What Can You Dispute On A Credit Report

You can dispute the following types of credit-report errors:

| Types of Credit-Report Errors | Description |

|---|---|

| Inaccurate Personal Info | This could be a misspelled name, an unknown address or an unrecognized employer. The last two, in particular, could be signs of fraud. If thats the case, you may need to suppress/block the info. |

| Duplicate Accounts | Sometimes, accounts are listed twice by mistake. In other cases, debt collectors may relist accounts to trick you into making a payment. |

| Fraudulent Accounts | This could be an honest mistake. But criminals are known to open financial accounts under other peoples Social Security numbers, rack up charges and leave their victims to clean up the mess. While you can dispute this type of error, its best to suppress/block any issues stemming from fraud. |

| Inaccurate Payment History |

You cannot dispute accurate information just because it reflects poorly on you. More accurately, you can try, but you probably wont win. There are strict timeframes for how long negative information stays on credit reports. And theres nothing you can do to shorten them.

Sure, you can explain special circumstances on the Personal Statement portion of your credit report to explain a negative notation. But if the information is accurate, it wont be removed.

For your convenience, heres a quick recap of how WalletHub recommends handling the credit report dispute process:

Form Letter To Use When Disputing A Charge

Team Clarks Consumer Action Center recommends that you call your credit card company to begin disputing a charge and then follow up with written documentation.

Many times the written portion of the process can be submitted and documented online through the credit card issuers website.

Other times, you may be required to send a physical copy of the letter through the mail. If you do that, Clark strongly recommends that you send it via Certified U.S. Mail so that you have a paper trail that confirms your card company has received your letter.

This written documentation will be used for the investigation of the dispute, so its important that you get it right.

The Federal Trade Commission has made this easy for you by creating a form letter that you can use to ensure that youre providing the proper information.

Heres how that form letter reads:

Think of the disputed transaction as trying to win a case in court. You want to put your best foot forward in communication, tell the truth and document everything along the way.

How Does Disputing A Charge Work

The dispute process varies depending on the credit card company, but with most, there are two convenient ways to dispute a credit card charge:

Your credit card company may ask for documentation supporting your dispute right away, or it may wait for the merchant’s response before requesting evidence from you. If you can, gather evidence first so you have it ready should you need it, especially when your dispute is related to issues with a product or service.

Note that if the dispute is due to an issue with a purchase you made, then you must contact the merchant first and try to resolve the matter. The law for consumer rights with credit card disputes, known as the Fair Credit Billing Act, states that consumers must make a good-faith effort to handle purchase problems with the merchant before filing a dispute.

Your credit card company will likely remove the charge from your statement during the dispute process. You won’t need to pay it until a decision is reached regarding the dispute, and if you win, you won’t need to pay it at all.

Recommended Reading: Minimum Credit Score For Carmax

What If The Credit Bureau Finds It To Be An Error

Take a moment to celebrate.

Then spread the news that the errors on your credit reports have been corrected.

Make sure your lender notifies all three credit bureaus, so they can adjust their records.

As an added safeguard, ask the credit bureaus to notify any lender that pulled your credit within the last six months, as well as any employer that pulled your credit during the last two years.

Review The Results Of The Investigation

The credit bureau involved must provide you with results of the investigation in writing and also a free copy of your credit report if the dispute results in a change to that report. The credit bureau must also provide you with the name, address and phone number of the furnisher that reported the incorrect information.

If a furnisher continues to report a disputed item, it is required to notify the credit bureau involved about your dispute. If the disputed information is found to be inaccurate, the furnisher must tell the credit bureau to update or delete the item. The furnisher must also notify all the credit bureaus to which it sent the incorrect information so that the bureaus can correct their records.

Even if the furnisher insists that the disputed information is accurate, you can still request that the credit bureau include a statement in your credit file explaining the dispute.

Recommended Reading: What Credit Score Is Needed For Les Schwab

Errors On Credit Reports Could Include

- Identity-related errors such as a misspelled name, wrong phone number or address, or your information incorrectly merged with another persons credit record

- Incorrectly reported accounts, such as a closed account reported as open or an account wrongly reported as delinquent

- Account balance and credit limit errors

- Reinsertion of inaccurate information after its corrected

Wait Up To 45 Days For The Credit Bureau Or Furnisher To Investigate And Respond

The credit bureau generally has 30 days after receiving your dispute to investigate and verify information with the furnisher. The credit bureau must also report the results back to you within five days of completing its investigation.

If you dispute the error with the information furnisher, that company must also report the results of its investigation to you. It also typically has 30 days to investigate. But if the furnisher stands by the accuracy of the information it reported, it wont update or remove the error.

One more thing to note is that either the credit bureau or the furnisher may decide that your dispute is frivolous. This generally happens when youve submitted incorrect or incomplete information on the dispute, but can also occur if youve tried to contest the same item multiple times without any new information or if youve attempted to claim that everything on your credit report is incorrect without proof.

If the bureau decides that your dispute is frivolous, it doesnt need to investigate it further as long as it communicates that to you within five days, along with the reasoning for deeming the dispute frivolous. If your original dispute was labeled frivolous, you can try to resubmit a dispute with updated materials.

