Can I Get A Mortgage & Home Loan W/ A 693 Credit Score

Getting a mortgage and home loan with a 693 credit score shouldn’t be very difficult. Your current score is a mid-to-high credit rating.

The #1 way to get a home loan with a 693 score is to complete minimal credit repair, and simply apply and wait for approval.

After a few short months of repairing your credit , youâll be in a much better position to get your ideal home loan terms.

Your Credit Score Can Fluctuate

You may see some short-term movement in your credit score. This happens as information is added or falls off your report, which can happen frequently. Our latestConsumer Pulse revealed one-third of consumers monitor their credit at least weekly. Its encouraging to see people take an active approach to managing their credit health. But when it comes to your credit score, theres no need to obsess over minor, day-to-day changes. Nor is it necessary to achieve a perfect score. Trying to stay within a certain credit range is a smart, less stressful way to monitor your score.

Also, your credit score may not be the only thing a lender looks at when making a lending decision. For example, if you apply for a mortgage, lenders may also verify your income, personal assets and employment history. Because lenders look at multiple factors, its important to strive for overall financial wellness in addition to any credit score goal you may have. Building an emergency savings account and creating a plan to pay down debt, if you have any, will help you be more financially secure and can reflect positively in your credit health.

Is 680 A Good Credit Score

FICO puts a 680 credit score in the good range. That means a 680 credit score is high enough to qualify you for most loans.

However, while 680 is a good credit score, its not the most competitive one.

What do we mean by that?

Well, in the second quarter of 2020, the median credit score for new mortgages was 786. Only 25% of mortgage borrowers qualified for a home loan between April and June had credit scores below. Furthermore, only 10% had credit scores less than 687, according to the data.

So when mortgage lenders are looking at a 680 credit score, theyll typically see it as good enough to qualify you for a loan but not high enough to offer lower interest rates.

That means its extra important to shop around with a few different lenders before deciding on a mortgage loan.

All lenders evaluate credit a little differently, and some are specifically geared toward borrowers with moderate credit scores.

One of these companies will be able to offer you a lower rate than a lender that prefers borrowers with scores in the mid to high700s.

You May Like: Does Quicken Loans Use Vantagescore

How A Bad Credit Score Isbad

As discussed previously, a bad credit score is anything listed below 670. If you want to get more specific, a score varying in between 580-669 is thought about reasonable, while anything in between 300 and 579 is considered bad. This is going off the FICO scoring thats most frequently used.

Not sure what your credit score is? . Its free!

Having a bad score can stop you from doing a great deal of things. This consists of getting approved for much better charge card, mortgages, apartments, individual loans, business loans, and more.

Plus, any loans or charge card you do get approved for will be far more pricey . This is due to the fact that loan providers charge much greater rate of interest to those they deem high threat in order to offset the additional risk they feel theyre taking by loaning you cash.

How do they get more costly? By charging greater rate of interest. For instance, if you secure a $10,000, 48 month loan on a cars and truck with a 3.4% rates of interest, youll pay about $704 in interest over the course of the loan. If you secured that very same loan with a 6.5% rate due to bad credit, you d pay about $1,376 in interest. Thats nearly double!

How To Build Your Credit

Here are some basic steps to help build your credit score:

- Always make payments on time.

- Pay down debts.

- Reduce the number of hard inquiries on your credit report.

- Avoid opening many new loans all at once.

- Keep your first credit card open so you can take advantage of the long credit history.

Great credit opens the door to financial opportunities, better interest rates and more. You can work to improve your credit score and get to a higher credit range. You took the first step today by learning what can improve your credit score. Now, you only have to start implementing these new financial habits.

