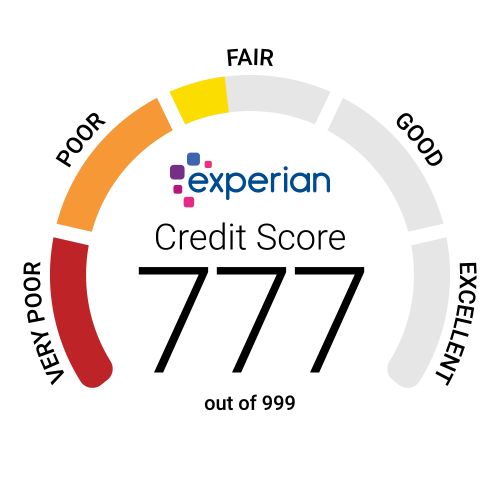

Is 770 A Good Credit Score

A credit score of 770 is considered good, but it’s not the best. In fact, there are many different levels of credit scores, and each one means something different. Knowing your credit score is important so you can understand what lenders are looking for when they decide whether to approve you for a loan or not. It’s also a good idea to monitor your credit score regularly so you can catch any potential problems early on and take steps to fix them. Checking your credit score doesn’t cost anything, so there’s no reason not to do it!

Shield Your Credit Score From Fraud

People with Very Good credit scores can be attractive targets for identity thieves, eager to hijack your hard-won credit history. To guard against this possibility, consider using credit-monitoring and identity theft-protection services that can detect unauthorized credit activity. Credit monitoring and identity theft protection services with credit lock features can alert you before criminals can take out bogus loans in your name.

was the most common form of identity theft , followed by employment or tax-related fraud , phone or utilities fraud , and bank fraud in 2017, according to the FTC.

Does Anyone Have 850 Credit Score

Yes. An Experian study found that as of 2019, 1.2% of all credit-holding Americans had a FICO score of 850. A perfect score generally requires years of exemplary financial behavior, like making on-time payments, keeping a low credit utilization ratio, and maintaining a long history of credit accounts.

Recommended Reading: Is 500 A Good Credit Score

Protect Your Credit Score From Fraud

People with Very Good credit scores are at risk of identity theft. To protect yourself, consider using credit monitoring and identity theft protection services that can detect unauthorized credit activity. These services can alert you before criminals can take out bogus loans in your name.Credit monitoring is also useful for tracking changes in your credit scores. If your score starts to slip, it can prompt you to take action. And, as you work toward a FICO® Score in the Exceptional range , credit monitoring can help you measure your progress.

Benefits of improving your score to:

Dealer Financing Can Be Costly

Many people do not realize that they do not have to use the dealerships financing options. Dealer financing is often the most expensive option.

In fact, according to U.S. News:

Having the entire car-buying process neatly bundled into one transactionmakes purchasing easy. However, its a horrible way to buy a car if you want to get a good deal. Its a common dealer trick to keep you focused solely on the monthly payment while they manipulate the trade-in value, vehicle price, and car loan terms. In most cases, they make a significant portion of their profit on the sale by marking up the cost of the car loans you are offered.

The one thing you should always do to get the best rate is to apply with more than one lender. Borrowers who shop around consistently get better rates than borrowers who take the first deal they are offered. Getting pre-approved by several lenders gives you confidence that you are getting the best deal you can.Be sure to keep your applications within a 15-day window. The credit bureaus will recognize that you are shopping and record only a single hard inquiry. Multiple hard inquiries can harm your credit!

Don’t Miss: Are Credit Cards Good For Credit Rating

Is 716 A Good Credit Score

A 716 FICO® Score is Good, but by raising your score into the Very Good range, you could qualify for lower interest rates and better borrowing terms. A great way to get started is to get your free credit report from Experian and check your credit score to find out the specific factors that impact your score the most.

Pay Your Bills On Time All Of Them

Paying your bills on time can improve your credit score and get you closer to an 800+ credit score. Its common knowledge that not paying bills can hurt your credit score, but paying them late can eventually hurt also.

I think a lot of people dont really understand that there isnt a bill thats really too small, says Thomas Nitzsche, a certified credit counselor and financial educator with ClearPoint Credit Counseling Solutions, and the owner of an 800+ credit score.

If a bill goes unpaid long enough and the debt is sold to a third-party collection agency, that will be reported to credit bureaus, Nitzsche says. But being late can lead to fourth-level reporting parties, such as online searches, that credit bureaus can become aware of.