Read Also: Does Affirm Report To Credit Agencies

What Can Be Disputed On A Credit Report

Essentially anything in the bankruptcy public records and accounts sections of your credit report can be disputed. For example, if you have a bankruptcy, a third-party collection account or an account with a lender on your credit report you feel is incorrect in any way, you can file a dispute with the credit reporting agency on whose report the information appears.

You can also dispute inaccurate PII, such as a name misspelling or an address with which you are unfamiliar.

If, after submitting a dispute, the data furnisher discovers that they are reporting incorrect information to the credit reporting agencies, they must correct it with all three of them. While the lender should update the information automatically, if changes are made, it can be a good idea to check the other credit bureaus just to be sure.

It is often beneficial to file a dispute directly with the company reporting the information, also known as the data furnisher, prior to contacting the credit reporting agencies. This is sometimes referred to as a “direct” dispute because you are filing your dispute directly with the lender or other business that reports the information to the credit bureaus. Notifying the lender that you believe an account is being reported inaccurately can help you get the information corrected more quickly.

Sample Letter: Credit Bureau Late Payment Dispute Request

You can use this sample letter to dispute information in your credit report. Just insert the appropriate information, like your name and address, the credit bureau name and address, and specific details in the body of the letter. If youre disputing more than one item, youll need to adjust the language to refer to multiple accounts.

Only include copies of documents, not the originals. If you choose to provide a copy of your credit report, circle the delinquent account in question.

Send your dispute request by certified mail, with a return receipt requested, so youll be sure that they receive it.

Enclosures:

Recommended Reading: Does Usaa Report Authorized Users

File A Complaint About The Creditor

If the creditor that furnished the incorrect or incomplete information fails to revise it or advise the credit reporting agency of a correction , you can file a complaint with the Federal Trade Commission . Or, if the creditor is a large financial institution, you may file a complaint with the federal agency that oversees that type of financial institution. The CFPB also oversees many types of financial agencies, so you can file a complaint there too.

If you aren’t sure which agency to contact, start with the FTC or CFPB, which will likely forward your complaint to the appropriate agency. Generally, these government agencies won’t represent you individually. But they could send an inquiry to the company, and if there are enough complaints or other evidence of wrongdoing, they might take legal action.

What Happens If A Dispute Is Denied

If your dispute is denied, then the charge will go back on your . You’re legally entitled to an explanation about why your dispute was denied and how you can appeal the decision. Your credit card company will likely send you both the explanation and instructions on how to appeal in writing.

An appeal gives you another opportunity to provide evidence and win the dispute. If that doesn’t work, you can also try filing a complaint with the Consumer Financial Protection Bureau. As a last resort, you can hire a lawyer, although the cost involved means this option won’t be worth it for most disputes.

Don’t Miss: How To Get Repossession Off Credit Report

How To Remove Items From Your Credit Report In 2022

Your credit report is meant to be an accurate, detailed summary of your financial history however, mistakes happen more often than you may think.

Whether its accounts that dont actually belong to you or outdated derogatory information thats still being reported, incorrect information could be bringing your score down unnecessarily.

Read on to learn how to remove erroneous information from your credit report and some tips on how to handle those negative items that are dragging your score down.

Determine If You Should Contact The Furnisher As Well

The CFPB also recommends that you contact the company that provided the information to the credit bureau. Companies that provide information to credit bureaus are also known as furnishers. Examples of furnishers include banks and credit card issuers. If the furnishers address is listed on your credit report, send your dispute to that address or contact the company for the correct address.

You can try going directly to the furnisher and asking them to correct their reporting mistake before contacting the credit bureau, says Kevin Haney, a credit bureau expert at Growing Family Benefits. That might save a step, since all the bureau can do in its investigation is communicate to the company that the consumer says its wrong, he says.

But if the error is an identity-related mistake made by a credit bureau, go to the bureau first.

Those are the most likely to get corrected, because the bureau owns the problem so it doesnt have to reach out to anyone, Haney says.

In this case, you should also check with the other major credit bureaus to make sure the identity-related error isnt on their reports as well.

Also Check: When Does Open Sky Report To Credit Bureau

How Long Does It Take

Generally speaking, the entire process takes about a month from the date you submit the dispute.

According to the FTC, the three major credit bureaus must investigate the disputed items unless they consider your dispute frivolous and the investigation is usually within 30 days after you dispute an item.

You may learn the results of the investigation more quickly if you file a dispute online and opt to receive an email notification. If you file a dispute by mail or phone, it may take another week or so to receive the results via snail mail.

