How Is My Credit Score Determined

-

What information goes into calculating a credit score?Credit scores use information from three key areas of your credit report: account information , public records and inquiries . Information such as race, gender, where you live and marital status are not used in credit scores.

-

Who calculates credit scores?Credit scores may come from several sources. Lenders may request that a credit score be provided along with your credit report. Credit reporting agencies provide the service of applying the credit scores from a number of credit score developers. Lenders specify which credit score they want delivered with the credit report. Credit scores may also be calculated by mortgage reporting companies that compile your credit reports from each of the national credit reporting companies and then deliver the combined reports and scores to the lender. Lenders may also apply their own, proprietary scores after receiving your credit report.

What Are The Types Of Credit Cards

There are several different types of credit cards aimed at fulfilling a specific consumer need. Generally speaking, cards typically fall into one of the following categories:

- Rewards cards. These offer a percentage back on your spending, either as cash back, points or miles depending on the particular card. These rewards can either be the same flat-rate on all of your spending, or varying amounts depending on the specific type of purchase.

- Low-interest cards. These cards offer a break on interest rates, usually an introductory 0% APR on purchases, spending or both. These cards can be a useful way to save on a big purchase or help pay down debt faster if used as a balance transfer card.

- Someone new to credit or who had credit missteps in their past who may not qualify for a card with generous rewards or promotional APR offers may want to look for a card designed to help build up their credit score through responsible payment behaviors. This can include student credit cards, secured credit cards and cards that use alternative data to review an application.

The Rise Of Consumer Permissioned Scorable Data

The way consumers use and manage their credit changes over time. How my father managed credit is different from how his grandchildren will manage their credit.

As a result, the way lenders evaluate credit risk needs to evolve to remain relevant and competitive. Adjustments in consumer credit behavior are the reason why companies like FICO and VantageScore will continue to release new scoring algorithms every few years.

Some of the newest innovations in credit scoring involve whats called consumer-permissioned data. Historically, the accounts on your credit reports came from financial services related companies that supplied information to the credit bureaus on a voluntary basis.

Recently, however, both Experian and TransUnion have introduced programs that let consumers give permission for other types of accounts to be added to their credit reports, which are also considered in their credit score calculations.

In 2018, Experian introduced a service called Experian Boost. Youve probably seen their commercials. Boost is free and allows you to add certain video streaming , utility, and telecom accounts to your Experian credit report as scorable entries. If youre able to add these accounts to your Experian report, it may improve your FICO and VantageScore credit scores.

The average Experian Boost user improves their Experian FICO Score 8 by 13 points.

There is currently no similar option for consumer-permissioned data for Equifax.

Also Check: Does Speedy Cash Check Your Credit

Fico : What You Need To Know About The Latest Credit Score

A Discover credit card now gets you free access to your latest FICO credit score. It’s a new service Discover Financial Services is offering to all of its cardholders.

A Discover Financial Services credit card © Scott Eells/Bloomberg via Getty Images Barclaycard US and First Bankcard began providing FICO scores to their customers in November… Continue Reading

The First In Big Data

1950 United StatesBy 1950, typical middle-class Americans already had revolving credit accounts at different merchants. Maintaining several different cards and monthly payments was inconvenient, and created a new opportunity.

At the same time, Diners Club introduces their charge card, which helps open the floodgates for other consumer credit products.

1955 United StatesEarly credit reporters use millions of index cards, sorted in a massive filing system, to keep track of consumers around the country. To get the latest information, agencies would scour local newspapers for notices of arrests, promotions, marriages, and deaths, attaching this information to individual credit files.

1958 United StatesBankAmericard is dropped in Fresno, California. American Express and Mastercard soon follow, offering Americans general credit for a wide range of purchases.

1960 United StatesAt a time when the technology was limited to filing cabinets, the postage meter, and the telephone, American credit bureaus issued 60 million credit reports in a single year.

1964 United StatesThe Association of Credit Bureaus in the U.S. conducts the first studies into the application of computer technologies to credit reporting. Accuracy of data is also improved around this time by standardizing credit application forms.

1970 United StatesThe first Fair Credit Reporting Act is passed in the United States. It establishes a standard legal framework for credit reporting agencies.

Recommended Reading: Open Sky Increase Credit Limit

Life Before Contemporary Credit Scoring Models

First things first, we need to agree on some terminology. A credit score is formally referred to as a credit bureau-based scoring system. The credit scores with which we are generally familiar are these types of scores, which almost entirely fall under either the FICO or VantageScore brands.

These are the scores that are sold by the credit bureaus and are entirely dependent on the information in your credit reports.

Before this type of credit score, applying for financing was a very different process. It was often difficult, and sometimes impossible, for certain consumers to borrow money.