From late utility bill payments to magazine subscriptions or even $10 medical co-pays that people dont think are important enough to pay on time, all bills should be paid on time.

Any bill I get is treated as a serious situation, he says.

Payment history counts for 35% of a credit score, says Katie Ross, education and development manager for American Consumer Credit Counseling, a national financial education nonprofit group.

Also Check: What Credit Score Do You Need For Home Depot Card

Time To Build Credit History Is Needed

Having a long credit history is one of the best ways to boost your credit score. This is because it shows that you have been responsible with credit for a long period of time. On the other hand, opening new credit accounts will lower your score because it looks like you are trying to take on too much debt at once. If you want to improve your credit score, focus on maintaining your older accounts in good standing.

Auto Loan Rates For A New Car With 770 To 779 Credit Score

The average interest rate for a new car loan with a credit score of 770 to 779 is 4.03%.

Most dealerships will advertise plenty of incentives for buying a new vehicle, such as cash rebates, low interest rates, or special lease offers. Buying a new car will generally come with much better interest rates than buying a used vehicle.

With a credit score of 770 to 779, you may qualify for some of these offers. Others may be reserved for buyers in the super-prime range.

Remember that the rates cited are averages. You may get different offers from different lenders. Make sure you shop around for the best rates instead of going with the option that has the best advertising.

Also Check: How To Dispute Hospital Bills On Credit Report

Ways To Reduce Your Auto Loan Interest Rate

With a credit score between 770 and 779, you are going to qualify for prime loans. You will have solid offers at attractive rates. If you can get into the super-prime range youll qualify for even better rates and promotions!

The time and money spent would put you in a lower risk bracket and open the doors to much more financial freedom and better opportunities.

Additional Auto Loan Resources

* Annual Percentage Rates , loan term, and monthly payments are estimated based on analysis of information provided by you, data provided by lenders, and publicly available information. All loan information is presented without warranty, and the estimated APR and other terms are not binding in any way. Lenders provide loans with a range of APRs depending on borrowers credit and other factors. Keep in mind that only borrowers with excellent credit will qualify for the lowest rate available. Your actual APR will depend on factors like credit score, requested loan amount, loan term, and credit history. All loans are subject to credit review and approval. When evaluating offers, please review the lenders Terms and Conditions for additional details.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity,this post may contain references to products from our partners.Heres an explanation forhow we make money.

Read Also: When Does Mortgage Report To Credit Bureaus

Your Credit Score Can Fluctuate

You may see some short-term movement in your credit score. This happens as information is added or falls off your report, which can happen frequently. Our latestConsumer Pulse revealed one-third of consumers monitor their credit at least weekly. Its encouraging to see people take an active approach to managing their credit health. But when it comes to your credit score, theres no need to obsess over minor, day-to-day changes. Nor is it necessary to achieve a perfect score. Trying to stay within a certain credit range is a smart, less stressful way to monitor your score.

Also, your credit score may not be the only thing a lender looks at when making a lending decision. For example, if you apply for a mortgage, lenders may also verify your income, personal assets and employment history. Because lenders look at multiple factors, its important to strive for overall financial wellness in addition to any credit score goal you may have. Building an emergency savings account and creating a plan to pay down debt, if you have any, will help you be more financially secure and can reflect positively in your credit health.

Recognize That Your Rates Can Increase

Currently, credit card companies cannot raise your credit rate for at least one year after you have opened your account, unless any of the following circumstances apply:

- A six month introductory rate exists

- You are late paying your bill by sixty days

- You have a card with a variable rate that is tied to an index and that index increases

You need to recognize that your credit rates will increase in the future, at least after the initial twelve months, and you need to establish with your potential creditor exactly when your rates will increase, by how much, and if there is anything you can do to lower your rates.

Read Also: What Credit Score Is Needed For Amex

How Can I Get A 770 Credit Score

There are a few things you can do to improve your credit score. First, make sure that you always pay your bills on time. This includes both and loan payments. Late payments can have a negative impact on your score, so its important to stay on top of them. You should also keep your balances low. Using too much of your available credit can hurt your score, so try to keep your balances below 30% of your limit. Finally, dont open too many new accounts at once. Opening multiple lines of credit in a short period of time can be seen as a red flag by lenders and will likely lower your score.

If you follow these tips, you should be well on your way to a 770 credit score. Having a high has many benefits and can help you save money, get a job, or rent an apartment. So start working on your credit today and enjoy the rewards tomorrow.

What Is The Average Credit Score

Data provided by Experian revealed that the average FICO credit score for Americans was 716 in 20212.