Your best credit score is an accurate & fair one start working to repair your credit with Lexington Law

You May Like: 676 Credit Score Good Or Bad

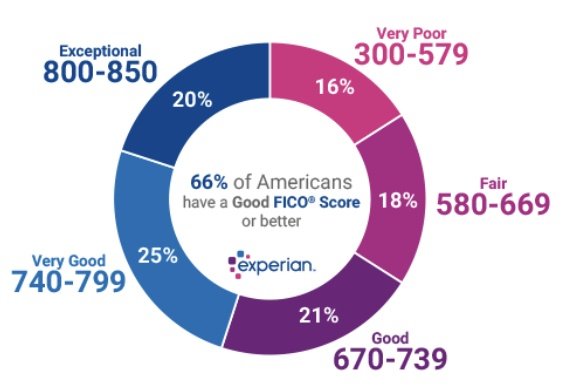

How Does Your Credit Score Compare

Most of the top credit rating agencies have five categories for credit scores: excellent, good, fair, poor and very poor. Each credit rating agency uses a different numerical scale to determine your credit score which means each CRA will give you a different credit score. However, youll probably fall into one category with all the agencies, since they all base their rating on your financial history.

|

Experian |

|---|

|

628-710 |

A fair, good or excellent Experian Credit Score

Experian is the largest CRA in the UK. Their scores range from 0-999. A credit score of 721-880 is considered fair. A score of 881-960 is considered good. A score of 961-999 is considered excellent .

A fair, good or excellent TransUnion Credit Score

TransUnion is the UKs second largest CRA, and has scores ranging from 0-710. A credit score of 566-603 is considered fair. A credit score of 604-627 is good. A score of 628-710 is considered excellent .

A fair, good or excellent Equifax Credit Score

Equifax scores range from 0-700. 380-419 is considered a fair score. A score of 420-465 is considered good. A score of 466-700 is considered excellent .

To get a peek at the other possible credit scores, you can go to ‘What is a bad credit score‘.

How To Improve Your 683 Credit Score

A FICO® Score of 683 provides access to a broad array of loans and credit card products, but increasing your score can increase your odds of approval for an even greater number, at more affordable lending terms.

Additionally, because a 683 FICO® Score is on the lower end of the Good range, you’ll probably want to manage your score carefully to prevent dropping into the more restrictive Fair credit score range .

35% of consumers have FICO® Scores lower than 683.

The best way to determine how to improve your credit score is to check your FICO® Score. Along with your score, you’ll receive information about ways you can boost your score, based on specific information in your credit file. You’ll find some good general score-improvement tips here.

Read Also: Notify Credit Bureau Of Death

Improving Your 694 Credit Score

A Credit Repair company like Credit Glory can:

An industry leader like Credit Glory can guide you through this process. Give them a call @ 885-2800, or chat with them, today â

Heres How To Improve A 693 Credit Score:

- Dispute Negatives: If you can prove that negative information on your credit report is inaccurate , you can dispute the record to have it corrected or removed.

- Pay Off Collections Accounts: Once you bring a collection accounts balance down to zero, it stops affecting your VantageScore 3.0 credit score.

- Reduce Utilization: Its best to use less than 30% of the available credit on your credit card accounts each month. You can reduce your credit utilization by spending less, making bigger payments or paying multiple times per month.

- Pay On Time: Payment history is the most important ingredient in your credit score. Paying on time every month establishes a track record of responsibility as a borrower, while a single late payment on your credit report can set back credit improvement efforts significantly.

You can track your credit scores progress for free on WalletHub, the only site with free daily updates and personalized advice.

Was this article helpful?

Ad Disclosure: Certain offers that appear on this site originate from paying advertisers, and this will be noted on an offers details page using the designation “Sponsored”, where applicable. Advertising may impact how and where products appear on this site . At WalletHub we try to present a wide array of offers, but our offers do not represent all financial services companies or products.

Related Scores

You May Like: How To Unlock Your Credit Report

What Lenders Like To See

Since there are various credit scores available to lenders, make sure you know which score your lender is using so you can compare apples to apples. A score of 850 is the highest FICO score you could get. Each lender also has its own strategy, so while one lender may approve your mortgage, another may noteven when both are using the same credit score.