In the past, bankers would make individual judgment calls for each applicant that requested a loan. Even with the help of credit reports, deciding who would qualify for a loan and who would be denied was subjective.

Between a lack of consumer protection laws and a lack of credit scores, you could be turned down for a loan due to factors that would be considered unconscionable in todays lending environment. It also took a very long time to respond to certain loan applications, like mortgages, because the process of assessing risk was manual and unscientific.

If you think these ancient lending evaluation methods werent entirely fair to all consumers, youre right. But by blocking opportunities for potential profits, the system didnt optimally serve lenders either.

What To Do If You Have A Limited Credit History

If youre new to credit, you may not have had the opportunity to build a credit history. A thin credit file or no credit file means you dont have enough credit history to generate credit scores. People in this category are sometimes also referred to as credit invisible.

Fortunately, there are ways you can start building your credit for the future.

Also Check: How Do You Remove Hard Inquiries Off Your Credit Report

What Are The Different Categories Of Late Payments And Do They Impact Fico Scores

A history of payments is the largest factor in FICO® Scores. FICO® Scores consider late payments in these general areas how recent the late payments are, how severe the late payments are, and how frequently the late payments occur. So this means that a recent late payment could be more damaging to a FICO® Score than a number of late payments that happened a long time ago. Late payments are listed on credit reports by how late the payments are. Typically, creditors report late payments in one of these categories: 30-days late, 60-days late, 90-days late, 120-days late, 150-days late, or charge off . Of course a 90-day late is worse than a 30-day late, but the important thing to understand is that people who continually pay their bills on time tend to appear less risky to lenders. However, for people who continue not to pay debt, and their creditor either charges it off or sends it to a collection agency, it is considered a significant event with regard to a score and will likely have a severe negative impact.

For Millennia Creditworthiness Was Judged On A Much More Casual Basis

Since the first caveman, Gug, asked his neighbor, Gorf, to borrow some wood to make a fire, lenders have had to consider whether the loans they offer will be paid back.

Sure Gug said that he promise make fire with wood, give back more wood and cooked meat tomorrow, but could Gug be counted on? What if Gug runs away to a different cave and Gorf never sees his wood again?

Perhaps Gorf could ask some of their fellows if Gug is reliable.

And thats pretty much how things worked for the next tens of thousands of years. Even as early credit bureaus started to emerge, representatives would often speak to local businesses to find out if a particular applicant was reliably paying the money they owed in a reasonable manner.

Additionally, potential lenders would usually rely on character judgments. Maybe the person who walked into their office always paid their bills on time, but the loan officer just didnt like something about the way the applicant conducted themselves. In which case: No loan for you!

That may not sound fair to you, and who do you turn to when something isnt fair? Well, Bill Fair, himself, of course.

You May Like: Itin Credit Report

What If I Dont Want Wells Fargo To Display My Fico Score Anymore

You can opt out of the service at any time. On the FICO® Score screen, select the I no longer want Wells Fargo to display my FICO® Score link. If you decide to start the service again in the future, you can select View Your FICO® Credit Score on the Account Summary and follow the instructions to opt back in.

