Does Paying Rent Improve Your Credit Score

Although landlords and property management companies aren’t required to report payments to the credit bureaus, a perfect payment pattern is still something to strive for. Not only will that information be appealing to anyone reviewing your credit report, adding a well-managed lease to your reports can cause your credit scores to rise.

Payment history is the weightiest scoring factor in both the FICO® Score and VantageScore® models, so the more evidence that you have been paying your bills on time, the better. Bear in mind that only the newest versions of the FICO® Score and VantageScore® models consider rental data, and some lenders still use older versions.

However, for the most current credit scoring systems that do take rental history into account, your on-time rental payments can give your scores a lift, especially if your credit history is young or you’ve had some credit problems in the past. According to Experian’s study, 75% of study participants who were scoreable before rental data was included on their credit files found that adding rental history increased their credit score. On average, those who saw an increase experienced a VantageScore 3.0 increase of 29 points.

What Should You Do If A Civil Judgment From An Eviction Is On Your Credit Reports

While evictions can stay on a credit report up to seven years, the three major reporting bureaus voluntarily stopped reporting most civil judgments in 2017 as part of a settlement agreement. The end result is that bankruptcy is the only public record likely to show up on your credit report.

Obtain a copy of your credit report and verify whether a civil judgment is wrongly on your report and hurting your credit. If you see an inaccurate judgment, youll need to contact the credit bureaus to get it removed.

Youre entitled to a free credit report from each of the three major credit reporting agencies each week until further noticeand you can sign up for credit monitoring services to stay up to date on whats impacting your credit. Many people find errors on their credit reports, and its important to get these things removed when theyre identified.

If youre concerned about whether or not you can pay your rent, contact your landlord immediately. Evictions require a legal process, and landlords want to avoid the fees and hassle of eviction if possible. If you explain whats happening, your landlord may offer you ways to make up the past-due rent and avoid the eviction.

If you need assistance with your credit, Lexington Law is here to help. We can help you address items on your credit reports and work to improve your chances of being approved for a new lease or loan. Contact us to learn more.

Reviewed By

Sexual Offenses Or Stalking Victims

Victims of recent sexual abuse or stalking and their parents or guardians can end a lease early. The abuse the victim survived must be listed in Section 92.0161 of the Texas Property Code. It must have occurred in the previous 6 months. To end the lease early, the victim or their parent/guardian must give the landlord documentation of the offense and 30 days’ written notice to move out. They must then move out of the rental. For complete details of the offenses covered by this law and the requirements for protection, please read Section 92.0161 of the Texas Property Code.

Also Check: How Can You Get A Credit Report

If You Must Break Your Lease Do It The Right Way

If youâre in a position where breaking your lease is unavoidable, itâs not the end of the world. There are almost always options available that can allow you to minimize the financial impact, especially in regards to your credit score.

The worst thing you can do is walk away doing nothing. You’ve been steadily building your credit, so work with your landlord to come up with a solution so you can minimize â or avoid entirely â the negative impact on your credit. If you are interested in building or repairing your credit score, consider getting a secured credit card.

About the author

Sean Bryant is a Denver-based freelance writer specializing in personal finance, credit cards and travel. With nearly 10 years of writing experience, his work has appeared in many of the industry’s top publications. He holds a Bachelor of Arts degree in Economics. He also runs OneSmartDollar.com.

What To Do If The Eviction Was Legitimate

Most people encounter financial difficulty at some point in their lives, and if your eviction was due to your inability to pay rent, there are still some things you can do. The first step is to reach out to your landlord and see if theres a way you can settle the matter. This could involve paying what you owe the landlord in exchange for having them remove your record from tenant screening reports once the settlement is complete.

If youre unable to make up your past-due payments and reach a settlement, the eviction will most likely stay on your record for seven years.

You May Like: How To Get A Public Record Off Your Credit Report

Make Sure To Pay Any Rent Or Fees You Owe

Once youve made an agreement with the landlord, youll want to make sure to pay any rent or fees you owe. It may be possible to arrange a payment plan, but make sure you have the terms in writing as discussed above.

Failure to pay what you owe for the lease you signed is likely to lead to a variety of financial and legal consequences. If youre struggling financially, try to work with the landlord to find a solution that works for everyone involved.