According to Experian, this average FICO score may be a result of credit scoring factors such as fewer late payments or delinquencies on credit cards, shrinking debt , and a decrease in credit utilization.

There are other credit scoring models such as VantageScore, but the majority of lending decisions are made using FICO scores, so this review is focused only on FICO scores.

Read Also: Does Fingerhut Report To Credit Bureaus

How To Improve Your Credit Score

Since your score still has some room for improvement, one of the following factors may be to blame:

- Derogatory marks: A derogatory mark on your credit report can have a major and long-lasting negative effect on your credit score.

- Insufficient: A thin credit file can bring down your credit score even if you dont have many derogatory marks. It could be that you havent used your credit enough to establish a positive enough payment history or that you dont have a good mix of different types of credit.

The good news is that you can recover from both situations. How long it will take to improve your credit score ultimately depends on your credit history and the decisions you make.

However, before you worry about fixing these problems, your first step should be to make sure you dont do anything to damage your strong credit history.

1. Get your credit reports and dispute any errors you find

Before you do anything else, go to AnnualCreditReport.com and request your credit reports from all three of the main credit bureaus in the US .

Make sure that your credit reports are accurate, and dispute any errors by mailing a dispute letter to the relevant credit bureau and your creditor. In particular, your credit report may contain any of the following types of errors:

- Late or missed payments that you actually made on time

- Accounts that arent yours

- Duplicate accounts

- Accounts with incorrect credit limits

- Accounts with incorrect open/close dates

2. Dont overuse any one credit account

What’s So Good About A Good Credit Score

A credit score in the good range may reflect a relatively short credit history marked by good credit management. It may also characterize a longer credit history with a few mistakes along the way, such as occasional late or missed payments, or a tendency toward relatively high credit usage rates.

Late payments appear in the credit reports of 29% of people with FICO® Scores of 710.

Lenders see people with scores like yours as solid business prospects. Most lenders are willing to extend credit to borrowers with credit scores in the good range, although they may not offer their very best interest rates, and card issuers may not offer you their most compelling rewards and loyalty bonuses.

Recommended Reading: What Is A Perfect Credit Score 2020

What Is A Good Credit Score According To Lenders

Lenders, such as credit card issuers and mortgage providers, may set their own standards on what “good credit” means as they decide whether to grant you credit and at what interest rate.

In practice, though, a good credit score is the one that helps you get what you need or want, whether that’s access to new credit in a pinch or lower mortgage rates.

What Number Is Perfect Credit

A perfect credit score of 850 is hard to get, but an excellent credit score is more achievable. If you want to get the best credit cards, mortgages and competitive loan rates which can save you money over time excellent credit can help you qualify. Excellent is the highest tier of credit scores you can have.

Recommended Reading: What Credit Score Do You Need To Finance A Car

Auto Loans You Can Get With A 770 Credit Score

Getting an auto loan is easy with a credit score of 770. Youll generally qualify for the lowest interest rates on the market, and you may even be eligible for 0% APR car loans that some new car dealers offer.

According to a 2020 quarterly report by Experian, people with credit scores of 661780 had average interest rates of 5.59% on their used car loans and 3.69% on new car loans, whereas people with credit scores of 501600 had average interest rates of 16.56% and 10.58%. 6

Depending on the loan term and how much youre borrowing, this difference could amount to hundreds of dollars in savings. Nevertheless, you could save even more by waiting until your score reaches 781850, at which point youll be considered a super-prime borrower.

Have A Credit History

You not only want a good record of paying your bills and credit cards on time, but you also want a long history of doing so. The older your credit accounts are, the better your credit score will be. You want to have credit accounts that have been open for 10 years or more.

Length of credit history accounts for 15% of a credit score, and closing old accounts can affect your credit score, Ross says.

Also Check: How To Get A Charge Off Removed From Credit Report

Credit Score: Personal Loan Options

Your credit score reflects your financial history and how likely you are to repay debts in the future. A 770 credit score means you’re a low-risk borrower, leading to lower interest rates and better loan terms. A 770 credit score is considered excellent, so you should have no trouble qualifying for personal loans with competitive interest rates.

How to build your credit?

Related Scores

How To Get A 770 Credit Score

Theres no one path you can follow to get an excellent credit score, but there are some key factors to be aware of while you continue to build and maintain it.

Even if youre holding steady with excellent credit, its still a good idea to understand these credit factors especially if youre in the market for a new loan or youre aiming for the highest score.

Also Check: How To Get Credit Report From Credit Bureau