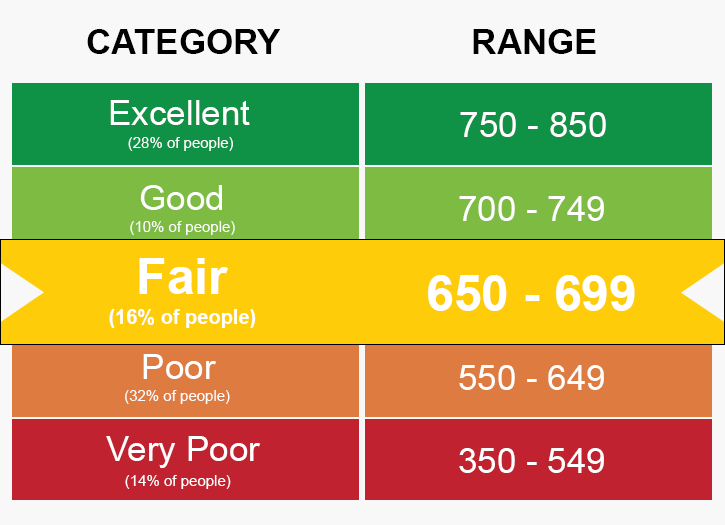

While there are no industry-wide standards for credit scores, the following scale from personal finance education website www.credit.org serves as a starting point for FICO scores and what each range means for getting a mortgage:

740850: Excellent credit Borrowers get easy credit approvals and the best interest rates.

670740: Good credit Borrowers are typically approved and offered good interest rates.

620670: Acceptable credit Borrowers are typically approved at higher interest rates.

580620: Subprime credit It’s possible for borrowers to get a mortgage, but not guaranteed. Terms will probably be unfavorable.

300580: Poor credit There is little to no chance of getting a mortgage. Borrowers will have to take steps to improve credit score before being approved.

What Is A Cibil Score

CIBIL score is a score to check your credit worthiness. CIBIL is a storehouse of credit information. It documents all credit related activity you have engaged in with banks and financial institutions. CIBIL collects and organises the credit information provided to them from these lenders in the form of credit reports. It then passes its records on to lenders, when requested, as a proof your creditworthiness.

CIBIL maintains a record of the status of all your loans. It also records data on all credit cards that you have held or hold. CIBIL essentially keeps a tab of your repayments, loan amounts, loan types, outstanding balances and amounts repaid.

Since a CIBIL score runs a trail on your loans and credit cards, the report created thereof also contains your personal information, particularly, your name, date of birth, address, phone number, passport number, voter ID number, PAN number, etc.

Read Also: Syncb/ppc Credit Card

Minimum Cibil Score To Get A Personal Loan Faqs

1. What is the credit score needed for a personal loan?

A. Credit score is the credit rating issued by CIBIL ranging from 300 to 900. It is one of the eligibility factors on which the lenders determine the loan eligibility of a person and the amount of loan that can be sanctioned by the lender. Ideally, having a credit score of 750+ is considered good for your loan prospects.

2. What should be the credit score for a personal loan?

A. Having a credit score of 750+ is good as it helps you secure the best interest rates on a personal loan.

3. Can you get a personal loan with a 600 credit score?

A. Yes. A person can get a personal loan with a credit score of 600 through some lenders. But, the interest rates and other terms of the loan may not work in the favour of the borrower.

4. What is the CIBIL score required for SBI personal loan?

A. SBI requires the applicants to have a minimum credit score of 650 to be eligible for the personal loans of the bank.

5. What is the credit score for personal loan approval?

A. The credit score is a 3-digit number issued by a credit rating agency to any person based on their credit history.

6. What are the credit rating agencies in India?

A. The credit rating agencies in India are,

- CIBIL

- CRIF Highmark

7. Is 550 a good CIBIL score?

Is 693 A Good Credit Score Instant Credit Boost

Im sure youve heard the term before. Its that 3 digit number that follows you & your financial life every where you go. You need it to get approved for loans, credit cards, houses, mortgages & more! And since you never ever really see it, its typically out of sight, out of mind but this number is something that needs to be taken severe.

