credit.

You may not be able to immediately qualify for the best credit cards, but there are others that apply to people with less-than-stellar credit.

Secured credit cards require a deposit that acts as your credit limit. If you make your credit card payments on time and in full on this new secured card, you then have a greater chance at qualifying for an unsecured credit card in the near future.

The Capital One Platinum Secured Credit Card has no annual fee and minimum security deposits of $49, $99 or $200, based on your creditworthiness. Those who qualify for the low $49 or $99 deposits will receive a $200 credit limit. Cardholders can obtain a higher credit limit if they make their first five monthly payments on time.

The Citi® Secured Mastercard® is another option with no annual fee. There is a $200 security deposit required, which then acts as your credit limit. Cardholders can also take advantage of Citi’s special entertainment access, which provides early access to presales and premium seating for concerts and games.

Once you open a new credit card, make sure you pay your monthly bills on time and in full so you can start working your way toward better credit.

Editorial Note:

Also Check: Is 652 A Good Credit Score

Consider Applying For A Secured Credit Card

After filing for bankruptcy, its unlikely that you will qualify for a traditional credit card. However, you may qualify for a secured credit card. A secured credit card is a credit card that requires a security depositthis deposit establishes your credit limit.

As you repay your balance, the credit card issuer usually reports your payments to the three credit bureaus. Repaying your balance on time can help you build credit. Once you cancel the card, a credit card provider typically issues you a refund for your deposit.

When shopping for secured credit cards, compare annual fees, minimum deposit amounts and interest rates to secure the best deal.

Main Types Of Bankruptcy For Consumers

Consumers primarily use Chapter 7 and Chapter 13 for filing bankruptcy. Either will activate an automatic stay to prevent creditors from collecting debt while your case is being processed. Filing either type of bankruptcy will decrease your anywhere from 130 to 240 points. People with higher credit scores will see their credit scores drop more than those whose credit scores were lower at the time of filing. But regardless of what your credit score is, when you file for bankruptcy, you will likely end up with a bad credit score for a while.

Bankruptcy can be complicated, so it might be a good idea to hire a bankruptcy attorney. If you have a simpler, Chapter 7 case, you can use Upsolveâs online tool to file for free without an attorney.

Also Check: Is 773 A Good Credit Score

How Does Credit Reporting Affect Me

Lenders throughout Canada will usually send a monthly report on their borrowers to the credit reporting agencies. The credit bureaus will also receive an update from the Superintendent of Bankruptcy on anyone who has filed bankruptcy. This update will also include anyone who has been discharged from bankruptcy. The credit reporting agencies including Equifax and TransUnion will then review this update and provide this information to lenders. This data enables lenders to review who is requesting to borrow from them, and make an informed decision. If, therefore, your credit report states bankruptcy and a poor repayment history, it could prove difficult for you to borrow. If you are looking to borrow from a lender, it is important that your credit report is as strong as possible.

How Long Discharged Debts Can Appear On Your Credit Report

A discharged debt can appear, as discharged or closed, for up to seven years after the debt has been waived. This is true of most debts, even those paid in full. A Chapter 13 Bankruptcy also remains on your credit report for seven years, while a Chapter 7 bankruptcy remains for up to 10 years.4

If you see debts, even marked as empty or discharged, for longer than seven years, youll need to take measures to have these debts removed or discover who illegally sold your debt to renew and lengthen the time limit.

Recommended Reading: What’s The Best Way To Check Your Credit Score

Make Sure You Pay All Your Bills Early Or On Time

Your payment history is the most important factor that makes up your FICO score, accounting for 35 percent. With that in mind, youll want to make sure you pay every bill you have early or on time. Set a reminder on your phone if you have to, or take the time to set up each of your bills on auto-pay. Whatever you do, dont wind up with a late payment that will only damage your credit score further and prolong your pain.

How Long Does Chapter 11 Bankruptcy Stay On Your Credit Report

4.8/510 years7 years

People also ask, does a bankruptcy automatically come off?

The Two Types of BankruptcyIt takes 10 years for this type of bankruptcy to come off your credit report. The bankruptcy itself will automatically be deleted from your report seven years from its filing date.

Also Know, does Chapter 11 affect personal credit? If you are operating as an LLC or corporation, a business bankruptcy under Chapter 7 or 11 should not affect your personal credit. However, there are exceptions. Pay the debt on time and your will be fine. If it goes unpaid, or you miss payments, however, it can have an impact on your personal credit.

In this manner, how much will credit score increase after bankruptcy falls off?

The Truth: While bankruptcy may help you erase or pay off past debts, those accounts will not disappear from your report. All bankruptcy-related accounts will remain on your report and affect your for seven to ten years, although their impact will lessen over time.

Can Chapter 7 be removed from credit before 10 years?

Chapter 7 bankruptcy is deleted 10 years from the filing date because none of the debt is repaid. Individual accounts included in bankruptcy often are deleted from your history before the bankruptcy public record. Usually, a person declaring bankruptcy already is having serious difficulty paying their debts.

Don’t Miss: What Is The Maximum Credit Score

Can Bankruptcy Affect Your Ability To Get A Loan

While a poor credit score can reduce your chances of being approved for a loan or other credit product, bankruptcy may prevent you from even being able to obtain one. Many lenders have a policy to decline loan applications made by people who are bankrupt. Even after bankruptcy no longer appears on your credit report, a prospective lender might check the National Personal Insolvency Index, discover you are a discharged bankrupt and choose to decline your loan.

A lender could see bankruptcy recorded on your credit report and immediately deem you ineligible for a loan or line of credit youve applied for, regardless of your overall credit score and history.

In certain circumstances, it is a criminal offence for people who are bankrupt or subject to a debt agreement to obtain, or seek to obtain, credit. If you do want to go ahead and apply for a loan, it is important to do your research, and consider seeking financial and legal advice if you need help. Your options will most likely be quite limited, and only include smaller-scale forms of lending, such as personal loans, depending on the lender in question and the size of the loan youre applying for. You might be more vulnerable to loans charged at a higher rate of interest, with more terms and conditions attached, or from lenders who are less credible.

Related: Personal loans with no credit checks what to watch out for