No matter what, after you break a lease, youll want to check your credit report and credit score to see the effects it had.

Landlord’s Failure To Disclose Management Information

Texas law requires that landlords provide tenants with correct and up-to-date information about who owns and manages the property. They also have to provide this information upon written request and whenever it changes. If they fail to do so or knowingly provide false information, the tenant can break the lease without going to court. To do so, the tenant must make a written request notifying the landlord that they intend to exercise their remedies under the law. They then must allow 7 days for the landlord to provide the information before ending the lease.

Recommended Reading: When Does Bankruptcy Clear From Credit Report

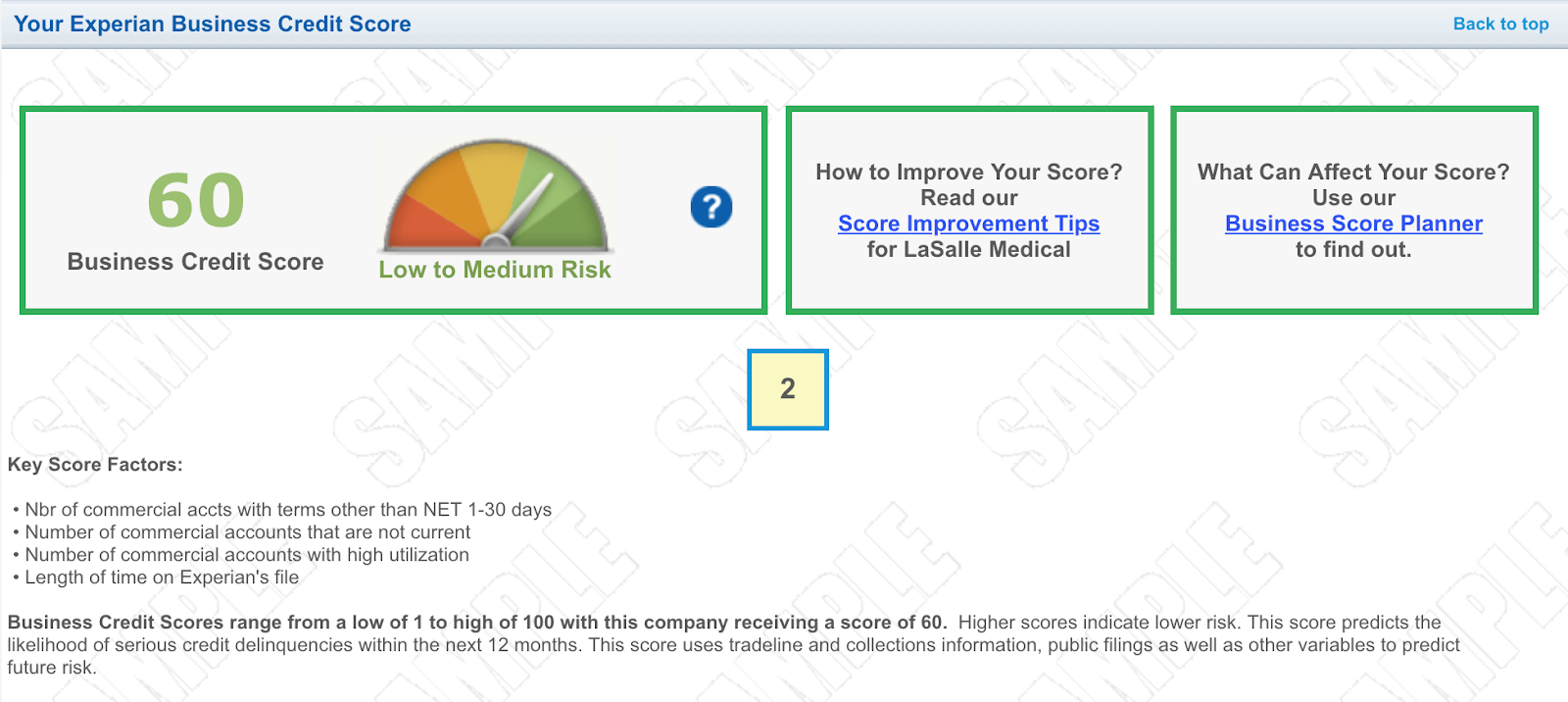

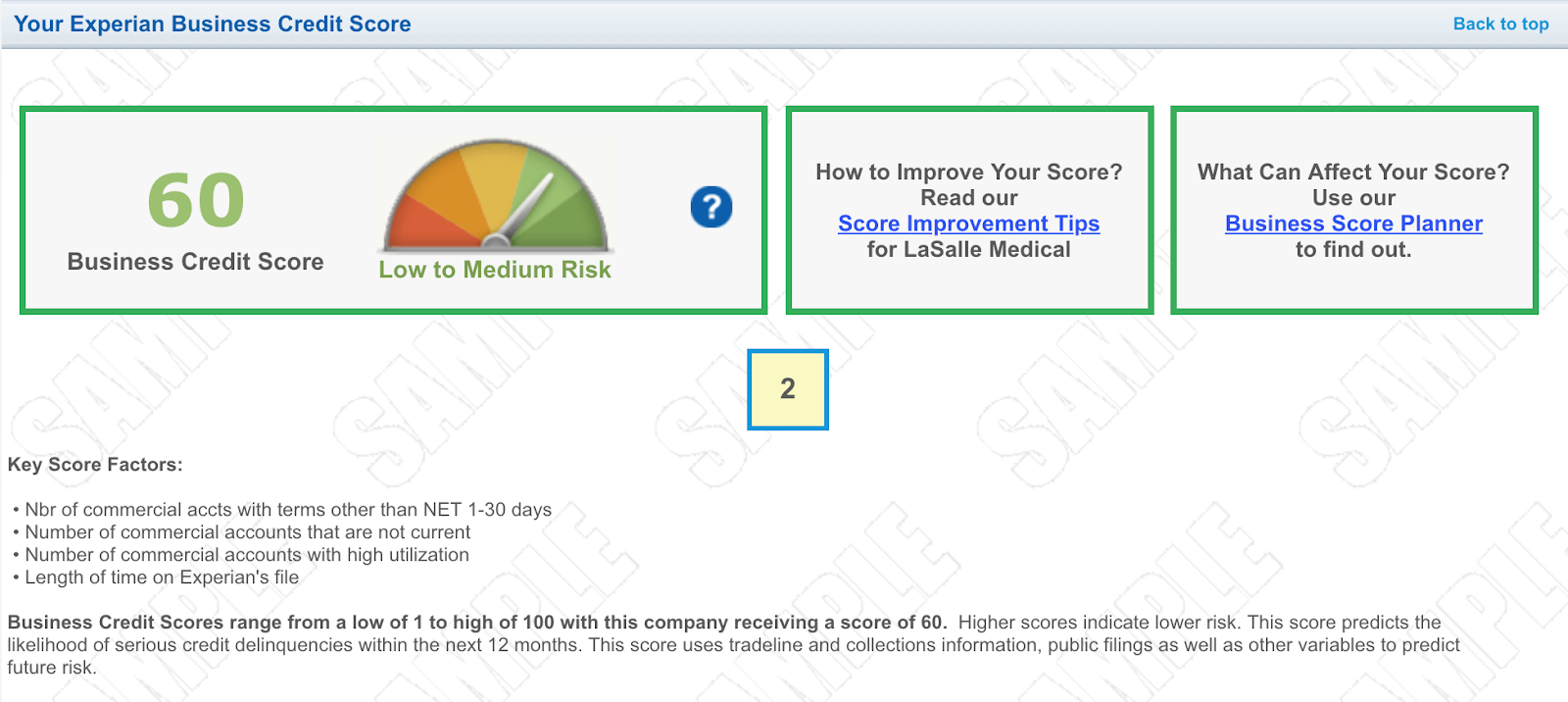

What Is A Fico Score

A FICO Score is the most widely used credit score by lenders.

Over 90% of lenders are highly dependent on this score to understand and check your credit risk.

The score is made up of the following five factors:

| 10% |

More accurately, it is a number that predicts the likelihood that you will pay back a loan in a timely fashion.

The number is calculated based on your credit reports with three credit bureaus Equifax, Experian, and TransUnion.

The credit can also change when your data changes at these credit bureaus.

They do not determine credit approval or interest rate. That credit-granting decision is up to the lender, though it does help them make that decision.

The scores range anywhere from 300 to 850.

