Your Fico Score: Just One Piece Of The Puzzle

Id like to conclude this post by offering a little perspective. You may want a perfect credit score, and if you do I suggest you go for it.

But theres more to your personal finance life than perfect credit. Different lenders consider criteria other than your credit history when you apply for a loan or a credit card.

Your debt-to-income ratio, for example, could disqualify you for some of the best credit cards and loan options. This ratio measures how well youre able to pay your current bills with the income youre bringing in.

Your employment history could matter to some lenders, too. Just like with the length of credit history, a longer employment history works in your favor.

If you work to create the most stable personal finance life possible, your FICO score will fall into place, and youll stay at the top of the credit score range.

Average Credit Score By Region

Want to know what your neighbourâs credit score looks like? Experian released the average credit scores by location. The worst credit scores in the UK on average are:

1) Kingston-upon-Hull – 696

2) Blaenau Gwent â 702

3) Blackpool â 709

4) Merthyr Tydfil â 712

5) Middlesbrough â 713

6) Northeast Lincolnshire â 717

7) Knowsley â 722

9) North Ayrshire â 737

10) St. Helens â 744

And the best average credit scores can be found in:

1) Isles of Scilly â 881

2) Wokingham â 877

7) St Albans â 871

8) South Cambridgeshire â 867

8) Brentwood â 850

10) West Oxfordshire â 844

You can find out what the average credit score is where you live by heading over here.

How To Build Up Your Credit Score

Your FICO® Score is solid, and you have reasonably good odds of qualifying for a wide variety of loans. But if you can improve your credit score and eventually reach the Very Good or Exceptional credit-score ranges, you may become eligible for better interest rates that can save you thousands of dollars in interest over the life of your loans. Here are few steps you can take to begin boosting your credit scores.

Check your FICO Score® regularly. Tracking your FICO® Score can provide good feedback as you work to build up your score. Recognize that occasional dips in score are par for the course, and watch for steady upward progress as you maintain good credit habits. To automate the process, you may want to consider a credit-monitoring service. You also may want to look into an identity theft-protection service that can flag suspicious activity on your credit reports.

Avoid high credit utilization rates. High , or debt usage. Try to keep your utilization across all your accounts below about 30% to avoid lowering your score.

Consumers with good credit scores have an average of 4.9 credit card accounts.

Seek a solid credit mix. No one should take on debt they don’t need, but prudent borrowingin the form of revolving credit and installment loanscan promote good credit scores.

Also Check: What Is A Good Business Credit Score

How Can I Get A Good Credit Score

To get a good credit score, you need to know first what your credit score is. It might already be good! You can find out what your credit score is by signing up for your Free Credit Report with TotallyMoney. It only takes a few moments, wonât harm your credit rating, and doesnât cost a penny. If you already know what your credit score is, and it could do with improving, you need to convince lenders that youâre a responsible borrower and that you can you can be relied upon to pay back what you owe. For more on how to get a good credit score, read our guide: â11 tips on how to improve your credit score.â

Tips To Get A Perfect Credit Score

The first thing to keep in mind is that obtaining a perfect credit score takes time.

Its rather easy to remove negative items from your credit report and get a better score, but a perfect score is another story.

Now, assuming you dont have any negative items on your credit report like late payments or a collections account, lets get into the more advanced credit behavior youll need to learn and put into practice.

Keep in mind that all of the steps outlined below are based on my personal experience, not random advice Ive read on the internet.

Don’t Miss: How To Unlock My Experian Credit Report

What Is The Credit Score Range In Canada

Your credit score is a three-digit number between 300 and 900 that represents your credit risk. Credit risk is the likelihood youll pay your bills on time, or pay back a loan on the terms agreed upon.

In Canada, credit scores range from 300 to 900 with the average Canadian credit score sitting at 650. According to TransUnion, a score above 650 will likely qualify you for a standard loan, while a score under 650 will likely make it difficult for you to receive new credit.

Its important to understand what your credit score means and how it will impact your ability to get approved for new credit. In order to do that, you need to get your credit report.

What Is A Good Credit Score For A Credit Card

Like other lenders, credit card issuers will consult your credit score to determine the risk of doing business with you before approving you for a new credit card. If you want to open a premium travel rewards credit card, you may need good and perhaps even excellent credit scores to qualify. For other types of credit cards, even some with 0% introductory APR offers, a good credit score may be sufficient to be approved for the card.

Beyond qualifying for a credit card, your score can also have a significant impact on the APR and other terms of your account. Credit card issuers not only rely on credit scores to help them determine whether or not to approve applications, but they also use scores to set the pricing on the accounts they approve.

Take this list of top credit cards, for example. Youll notice that every credit card offer features not a specific rate, but rather an APR range. A card issuer might advertise an APR of 13.49% to 24.49%. The reason for that range is because the card issuer will base the final rate it offers you on the condition of your credit.