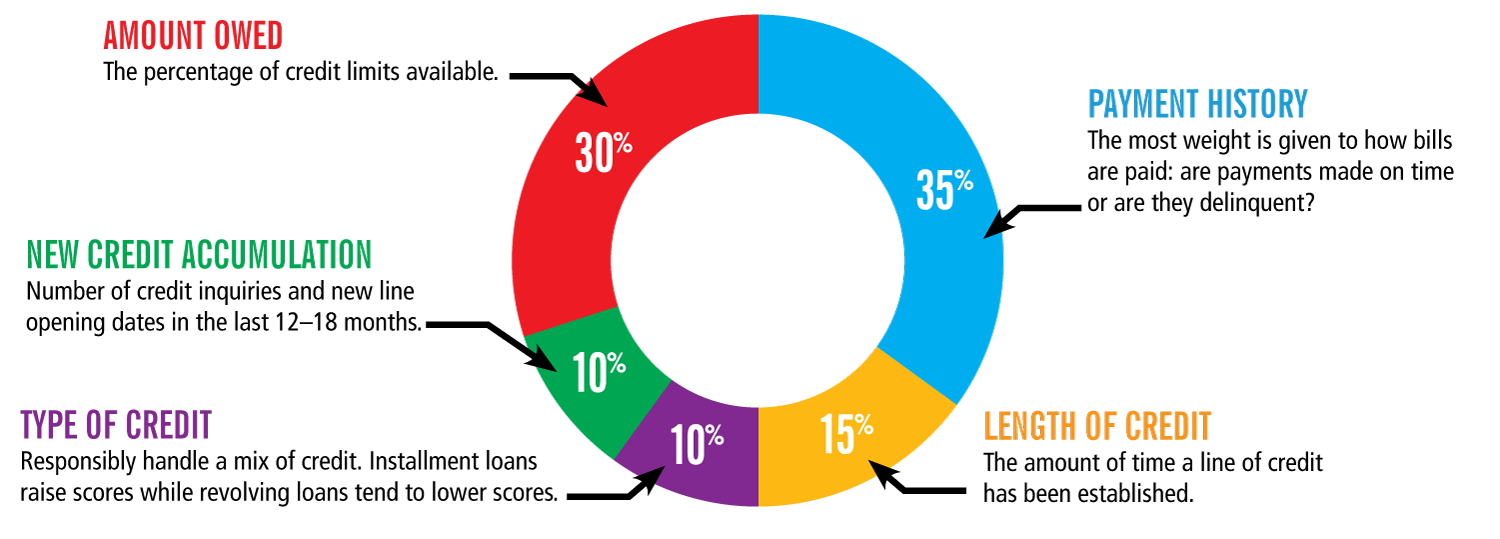

Used Credit Vs Available Credit: ~30%

A key part of your credit score analyzes how much of the total available credit is being used on your credit cards, as well as any other revolving lines of credit. A revolving line of credit is a type of loan that allows you to borrow, repay, and then reuse the credit line up to its available limit.

Also included in this factor is the total line of credit or credit limit. This is the maximum amount you could charge against a particular credit account, say $2,500 on a credit card.

Recommended Reading: Comenity Bank Credit Score

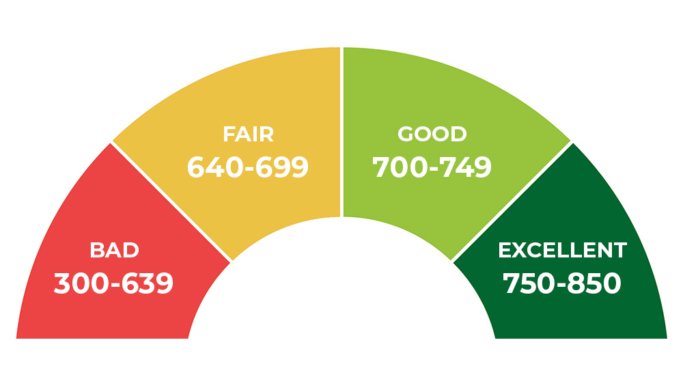

What Does My Credit Score Mean

Your credit score is a three-digit number that sums up all the information on your credit report into one tidy number. It follows you around for your entire life, its value moving up and down depending on whats happening in your financial life.

This three-digit score goes by two different names, FICO or VantageScore. The FICO score is named after the company who invented this three-digit scoring system in the mid-1980s, Fair Isaac, Inc. Many lenders use the FICO scoring system.

More recently, the three major credit reporting agencies created their own scoring system, called the VantageScore, designed to produce a more consistent score across all three credit reporting agencies.

So what does a score mean? Whats a good credit score? Or a bad one?

How Is My Credit Score Calculated

To see how it all breaks down, here’s an example of how most scores are calculated. Your payment history generally makes up 40% of your score, while credit utilization is 20%. The length of your credit history contributes 21%, and total amount of recently reported balances 11%. Finally, new credit accounts are responsible for 5% while your available credit makes up 3%. All of these values are then broken down into a credit score, which typically ranges between 300 and 850the higher the number the better. TransUnion’s credit score check can let you know where your score falls.

Also Check: Collections Account Closed Meaning

The Histories Of Credit Bureaus

The credit bureaus themselves have interesting histories. Equifax, originally called Retail Credit Company, was founded in 1899 in Atlanta by brothers Cator and Guy Woolford. The Woolfords would keep a list of creditworthy customers and compile their findings, which they would then sell. In many communities, representatives of the Welcome Wagon would take note of a persons home, furnishings and character, among other factors. They would then report that information back to Equifax.

Experian is the newest credit bureau, buying out the famous TRW Information Services, which was the largest credit bureau at the time. In the 1970s and 1980s, one would say, Let me pull their TRW. TRW itself was part of a defense conglomerate.

TransUnion began as a railroad car leasing company. It acquired a credit bureau in 1969. Back then, without computers, data was stored on index cards. The credit bureau that TransUnion purchased had stuffed more than 3.6 million such cards into more than 400 filing cabinets.

Why Do Fico Scores Fluctuate

There are many reasons why your score may change. The information on your credit report changes each time lenders report new activity to the credit bureau. So, as the information in your credit report at that bureau changes, your FICO® Scores may also change. Keep in mind that certain events such as late payments or bankruptcy can lower your FICO® Scores quickly.