FICO uses these five credit ranges to rate you:

| Status | |

|---|---|

| Poor | 579 and below |

Reducing debt, missing payments, and creating new credit accounts can all positively and negatively affect it.

Ultimately the FICO score makes the lending process efficient and fair. It applies the same set of standards to all borrowers.

Check Your Credit After Breaking A Lease

After youve broken your lease and paid any associated costs, youll want to get a copy of your credit report from each of the three bureaus. Read the reports closely to make sure you dont have any new or incorrect debts listed that might affect your score. If you want to get your broken lease off your credit history, youll need to make sure that you pay off any collection debts associated with unpaid rent or fees.

Youll also want to check your credit score to make sure youre still trending toward meeting your financial goals. A higher credit score can help you get better interest rates on loans or credit cards.

If your score has taken a hit and your credit report contains inaccurate informationeither related to breaking your lease or anything elseyoull want to start a dispute. This is an important part of repairing your credit and ensuring your credit history only contains factual information.

Even though breaking a lease does not directly affect your credit, its best to double-check and make sure everything is rolling along nicely after settling things with your landlord.

You May Like: What Does A Bad Credit Rating Mean

Offer A Larger Deposit

Typically, you’re required to pay the first month’s rent and a security deposit equivalent to one month’s rent. If an honest explanation doesn’t convince a landlord to rent to you, offer to put down a larger deposit. However, in states that cap the amount landlords can charge for security deposits, this might not be an option. In states like Pennsylvania, landlords are allowed to collect up to two months’ worth of rent as a deposit, so you could offer this amount to coax a hesitant landlord into renting to you.

How Can I Include Rent Payments In My Credit Report

Most credit reports dont include any rent payment history. However, this information can be included if you or your landlord chooses to report it to credit bureaus.

- Check with your landlord or property manager. Your landlord or property manager may already be reporting your rental payment history to the credit bureaus with the help of Esusu. If not, ask them to register for Esusus rent reporting service on your behalf.

- Report it yourself. If your landlord or property manager doesnt want to report your rental payments to credit bureaus, you can sign-up with Esusu yourself. For $50 a year, we help report all your rent payments to TransUnion and Equifax. Learn more and sign up.

Including rent payment history in your credit report is a great way to build credit while avoiding debt. Without opening new lines of credit, you dont have to worry about interest rates or late fees. All you have to do is pay rent on time.

Don’t Miss: How To Establish A Credit Report

You Are Likely To Be Sued By The Landlord

The last thing you will want after breaking your lease agreement is facing litigation. Regardless of how genuine the reason could be, reaching common ground with the landlord is a wise thing to do instead. Being sued will only add the possibility of getting fined and further increase your cost that you were initially running away from.

Thoroughly Read The Lease Agreement

While youâre looking for language on subletting, look closely at the rest of the lease. Many leases include a section about early termination.

Early termination clauses exist because landlords know situations arise in which their tenants need to move, breaking their lease early. Early lease termination clauses often require giving your landlord a proper written warning before leaving.

You May Like: What Does Your Credit Score Start At

Are Rental Payments Included In My Credit Report

Esusu August 31, 2021

Pressed for time? Heres what you need to know.

Historically, credit reports dont include rent payments. Why? Because rent isnt considered debt. As we all know, landlords and property managers dont lend us rent money each month to be repaid later with interest.

Until 2010, the only time rent payments would show up on your credit report is if you have late or missing payments. If your landlord sells the rent you owe to a collections agency, then it becomes debt. This information will definitely appear on your credit report and can negatively affect your credit score. Since 2010, on-time payments can be included in your credit report.

If you have a stellar track record of on-time rent payments, that can be a great way to show lenders that youre a responsible consumer. A history of on-time rent payments can also help you build credit without taking on additional debt. It can even boost your credit score.

In this article:

How Can Rent Payments Help Me Build Credit

When it comes to applying for loans, payment history carries a lot of weight. This makes sense. If youre lending someone money, youd probably want to make sure theyll pay you back. Lenders want this peace of mind, too. Theyll look at your payment history to see if youre someone who will repay in a timely manner.

A stellar track record of on-time rent payments can be a great way to show lenders youll have no problems doing so. The proof? You pay your rent on time every month! Having on-time rent payment history in your credit report can help you demonstrate good character. This could increase your chances of getting a loan or credit card approved. It may even help you snatch that next apartment.