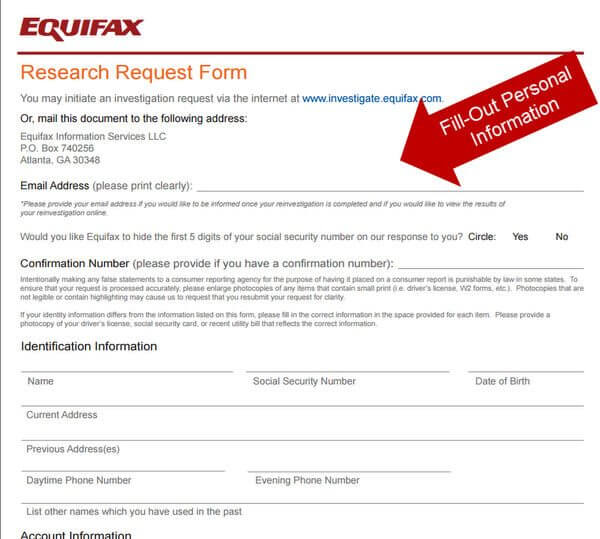

Gather Materials & Documents To Dispute Errors

Before you submit your dispute, you should gather the personal information and documents the credit bureau or creditor may need to investigate your claim.

When you open a dispute, you may be asked for the following personal information:

- A copy of your drivers license or government-issued ID

- SSN

- Your current address and addresses for the past two years

In addition, you may be asked for the following documentation to support your dispute:

- Federal Trade Commission Identity Theft Report or a police report if an account has been added as a result of identity theft

- Billing statements

- Canceled check or money order stub showing a bill has been paid

Read Also: Does Les Schwab Report To Credit Bureaus

Npr Reports That Donotpay Has An Impressive Success Rate That Has Allowed Hundreds Of Thousands Of People To Dispute And Beat Their Parking Tickets

How to dispute collections and win. You can file a dispute with the credit bureaus by phone, mail, or online Countless times along the way, i thought of just throwing in the towel and paying the bill. Dispute the account with the credit bureau even if its accurate.

The fdcpa offers remedies and protections for consumers that can be applied to any debt that is in dispute, including any personal, family, or household debts, debts associated with the an automobile purchase, for retail financing, for medical care, for first and second mortgages, and/or for money owed on credit card accounts. Whenever a debt collector violates that law, you should file a complaint with the ftc. Youre entitled to accurate and verifiable information on your credit report

Dealing with collections in the courts. You should lodge a dispute with each agency that you sent a letter to. Once you dispute the debt, the debt collector can’t call or contact you to collect the debt or the disputed part of the debt until the debt collector has provided verification of the debt in writing.

I monitor my report monthly and i have become a responsible consumer and this is an unfamiliar debt to me. How to actually win your dispute the fair credit reporting act requires the credit bureaus to conduct a reasonable investigation when a consumer files a dispute, although this rarely happens. You will have to claim the account isnt yours or that is inaccurate in.

How To Dispute A Credit Card Charge

Many or all of the products here are from our partners that pay us a commission. Its how we make money. But our editorial integrity ensures our experts opinions arent influenced by compensation. Terms may apply to offers listed on this page.

Typically, cardholders can dispute charges they didn’t make — so if someone steals your card or uses your card number to make a purchase without your permission, you would not be responsible for paying for the purchase.

In certain cases, cardholders can also dispute purchases they made, such as when merchants provide unsatisfactory goods or services or fail to provide promised goods or services. The Fair Credit Billing Act protects your right to dispute charges under these circumstances.

Disputing charges can save you a fortune if you were the victim of fraud or if a merchant fails to live up to expectations, but there are rules you need to follow and steps you need to take. In this guide, we cover how to dispute a credit card charge,and what you need to know so you’re prepared when a charge you disagree with shows up on your bill.

Don’t Miss: Syncb/ppc On Credit Report

There Is Information On My Credit Report That I Believe Is Incorrect What Can I Do About It

Sometimes referred to as filing a dispute, there are important things to know about disputing information on your credit report. By law, you are allowed to dispute inaccurate information on your credit report, and there is no fee for filing a dispute. You may submit your dispute to the business that provided the information to the credit reporting agency and/or to the credit reporting agency that included the information on your credit report.

If Youve Spotted An Error On One Of Your Credit Reports You Should Take Immediate Steps To Correct The Inaccuracy

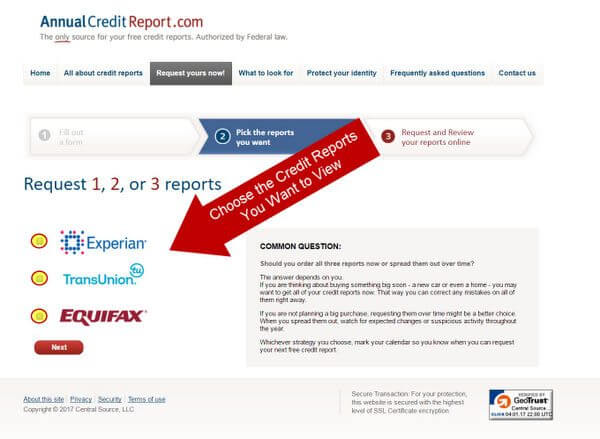

Around 25% of U.S. consumers found errors that could affect their credit scores in one of their credit reports, according to a 2012 study by the Federal Trade Commission. The same study reported that one in five consumers had an error that a credit bureau corrected after the consumer disputed the mistake on at least one report.

An error on your credit reports could lead to lower credit scores and impact your ability to open a new credit account or get a loan. Here are steps you can take to ask the credit bureaus to remove incorrect derogatory marks from your credit.

You May Like: Square Capital Eligibility