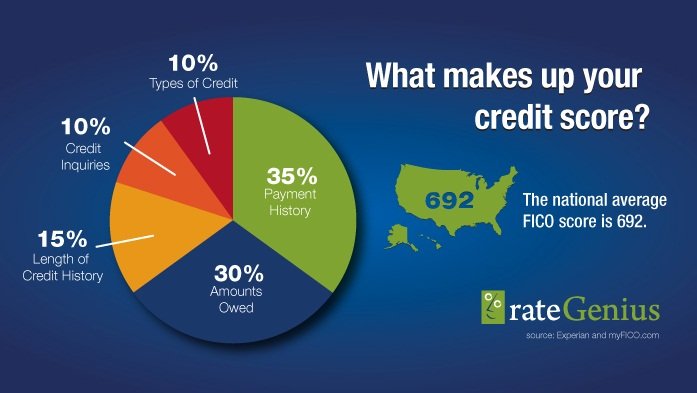

FICO® Scores consider five main categories of information in your credit report.

- Your payment history

- Types of credit in use

Also Check: Does Applying For Paypal Credit Affect Score

How Do Public Records And Judgments Impact Fico Scores

Public records are legal documents created and maintained by Federal and local governments, which are usually accessible to the public. Some public records, such as divorces, are not considered by FICO® Scores, but adverse public records, which include bankruptcies, are considered by FICO® Scores. FICO® Scores may be affected by the mere presence of an adverse public record, whether paid or not. Adverse public records will have less effect on a FICO® Score as time passes, but they can remain in your credit reports for up to ten years based on what type of public record it is.

What Is A Credit Bureau

A credit bureau, also known as a consumer reporting agency, collects and stores individual credit information and provides it to creditors so they can make decisions on granting loans and other credit activities. Typical clients include banks, mortgage lenders, and credit card issuers. The three largest credit bureaus in the U.S. are Equifax®, Experian®, and TransUnion®.

Recommended Reading: Credit Score 570

How Are Credit Scores Calculated

Reading time: 4 minutes

Highlights:

-

Payment history, the amount of credit youre using, and the length of your credit history are factors included in calculating your credit scores

While your credit score is important, it is only one of several pieces of information an organization will use to determine your creditworthiness. For example, a mortgage lender would want to know your income as well as other information in addition to your credit score before it makes a decision.

A Chronology Of The Credit Card

Heres a quick timeline of the history of credit cards.

- 1950: Diners Club issues the first charge card

- 1958: Bank of America issues the first general-purpose credit card that offered a revolving credit feature

- 1958: American Express Company issues a travel and entertainment payment card

- 1969: Magnetic strip standard is adopted in the U.S.

- 1976: Bank of America spins off BankAmericard and joins with other banks to create Visa

- 1979: Mastercard brand comes into existence, formerly the Interbank Card Association and Master Charge

- 1986: As a subsidiary of Sears, Dean Witter Financial Services Group launches the Discover Card

- 2015: EMV chips become standard to help protect buyers against fraudulent card transactions

Don’t Miss: Aargon Debt Collector

Can I See My Credit History On My Free Credit Reports

Yes! Credit Karma offers free access to your credit reports and VantageScore 3.0 credit scores from Equifax and TransUnion. Well also show you items in your credit history that could be impacting your scores, and help you monitor your credit for signs of errors or inconsistencies. Your scores and reports can be updated weekly, so you can track how your credit history changes and impacts your scores over time.

Ready to help your credit go the distance?

Log in or create an account to get started.

How Do I Improve My Credit Score

The single most important thing you can do to improve your score is pay your bills on time, every month. Getting and keeping your paperwork organized can help you improve your credit score. By keeping your monthly bills in a To Pay folder with due dates highlighted and marked on your calendar, you become less likely to miss a payment, or even lose track of a bill because its hiding in a stack of unorganized papers.

Here is how FICO and VantageScore view your financial behavior and assign percentages to each behavior to determine your credit score. The higher the percentage, the more important that behavior becomes in determining your credit score.

As you can see, both FICO and VantageScore place a high importance on your payment historywhether or not you pay your bills on time, every month.

Don’t Miss: Free Credit Report Usaa

How Many Credit Cards Should I Have

The number of credit cards you should have is not a set answer that applies to everyone. The answer is different for each person, but its also likely to change as your spending habits and knowledge about various offers evolve. For example, someone just starting out with credit cards is likely to do best managing just one payment account. But as you begin to build responsible payment behavior, you may want to experiment with of various rewards cards to maximize your return on spending.

Having too many credit cards also comes with potential downsides including having to track multiple payments and the risk of overextending yourself on credit.