Appearing responsible on your credit report is different from improving your actual credit score. Your credit score is calculated from the information on your credit report. FICO Score 8 is the credit score model most lenders use to assess your creditworthiness. This model doesnt include rent payment histories in its calculations, which means on-time rent payments wont boost your score.

Newer credit scoring models, such as the FICO Score 9, FICO XD, and VantageScore, do include rent payments in its calculations. For these models, on-time rental payments can boost your credit score, especially if you dont have much history or your credit needs repairing.

Don’t Miss: How To Send A Credit Report By Email

Find A New Tenant Or A Sublet

Your landlord may be more willing to accept you breaking the lease if you provide a suitable replacement. While some landlords will seek to find a replacement on their own, if you know someone who would be a good fit, that could expedite the process of breaking your lease.

Depending on your contract, you may be allowed to sublet your apartment for the remainder of your leasethat means youll find someone to live in the unit and theyll pay you rent each month. Keep in mind that your lease may not allow subletting, and youre still ultimately on the hook for the rent.

Breaking Your Lease With Some Penalties

When it comes to walking away from your lease, you might be able to mitigate your full financial responsibility by allowing your landlord to rerent and find a new tenant for a new lease.

When trying this option, it’s always best to approach your landlord well in advance and reread your lease agreement to make sure that this is a viable option with minimal repercussions.

Don’t Miss: How High Can A Credit Score Be

Apply To Private Owners

Instead of applying for an apartment operated by a management company, search for owner-managed complexes. Individuals might be more understanding of past problems and/or have more lenient eligibility requirements. Some property owners don’t even run credit checks or call references. However, a potential drawback to renting an apartment from an owner with lax qualifying criteria or background checks could mean living next to undesirable neighbors.

A lease is a binding contract, but most states offer legitimate reasons to break one. There are also many reasons your landlord can evict you, which isn’t the same as breaking your lease, but evictions have similar barriers to renting an apartment. If you’ve previously broken a lease for a legitimate reason or were illegally evicted, and it shows up on a tenant search, take steps to have this information corrected or removed.

Note to readers: if you purchase something through one of our affiliate links we may earn a commission.

How To Get A Copy Of Your Credit Report From All Three Major Credit Bureaus

You can order one free copy annually of your credit report from Equifax, Experian and TransUnion by requesting it online with each bureau. Or get your hands on all three reports at once by ordering them at AnnualCreditReport.com.

Youre also entitled to a free copy of your credit report from a credit bureau that provided a report to a creditor that declined your credit application.

You May Like: Is 742 A Good Credit Score

Is My Rental History On My Credit Report

When you review your credit reports, you might notice that your history making on-time rent payments isn’t listed anywhere. But that doesn’t mean there’s no way to use your history as a reliable tenant to improve how lenders and credit card issuers view you as a borrower.

There are steps you can take to add your monthly rent payments to your credit reports and possibly improve your credit scores in the process. Here’s how to do it and why you may want to.

Landlord’s Failure To Install Inspect Or Repair A Smoke Alarm

Texas law requires that landlords make sure smoke alarms are installed, inspected, and working at the beginning of a tenant’s lease. If they do not, the tenant can request a landlord install or repair a smoke alarm. If the landlord fails to do so, the tenant has the right to end the lease without court action. To do so, the tenant must make a written request notifying the landlord that they intend to exercise their remedies under the law. They then must allow 7 days for the landlord to install, inspect, or repair the alarm before ending the lease.

Don’t Miss: How To Get Free Credit Report Without Paying

If You Lease Does It Go On Credit Report

I am thinking about Leasing an car, because we are also in the process of purchasing a home as well and the mortgage company that we will be going through suggested that we or I do not purchase a car, until after closing… Anyway,I need a vehicle now, so I was wondering that if I get an Lease does it still show on the credit report and how does it report, would it generally report showing the full purchase price of the vehicle, or what?

I really wouldn’t put any miles on it at all, my job is 5 miles away, my kids school is 1 mile away, and when I go out of town I just rent a vehicle. The only thing I am worried about is the approval, I was late on my current auto loan , back in 2006.

Any suggestions would be greatly appreciated