Though none people like it, the reality that a credit score is so essential to almost whatever we do economically is precisely why we said it has to be taken severe. It can take years to build up a great score and only a day or more to bring the whole thing crashing down.

Thankfully, theres things you can do to safeguard and inform yourself on the subject. From techniques to give you a near-instant increase to your score to comprehending what a credit score even is from a basic level, were going to walk you through this step by step. Get ready to take control of your financial flexibility once and for all!

Read Also: Paypal Credit Fico Score

What Are The Different Credit Score Tiers You Can Fall Into

According to Experian’s analysis of auto loans in the second quarter of 2021, borrowers who received financing for a new car had an average credit score of 732, while borrowers who received financing for a used car had an average credit score of 665.

In its analysis of auto loans, Experian separates current auto-loan borrowers into five categories based on credit scores:

- Super prime

- Subprime 11.03%

- Deep subprime 14.59%

Interest rates tend to be even higher for used car loans, reaching 17.11% for subprime borrowers and 20.58% for deep subprime borrowers.

Some auto lenders may also require a cosigner for those with lower credit scores. A cosigner is somebody with established credit who legally agrees to take responsibility of paying back the loan if the primary borrower fails to do so.

Factors Affecting The Eligibility Of Personal Loans

There are many factors affecting the eligibility of a person for personal loans. The major factors are:

- The credit profile of the applicant

- Loan amount required

- Tenure applied

- Repayment capacity/ income of the applicant

Among these, the credit profile of the applicant comprises the credit score of the applicant as well as the credit report issued by the credit rating agency. It is one of the most important considerations for sanctioning a personal loan.

Additional Reading: Personal Loan Eligibility Calculator

Recommended Reading: What Collection Agency Does Verizon Use

Why Your Credit Score Is 693

Your credit score is a graded score that is calculated based on your past financial decisions and behaviors. A credit score of 693 typically represents a mixture of some good as well as some not-so-good financial behavior.

Its wise to consider how your score got to 693 so that you can keep it from slipping back into the Fair credit range . Below are several of the most important things that factor into your credit score. Examine each one and gauge how it may have impacted your score thus far.

Have any of these factors raised your score? Have they held it back? As you figure this out, take notes. The information will be helpful as you strategize how to improve your credit even further in the future.

Minimum Cibil Score Required To Get A Credit Card

CIBIL scores are generally in the range of 300-900. A good CIBIL score may fall somewhere in the range of 700 upwards. Most banks and financial institutions follow a similar pattern of assigning credit to your rating hence knowing one banks minimum CIBIL score for a credit card should be a reasonable basis to determine minimum requirements of banks in general.

Banks usually accept a CIBIL score in the range of 700-750 and above to issue a credit card to an applicant. This is subject to the applicant meeting all other eligibility requirements.

However, there are some credit cards offered to persons with low credit scores.

Read Also: How To Check My Itin Credit Score

Is 693 A Good Fico Score

Your credit is considered Average.

First find out exactly why your score is 693 and try to increase it,

Below is a way of interpreting your credit score.

Given the current credit score stats, how does this relate to your own personal score? Generally, if your score is higher than 660, you will be considered a good credit risk. If your score is below 620, then you might have a tougher time getting a loan. The following ratings explain the impact of the different score ranges:

- 720-850 – Excellent – This represents the best score range and best financing terms.

- 700-719 – Very Good – Qualifies a person for favorable financing.

- 675-699 – Average – A score in this range will usually qualify for most loans.

- 620-674 – Sub-prime – May still qualify, but will pay higher interest.

- 560-619 – Risky – Will have trouble obtaining a loan.

- 500-559 – Very Risky – Need to work on improving your rating.