Defining a specific number that a credit card issuer defines as a good score is tough for two reasons:

Recommended Reading: How To Remove A Repossession From Your Credit

Shopping For Credit Cards With A 656 Credit Score

When shopping for credit cards, make sure you explore all of your options. In other words, dont just sit down with one potential creditor and decide to accept their deal or not. Sit down with multiple potential creditors and compare and contrast them to find out what works best for you.

If you already have a credit card, but have been shopping for one that is cheaper, you can then go to your existing creditor and request them to either match or beat an offer from another credit card company. Tell them that you believe you are paying too much money in fees and interest, and ask them if they are willing to lower their rates and fees down to the other credit card company that you are thinking about switching to.

If they refuse, then you can switch accounts, but dont close your existing account immediately. You still want to make the minimum payment on. it while you are waiting for your balance to transfer to your new account. You only want to close a credit account when your balance is at zero.

Personal Loans With A 656 Credit Score

Are you in the market for a personal loan?

While you might qualify for a personal loan with fair credit, you could be charged a higher interest rate and more fees than you would with scores in the good or excellent range.

These higher rates and fees might make the loan a less desirable proposition, depending on what you need it for. For example, if you want to consolidate credit card debt with a personal loan, the interest rate with your new loan may not be low enough to save you money in the long run especially considering all the fees you might be charged upfront.

On the other hand, if youre using a personal loan to finance a major purchase, you should consider whether its something you need now or can wait to buy. If you can wait and spend some time building your credit, you might be able to qualify for a loan with a lower interest rate.

When youre ready to move forward with a personal loan, you can compare personal loan options on Credit Karma.

Don’t Miss: Does Removing Authorized User Affect Their Credit

Different Credit Score Groups

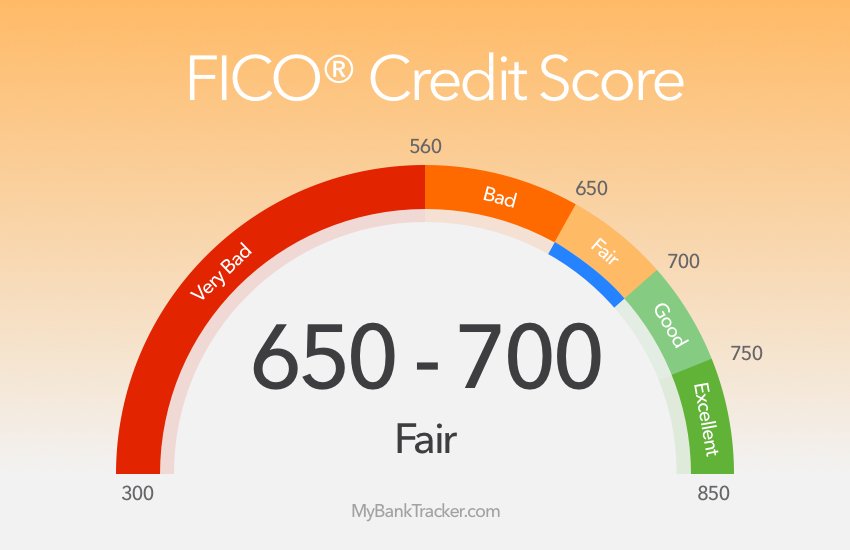

Depending on your credit score , there are different pros and cons at hand. For someone in the very poor credit range, lenders will be very little likely to consider you an adequate borrower. Your ability to pay back money borrowed is exceedingly risky. Being in the poor FICO range is still viewed as a risk. On the bright side, there are some lenders who will accept those with an at-risk 656 credit score. If you have fair credit, however, you can expect most lenders to consider this score good enough. Those with good or excellent credit, likewise, will be considered a very dependable or an exceptionally dependable borrower, respectively. This is why it is crucial to seek at least fair credit, if not good or exceptional.

Americans FICO scores are all over the place with 20% in with exceptional scores, 18% with good, 22% with fair, 20% with poor, and 17% with very poor credit. While the latter statistics may or may not be surprising, many factors are put into calculating ones credit score.

Its important to note that calculating your 656 FICO credit score is a more complex task than what it sounds.Receiving your credit score may vary from source to source for this reason. Other information, besides the latter five, are also incorporated into the credit score evaluation process.

Poor Credit Score: 550 649

This grand score is on account of several late or pending payments, numerous defaults on products from different lenders. This score can also be due to bankruptcy which is a scar that will remain on your record for a whole decade. Getting a new credit is near to a miracle for such individuals. It would be advisable for them to look up a professional finical advisor that will aid them in repairing their credit.

Recommended Article:

Don’t Miss: How To Get Credit Report Without Ssn

Secured Vs Unsecured Cards

Secured cards

Secured cards are just what the name implies. The amount of your credit line is based on the security deposit you put up. For example, if you make the $300 deposit, youll have a $300 credit limit. Other than the security deposit, secured cards work just like unsecured cards. You run charges and make monthly payments. The payment history is reported to the major credit bureaus, which will impact your credit score. And even though there is a security deposit, you will still be charged interest on outstanding balances. Secured cards often come with no annual fee or a very low one. Most will also increase your credit limit based on your on-time monthly payments. And some will convert your card to unsecured after a certain amount of time.

Unsecured cards

Naturally, no security deposit is required. But the annual fee may be higher than it is for ac secured card. If your credit limit is very low, the annual fee could represent a major cost. The table below summarizes the difference between secured and unsecured credit cards:

| N/A |

Want To Improve Your Credit Score

If your credit score is a little lagging or damaged by past mistakes, donât be disheartened. Your credit score can change for the better over time by making positive steps like these:

- Pay off credit debt – Lenders like to see you using credit – but not all of it. Sticking to less than 30% of your overall limit can make you seem responsible, so if you can reduce your debt to this figure, your credit score could rise.

- Join the Electoral Roll – To help lenders identify you, . This only takes minutes and itâs a really simple way to boost your credit score.

- Always pay on time, every time – If you have existing credit agreements, set up alerts and pay with Direct Debit to make sure you never miss a payment. Even if youâve made mistakes in the past, keeping up with current debts will help you improve your credit score.

- Keep applications low – Applying for credit means lenders need to check your credit report, which will leave a search on your history. Too many searches can make it seem like youâre desperate to get your hands on money, which could be off-putting to some lenders.

Tip: try checking if youâre eligible before you apply to help keep applications low.

Disclaimer: All information and links are correct at the time of publishing.

Become a money maestro!

Sign up for tips on how to improve your credit score, offers and deals to help you save money, exclusive competitions and exciting products!

Also Check: Paypal Credit Bureau

Can You Get A Personal Loan With A Credit Score Of 656

There are very few lenders who will approve you for a personal loan with a 656 credit score. However, there are some that work with bad credit borrowers. But, personal loans from these lenders come with high interest rates.

Its best to avoid payday loans and high-interest personal loans as they create long-term debt problems and just contribute to a further decline in credit score.

To build credit, applying for a may be a good option. Instead of giving you the cash, the money is simply placed in a savings account. Once you pay off the loan, you get access to the money plus any interest accrued.

What Is A Good Credit Score

What is considered a good credit score? :59

Reading time: 3 minutes

-

Theres no magic number to reach when it comes to receiving better loan rates and terms

Its an age-old question we get, and to answer it requires that we start with the basics: What is a, anyway?

A credit score is a number, generally between 300 and 900, that helps determine your creditworthiness. Credit scores are calculated using information in your , including your payment history the amount of debt you have and the length of your credit history.

Its also important to remember that everyones financial and credit situation is different, and theres no magic number to reach when it comes to receiving better loan rates and terms.

There are many different credit score models used today by lenders and other organizations. These scores all have the same goal: to predict a consumers likelihood to pay their bills. There are some differences around how the various data elements on a credit report factor into the score calculations.

Although credit scoring models vary, generally, credit scores from 660 to 724 are considered good 725 to 759 are considered very good and 760 and up are considered excellent. Higher credit scores mean you have demonstrated responsible credit behaviour in the past, which may make potential lenders and creditors more confident about your ability to repay a debt when evaluating your request for credit.

How Do Your Actions Impact Credit Scores?

You May Like: 778 Fico Score

Rebuilding Your 656 Credit Score

A Credit Repair company like Credit Glory can:

An industry leader like Credit Glory can guide you through this process. Give them a call @ , or chat with them, today â

How Does My Credit Score Affect My Auto Loan Rate

Depending on your credit score, the interest rate you receive can vary widely. In fact, the difference in interest rates on a new car loan for someone with excellent credit versus someone with very poor credit can vary by as much as ten percentage points.

Use our 3-step loan calculator to determine the difference in interest rates.

For example, if your excellent credit qualifies you for 6% interest rate on a $18,000 vehicle rather than the 12% interest rate for which a less-than-stellar credit score might qualify, you’ll save more than $50 each month over the five-year term of the vehicle loan. That’s a $3,000 savings thanks to your good credit!

When it comes to car buying, your credit score plays a major role in the type of financing that’s available to you. For people with a strong score, this works in your favor. You might be in the perfect position to obtain an auto loan.

For those with lower scores or no credit, this may pose a bit of a challenge, but don’t despair! There are actionable steps you can take toward improving your score. The good news is that a properly managed auto loan can improve your credit score moving forward. So once you secure an auto loan, you can work toward strengthening your credit history for your next car, truck, or recreational vehicle.

Now that you are armed with all the facts you need to obtain an auto loan, all that’s left to do is find the right vehicle for you.

Don’t Miss: Does American Express Report To Credit Bureaus